Fill and Sign the Jury Instruction 10102 Debt Vs Equity Form

Useful Suggestions for Finalizing Your ‘Jury Instruction 10102 Debt Vs Equity’ Online

Are you weary of dealing with paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and organizations. Say farewell to the cumbersome process of printing and scanning documents. With airSlate SignNow, you can seamlessly fill out and sign documents online. Take advantage of the powerful features embedded in this user-friendly and cost-effective platform and transform your approach to document management. Whether you need to authorize forms or collect signatures, airSlate SignNow simplifies it, requiring only a few clicks.

Follow this detailed guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template repository.

- Access your ‘Jury Instruction 10102 Debt Vs Equity’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and allocate fillable fields for other parties (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to fret if you need to collaborate with your colleagues on your Jury Instruction 10102 Debt Vs Equity or send it for notarization—our platform has you covered with all you need to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

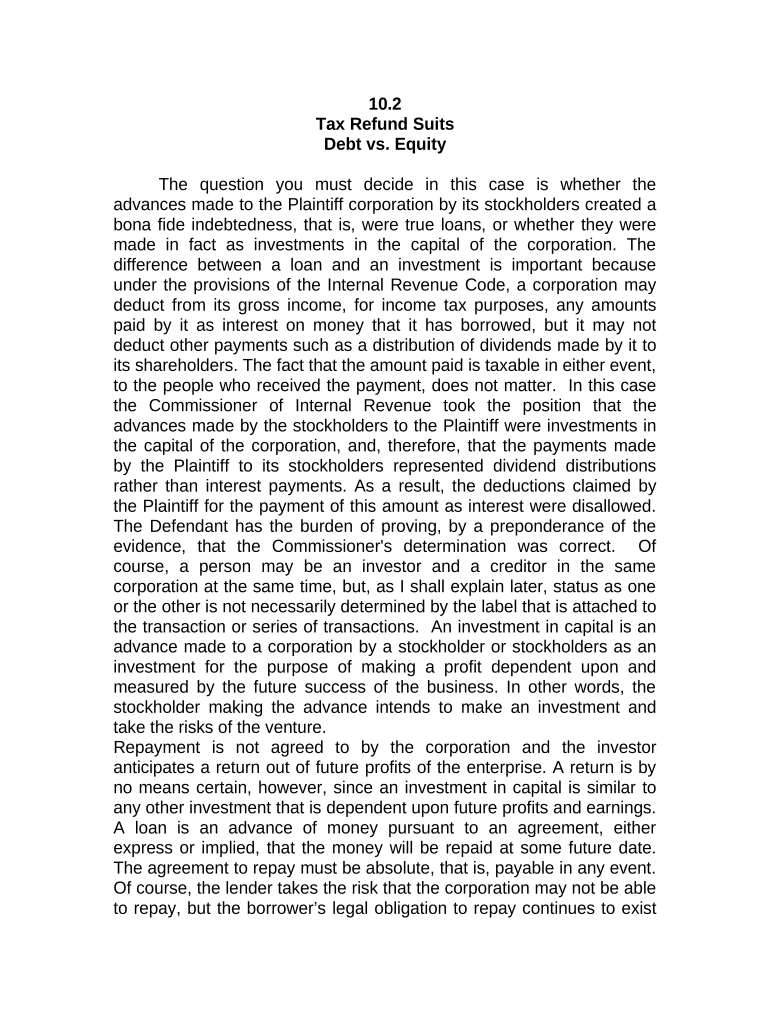

What is the significance of Jury Instruction 10 10 2 Debt Vs Equity in legal proceedings?

Jury Instruction 10 10 2 Debt Vs Equity is crucial as it guides jurors in distinguishing between debt and equity in financial contexts. Understanding this instruction helps jurors make informed decisions about financial disputes, ensuring that verdicts align with legal standards. Utilizing tools like airSlate SignNow can streamline the document signing process related to these cases.

-

How can airSlate SignNow assist in cases involving Jury Instruction 10 10 2 Debt Vs Equity?

airSlate SignNow offers an efficient platform for preparing and signing legal documents related to Jury Instruction 10 10 2 Debt Vs Equity. By simplifying the eSigning process, legal professionals can focus on case strategy rather than paperwork logistics. This ensures that all necessary documentation is completed swiftly and accurately.

-

Is airSlate SignNow cost-effective for small law firms dealing with Jury Instruction 10 10 2 Debt Vs Equity cases?

Yes, airSlate SignNow is designed to be a cost-effective solution for small law firms handling Jury Instruction 10 10 2 Debt Vs Equity cases. With competitive pricing plans tailored for different business sizes, firms can access powerful eSigning features without breaking the bank. This affordability helps small firms manage their budgets while still providing top-notch services.

-

What features does airSlate SignNow offer that are beneficial for legal professionals working on Jury Instruction 10 10 2 Debt Vs Equity matters?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are invaluable for legal professionals addressing Jury Instruction 10 10 2 Debt Vs Equity. These tools enhance workflow efficiency, allowing lawyers to manage cases effectively and meet deadlines with ease. Additionally, the platform ensures compliance with legal standards.

-

Can airSlate SignNow integrate with other software used in managing Jury Instruction 10 10 2 Debt Vs Equity cases?

Absolutely! airSlate SignNow easily integrates with various legal and business applications, enhancing its functionality for cases involving Jury Instruction 10 10 2 Debt Vs Equity. This integration capability allows law firms to synchronize their workflows seamlessly, improving overall productivity and ensuring that all documentation is easily accessible.

-

How secure are the documents signed through airSlate SignNow in relation to Jury Instruction 10 10 2 Debt Vs Equity?

The security of documents signed through airSlate SignNow is a top priority, especially for sensitive cases like those involving Jury Instruction 10 10 2 Debt Vs Equity. airSlate SignNow employs advanced encryption and compliance with industry standards to protect your documents. Clients can trust that their legal documents are handled with the utmost security.

-

What are the benefits of using airSlate SignNow for eSigning documents related to Jury Instruction 10 10 2 Debt Vs Equity?

Using airSlate SignNow for eSigning documents associated with Jury Instruction 10 10 2 Debt Vs Equity offers numerous benefits, including speed, convenience, and compliance. The platform allows legal teams to obtain signatures quickly, reducing turnaround times for critical documents. This efficiency can be a game-changer in fast-paced legal environments.

The best way to complete and sign your jury instruction 10102 debt vs equity form

Find out other jury instruction 10102 debt vs equity form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles