Fill and Sign the Individual Lender Form

Practical advice on finalizing your ‘Individual Lender’ online

Are you fed up with the burden of handling paperwork? Discover airSlate SignNow, the top eSignature platform for individuals and organizations. Bid farewell to the labor-intensive task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Leverage the powerful features included in this intuitive and affordable platform and transform your approach to paperwork handling. Whether you need to sign forms or gather signatures, airSlate SignNow takes care of it all seamlessly, requiring just a few clicks.

Follow this step-by-step tutorial:

- Log in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Individual Lender’ in the editor.

- Click Me (Fill Out Now) to fill in the form on your part.

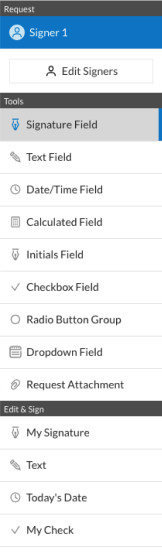

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t fret if you need to work with others on your Individual Lender or send it for notarization—our solution provides everything necessary to complete such tasks. Create an account with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

What is an Individual Lender?

An Individual Lender is a person who provides loans to borrowers, typically for personal or business purposes. They often operate independently, offering flexible terms compared to traditional financial institutions. Understanding the role of an Individual Lender can help you navigate your financing options effectively.

-

How does airSlate SignNow benefit Individual Lenders?

airSlate SignNow streamlines the document signing process for Individual Lenders, allowing them to send and eSign contracts quickly and securely. This efficiency can enhance the lending experience for both lenders and borrowers. With airSlate SignNow, Individual Lenders can focus more on their clients and less on paperwork.

-

What features does airSlate SignNow offer for Individual Lenders?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage, all tailored for Individual Lenders. These tools simplify the management of loan agreements and ensure compliance with legal standards. Individual Lenders can benefit from a user-friendly interface that enhances productivity.

-

Is airSlate SignNow cost-effective for Individual Lenders?

Yes, airSlate SignNow offers competitive pricing plans that are designed to be cost-effective for Individual Lenders. By reducing the time spent on document management, Individual Lenders can save money and increase their profitability. The value provided by airSlate SignNow far outweighs the investment.

-

Can Individual Lenders integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow integrates seamlessly with various applications that Individual Lenders may already be using, such as CRM systems and accounting software. This integration helps streamline workflows and enhances overall efficiency. Individual Lenders can customize their tech stack to suit their specific needs.

-

What are the security features of airSlate SignNow for Individual Lenders?

airSlate SignNow prioritizes security with features like encryption, secure access controls, and audit trails, ensuring that Individual Lenders' documents are protected. These security measures help build trust with borrowers and comply with regulatory requirements. Individual Lenders can operate with peace of mind knowing their data is secure.

-

How can Individual Lenders ensure compliance using airSlate SignNow?

Individual Lenders can ensure compliance by utilizing airSlate SignNow's legally binding eSignature capabilities and customizable templates that adhere to industry standards. The platform provides guidance on best practices for document management. This helps Individual Lenders maintain compliance while focusing on their lending activities.

The best way to complete and sign your individual lender form

Get more for individual lender form

Find out other individual lender form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles