1 U.S. Legal Forms, Inc. Medicaid Long Term Care Handbook, Planner, and State Resource Guide * * * A general information guide on how to plan and pay for long term care. ©2006 U.S. Legal Forms, Inc. All rights reserved. This handbook, developed by U.S. Legal Forms, Inc. (USLF), is protected by copyright, and may

not be reprinted, distributed or displayed by any means without the express written consent of

USLF.This handbook is provided without any warranty, express or implied, as to its legal effect and

completeness. Please use at your own risk. If you have a serious legal problem, we suggest that you

consult an attorney in your state. U.S. Legal Forms, Inc. does not provide legal advice. The products

offered by U.S. Legal Forms, Inc. are not a substitute for the advice of an attorney.THIS HANDBOOK IS PROVIDED “AS IS” WITHOUT ANY EXPRESS OR IMPLIED WARRANTY OF ANY KIND INCLUDING WARRANTIES OF MERCHANTABILITY,

NONINFRINGEMENT OF INTELLECTUAL PROPERTY, OR FITNESS FOR ANY

PARTICULAR PURPOSE. IN NO EVENT SHALL U.S. LEGAL FORMS, INC. OR ITS AGENTS OR OFFICERS BE LIABLE FOR ANY DAMAGES WHATSOEVER (INCLUDING,

WITHOUT LIMITATION, DAMAGES FOR LOSS OF PROFITS, BUSINESS INTERRUPTION,

LOSS OF INFORMATION) ARISING OUT OF THE USE OR OF INABILITY TO USE THIS

HANDBOOK, EVEN IF U.S. LEGAL FORMS, INC. HAS BEEN ADVISED OF THE

POSSIBILITY OF SUCH DAMAGES.

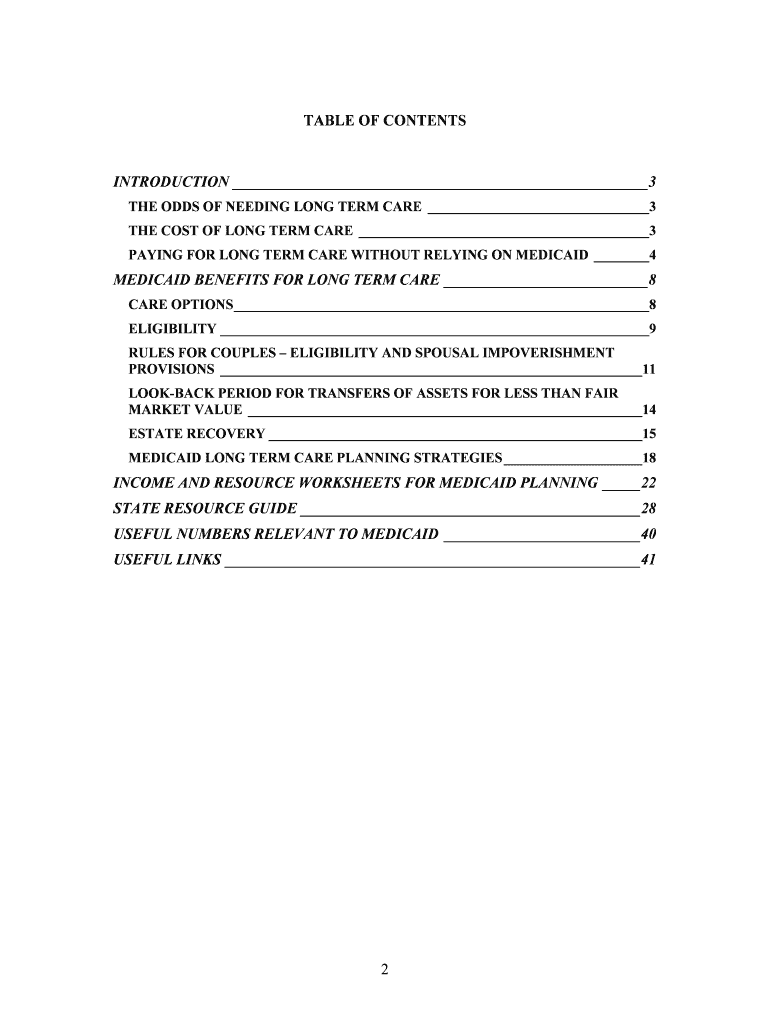

2 TABLE OF CONTENTS INTRODUCTION_______________________________________________________ 3THE ODDS OF NEEDING LONG TERM CARE________________________________3THE COST OF LONG TERM CARE __________________________________________ 3PAYING FOR LONG TERM CARE WITHOUT RELYING ON MEDICAID ________4MEDICAID BENEFITS FOR LONG TERM CARE ___________________________8CARE OPTIONS____________________________________________________________ 8ELIGIBILITY______________________________________________________________ 9RULES FOR COUPLES – ELIGIBILITY AND SPOUSAL IMPOVERISHMENT

PROVISIONS _____________________________________________________________ 11

LOOK-BACK PERIOD FOR TRANSFERS OF ASSETS FOR LESS THAN FAIR

MARKET VALUE_________________________________________________________ 14

ESTATE RECOVERY______________________________________________________ 15MEDICAID LONG TERM CARE PLANNING STRATEGIES ____________________18INCOME AND RESOURCE WORKSHEETS FOR MEDICAID PLANNING_____22STATE RESOURCE GUIDE_____________________________________________ 28USEFUL NUMBERS RELEVANT TO MEDICAID __________________________ 40USEFUL LINKS_______________________________________________________ 41

3 INTRODUCTION THE ODDS OF NEEDING LONG TERM CARESaving enough to retire comfortably and leave a legacy to your loved ones requires sound

investment and planning. However, many overlook what could be their most costly

expense related to aging; paying for long term care. Long term care is extremely

expensive whether you receive care in a nursing home, assisted living facility, or in your

own home.It’s nearly impossible to predict whether a given individual will need long term care.

However, we can estimate our chances. Kemper and Murtaugh reported in the New

England Journal of Medicine that half of women age 65 and older will spend some time

in a nursing home. 31% of all women will stay in a nursing home for more than one year.

9% of all women will stay in a nursing home for more than five years. One-third of men

age 65 and older will spend some time in a nursing home. 14% of all men will spend

more than one year in a nursing home. 4% of all men will spend more than five years in a

nursing home.THE COST OF LONG TERM CAREWhat will that cost you? According to the 2005 MetLife Market Survey of Nursing Home

and Home Care Costs, the estimated average cost for a nursing home stay is over $64,000

per year for a semi-private room ($175/day). The cost for a private room is just over

$74,000 ($202/day). Assisted living at home can cost more than $38,000 per year or $19

per hour for a home healthcare aid ($104/day). Long-term care costs can be considerably

higher in larger metropolitan areas. For example, the average cost for long term care in

Stamford Connecticut is $120,975 ($331.44/day). These figures are expected to almost

triple over the next 20 years if long term care costs increase at the rate of 5% per year.

You can look at various scenarios using

SmartMoney’s long term care calculator.

For a quick estimate on what long term care could cost you in the future, assume that

you’re 40 and you’ve saved $500,000 for long term care. You don’t add any more money

to your long term care account and it earns 2% interest annually after taxes. You won’t

need long term care until you’re 70. That gives your long term care account 30 years to

accumulate interest before you start drawing on it. However, the cost of long term care

will not remain constant. It is expected increase at the rate of 5% per year and triple over the next 20 years. We’ll assume you’ll need long term care for 4 years and that you want

a private room costing $202 per day in today’s dollars. Under these conditions, you will

burn through your account before your third year of care. By the end of year 5, the

balance on your account will be -$450,741 (supposing our hypothetical bank allows you

to carry a negative balance).See below for a table of cost scenarios.

4Affordability of Nursing Home Care in a Private Room at $202 per day in today’s

dollars assuming the cost of long term care will increase at the rate of 5% per year.Savings earning 2% interest after taxNumber of Years Before Receiving

CareDuration of Care (years)Savings Remaining after Receiving Long Term Care$500,000102$373,083$500,000103$248,137$500,000104$114,070$500,000105-29,628$750,000102$683,927$750,000103$565,197$750,000104$437,472$750,000105$300,241$500,000302$264,175$500,000303-$81,861$500,000304-$450,741$500,000305-$838,075$750,000302$726,072$750,000303$389,274$750,000304$28,175$750,000305-358,591PAYING FOR LONG TERM CARE WITHOUT RELYING ON MEDICAIDHow will you pay for your long term care costs if you don’t rely on Medicaid? Your

options include: relying on Medicare, relying on your family to take care of you; using

your savings, tapping into the equity in your home, cashing in a whole life insurance

policy, purchasing long-term care insurance, and enrolling in a continuing care retirement

community. These options are explored in more detail below.Medicare – Medicare provides limited long term care. If an individual covered by

Medicare spends at least three (3) consecutive days in a hospital, Medicare will pay post-

hospital care in a qualified skilled nursing facility for up to one hundred (100) days in any

benefit period. Medicare pays all costs for the first twenty (20) days and everything

above a $119 (2006) co-payment for the next eighty (80) days. Eighty (80) days of co-

payments in long term care will cost $9,520. Medicare will pay no further costs for long

term care during that benefit period.Family Support and Caregiving – You must have family members able and willing to

provide care. You may still need to pay for services that family members are unwilling or

unable to provide.Personal Savings – This option is essentially “self-insuring” and requires careful planning and may only be appropriate for people with above average resources. If you

choose this option: you will be able to choose where and how you receive care; you

5won’t have to worry about qualifying for long-term care insurance; and you get to keep

your money if you end up not needing long term care. However, you could easily end up

lacking the funds you need to pay for long term care needs.Life Settlement – A life settlement is when you sell your life insurance for the present

value of the policy. You might consider this if the original reason why you bought your

life insurance policy no longer exists as might be the case in the event of a divorce or the

death of a spouse. To be eligible, you can’t be ill and must be over age 74 if you are a

female or over age 70 if you are a male. However, you may be able to make a life

settlement at a younger age if your life expectancy is 12 years of less. The money from a

life settlement may be taxable. For more information, contact the IRS or a CPA. If you

choose this option: you will be able to choose where and how you receive care; you

won’t have to worry about qualifying for long-term care insurance; and you get to keep

any money you don’t spend on long term care. However, you may end up with not

enough money to pay for your long term care needs.Viatical Settlement – If you are terminally or chronically ill, you may be able to sell your

life insurance policy to a third party. The amount you receive is usually based on your

remaining life expectancy and ranges from 50% to 80% of the death benefit. After your

settlement, you no longer have to make payments on the policy because you no longer

own it. When you die, the third party receives the full death benefit. Many people can’t

use this option because their life expectancy is considered to be more than five years.

You should contact your state’s Attorney General’s Office or Department of Insurance

before deciding to do this. The money from a viatical settlement may be tax free. For

more information, contact the IRS or a CPA. If you choose this option: you will be able

to choose where and how you receive care; you won’t have to worry about qualifying for

long-term care insurance; and you get to keep any money you don’t spend on long term

care. However, you may end up with not enough money to pay for your long term care

needs.Accelerated Death Benefit – An Accelerated Death Benefit (ADB) is a benefit you can

add to a life insurance policy for little or no additional cost. It can provide cash advances

against your death benefit while you are still alive if you become terminally ill, need

nursing home care, or can’t perform activities of daily living. You need to be aware that

there are spending caps on some ADB policies. When you are receiving an ADB, you

still own the policy and must continue paying premiums. If you choose this option: you

will be able to choose where and how you receive care and you won’t have to worry

about qualifying for long-term care insurance. However, you may not end up with

enough money to pay for your long term care needs. Using an ADB in lieu of a long-term

care insurance policy may have some disadvantages because an ADB will not offer

inflation protection, the monthly benefit amount may be lower, and the coverage period

may be shorter.Reverse Mortgage – A reverse mortgage is a special type of home loan where the

homeowner converts a portion of the equity in their home to cash. With a reverse

mortgage, you don’t have to meet any income or medical requirements to qualify. The

6amount you can borrow depends on your age, the current interest rate, and the appraised

value of your home. You don't make payments, because the loan is not due as long as the

house is your principal residence. You will still be required to pay your real estate taxes

and other conventional payments like utilities. If you do not make the payments, you may

have to immediately repay the loan in full. When you sell your home or no longer use it

for your primary residence, you or your estate must repay the cash you received from the

reverse mortgage, plus interest and other fees, to the lender. The remaining equity in your

home, if any, belongs to you or to your heirs. There are potential drawbacks. The cost of

your long-term care expenses might be more than the amount you borrowed. You may

have to sell your home to repay the reverse mortgage. You may outlive the length of a

reverse mortgage. If this happens, you may have to sell your home to repay back the

reverse mortgage loan. See

U.S. Department of Housing and Urban Development (HUD)

for information on reverse mortgages through HUD. The American Association of

Retired Persons (AARP) is also a good source of information.

Veterans’ Benefits – The Department of Veterans Affairs (VA) may provide long-term

care for service-related disabilities or for certain eligible veterans. There might be a

waiting list for VA nursing homes. The VA also provides some at-home care.Long-Term Care Insurance – Long-term care insurance policies vary widely. Some

policies only cover nursing home care. Others may include coverage for a whole range of

services like care in an adult day care center, assisted living, medical equipment, and

formal and informal home care. Some policies provide a nonforfeiture benefit that allows

you to get money back if you don’t use your policy. You might consider purchasing a

rider for inflation to cover increases in the cost of care. Long-term care insurance

premiums vary, depending on your age and health at the time you buy your policy and

how much coverage you want. Additionally, you must be in generally good health to pass

underwriting when purchasing a policy. For this reason, it may be better to buy long-term

care insurance at a younger age when premiums are lower. However, you can buy long-

term care insurance at any age. Tax-qualified long-term care insurance policies offer

certain tax benefits. Depending on your age, you can deduct some or all your premiums

as a medical deduction on your federal income tax form if you itemize your deductions.

When you receive payments from a Tax-Qualified policy, you generally don’t have to

pay federal tax on them.Currently, four states offer long-term care insurance through an insurance partnership.

They are

New Y ork, Connecticut, Indiana and California.

Unitedseniorshealth.org provides a lot of useful information on insurance. Long-term

care insurance gives you more control and choices over your long-term care. You will be

able to choose the type of services and customize your care based upon your needs. You

won’t have to use your savings or life insurance to pay for long-term care. This will allow

you to leave a legacy to your heirs. However, you need to be sure you purchase your policy from a reliable insurance company. You may not be able to purchase long term

care if you have a pre-existing condition. If you are not able to pay your premiums, you

will lose your policy.

7Limited Long Term Care Insurance – Limited long-term care insurance policies let you

pay premiums for a fixed period of time rather than over the life policy. For instance:

there are single pay policies where you only make one large premium payment; some

policies are based on a 10 or 20 year premium period; and some policies allow you to

only pay premiums until you reach 65. Premium payments on limited pay policies will be

larger than premium payments for traditional policies.Continuing Care Retirement Community – Continuing Care Retirement Communities

(CCRC) provide housing, health care, and social services in a single community

comprising individual homes or apartments, an assisted living facility, and a nursing

home. Where you live depends on the level of care you need. CCRCs are the most

expensive long-term-care solution. Their monthly maintenance fees range from $650 to

$3,500 and may be increased from year to year as inflation dictates. In addition to the

monthly payments, there are buy-in, or entrance, fees that range from $38,000 to

$400,000. The fees vary according to whether the resident owns or rents the living space;

the size and location of the residence; amenities; whether the living space is for one or

two individuals; the type of service plan; and the current risk for needing intensive long-

term care. The entry fees may or may not be refundable depending on the institution.

Some communities offer a “life care contract.” This means, if you need care in the

assisted living facility or in the nursing home, then you are guaranteed to pay the same

entry fee and monthly fee as someone who lives in an individual home or apartment.

Even with a “life care contract” some costs might not be covered. You have to be in fairly

good health when moving into a CCRC. Most CRCCs don’t provide the option of at-

home care. Therefore, you will probably have to move from your home or apartment to

assisted living or the nursing home when you are no longer able to take care of your basic

needs.

8 MEDICAID BENEFITS FOR LONG TERM CARE Many people do not have the resources to pay for long term care including individuals

who did well for themselves in their working years. This may leave Medicaid as their

only viable option. Those who rely on Medicaid naturally have concerns on what

programs are offered, what costs are not covered, eligibility guidelines, what will happen

to their standard of living, and what will happen to the standard of living of their spouse

after they are on Medicaid.Medicaid was established in 1965 by Title XIX of the Social Security Act to furnish

medical assistance to the needy. It is a cooperative venture jointly funded by the federal

and state governments (including the District of Columbia and the Territories) and is

administered by the states. Within broad federal rules, each state decides what groups are

eligible, what services to provide, what to pay service providers, and its operating

procedures. Payments for services are made directly by the state to the providers

providing care.The Omnibus Budget Reconciliation Act of 1993 (‘OBRA 93”) revised the federal

guidelines for Medicaid eligibility. Its provisions are generally effective after August 10,

1993.The Deficit Reduction Act, effective on February 8, 2006 (DRA 2005), contains several

provisions affecting Medicaid services, eligibility, and asset transfers.CARE OPTIONSMedicaid qualified individuals can receive care: in a traditional nursing home; in a

hospice; in their home through a Home and Community Based Services (HCBS) Waiver

Program; through a Program of All Inclusive Care for the Elderly (PACE); or in a

hospital for care that extends for at least 31 consecutive days.Nursing homes and hospices must be approved by Medicaid. If you receive care in a

facility not Medicaid approved, Medicaid may not pay your long term care costs. This

limits your options.Medicaid allows states to offer HCBS under a “waiver” of certain Medicaid rules. These

waiver programs may cover people age 65 and older who (1) would be eligible for

Medicaid if they resided in a nursing home; and (2) would otherwise require the level of

care furnished in a nursing facility. In some states, the amount of income and resources

available to a Community Spouse is considerably less when the Institutional Spouse

receives care at home under a HCBS waiver program. This is an issue worthy of

consideration and may influence where you choose to live if relocating is an option for

you. In addition, HCBS waiver programs are often difficult to get into and some state’s

financial eligibility standards for the HCBS waiver program are often more restrictive

than for traditional nursing home care.

9PACE is an optional program that states may provide. It features comprehensive medical

and social services that can be provided at an adult day health center, home, and/or

inpatient facilities. For most patients, the comprehensive services package permits them

to continue living at home while receiving services, rather than being institutionalized.ELIGIBILITYTo qualify for Medicaid long term care, you must:�be a U.S. citizen or an alien lawfully admitted for permanent residence;�be a resident of the state where you are applying;�meet your state’s functional criteria (65 or older, blind or disabled) and be certified

by the attending physician as needing institutional care;�apply for and accept all benefits for which you may be entitled (e.g., VA, disability,

or retirement benefits); and�not have monthly resources (assets) or income exceeding the amount specified by

your state for the applicable Medicaid category.Financial EligibilityMedicaid eligibility is generally determined using the same income and resource

provisions used for determining eligibility for benefits from the Supplemental Security Income (SSI) program. However, some states employ more restrictive Medicaid eligibility criteria. These states are often called the 209(b) states after the relevant Medicaid statute. They are Connecticut, Hawaii, Illinois, Indiana, Minnesota, Missouri,

New Hampshire, North Dakota, Ohio, Oklahoma, and Virginia. Some states use less

restrictive income and resource methodologies in determining Medicaid eligibility through 1902(r)(2).Resources (Assets)Resource eligibility includes both the resource standard that you must meet and the

methodology that each state uses to determine whether you meet that standard. Your

state’s resource standard is based on a multiple of the SSI resource standard of $2,000.00

for an individual and $3,000.00 for a couple (where both husband and wife receive care)

and can range from anywhere between $999.00 and $4,000.00. The methodology for

determining whether you meet this standard excludes certain resources up to a cash value

set by your state within Medicaid guidelines. Excluded resources include the following:�Up to $500,000 of the equity in your home. States have the option of increasing this

amount to $750,000.�Certain income producing property.�At least one vehicle.�Household goods�Personal property up to an amount specified by your state�Up to $10,000 of the cash surrender value of a whole life policy�Burial fund or prepaid burial contract up to a specified amount

10�Burial space items such as a casket, vault, burial plot, marker, and opening/closing

of grave.The above resources are excluded for the purpose of determining eligibility. However,

states are required to recover what it paid for your care from your estate including the

excluded items listed above. Estate recovery is discussed below.Medicaid defines your home as your principal place of residence. States vary on the

criteria they use to determine whether a home is your principal place of residence. It is if

you, your spouse, or dependent relative actually live there, or intend to return there after a

temporary absence. If you’re single with no dependent relative living in your home, there

is a chance your home will become a countable asset after you are admitted to a nursing

home or other medical institution. Whether or not your home becomes a countable

resource depends on: 1) whether you intend to return home, and 2) how the Medicaid

policies of your state view your intent.Most states do not count a home as an available asset in determining Medicaid eligibility

as long as you “expresses an intent to return home” from a nursing home or medical

institution, regardless of how long you have been institutionalized or whether there is any

reasonable expectation that you could possibly return home. Your subjective intent may

be expressed in a signed letter or affidavit. There need not be any reasonable expectation

that you will ever be discharged to return home regardless of your health, functional

status, or length of stay in the nursing home. When you cannot clearly state your

intentions due to physical or mental incapacities, federal guidance allows your relatives

or others to make a statement of intent on your behalf. You may need to contact your

state’s Medicaid office to determine how your state applies these guidelines in individual

cases.The 209(b) states use criteria more restrictive than SSI guidelines in determining

Medicaid eligibility and may disregard your subjective statement of intent to return

home. These states can opt to use objective criteria such as the assessment by a physician

or other treatment professional on the likelihood you will be discharged to return home.

Some of these states may presume that a permanent change of residence has occurred

after an extended period of time in an institution when there is no reasonable expectation

that you will return home.Once your state no longer considers real estate you own to be your home, its equity

becomes available to reimburse Medicaid for expenses it pays toward your care.IncomeIncome eligibility includes both the income standard that you must meet and the

methodology that each state uses to determine whether you meet that standard. The

income standard represents a dollar amount. The methodology for determining whether

you meet this standard includes what sources of income are included or disregarded.

11States may establish income limits from 100% up to 300% of the SSI benefit rate. The

2006 SSI benefit rate is $603.00 for an individual. Three times the SSI benefit rate raises

the income eligibility limit to $1809.00.Through section 1902(r)(2) of the Medicaid statute, some states offer benefits to

individuals under the optional “medically needy” category. Individuals described in this

category need long-term care but their income exceeds their state’s eligibility limit. Yet, they do not have enough income to pay for the long-term care they need. For instance,

John Doe lives in a state that sets the Medicaid eligibility income limit at the SSI benefit

rate of $603.00 per month. His countable income is $2000.00. Long term care in his state

costs $3,000 per month. John Doe’s income exceeds his state’s Medicaid eligibility limit.

However, he cannot afford long term care. States that offer benefits for the Medically

Needy category would let John contribute all his countable income to pay for his care

(called “spend down”) and rely on Medicaid to pay the difference. Individuals in John

Doe’s situation that live in states that do not offer assistance to the Medically Needy

category might still be able to qualify for Medicaid by setting up a “Miller Trust” that

receives all your income pays your long-term care costs.209(b) states use criteria more restrictive than SSI income guidelines in determining

Medicaid eligibility. These states are listed above.Once you are Medicaid eligible, Medicaid determines how much of your income you

may keep and how much goes toward paying for your care. You may retain:�A personal needs allowance of at least $30 per month or more at state’s option;�Unrestricted amounts for health insurance premiums or out-of-pocket medical expenses not covered by Medicaid; and�At your state’s option, a time-limited allowance to maintain your home if a

physician determines that you are likely to return home within 6 months.RULES FOR COUPLES – ELIGIBILITY AND SPOUSAL IMPOVERISHMENT

PROVISIONSIn 1988, Congress enacted provisions to help prevent the impoverishment of the spouse

remaining at home (Community Spouse) while the other spouse is institutionalized

(Institutional Spouse). These provisions protect the income and assets of the Community

Spouse up to an amount set by your state within federal limits. The spousal

impoverishment provisions apply when one member of a couple enters a nursing facility

or other medical institution and is expected to remain there for at least 30 days. States

must apply Medicaid spousal impoverishment provisions irrespective of state laws regarding community property or division of marital property.Rules for Couples – Treatment of Resources (Assets)When a spouse applies for benefits, Medicaid looks at the couples’ combined resources

regardless of ownership. Medicaid does not count the excluded resources listed above.

Medicaid then assigns half of the resources to each spouse. The Community Spouse’s

12half share is then compared to the state’s minimum and maximum protected resource

amounts. If this half share is less than the minimum, the Community Spouse is permitted

to keep more than a half share to boost his or her share up to the minimum level. If the

half share of resources is greater than the maximum allowance, then the share protected

for the Community Spouse is limited to the maximum amount resulting in the

Community Spouse receiving less than half of the countable assets. The couple then

handles the details of allocating their specific assets. Once the Community Spouse’s

share of resources is established, his or her resources are no longer considered available

to the Institutional Spouse even if they appreciate in value.The Institutional Spouse’s share of resources is compared with the state’s resource

standard to determine their eligibility. Your state’s resource standard is based on a

multiple of the SSI resource standard of $2,000.00 for an individual and $3,000.00 for a

couple (applicable if both husband and wife receive long term care) and can range from

anywhere between $999.00 and $4,000.00.

Federal law determines the minimum and maximum protected resource amounts. As of

2006, the minimum amount is $19,908 and the maximum amount is $99,540. States have

the option to raise the minimum to any level up to the federal maximum. In the year

2000, 36 states opted to raise their minimum levels and most of these states raised the

minimum up to the federal maximum.The Community Spouse may be able to retain more than the maximum protected amount

by: (1) obtaining a court order for more; 2) requesting a hearing to petition for an amount

sufficient to generate income consistent with Medicaid income protection guidelines for

spouses; or 3) “just saying no” by taking sole ownership of marital assets and refusing to

make any of them available to pay for the institutionalized spouses care. “Just saying no”

may prevent the institutional spouse from qualifying for Medicaid because he or she will

be prevented from spending down their share of the marital assets to qualify. However,

the state might make a determination of hardship in order to provide Medicaid benefits.

The state might also take legal action against the Community Spouse to recover the

assets.Rules for Couples – Treatment of IncomeThe income for each spouse is divided according to their “name on the check.” Income

the couple receives jointly is divided equally. Medicaid then looks at the applicant’s

income to determine eligibility. Income standards for an Institutional Spouse are the same

as those for a single individual. Spousal impoverishment rules do not apply until the

Medicaid applicant is eligible for benefits.After determining eligibility, Medicaid allows the Institutional Spouse to keep:�A personal needs allowance (PNA) for the Institutional Spouse of at least $30 per

month or more at state’s option); and�Unrestricted amounts for health insurance premiums or out-of-pocket medical expenses not covered by Medicaid.

13Then, a portion of the Institutional Spouse’s income goes to the Community Spouse to

the extent the Community Spouse’s income is less than his or her state’s minimum

maintenance needs allowance (MMNA). Federal law prescribes that the MMNA should

be equal at least 150% of the federal poverty level for a couple ($1,650 in 2006; higher in

Alaska and Hawaii). States have the option of using a higher MMNA level (up to

$2,488.50 in 2006). In 2000, 35 states used the higher limit. If there are other family members living in the household, the Community Spouse may

also receive a family monthly income allowance if the funds are available from the

Institutional Spouse’s income. However, the family monthly income allowance will be

reduced to the extent of the income of such family members. ILLUSTRATION #1For example John is the Institutional Spouse and Jane is the Community Spouse. John’s

income is $1,600. Medicaid deducts $30.00 for his PNA and $300.00 for health insurance

premiums. This leaves $1,270 of John’s income available to Jane up to their state’s

MMNA. Their state has set the MMNA at $2,488.50. Jane earns $1,400.00 per month. In

order for her to receive a MMNA of $2,488.50, she needs to receive $1088.50 from

John’s income ($1,400.00 + $1088.50 = $2,488.50). Jane has no family members living

at home, so she does not qualify for a family monthly income allowance. This leaves

$181.50 of John’s income to pay for his long term care expenses ($1,270.00 - $1088.50 =

$181.50).ILLUSTRATION #2What if Jane earns $900.00 and everything else in the above example is the same?

$1,270.00 of John’s income is still available to Jane. Now, Jane must receive $1,588.50

from John’s income for her income to equal her state’s MMNA of $2,488.50. In this case,

the $1,270.00 from John’s income goes to Jane so that her income will total $2,170.00

($1,270.00 + $900.00 = $2,170.00). John doesn’t have anything else to transfer to her.

Jane’s total income will be less than her state’s MMNA of $2,488.50. This illustrates how

the Community Spouses Maintenance Needs Allowance is limited to the funds available

from the Institutional Spouses Income.

14LOOK-BACK PERIOD FOR TRANSFERS OF ASSETS FOR LESS THAN FAIR

MARKET VALUEIf you have too many assets to qualify for Medicaid long term care, you can’t just give

them away to become eligible. You can’t transfer assets for less than fair market value

(FMV) either. Transferring assets for less than FMV includes: transfers or cash gifts to

family members; payment for education of grandchildren; donations to charitable

organizations; and other ordinary transactions. Medicaid also has strict rules covering

trusts and annuities. The period of time Medicaid will look back to review your financial

records is called the “look-back period.” The look-back period varies depending on the

date you made the transfer.An applicant will not be considered ineligible for Medicaid based on a transfer of assets

if the applicant provides evidence that he or she intended to dispose of assets at fair

market value, the transfer was exclusively for a purpose other than to qualify the

individual for Medicaid, all of the transferred assets are returned to the individual, or

denial of Medicaid would work an undue hardship on the individual. Undue hardship is

generally defined as a deprivation of necessary medical care, food, clothing, or shelter.Pre-OBRA 93 RulesPrior to August 10, 1993, the look-back period was 30 months. If Medicaid determined

you transferred assets for less than full market value, Medicaid would deny you eligibility

for up to 30 months from the date of the transfer.OBRA 93 RulesEffective August 10, 1993, OBRA-93 increased the general look-back period from 30 to

36 months. OBRA 93 also created a special 60 month look-back period for certain trust

transfers. It addressed transfers of joint tenancy property, treating any action taken by a

co-owner of joint tenancy property as a transfer subject to the look-back period if such

transfer reduced or eliminated the Medicaid applicant’s ownership or control of the

jointly-held asset. In addition, it eliminated the 30 month cap on ineligibility and

eliminated overlap of ineligibility periods resulting in longer periods of ineligibility.DRA 2005 RulesDRA 2005 applies to transfers made on or after February 8, 2006. It expanded the look-

back period for outright transfers from 36 to 60 months. Therefore, under DRA 2005

outright transfers and transfers utilizing trusts are both subject to a 60 month look-back

period. DRA 2005 also changed when the penalty begins to run. The penalty period used

to begin on the date you made the transfer. Therefore, if the penalty was for 11 months,

and you applied for Medicaid 12 months after the transfer, the penalty period would have

ended one month before you applied for Medicaid. However, under DRA 2005, the 11

month penalty would not begin until you are eligible for Medicaid assistance and would

otherwise be receiving Medicaid assistance but for the penalty period.

15ESTATE RECOVERYIn 1993, Congress made it mandatory for states to seek recovery for Medicaid payments

from the probate estate of Medicaid long term care recipients. However, Michigan does

not have a recovery program and some states are not as aggressive as others.States may seek recovery from resources that were exempt in determining eligibility such

a Medicaid recipient’s home that was previously exempt as a countable resource in

determining eligibility. Medicaid will delay recovery if the recipient’s spouse or a

disabled or blind child of the recipient lives there. States will also waive recovery if it

would cause undue hardship. Each state sets up its own criteria on what constitutes

“undue hardship.”Because the original recovery program was limited to a Medicaid recipient’s probate

estate, Medicaid could not recover assets passed down outside of probate. A Community

Spouse could avoid probate by setting up a trust or joint tenancy with a family member.

In addition, nothing prevented a Community Spouse from selling or transferring their

home without consequence except possibly triggering the 60 month look-back period if

the Community Spouse ever applied for Medicaid long term care benefits within 60

months following the transfer.In response to this loophole, Congress allowed states, at their discretion, to: (1) expand

their definition of an estate to include nonprobate assets; and (2) place a lien against real

property preventing a sale until the lien is satisfied utilizing TEFRA liens.The table below provides a general impression on how aggressive different states are in

pursuing estate recovery.Based on data reported by Karp, Sabatino, and Wood (June 2005)Range of

Recovery Options PursuedEstates from which recovery attemptedAverage Recovery per EstateUse of TEFRA Liens

Number of

TEFRA Liens Imposed in 2003ALABAMAExpansive20$16,704yes628ALASKASlightly ExpansiveData unavailablenoARIZONA Slightly Expansive116$13,813noARKANSASMinimum189$8,510yesCALIFORNIA Expansive20000$2,696yes20COLORADO n/ryesCONNECTICUTSlightly Expansive1477$7,292yesDELAWAREExpansive114$4,393yes14

16DISTRICT OF

COLUMBIASlightly Expansive75$22,354noFLORIDASlightly Expansive869$10,702noGEORGIAImplementing ProgramData unavailablenoHAWAIIExpansive101$25,139yes89IDAHOSlightly Expansive2400$2,325yes120ILLINOISExpansiveData unavailableyes691INDIANAExpansive4610$1,626yes0IOWASlightly Expansive6200$1,746noKANSASSlightly Expansive525$10,981noKENTUCKYSlightly Expansive27891$93noLOUISIANASlightly Expansive19$4,521noMAINESlightly Expansive362$13,812noMARYLANDSlightly ExpansiveData UnavailableyesMASSACHUSETTSSlightly Expansive1703$16,442yes716MICHIGAN

No estate

recovery program

n/a

MINNESOTAExpansiveData Unavailableyes800*MISSISSIPPIminimum962$1,788noMISSOURIn/rData unavailablenoMONTANAExpansive101$20,045yes178NEBRASKASlightly Expansive228$5,263noNEVADASlightly Expansive1165$1,014noNEW HAMPSHIRESlightly Expansive400$10,062yes150NEW JERSEYSlightly Expansive363$15,317noNEW MEXICOminimumData unavailablenoNEW YORKSlightly ExpansiveData unavailableyesNORTH CAROLINAminimum1000$5,000noNORTH DAKOTASlightly Expansive1400$1,268no

17OHIOSlightly Expansive30000$462noOKLAHOMAExpansive150$11,667yes150OREGONSlightly Expansive7200$2,778noPENNSYLVANIAminimum4802$5,081noRHODE ISLANDSlightly ExpansiveData unavailablenoSOUTH CAROLINAminimum1225$4,017noSOUTH DAKOTASlightly Expansive1307$918yes0TENNESSEESlightly ExpansiveData unavailablenoTEXASImplementing ProgramData unavailablen/rUTAHSlightly Expansive144$15,824noVERMONTminimum122$8,073noVIRGINIA Slightly Expansive208$4,207n/rWASHINGTONSlightly Expansive647$17,929noWEST VIRGINIAminimum325$1,210noWISCONSINSlightly Expansive5800$3,034yes200WYOMINGSlightly Expansive350$3,832yes0n/r – State did not respond to survey or responded that they did not knowBlank cells means the question is not applicable to the particular state.* - Estimate

18MEDICAID LONG TERM CARE PLANNING STRATEGIESThere are strategies you can use to qualify for Medicaid long term care and still leave a

legacy to your loved ones.SPENDING DOWN COUNTABLE RESOURCESYou can spend down countable resources as long as you receive something in return at

fair market value. You could go on a trip or take art classes. You can also pay past or

future bills such as prepaying real estate, insurance, funeral expenses, or other large bills.CONVERTING COUNTABLE RESOURCES TO EXCLUDED RESOURCESYou can do this by using countable resource to purchase medical equipment, prepay

health insurance, prepay a mortgage on a residence, or make improvements to your

residence. If emotional sentiment is not at issue, you might be able to sell an engagement

ring or wedding band and purchase a more expensive ring.FEDERALLY SANCTIONED TRANSFERSThe following transfers are permitted by federal law without losing Medicaid eligibility:Permitted Transfer of a HomeTransfer of your primary residence to a child who is under 21 or is blind or permanently

and totally disabled. See, 42 U.S.C. § 1396p(c)(2)(A)(IV).Transfer of a home to a sibling who already has an equity interest in the home and who

was residing in it for at least a year immediately before the Medicaid applicant became

institutionalized.Transfer to a child who lived in the Medicaid applicant’s home for at least two years prior

to the applicant becoming institutionalized and who provided him or her with care that

allowed the applicant to stay at home rather than becoming institutionalized.Permitted Transfer of AssetsA Medicaid applicant or recipient may transfer assets to the following individuals without

a period of ineligibility:� Applicant’s spouse. See U.S.C. § 1396p(c)(2)(B);�To a third party for the sole benefit of the applicant’s spouse;�Transfers to certain disabled individuals, or to trusts established for those

individuals;�Transfers for a purpose other than to qualify for Medicaid; and Transfers where

imposing a penalty would cause undue hardship.

19LONG-TERM CARE INSURANCE AND TRANSFERThis approach allows you to leave an inheritance to your children but not until you know

you will require long term care. Purchase a long-term care insurance policy that covers

you for at least 5 years. If you transfer your assets before or right after you begin long-

term care, your insurance policy will pay your long-term care costs during the look-back

period. If you need long-term care beyond that time, you won’t be affected by Medicaid’s

look-back provisions as long as you transferred your assets more than 5 years prior to

applying for Medicaid. You will also be able to utilize financial instruments such as trusts

or annuities to transfer your assets without affecting your Medicaid eligibility. Consider

preparing a durable power of attorney giving your agent power to immediately transfer

your assets in the event you become disabled.If one spouse’s income exceeds Medicaid’s eligibility limits but the other spouse’s

income does not, consider purchasing long-term care insurance only for the spouse with

the greater income and rely on Medicaid for long-term care needs for the spouse with less

income. This way, the insured spouse’s long-term care insurance will pay for their long-

term care if they need it and their spouse will be able to continue to benefit from the

insured spouse’s income. If the uninsured spouse needs long term care, the wages of the

insured spouse will not be used to determine eligibility of the uninsured spouse.

However, some states will count the non-Medicaid spouse’s income if the Medicaid

spouse receives home based long-term instead of care in a nursing home. In addition,

your combined assets may not exceed the resource limits set by your state’s Medicaid

program.CONVERTING EXCESS RESOURCES INTO INCOMEIf you have resources exceeding Medicaid eligibility limits and your income is less than

what Medicaid allows, you could convert your excess resources into a stream of income.AnnuitiesAn annuity is used to convert countable resources into a stream of income by purchasing an annuity contract for a lump sum in return for a string of payments to be received in the

future. Consequently, you can use an annuity to lower your countable resources and

increase income up to the maximum amount allowed by Medicaid. Be careful, Annuities

have been associated with poorly understood consequences and costs to the consumer.

For annuities not to be counted as a transfer of assets below FMV within the 60 month

look-back period, they are required to: (1) be irrevocable; (2) calculate the annuity's

return to be commensurate with a reasonable, actuarially sound estimate of the life

expectance of the annuity beneficiary; (3) provide equal steady income stream (balloon

payments not allowed); and (4) be disclosed. In addition to the requirements listed above,

if the annuity was created on or after February 8, 2006, the trust must name the state as an

irrevocable beneficiary for at least the value of Medicaid assistance provided. There is an

exception if the Medicaid applicant has a spouse or disabled or minor child in which case

the spouse, disabled or minor child may be named primary beneficiary with the Division

20of Medicaid named irrevocable contingent beneficiary. If the conditions above are not

met, the annuity will be treated as a prohibited asset transfer subject to a penalty.

However, if the annuity was created more than 5 years prior to applying for Medicaid, the

60 month look-back period will not apply.TrustsA trust is a legal relationship, used to manage real or personal property, established by

one person (the grantor or settler) through a trust document for the benefit of another

(the beneficiary). Either a third person (the trustee) or the grantor manages the trust. The

property of the trust is called the corpus.Where an individual, his or her spouse, or anyone acting on the individual's behalf,

establishes a trust using at least some of the individual's funds, that trust can be

considered available to the individual for purposes of determining eligibility for

Medicaid.In determining whether the trust is available, Medicaid does not give any consideration to

the purpose of the trust, the trustee's discretion in administering the trust, use restrictions

in the trust, exculpatory clauses, or restrictions on distributions.How Medicaid treats a trust depends on what type of trust it is; for example, whether it is

revocable or irrevocable, and what specific requirements and conditions the trust

contains. In general, Medicaid treats:�Payments actually made to or for the benefit of the beneficiary as income;�Amounts that could be paid to or for the benefit of the beneficiary, but are not, as

available resources;�Amounts that could be paid to or for the benefit of the beneficiary, but are paid to

someone else, as transfers of assets for less than fair market value; and�Medicaid treats amounts that cannot, in any way, be paid to or for the benefit of the

individual as transfers of assets for less than fair market value.Medicaid does not count certain trusts as being available to the individual. They include

the following:�Trusts established by a parent, grandparent, guardian, or court for the benefit of an

individual who is disabled and under the age of 65, using the individual's own

funds.�Trusts established by a disabled individual, parent, grandparent, guardian, or court

for the disabled individual, using the individual's own funds, where the trust is made

up of pooled funds and managed by a non-profit organization for the sole benefit of

each individual included in the trust.�Trusts composed only of pension, Social Security, and other income of the

individual, in states which make individuals eligible for institutional care under a

special income level, but do not cover institutional care for the medically needy.

21In all the above instances, the trust must provide that the state receives any funds, up to

the amount of Medicaid benefits paid on behalf of the individual, remaining in the trust

when the individual dies.A trust will not be counted as available to the individual where the state determines that

counting the trust would work an undue hardship.Medicaid has strict rules on the use of trusts by Medicaid applicants. It is best to consult

an attorney before attempting to use a trust in Medicaid planning.LoansFor a loan not to be treated as a transfer of assets it must be actuarially sound and the loan

payments must be in equal amounts during the term of the loan with no deferral and no

balloon payments. Medicaid also prohibits cancellation of the balance of a loan note at

death. Medicaid will count the loan amount as a resource available to the Medicaid

applicant and count the interest portion of the repayment as income.Some states do not treat the loan amount a countable resource if the loan meets certain

guidelines. If the loan is not considered an available resource, the interest and principal of

the repayment is considered to be income. Consult your Medicaid representative in your

state to see if this option is available LESS COMMON FINANCIAL STRATEGIESLess common financial strategies for sheltering assets include life estates, family reverse

mortgages, and care agreements. These arrangements are similar to annuities in that

assets are exchanged for something of value in a non-commercial context (for example,

agreements with family members or other private parties). The return may be in the form

of income payments, use rights in the case of a life estate consisting of the home, or care-

giving services.

22 INCOME AND RESOURCE WORKSHEETS FOR MEDICAID PLANNING I. GATHER STATE SPECIFIC INFORMATIONObtain the following information from a Medicaid Representative in Your State. To

find a Medicaid Representative in your state, use the State Resource Guide belowLong Term Care EligibilityNursing Home(contact Medicaid rep)Home Based Care(contact Medicaid rep)Financial Limits:Resource limit Income limit Post Eligibility:Personal needs allowance (PNA) for recipient Allowance for non-covered medical expenses Allowance for medical

insurance Spousal Impoverishment

Provisions:Minimum protected resource amount Maximum protected

resource amount Minimum maintenance needs allowance (MMNA) Family monthly income allowance for other family

members living in the

household with the

Community Spouse.

Medical Expenses Not Covered by Medicaid

23GATHER STATE SPECIFIC INFORMATION (CONTINUED)Nursing HomeHome Based CareExcludable Resource(contact Medicaid rep)Excludable Amount (contact Medicaid rep)Home equity Income producing property Vehicle Household goods Personal property Cash surrender value of a life insurance policy. Burial spaces intended for family members Nursing HomeHome Based CareExcludable Income (may

only be applicable to home based care - contact Medicaid rep)Allowable Amount(contact Medicaid rep)

24II. Estimate your Countable Resources and IncomeMy ResourcesValueValue of Exclusion (if

available) Totals Countable Resources (Total Value – Total Value of Exclusion = Countable Resources) My IncomeValueValue of Exclusion (if

available) Totals Countable Income (Total Value – Total Value of Exclusion = Countable Income)

25III. Estimate your EligibilityA. Single PersonCalculation For Long Term Care In A Nursing HomeResourcesIncomeMedicaid limits My countable totals Estimation of eligibility (Medicaid limits – my countable totals = eligibility

estimate).

If both numbers above are positive you may qualify. Medicaid alone makes determinations on eligibility.Calculation For Long Term Care At HomeResourcesIncomeMedicaid limits My countable totals Estimation of eligibility (Medicaid limits – my countable totals = eligibility

estimate).

If both numbers above are positive you may qualify. Medicaid alone makes determinations on eligibility.

26III. Estimate your Eligibility (Continued)B. Married Person - ResourcesResource CalculationNursing HomeCare at HomeMedicaid resource limits Combined countable resources and my income Spousal half ( = number

above divided by 2) MinimumMaximumMinimumMaximumProtected resource amounts (PRA) Compare the half share of the Community Spouse with the minimum and maximum

PRA. If this half share is less than the minimum, the Community Spouse is permitted to

keep more than a half share to boost their share of resources up to the minimum level (to

the extent permitted by their combined resources). If the half share of resources is greater

than the maximum level, then the share protected for the Community Spouse is limited to

the maximum level and the Community Spouse receives less than half of the countable resources. Community Spouse’s share

of combined countable

resources

Institutional Spouse’s share of combined countable

resources

Estimate of resource eligibility (Medicaid limits – institutional spouse’s share = eligibility estimate).

If the number above is positive, you may qualify. Medicaid alone makes determinations on eligibility.

27III. Estimate your Eligibility (Continued)B. Married Person - IncomeIncome CalculationNursing HomeCare at HomeMedicaid limits My countable totals Estimation of eligibility (Medicaid limits – my countable totals = eligibility

estimate).

If both numbers above are positive you may qualify. Medicaid alone makes determinations on eligibility.Minimum Maintenance Needs Allowance (only determined if the Institutional

Spouse has been declared eligible for Medicaid benefits).Community Spouse’s

Countable income Your state’s Minimum Maintenance Needs

Allowance (MMNA)

Your state’s family monthly income allowance for other

family members living in the

household with the Community Spouse.

Total allowance amount allowed Compare the Community Spouse’s countable income with the total allowance amount. If

the Community Spouse’s countable income is less than the total allowance amount, the

Community Spouse may receive an allowance from the Institutional Spouse’s income up

an amount where the Community Spouse’s income plus his or her allowance equals the

total allowance amount. If the Community Spouse’s income is greater than your state’s

MMNA, the Community Spouse gets to keep it all without affecting the Institutional

Spouse’s eligibility.Allowance to Community Spouse from Institutional Spouse’s income

28 STATE RESOURCE GUIDE

ALABAMA

Medicaid is administered by the Governor’s Office through the

Alabama Medicaid Agency.501 Dexter Avenue

P.O. Box 5624

Montgomery, AL 36103-5624

Ph: 334-242-5000

Ph: 800-362-1504

Fax: 334-353-5536

Web site: Alabam

a Medicaid Agency Applications and Forms

ALASKA

Medicaid is administered by the Department of Health and Social

Services (DHSS) through the Division of Health Care Services and

the Division of Public Assistance (handles eligibility).Applications are made through the Division of Public Assistance.

Division of Public Assistance Application

Ph: 800-780-9972Division of Health Care Services - Medicaid Handbook

ARIZONA

Medicaid is administered by the Arizona Health Care Cost

Containment System (AHCCCS) Administration and provides

long term care through the Arizona Long Term Care System

(ALTCS).801 E. Jefferson Street

Phoenix, AZ 85034E-mail: MemberServices@azahcccs.govPh: 602-417-7000Ph: 800-962-6690Ph: 800-523-0231Web site: AHCCCS Brochure

ARKANSAS

Medicaid is administered by the Department of Health & Human

Services (DHHS).Donaghey Plaza West Slot S201 P.O. Box 1437Little Rock, AR 72203-1437Ph: 501-682-8487Ph: 501-682-6321 Ph: 800-582-4887 E-mail

OLTC2@arkansas.gov .

Web site: Office of Long Term Care and DHHS - Office of

Program Planning and Development

CALIFORNIA

Medicaid in California is called Medi-Cal. It is administered by the Department of Health Services through Medical Care Services

(MCS).Ph: 800-541-5555Automated Phone Center: 800-786-4346Web site: Medical Care Services - Medi-Cal and Medi-Cal

Information Mail-In Application

29

COLORADO

Medicaid is administered by the Colorado State Department of

Health Care Policy and Financing.Ph: 800-221-3943E-mail addresses are firstname.lastname@state.co.usBrian Zohynas – Supervisor; ext: 2814Casey Dills – Adult Medicaid Policy; ext: 3544Janeece Lawrence – Adult Medicaid Policy; ext: 5928Eric Stricca – Adult Medicaid Policy; ext: 4475Medicaid Eligibility Contacts Application

CONNECTICUT

Medicaid is administered by the Department of Income

Maintenance through the Department of Social Services (DSS).State of ConnecticutDepartment of Social Services25 Sigourney St.Hartford, CT 06106-5033General Information: 800-842-1508Elderly Services (in state): 800-443-9946 (out of state): 860-424-4925Medicaid Brochure The brochure contains regional phone numbers.Long Term Care Ombudsman Program

DELAWARE

Medicaid is administered by the Department of Health and Social

Services through the Division of Social Services (DSS)The Division of Social ServicesThe Lewis Building1901 N. Du Pont Hwy.P.O. Box 906New Castle, DE 19720Ph: 302-255-9500Ph: 800-372-2022Fax: 302-255-4454E-mail: dhssinfo@state.de.us DSS - Long Term Care Medicaid Programs Long Term Care

Guide

Application for Social Services and Internet Screening Tool

DISTRICT OF COLUMBIA

Medicaid is administered by the Department of Human Services

through the Medical Assistance Administration within the DC

Department of Health.825 North Capitol Street, NE5th

FloorWashington, DC 20002Department of Health - Medicaid (not very helpful)Ph: 202-442-5988Ph (citywide call center): 202-727-1000

30

FLORIDA

Medicaid is administered by the Agency for Health Care

Administration (AHCA)Medicaid Services2727 Mahan Dr., Mail Stop 20Tallahassee, FL 32308Ph: 850-488-9347 SC 278-9347Fax: 850-922-7303 SC 292-7303AHCA - Medicaid Dept of Elder Affairs Summary of Services Florida Senior Care Long Term Care Waiver Applications

GEORGIA

Medicaid is administered by the Georgia Department of Community Health (DCH) through the Division of Medical

Assistance. You apply for Medicaid through the Division of Family

& Children Services (DFCS).To locate a county health department, call 404-657-2700.Web site: DCH - Medicaid Eligibility Criteria DFCS Offices

HAWAII

Medicaid is administered by the Department of Human Services

(DHR). The Adult and Community Care Services (ACCS)

administers several Medicaid programs for the elderly.Department of Human Services

1390 Miller Street, Room 209

Honolulu, HI 96813Oahu: 808-832-5115 Kauai: 808-241-3337 Maui, Lanai and Molokai: 808-243-5151East Hawaii: 808-933-8820

West Hawaii: 808-327-6280DHR - ACCS

IDAHO

Medicaid is administered by the Idaho Department of Health &

WelfareMedicaid Administrator: 208-334-5747Local Offices and Department Contacts Web site: Dept of Health & Welfare - Medical Application for Assistance

ILLINOIS

Medicaid is administered by the State Department of Public Aid of

Illinois through the Department of Healthcare and Family Services

(DHFS)Illinois Department of Human Services100 South Grand Avenue, East, 2nd Floor Springfield, Illinois 62762Ph: 800-843-6154 or (TTY) 800-447-6404401 S Clinton St Chicago, IL 60607 Ph: 312-793-2354 or TTY: 312-793-2354Brochure County Administrative Offices

31

INDIANA

Medicaid is administered by the Office of Medicaid Policy and

Planning through the Family & Social Services Administration

(FSSA). Visit the

Area Agencies on Aging (AAA) to apply. To find

nearest AAA – 800-986-3505

FSSA - Medicaid Medical Waiver Programs and Applications

Forms

IOWA

Medicaid is administered by the Iowa Department of Human

Services (DHS)Contact Eileen Creager, Bureau Chief

Bureau of Long Term Care

Des Moines, Iowa 50319

515-281-5169 ecreage

@dhs.state.ia.us

Medical Assistance Services - Bureau of Long Term CareCounty Offices

KANSAS

Medicaid is administered by the Secretary of Social and

Rehabilitation Services Department of Social and Rehabilitation

Services (SRS) through the Division of Health Policy and Finance

(DHPF).Contact HealthWave Clearinghouse: 800-792-4884Contact a local SRS office at 888-369-4777 and ask to speak to a

long-term case worker for questions on long-term care.DHPF - Medicaid Medical Assistance Program Web Site Kansas Medical Assistance Program (KMAP) Benefits Guide

KENTUCKY

Medicaid in Kentucky is called KyHealth Choices. It is

administered by The Department for Medicaid ServicesDivision of Service Regions275 E. Main St., 3C-AFrankfort, KY 40621502-564-7463Main PageTo apply, contact the Department for Community Based Services

(DCBS) office in the county where you live.

DCBS County Offices

LOUISIANA

Medicaid is administered by the Department of Health and

Hospitals (DHH), Office of the Secretary through the Bureau of

Health Services Financing.Long Term CareP.O. Box 91030Baton Rouge, LA 70821-9030Ph: 225-342-5774Fax: 225-342-9508Long Term Care Hotline: 877-456-1146E-mail: medweb@dhh.la.govLouisiana Medicaid Long Term Care Publications and

Applications

Long Term Care Frequently Asked Questions

32

MAINE

Medicaid in Maine is called MaineCare. It is administered by The

Department of Human Services through The Office of MaineCare

Services (OMS) (formerly know as Bureau of Medical Services).You may reach OMS by Phone at 207-624-7539 or 800-321-5557Ph: 800-977-6740, option 3; Ph (TTY): 800-977-6741List of Regional Contacts MainCare Ha ndbook (PDF) Applications

MARYLAND

Medicaid is administered by the Department of Health & Mental

Hygiene.Which Local Department of Social Services office to go to: 1-800-332-6347Question about Medical Assistance Eligibility Policy: (410) 767-14631-800-492-5231, ext., 1463Maryland Medicaid Long Term Care Eligibility Q&A

MASSACHUSETTS

Medicaid in Massachusetts is called MassHealth. It is administered

by the Division of Medical Assistance in the Massachusetts

Executive Office of Health and Human Services through the Office

of Medicaid.One Ashburton Place, 11th

FloorBoston, MA 02108617-573-1770MassHealth Member Customer Service Center

1-800-841-2900Web Site Long Term Care Forms and Publ ications

MICHIGAN

Medicaid is administered by the Michigan Department of

Community Health.The Michigan Medicare and Medicaid Assistance Program

(MMAP) provides free counseling and education on Medicare and

Medicaid benefits. Ph: 800-803-7174.Department of Human Services (DHS) provides information on

independent living, senior services, adult community placement,

and medical services. Ph: 517-373-2038.Long Term Care Ombudsman: 866-485-9393.Web Site Contact Info Self-Screening Questionnaire Long Term

Care Options (PDF)

MINNESOTA

Medicaid is called MinnesotaCare in Minnesota. It is administered

by the Minnesota Department of Human Services (MDHS).MinnesotaCare P. O. Box 64838 St. Paul, MN 55164-0838(651) 297-3862 (Twin Cities metro area)(800) 657-3672 (outside Twin Cities metro area)TTY: (800) 627-3529 or 711Contacts MinnesotaCare Nursing Home Care Home and

Community Based Services

33

MISSISSIPPI

Medicaid is administered by the Office of the Governor through the

Division of Medicaid.Robert E. Lee Building239 North Lamar Street, Suite 801Jackson, MS 39201-1399Ph: 866-635-1347Division of Medicaid

MISSOURI

Medicaid is administered by the Department of Social Services of

the State of Missouri through the Division of Medical Services

(DMS)Division of Medical Services (DMS): 573-751-3425Long Term Care Ombudsman: 800-309-3282Missouri Care