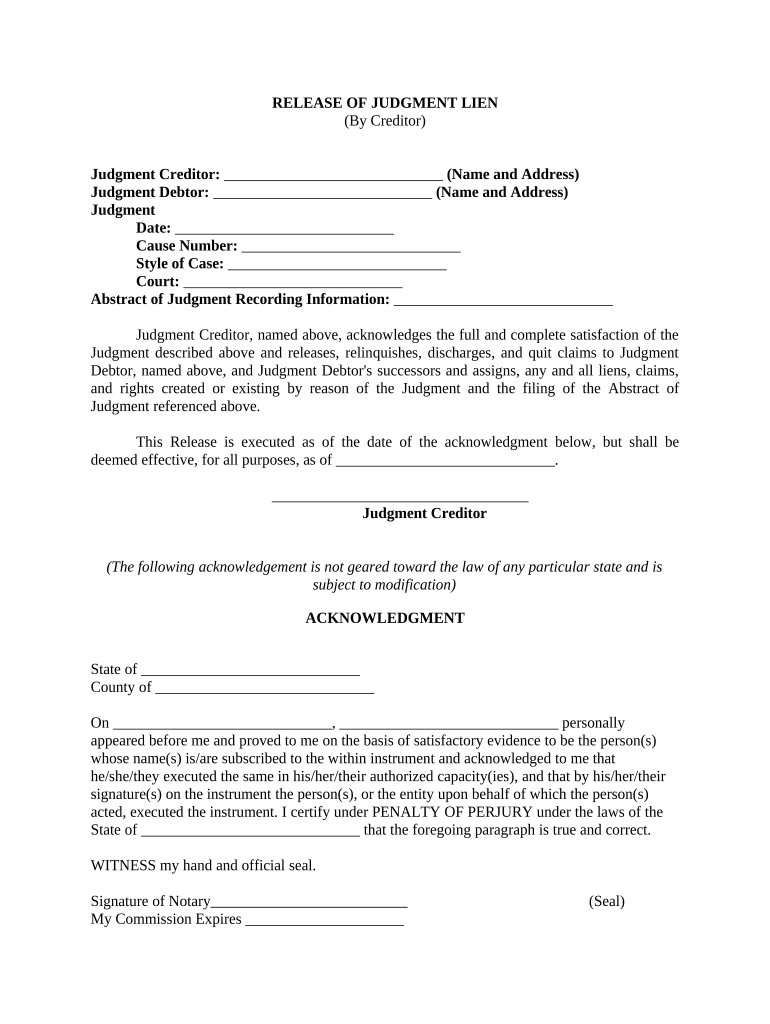

Fill and Sign the Lien Creditor Form

Valuable suggestions for preparing your ‘Lien Creditor’ online

Are you fed up with the inconvenience of handling paperwork? Discover airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the laborious procedure of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and sign paperwork online. Utilize the powerful features embedded in this user-friendly and affordable platform and transform your method of document management. Whether you need to authorize forms or gather signatures, airSlate SignNow manages it effortlessly, needing just a handful of clicks.

Adhere to this comprehensive guide:

- Access your account or initiate a free trial with our service.

- Select +Create to upload a file from your device, cloud, or our form library.

- Open your ‘Lien Creditor’ in the editor.

- Click Me (Fill Out Now) to finish the document on your end.

- Add and designate fillable fields for other participants (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Lien Creditor or send it for notarization—our platform provides all the tools you need to achieve these objectives. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is a Lien Creditor and how does it relate to airSlate SignNow?

A Lien Creditor is a party that has a legal claim or lien against a debtor's property. With airSlate SignNow, Lien Creditors can efficiently manage documentation related to liens, ensuring that all necessary agreements are signed electronically and securely. This streamlines the process of enforcing liens and enhances overall compliance.

-

How does airSlate SignNow benefit Lien Creditors in document management?

airSlate SignNow offers Lien Creditors a user-friendly platform to create, send, and eSign documents. This not only saves time but also reduces the risk of errors in legal documentation. By digitizing the signing process, Lien Creditors can ensure faster turnaround times and improved accuracy.

-

What features does airSlate SignNow provide for Lien Creditors?

For Lien Creditors, airSlate SignNow includes features such as customizable templates, real-time tracking of document status, and secure cloud storage. These tools help Lien Creditors manage their paperwork efficiently, ensuring that all necessary signatures are collected without delay.

-

Is airSlate SignNow cost-effective for Lien Creditors?

Yes, airSlate SignNow is designed to be a cost-effective solution for Lien Creditors. With flexible pricing plans, it provides essential eSigning features without breaking the bank, allowing Lien Creditors to save on administrative costs while improving their workflow.

-

Can Lien Creditors integrate airSlate SignNow with their existing systems?

Absolutely! airSlate SignNow offers integrations with various software and tools commonly used by Lien Creditors, including CRMs and document management systems. This seamless integration ensures that Lien Creditors can incorporate eSigning into their current processes with minimal disruption.

-

What security measures does airSlate SignNow offer for Lien Creditors?

Security is a top priority for airSlate SignNow, especially for Lien Creditors who handle sensitive documents. The platform uses advanced encryption and complies with industry standards to protect data integrity, ensuring that all documents signed by Lien Creditors remain secure and confidential.

-

How can Lien Creditors ensure compliance with legal requirements using airSlate SignNow?

airSlate SignNow helps Lien Creditors maintain compliance with legal requirements by providing features such as audit trails, secure storage, and legally binding eSignatures. These elements are crucial for Lien Creditors who must adhere to specific regulations in their documentation processes.

The best way to complete and sign your lien creditor form

Find out other lien creditor form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles