Fill and Sign the Letter Direct Debit Form

Essential tips for finishing your ‘Letter Direct Debit’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for both individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Take advantage of the powerful features integrated into this user-friendly and cost-effective platform, transforming your method of document management. Whether you need to approve forms or collect signatures, airSlate SignNow manages everything with ease, needing just a few clicks.

Follow these comprehensive steps:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a document from your device, cloud, or our template library.

- Access your ‘Letter Direct Debit’ in the editor.

- Click Me (Fill Out Now) to finish the document on your part.

- Add and assign fillable fields for others (if needed).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with your team on your Letter Direct Debit or send it for notarization—our platform has everything necessary to accomplish those tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

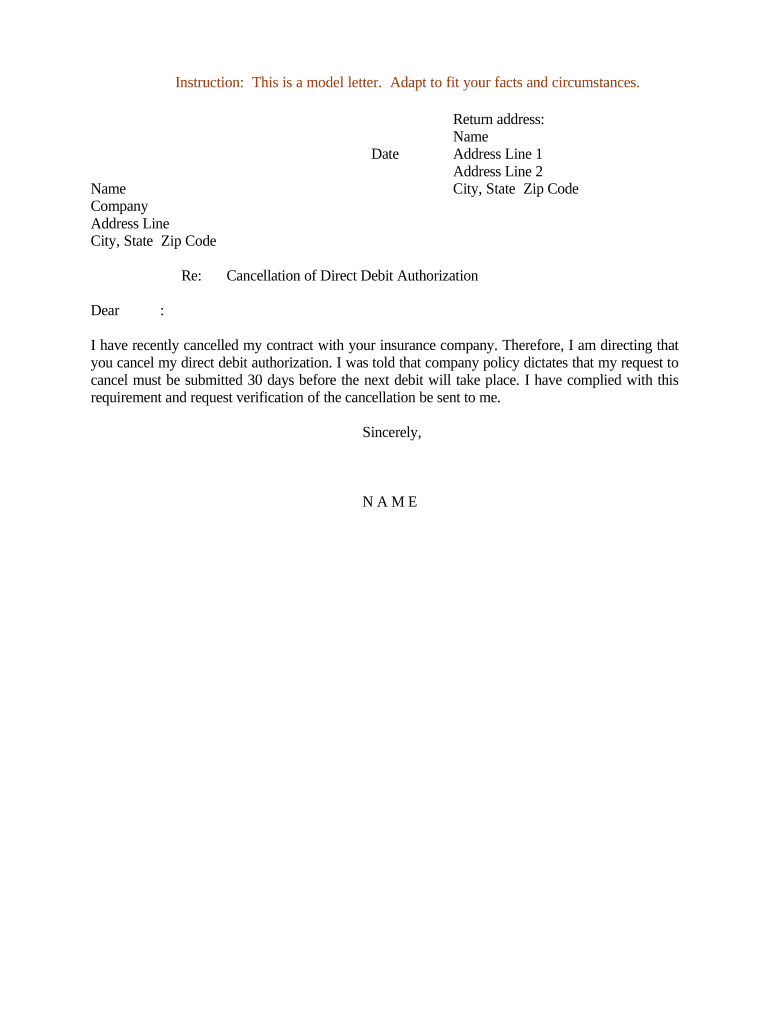

What is a Letter Direct Debit and how does it work?

A Letter Direct Debit is a document that authorizes a bank to automatically withdraw funds from a customer's account. Using airSlate SignNow, you can easily create and send a Letter Direct Debit for electronic signature, ensuring a fast and secure transaction process.

-

How can airSlate SignNow help with managing Letter Direct Debit?

airSlate SignNow simplifies the management of Letter Direct Debit by allowing you to create, send, and eSign documents all in one platform. This streamlines your workflow and ensures that all necessary approvals are secured quickly and efficiently, making the process seamless.

-

What are the pricing options for using airSlate SignNow for Letter Direct Debit?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small business or a large enterprise, you can choose a plan that allows you to manage your Letter Direct Debit transactions effectively without breaking the bank.

-

Are there any integrations available for handling Letter Direct Debit with airSlate SignNow?

Yes, airSlate SignNow integrates with a variety of applications, allowing you to manage your Letter Direct Debit alongside your existing systems. With integrations to popular tools like CRM software and accounting applications, you can streamline your entire payment process.

-

What are the benefits of using airSlate SignNow for Letter Direct Debit?

Using airSlate SignNow for Letter Direct Debit provides numerous benefits, including enhanced security, faster processing times, and reduced paper usage. By digitizing your Letter Direct Debit process, you can save time and resources while ensuring compliance and accuracy.

-

Is it easy to set up a Letter Direct Debit with airSlate SignNow?

Absolutely! Setting up a Letter Direct Debit with airSlate SignNow is straightforward. The user-friendly interface allows you to create templates and send them for eSignature in just a few clicks, making it accessible for anyone, regardless of technical expertise.

-

Can I track the status of my Letter Direct Debit with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Letter Direct Debit. You will receive notifications when documents are viewed, signed, or completed, giving you full visibility throughout the process.

The best way to complete and sign your letter direct debit form

Find out other letter direct debit form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles