Fill and Sign the Kentucky 51a125 Form

Useful tips for finalizing your ‘Kentucky 51a125 Form’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature service for individuals and small to medium-sized businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign documents online. Utilize the powerful features integrated into this intuitive and affordable platform and transform your method of paperwork management. Whether you need to approve documents or gather eSignatures, airSlate SignNow makes it all easy, requiring just a few clicks.

Adhere to this detailed guide:

- Access your account or register for a complimentary trial with our service.

- Hit +Create to upload a file from your device, cloud, or our template library.

- Open your ‘Kentucky 51a125 Form’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Insert and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your Kentucky 51a125 Form or send it for notarization—our solution provides everything you require to accomplish these tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

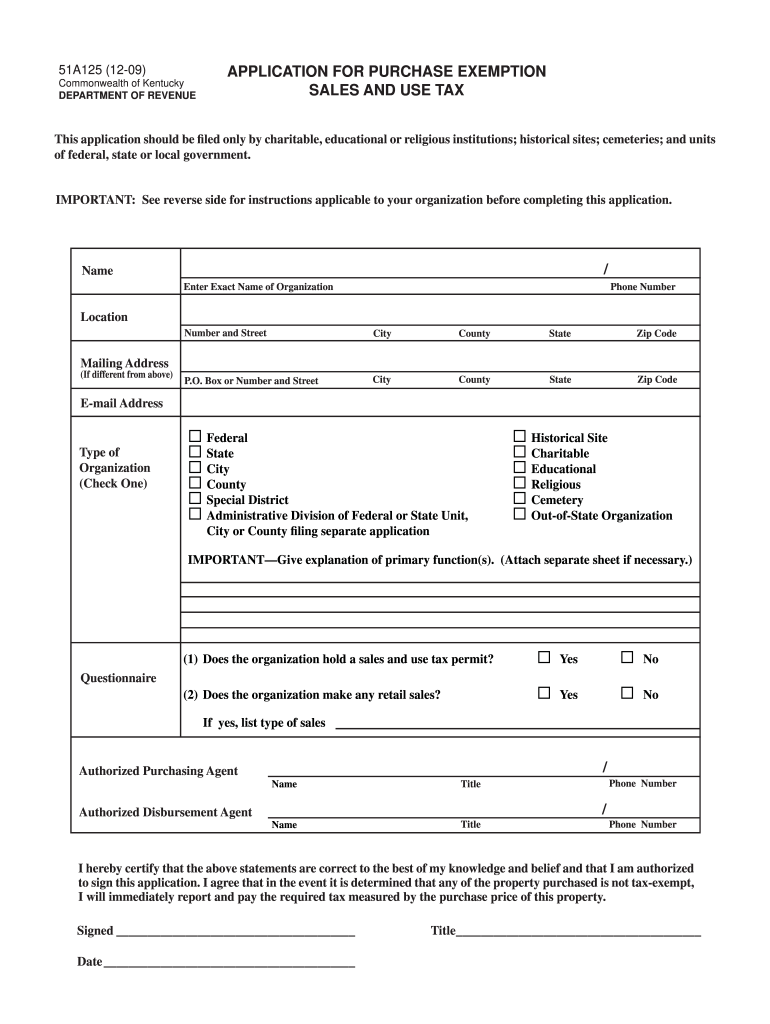

What is the Kentucky Exemption Tax Form and who needs it?

The Kentucky Exemption Tax Form is a document that allows eligible taxpayers to claim exemptions from certain state taxes. This form is crucial for individuals or businesses that qualify for tax exemptions based on specific criteria set by the state of Kentucky. By completing the Kentucky Exemption Tax Form, you can reduce your tax liability and ensure compliance with state regulations.

-

How can airSlate SignNow help me fill out the Kentucky Exemption Tax Form?

airSlate SignNow offers an intuitive platform that simplifies the process of filling out the Kentucky Exemption Tax Form. With our easy-to-use tools, you can quickly complete the form, add electronic signatures, and securely send it to the necessary parties. This streamlines your workflow and saves you time during tax season.

-

Is there a cost associated with using airSlate SignNow for the Kentucky Exemption Tax Form?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers based on your needs. Each plan includes features tailored to manage documents like the Kentucky Exemption Tax Form effectively. You can choose a plan that fits your budget while taking advantage of our robust eSigning capabilities.

-

Can I integrate airSlate SignNow with other software for managing the Kentucky Exemption Tax Form?

Absolutely! airSlate SignNow offers seamless integration with various business applications, allowing you to manage your documents, including the Kentucky Exemption Tax Form, more efficiently. By connecting with tools like CRM systems or accounting software, you can streamline your document workflows and enhance productivity.

-

What security features does airSlate SignNow provide for the Kentucky Exemption Tax Form?

airSlate SignNow prioritizes your security with advanced encryption methods and secure storage for documents like the Kentucky Exemption Tax Form. Our platform complies with industry standards to protect your sensitive information, ensuring that your documents are safe from unauthorized access.

-

How quickly can I get the Kentucky Exemption Tax Form signed using airSlate SignNow?

Using airSlate SignNow, you can send the Kentucky Exemption Tax Form for signing and receive it back in a matter of minutes. Our platform is designed for efficiency, allowing you to track the signing process in real-time and eliminate delays in document management.

-

What are the benefits of using airSlate SignNow for the Kentucky Exemption Tax Form?

By using airSlate SignNow for the Kentucky Exemption Tax Form, you gain access to an easy-to-use interface, quick turnaround times, and enhanced security features. These benefits not only simplify the signing process but also help you stay organized and compliant with state tax requirements.

Find out other kentucky 51a125 form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles