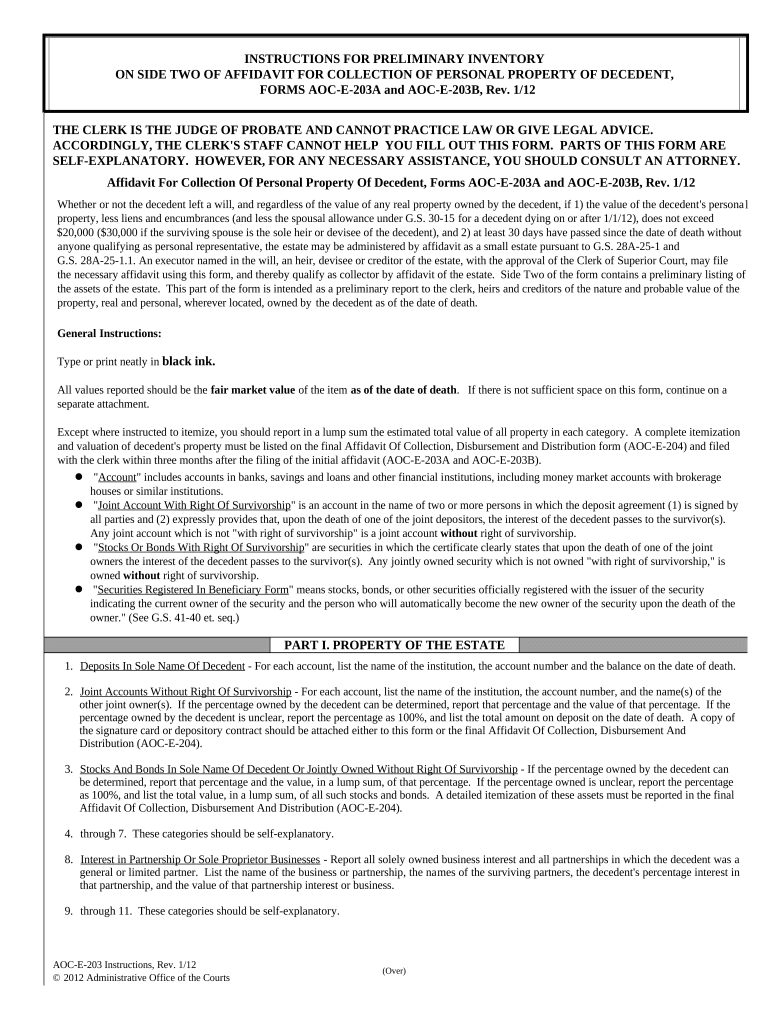

INSTRU C TI O NS FOR PRELIM I NARY INVENTORY

ON SIDE TWO OF AFF I DA V IT FOR COLLE C TION OF PERSONAL PROPERTY OF DECEDE N T,

FORMS AO C -E-203A and AOC-E-203B, Rev. 1/12

THE CLERK IS THE JUDGE OF PROBATE AND CANN O T PRA C TICE LAW OR GIVE LEGAL AD V ICE.

AC C ORDINGLY, THE CLERK'S STAFF CANNOT HELP YOU FILL OUT THIS FORM. PARTS OF THIS FORM ARE

SELF-EXPLAN A TORY. HOWEVER, FOR ANY NEC E S S ARY ASSISTAN C E, Y O U SHOULD CONSULT AN ATTORNEY.

Aff i davit For Collection Of Personal Property Of Decedent, Forms AOC-E-203A and AOC-E-203B, Rev. 1/12

Whether or not the decedent left a will, and regar d less of the value of any real property owned by the decedent, if 1) the value of the decedent ' s persona

propert y , less liens and encu m brances (and less the spousal allowance under G.S. 30-15 for a decedent dying on or after 1/1/12), does not exceed

$20,000 ($30,000 if the surviving spouse is the sole heir or devisee of the decedent), and 2) at lea s t 30 da y s have passed since the date of death without

a n y one qualif y ing as personal representative, the estate may be administered by affidavit as a small e s tate pursuant to G. S . 28A-25-1 and

G.S. 28A-25-1.1. An executor na m ed in the will, an heir, devisee or creditor of the e s tate, with the approval of the Clerk of S uperior Court, m ay file

the necessary affidavit using this form, and thereby qualify as collector by affidavit of the e s tate. Side Two of the form contains a preli m inary listing of

the assets of the estate. This part of the form is intended as a preliminary report to the clerk, heirs and creditors of the nature and probable value of the

propert y , real and personal, wherever located, owned by the decedent as of the date of death.

General Instructions:

T y pe or print neatly in black ink.

All values reported should be the fair mar k et value of the item as of the date of death . If there is not sufficient s pace on this form, continue on a

separate attachment.

Except where instructed to itemize, y ou should report in a lump sum the esti m ated total value of all property in each categor y . A complete ite m ization

and valuation of decedent ' s property must be listed on the final Affidavit Of Collection, Disbursement and Distribution form (AOC-E-204) and filed

with the clerk within three months after the filing of the initial affida v it ( AOC-E-203A and AOC-E-203B).

" Account " includes accounts in banks, savings and loans and other financial i n stitution s , including m oney market accounts with brokerage

houses or similar institutions.

" Joint Account With Right Of Survivorshi p " is an account in the name of two or more persons in which the depo s it agree m ent (1) is signed by

all parties and (2) expressly provides that, upon the death of one of the joint depo s itors, the intere s t of the decedent passes to the survivor(s).

Any joint account which is not " with right of survivorship" is a joint account without right of survivorship.

" Stocks Or Bonds With Right Of Survivorshi p " are securities in which the certificate clearly states that upon the death of one of the joint

owners the interest of the decedent passes to the survivor(s). Any jointly owned security which is not owned " with right of survivorship," is

owned without right of survivorship.

" Securities Registered In Beneficiary For m " means stocks, bonds, or other securities officially registered with the issuer of the s ecurity

indicating the current owner of the security and the person who will auto m atically beco m e the new owner of the s ecurity upon the death of the

owner." (See G.S. 41-40 et. seq.)

PART I. PROPERTY OF THE EST A TE

1. Deposits In Sole Na m e Of Decedent - For each account, list the name of the institution, the account nu m ber and the balance on the date of death.

2. Joint Accounts Without Right Of Survivorship - For each account, list the na m e of the institution, the account nu m ber, and the na m e(s) of the

other joint owner(s). If the percentage owned by the decedent can be deter m ined, report that percentage and the value of that percentage. If the

percentage owned by the decedent is unclear, report the percentage as 100%, and list the total a m ount on deposit on the date of death. A copy of

the signature card or depository contract should be attached either to this form or the final Affidavit Of Collection, Di s bursement And

Distribution (AOC-E-204).

3. Stocks And Bonds In Sole Name Of Decedent Or Jointly Owned Without Right Of Survivorship - If the percentage owned by the decedent can

be determined, report that percentage and the value, in a l u mp sum, of that percentage. If the percentage owned is unclear, report the percentage

as 100%, and list the total value, in a lump sum, of all such stocks and bonds. A detailed ite m ization of the s e assets must be reported in the final

Affidavit Of Collection, Disbursement And Distribution (AOC-E-204).

4. through 7. These categories should be self-explanator y .

8. Interest in Partnership Or Sole Proprietor Businesses - Report all solely owned business interest and all partner s hips in which the decedent was a

general or limited partner. List the name of the business or partnership, the na m es of the surviving partner s , the decedent ' s percentage intere s t in

that partnership, and the value of that partnership interest or business.

9. through 11. These categories should be self-explanator y .

AOC-E-203 Instructions, Rev. 1/12

© 2012 Ad m inist r ative O ffice of the Courts (Over) l

12. Real Estate Willed To The Estate - ( NOT E : ( a) Real property willed to any person or entity other than the estate must be reported in Part II,

Item 5. ( b) If any real estate has been willed to the estate, a personal representative mu s t be appointed.) Indicate only r eal estate which the

decedent devised ( willed) to his or her estate or to his or her executor in the capacity as executor ( not as an individual ) . Usually, such a devise is

accompanied by a direction to sell the real estate and distribute the proceeds as specified in the will. A li s ting of all s uch properties, together

with an identification or legal description of each parcel or tract should be reported here, using fair market value as of the date of death.

13. Esti m ated Annual Inco m e Of The Estate - Income of the estate includes, for exa m ple, intere s t on checking and other accounts opened in the

name of the estate , dividends and interest on stocks and bonds owned in the na m e of the estate, and other inco m e to the e s tate. Inco m e of the

estate does not include interest on accounts, or dividends or interest on stocks or bonds, which pass directly to a surviving joint owner.

PART II. PROPERTY WHICH CAN BE ADDED TO EST A TE IF N EEDED TO PAY CLAIMS

This part of the form is used to list certain ki n ds of property which the decedent owned or in which the decedent had an intere s t during his or her life

ti m e, which are not ordinarily part of the estate, but which m ay be recovered by the personal representative if the assets of the estate are not s ufficient

to pay all the debts of the decedent and claims against the estate.

1. Joint Accounts With Right Of Survivorship Under G.S.41-2.1 - List all joint accounts with right of survivorship. For each account, li s t the na m e

of the financial institution, the account nu m ber, the na m es of the other joint owners, and the total balance on the date of death. Attach a copy of

the signature card or depository contract of each such account to the form or to y our final Affidavit Of Collection, Di s bursement And Distribution

(AOC-E-204).

2. Stocks/Bonds/Securities Registered In Beneficiary Form Or Jointly Owned With Right Of Survivorshi p . - A lump sum total of the value of all

such stocks or bonds should be reported here. A detailed itemization of these assets m ust be reported in the final Affidavit Of Collection,

Disbursement And Distribution (AOC-E-204). It also includes securities registered in beneficiary form and i mm ediately transferrable on death.

3. Other Personal Property Recoverable Under G.S. 28A-15-10 - This category includes accounts which are called " Trustee Account s " in the

signature card or deposit agree m ent or in which the decedent other w ise established a " Tentative" or " Totten" trust; securities registered in

beneficiary form and automatically transferred on death; property which the decedent gave to s o m eone in conte m plation of his or her own death;

and property transferred by the decedent, without receiving adequate consideration, with the intent to hinder, delay or defraud his or her creditor s .

If y ou believe there m ay be any property which falls into this categor y , y ou m ay wish to consult an attorne y .

4. Real Estate Owned By The Decedent And Not Listed Elsewhere - ( NOTE: Real estate owned by the decedent and s pouse as tenants by the

entireties should be reported in Part III. Do not report real estate in which the decedent had an inte r est only f o r his or her lifetime . ) A detailed

listing of all other inte r ests in real estate owned by the decedent together with an identification or legal de s cription of each parcel or tract s hould

be reported here using fair m arket value as of the date of death.

PART III. OTHER PROPE R TY

This part of the form is used to list certain propert y , rights and clai m s which are not ad m inistered by the collector by affidavit as part of the decedent ' s

estate and which the collector cannot generally recover to pay debts of the decedent or clai m s against the estate. However, this property m ay be

included in the value of the " estate" for state or federal estate tax purposes, or which are li s ted for the infor m ation of heirs and others to whom the

property m ay pass.

1. Entireties Real Estate - Indicate whether or not there is real estate jointly owned by the decedent and his or her surviving spouse as tenants by the

entireties.

2. Insurance, Retire m ent Plan, IRA, Etc., Pa y able To Persons Other Than the E s tate - This category includes all life in s urance proceed s , death

benefits under pension and retire m ent plans, and the balance re m aining in IRA, 401(k) and other similar accounts which, at the death of the

decedent, pass to a beneficiary other than the estate.

SIGNATURE - All applicants must sign. The signature of each must be separately notari z ed before a notary public or ac k nowledged before

the cler k , assistant, or deputy.

AOC-E-203 I nstructions, Side Two, Rev. 1/12

© 2012 Ad m inist r ative O ffice of the Courts

Useful tips on setting up your ‘Instructions For Preliminary Inventory For Collection Of Personal Property Of Decedent North Carolina’ online

Are you fed up with the complications of handling paperwork? Look no further than airSlate SignNow, the top eSignature solution for individuals and small businesses. Bid farewell to the cumbersome procedure of printing and scanning documents. With airSlate SignNow, you can easily finalize and sign documents online. Utilize the robust features embedded in this user-friendly and affordable platform and transform your method of document management. Whether you need to sign forms or collect electronic signatures, airSlate SignNow takes care of everything effortlessly, requiring just a few clicks.

Follow this detailed guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Access your ‘Instructions For Preliminary Inventory For Collection Of Personal Property Of Decedent North Carolina’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you need to work with your coworkers on your Instructions For Preliminary Inventory For Collection Of Personal Property Of Decedent North Carolina or send it for notarization—our platform offers everything you require to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!