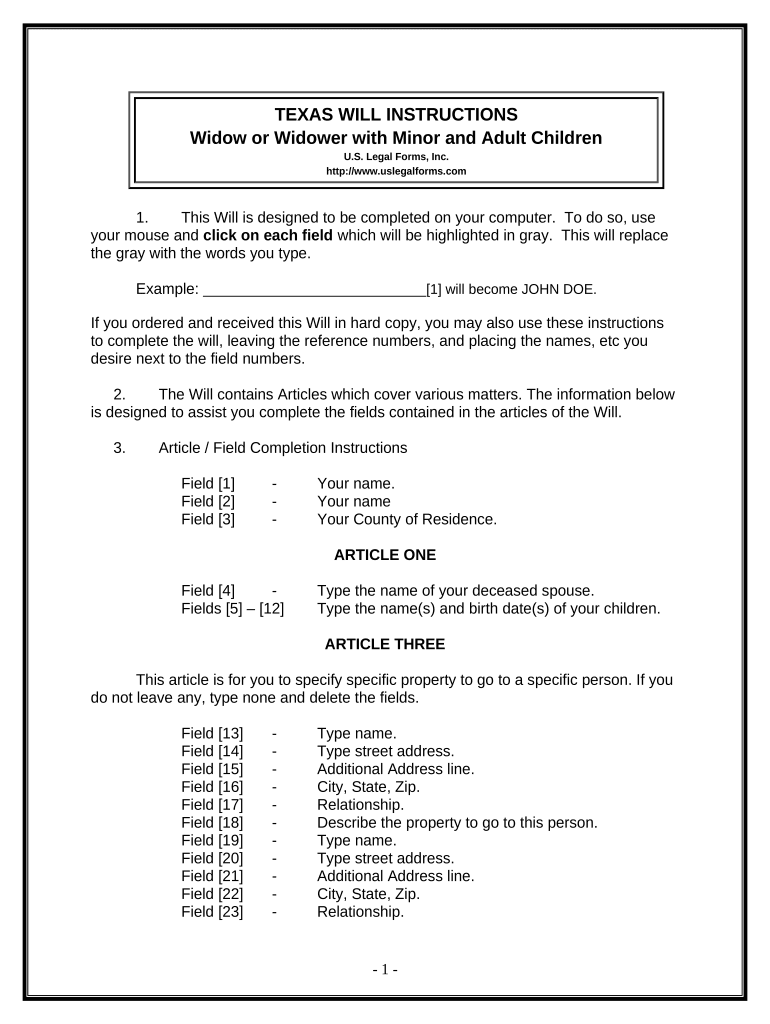

TEXAS WILL INSTRUCTIONS

Widow or Widower with Minor and Adult Children

U.S. Legal Forms, Inc.

http://www.uslegalforms.com

1. This Will is designed to be completed on your computer. To do so, use

your mouse and click on each field which will be highlighted in gray. This will replace

the gray with the words you type.

Example: _____________________________[1] will become JOHN DOE.

If you ordered and received this Will in hard copy, you may also use these instructions

to complete the will, leaving the reference numbers, and placing the names, etc you

desire next to the field numbers.

2. The Will contains Articles which cover various matters. The information below

is designed to assist you complete the fields contained in the articles of the Will.

3. Article / Field Completion Instructions

Field [1] - Your name.

Field [2] - Your name

Field [3] - Your County of Residence.

ARTICLE ONE

Field [4] - Type the name of your deceased spouse.

Fields [5] – [12] Type the name(s) and birth date(s) of your children.

ARTICLE THREE

This article is for you to specify specific property to go to a specific person. If you

do not leave any, type none and delete the fields.

Field [13] - Type name.

Field [14] - Type street address.

Field [15] - Additional Address line.

Field [16] - City, State, Zip.

Field [17] - Relationship.

Field [18] - Describe the property to go to this person.

Field [19] - Type name.

Field [20] - Type street address.

