Fill and Sign the Instructions for Preliminary Inventory on Side Two of Application Form

Valuable advice on readying your ‘Instructions For Preliminary Inventory On Side Two Of Application ’ digitally

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for both individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and endorse paperwork online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform to transform your method of document handling. Whether you need to sign forms or gather electronic signatures, airSlate SignNow manages everything effortlessly, needing just a few clicks.

Follow this detailed guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template repository.

- Edit your ‘Instructions For Preliminary Inventory On Side Two Of Application ’ in the editor.

- Select Me (Fill Out Now) to prepare the document from your side.

- Add and designate fillable areas for other participants (if needed).

- Move forward with the Send Invite options to solicit electronic signatures from others.

- Save, print your version, or convert it into a reusable template.

Don't fret if you need to collaborate with others on your Instructions For Preliminary Inventory On Side Two Of Application or send it for notarization—our platform has all you need to accomplish these tasks. Register with airSlate SignNow today and elevate your document handling to a new level!

FAQs

-

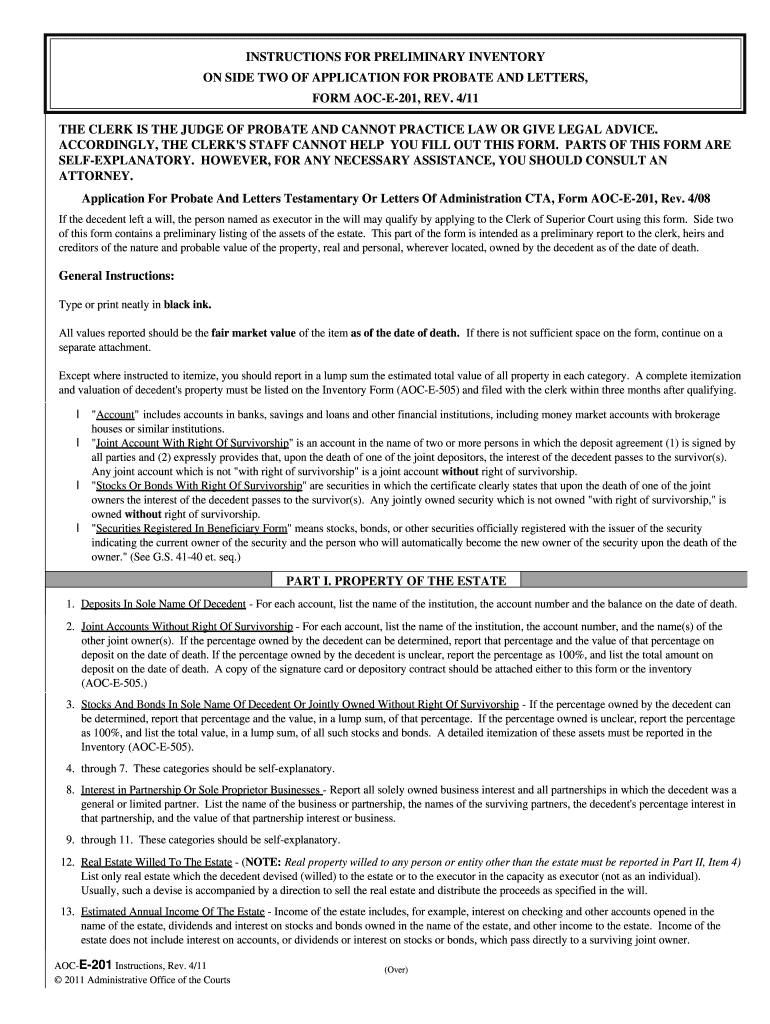

What are the Instructions For Preliminary Inventory On Side Two Of Application?

The Instructions For Preliminary Inventory On Side Two Of Application provide detailed guidance on how to accurately complete the inventory section of your application. This ensures that all necessary information is captured correctly, facilitating a smoother application process. Following these instructions helps prevent delays and potential rejections.

-

How can airSlate SignNow assist with the Instructions For Preliminary Inventory On Side Two Of Application?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing the Instructions For Preliminary Inventory On Side Two Of Application. With features like templates and e-signatures, you can easily fill out and submit your application without hassle. This streamlines your workflow and enhances efficiency.

-

Are there any costs associated with using airSlate SignNow for the Instructions For Preliminary Inventory On Side Two Of Application?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan provides access to features that can help you with the Instructions For Preliminary Inventory On Side Two Of Application. You can choose a plan that fits your budget while still benefiting from our comprehensive e-signature solutions.

-

What features does airSlate SignNow provide for completing the Instructions For Preliminary Inventory On Side Two Of Application?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure e-signatures. These tools are designed to help you efficiently complete the Instructions For Preliminary Inventory On Side Two Of Application. Additionally, our platform ensures that your documents are stored securely and are easily accessible.

-

Can I integrate airSlate SignNow with other applications while following the Instructions For Preliminary Inventory On Side Two Of Application?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow while adhering to the Instructions For Preliminary Inventory On Side Two Of Application. This means you can connect with tools you already use, enhancing productivity and ensuring a seamless experience.

-

What benefits can I expect from using airSlate SignNow for the Instructions For Preliminary Inventory On Side Two Of Application?

Using airSlate SignNow for the Instructions For Preliminary Inventory On Side Two Of Application offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform simplifies the document signing process, allowing you to focus on your core business activities while ensuring compliance with application requirements.

-

Is there customer support available for questions about the Instructions For Preliminary Inventory On Side Two Of Application?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions regarding the Instructions For Preliminary Inventory On Side Two Of Application. Our support team is available via chat, email, or phone to ensure you have the help you need when navigating the application process.

The best way to complete and sign your instructions for preliminary inventory on side two of application form

Find out other instructions for preliminary inventory on side two of application form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles