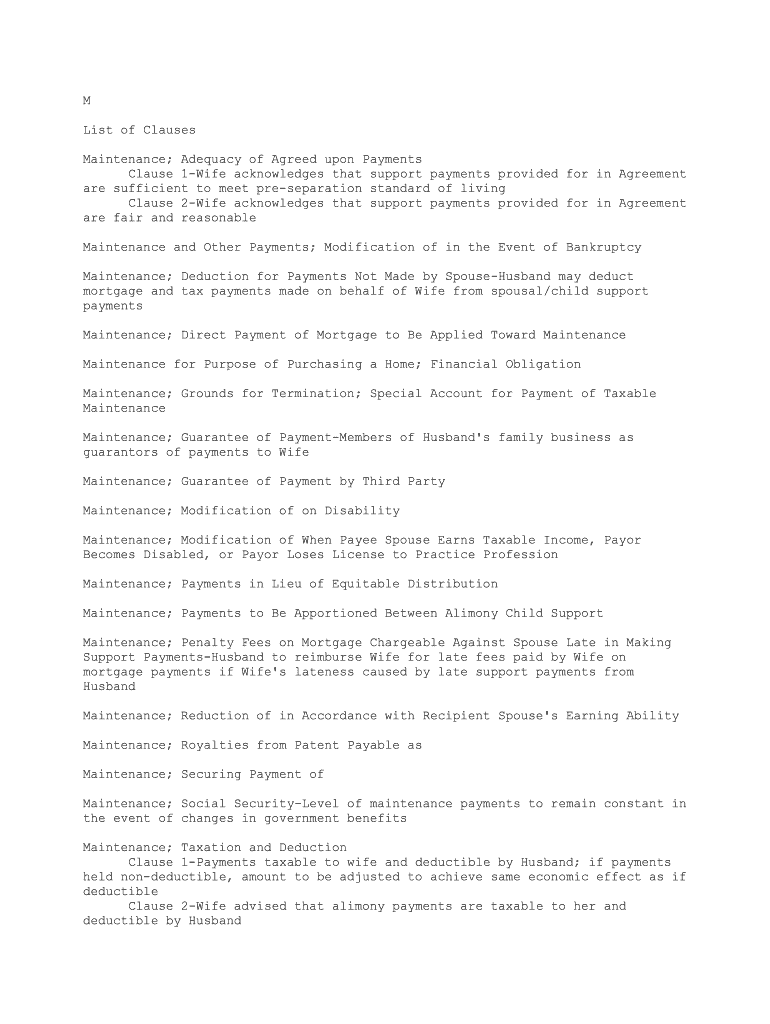

M

List of Clauses

Maintenance; Adequacy of Agreed upon PaymentsClause 1-Wife acknowledges that support payments provided for in Agreement

are sufficient to meet pre-separation standard of living

Clause 2-Wife acknowledges that support payments provided for in Agreement

are fair and reasonable

Maintenance and Other Payments; Modification of in the Event of Bankruptcy

Maintenance; Deduction for Payments Not Made by Spouse-Husband may deduct

mortgage and tax payments made on behalf of Wife from spousal/child support payments

Maintenance; Direct Payment of Mortgage to Be Applied Toward Maintenance

Maintenance for Purpose of Purchasing a Home; Financial Obligation

Maintenance; Grounds for Termination; Special Account for Payment of Taxable

Maintenance

Maintenance; Guarantee of Payment-Members of Husband's family business as

guarantors of payments to Wife

Maintenance; Guarantee of Payment by Third Party

Maintenance; Modification of on Disability

Maintenance; Modification of When Payee Spouse Earns Taxable Income, Payor

Becomes Disabled, or Payor Loses License to Practice Profession

Maintenance; Payments in Lieu of Equitable Distribution

Maintenance; Payments to Be Apportioned Between Alimony Child Support

Maintenance; Penalty Fees on Mortgage Chargeable Against Spouse Late in Making

Support Payments-Husband to reimburse Wife for late fees paid by Wife on

mortgage payments if Wife's lateness caused by late support payments from Husband

Maintenance; Reduction of in Accordance with Recipient Spouse's Earning Ability

Maintenance; Royalties from Patent Payable as

Maintenance; Securing Payment of

Maintenance; Social Security-Level of maintenance payments to remain constant in

the event of changes in government benefits

Maintenance; Taxation and Deduction

Clause 1-Payments taxable to wife and deductible by Husband; if payments

held non-deductible, amount to be adjusted to achieve same economic effect as if

deductible Clause 2-Wife advised that alimony payments are taxable to her and

deductible by Husband

Maintenance; Tax Law Change That Would Disallow Alimony Deduction

Maintenance; Temporary Increase of During Recipient Spouse's Period of

Unemployment

Maintenance; Termination of Payments on Marriage or Cohabitation; "Cohabitation"

Defined-Maintenance payments to Wife to cease on her cohabitation with another man

Maintenance; Waiver ofClause 1-Mutual waiver of support by other spouse

Clause 2-Wife waives maintenance and equitable distribution in exchange

for lump sum payment

Maintenance; Waiver of Right to Seek Modification

Marital Estate; Final Date for Claims Against

Marital Home; Access to-Wife not to change locks on marital home and to allow

Husband access to certain rooms

Marital Home; Allocation of Expenses

Marital Home; Appraisal of-Procedure for establishing appraisal for purpose of sale

Marital Home; Ascertainment of Liens

Marital Home; Ascertainment of Liens; Declination of Search

Marital Home as Income Producing Property; Allocation of Expenses

Marital Home; Attribution of Costs for Major Repairs

Marital Home; Attribution of Costs for Major Repairs in Event of Non-Compliance

Marital Home; Conveyance of Interest to Spouse Clause 1-Husband conveys all right in marital home to Wife

Clause 2-Wife to execute bargain and sale deed on marital property in

favor of Husband; deed to be held in escrow for stated period; Husband may

refinance home during escrow period

Clause 3-Conveyance by Husband to Wife; Wife responsible for mortgage

Clause 4-Wife to convey all interest in marital home to Husband; Wife to

have right to occupancy until occurrence of specified event Clause 5-Husband conveys interest in marital home to Wife in exchange for

relief from support payments

Clause 6-Transfer of residence to Husband; indemnity of Wife from

liability; assignment of insurance policies

Clause 7-Conveyance to Wife of premises in "as is" condition by deed

comparable to current deed; Wife responsible for all future care of premises;

assignment of escrow; Husband's warranties; delivery of documents

Clause 8-Conveyance of interest to Wife in consideration for her waiver of

interest in Husband's pension

Marital Home; Conveyance of Interest to Spouse; Delivery of Documents-Husband to

deliver all documents necessary to transfer marital home to Wife; Wife may sign

documents in Husband's name if Husband fails to sign

Marital Home; Conveyance of Interest to Spouse; Expenses of Transferring Title

Marital Home; Conveyance of Interest to Spouse; Mortgage in Satisfaction of

Marital Home; Expenses; Indemnification forClause 1-Wife to indemnify Husband from all debts arising out of ownership

of marital home

Clause 2-Wife to indemnify Husband from all debts arising out of marital

home, including mortgage payments, real estate taxes and utilities Clause 3-Husband to indemnify Wife from all debts and obligations incurred

by Husband in connection with marital home Clause 4-Wife to indemnify Husband for all claims arising out of existing

mortgage

Marital Home; Expenses; Responsibility for-Wife responsible for all expenses

involving marital home upon conveyance to her

Marital Home; Expenses; Responsibility for Costs Until Sale Is Effectuated

Clause 1--Husband's responsibility

Clause 2--Wife's responsibility

Marital Home; Expenses; Responsibility for Until Sale of Home or a Date Certain

Marital Home; Expenses; Tax Treatment Clause 1-Payments by Husband marital home expenses to be divided between

maintenance and child support and treated accordingly for tax purposes Clause 2--Husband's payment of marital home expenses not to be considered

maintenance to Wife; Husband entitled to income tax deduction for mortgage

interest and real property taxes

Marital Home; Expenses; Waiver of Reimbursement for

Marital Home; Expenses; Warranty of Payment

Marital Home; Explanation of Why Residence Is One Spouse's Separate Property

Marital Home; Failure of Occupant Spouse to Pay Mortgage Entitles Non-Occupant

Spouse to Be Named Receiver

Marital Home; Joint Occupancy Until Closing of Sale

Marital Home; Occupancy of Clause 1-Wife to have exclusive occupancy of marital home

Clause 2-Wife to have exclusive occupancy of marital home during

"residence period"; "residence period" defined

Clause 3-Wife to have exclusive occupancy of marital home until the

earlier of youngest child marrying or a stated date; house to be sold with

proceeds of sale divided equally between parties

Clause 4-Wife has right to occupy marital home, which is separate property

of Husband, until emancipation of youngest child; formula for payment of

expenses in the event of Wife's remarriage Clause 5-Wife to have exclusive occupancy and be responsible for expenses

Marital Home; Occupancy of by One Spouse Until Occurrence of Stated EventClause 1-Occupancy by Wife until death, remarriage or cohabitation

Clause 2-Upon occurrence of specified event, home is to be sold;

apportionment of sale proceeds

Marital Home; Occupancy; Rent Payable to Other Spouse-Wife to pay rent to

Husband for occupancy of marital home

Marital Home; Option to Purchase

Clause 1-Husband has option to purchase Wife's interest in marital home;

procedure for determining fair market price Clause 2-Husband to have right of first refusal to buy house

Clause 3-Wife given option to purchase Husband's rights in marital home

Clause 4-Mutual option to purchase

Marital Home; Outstanding Mortgage, Pay-Down of

Marital Home; Preservation of Good Condition by Spouse in Residence

Marital Home; Refinancing of

Marital Home; Repairs to Clause 1-Husband to advance stated sum for repairs to marital home

Clause 2-Parties to share costs of repairs to marital home

Clause 3-Responsibility for cost of major repairs on marital home;

procedure for obtaining estimates of cost

Clause 4-Equal allocation of costs; "major repair" defined

Marital Home; Responsibility for Costs Until Sale is Effectuated

Marital Home; Sale of; Additional Maintenance Payment as Incentive for Occupying

Spouse to Sell-Husband to make additional maintenance payment to Wife if she

sells marital home before a specified date

Marital Home; Sale of; Costs of Sale Clause 1-Costs of sale to be borne equally

Clause 2-Parties individually responsible for tax consequences of sale of

marital home Clause 3-Tax liability on sale of marital home to be borne equally

Marital Home; Sale of; Credit for Expenses Clause 1--Husband to pay costs to prepare home for sale and be reimbursed

on sale of house Clause 2--Wife to be credited for expenditures from Husband's share of

proceeds of sale

Marital Home; Sale of; Distribution of Net Proceeds Clause 1-Home previously sold

Clause 2-Home to be sold in the future

Clause 3-Purchaser to deliver checks for Wife, Husband and broker

Clause 4-Wife to pay Husband one-half of net proceeds from sale of marital

home

Marital Home; Sale of; Establishing a Sales Price; "Sales Price" Defined

Marital Home; Sale of; Procedure

Clause 1-Husband to sell home at any price in excess of stated amount;

thereafter, home to be offered for sale at fair market price

Clause 2-Husband to sell marital home; Wife to receive half of proceeds,

less equitable distribution payment

Marital Home; Sale of; Responsibility for Showing of House for Sale

Marital Home; Sale of; Timing of Sale Clause 1-Home is to be placed on the market by date certain

Clause 2-Home to be sold if Wife remarries or vacates residence

Marital Home, Sale Price; Reduction of-Price to be reduced after specified

period that house is on market

Marital Home, Separate Property of One Spouse, to Be Residence of Other Spouse

for Limited Period; Consequences for Holdover Tenancy

Marital Home; Transfer of to Spouse in Contemplation of Refinancing

Marital Home; Use of Portion of Premises by Party Not in Occupancy

Marital Home; Vacating Premises Clause 1-Husband to vacate marital home and to transfer all interest in

home to Wife

Clause 2-Husband to vacate marital home; premises to be left in good

condition Clause 3-Responsibility for costs after Husband vacates premises

Clause 4-Escrow account to be established by Husband to cover costs after

he vacates premises

Marital Home; "Vacating Premises" Defined

Marital Home; Value of-Acknowledgement by parties of value of marital home

Marital Home; Waiver of Spouse's Interest in

Marital Home; Warranty that Neither Party Has Encumbered Home

Clause 1-Parties warrant that they have not encumbered marital home beyond

existing mortgage

Clause 2-Despite warranty, Husband retains right to refinance first

mortgage

Mediation in Drafting of Agreement; Right to Consult an Independent Attorney

Medical Expenses; Defined

Medical Expenses; Proof of-Wife to send bills to Husband

Medical Expenses; Responsibility for

Clause 1-General responsibility of Husband

Clause 2-Husband responsible for all medical expenses of children; Wife to

cooperate in documentation for insurance purposes; consent of Husband needed for

special medical services not covered by insurance Clause 3-Each party responsible for his or her own medical expenses

Medical Expenses; Unreimbursed Expenses

Clause 1-Husband has limited duty to pay for orthodontia, cosmetic

surgery, psychologist and psychiatrist

Clause 2-Parties to share costs of unreimbursed expenses

Clause 3-Husband responsible for all children's unreimbursed medical

expenses

Medical Reports of Children-Each parent entitled to complete information

Mortgage; Cooperative Loan-Husband to make effort to remove Wife's name from

loan against cooperative apartment and to assume all obligations on loan

Mortgage; Refinancing of to Pay for Property Distribution-Husband to mortgage

marital home to make property distribution payment to Wife

Mortgage; Removal of One Spouse as Obligor

Mortgage; Security for Payments in the Event of Death or Default-Husband to

secure life insurance for mortgage and execute Confession of Judgment

Moving; Change of Address of Parties-Parties to notify each other of any change

of address

Moving; Expenses

Moving; Limitation on Distance

Clause 1-Loss of support and custody of children if Wife moves beyond

specified distance

Clause 2-Notice required if parties should change residence

Clause 3-Application for change of custody permitted if Wife should change

residence of children

Clause 4-Wife agrees not to move as long as she is not remarried, there is

a minor child, and Husband is not in arrears in support obligations Clause 5-Remarriage of Wife

Clause 6-Exception for vacation home

Clause 7-Imposition of specific circumstances in which relocation of Wife

is permissible Clause 8-Declaration that Wife not be permitted to move, except for clear

economic need, is in best interests of the children

Clause 9--Reduction of Child Support

Moving; Notice of-Wife with custody of children must give written notice before moving

Moving; Right of Custodial Parent-Unrestricted right to move given to Wife after

specified period of time; adjustment of Husband's visitation schedule M

Text of Clauses

Maintenance; Adequacy of Agreed upon Payments

Clause 1-Wife acknowledges that support payments provided for in Agreement

are sufficient to meet pre-separation standard of living:

The Wife acknowledges that the payments of maintenance and child

support provided for in this Agreement are sufficient to sustain the wife and

children in accordance with their pre-separation standard of living, inclusive

of the expenses of summer camp attendance for the children and unreimbursed

medical expenses for the Wife and children.Clause 2-Wife acknowledges that support payments provided for in Agreement

are fair and reasonable: The Wife acknowledges that the provisions of the Agreement for her

support and maintenance and for the support and maintenance of the children are

fair, adequate and satisfactory to her, and in keeping with her accustomed

standard of living and her reasonable requirements, and giving consideration to

her own ability to provide for her own support and the support of the children

and having contemplated all her present and future needs and all the present and

future needs of the children. The Wife, therefore, accepts these provisions in

full and final settlement and satisfaction, and she hereby releases and

discharges the Husband absolutely and forever, for the rest of her life, from

any and all claims and demands, past, present or future, for support and

maintenance, except as contained in this Agreement.

Maintenance and Other Payments; Modification of in the Event of Bankruptcy

1. The parties have entered into this Agreement with the expectation that

they will each perform their respective obligations hereunder, including those

relating to maintenance, child support, property division, and the payment of

any distributive award, and that none of those obligations will be discharged,

canceled, terminated, diminished or in any way affected by the filing of a

petition in bankruptcy, or by the making of an assignment for the benefit of

creditors ("modified by reason of bankruptcy"). In particular, the Husband

recognizes that notwithstanding how they are characterized in the Agreement, all

of said payments and transfers to the Wife are actually in the nature of

alimony, maintenance, or child support, and the Husband will not assert a

contrary position in any bankruptcy or insolvency proceedings.

2. In the event any payment or other transfer arising under this Agreement

is discharged or downwardly modified by reason of bankruptcy, the party

adversely affected by such modification shall (a) be entitled to apply to any

court of competent jurisdiction for modification of the support provisions of

this Agreement and any order or decree into which it may have been incorporated,

irrespective of the support waivers contained in the Agreement and the

limitations placed upon the modification of agreements under the laws of the

particular jurisdiction or, in the alternative (b) elect to have any such

reduction paid as additional tax-free, non-modifiable maintenance at the rate of

$_______ per month, plus interest payable monthly at the rate of ____% per day,

until the amount (not including interest) equal to the total of the reduced

payments has been paid.

Maintenance; Deduction for Payments Not Made by Spouse-Husband may deduct

mortgage and tax payments made on behalf of Wife from spousal/child support

payments (See also: Marital Home; Occupancy of)

It is herewith agreed that the Wife shall be solely responsible for

mortgage and tax payments during the period of exclusive use and occupancy of

the marital home. In the event that the Wife fails to make the aforesaid

payments, the Husband is entitled to make such payments to the source, and the

Husband shall be entitled to deduct the amount paid from spousal/child support payments.

Maintenance; Direct Payment of Mortgage to Be Applied Toward Maintenance

The parties agree that the support and maintenance as set forth herein

shall be paid by the Husband to the Wife via direct payments of the mortgage,

maintenance and parking charges for and/or connected with the marital residence

with the remaining sums to be paid directly to the Wife.

Maintenance for Purpose of Purchasing a Home; Financial Obligation

In order to assist the Wife in acquiring a separate co-operative or

condominium apartment, the Husband shall make monthly maintenance payments to

the Wife for a period of eighteen (18) years commencing on the first day of the

first month following the closing of the sale of the marital home. The

maintenance payment due in accordance with this paragraph shall be made

regardless of whether the Wife subsequently remarries. The amount of the

aforementioned maintenance obligation shall be equal to the amount of monthly

principal and interest due on a $_________ acquisition based upon eighty percent

(80%) financing, thirty (30) year amortization and an interest rate no greater

than seven percent (7%) annually.

Maintenance; Grounds for Termination; Special Account for Payment of Taxable

Maintenance The Husband agrees to pay to the Wife as maintenance the sum of $______ a

week beginning on ___________ until such time as the occurrence of the first of

the following events:

(1) the Wife's remarriage or co-habitation, co-habitation is being

defined as the Wife living or residing with an unrelated adult male on a regular

or continuing basis for more than ninety (90) days within any twelve month period.;

(2) the death of the Wife;

(3) the death of the Husband; or

(4) the Husband experiences a substantial change in his financial

circumstances such that he cannot reasonably be expected to pay the Wife in

accordance with this Agreement, as shall be determined by a court of competent

jurisdiction. The parties expressly agree that the Husband's obligation to pay

maintenance to the Wife is based on his current income and not the parties'

tangible assets. The parties expressly acknowledge that the Husband's income is

subject to fluctuation and may decrease substantially or increase at any time as

a result of circumstances beyond his control. The Wife agrees that any

determination as to whether the Husband can reasonably pay maintenance at the

levels provided for in this Agreement will be based on his income and not based

on any other standard and he shall not have to sell any assets to pay

maintenance.

While the parties have agreed to file joint tax returns during the

remainder of their marriage, in the event, for whatever reason, whether a

subsequent divorce or otherwise, the parties file separate income tax returns,

the parties agree that the aforesaid payments shall be completely taxable to the

Wife and deductible by the Husband. Further, in the event that the parties file

separate tax returns, if as a result of any tax rule or regulation ruling by any

taxing authority, legislative, judicial, or quasi-judicial body, that the

aforesaid payments are or are held or declared to be non-deductible by the

Husband (including by virtue of the Alternative Minimum Tax), the Husband's

support payments shall be reduced by an amount equal to the tax savings the

Husband would have enjoyed had the maintenance been fully deductible by the Husband. In accordance with the Husband's monthly obligation to pay maintenance to

the Wife, and in the event the parties become divorced and will then be required

to file separate tax returns, the parties agree that the Husband shall pay the

wife the sum of $_______ on a weekly basis each Monday. In addition, the Husband

shall deposit the sum of $______ each Monday into a savings account which shall

be maintained and owned by both the Husband and Wife for the purposes of

maintaining sufficient funds to satisfy the Wife's income tax liability in

connection with the receipt of $______ each week in taxable maintenance. The

account shall be established so that any withdrawal from same shall require the

signature and approval of both the Husband and the Wife. Any sums paid into the

account by the Husband in any given tax year in excess of the Wife's ultimate

tax liability shall be given to the Wife. In the event the Wife's tax liability

exceeds the balance of funds paid into the account by Husband in any given tax

year, the Wife shall be required to make-up the short-fall. Notwithstanding the

preceding obligation, the Husband shall not be required to pay any tax, interest

or penalty assessed against the Wife which results from or relates to her

failure to timely file an income tax return or any liability resulting from any

erroneous inclusion or exclusion, omission or misrepresentation, whether willful

or otherwise, on her tax return. In that event, the Husband's obligation shall

be limited to the funds he has deposited into the joint savings account.

Maintenance; Guarantee of Payment-Members of Husband's family business as

guarantors of payments to WifeThe payments the Husband is required to make under the terms of this

Agreement shall be guaranteed by A.S., or if A.S. shall be deceased by M.S. and

R.S., jointly and severally (each of whom is referred to as the guarantor). In

the event the Husband fails to make any payments when due, the guarantor shall

promptly make such payment, but in no event later than ten days after the

sending of written notification by certified mail, return receipt requested, of

such nonpayment by the Husband.

The guarantors, by affixing their signature to this agreement, bind

themselves to be obligated to the provisions of this paragraph.

Maintenance; Guarantee of Payment by Third Party

The maintenance payments the Husband is required to pay hereunder shall be

guaranteed by ________________ (Guarantor). In the event the Husband fails to

make any payments when due, the Guarantor shall promptly make such payment, but

in no event later than ten days after the sending by the Wife of written

notification by certified mail, return receipt requested, of such nonpayment.

Maintenance; Modification of on Disability

In the event of a catastrophic illness which would render the Husband

either partially or totally disabled to the extent of making him unable to

engage in full time employment at his prior earning levels, the payment of

maintenance provided for in this Agreement may be modified and the parties shall

re-negotiate their respective rights and obligations.

Maintenance; Modification of When Payee Spouse Earns Taxable Income, Payor

Becomes Disabled, or Payor Loses License to Practice Profession In the event the Wife obtains employment or begins to earn taxable income

of any kind, including Social Security Disability income (except for the

maintenance payments set forth herein), the Husband's maintenance obligation

shall be reduced by one dollar ($1.00) for every one dollar ($1.00) received by

the Wife from such other sources. Without limiting the generality of the provisions as set forth, in the

event of a catastrophic illness which would render the Husband either partially

or totally disabled to the extent of making him unable to engage in full time

employment at his prior earning levels or in the event the Husband shall lose

his license and ability to practice his occupation or profession and he has no

other comparable source of income to satisfy his spousal support obligations as

set forth herein, or in the event a substantial change of circumstances occurs

and the Husband's income is insufficient to pay the maintenance provided for in

this Agreement, the Husband's maintenance obligation may be modified and the

parties shall renegotiate their respective rights and obligations. In the event

the parties cannot reach an agreement with respect to the modified maintenance

obligation, the dispute shall be submitted to a court of competent jurisdiction.

Any disability insurance payments received by the Husband will be taken into

consideration in any recalculation of maintenance. In the event that maintenance is modified, the parties (or the court)

shall attempt to structure the maintenance payments in such a manner as to

maximize any tax savings the Husband may realize as a result of having the

payments be considered taxable to the Wife and deductible by the Husband for

income tax purposes.

The parties, therefore, accept these provisions in full and final

settlement and satisfaction, and they hereby release and discharge each other,

absolutely, from any and all claims and demands past, present and future for any

support and maintenance except has provided herein. The Husband currently maintains a disability income insurance policy with

________, policy #________ which provides that he is entitled to receive

$_________ per month until the age of sixty-five in the event of his disability.

The Husband shall be required to maintain the said policy for so long as he is

employed and is obligated to make payments to the Wife pursuant to this Article.

Maintenance; Payments in Lieu of Equitable Distribution (See also: Marital Home;

Sale of: Distribution of Proceeds)

Husband agrees to pay and the Wife accepts as additional maintenance to be

considered non-taxable to her and non-deductible by the Husband, and in view of

such additional maintenance waives and releases any right to equitable

distribution of the marital property: the sum of $__________, or a lesser amount

as more fully described in Exhibit "A" of this Agreement representing a present

value discount for the accelerated payment of such additional maintenance

payable simultaneously with the execution of this Agreement, by a note

containing the following payment terms:

(1) The first installment of the maintenance note shall be in the

amount of $__________ due one year from the date of the signing of this

Agreement.

(2) The balance of the maintenance note shall be paid in sixty-three

(63) equal monthly installments of $_________ and a final installment of

$______. The first such installment is due on the _______ day of the thirteenth

month following the signing of this Agreement or on the first day of the month

following the sale of the Marital Residence, whichever comes first. Payments

shall then continue on the first of each month until the note is paid in full.

Maintenance; Payments to Be Apportioned Between Alimony Child Support

The Husband shall pay to the Wife the sum of $50,000, payable in

installments of $______ per month. The parties hereby acknowledge that the

aforesaid payment of $50,000 to the Wife by the Husband shall be deemed to

include child support for the parties child. The Wife hereby acknowledges,

specifically, that sum of $1,500 per month shall be allocated from the aforesaid

sum to the child's expenses, including room, board and tuition at college,

effective on the date of execution of this Agreement and continuing until _____

__, 20__ when the Husband would have paid for ___ months at the rate of $1,500

per month . However, the parties acknowledge that the child shall turn twenty-

one on ____ __, 20__, at which time he shall be emancipated and, at such time,

the Husband shall make all payments to the Wife on the full amount of $50,000

for the benefit of the Wife solely.

Maintenance; Penalty Fees on Mortgage Chargeable Against Spouse Late in Making

Support Payments-Husband to reimburse Wife for late fees paid by Wife on

mortgage payments if Wife's lateness caused by late support payments from

Husband (See also: Marital Home; Expenses; Indemnification for-Support Arrears)In the event the Wife is required to pay any late fees in connection with

the mortgage payments due on the marital home because of late support payments

due from the Husband, then in such event the Husband shall immediately reimburse

the Wife for such late fees. A late payment shall be deemed any payment made to

the Wife five days or more after the date which payment is required to be made

as herein-above set forth and which resulted a "late fee."

Maintenance; Reduction of in Accordance with Recipient Spouse's Earning Ability

It is assumed that the Wife shall use her best efforts to earn money in

the future. It is therefore agreed that all maintenance set forth in this

Agreement shall cease on January 1, of any calendar year after a year (the

"Reduction Date") in which the Wife's gross income as defined by the Child

Support Standards Act, Article 4, Section 413(5) (hereinafter referred to as

"C.S.S.A.") shall equal or exceed $50,000. If said gross income as defined by

C.S.S.A. of the Wife in any one year hereafter is between $25,000 and $50,000,

said maintenance provisions in favor of the Wife shall be reduced as of the

Reduction Date by the percentage that is equal to the proportion each $1,000 in

an increase in the Wife's gross income as defined by C.S.S.A. over $25,000 is to

$50,000. For example, if in the year 20__ the Wife's gross income as defined by

C.S.S.A. is $30,000, as of January 1, of the following calendar year, the

spousal maintenance payment will be reduced annually by the percentage equal to

the fraction 30,000/50,000, or 60%.

Maintenance; Royalties from Patent Payable as

In the event the Husband is in receipt of income from a patent that he

holds in connection with _____________, the Husband shall pay to the Wife as and

for additional maintenance, notwithstanding any other obligation pursuant to

this Agreement, during her lifetime, fifty percent (50%) of any royalty payments

that are made in connection with this patent. This obligation shall terminate on

the death of either party, but shall not terminate on the remarriage of the

Wife. The Wife shall be entitled to disclosure of the Husband's federal and

state income tax returns and any reasonable back-up documentation as requested

by her accountant, so that compliance with the provisions of this paragraph may

be monitored.

Maintenance; Securing Payment of

In order to provide for the Wife's financial security, the Husband agrees

that he will restrict his access or use of the capital appreciation account at

ABC as follows:

(1) So long as the Husband duly performs all of his obligations

under this Agreement, he shall be entitled to receive and retain for his sole

benefit any and all dividends or distributions received on the capital

appreciation account;(2) In the event that the Husband liquidates or changes the account

in any fashion, he will notify the Wife and will pay her an amount equal to any

funds he has withdrawn after payment of any applicable federal, state or other

taxes paid, or to be paid on such sums, except that under no circumstances shall

the amounts due and owing to the Wife from said liquidation be greater than the

Husband's total remaining obligation under paragraph __ of this Agreement. (3) In the event of the death of the Husband, the total sum owed

shall be considered due and owing and shall be a charge against his estate. In

the event of a default by the Husband during his lifetime, the Wife shall be

allowed to direct the liquidation of the account to the extent of the balance

owed to her pursuant to this article and any reasonable attorneys' fees that may

be required to effectuate that result.

Maintenance; Social Security-Level of maintenance payments to remain constant in

the event of changes in government benefits:

If the Wife is unable to receive Social Security or Medicare as a result

of governmental, statutory or other systemic changes when the Wife reaches the

age at which, at the time of the signing of the agreement, the Wife would have

otherwise been eligible to receive such assistance, then it is the intention of

both parties that the Husband will continue to pay maintenance at the same level

as the Husband paid in the year prior to the Wife reaching this age.

Maintenance; Taxation and Deduction

Clause 1-Payments taxable to wife and deductible by Husband; if payments

held non-deductible, amount to be adjusted to achieve same economic effect as if

deductible: The Husband agrees to pay to the Wife as maintenance the sum of

$________ a month for ________ years beginning on January 1, _______. The

parties agree that the aforesaid payments shall be completely taxable to the

Wife and deductible by the Husband. If as a result of any ruling by any taxing

authority, legislative, judicial, or quasi-judicial body, the aforesaid payments

are held or declared to be non-deductible by the Husband, then the Husband's

payments shall be adjusted so that the net economic effect to the Husband will

be as if it were fully deductible to the Husband.

Clause 2-Wife advised that alimony payments are taxable to her and

deductible by Husband:

The Wife has been advised by her counsel and by her financial

advisors that the entire amount of alimony being paid to her for her support and

maintenance are separate periodic maintenance payments included and intended to

be included with other income of the Wife within the meaning and intent of the

United States Internal Revenue Code; and are deductible from the Husband's gross

income pursuant to the provisions of the United States Internal Revenue Code.

The Wife agrees that all said payments under this Article shall be included in

her federal and state income tax returns and that she shall pay such federal and

state income taxes as may be due on the payments made under this Article.

Maintenance; Tax Law Change That Would Disallow Alimony Deduction

The parties recognize and agree that all payments provided for in this

Article are maintenance and alimony payments which the Wife is required to

include in her gross income for income tax purposes and which the Husband is

entitled to deduct on his tax returns (hereinafter referred to as the "Alimony

Deduction"). If at any time subsequent to the date hereof by reason of any

change of law, or by reason of interpretation, or by reason of any change of

law, or by reason of interpretation, or by reason of any other matter, the

Husband is forbidden or prohibited in connection with his income tax returns

from taking in full the Alimony Deduction pursuant to this Article, or if such

deductions are disallowed (irrespective of whether by reason of any statutory

amendment, court decision, Internal Revenue Service regulation, ruling or final

determination, including but not limited to a "ninety day letter" which has not

been changed by administrative revision, whether based on present or future law

or if such deductions become subject to recapture as additional income to the

Husband in subsequent years), the Husband and Wife shall agree on an equitable

adjustment in the payments made and in those, if any, remaining to be made, to

reflect (1) the additional tax burden thereby imposed on the Husband, and (2)

the lesser tax burden thereby imposed on the Wife. The equitable adjustment

shall be to achieve the result that the net after tax results to both parties

are substantially as intended under this Agreement. In the event that the

Husband and Wife are unable to agree on such adjustment, either party may make

application to a court of competent jurisdiction to determine to amount of the

adjustment, and the party prevailing shall be entitled to recover from the other

party his or her reasonable attorneys fees and expenses incurred in connection

with such dispute including negotiations leading to said litigation and the

costs of the litigation, itself.

Maintenance; Temporary Increase of During Recipient Spouse's Period of

UnemploymentIf the Wife is discharged from her job at ____________, due to no fault of

her own, the Husband shall pay to her the amount of her salary at discharge as

additional maintenance which shall be tax deductible to the Husband taxable to

the Wife for a maximum period of eighteen months or such shorter period as shall

be determined by (1) the Wife's re-employment, (2) the Wife's death, (3) the

Husband's death, or (4) the Wife's cohabitation or remarriage.

Maintenance; Termination of Payments on Marriage or Cohabitation; "Cohabitation"

Defined-Maintenance payments to Wife to cease on her cohabitation with another

man (See also: Child Support; Reduction of on Cohabitation or Remarriage--

Cohabitation Defined-Remarriage Defined)

(1) "Cohabitation" is hereby defined as the Wife living or residing with

an unrelated adult male on a regular or continuing basis for more that thirty

(30) consecutive days within any twelve (12) month period. (2) In the event that the Wife marries or cohabits with another man as

defined above in Paragraph 1, then all support and maintenance, or other

payments to the Wife, as well as all of the Wife's expenses payable by the

husband pursuant to Articles__, and __ shall be immediately and forever

terminated.

Maintenance Trust; Establishment of

(1) Commencing ___ __, 20__, and continuing until the Wife's death,

regardless of the Wife's subsequent remarriage or remarriages, and regardless of

her cohabitation with any person she shall receive the sum of $______ per month

for her support and maintenance. Said sum shall be funded, paid and secured by a

trust created by the Husband as hereinafter set forth.

(2) In the event, and only to the extent that the cost of living (as

hereinafter defined) increases more than 10% from the present index (as

hereinafter identified), commencing in the year that the 10% increase is

reached, and only to the extent that there are available income and/or funds in

an amount greater than the Initial Corpus Trust in excess of the sum required to

pay the monthly payments, and continuing on an annual basis thereafter, the

Wife's payments shall be modified by a Cost of Living Adjustment (COLA). The

said COLA shall be tied to and defined by the United States Consumer Price Index

that governs the Northeast Corridor for Urban Wage Earners (the "Index"), or any

successor Index that applies to such geographic area. The COLA shall be computed

by determining the aforementioned Consumer Price Index for the preceding year

and applying such percentage to the next twelve months' payments to the Wife.

The Index to be used for comparison purposes shall be the Index in effect on

_____ __, 20__.(3) It is expressly agreed and acknowledged by the parties that it is

intended that the monthly payments of $_____ together with any modifications due

to the COLA to be received by the Wife until her death shall not be taxable to

her nor deductible by the Husband for income tax purposes under Sections 71 and

215 of the Internal Revenue Code or their successor statutes, or under any

state, local or foreign income tax statutes or regulations. (4) The parties agree and acknowledge that it is critical to the Wife's

financial well-being to receive and collect the monthly payments on the first

business day of each month, and the Husband's failure to pay the Wife so that

the said payments are received and collected by the Wife on the first day of

each month shall be deemed a breach of this Agreement, permitting the Wife to

seek immediate relief under the laws of the State of _________or any other court

of competent jurisdiction in addition to any other rights and remedies available

to the Wife. (5) In consideration for and on behalf of the Husband's monthly support

obligations as set forth in this Article, and in order to effectuate the ends

sought herein, the Husband shall cooperate in establishing a trust (the Trust)

that shall be governed and controlled by the trust instruments to be executed

contemporaneously with the execution of this Agreement, copies that are

substantially in conformance with said trust instruments being annexed hereto as

Schedule A and being made a part of this Agreement. In connection therewith, it

is agreed that to secure the Wife's lifetime monthly payments hereunder, the

Trust shall be formed and its corpus shall be funded with and consist of (a)

$______ in cash representing twelve months of the maintenance payments, and (b)

other assets designated in Schedule B with the values therein stated (Initial

Trust Corpus). The Husband shall have an irrevocable option to purchase any of

the assets from time to time, except as provided below for a triggering event,

at the assigned price in the Trust Agreement. Said option shall be exercised by

giving written notice to the Trustee who shall acknowledge same and confirm to

the Husband that the asset to be purchased pursuant to the option is available

and ready for pick-up on receipt of the option price by wire transfer to the

Trustee's account indicated in the confirmation. The following events shall be

considered "triggering events" and shall require the Husband to exercise his

option within the allotted time period.

(a) If the Trustee is about to proceed to sell a specific asset

because the cash assets in the Trust are less than the amount that would be

payable to the Wife for one year, then in such case, the Trustee shall give

written notice to the Husband that it is about to proceed to sell a particular

asset and the Husband shall have forty-five days to exercise his option to buy

that asset at the assigned price, failing which the Trustee shall be free to

sell the asset as it sees fit. (b) In the event of a default, the Trustee shall give notice of its

intent to invade and sell trust assets, and the Husband shall have thirty days

to exercise his option to buy the assets designated for sale by the Trustee at

the assigned price, failing which the Trustee shall be free to sell the assets

as it sees fit.(c) If and when the Husband exercises his right to purchase as

hereinabove set forth, the assigned value shall be subject to an additional sum

that shall be calculated by using the cumulative cost of living increases, if

any, commencing _____ __, 20__, as said increases are set forth and defined by

the United States Consumer Price Index for the Northeast Corridor for Urban Wage

Earners (the "Index"), or any successor Index that applies to such geographic

area. The COLA shall be computed by determining the aforementioned Consumer

Price Index commencing with the Index in effect on _____ __, 20__, and applying

such percentage to subsequent years.

(6) The parties acknowledge that the terms of the Trust described and set

forth in this Article are subject to acceptance by the Trustee to be mutually

selected by the parties. (7) During the term of the trust and in the event Husband obtains any form

of property and liability insurance with respect to any and/or all assets

included in the Trust, the Trust shall be named as a co-insured under such

insurance policy or policies, if any, and in the event of an insurance and/or

claim under such policy or policies, and if such assets are still part of the

trust corpus at the time of the claim and are not otherwise fully insured for

such loss by the Trust, or if the Trustee is unable for any reason to fully

recover from the Trust's property liability insurance carrier(s) the full

insured value of such assets, the Trustee shall be entitled to receive from the

proceeds of any such insurance obtained by Husband, a sum equivalent to the full

amount of the price assigned to each asset involved in such loss plus the

appreciation (COLA) before any insurance distribution is made.

(8) The parties agree that the Wife or her designated agents shall be

entitled to receive written annual accountings from the Trust.

(9) The monthly payments of $_____ together with any modifications due to

the COLA hereinabove set forth shall be paid to the Wife on a net basis, free

from any claim of the Trust or any other person or entity that commission fees,

trustee fees, or the like are due from the Wife, it being the parties' express

intent that the Wife shall receive her monthly payments free and clear of the

costs, if any, associated with the generation by the Trust of said monthly sums. (10) The parties agree that if at any time during the Wife's life the cash

portion of the trust corpus falls below the amount payable to the Wife over a

period of one year, then and in that event (a) the Wife shall receive written

notice from the trustee of such fact, and (b) the Trustee shall, consistent with

the terms and provision of such Trust, shall immediately proceed to sell any

asset in the trust corpus so as to increase the cash portion to a sum equal to

or greater than the amount payable to the Wife over a period of one year.

(11) In the event that the Wife does not receive her monthly payments on a

timely basis, or the Trust defaults in connection with any of its obligations,

in addition to any other enforcement rights and remedies available to the Wife,

she shall be entitled to cause the Trustee to invade the trust corpus in order

to sell such portion of the trust corpus required to pay and/or reasonably raise

the sums needed to pay the monthly payments that are in default by sale of any

asset in the Trust to obtain the sums required to satisfy the Wife's claim for

unpaid maintenance.

(12) In the event that the Trust defaults in connection with any of its

obligations due to the Trustee's gross negligence or willful default as found by

a court of competent jurisdiction, in addition to any other enforcement rights

and remedies available to the Wife, she shall be entitled to invade and access

the Trust and trust corpus in order to take possession, control and title of the

entire trust corpus, subject to the option provisions of this Article.

(13) Upon the Wife's death, the parties children shall be entitled to the

remaining balance of the trust corpus not used for the Wife's support and

maintenance in equal shares, per stirpes, or if the children predecease the

Wife, to the alternate beneficiary provided for in the trust assets.

(14) So long as she receives monthly payments on a timely basis, the Wife

shall be responsible for her own living expenses including, but not limited to,

medical coverage, travel, housing, entertainment, and the like. In the event

that the aforementioned trust fails to comply with its monthly obligations as

hereinabove set forth, and in addition to any other enforcement remedies

available to the Wife in this or any other jurisdiction, she shall be absolutely

free to seek, inter alia, compliance and enforcement directly from the Husband

and/or any property or assets held in his name wherever they may be situated,

but such personal liability on the Husband's part shall terminate upon the

Wife's remarriage or her cohabitation with an unrelated adult male for a period

of not less than four consecutive months.

Maintenance; Waiver of

Clause 1-Mutual waiver of support by other spouse:The Husband and the Wife desire and intend by this Agreement to

execute a complete, final and permanent settlement and adjustment of all

property, support and other financial rights, obligations, interest and claims

of every kind and nature arising from, in connection with, or related to the

marriage relationship.

(1) The Wife represents that she has been and continues to be

in good health, and that she has been and continues to be capable of being

gainfully employed, and that she is presently self supporting and expects to

remain so. Accordingly the Wife expressly waives all claims, if any, for past,

present and future support payments from the Husband.

(2) The Husband represents that he has been and continues to

be in good health, and that he has been and continues to be capable of being

gainfully employed, and that he is presently self supporting and expects to

remain so. Accordingly the Husband expressly waives all claims, if any, for

past, present and future support payments from the Wife.

Clause 2-Wife waives maintenance and equitable distribution in exchange

for lump sum payment (See also: Settlement; Lump Sum Payment): The Husband shall pay to the Wife, as and for a lump sum

distribution, representing her interest in the marital assets, and for any claim

she may have by virtue of equitable distribution or otherwise on or before the

_________ day following execution of this Agreement, by money order or bank

certified check drawn or issued by a Commercial Savings Bank located in the City

of _____________, the sum of $___________. Payment in full and satisfaction of

said check or money order in payment thereof, will be deemed as the Wife's

acceptance of said sum in full satisfaction of her claims to equitable

distribution and in full satisfaction of her interest, if any, in any property

of the Husband and of her claims to maintenance, alimony and/or support except

as otherwise set forth in this Agreement. In waiving maintenance, alimony and/or support or any other form of

periodic payment, the Wife has taken into consideration her ability of being

self-supporting and/or being gainfully employed. Notwithstanding this, if she

chooses not to work or is unable to work, the sums provide under equitable

distribution together with any interest or income attributable thereto, are

sufficient for her support or maintenance.

Maintenance; Waiver of Right to Seek Modification

Each party specifically waives their respective rights which presently

exists under Section _______ of the ________ Law of the State of _____________

to seek modification of the maintenance provisions herein.

Marital Estate; Final Date for Claims Against (See also: After Acquired

Property; Status of)

The Husband and Wife hereby agree that the date of this Agreement, shall

govern and control the assertion of any claim for equitable distribution that

either may have against the marital property of the other, and the Husband and

Wife hereby waive, release and relinquish any claim for equitable distribution

that either of them may have to any property acquired by them on or after the

date of this Agreement.

Marital Home See also, the following subject areas: Condominium Apartment;

Conveyance of Interest to Spouse-Cooperative Apartment; Conveyance of Interest

to Spouse-Estate; Transfer of Real Property on Death of Proprietary Spouse-

Rental Apartment; Conveyance of Interest to Spouse-Rental Apartment;

Responsibility for Payment of Rent; Rent Deemed Offset Toward Maintenance and

Child Support-Rental Apartment; Rights in Cooperative or Condominium Conversion;

Conveyance of Interest to Spouse.

Marital Home; Access to-Wife not to change locks on marital home and to allow

Husband access to certain rooms

The Wife agrees that she will not change the locks on the marital

residence. The Wife agrees to allow the Husband access to the basement, study

and laundry room in the marital residence.

Marital Home; Allocation of Expenses (See also: Marital Home; Expenses; Warranty

of Payment)

Clause 1:During the period of time that the parties own the marital

residence:

(1) The Wife shall pay all amounts that are due and payable

pursuant to the existing mortgage including, without limitation the monthly

payments of interest, amortization of principal, and escrow fund deposits, and

all taxes-county, city, school-imposed on the marital residence.

(2) The Husband shall pay all the expenses of maintaining the

marital residence. Such expenses shall, without limitation of the foregoing, be

deemed to consist of:

(a) the cost of all utilities;

(b) the cost of all household maintenance.

(3) The Husband and Wife shall pay equally the cost of all

insurance coverage for the marital residence. (4) The Wife shall be entitled to all federal, state and local

deductions and/or credits pertaining to payments of these expenses.

Clause 2:(1) The Husband agrees that he will pay the following expenses on

the marital residence; first and second mortgage, [name of bank] loan, and

homeowner's insurance. The Husband agrees to save and hold the Wife free and

harmless from and indemnified against the foregoing expenses.(2) The Wife agrees that she will pay the following expenses on the

marital residence: all utilities, including telephone, gas and electric, all

repairs and maintenance of the property. The Wife agrees to save and hold the

Husband free and harmless from and indemnified against the foregoing expenses.

Clause 3:During the period in which the Wife resides in the marital

residence, and commencing [date], the Husband agrees to provide the sum of

$_______ per month which shall be used for the expenses on the marital residence

including, but not limited to, the mortgage, real estate taxes, necessary

repairs, fuel and utilities. The sum of $________ per month shall be the

Husband's total contribution to these expenses regardless of the fact that the

expenses on the marital residence may total more than $_________ per month,

except, however, that the Husband shall pay the total cost of homeowner's

insurance, and one-half the cost of all necessary repairs in excess of $________

for labor and/or materials, provided the Wife first obtains the Husband's

consent to said repair if the repair is a non-emergency repair, and the Husband

is given the option to complete the construction. The Husband's consent for non-

emergency repairs shall not be unreasonably withheld. The payment of $________

per month shall cease upon the closing of the sale of the marital residence. The

Husband shall pay to the Wife, simultaneously with the execution of this

Agreement, the sum of $________ as reimbursement for the foregoing expenses

during the period from ______, 19__ to _______, 19 __ inclusive. The Wife agrees that she shall assume and maintain full and complete

responsibility and liability for all expenses, taxes, maintenance charges and

any other costs related to the apartment premiss aforementioned.

Marital Home; Appraisal of-Procedure for establishing appraisal for purpose of

sale (See also: Marital Home; Sale of)

Clause 1:The parties warrant herein that they will obtain an appraisal with

respect to the value of the marital residence. Said appraisal is to be made by a

mutually agreed upon licensed real estate broker who is familiar with recent

sales of comparable real estate in the vicinity of the marital residence. If the

parties are unable to agree on (1) the real estate brokers with whom the marital

residence shall be placed for sale, or (2) the price at which the marital

residence shall be placed for sale, such decision shall be made by the spouses

each appointing a local real estate broker who is a member of the County Real

Estate Board, who shall each submit a written appraisal. The real estate brokers

so chosen shall also agree upon a third broker who shall submit an appraisal of

the property. The average of the three appraisals shall be the selling price and

shall be binding upon the parties. The costs of the appraisal shall be shared

equally between the parties. Any exclusive listing shall be limited to a period

of ______ days. In the event that an exclusive listing is not in effect, either

spouse may list the residence with a licensed real estate broker of his or her

choice at the selling price.

Clause 2:In the event that the parties cannot agree on the fair market value

of the marital residence, then either party may send to the other a letter

acknowledging this fact and within fifteen days of the sending of such letter,

each party will choose a licensed real estate broker from the area in which the

property is located. Within ten days thereafter each of two said brokers will

agree on a third, whose opinion as to the fair market value will be binding upon

the parties. Each of the parties will pay the fee of his or her own broker and

the parties will each pay one-half of the fee of the third broker.Clause 3:(1) Within 180 days of the execution of this Agreement, the parties

shall offer the marital residence for sale, at a minimum net sale price to be

agreed upon by the parties. If the parties can not agree between themselves as

to an offering price for the marital residence within seven months of the date

hereof, it shall be offered for sale at 10% above fair market value determined

as follows: each party shall, within thirty days of the date thereof, choose a

local disinterested real estate appraiser to appraise the marital residence and

to render an opinion as to its fair market value; or the parties may elect to

jointly select an appraiser and agree to accept his or her conclusion. The said

appraisals are to be completed within thirty days following the date on which

the appraiser or appraisers are retained thereof. If the parties choose one

appraiser, the appraisal rendered shall be binding upon them. If there are two

appraisals, the two appraisers will endeavor to agree on the fair market value

of the marital residence for which they rendered an appraisal. This will be done

within thirty days following the date on which their appraisals are completed as

provided herein. In the event the two appraisers cannot agree on the fair market

value, they shall, within ten days thereafter jointly choose a third

disinterested local real estate appraiser whose determination will be binding

and which appraisal shall be completed within thirty days following the date on

which the third appraiser is retained. Each party shall bear the cost of the

appraiser chosen by that party and, if a third appraiser is required, the

parties shall share equally the cost of such appraiser. Should the parties elect

to use the same appraiser, they shall share the costs equally. (2) The parties shall be entitled to equally share all of the net

proceeds of the sale of the Marital Residence. Net proceeds are defined to be

the balance of the proceeds of the sale of the marital residence after the

payment of the outstanding loans to ____ and ____, brokerage commissions, legal

fees and other customary costs of closing. (3) The Husband and the Wife hereby agree to cooperate with the

efforts of the other party in relation to said sale, including but not limited

to providing access to the marital residence, and financial documents concerning

the marital residence to any potential buyer. Each party who offers the marital

residence for sale shall apprise the other of the names of any and all brokers

retained to sell the property as well as all listings, a record of the showings

of the apartment, and all offers received on the apartment.

Marital Home; Ascertainment of Liens

The parties acknowledge that a search of the County Clerk's records with

reference to ascertaining the existence of a lien against the property has been

recommended by counsel, and the parties agree that such search shall be

conducted and that the fee for same, in the approximately sum of two hundred

dollars ($200.00), shall be paid prior to the performance of the search. Said

fee shall be paid by the transferee Wife.

Marital Home; Ascertainment of Liens; Declination of Search

The Wife, as transferee of the marital home, acknowledges that a search of

the County Clerk's records with reference to ascertaining the existence of liens

against the property has been recommended by counsel and the Wife has declined

to have such search conducted.

Marital Home as Income Producing Property; Allocation of ExpensesThe parties acknowledge that the second floor level of the marital

residence (as previously defined) is a rental premise which is occupied by

tenants. The Husband agrees to be responsible for the collection of the rent and

the payment of the mortgage on the House. The Wife agrees to be responsible for

the payment of the real estate tax and the insurance on the House (which is

included in the monthly mortgage payment). These expenses shall be paid by the

Wife through a reduction of the Husband's child support payment, with the

Husband paying these expenses directly to the source. The Wife shall also be

responsible for the payment of the gas and electric, fuel and gardening except

to the extent that such costs are attributable to the rental property and as

such, at the time of the sale of the marital residence the Wife shall receive a

credit for such payments attributable to the rental property.

Marital Home; Attribution of Costs for Major Repairs

The parties further agree that they will both be equally responsible for

all major repairs which may be needed in connection with the home. A major

repair is defined as one in excess of two hundred dollars ($200). Prior to

incurring any expense for a major repair, the party occupying the home shall

submit to the other party, in writing, a written estimate detailing the work to

be performed. The non-occupying party must be consulted before the work is

commenced and the non-occupying party must consent to the work being done, said

consent shall not be unreasonably withheld. In the event the other party does

not approve said proposal and the parties cannot otherwise agree, either party

shall be entitled to submit the claim to arbitration for a final determination.

Marital Home; Attribution of Costs for Major Repairs in Event of Non-Compliance

In the event a party fails to pay his or her share of the cost of major

repairs, after agreement by the parties or, in the event a determination is made

after arbitration, and one of the parties is obligated to make the repair and

advance the moneys, then the non-complying party shall become indebted to the

complying party in the amount of money expended by the complying party. In

addition, the amount owed the party who advanced the money shall accrue interest

at the rate of ____ percent (___%) per annum, of principal expended on repairs.

Such accrued amount shall be paid no later than the closing of the sale of the

home out of the non-complying party's share of the proceeds from the sale of the

home, or taken into account in the calculation of the division of proceeds from

the sale of the non-complying party's interest in the home.

Marital Home; Conveyance of Interest to Spouse (See also: Cooperative Apartment;

Conveyance of Interest to Spouse-Condominium Apartment; Conveyance of Interest

to Spouse-Marital Home; Vacating Premises

Clause 1-Husband conveys all right in marital home to Wife:The Husband hereby releases and conveys to the Wife his entire right

and interest including any lease and utility security deposits in the marital

leasehold known as _________.

Clause 2-Wife to execute bargain and sale deed on marital property in

favor of Husband; deed to be held in escrow for stated period; Husband may

refinance home during escrow period:

(1) Within five days after its receipt by the Wife's counsel, the

Wife will execute a bargain and sale deed (to be prepared by Husband's counsel)

with covenants against grantor's acts, conveying to the Husband her entire

right, title and interest to and in the property located at _______ which is

presently held in the names of the Husband and the Wife as tenants by entirety,

which deed will be held in escrow by ______ as escrow agents until its delivery

to the Husband as set forth in this Article.(2) It is herein agreed that during such period that the deed is

held in escrow, the Husband may at his sole discretion refinance the premises

known as ______ and the Wife agrees to interpose no objection to such

refinancing. Simultaneously with any closing of any refinancing, the deed will

be released and delivered to the title closer and the Husband by the escrow

agent, and simultaneously with the closing the Husband shall make the payments

to the Wife under Article ____, Paragraph ____.

Clause 3-Conveyance by Husband to Wife; Wife responsible for mortgage:The Husband hereby transfers all of his right, title and interest in

the property at ______ to the Wife. He further waives all right he may have to

said home, including the right of occupancy. He agrees to execute any and all

documents necessary to effectuate t