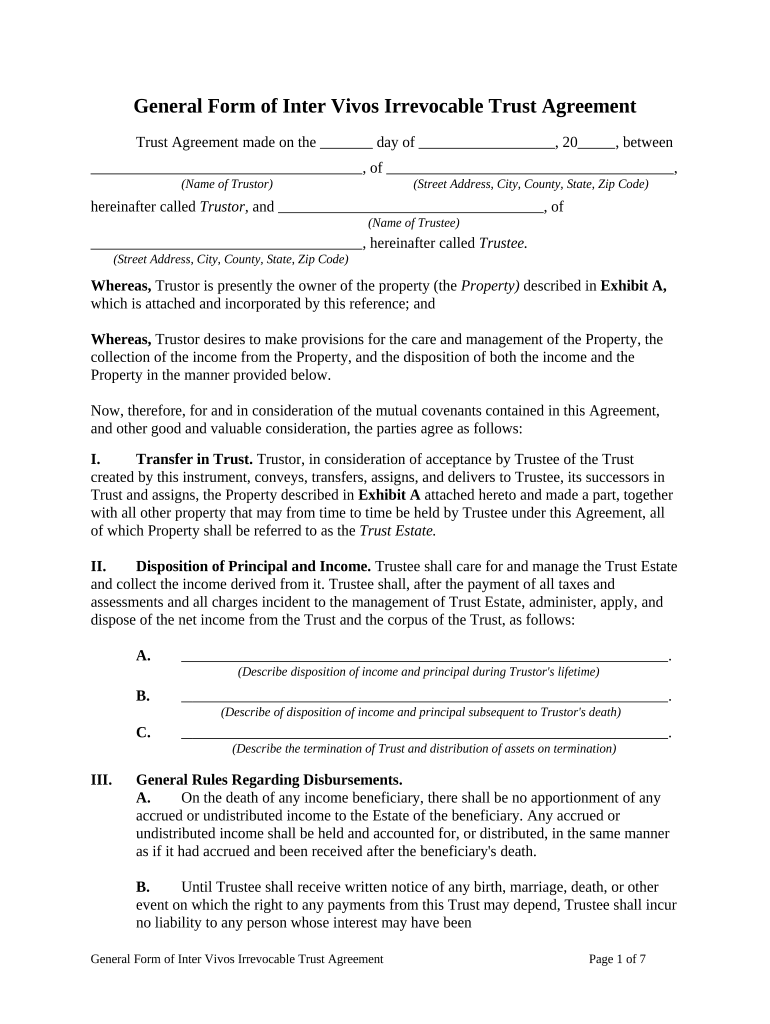

General Form of Inter Vivos Irrevocable Trust Agreement

Trust Agreement made on the day of , 20 , between

, of ,

(Name of Trustor) (Street Address, City, County, State, Zip Code)

hereinafter called Trustor, and , of

(Name of Trustee)

, hereinafter called Trustee.

(Street Address, City, County, State, Zip Code)

Whereas, Trustor is presently the owner of the property (the Property) described in Exhibit A,

which is attached and incorporated by this reference; and

Whereas, Trustor desires to make provisions for the care and management of the Property, the

collection of the income from the Property, and the disposition of both the income and the

Property in the manner provided below.

Now, therefore, for and in consideration of the mutual covenants contained in this Agreement,

and other good and valuable consideration, the parties agree as follows:

I. Transfer in Trust. Trustor, in consideration of acceptance by Trustee of the Trust

created by this instrument, conveys, transfers, assigns, and delivers to Trustee, its successors in

Trust and assigns, the Property described in Exhibit A attached hereto and made a part, together

with all other property that may from time to time be held by Trustee under this Agreement, all

of which Property shall be referred to as the Trust Estate.

II. Disposition of Principal and Income. Trustee shall care for and manage the Trust Estate

and collect the income derived from it. Trustee shall, after the payment of all taxes and

assessments and all charges incident to the management of Trust Estate, administer, apply, and

dispose of the net income from the Trust and the corpus of the Trust, as follows:

A. .

(Describe disposition of income and principal during Trustor's lifetime)

B. .

(Describe of disposition of income and principal subsequent to Trustor's death)

C. .

(Describe the termination of Trust and distribution of assets on termination)

III. General Rules Regarding Disbursements.

A. On the death of any income beneficiary, there shall be no apportionment of any

accrued or undistributed income to the Estate of the beneficiary. Any accrued or

undistributed income shall be held and accounted for, or distributed, in the same manner

as if it had accrued and been received after the beneficiary's death.

B. Until Trustee shall receive written notice of any birth, marriage, death, or other

event on which the right to any payments from this Trust may depend, Trustee shall incur

no liability to any person whose interest may have been

General Form of Inter Vivos Irrevocable Trust Agreement Page 1 of 7

affected by that event for disbursements made in good faith.

C. If Trustor's and Trustor shall both die either in or as a

(wife or husband)

result of a common accident or disaster or under such circumstances that it is difficult or

impracticable to determine who survived the other, then for purposes of this Agreement

Trustor's shall be deemed to have survived Trustor. If any

(wife or husband)

beneficiary under this Agreement other than Trustor's and

(wife or husband)

Trustor, or any other person on whose death the rights of the beneficiary under this

Agreement depend, shall both die either in or as a result of a common accident or disaster

or under such circumstances that it is difficult or impracticable to determine who

survived the other, then for purposes of this Agreement the beneficiary shall be deemed

to have predeceased Trustor or such other person, as the case may be.

D. In any case in which Trustee is authorized in its discretion, or is directed, or both,

to pay or distribute income to any beneficiary, whether a minor or otherwise, Trustee

may, in its sole discretion, at any time, apply the full or any part of the income to or for

the care, comfort, maintenance, support, education, use, or other benefit of the

beneficiary directly, instead of paying or distributing the same to the beneficiary.

E. In case any beneficiary shall be a minor or incompetent, Trustee may, in its sole

discretion, make payment or distribution of any Property to which the minor or

incompetent shall be entitled under this Agreement to the guardian, legal or natural, the

committee, or any other legal representative, wherever appointed, of the minor or

incompetent or to the person with whom the minor or incompetent shall reside. The

written receipt of the person or persons to whom any such payment or distribution is so

made shall be a full and sufficient discharge of Trustee for the same even though Trustee

may be such person or one of such persons.

IV. Additions to Trust. Trustor, and any other person, shall have the right at any time to add

Property acceptable to Trustee to this Trust. Such Property, when received and accepted by

Trustee, shall become part of the Trust Estate.

V. Powers of Trustee. In addition to any powers given to it by law or otherwise, Trustee is

authorized and empowered with respect to any property at any time held under any provision of

this Agreement, including accumulated income, if any, and any property held pursuant to any

power in Trust, and until the actual distribution of the property:

A. To sell on such terms and conditions as it in its sole discretion may determine.

B. To invest and reinvest in and to acquire by exchange or otherwise property of any

character including stocks of any classification, obligations, or other property, real or

personal, whether or not of the same kind, and participations in any common trust fund

administered by Trustee, without regard to diversification and without being limited to

the investments authorized by law for the investment of trust funds.

General Form of Inter Vivos Irrevocable Trust Agreement Page 2 of 7

C. To retain property of any kind received by it without regard to diversification and

without being limited to the investments authorized by law for the investment of trust

funds.

D. To join in, consent to, or become a party to any reorganization, merger,

consolidation, dissolution, readjustment, exchange, or other transaction and any plan or

action under or in connection with the same; to deposit any such property with any

protective, reorganizational, or similar committee; to delegate discretionary powers to the

committee and to share in the payment of its expenses and compensation and to pay any

assessments levied with respect to the property and to receive property under any

reorganization, merger, consolidation, dissolution, readjustment, exchange or other

transaction whether or not the same is authorized by law for the investment of trust funds.

E. To exercise all conversion, subscription, voting, and other rights of whatsoever

nature pertaining to any such property and to grant proxies, discretionary or otherwise,

with respect to those rights.

F. To make and retain joint investments and investments of undivided interests in

any property, real or personal, whether or not all the property is held under this

agreement and whether or not the provisions under which such other property is held are

similar.

G . With respect to any real property (including real property acquired on foreclosure

or by deed in lieu of foreclosure) at any time held under this agreement, to sell, exchange,

partition, lease, sublease, mortgage, improve, or otherwise alter on such terms as it may

deem proper, and to execute and deliver deeds, leases, mortgages, or other instruments

relating to the real property. Any lease may be made for such period of time, including a

lease beyond a - year period, as it may deem proper and without the approval

(e.g. five)

of any court.

