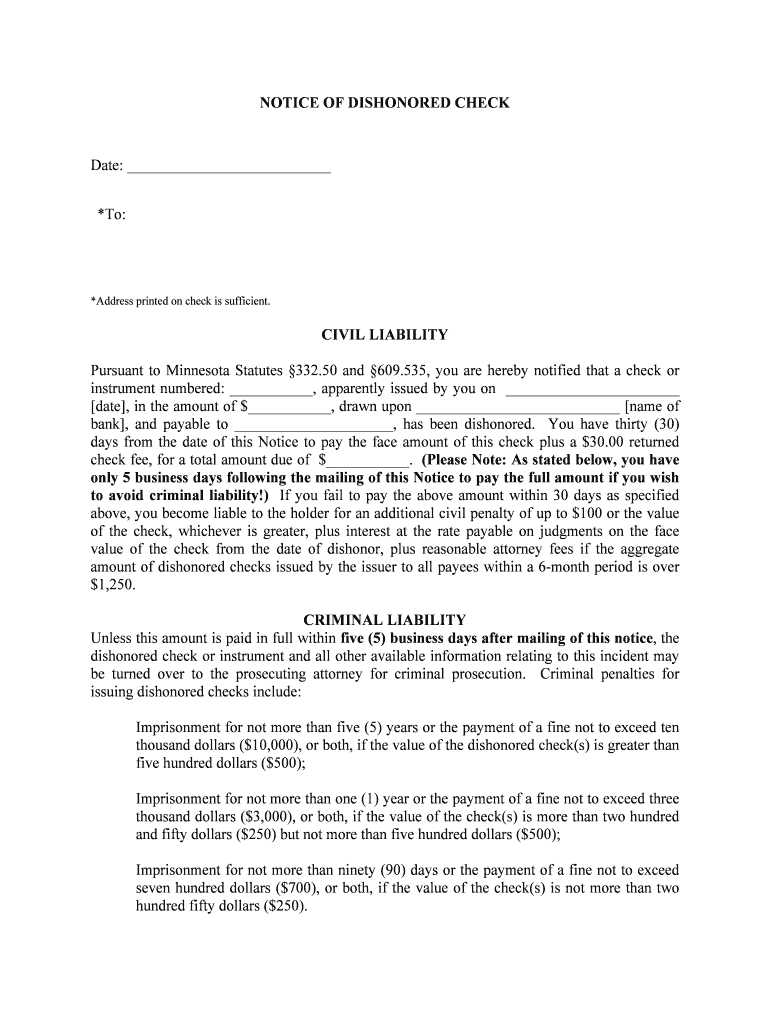

NOTICE OF DISHONORED CHECK

Date: ___________________________

*To:

*Address printed on check is sufficient. CIVIL LIABILITY

Pursuant to Minnesota Statutes §332.50 and §609.535, you are hereby notified that a check or

instrument numbered: ___________, apparently issued by you on _______________________

[date], in the amount of $___________, drawn upon ___________________________ [name of

bank], and payable to _____________________, has been dishonored. You have thirty (30)

days from the date of this Notice to pay the face amount of this check plus a $30.00 ret urned

check fee, for a total amount due of $___________. (Please Note: As stated below, you have

only 5 business days following the mailing of this Notice to pay the full amount if you wish

to avoid criminal liability!) If you fail to pay the above amount within 30 days as specified

above, you become liable to the holder for an additional civil penalty of up to $100 or the value

of the check, whichever is greater, plus interest at the rate payable on judgments on the face

value of the check from the date of dishonor, plus reasonable attorney fees if the aggregate

amount of dishonored checks issued by the issuer to all payees within a 6-month period is over $1,250.

CRIMINAL LIABILITY

Unless this amount is paid in full within five (5) business days after mailing of this notice , the

dishonored check or instrument and all other available information relating to this incident may

be turned over to the prosecuting attorney for criminal prosecution. Criminal penalties for

issuing dishonored checks include:

Imprisonment for not more than five (5) years or the payment of a fine not to exceed ten

thousand dollars ($10,000), or both, if the value of the dishonored check(s) is greater than

five hundred dollars ($500);

Imprisonment for not more than one (1) year or the payment of a fine not to exceed three

thousand dollars ($3,000), or both, if the value of the check(s) is more than two hundred

and fifty dollars ($250) but not more than five hundred dollars ($500);

Imprisonment for not more than ninety (90) days or the payment of a fine not to exceed

seven hundred dollars ($700), or both, if the value of the check(s) is not more than two

hundred fifty dollars ($250).

A copy of the statutes governing the issuance of dishonored checks has been enclosed for

your convenience.

Pay the full amount to ___________________________ at the following address:

Mail or deliver the total amount to the following:

Notice Issued by:

Signature: ________________________________

Print Name: _______________________

Title: _______________________

332.50 [ISSUANCE OF WORTHLESS CHECK.]

Subdivision 1. [DEFINITIONS.] (a) The definitions provided in this subdivision apply to this section.

(b) "Check" means a check, draft, order of withdrawal, or similar negotiable or nonnegotiable instrument.

(c) "Credit" means an arrangement or understanding with the drawee for the payment of the check.

(d) "Dishonor" has the meaning given in section 336.3-502, but does not include dishonor due to a stop payment order requested by an issuer who has a good faith

defense to payment on the check. "Dishonor" does include a stop payment order

requested by an issuer if the account did not have sufficient funds for payment of

the check at the time of presentment, except for stop payment orders on a check

found to be stolen.

(e) "Payee" or "holder" includes an agent of the payee or holder.

Subd. 2. [ACTS CONSTITUTING.]

Whoever issues any check that is dishonored is liable for the following penalties:

(a) A service charge not to exceed $30, may be imposed immediately on any dishonored check by the payee or holder of the check, regardless of mailing a

notice of dishonor, if notice of the service charge was conspicuously displayed on

the premises when the check was issued. Only one service charge may be

imposed under this paragraph for each dishonored check. The displayed notice

must also include a provision notifying the issuer of the check that civil penalties

may be imposed for nonpayment.

(b) If the amount of the dishonored check is not paid within 30 days after the payee or holder has mailed notice of dishonor pursuant to section 609.535 and a

description of the penalties contained in this subdivision, whoever issued the

dishonored check is liable to the payee or holder of the check for:

(1) the amount of the check, the service charge as provided in paragraph (a), plus a civil penalty of up to $100 or the value of the check, whichever is

greater. In determining the amount of the penalty, the court shall consider

the amount of the check and the reason for nonpayment. The civil penalty

may not be imposed until 30 days following the mailing of the notice of

dishonor. A payee or holder of the check may make a written demand for

payment of the civil liability by sending a copy of this section and a

description of the liability contained in this section to the issuer's last

known address. Notice as provided in paragraph (a) must also include

notification that additional civil penalties will be imposed for dishonored

checks for nonpayment after 30 days;

(2) interest at the rate payable on judgments pursuant to section 549.09 on the face amount of the check from the date of dishonor; and

(3) reasonable attorney fees if the aggregate amount of dishonored checks issued by the issuer to all payees within a six-month period is over $1,250.

(c) This subdivision prevails over any provision of law limiting, prohibiting, or otherwise regulating service charges authorized by this subdivision, but does not

nullify charges for dishonored checks, which do not exceed the charges in

paragraph (a) or terms or conditions for imposing the charges which have been

agreed to by the parties in an express contract.

(d) A sight draft may not be used as a means of collecting the civil penalties provided in this section without prior consent of the issuer.

(e) The issuer of a dishonored check is not liable for the penalties described in paragraph (b) if a pretrial diversion program under section 628.69 has been

established in the jurisdiction where the dishonored check was issued, the issuer

was accepted into the program, and the issuer successfully completes the

program.

Subd. 3. [NOTICE OF DISHONOR REQUIRED.]

Notice of nonpayment or dishonor that includes a citation to this section and section 609.535,

and a description of the penalties contained in these sections, shall be sent by the payee or holder

of the check to the drawer by certified mail, return receipt requested, or by regular mail,

supported by an affidavit of service by mailing, to the address printed or written on the check.

The issuance of a check with an address printed or written on it is a representation by the drawer

that the address is the correct address for receipt of mail concerning the check. Failure of the

drawer to receive a regular or certified mail notice sent to that address is not a defense to liabili ty

under this section, if the drawer has had actual notice for 30 days that the check has been

dishonored.

An affidavit of service by mailing shall be retained by the payee or holder of the check.

Subd. 4. [PROOF OF IDENTITY.]

The check is prima facie evidence of the identity of the issuer if the person receiving the check:

(a) records the following information about the issuer on the check, unless it is printed on the face of the check:

(1) name;

(2) home or work address;

(3) home or work telephone number; and

(4) identification number issued pursuant to section 171.07;

(b) compares the issuer's physical appearance, signature, and the personal information recorded on the check with the drawer's issuer's identification card issued

pursuant to section 171.07; and

(c) initials the check to indicate compliance with these requirements.

Subd. 5. [DEFENSES.]

Any defense otherwise available to the issuer also applies to liability under this section.

609.535 Issuance of dishonored checks.

Subdivision 1. Definitions.

For the purpose of this section, the following terms have the meanings given them.(a) "Check" means a check, draft, order of withdrawal, or similar negotiable or nonnegotiable instrument.

(b) "Credit" means an arrangement or understanding with the drawee for the payment of a check.

Subd. 2. Acts constituting.

Whoever issues a check which, at the time of issuance, the issuer intends shall not be paid, is

guilty of issuing a dishonored check and may be sentenced as provided in subdivision 2a. In

addition, restitution may be ordered by the court.

Subd. 2a. Penalties. (a) A person who is convicted of issuing a dishonored check under subdivision 2 may

be sentenced as follows:

(1) to imprisonment for not more than five years or to payment of a fine of not more than $10,000, or both, if the value of the dishonored check, or

checks aggregated under paragraph (b), is more than $500;

(2) to imprisonment for not more than one year or to payment of a fine of not more than $3,000, or both, if the value of the dishonored check, or checks

aggregated under paragraph (b), is more than $250 but not more than

$500; or

(3) to imprisonment for not more than 90 days or to payment of a fine of not more than $700, or both, if the value of the dishonored check, or checks

aggregated under paragraph (b), is not more than $250.

(b) In a prosecution under this subdivision, the value of dishonored checks issued by the defendant in violation of this subdivision within any six-month period may be

aggregated and the defendant charged accordingly in applying this section. When

two or more offenses are committed by the same person in two or more counties,

the accused may be prosecuted in any county in which one of the dishonored

checks was issued for all of the offenses aggregated under this paragraph.

Subd. 3. Proof of intent.

Any of the following is evidence sufficient to sustain a finding that the person at the time the

person issued the check intended it should not be paid:

(1) proof that, at the time of issuance, the issuer did not have an account with the drawee;

(2) proof that, at the time of issuance, the issuer did not have sufficient funds or credit with the drawee and that the issuer failed to pay the check within five business

days after mailing of notice of nonpayment or dishonor as provided in this

subdivision; or

(3) proof that, when presentment was made within a reasonable time, the issuer did not have sufficient funds or credit with the drawee and that the issuer failed to pay

the check within five business days after mailing of notice of nonpayment or

dishonor as provided in this subdivision.

Notice of nonpayment or dishonor that includes a citation to and a description of the penalties in

this section shall be sent by the payee or holder of the check to the maker or drawer by certified

mail, return receipt requested, or by regular mail, supported by an affidavit of service by mailing,

to the address printed on the check. Refusal by the maker or drawer of the check to accept

certified mail notice or failure to claim certified or regular mail notice is not a defense tha t notice

was not received.

The notice may state that unless the check is paid in full within five business days after mailing

of the notice of nonpayment or dishonor, the payee or holder of the check will or may refer the

matter to proper authorities for prosecution under this section.

An affidavit of service by mailing shall be retained by the payee or holder of the check.

Subd. 4. Proof of lack of funds or credit.

If the check has been protested, the notice of protest is admissible as proof of presentation,

nonpayment, and protest, and is evidence sufficient to sustain a finding that there was a lack of

funds or credit with the drawee.

Subd. 5. Exceptions.

This section does not apply to a postdated check or to a check given for a past consideration,

except a payroll check or a check issued to a fund for employee benefits.

Subd. 6. Release of account information to law enforcement authorities.

A drawee shall release the information specified below to any state, county, or local law

enforcement or prosecuting authority which certifies in writing that it is investigating or

prosecuting a complaint against the drawer under this section or section 609.52, subdivision 2,

clause (3)(a), and that 15 days have elapsed since the mailing of the notice of dishonor required

by subdivisions 3 and 8. This subdivision applies to the following information relating to the

drawer's account:(1) documents relating to the opening of the account by the drawer and to the closing of the account;

(2) notices regarding nonsufficient funds, overdrafts, and the dishonor of any check drawn on the account within a period of six months of the date of request;

(3) periodic statements mailed to the drawer by the drawee for the periods immediately prior to, during, and subsequent to the issuance of any check which

is the subject of the investigation or prosecution; or

(4) the last known home and business addresses and telephone numbers of the drawer.

The drawee shall release all of the information described in clauses (1) to (4) that it possesses

within ten days after receipt of a request conforming to all of the provisions of this subdivision.

The drawee may not impose a fee for furnishing this information to law enforcement or

prosecuting authorities.

A drawee is not liable in a criminal or civil proceeding for releasing information in accordance

with this subdivision.

Subd. 7. Release of account information to payee or holder. (a) A drawee shall release the information specified in paragraph (b), clauses (1) to (3) to the payee or holder of a check that has been dishonored who makes a

written request for this information and states in writing that the check has been

dishonored and that 30 days have elapsed since the mailing of the notice

described in subdivision 8 and who accompanies this request with a copy of the

dishonored check and a copy of the notice of dishonor.

The requesting payee or holder shall notify the drawee immediately to cancel this

request if payment is made before the drawee has released this information.

(b) This subdivision applies to the following information relating to the drawer's account:

(1) Whether at the time the check was issued or presented for payment the drawer had sufficient funds or credit with the drawee, and whether at that

time the account was open, closed, or restricted for any reason and the

date it was closed or restricted;

(2) The last known home address and telephone number of the drawer. The drawee may not release the address or telephone number of the place of

employment of the drawer unless the drawer is a business entity or the

place of employment is the home; and

(3) A statement as to whether the aggregated value of dishonored checks attributable to the drawer within six months before or after the date of the

dishonored check exceeds $250; for purposes of this clause, a check is not

dishonored if payment was not made pursuant to a stop payment order.

The drawee shall release all of the information described in clauses (1) to (3) that

it possesses within ten days after receipt of a request conforming to all of the

provisions of this subdivision. The drawee may require the person requesting the

information to pay the reasonable costs, not to exceed 15 cents per page, of

reproducing and mailing the requested information.

(c) A drawee is not liable in a criminal or civil proceeding for releasing information in accordance with this subdivision.

Subd. 8. Notice.

The provisions of subdivisions 6 and 7 are not applicable unless the notice to the maker or

drawer required by subdivision 3 states that if the check is not paid in full within five business

days after mailing of the notice, the drawee will be authorized to release information relating to

the account to the payee or holder of the check and may also release this information to law

enforcement or prosecuting authorities.

Useful suggestions for preparing your ‘Insufficient Funds Check Packet City Of St Cloud’ online

Are you weary of dealing with tedious paperwork? Look no further than airSlate SignNow, the optimal eSignature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and authorize paperwork online. Leverage the robust features integrated into this user-friendly and cost-effective platform to transform your document management strategy. Whether you need to approve forms or gather electronic signatures, airSlate SignNow manages it all seamlessly, requiring just a few clicks.

Adhere to this detailed guide:

- Log into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Insufficient Funds Check Packet City Of St Cloud’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Insert and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your version, or transform it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Insufficient Funds Check Packet City Of St Cloud or send it for notarization—our solution provides everything you require to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!