Attention:

This form is provided for informational purposes only. Copy A appears in red, similar

to the official IRS form. Do not file copy A downloaded from this website. The official

printed version of this IRS form is scannable, but the online version of it, printed from

this website, is not. A penalty of $50 per information return may be imposed for filing

forms that cannot be scanned.

To order official IRS forms, call 1-800-TAX-FORM (1-800-829-3676) or Order

Information Returns and Employer Returns Online, and we’ll mail you the

scannable forms and other products.

See IRS Publications 1141, 1167, 1179 and other IRS resources for information

about printing these tax forms.

�7979

VOID

CORRECTED

PAYER’S name, street address, city, state, ZIP code, and telephone no.

1a Date of sale or exchange

OMB No. 1545-0715

2011

1b Date of acquisition

Form

2 Stocks, bonds, etc.

$

PAYER’S federal identification number

RECIPIENT’S identification number

3 Cost or other basis

Reported

to IRS

͖

1099-B

Gross proceeds

Gross proceeds less commissions and option premiums

4 Federal income tax withheld

$

$

5 Wash sale loss disallowed

RECIPIENT’S name

Proceeds From

Broker and

Barter Exchange

Transactions

6 Check if a noncovered

security

$

7

Street address (including apt. no.)

8 Type of gain or loss

Short-term

Long-term

9

City, state, and ZIP code

Account number (see instructions)

Description

2nd TIN not. 10 Profit or (loss) realized in

2011 on closed contracts

$

$

$

Form

1099-B

File with Form 1096.

For Privacy Act

and Paperwork

Reduction Act

Notice, see the

2011 General

Instructions for

Certain Information

Returns.

$

15 Check if loss not

allowed based on

amount in box 2

$

Cat. No. 14411V

Do Not Cut or Separate Forms on This Page

For

Internal Revenue

Service Center

11 Unrealized profit or (loss) on 14 Bartering

open contracts—12/31/2010

12 Unrealized profit or (loss) on 13 Aggregate profit or (loss) on

contracts

open contracts—12/31/2011

CUSIP number

Copy A

—

Department of the Treasury - Internal Revenue Service

Do Not Cut or Separate Forms on This Page

�CORRECTED (if checked)

PAYER’S name, street address, city, state, ZIP code, and telephone no.

1a Date of sale or exchange

OMB No. 1545-0715

2011

1b Date of acquisition

Form

2 Sales price of stocks,

bonds, etc.

$

PAYER’S federal identification number

RECIPIENT’S identification number

3 Cost or other basis

Reported

to IRS

͖

Proceeds From

Broker and

Barter Exchange

Transactions

1099-B

Sales price

Sales price less commissions and option premiums

4 Federal income tax withheld

Copy B

For Recipient

$

RECIPIENT’S name

$

5 Wash sale loss disallowed

6 If this box is checked,

boxes 1b, 3, 5, and 8

may be blank

$

Street address (including apt. no.)

7

8 Type of gain or loss

Short-term

Long-term

City, state, and ZIP code

9 Description

Account number (see instructions)

10 Profit or (loss) realized in

2011 on closed contracts

CUSIP number

12 Unrealized profit or (loss) on 13 Aggregate profit or (loss) on

contracts

open contracts—12/31/2011

$

$

Form

1099-B

(keep for your records)

This is important tax

information and is

being furnished to the

Internal Revenue

Service. If you are

required to file a return,

a negligence penalty or

other sanction may be

imposed on you if this

income is taxable and

the IRS determines that

it has not been

reported.

11 Unrealized profit or (loss) on 14 Bartering

open contracts—12/31/2010

$

$

15 If box checked, loss

based on amount in

box 2 is not allowed

$

Department of the Treasury - Internal Revenue Service

�Instructions for Recipient

Brokers and barter exchanges must report proceeds from transactions to you

and the IRS on Form 1099-B. Reporting is also required when your broker

knows or has reason to know that a corporation in which you own stock has

had a reportable change in control or capital structure. You may be required to

recognize gain from the receipt of cash, stock, or other property that was

exchanged for the corporation’s stock. If your broker reported this type of

transaction to you, the corporation is identified in box 9.

Account number. May show an account or other unique number the payer

assigned to distinguish your account.

CUSIP number. For broker transactions, may show the CUSIP (Committee on

Uniform Security Identification Procedures) number of the item reported.

Box 1a. Shows the trade date of the sale or exchange. For short sales, the

date shown is the date the security was delivered to close the short sale. For

aggregate reporting in boxes 10 through 13, no entry will be present.

Box 1b. This box may be blank if box 6 is checked or if the securities sold

were acquired on a variety of dates. For short sales, the date shown is the

date you acquired the security delivered to close the short sale.

Box 2. Shows the aggregate cash proceeds from transactions involving stocks,

bonds, other debt obligations, commodities, or forward contracts. May show

the proceeds from the disposition of your interest(s) in a widely held fixed

investment trust. May also show the aggregate amount of cash and the fair

market value of any stock or other property received in a reportable change in

control or capital structure arising from the corporate transfer of property to a

foreign corporation. Losses on forward contracts are shown in parentheses.

This box does not include proceeds from regulated futures contracts. The

broker must indicate whether the sales price or the sales price less

commissions (including transfer taxes) and option premiums was reported to

the IRS. Report this amount as explained in the instructions for Schedule D

(Form 1040).

Box 3. Shows the cost or other basis of securities sold. If box 6 is checked,

box 3 may be blank. See the Schedule D (Form 1040) instructions or Pub. 550

for details about basis.

Box 4. Shows backup withholding. Generally, a payer must backup withhold if

you did not furnish your taxpayer identification number to the payer. See Form

W-9 for information on backup withholding. Include this amount on your

income tax return as tax withheld.

Box 5. Shows the amount of nondeductible loss in a wash sale transaction.

For details on wash sales, see the Schedule D (Form 1040) instructions and

Pub. 550.

Box 6. If this box is checked, the securities sold were noncovered securities

and boxes 1b, 3, 5, and 8 may be blank. Generally, a noncovered security is a

security other than stock; stock purchased before 2011; stock in most mutual

funds and other regulated investment companies; and stock held in a dividend

reinvestment plan in 2011.

Box 8. Shows type of gain or loss.

Box 9. Shows a brief description of the item or service for which the proceeds

or bartering income is being reported. For regulated futures contracts and

forward contracts, “RFC” or other appropriate description may be shown. For

a corporation that had a reportable change in control or capital structure, this

box may show the class of stock as C (common), P (preferred), or O (other).

Regulated Futures Contracts (Boxes 10 Through 13):

Box 10. Shows the profit or (loss) realized on regulated futures or foreign

currency contracts closed during 2011.

Box 11. Shows any year-end adjustment to the profit or (loss) shown in box 10

due to open contracts on December 31, 2010.

Box 12. Shows the unrealized profit or (loss) on open contracts held in your

account on December 31, 2011. These are considered sold as of that date.

This will become an adjustment reported in box 11 in 2012.

Box 13. Boxes 10, 11, and 12 are all used to figure the aggregate profit or

(loss) on regulated futures or foreign currency contracts for the year. Include

this amount on your 2011 Form 6781.

Box 14. Shows the cash you received, the fair market value of any property or

services you received, and the fair market value of any trade credits or scrip

credited to your account by a barter exchange. See Pub. 525.

Box 15. If checked, you cannot take a loss on your tax return based on gross

proceeds from a reportable change in control or capital structure reported in

box 2. Do not report this loss on Schedule D (Form 1040). The broker should

advise you of any losses on a separate statement.

�VOID

CORRECTED

PAYER’S name, street address, city, state, ZIP code, and telephone no.

1a Date of sale or exchange

OMB No. 1545-0715

2011

1b Date of acquisition

Form

2

Stocks, bonds, etc.

$

PAYER’S federal identification number

͖

1099-B

Gross proceeds

Gross proceeds less commissions and option premiums

3 Cost or other basis

4 Federal income tax withheld

$

RECIPIENT’S name

RECIPIENT’S identification number

Reported

to IRS

Proceeds From

Broker and

Barter Exchange

Transactions

$

5 Wash sale loss disallowed

6 Check if a noncovered

security

$

Street address (including apt. no.)

7

8 Type of gain or loss

Short-term

Long-term

City, state, and ZIP code

Account number (see instructions)

9 Description

2nd TIN not. 10 Profit or (loss) realized in

2011 on closed contracts

$

CUSIP number

1099-B

For Privacy Act

and Paperwork

Reduction Act

Notice, see the

2011 General

Instructions for

Certain Information

Returns.

11 Unrealized profit or (loss) on 14 Bartering

open contracts—12/31/2010

$

12 Unrealized profit or (loss) on 13 Aggregate profit or (loss) on

contracts

open contracts—12/31/2011

$

Form

Copy C

For Payer

$

15 Check if loss not

allowed based on

amount in box 2

$

Department of the Treasury - Internal Revenue Service

�Instructions for Payer

General and specific form instructions are provided as

separate products. The products you should use to

complete Form 1099-B are the 2011 General

Instructions for Certain Information Returns and the

2011 Instructions for Form 1099-B. A chart in the

general instructions gives a quick guide to which form

must be filed to report a particular payment. To order

these instructions and additional forms, visit IRS.gov or

call 1-800-TAX-FORM (1-800-829-3676).

Caution: Because paper forms are scanned during

processing, you cannot file with the IRS Forms 1096,

1097, 1098, 1099, 3921, 3922, or 5498 that you print

from the IRS website.

Due dates. Furnish Copy B of this form to the

recipient by February 15, 2012.

File Copy A of this form with the IRS by

February 28, 2012. If you file electronically, the due

date is April 2, 2012. To file electronically, you must

have software that generates a file according to the

specifications in Pub. 1220, Specifications for Filing

Forms 1097, 1098, 1099, 3921, 3922, 5498, 8935, and

W-2G Electronically. The IRS does not provide a fill-in

form option.

Foreign recipient. If the recipient of the proceeds is a

nonresident alien, you may have to withhold federal

income tax and file Form 1042-S, Foreign Person’s

U.S. Source Income Subject to Withholding. See the

Instructions for Form 1042-S and Pub. 515,

Withholding of Tax on Nonresident Aliens and Foreign

Entities.

Need help? If you have questions about reporting on

Form 1099-B, call the information reporting customer

service site toll free at 1-866-455-7438 or

304-263-8700 (not toll free). For TTY/TDD equipment,

call 304-579-4827 (not toll free). The hours of operation

are Monday through Friday from 8:30 a.m. to

4:30 p.m., Eastern time.

�

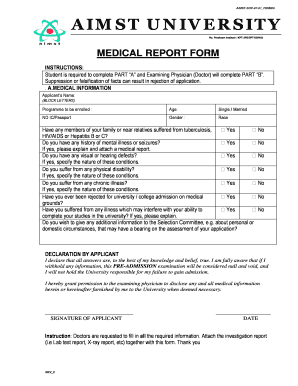

Useful suggestions for finishing your ‘Medical Report For University’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Say farewell to the tedious task of printing and scanning documents. With airSlate SignNow, you can smoothly finalize and approve paperwork online. Utilize the powerful tools bundled within this user-friendly and economical platform to transform your document management strategy. Whether you need to authorize forms or collect signatures, airSlate SignNow manages it all effortlessly with just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or start a free trial with our service.

- Click +Create to upload a document from your device, cloud, or our form library.

- Open your ‘Medical Report For University’ in the editor.

- Click Me (Fill Out Now) to complete the paperwork on your end.

- Insert and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to request electronic signatures from others.

- Save, print your version, or convert it into a reusable template.

Don't be concerned if you need to collaborate with your teammates on your Medical Report For University or send it for notarization—our platform has everything you require to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management experience to new levels!

Medical report for university sample pdf

Medical report for university sample

Medical report for university template

Medical report for university pdf

Medical report for university example

Medical report Sample PDF

Medical Report letter from Doctor pdf

Medical certificate for university admission

Medical report for university template

Medical report for university sample

Medical report for university online

Medical report for university pdf