H. To extend the time of payment of any bond (or other obligation) and mortgage

held by it, or of any installment of principal or interest or hold such bond (or other

obligation) and mortgage after maturity as past due; to consent to the alteration or

modification of any terms of the same, waive defaults in the performance of the terms of

the same; to foreclose any such mortgage or compromise or settle claims under the

mortgage; to take over, take title to, or manage the property, or any part of it, affected by

any such mortgage, either temporarily or permanently, and in partial or complete

satisfaction of any claim under the mortgage; to protect the property against or redeem it

from foreclosure or nonpayment of taxes, assessments, or other liens; to insure, protect,

maintain, and repair the property; and generally without limitation by the foregoing

specification to exercise with respect to such bond (or other obligation) and mortgage on

such property all rights and powers as may be exercised by a person owning similar

property in his or her own right.

I. To borrow money to provide funds for any purpose without resorting to the sale

of any assets; and for the purpose of securing the repayment of the borrowed money, to

pledge, mortgage, or otherwise encumber any and all such property on such terms,

General Form of Inter Vivos Irrevocable Trust Agreement Page 3 of 7

covenants, and conditions as it may deem proper and also to extend the time of payment

of any loans or encumbrances which at any time may be encumbrances on any such

property irrespective of by whom the same were made or where the obligations may or

should ultimately be borne on such terms, covenants, and conditions as it may deem

proper.

J. Without limitation by the specification of the following, to exercise any and all

the powers, authorities, and discretions provided in this agreement in respect of any

shares of stock of Trustee and any successor corporation whether by merger,

consolidation, reorganization, sale, or otherwise.

K. To register any property belonging to any Trust created by this Agreement in the

name of its nominee, or to hold the same unregistered, or in such form that title shall pass

by delivery.

L. To distribute in cash or in kind or partly in cash and partly in kind.

VI. Duration of Powers of Trustee. All of the rights, powers, authorities, privileges, and

immunities given to Trustee by this Agreement shall continue after termination of the Trust

created by this Agreement until Trustee shall have made actual distribution of all Property held

by it under this Agreement.

VII. Directions to Trustee. If and so long as any person, including Trustor, is authorized by

this Agreement to direct Trustee with respect to sales or retention of Trust Property, and

investments and reinvestments of Trust funds, Trustee shall not be accountable for any loss

sustained by reason of any action taken or omitted pursuant to the written direction of such

person. No person dealing with Trustee need inquire whether such directions have been complied

with by Trustee.

VIII. Transactions with Third Parties. No person dealing with Trustee shall be bound to

administer the application or disposition of cash or other Property transferred to Trustee, or to

inquire into the authority for, or propriety of, any action by Trustee.

IX. Bond of Trustee; Court Approval and Personal Liability. No bond, surety or other

security shall be required of Trustee for the faithful performance of its duties under this

Agreement, any law of any state or other jurisdiction to the contrary notwithstanding. Also,

Trustee shall not be required to qualify before, be appointed by, or, in the absence of breach of

Trust, account to any court, or to obtain the order or approval of any court in the exercise of any

power or discretion under this Agreement. Trustee shall not be personally liable on any contract,

note, or other instrument executed by it as Trustee under this Agreement or for any indebtedness

of the Trust Estate.

X. Compensation. The original Trustee under this Agreement, and all successor Trustees,

shall be entitled to reasonable compensation for their services as Trustee.

XI. Resignation and Succession of Trustees.

A. Trustee, or any successor, may resign at any time on giving written notice

General Form of Inter Vivos Irrevocable Trust Agreement Page 4 of 7

days before the resignation shall take effect, to Trustor or, after the death of

(Number)

Trustor, to all adult beneficiaries and to a parent, or a guardian, if any, of each minor or

incompetent beneficiary who may then be receiving or entitled to receive income under

this Agreement.

B. Those to whom a notice of resignation may be given shall unanimously designate

a successor Trustee by written notice to the resigning Trustee within days

(Number)

after receipt of notice of resignation. If a successor Trustee shall not be so designated, the

resigning Trustee shall have the right to secure the appointment of a successor Trustee by

a court of competent jurisdiction, at the expense of the Trust Estate.

C. The resigning Trustee shall transfer and deliver to its successor the then-entire

Trust Estate. The resigning Trustee shall then be discharged as Trustee of this Trust and

shall have no further powers, discretions, rights, obligations, or duties in reference to the

Trust Estate. On the day the resignation becomes final, all powers, discretions, rights,

obligations, and duties of the resigning Trustee shall inure to, and be binding on, the

successor Trustee.

XII. Allocation of Income and Principal. Trustee shall determine what is income and what is

principal of the Trust created under this Agreement. Trustee shall determine what expenses,

costs, taxes, and charges of any kind whatever shall be charged against income and what shall be

charged against principal in accordance with the applicable statutes of

(Name of State)

as they now exist and may from time to time be enacted, amended, or repealed.

XIII. Accounting. Trustee shall not be required to file annual or other accounts in any court.

However, Trustee shall render annual statements of account to Trustor and after Trustor's death

to all adult beneficiaries, and shall, whenever called on to do so, exhibit to any of the

beneficiaries of the Trust created by this Agreement all documents, securities, and papers

forming part of, or relating to, the Trust. The approval of any account of Trustee, in an

instrument signed by or on behalf of the beneficiary or beneficiaries at the time of approval of

the current Trust income shall be a complete release and discharge of Trustee with respect to the

administration of the Trust Property, insofar as the administration is reflected in the account, for

the period covered by the account. Any item of an account to which no objection is made in

writing to Trustee within days after delivery of the account to Trustor, or after

(Number)

Trustor's death to any adult beneficiary, shall be conclusively presumed to be approved by all

parties to whom the account was delivered.

XIV. Purpose and General Construction of Trust. The primary purpose and intent

General Form of Inter Vivos Irrevocable Trust Agreement Page 5 of 7

of Trustor in creating the Trust under this Agreement is to benefit those who shall from time to

time be income beneficiaries. The rights and interest of remaindermen and of successor income

beneficiaries are subordinate to that purpose. The provisions of this Agreement shall be liberally

construed in the interest and for the benefit of the current income beneficiaries of the Trust

Estate. The foregoing shall not, however, be deemed to limit the discretion conferred on Trustee

by this Agreement.

XV. Definitions.

A. The words “child,” “children” and “issue,” wherever used in this Agreement,

shall include persons who shall have been legally adopted, and any children or issue,

whether natural or legally adopted, of any such legally adopted persons.

B. The words “child” and “children,” wherever used in this Agreement, shall not

include grandchildren or more remote descendants.

C. The word “issue,” wherever used in this Agreement, shall include descendants of

whatever degree.

D. In any case in which any Property is disposed of under this Agreement to

Trustor's issue or the issue of any other person, such issue shall take per stirpes and not

per capita, except that where all of the issue who shall be entitled to take shall be of an

equal degree of consanguinity to Trustor or such other person, as the case may be, such

issue shall take per capita.

XVI. Spendthrift Provision. No title or interest in the money or other Property constituting

the principal of the Trust Estate, or in any income accruing from or on the principal, shall vest in

any beneficiary during the continuance of the Trust created by this Agreement. No such

beneficiary shall have the power or authority to anticipate in any way any of the rents, issues,

profits, income, monies, or payments provided or authorized to be paid to the beneficiary, or any

part of the same, nor to alienate, convey, transfer, or dispose of the same or any interest in or any

part of the same in advance of payment. None of the same shall be involuntarily alienated by any

beneficiary or be subject to attachment, execution, or be levied on or taken on any process for

any debts that any beneficiary of the Trust shall have contracted or shall contract, or in

satisfaction of any demands or obligations that any beneficiary shall incur. All payments

authorized and provided to be made by Trustee shall be made and shall be valid and effectual

only when paid to the beneficiary to whom the same shall belong, or otherwise as provided in

this Agreement.

XVII. Perpetuities Savings Clause. Any other term or provision of this Agreement to the

contrary notwithstanding, the Trust created by this Agreement shall not continue beyond, but

shall terminate, years after the death of the last survivor of Trustor, Trustor's

(Number)

present spouse, and any beneficiary named in and living on the date of this Agreement.

XVIII. Revocation and Amendment. This Trust shall be irrevocable and shall not be altered,

amended, revoked, or terminated by Trustor or any other person

General Form of Inter Vivos Irrevocable Trust Agreement Page 6 of 7

XIX . Governing Law. This Trust shall be governed and construed in all respects according to

the laws of the state of .

(Name of State)

XX. Binding Effect. This Agreement shall be binding on Trustor, Trustor's executor,

administrator, successors and assigns, and Trustee and Trustee's successors and assigns.

Trustor and Trustee have executed this Agreement as of the day and year first above

written.

By: By:

(Signature of Trustor) (Signature of Trustee)

(Printed Name of Trustor) (Printed Name of Trustee)

( Acknowledgments before Notary Public)

(Attach Exhibit)

General Form of Inter Vivos Irrevocable Trust Agreement Page 7 of 7