Field [21] - Additional Address line.

Field [22] - City, State, Zip.

Field [23] - Relationship.

- 1 -

Field [24] - Description of property.

Field [25] - Type name.

Field [26] - Type street address.

Field [27] - Additional Address line.

Field [28] - City, State, Zip.

Field [29] - Relationship.

Field [30] - Describe the property

ARTICLE FOUR

This article is for you to leave your homestead, if you have one on the date of

death to persons designated.

Field [31] - Type name(s) of your child(ren).

Field [32-34] Omitted

ARTICLE FIVE

This article is for you to leave all the rest and remainder of your property except

your homestead and any special items you listed in Article Three.

Field [35] - Type name(s) of your child(ren).

Fields [36-38] Omitted

ARTICLE SIX

This article provides for the establishment of a trust for the benefit of minor

beneficiaries.

Field [39] Enter the age below which you desire that minor

beneficiary’s property be placed in trust.

Fields [40-42] Enter age at which property is to be released from

trust.

ARTICLE EIGHT

This article provides for the appointment of a Trustee and Successor Trustee.

Field [43] Type the name of the Trustee.

Field [44] Type the name of the Successor Trustee.

ARTICLE NINE

This article provides for the appointment of a guardian of minor children

- 2 -

Field [45] Enter the age below which you desire a guardian be

appointed for your children.

Field [46] Type the name of the guardian.

ARTICLE TEN

This article is for you to name your personal representative. This must be an

adult and can be an adult child.

Field [47] - Type name of Personal Representative.

Field [48] - Type name of successor Personal Representative.

ARTICLE FOURTEEN

All parts of Article 14 are optional. Complete as desired. Be sure to write your

initials for any of these items you desire to apply.

Field [49] - Type name of Cemetery.

Field [50] - Type County.

Field [51] - Type State.

All other blanks in the Will are typically completed by hand, such as the names of

the witnesses, day, month and year executed, etc.

Once you have completed the Will, double check all entries and then print. The Will

should be signed by you in front of two witnesses, not related to you, and a notary.

Please sign the Will in the places designated.

You should keep your Will in a safe place once executed. It is also

recommended that you give a copy to your executor or other person as additional proof

of execution.

- 3 -

ADDITIONAL INFORMATION ABOUT YOUR WILL FORM

This section will briefly explain some of the articles of your will and provide other

information. Articles of the Will which are basically self-explanatory are not discussed

here. In addition, information which is already provided in the instructions above is not

repeated.

First Paragraph: The first paragraph of the Will, provides your name,

residence information and provides that all prior Wills, if any, are revoked since you

have now made a new Will.

Article Three: Some people have specific property that they desire to leave

to a specific person, such as a ring or antique. This Article is for you to leave such

property. You do not have to name specific property and may simply state none if no

property is to be left under this Article.

Article Ten: This Article is for you to name a personal representative, also

called executor or executrix. The person named should be an adult.

Article Eleven: If not waived, some Courts will require your Personal

Representative post a bond, and file an inventory, accounting and/or appraisal. All can

be costly and time consuming. This Article states your intention that your Personal

Representative not be required to post a bond or file an inventory or accounting.

Article Twelve: This Article sets forth powers of your Personal

Representative and is designed to give broad powers without the requirement that Court

approval be sought for action by the Representative to the extent permitted by the laws

of your State.

Article Thirteen: This article sets forth some legal construction intentions to

clarify some of the issues which may arise.

- 4 -

BASIC INFORMATION

What is a Will? A Will is a document

which provides who is to receive your

property at death, who will administer your

estate, the appointment of trustees and

guardians, if applicable, and other

provisions.

Who may make a Will? Generally, any

person 18 years or older of sound mind

may make a Will. (Some states allow

persons under 18 to make a Will)

What happens if I die without a Will? If

you die without a will you are an intestate.

In such a case, state laws govern who

receives your property. These laws are

called "intestate succession laws". If you

die without a Will, the Court decides who

will administer your estate. Generally, it is

more expensive to administer an estate of

a person who died without a Will, than a

person who dies with a Will.

General

When making a Will you need to consider

who will be named as your personal

representative or executor to administer

your estate, who you will name as guardian

and trustee of minor children if your spouse

does not survive you and who will receive

your property. You should also consider tax

issues. The person appointed as executor

or administrator is often your spouse, but

you should also name an alternate, in case

your spouse predeceases you. The person

you name should be a person you can trust

and who will get along with the

beneficiaries named in the Will.

In the event your spouse predeceases you,

the guardian you name will have actual

custody of your minor children unless a

court appoints someone else. The trustee

you appoint to administer a trust you

established will be in charge of the assets

of the trust for the benefit of the minor

beneficiaries.

Generally, a Will must be signed in the

presence of at least two witnesses (three

for Vermont) who also sign the Will. A

notary public will also need to sign if the

Will contains a self-proving affidavit.

Generally, a self-proving affidavit allows the Will to be admitted to probate without

other evidence of execution.

Joint Property: Many people do not

understand that joint property may pass

outside your Will and also sometimes

assume that it will pass through their Will.

They do not understand the significance of

joint ownership. The issue is common in

the following areas, provided as examples:

(a) Real Estate: Often, a husband

and wife will own real estate as joint

tenants with rights of survivorship. If one

party dies, the surviving party receives the

property regardless of what the Will

provides. This is common and generally

acceptable. However, if this is not your

desire you should change the ownership of

the property to tenants in common or other

form of ownership. If you own real estate

as tenants in common, then you may

designate who will receive your share of

the property at your death. This issue can

be a problem when uninformed persons

take title to real estate as joint tenants with

rights of survivorship but really intended to

leave their share to, for example, children

of a prior marriage.

(b) Bank Accounts/Certificates of

Deposit, Stock, Retirement Plans, IRA’s

and other type Property: The same

ownership as real estate can be made of

these investments. In fact, many Banks

routinely place Bank accounts and

Certificates of Deposit in the joint tenant

with right of survivorship form of ownership

if more than one person is on the account

or CD, without advising you of the

consequence of same. In situations where

the persons are husband and wife and

there is no issue or concern over divorce or

children from previous marriages, this may

be the best course of action. However, with

divorce on the rise, premarital agreements

and multiple marriages being common, the

parties may be doing something that was

not their intent. Another common

problematic situation is where a parent has

more than one child but only one child

resides in the hometown of the parent. The

parent may place the name of the child

who resides there on all accounts, CD’s

and other investments for convenience

reasons and establish a joint tenant with

- 5 -

right of survivorship situation without

realizing that only that child will be entitled

to those assets at the parent’s death. Simply put, you should be aware when you

acquire an asset or investment exactly how

it is titled.

- 6 -

For additional information, see the Law Summary and Information and Preview links in

the search results for this form. A Definitions section is also linked on the Information

and Preview page.

DISCLAIMER/LICENSE/LIABILITY LIMITATION

All forms in this package are provided without any warranty, express or implied, as

to their legal efect and completeness. Please use at your own risk. If you have a

serious legal problem we suggest that you consult an attorney. U.S. Legal Forms,

Inc. does not provide legal advice. The products ofered by U.S. Legal Forms (USLF)

are not a substitute for the advice of an attorney.

Your Will starts on the next page.

LAST WILL AND TESTAMENT OF

___________________________________[1]

BE IT KNOWN THIS DAY THAT,

I, _____________________________[2] , of __________________[3] County, Texas,

being of legal age and of sound and disposing mind and memory, and not acting under duress,

menace, fraud, or undue influence of any person, do make, declare and publish this to be my

Will and hereby revoke any Will or Codicil I may have made.

ARTICLE ONE

Marriage and Children

I was married to _____________________________[4] , now deceased, and have the

following children from a said marriage:

Name: _____________________________[5] Date of Birth: __________________[6]

Name: _____________________________[7] Date of Birth: __________________[8]

Name: _____________________________[9] Date of Birth: _________________[10]

Name: ____________________________[11] Date of Birth: _________________[12]

ARTICLE TWO

Debts and Expenses

I direct my Personal Representative to pay all costs and expenses of my last illness and

funeral expenses. I further direct my Personal Representative to pay all of my just debts that

may be probated, registered and allowed against my estate. However, this provision shall not

extend the statute of limitations for the payment of debts, or enlarge upon my legal obligation or

any statutory duty of my Personal Representative to pay debts.

ARTICLE THREE

Specific Bequests of Real and/or Personal Property

I will, give and bequeath unto the persons named below, if he or she survives me, the

Property described below:

Name Address Relationship

[13] [14]

[15]

[16] [17]

Property: [18]

Name Address Relationship

[19] [20]

[21]

[22] [23]

Property: [24]

Signed by Testator/Testatrix: __________________________________ - 1 -

Name Address Relationship

[25] [26]

[27]

[28] [29]

Property: [30]

[LIST OR STATE NO PROPERTY LEFT UNDER THIS ARTICLE]

In the event I name a person in this Article and said person predeceases me, the

bequest to such person shall lapse and the property shall pass under the other provisions of this

Will. In the event that I do not possess or own any property listed above on the date of my

death, the bequest of that property shall lapse.

ARTICLE FOUR

Homestead or Primary Residence

I will, devise and bequeath all my interest in my homestead or primary residence, if I own

a homestead or primary residence on the date of my death that passes through this Will, to my

child(ren), _____________________________[31] . If I have more than one child, they are to

receive the property equally, per stirpes.

ARTICLE FIVE

All Remaining Property – Residuary Clause

I will, devise, bequeath and give all the rest and remainder of my property and estate of

every kind and character, including, but not limited to, real and personal property in which I may

have an interest at the date of my death and which is not otherwise effectively disposed of, to

my child(ren), _____________________________[35] . If I have more than one child, they are

to receive the property equally, per stirpes. [Name children to receive residuary estate. “Per

Stirpes” means the descendants of the persons you name will receive the property left to that

person if they predecease you]

ARTICLE SIX

Property To Vest In Trustee for Minor Beneficiary

In the event that any of my children are minors under the age of

__________________[39] years of age, then I direct that my Personal Representative shall

transfer, assign and deliver over to my Trustee, named below, such minor beneficiary's share of

my estate and the objects of property described herein. I direct my Trustee to hold said

Beneficiaries share of my estate on the following terms and conditions:

A.

The Trustee shall hold and administer the assets of the Trust for the use and benefit of

the Beneficiaries for the purpose of providing for their health, education and general welfare in

accordance with their accustomed standard of living as much as is possible, considering the

value of the Trust property and their other sources of income.

B.

Signed by Testator/Testatrix: __________________________________ - 2 -

The Trustee, may in his or her discretion, distribute to or for the benefit of the named

Beneficiaries, such portions of the income and principal of the Trust as he or she in his or her

sole discretion shall determine to be necessary to accomplish the purposes of this Trust. The

Trustee may make such distributions as often or as seldom as he or she may determine in his

or her sole discretion without the necessity of any court authority or approval, this being a

private trust.

C.

As each Beneficiary herein reaches the age of ________[40] years, the Trustee shall

distribute to said beneficiary his or her share of the trust principal and income as of the

distribution date. When the youngest Beneficiary reaches the age of ________[41] years, the

Trustee shall distribute all of the remaining Trust property including principal and accumulated

income to the Beneficiary and this Trust shall terminate. In making said distributions, the

Trustee may make distributions in kind and shall have the sole discretion as to valuation of the

Trust property in determining and apportioning distributions among the Beneficiaries.

D.

In the event of the death of any of the above named Beneficiary prior to the final date of

distribution, and said deceased Beneficiary shall leave living issue, the Trustee shall hold only

that portion of the Trust property attributable to said deceased Beneficiary beyond the

distribution dates as provided in Subparagraph C above, and administer said Trust property for

the use and benefit of said living issue. When said youngest living issue reaches the age of

__________________[42] years, the Trust as to said living issue shall terminate and the

Trustee shall distribute all of the remaining Trust property in equal shares to said living issue. In

the event of the death of any of the above named Beneficiaries prior to the final date of

distribution and said deceased Beneficiaries leave no living issue, then that portion of the Trust

property to be distributed to the deceased Beneficiaries as provided for in Subparagraph C

above, shall instead be distributed to the surviving Beneficiaries in equal shares.

E.

Personal and real property may be maintained for my Beneficiaries or converted to cash

as my Trustee shall determine. I direct that my Trustee administer hereunder any funds coming

into the hands of my Beneficiaries pursuant to any life insurance policy insuring my life.

ARTICLE SEVEN

Creditors of Beneficiaries

Neither the principal nor the income of any Trust provision contained in this Will nor any

part of same shall be liable for the debts of any Beneficiary hereunder, nor shall the same be

subject to seizure by any Creditor of any Beneficiary, and no Beneficiary therein shall have any

power to sell, assign, transfer, encumber, or in any manner to anticipate or dispose of his or her

interest in the Trust fund, nor any part of same nor the income produced from said fund nor any

part of same.

ARTICLE EIGHT

Signed by Testator/Testatrix: __________________________________ - 3 -

Appointment of Trustee

I appoint _____________________________[43] , or if the appointee fails to qualify or

ceases to act, I appoint _____________________________[44] , as Trustee of the Trust

provisions of this Will to serve in said capacity with all the powers during the administration of

the Trust as are granted to Trustees under Texas law including the power to sell any of the real

or personal property of the Trust for cash or on credit or to mortgage it or to lease it, all to be

exercised without Court order. The Trustee named herein shall also have all powers as are

granted to my Personal Representative under the provisions of this Will during the

administration of this private Trust.

ARTICLE NINE

Appointment of Guardian

In the event that a guardian is necessary for any of my children that may be minors under

the age of __________[45] years, then on the date of my death, I appoint

_____________________________[46] , as Guardian of said minor children.

ARTICLE TEN

Appointment of Personal Representative, Executor or Executrix

I hereby appoint _____________________________[47] , as Personal Representative of

my estate and this Will. In the event my Personal Representative shall predecease me, or, for

any reason, shall fail to qualify or cease to act as my Personal Representative, then I hereby

appoint _____________________________[48] to serve as successor Personal Representative

of my estate and Will.

The term “Personal Representative”, as used in this Will, shall be deemed to mean and

include “Personal Representative”, “Executor” or “Executrix”.

ARTICLE ELEVEN

Waiver of Bond, Inventory, Accounting, Reporting and Approval

My Personal Representative and successor Personal Representative shall serve without

any bond. I direct that no action shall be had in any court exercising probate jurisdiction in

relation to the settlement of my estate other than the probating and recording of my will and the

return of an inventory, appraisement and list of claims of my estate; provided that, if the

Personal Representative is permitted to file an affidavit in lieu of inventory under Texas law, I do

not require the Personal Representative to file the inventory, appraisement and list of claims

with the court if required by law.

ARTICLE TWELVE

Powers of Personal Representative, Executor and Executrix

I direct that my Personal Representative shall have broad discretion in the administration

of my Estate, without the necessity of Court approval. I grant unto my Personal Representative,

all powers that are allowed to be exercised by Personal Representatives by the laws of the

State of Texas and to the extent not prohibited by the laws of Texas, the following additional

powers:

Signed by Testator/Testatrix: __________________________________ - 4 -

1. To exercise all of the powers, rights and discretions granted by virtue of any

"Uniform Trustees' Powers Law," and/or “Probate Code” adopted by the State of Texas.

2. To compromise claims and to abandon property which, in my Executor’s opinion

is of little or no value.

3. To purchase or otherwise acquire and to retain any and all stocks, bonds, notes

or other securities, or shares or interests in investment trusts and common trust funds, or in any

other property, real, personal or mixed, as my Personal Representative may deem advisable,

whether or not such investments or property be of the character permissible by fiduciaries,

without being liable to any person for such retention or investment.

4. To settle, adjust, dissolve, windup or continue any partnership or other entity in

which I may own a partnership or equity interest at the time of my death, subject, however, to

the terms of any partnership or other agreement to which I am a party at the time of my death. I

authorize my Personal Representative to continue in any partnership or other entity for such

periods and upon such terms as they shall determine. My Personal Representative shall not be

disqualified by reason of being a partner, equity owner or titleholder in such firm from

participating on behalf of my estate in any dealings herein authorized to be carried on between

my Personal Representative and the partners or equity owners of any such partnership or other

entity.

5. To lease, sell, or offer on a lease purchase, any real or personal property for

such time and upon such terms and conditions in such manner as may be deemed advisable by

my Personal Representative, all without court approval.

6. To sell, exchange, assign, transfer and convey any security or property, real or

personal, held in my estate, or in any trust, at public or private sale, at such time and price and

upon such terms and conditions (including credit) as my Personal Representative may deem

advisable and for the best interest of my estate, or any trust. I hereby waive any requirement of

issuing summons, giving notice of any hearing, conducting or holding any such hearing, filing

bond or other security, or in any way obtaining court authority or approval for any such sale,

exchange, assignment, transfer or conveyance of any real or personal property.

7. To pay all necessary expenses of administering the estate and any trust

including taxes, trustees' fees, fees for the services of accountants, agents and attorneys, and

to reimburse said parties for expenses incurred on behalf of the estate or any trust hereunder.

8. Unless otherwise specifically provided, to make distributions (including the

satisfaction of any pecuniary bequest) in cash or in specific property, real or personal, or in an

undivided interest therein, or partly in cash and partly in other property, and to do so with or

without regard to the income tax basis of specific property allocated to any beneficiary and

without making pro rata distributions of specific assets.

9. To determine what is principal and what is income with respect to all receipts and

disbursements; to establish and maintain reserves for depreciation, depletion, obsolescence,

taxes, insurance premiums, and any other purpose deemed necessary and proper by them and

to partite and to distribute property of the estate or trust in kind or in undivided interests, and to

determine the value of such property.

Signed by Testator/Testatrix: __________________________________ - 5 -

10. To participate in any plan of reorganization, consolidation, dissolution,

redemption, or similar proceedings involving assets comprising my estate or any trust created

hereunder, and to deposit or withdraw securities under any such proceedings.

11. To perform such acts, to participate in such proceedings and to exercise such

other rights and privileges in respect to any property, as if she or he were the absolute owner

thereof, and in connection therewith to enter into and execute any and all agreements binding

my estate and any trust created hereunder.

12. To compromise, settle or adjust any claim or demand by or against my estate, or

any trust, to litigate any such claims, including, without limitation, any claims relating to estate or

income taxes, and to agree to rescind or modify any contract or agreement.

13. To borrow money from such source or sources and upon such terms and

conditions as my Personal Representative shall determine, and to give such security therefore

as my Personal Representative may determine.

All authorities and powers hereinabove granted unto my Personal Representative shall

be exercised from time to time in her or his sole and absolute discretion and without prior

authority or approval of any Court, and I intend that such powers be construed in the broadest

possible extent.

ARTICLE THIRTEEN

Construction Intentions

It is my intent that this Will be interpreted according to the following provisions:

1. The masculine gender shall be deemed to include the feminine as well as the

neuter, and vice versa, as to each of them; the singular shall be deemed to include the plural,

and vice versa.

2. The term “testator” as used herein is deemed to include me as Testator or

Testatrix.

3. This Will is not a result of a contract between myself and any beneficiary,

fiduciary or third party and I may revoke this Will at any time.

4. If any part of this Will shall be declared invalid, illegal, or inoperative for any

reason, it is my expressed intent that the remaining parts shall be effective and fully operative

and it is my intent that any Court so interpreting same construct this Will and any provision in

favor of survival.

ARTICLE FOURTEEN

Misc. Provisions

I direct that this Will and the construction thereof shall be governed by the Laws of the

State of Texas.

(I have placed my initials next to the provisions below that I desire to adopt. Unmarked

provisions are not adopted by me and are not a part of this Will)

Signed by Testator/Testatrix: __________________________________ - 6 -

_______ If any person named herein is indebted to me at the time of my death and such

indebtedness be evidenced by a valid Promissory Note payable to me, then such

person’s portion of my estate shall be diminished by the amount of such debt.

_______ Any and all debts of my estate shall first be paid from my residuary estate. Any

debts on any real property left herein shall be assumed by the person to receive

such real property and not paid by my Personal Representative.

_______ I desire to be buried in the _____________________________[49] cemetery in

__________________[50] County, __________________[51] .

_______ I direct that my remains be cremated and that the ashes be disposed of

according to the wishes of my Executor.

I, ___________________________________ , having signed this Will in the presence of

_____________________________ and ________________________________ who attested

it at my request on this the _____ day of _____________, 20_____ at

____________________________________________________________(address), declare

this to be my Last Will and Testament.

________________________________

_____________________________

Testator/Testatrix

The above and foregoing Will of _____________________________ was declared by

_____________________________ in our view and presence to be his Will and was signed

and subscribed by the said _____________________________ in our view and presence and

at his request and in the view and presence of _____________________________ and in the

view and presence of each other, we, the undersigned, witnessed and attested the due

execution of the Will of _____________________________ on this the _____day of

__________________, 20___.

Witness Signature Witness Signature

Print Name: Print Name:

Address: Address:

City, State, Zip: City, State, Zip:

Phone: Phone:

Signed by Testator/Testatrix: __________________________________ - 7 -

THE STATE OF TEXAS

COUNTY OF ______________________________

BEFORE ME, the undersigned authority, on this day personally appeared

______________________________ , ______________________________ and

______________________________ , known to me to be the Testator/Testatrix and Witnesses,

respectively, whose names are subscribed to the annexed or foregoing instrument in their

respective capacities, and all of said persons being by me duly sworn, the said

______________________________ Testator/Testatrix, declared to me and to the said

Witnesses in my presence, that said instrument is the Last Will and Testament, and that he or

she had willingly made and executed it as his or her free act and deed for the purposes therein

expressed; and the said Witnesses, each on their oath, stated to me in the presence and

hearing of the said Testator/Testatrix that the said Testator/Testatrix had declared to them the

said instrument is his or her Last Will and Testament and that he or she executed the same as

such and wanted each of them to sign it as a Witness; and upon, their oaths each Witness

stated further that they did sign the same as Witnesses in the presence of the said

Testator/Testatrix and at his or her request; and that he or she was at that time eighteen (18)

years of age or over (or being under such age, was or had been lawfully married , or was then a

member of the armed forces of the United States or of an auxiliary thereof or of the maritime

Service) and was of sound mind; and that each of said Witnesses was then at least fourteen

(14) years of age.

______________________________

Testator/Testatrix

Typed Name:

______________________________

______________________________

Witness

_____________________________

Witness

SUBSCRIBED AND ACKNOWLEDGED before me by the said

______________________________ , Testator/Testatrix and subscribed and sworn to before me

by the said ______________________________ and ______________________________ ,

Witnesses, this _____ day of __________ , 20 _____ .

_______________________________

Notary Public, State of Texas

Print Name:

_________________________________

Commission Expires: ______________________________

TS Probate Code, Chapter IV, §59 Texas Self-Proving Affidavit

TS Probate Code, Chapter IV, §59 Texas Self-Proving Affidavit