IDR PERFORMANCE REPORT

For

Fiscal Year 2010

Mark R. Schuling

Director

�TABLE OF CONTENTS

Introduction ........................................................................................................... 1

Agency Overview ...............................................................................................2-5

Key Results........................................................................................................6-9

Performance Measures-Local Government Assistance .................................10-11

Performance Measures-Resource Management ...........................................12-13

Performance Measures-Collections and Compliance ....................................14-18

Performance Measures-Tax Research and Program Analysis ......................19-20

Agency Contacts and Acknowledgments............................................................ 21

�INTRODUCTION

On behalf of the staff of the Iowa Department of Revenue, I am pleased to present our Fiscal Year

2010 Annual Report. The mission of our Department is “To serve Iowans and to support government

services in Iowa by collecting all taxes required by law, but no more.”

The Department deposits over 90% of the state’s appropriable receipts. Other state agencies depend on

timely deposits to provide the funds they use to operate. This is accomplished by providing taxpayers

with current and complete information, and up-to-date technology to support tax filings and payments.

This report provides information about some of the ways in which that mission was accomplished

during the past fiscal year.

The Iowa Department of Revenue (IDR) monitors performance of four core functions, under which

there are seven services, products and activities (SPAs). In all, 74 measures are used to monitor the

core functions and the SPAS in the IDR’s Performance Report.

We are pleased to report an excellent year by the IDR. Sixty-three measures or 85% were met or

exceeded during the fiscal year. Several of the measures missed were due to staffing reductions and

furloughs due to the fiscal funding reductions.

Performance measures monitoring the core functions of local government assistance show the IDR has

done extremely well in education and service to local governments. A total of eleven of the twelve

outcome measures met or exceeded their targets.

Performance measures monitoring the core functions of revenue collection and compliance show that

29 of the 37 outcome measures met or exceeded their targets. All of the measures that involved

revenue collections exceeded their measures except for one and this measure was not achieved as a

result of reductions in staffing resulting in lower than anticipated work hours spent on audits. All eight

of the non-revenue collection measures that were not achieved involved reductions in staffing resulting

in lower than anticipated work hours spent on collections and audits.

Performance measures monitoring the core functions of research, analysis and information

management show the IDR has done extremely well in providing taxpayer analysis and economic and

statistical research. A total of 11 of the 11 outcome measures met or exceeded their targets.

Performance measures monitoring the core functions of resource management show the IDR has done

extremely well in supporting the agency in meeting its targets within budget. A total of 12 of the 14

outcome measures met or exceeded their targets.

We recognize our responsibilities to the taxpayers, and service is a priority. We are pleased to offer our

professional services through the Internet and will continue to make progress and improve on those

services. Our actions comply with the statutory provisions of the State of Iowa, and our duties under

those statutes are carried out in a fiscally responsible manner.

Yours truly,

Mark R. Schuling, Director

Iowa Department of Revenue

IOWA DEPARTMENT OF REVENUE PERFORMANCE REPORT FY10

1

�AGENCY OVERVIEW

The Iowa Department of Revenue is responsible for administering the taxes noted below:

Taxes Established by Iowa Code

Individual Income Tax

Consumer Use Tax

Motor Fuel Taxes

Corporation Income Tax

Retailer Use Tax

Fiduciary Tax

Partnership Income Tax

Hotel / Motel Tax

Inheritance & Estate Taxes

Franchise Income Tax

Local Option Tax

Cigarette / Tobacco Tax

Sales Tax

Withholding Tax

Drug Stamp Tax

Property Tax

Replacement Tax

Real Estate Transfer Tax

Motor Vehicle Use Tax

Car Rental Tax

Moneys & Credits Tax

Vision

To be recognized as a department employing a well-trained workforce that in a fair and respectful

manner provides responsive and accurate services that enables all customers to comply with Iowa’s tax

law.

Mission

The Department’s mission is to serve Iowans and to support government services in Iowa by collecting

all taxes required by law, but no more.

Guiding Principles

•

Customer Focus:

We will encourage collaboration and partnership with our internal and external customers.

We operate in an ever-changing environment and will integrate advanced technology into

our work processes in order to make them more efficient and of higher value to our

customers.

•

Integrity:

We will through honest and open policies maintain the public’s confidence in our ethical

standards.

We will carefully safeguard our customer’s confidential information.

IOWA DEPARTMENT OF REVENUE PERFORMANCE REPORT FY10

2

�•

Responsibility:

We will provide expert advice and support to policy-makers and to local and state

government entities.

We will help local governments responsibly manage their resources through education and

supervision of the property tax system and local option taxes.

•

Understanding:

We will recognize that Iowa tax laws are complex and will provide the services and

education necessary to enable compliance by all our customers.

We understand that to have a well educated and responsive work force we need to provide

our employees with ongoing training to develop their professional skills and to achieve

personal growth.

•

Fiscal Management:

We will responsibly manage our financial resources to fulfill our mission.

We will continually monitor and measure our processes to assure economy and efficiency.

Core Functions

●Local Government Assistance – Provide assistance to local governments by administering fair and

equitable assessments and programs for property tax relief and local option sales taxes.

●Revenue Compliance and Collection – Educate customers on tax policy and collect revenues in

compliance with Iowa’s tax laws, including processing and collections, policy development, education,

examination, audit, and timely resolution of disputed tax issues.

●Research, Analysis, and Information Management – Provide tax policy analysis, fiscal impact

estimation, and economic and statistical research and analysis to help customers, stakeholders, and

policy-makers make informed decisions.

●Resource Management – Provide vital infrastructure necessary to administer and support agency

operations, including personnel, the agency’s Web site, performance measurements, and the

development and support of technology and information applications.

Department Operational Units

The organization is structured into seven operational units. The following is a brief overview of the

Department’s primary organizational entities and services provided.

●Director’s Office

The Director's Office consists of two sections:

IOWA DEPARTMENT OF REVENUE PERFORMANCE REPORT FY10

3

�The Internal Audit Section and The Tax Research and Program Analysis Section.

●Compliance

The Compliance Division is divided into three major sections: Field Audit, Office Examination and

Tax Gap.

●Technology and Information Management

Maintains and develops the Department's computerized systems, including the planning and technical

support of the Wide Area Network and related automated systems.

●Internal Services

The Internal Services Division includes:

Employee Resource Team

Budget and Finance Office

Communication Section

Performance Management Section

●Revenue Operations

The Revenue Operations Division has three major sections:

Customer Accounts

Collections

Document Processing

●Property Tax

The Property Tax Division assists local governments in making property tax assessments fair and in

compliance with the law.

●Taxpayers Services and Policy

The Taxpayers Services and Policy Section includes:

Audit Services

Tax Policy

Taxpayer Services

Customers

The Department’s customer base is, by its very nature, one of the largest of Iowa State governmental

agencies. In addition to all persons with Iowa tax responsibilities throughout the state and nation, the

Department deals with all levels of state, local and federal governments, tax practitioners, business

groups, state employees, the legislature and other states’ revenue agencies.

The Department deposits over 90% of the state’s appropriable receipts. Other state agencies depend on

timely deposits to provide the funds they use to operate. Externally, taxpayers expect timely processing

of refunds or that an audit billing is accurate and understandable.

Each customer expects information and products to be disseminated timely, accurately and clearly.

This expectation holds true for both external inquiries and for product generated by the Department.

IOWA DEPARTMENT OF REVENUE PERFORMANCE REPORT FY10

4

�Staff

The Director of the Iowa Department of Revenue is Mark Schuling. During FY10 there were 356 fulltime employees working for the Department. Three employees work at out-of-state locations, 77 are

assigned to 10 field offices across Iowa, and the remaining 276 are domiciled in Des Moines.

All contract-covered job classifications in this Department fall under the AFSCME bargaining

agreement. The Department director is a position appointed by the governor.

IOWA DEPARTMENT OF REVENUE PERFORMANCE REPORT FY10

5

�KEY RESULT

Core Function

Name: Revenue Collections and Compliance

Description: The Department of Revenue collects delinquent tax debt and also provides collection

services to the Iowa Judicial Branch, Iowa College Student Aid Commission, Department of Human

Services and Department of Natural Resources

Why we are doing this: To provide quality, competitive collection services. The Collection Enterprise

is self-supporting.

What we are doing to achieve results: The Collection Enterprise completed a major upgrade to

collection software and coordinated that effort with a business process reengineering designed to

maximize the effectiveness of the new software and to utilize nationally recognized best practices.

Results

Dollars Collected By Collection Enterprise

Performance Measure:

$250

Dollars collected by

Collection Enterprise.

Dollars In Millions

Performance Target:

The Department estimated in

Fiscal Year 2010 a total of

$157.5 M in tax and non-tax

collections.

$25.6

$200

$28.7

$25.4

$150

$21.9

$166.9

$21.0

$143.4

$100

$123.3

$134.2

$95.2

$50

$0

What was Achieved:

FY 06

FY 07

FY 08

FY 09

The Department far exceeded

Tax Collections Non-Tax Collections

Its expectations in fiscal year

2010 with $192.5 million

collected in both tax and non-tax liabilities placed with the Department.

FY 10

Data Sources:

Collections Annual Report, Dollars Collected per Dollar Spent by Tax and Non-Tax Programs.

Resources: Collections represent recoveries by all units of the Collections Enterprise.

IOWA DEPARTMENT OF REVENUE PERFORMANCE REPORT FY10

6

�KEY RESULT

Core Function

Name: Revenue Collections and Compliance

Description: The Department of Revenue receives and processes income tax returns from taxpayers

each year. Some taxpayers must pay additional tax when filing their returns. However, a majority of

taxpayers are entitled to refunds. The Department recognizes that taxpayers entitled to refunds prefer

having their payments in a timely manner.

Why we are doing this: To serve the taxpayers of Iowa by processing tax information so that refunds

are issued in a timely manner.

What we are doing to achieve results: The Iowa Department of Revenue has two key systems for

processing individual income tax returns. One system is used to process returns filed on paper

documents. The second system is for processing electronically-filed returns. The Department monitors

the processing efficiency and turn-around time for both systems. Since refunds requested electronically

are issued much quicker, the Department continues to promote electronically filing returns.

Results

Performance Measure:

Percent of electronically-filed

Individual income tax refunds

issued within 14 days.

% Electronic Refunds Issued in 14 Days

Calendar Year

100%

96%

97%

97%

96%

95%

2005

2006

2007

2008

2009

80%

Performance Target:

95% of refunds issued in 14 days.

What was Achieved:

The Department met its goal

of 95% of electronic refunds

issued in fourteen days.

60%

40%

20%

0%

Data Sources:

Iowa Revenue Information System.

IOWA DEPARTMENT OF REVENUE PERFORMANCE REPORT FY10

7

�KEY RESULT

Core Function

Name: Revenue Collections and Compliance

Description: Percent of Dollars Deposited on the Same Day as Receipt.

Why are we doing this: Prudent money management principles require that revenues be deposited as

quickly as possible to maximize investment proceeds and cash flow, and to provide for accurate

accounting. The timely deposit of revenues ensures that funds are available for the continued

provision of state government services.

What we are doing to achieve results: The Revenue Operations Division deploys strategies to

improve deposit of sales tax and income tax withholding during high-volume quarterly periods.

Results

Performance Measure:

Percent of dollars deposited on

the same day as received.

% Dollars Deposited on the Same Day as Received

100%

85%

86%

86%

87%

FY 06

Performance Target:

80% of dollars received will

be deposited on the same day

as received.

82%

FY 07

FY 08

FY 09

FY 10

80%

60%

40%

What was achieved:

87% of dollars received into the

Department was deposited on

the same day as receipt.

20%

0%

Data Sources:

Revenue Operations reports and information systems.

IOWA DEPARTMENT OF REVENUE PERFORMANCE REPORT FY10

8

�KEY RESULT

Core Function

Name: Revenue Collections and Compliance

Description: The Examination and Audit Sections review returns covering 14 major taxes established

by Iowa law. These sections determine unpaid tax liabilities and bill for the correct amount of tax. The

staff tries to make audits both educational and informative to avoid the need for future audits of the

same taxpayer.

Why are we doing this: To improve the voluntary compliance with Iowa's tax system.

What we are doing to achieve results: The Examination and Audit Sections integrate internal and

external databases to enhance compliance and enforcement.

Results

Performance Measure:

Revenue Established

Revenue Collected

FY 2010 Office and Field Enforcement Programs Actual

Revenue Established and Collected

$300,000,000

Performance Target:

Establish

$172,290,547 and

Collect $75,233,199.

$269,180,176

$250,000,000

$200,000,000

$153,322,904

$150,000,000

$100,000,000

What was achieved:

$50,000,000

The Examination and Audit

$0

Sections established

Revenue Established

$269,180,176 in revenue and

collected $126,099,155. In addition,

the Examination and Audit Sections reduced refunds by $27,223,749.

Revenue Coll/Refunds Reduced

The dollars collected and refunds reduced total $153,322,904.

Data Sources:

Compliance Division Return on Investment and Cost Benefits reports. Business Objects query tools.

IOWA DEPARTMENT OF REVENUE PERFORMANCE REPORT FY10

9

�Agency Performance Report

FY 2010

Name of Agency: Iowa Department of Revenue

Agency Mission: The Iowa Department of Revenue will serve Iowans and support government services in Iowa by collection all

taxes required by law, but no more.

Core Function: Local Government Assistance

Performance

Target

Performance

Actual

Agricultural

75%

71%

Residential

75%

88%

Commercial

75%

81%

2.Number of appraisals completed to date.

100%

100%

3.Automation of collection information from

counties.

75% automated by

06/30/10

Send exam results

by 11/07/09 05/09/10

Notify by 08/31/09 01/31/10

Oral response

Useful advice on preparing your ‘Medical Form New Orleans’ online

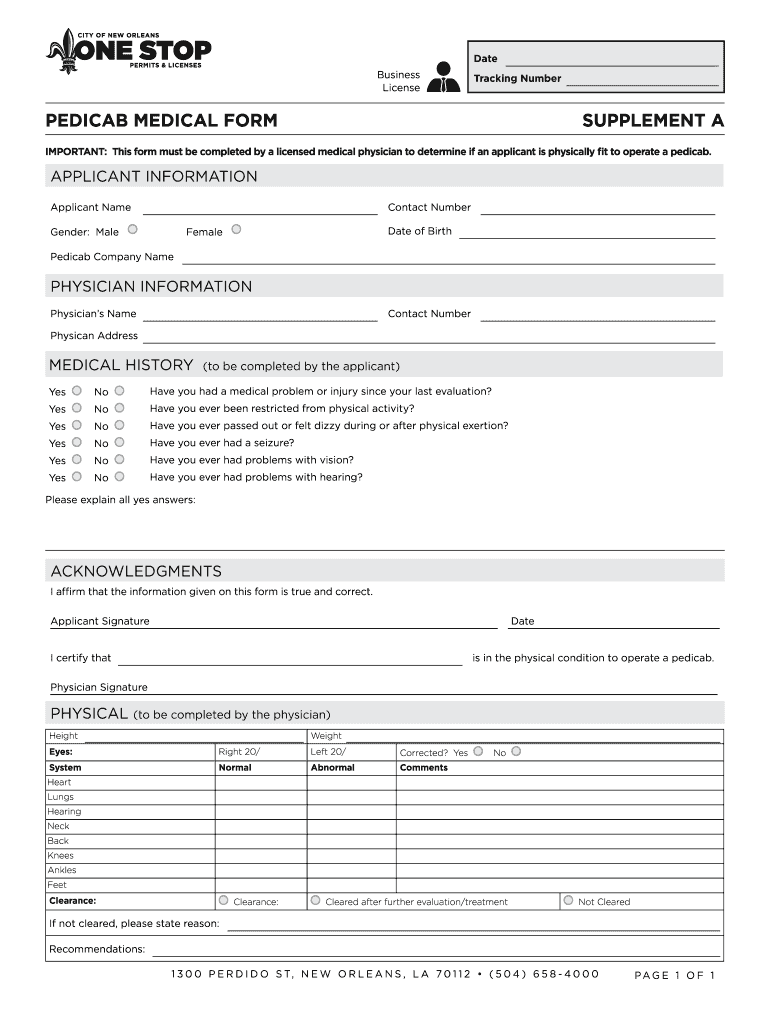

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and organizations. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can easily fill out and sign papers online. Utilize the powerful tools integrated into this user-friendly and cost-effective platform and transform your method of paperwork management. Whether you need to authorize forms or gather signatures, airSlate SignNow takes care of everything seamlessly, with just a few clicks.

Follow this detailed guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Medical Form New Orleans’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Include and assign fillable fields for others (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to work with your colleagues on your Medical Form New Orleans or send it for notarization—our solution provides you with everything required to accomplish these tasks. Create an account with airSlate SignNow today and enhance your document management to new levels!