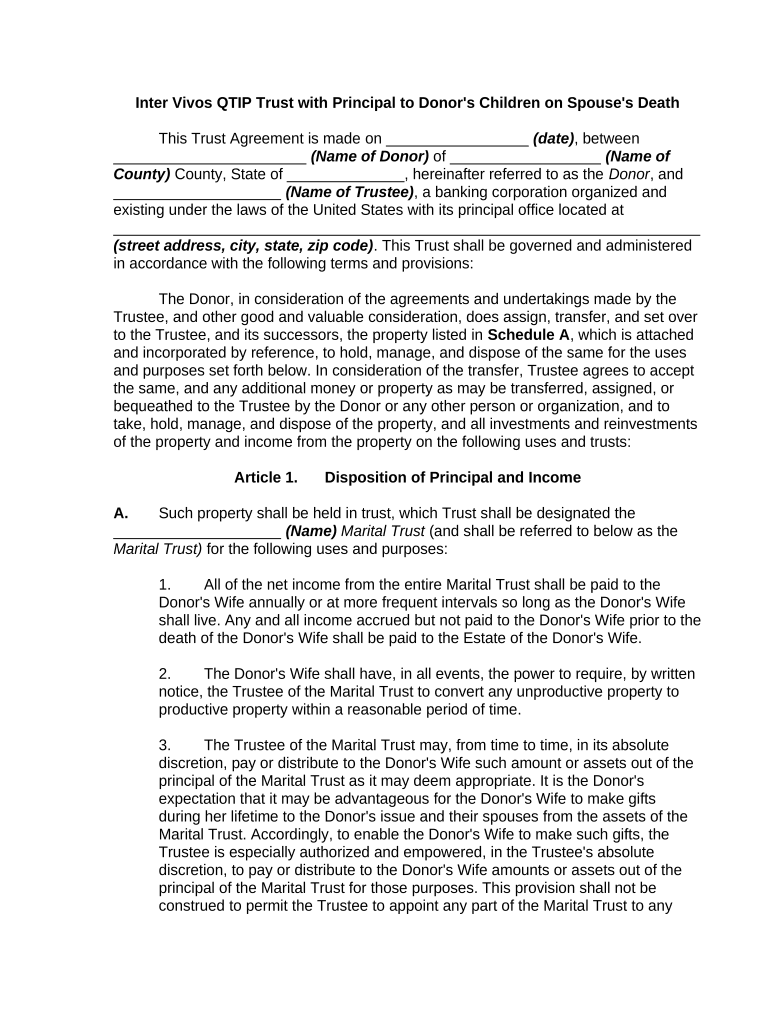

Inter Vivos QTIP Trust with Principal to Donor's Children on Spouse's Death

This Trust Agreement is made on _________________ ( date) , between

_______________________ (Name of Donor) of __________________ (Name of

County) County, State of ______________, hereinafter referred to as the Donor , and

____________________ (Name of Trustee) , a banking corporation organized and

existing under the laws of the United States with its principal office located at

______________________________________________________________________

(street address, city, state, zip code) . This Trust shall be governed and administered

in accordance with the following terms and provisions:

The Donor, in consideration of the agreements and undertakings made by the

Trustee, and other good and valuable consideration, does assign, transfer, and set over

to the Trustee, and its successors, the property listed in Schedule A , which is attached

and incorporated by reference, to hold, manage, and dispose of the same for the uses

and purposes set forth below. In consideration of the transfer, Trustee agrees to accept

the same, and any additional money or property as may be transferred, assigned, or

bequeathed to the Trustee by the Donor or any other person or organization, and to

take, hold, manage, and dispose of the property, and all investments and reinvestments

of the property and income from the property on the following uses and trusts:

Article 1. Disposition of Principal and Income

A. Such property shall be held in trust, which Trust shall be designated the

____________________ (Name) Marital Trust (and shall be referred to below as the

Marital Trust) for the following uses and purposes:

1. All of the net income from the entire Marital Trust shall be paid to the

Donor's Wife annually or at more frequent intervals so long as the Donor's Wife

shall live. Any and all income accrued but not paid to the Donor's Wife prior to the

death of the Donor's Wife shall be paid to the Estate of the Donor's Wife.

2. The Donor's Wife shall have, in all events, the power to require, by written

notice, the Trustee of the Marital Trust to convert any unproductive property to

productive property within a reasonable period of time.

3. The Trustee of the Marital Trust may, from time to time, in its absolute

discretion, pay or distribute to the Donor's Wife such amount or assets out of the

principal of the Marital Trust as it may deem appropriate. It is the Donor's

expectation that it may be advantageous for the Donor's Wife to make gifts

during her lifetime to the Donor's issue and their spouses from the assets of the

Marital Trust. Accordingly, to enable the Donor's Wife to make such gifts, the

Trustee is especially authorized and empowered, in the Trustee's absolute

discretion, to pay or distribute to the Donor's Wife amounts or assets out of the

principal of the Marital Trust for those purposes. This provision shall not be

construed to permit the Trustee to appoint any part of the Marital Trust to any

person other than the Donor's Wife or to impose any obligation on the Donor's

Wife to make such gifts.

4. On the death of the Donor's Wife, an amount equal to the additional

federal estate and inheritance taxes imposed on the Estate of Donor's Wife shall

be paid by this Trust in satisfaction of the taxes.

B. On the death of the Donor's Wife, the then remaining principal of the Trust shall

be divided by the Trustee into as many equal shares as there shall be children of the

Donor then surviving and deceased children of the Donor leaving issue then surviving,

each of which shares shall be held and administered as follows:

1. One such share shall be paid and distributed to each of the then surviving

children of the Donor and one such share, per stirpes, to the then surviving issue

of each then deceased child of the Donor; provided, however, that if any such

child of the Donor shall not have attained the age of ____ years, or if any such

child of a deceased child of the Donor shall not then have attained the age of 21

years, the share or partial share which would otherwise be paid and distributed to

the child or grandchild of the Donor (but not the share or partial share of any

issue of any deceased grandchild of the Donor, which share shall be paid and

distributed to such issue free of Trust) shall be designated with the name of the

child or grandchild and shall continue to be held as a separate and distinct Trust

and Trust fund for the following uses and purposes:

a. With respect to each such Trust, the Trustee may, from time to time

in its sole and absolute discretion, pay or distribute to any one or more

then living of the group consisting of the child or grandchild with whose

name the Trust is designated, the spouses and issue of the child or

grandchild, and the parent of the grandchild, such part or all of the net

income of the Trust as they may deem appropriate.

b. When any child of the Donor with whose name such a Trust is

designated shall have attained the age of _____ years, ______% of the

principal of the Trust designated with the name of the child shall be paid

and distributed to that child; when any child shall have attained the age of

______ years, ____________% of the remaining balance of the principal

of the Trust shall be paid and distributed to the child; provided, however,

that the Trustee may in the Trustee's absolute discretion postpone the

date on which the right to the mentioned distributions vest for a period not

exceeding (e.g., two) _____ years.

c. When any child of the Donor with whose name such a Trust is

designated shall have attained the age of ______ years, or when any

grandchild of the Donor with whose name such a Trust is designated shall

have attained the age of 21 years, the entire remaining principal of the

Trust designated with the name of the child or grandchild, together with

any and all accrued, accumulated, and undistributed income shall be paid

and distributed to the child or grandchild, as the case may be.

d. If any child of the Donor with whose name such a Trust is

designated shall die prior to the termination of the Trust, the entire

principal of the Trust shall be paid and distributed to the estate of the child

of the Donor.

e. If any grandchild of the Donor with whose name such a Trust is

designated shall die prior to the termination of the Trust, the entire

principal of the Trust designated with the name of the grandchild shall be

paid and distributed to the estate of the grandchild.

2. Net income not required to be paid or distributed from any Trust created

by this article may be added to any subsequent income payment from the Trust.

Until distributed, accumulated income shall be regarded for all purposes under

this Trust as principal of the respective Trusts created by this Article.

3. If, prior to the time that any Trust fund shall be set up for and designated

with the name of any person under the foregoing provisions, or any addition shall

be made to any such fund, or any other fund or share of any other fund shall

become payable to him or her or to a Trust for his or her benefit under the

provisions of this agreement, the person shall have arrived at the age when a

mandatory partial or total distribution to him or her is required under the terms of

this agreement, then the person's fund or share of any other fund promptly shall

be partially or totally paid and distributed to the person in the same proportions

as required by such mandatory provisions.

C. If at any time after the death of the Donor's Wife, there shall be no beneficiary

eligible to receive the income or principal of any Trust created under this agreement,

then the entire principal of the Trust shall be paid and distributed to the persons then

living who would have been the next of kin of the person with whose names the Trust is

designated, if the person had died at the time or times of such payment and distribution,

under the then existing laws of ________________ (name of state) relating to the

distribution of intestate personal property, in the proportions prescribed by such laws;

provided, however, that for purposes of this paragraph, the Donor shall be deemed to

have predeceased the beneficiary.

D. With respect to any Trust or Trust fund created under this Article 1 , the Trustee

may pay to or apply for the benefit of any beneficiary currently eligible to receive the

income or any part of it arising from any such Trust fund such amounts out of the

principal of the Trust fund as the Trustee in its absolute discretion may deem

appropriate. No such payment or distribution shall constitute an advance against any

amount receivable by any person from any Trust created by this Article 1 , unless the

Trustee shall otherwise provide in writing at the time of making the payment, and then

only to the extent so provided.

E. All interest, both in income and in principal, in all Trusts created in this Article 1

are intended for the personal protection and welfare of the beneficiaries of the Trusts;

no such interest shall be transferable, voluntarily or involuntarily, by the beneficiary nor

subject to the claims of creditors or of a spouse or former spouse of the beneficiary.

F. Any of the Trusts created under this Article 1 may be terminated, in whole or in

part, at any time after the death of the Donor's Wife, if such action is deemed advisable

and for the best interests of the Trust or Trusts, or the beneficiaries of them, for any

reason whatsoever (including the determination that the principal of the Trust is so small

as to make the efficient management of it impractical) in the sole discretion of the

Trustee whose judgment shall be conclusive and free from question by anyone or in any

court. In the event of such termination, the principal of each Trust so terminated,

together with the accrued, accumulated, and undistributed income, shall be paid over

and distributed to the person with whose name the Trust is designated.

G. Any person may irrevocably disclaim and renounce any part or all of any gift

made to the person by this Article. Any such disclaimer and renunciation shall be

effected in the manner required by applicable law. If any person disclaims and

renounces all interest in all or any part of any gift made to the person by this Article, all

of the gift or all of such part shall be disposed of as if the person had died prior to the

time when the gift vested.

H. Notwithstanding any other provision of this instrument with respect to the time of

the termination of any Trust created by this instrument, if on the expiration of the period

of twenty years and eleven months immediately following the death of the last survivor

of the Donor, the Donor's Wife and the Donor's issue living on the day preceding the

date of the execution of this instrument, any Trust created by this instrument, or any part

of any such Trust, shall then remain in existence, then the Trust or part of it shall

promptly be paid and distributed to the person with whose name the Trust is

designated.

Article 2 Additions to Trust

The Donor or any other person or organization may, at any time, give, transfer, or

bequeath to this Trust or to any separate Trust fund created under this agreement,

either by inter vivos transfer or testamentary disposition, additional money or property of

any kind acceptable to the Trustee. In that event, such additional property shall become

a part of the corpus of the Trust or Trust fund to which it is given and shall be divided,

allocated, administered, and distributed as if it originally had been a part of the same.

The Trustee may assume any obligation associated with any such property.

Article 3 Discretion of Trustee

In making any division or apportionment of any Trust created by this instrument,

or of any portion of such Trust, for the purpose of creating any fund or portion, or any

part of the same, or for any other purpose of whatever nature, the Trustee shall not be

required to convert any property, real or personal, tangible or intangible, into money or

to divide or apportion each or any item of property, but the Trustee may allot all or any

part (including an undivided interest) of any item of property, real or personal, tangible

or intangible, to any fund or to any beneficiary provided for by this instrument; or the

Trustee may convert any property, real or personal, into any other form, it being the

Donor's intent and purpose to leave all such divisions and apportionments entirely to the

discretion of the Trustee with the direction merely that each fund, share, portion, or part

at any time created or provided for in this agreement shall be constituted so that the

same in the judgment of the Trustee shall have the value, relative or absolute,

designated by this instrument.

Article 4 Irrevocability

It is the intention of the Donor that this instrument shall constitute an irrevocable

gift in Trust of all property at any time held under this agreement. Any right, title, or

reversionary interest in that property, of any kind or description, which the Donor now

has or may subsequently acquire, either by operation of law or otherwise, is renounced

and relinquished forever. Any future gift of property to this Trust whether by the Donor

or any other person shall likewise be irrevocable. Any right, title, or reversionary interest

in that property, of any kind and description, which the Donor of it may have or

subsequently acquire, by operation of law or otherwise, shall, by the making of the gift

to this Trust, be renounced and relinquished forever.

Article 5 Principal and Income

All questions relating to the ascertainment of income and principal and the

allocation of receipts and disbursements between income and principal shall be

resolved by the Trustee in accordance with the terms of the Uniform Principal and

Income Act from time to time in effect in _________________ (name of state) , or if that

Act should be abolished, then in accordance with the terms of the Act as it was last in

effect in ________________ (name of state) ; provided, however, that the Trustee may

withhold from amounts otherwise payable as income under the Act a reasonable

allowance for depreciation or depletion on property subject to depreciation or depletion

under generally accepted accounting principles, and provided further, that the Trustee

may allocate annual Trustee' fees partially or entirely to income, in its discretion.

Article 6 Payments to Minor of Incompetent

A. If any person to whom any payment or distribution from any Trust created by this

instrument is required or permitted by any provision of this instrument to be made is

then a minor, incompetent, or for any other reason incapable of receiving such payment

or distribution, or if there is a substantial risk that the payment or distribution will be

involuntarily diverted from benefiting such person, the Trustee may, but need not, from

time to time exercise any one or more of the following powers:

1. Transfer property to the name of the person (as by depositing cash or

registering securities in the person's name), whether or not the person is then

able to exercise control over the property.

2. Transfer property to any custodian or guardian of the property of the

person without bond.

3. Transfer property to the Trustee of any Trust empowered to receive and

hold the property and to distribute the property and any income from it to that

person as soon as the person is capable of receiving it without substantial risk of

involuntary diversion, if the transfer will not fail because of a violation of any rule

against perpetuities, the accumulation of profits, restraint on alienation, the

duration of Trusts, or the remoteness of vesting.

4. Transfer property to any creditor of the person in discharge of any debts of

the person.

5. Use such payment or distribution to obtain goods or services for the

person if any debt of any other person is not consequently discharged.

B. Nothing contained in this article shall authorize any Trustee to transfer any

property to itself in a nonfiduciary capacity or to use any such payment or distribution to

support or maintain any person whom the Trustee is obligated to support or maintain.

C. No such payment or distribution shall absolve any person from any obligation to

support or maintain the beneficiary of the payment or distribution.

D. The receipt of any person to whom property is transferred pursuant to this Article

or other evidence of application made under this agreement for the benefit of any

beneficiary shall fully discharge the Trustee from any further liability in connection with

such payment or distribution.

E. The determinations of the Trustee with respect to all matters referred to in this

article shall be final.

Article 7 Powers of Trustee

Subject to the provisions and limitations set forth in this instrument, the Trustee

shall have the powers granted below in addition to the powers granted by applicable

law. The powers granted below shall not be exhausted by any use of them, but each

shall be continuing; and each shall continue and be exercisable until all provisions of

this instrument are fully executed. Any of the powers granted may be exercised without

the license or authorization of any court or other legal authority. The determination of

the Trustee with respect to whether to exercise any power shall be final. These powers

are the following powers:

A. To change the situs of the Trust and of any property which is part of the

Trust to any place in the United States of America or any other country.

B. Not to file an inventory of the property which is part of the Trust nor annual

accounts of administration with and not to have any of the property examined by

any court where such filing or examination is not required by applicable law.

C. To retain for any period of time any property which may be received or

acquired, even though its retention by reason of its character or otherwise would

not be appropriate apart from this provision.

D. To collect, receive, and receipt for rents, profits, or other income from any

property which may be held.

E. To expend money or other property in order to collect, sell, manage,

conserve, or administer any property which may be held, or in order to improve,

repair, equip, develop, furnish, maintain, alter, extend, or add to any such

property.

F. To sell at public or private sale (including, specifically, the power to initiate

or participate in any public offering or underwriting), partition, exchange for like or

unlike property, lease for any period of time even though it may be longer than

the duration of the Trust, modify, renew, or extend any lease, grant options on,

release, demolish, abandon, dedicate, and otherwise dispose of any property

which may be held, on such terms and conditions, including credit, and for such

consideration, even though it may be less than the value at which such property

was received or acquired, or for such other benefit, even though it may be

intangible, as may be deemed appropriate.

G. To transfer title to, grant rights in, and convey in fee simple or otherwise

any property which may be held, free of all Trusts.

H. To invest and reinvest in any and all kinds of securities, domestic or

foreign, including common and preferred stocks, bonds, debentures, notes,

commodity contracts, mortgages and options on property; in money market

funds, commercial paper, repurchase agreements, United States Treasury

obligations, certificates of deposit, savings accounts, checking accounts, and any

other cash investment medium; in investment Trusts and in common Trust funds;

in any real property; in any personal or mixed property; in any business, mining

or farming operation, or other venture; or in any other interest or investment

medium, even though such investment would not be of a character authorized by

applicable law but for this provision.

I. Not to diversify the property which may be held, whether the property was

originally received or subsequently acquired by exchange, investment, or

otherwise.

J. With respect to property subject to depreciation or depletion, to withhold

an amount from Trust income in the discretion of the Trustee to provide for a

reasonable allowance for depreciation or depletion on the property under

generally accepted accounting principles.

K. To retain cash for reasonable periods of time in amounts sufficient to meet

anticipated needs, including payments of expenses and to beneficiaries.

L. To do all things necessary, customary, or desirable to conduct the affairs

of an unincorporated business, mining or farming operation, real estate

operation, or other venture.

M. To do all things necessary, customary, or desirable to conduct the affairs

of any corporation; to act as officer, director, or attorney or employee of any

corporation; and to place stock in the name of a Trustee or any beneficiary of the

Trust in order to qualify him or her as a director of the corporation.

N. Alone or with others, to organize, reorganize, merge, consolidate,

recapitalize, dissolve, liquidate, or otherwise create or change the form of any

corporation, partnership, joint venture, or other entity.

O. To exercise all voting, sale, purchase, exchange, or other rights or options

with respect to any security or other property which may be held.

P. To refuse, reject, or not to exercise any offer to purchase, option to

purchase, voting, or other right or option with respect to any security or other

property which may be held.

Q. To participate in any plan or proceeding for protecting or enforcing any

right, obligation, or interest arising from any property which may be held; to serve

as a member of a security-holder protective committee; and to deposit securities

in accordance with any plan agreed on.

R. To expend money or other property, whether by bidding in at foreclosure,

by making a contribution to capital, by paying an assessment or otherwise, in

order to protect any property which may be held.

S. To pay, contest, compromise, abandon, release, adjust, submit to

arbitration, sue on, defend, and otherwise deal with and settle any claim in favor

of or against the Trust or the Trustee.

T. To receive, acquire, and retain policies of fire, motor vehicle, business

interruption, title, liability, fidelity, indemnity or other casualty insurance, either in

stock or in mutual companies, in any amount, against any risk in which the Trust

has an insurable interest.

U. To borrow money or other property for such periods of time, on such terms

and conditions, and for such purposes as may be deemed appropriate; to

mortgage, pledge, or otherwise encumber any property which may be held as

security for any such loan; and to renew, extend, or refund any existing loan

either as maker or endorser.

V. With respect to any obligation held, whether secured or unsecured, to

reduce the interest rate on it, to continue it on and after maturity with or without

renewal or extension and without regard to the then value of any security, to

foreclose on the security or to acquire the security without foreclosure.

W. To keep books of account and to make reports on such reasonable basis

and with such detail as may be deemed appropriate.

X. To execute any instrument, under seal or otherwise.

Y. To bind absolutely, by any action taken or not taken, all beneficiaries, born

or unborn, ascertained or unascertained, of the Trust as against any other party;

and no party dealing with the Trustee shall have any duty to follow any property

transferred by the party to the Trustee.

Z. To sell any property to, to exchange any property with, to purchase any

property from or otherwise to deal with any beneficiary of the Trust or with any

Trust or estate of which either the Donor, the Donor's spouse or any issue of the

Donor is or was a Donor or beneficiary, whether created by this instrument or

not, even though Trustee is also a fiduciary of such other Trust or estate; and

when dealing with any fiduciaries, the Trustee shall have no duty to follow any

property transferred by them.

AA. To act notwithstanding the self-interest of any of the Trustee, including the

powers to lease, mortgage, or sell any property to or lease or purchase any

property from any Trustee, to determine the amount of and to receive their

compensation for services as Trustee or in any other capacity; in the case of a

corporate Trustee, to borrow from, deposit money, or otherwise deal with its own

banking department, to invest in its own stock or stock of any of its affiliates, or to

invest in its own Common Trust fund, and to be interested in any investment,

corporation, unincorporated business, farming or mining operation, real estate

operation, or other venture in which the Trust is interested.

BB. To obtain the advice of accountants, attorneys-at-law, brokers, investment

counsel, realtors, appraisers, and other experts, and to compensate such experts

by salary, commission, fee, or otherwise, and to act pursuant to the advice of

such experts without independent investigation.

CC. To delegate to one or more agents: the authority to execute contracts,

checks, documents of title, and other instruments, to keep books of account, to

prepare reports and tax returns, to hold possession and record ownership of

securities, bank accounts, and other property, or to perform any other ministerial

functions; the authority to perform the following discretionary functions: the

management of any investment, unincorporated business, farming or mining

operation, and real estate operation, or other venture (whether by employing

agents, giving proxies, entering into voting trusts, or otherwise), and the selection

of the time to acquire or to dispose of any property which may be held, any

power, including this power, possessed by the Trustee which is necessary,

customary, or desirable so that the delegate may perform any function delegated

pursuant to this paragraph; and to compensate such agents by salary,

commission, fee, or otherwise.

DD. To enter into binding agreements not to exercise any power which they

possess on such terms and conditions and for such reasons as may be deemed

appropriate.

EE. To enter into any pooling or unitization agreement.

FF. To purchase options on any property.

GG. To advance money on behalf of the Trust for which advances, with any

interest, the Trustee shall have a lien on the assets of the Trust as against any

beneficiary.

HH. To permit any beneficiary to have the use, possession, and enjoyment of

any property then distributable pending actual distribution of the property.

Article 8 Governing Law

The construction, validity, and effect of this agreement and the rights and duties

of the beneficiaries and Trustee shall at all times be governed exclusively by the laws of

____________________ (name of state) .

Article 9 Limitations on Trustee’s Power

Notwithstanding any powers conferred on the Trustee elsewhere in this

agreement, no Trustee or successor Trustee or any other person shall have at any time,

or in any manner or capacity, either directly or indirectly, the power to do any of the

following in respect of any Trust or Trust fund created under this agreement:

A. To revest title to any part of the principal of any Trust fund in the Donor

(including without further mention in this Article Nine any other Donor of property

under this agreement); to hold or accumulate any part of the income of any Trust

or Trust fund for future distribution to the Donor; or to distribute any part of the

income of any Trust or Trust fund to the Donor.

B. To enable any person to purchase, exchange, or otherwise deal with or

dispose of any part or all of the principal or income of any Trust or Trust fund for

less than adequate and full consideration in money or money's worth.

C. To enable the Donor directly or indirectly to borrow any part or all of the

principal or income of any Trust or Trust fund.

D. To exercise any power of administration over any Trust created under this

agreement other than in a fiduciary capacity for the benefit of the beneficiaries.

E. To apply any part of the income (whether current or accumulated) to the

payment of premiums on policies of insurance on the life of the Donor or the

Donor's spouse.

Article 10 Counterparts

This agreement may be executed in any number of counter-parts, any one of

which shall constitute the agreement between the parties.

Article 11 Amendments

The Trustee is authorized and empowered in its sole and absolute discretion to

amend, change, or supplement this instrument in any manner whatsoever, except as

provided below. Such amendments, changes, or supplements shall be effective on the

execution by the Trustee of a writing setting forth the same or as of such earlier or later

date as the Trustee may specify in the writing. However, no amendment, change, or

supplement of this instrument shall operate to diminish, enlarge, or otherwise alter the

interests of the beneficiaries, or to grant or create for the benefit of any Donor under this

agreement, directly or indirectly, any interest, right, or power, administrative or

otherwise, in the Trusts provided for, the Trust funds, or the income of the same, or to

grant to any person any power expressly forbidden under the provisions of this

agreement. The principal purpose for this power is to enable the Trustee to make

technical amendments to the Trust instrument in order that the Trust instrument will best

conform to the law, and particularly the tax law, in effect from time to time during the

continuance of the Trusts.

Article 12 Construction

A. Unless the context requires otherwise, all words used in this instrument in the

singular number shall extend to and include the plural; all words used in the plural

number shall extend to and include the singular; and all words used in any gender shall

extend to and include all genders.

B. For all purposes under this instrument, the adoption of a minor who is not an

issue of the Donor by a person or persons shall have the same effect except for

determining his or her age as if the minor were born to such person or persons on the

date of his or her adoption.

C. As used in this instrument, the terms "brother" and "sister" shall include persons

who have acquired the designated relationship by the half as well as the whole blood,

but shall be limited to persons related to the Donor by blood or adoption.

D. As used in this instrument, the term "Trustee" shall include all those holding that

office under this agreement from time to time without regard to whether they were

initially appointed, successor, or additional Trustee.

E. As used in this instrument, the term "children" means first generation offspring of

the designated ancestor; the term "issue" means both children of the designated

ancestor and lineal descendants indefinitely.

Article 13 Trustee

A. ____________________ (Name of Trustee) , a banking corporation organized

and existing under the laws of the United States with its principal office located at

______________________________________________________________________

(street address, city, state, zip code) , is appointed initial Trustee under this

agreement. Said Trustee and each of its successors may resign at any time for any

reason by delivering a written instrument to that effect to all adult beneficiaries and to

the guardians or other fiduciaries of the Estates of any minor or incompetent

beneficiaries who may then be receiving or entitled to receive income under this

Agreement. Any such resignation shall be effective as of the date of completion of

delivery of the instrument or as of such later date as shall be specified in the instrument.

B. If, for any reason, the Trustee of any Trust created under this agreement shall

cease to be a Trustee, then such person as shall have been designated by written

instrument signed by the former Trustee shall be appointed as a successor Trustee. If

no such successor Trustee shall have been so designated within (e.g. 60) ______ days

of the vacancy in the office of Trustee, or if the designated successor Trustee shall

decline to act as a Trustee, or if for any reason a successor Trustee is not or cannot be

appointed, then _________________________________________________________

______________________ (Name and address) shall act as a successor Trustee to

the Trust.

C. No Trustee to whom a payment or distribution of property, income, or corpus may

be made or withheld under any of the provisions of this Trust agreement or of any Trust

created under this agreement shall be permitted or required by the provisions of this

agreement to vote on or participate in any action taken on the same. All decisions

concerning such payment, distribution, or retention shall be made solely by the other

Trustee acting under this agreement.

D. There shall be at all times, as to each of the Trusts created by this instrument, at

least one independent Trustee. As used in this instrument, the term "independent

Trustee" shall mean, collectively, all persons, corporations, partnerships, or associations

who have no beneficial interest, vested or contingent, in the property of the Trust of

which they are Trustee, who are not "related or subordinate parties" as that term is

defined in Section 672(c) of the Internal Revenue Code of 1954, as amended. In

addition, each must be one who can possess the powers vested in it, him or her without

causing income or principal to be attributable to a Trust beneficiary for federal income,

gift, or estate tax purposes prior to the actual distribution of the income or principal to

the beneficiary. The initial independent Trustee is ___________________ (Name of

Trustee) , a banking corporation organized and existing under the laws of the United

States with its principal office located at ______________________________________

______________________________________ (street address, city, state, zip code) .

E. All discretionary powers and duties vested in any Trustee under this agreement

which is not a natural person may be exercised on its behalf, from time to time, by its

governing board, or by an appropriate committee, or by its principal officers or Trust

officers.

F. No bond or other security shall ever be required to be given or filed by any

Trustee under this agreement for the faithful execution of its duty. If, notwithstanding the

foregoing provision, a bond shall nevertheless be required, no sureties shall be required

on it.

G. No Trustee under this agreement shall be liable except for willful malfeasance or

bad faith.

IN WITNESS WHEREOF, on this the ______day of _____________, 20____,

Grantor and Trustee have signed this Instrument.

____________________________

(Printed Name of Grantor )

____________________________

(Signature of Grantor )

____________________________

(Name of Trustee)

By:____________________________

____________________________

(P rinted name & Office in Corporation)

___________________________

(Signature of Officer)

Attach Schedule A

(Acknowledgment form may vary by state)

STATE OF _____________

COUNTY OF ____________

Personally appeared before me, the undersigned authority in and for the said

county and state, on this _____ day of ______________, 20_____, within my

jurisdiction, the within named ________________________ (Name of Officer) , who

acknowledged that he is _______________________ (Name of Office) of

___________________________ (Name of Corporation) , a _________________

(name of state) corporation, and that for and on behalf of the said corporation, and as

its act and deed he executed the above and foregoing instrument, after first having been

duly authorized by said corporation so to do.

________________________________

NOTARY PUBLIC

My Commission Expires:

____________________

State of _____________________

County of ___________________

Personally appeared before me, the undersigned authority in and for the said

County and State, on this _________________ (date) , within my jurisdic tion, the within-

named _____________________ (Name of Grantor) , who acknowledged that he

executed the above and foregoing instrument.

___________________________

NOTARY PUBLIC

My Commission Expires:

____________________

State of _____________________

County of ___________________

Personally appeared before me, the undersigned authority in and for the said

County and State, on this ___________________ (date) , within my jurisdic tion, the

within-named _____________________ (Name of Grantor ) , who acknowledged that

he executed the above and foregoing instrument.

________________________________

NOTARY PUBLIC

My Commission Expires:

____________________