Fill and Sign the Individual Credit Application Georgia Form

Useful tips on finalizing your ‘Individual Credit Application Georgia’ online

Are you fed up with the inconvenience of handling paperwork? Your search ends with airSlate SignNow, the leading eSignature solution for individuals and small businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the extensive features available in this intuitive and cost-effective platform and transform your approach to document management. Whether you need to approve documents or gather electronic signatures, airSlate SignNow manages it all smoothly, necessitating just a few clicks.

Follow this detailed guide:

- Log into your account or initiate a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Edit your ‘Individual Credit Application Georgia’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if needed).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with your team on your Individual Credit Application Georgia or send it for notarization—our platform provides you with all the tools necessary to accomplish these tasks. Register with airSlate SignNow today and take your document management to new levels!

FAQs

-

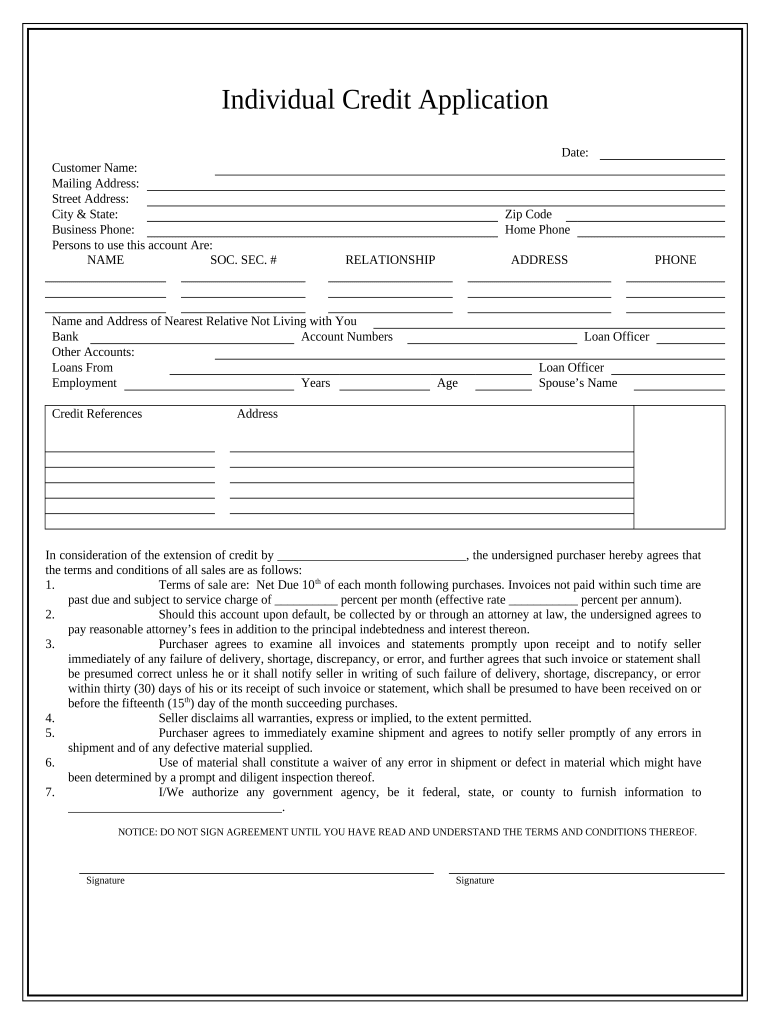

What is an Individual Credit Application Georgia?

An Individual Credit Application Georgia is a specific form used by individuals in the state of Georgia to apply for credit. This application typically collects personal and financial information to assess the applicant's creditworthiness. Using airSlate SignNow, you can easily eSign and submit your Individual Credit Application Georgia securely and efficiently.

-

How does airSlate SignNow simplify the Individual Credit Application Georgia process?

airSlate SignNow streamlines the Individual Credit Application Georgia process by allowing users to fill out, sign, and send documents electronically. This eliminates the need for printing and mailing, saving time and reducing paperwork. Our platform is user-friendly, making it easy for anyone to manage their credit applications.

-

What features does airSlate SignNow offer for Individual Credit Applications Georgia?

With airSlate SignNow, you can take advantage of features like customizable templates for Individual Credit Applications Georgia, advanced eSignature options, and secure document storage. Our platform also provides real-time tracking of document status, ensuring you stay informed throughout the application process.

-

Is airSlate SignNow affordable for Individual Credit Application Georgia?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures that you can manage your Individual Credit Application Georgia without breaking the bank. We also provide a free trial for new users to explore our features before committing.

-

Can I integrate airSlate SignNow with other applications for my Individual Credit Application Georgia?

Absolutely! airSlate SignNow seamlessly integrates with various applications like CRM systems and payment processors. This means you can enhance your workflow for the Individual Credit Application Georgia by connecting it with tools you already use for a more efficient process.

-

What security measures are in place for Individual Credit Application Georgia with airSlate SignNow?

Security is a top priority at airSlate SignNow. For your Individual Credit Application Georgia, we implement robust encryption protocols, secure data storage, and compliance with industry regulations. This ensures that your sensitive information remains protected throughout the application process.

-

How can I track the status of my Individual Credit Application Georgia using airSlate SignNow?

With airSlate SignNow, tracking the status of your Individual Credit Application Georgia is easy. Our platform provides real-time updates and notifications, allowing you to see when your application has been viewed, signed, or completed. This transparency helps you stay informed and manage your applications effectively.

The best way to complete and sign your individual credit application georgia form

Find out other individual credit application georgia form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles