Fill and Sign the Landlord Consent Model Assignment of Lease Consent Agreement Form

Practical advice on finalizing your ‘Landlord Consent Model Assignment Of Lease Consent Agreement’ online

Are you weary of the troubles associated with managing paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for both individuals and organizations. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign documents online. Utilize the powerful features built into this user-friendly and cost-effective platform to transform your method of document management. Whether you need to sign forms or collect electronic signatures, airSlate SignNow simplifies the process, needing just a few clicks.

Adhere to this comprehensive guideline:

- Access your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Landlord Consent Model Assignment Of Lease Consent Agreement’ in the editor.

- Click Me (Fill Out Now) to finish the form on your end.

- Add and assign fillable fields for others (if needed).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your Landlord Consent Model Assignment Of Lease Consent Agreement or send it for notarization—our solution provides everything required to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

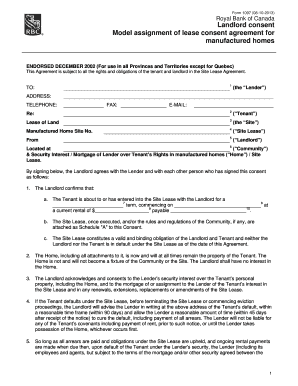

What is a Landlord Consent Model Assignment of Lease Consent Agreement?

A Landlord Consent Model Assignment of Lease Consent Agreement is a legal document that allows tenants to transfer their lease obligations to another party with the landlord's approval. This agreement ensures that all parties are aware of their rights and responsibilities, making it a crucial part of lease management.

-

How can airSlate SignNow help with creating a Landlord Consent Model Assignment of Lease Consent Agreement?

AirSlate SignNow simplifies the process of creating a Landlord Consent Model Assignment of Lease Consent Agreement by providing customizable templates. Users can easily fill in the necessary details and eSign the document, streamlining the approval process while ensuring compliance.

-

What are the key features of the Landlord Consent Model Assignment of Lease Consent Agreement template?

The Landlord Consent Model Assignment of Lease Consent Agreement template includes essential clauses such as tenant obligations, landlord approval conditions, and assignment terms. This comprehensive approach helps to protect both the landlord's and tenant's interests, ensuring clarity in the lease assignment process.

-

Is the Landlord Consent Model Assignment of Lease Consent Agreement legally binding?

Yes, a properly executed Landlord Consent Model Assignment of Lease Consent Agreement is legally binding. It is important to ensure that all parties sign the document to validate the agreement, providing legal protection in case of disputes.

-

What are the benefits of using airSlate SignNow for lease agreements?

Using airSlate SignNow for your Landlord Consent Model Assignment of Lease Consent Agreement offers numerous benefits, including time-saving eSigning capabilities and secure document storage. This user-friendly platform enhances collaboration between landlords and tenants, making lease management more efficient.

-

Can I integrate airSlate SignNow with other software for lease management?

Absolutely! airSlate SignNow offers integrations with various software tools, making it easier to manage your Landlord Consent Model Assignment of Lease Consent Agreement alongside your existing systems. This seamless integration ensures that your document workflow remains efficient and organized.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow provides flexible pricing options tailored to fit the needs of businesses of all sizes. You can choose a plan that best suits your requirements for managing documents like the Landlord Consent Model Assignment of Lease Consent Agreement, ensuring you get value for your investment.

Find out other landlord consent model assignment of lease consent agreement form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles