Fill and Sign the Life Insurance Form

Practical advice for finalizing your ‘Life Insurance Form’ digitally

Are you weary of the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading eSignature platform for individuals and small to medium-sized businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and endorse documents online. Take advantage of the extensive functionalities integrated into this user-friendly and cost-effective platform to transform your method of document management. Whether you need to authorize forms or collect signatures, airSlate SignNow takes care of everything effortlessly, necessitating just a few clicks.

Adhere to these comprehensive steps:

- Sign in to your account or sign up for a complimentary trial of our service.

- Click +Create to upload a document from your device, cloud storage, or our form collection.

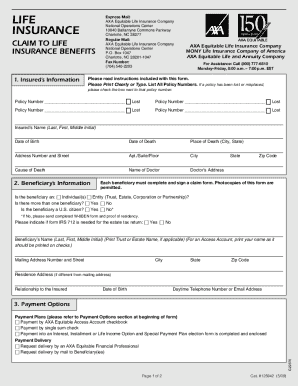

- Open your ‘Life Insurance Form’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite options to request eSignatures from others.

- Download, print your copy, or convert it into a multi-usable template.

No need to worry if you need to work with your teammates on your Life Insurance Form or send it for notarization—our solution provides everything necessary to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to greater heights!

FAQs

-

What is the Life Insurance Form and how does it work?

The Life Insurance Form is a customizable document template that allows users to create, send, and eSign life insurance agreements efficiently. With airSlate SignNow, you can easily fill out the form, add necessary details, and gather signatures from all parties involved in a secure and legally binding manner.

-

How much does it cost to use the Life Insurance Form with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. The cost to use the Life Insurance Form depends on the specific plan you choose, which includes features like unlimited document signing, integrations, and secure storage.

-

What features does the Life Insurance Form include?

The Life Insurance Form comes with a range of features designed to streamline the signing process, including customizable fields, automated reminders, and real-time tracking of document status. These features ensure that the form is easy to use and enhances the overall efficiency of managing life insurance agreements.

-

Can I integrate the Life Insurance Form with other software?

Yes, airSlate SignNow allows for seamless integration of the Life Insurance Form with various third-party applications such as CRM systems, cloud storage services, and productivity tools. This ensures that you can manage your life insurance documentation alongside other essential business processes.

-

Is the Life Insurance Form secure for sensitive information?

Absolutely! The Life Insurance Form is designed with top-notch security features, including encryption and secure cloud storage. This protects sensitive information contained within life insurance agreements, giving you peace of mind while handling important documents.

-

How can I customize the Life Insurance Form to fit my business needs?

You can easily customize the Life Insurance Form by adding your branding, modifying text fields, and including specific clauses relevant to your life insurance policies. airSlate SignNow's user-friendly interface makes it simple to tailor the form to meet your unique requirements.

-

What are the benefits of using the Life Insurance Form for my business?

Using the Life Insurance Form simplifies the process of managing life insurance agreements, reduces paperwork, and speeds up the signing process. This efficiency not only saves time but also enhances customer satisfaction by allowing clients to sign documents quickly and securely.

Find out other life insurance form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles