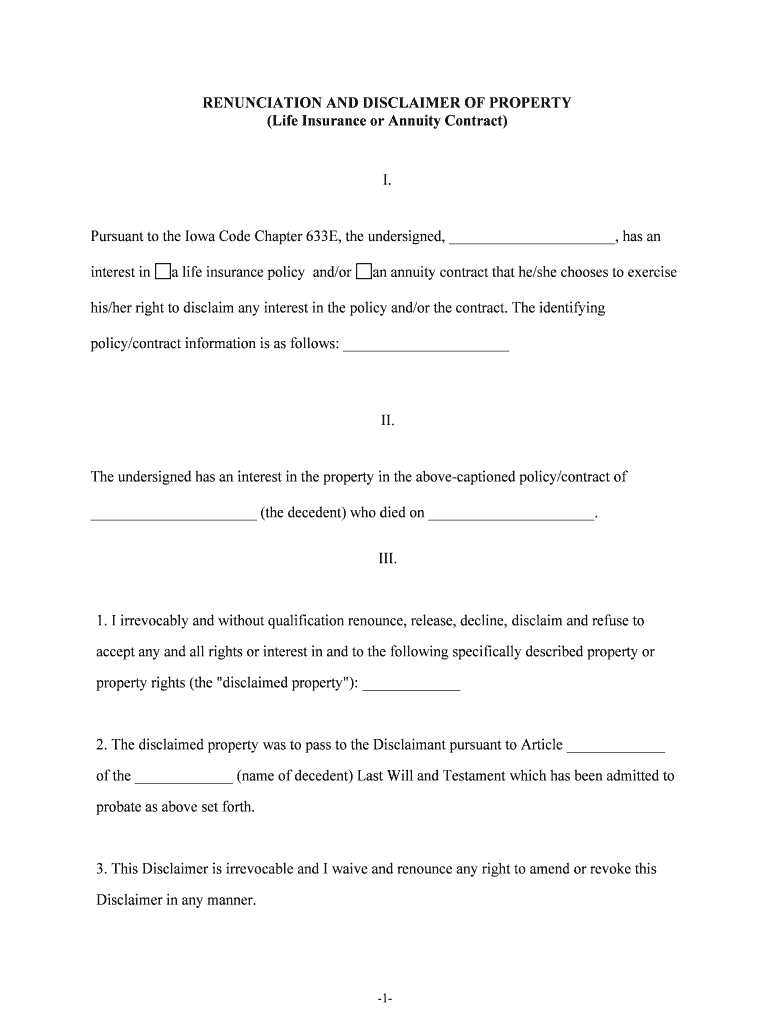

Fill and Sign the Life Insurance or Annuity Contract Form

Useful tips on setting up your ‘Life Insurance Or Annuity Contract’ digitally

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading electronic signature platform for individuals and organizations. Bid farewell to the monotonous tasks of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and approve paperwork online. Leverage the robust features included in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or gather electronic signatures, airSlate SignNow manages everything seamlessly, with just a few clicks.

Follow these detailed instructions:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud, or our form repository.

- Open your ‘Life Insurance Or Annuity Contract’ in the editor.

- Click Me (Fill Out Now) to finish the form on your end.

- Add and designate fillable fields for additional parties (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you wish to work with others on your Life Insurance Or Annuity Contract or send it for notarization—our solution offers everything you need to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the difference between a Life Insurance Or Annuity Contract?

A Life Insurance Or Annuity Contract serves different purposes; life insurance provides financial protection for beneficiaries upon the policyholder's death, while an annuity contract is designed to provide a steady income stream during retirement. Understanding these differences can help you choose the right product based on your financial goals.

-

How do I determine the cost of a Life Insurance Or Annuity Contract?

The cost of a Life Insurance Or Annuity Contract varies based on factors such as age, health, and the type of coverage or annuity chosen. It's essential to compare quotes from different providers to find a plan that fits your budget while meeting your financial needs.

-

What are the key benefits of a Life Insurance Or Annuity Contract?

A Life Insurance Or Annuity Contract offers several benefits, including financial security for your loved ones, tax-deferred growth of your investment, and a reliable income stream during retirement. These features make them valuable tools for long-term financial planning.

-

Can I customize my Life Insurance Or Annuity Contract?

Yes, many providers allow you to customize your Life Insurance Or Annuity Contract to better suit your needs. You can often choose coverage amounts, payment options, and additional riders to enhance your policy's benefits.

-

What integrations are available with a Life Insurance Or Annuity Contract?

Integrations for a Life Insurance Or Annuity Contract may include financial planning software, customer relationship management (CRM) systems, and document management tools. These integrations can streamline your processes and improve overall efficiency.

-

How do I file a claim on my Life Insurance Or Annuity Contract?

To file a claim on your Life Insurance Or Annuity Contract, you typically need to contact your insurance provider and provide necessary documentation, such as the policy number and proof of death or disability. Each provider may have specific procedures, so it's essential to follow their guidelines.

-

Are there any tax implications with a Life Insurance Or Annuity Contract?

Yes, there can be tax implications associated with a Life Insurance Or Annuity Contract. Generally, the death benefit from life insurance is tax-free for beneficiaries, while annuity payouts may be subject to income tax. Consulting a tax professional can help clarify your specific situation.

The best way to complete and sign your life insurance or annuity contract form

Find out other life insurance or annuity contract form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles