Fill and Sign the Medical Report Sample in Ghana Form

Practical Suggestions for Preparing Your ‘Medical Report Sample In Ghana’ Online

Are you weary of the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and organizations. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Leverage the extensive features integrated into this user-friendly and budget-friendly platform to transform your approach to document management. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our form collection.

- Open your ‘Medical Report Sample In Ghana’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Insert and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your colleagues on your Medical Report Sample In Ghana or send it for notarization—our platform has everything you need to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

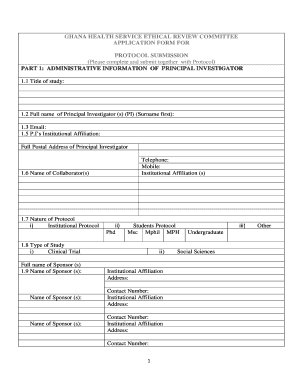

What is a Medical Report Sample In Ghana and how can it be used?

A Medical Report Sample In Ghana serves as a template that outlines the necessary information required for medical documentation. This sample is essential for healthcare professionals and patients to understand the format and content needed for official reports. Using a standardized medical report can streamline the process of documentation and ensure compliance with local regulations.

-

How can airSlate SignNow help me create a Medical Report Sample In Ghana?

airSlate SignNow provides an intuitive platform that allows you to easily create a Medical Report Sample In Ghana. With customizable templates and eSign capabilities, you can quickly generate professional medical reports that meet the specific needs of your practice or healthcare facility. This saves time and enhances efficiency in your documentation process.

-

What features does airSlate SignNow offer for managing Medical Report Samples In Ghana?

airSlate SignNow offers a variety of features for managing Medical Report Samples In Ghana, including document templates, secure eSignature options, and cloud storage. These features enable healthcare providers to easily create, send, and store medical reports, ensuring that all necessary information is captured accurately and securely.

-

Is airSlate SignNow affordable for creating Medical Report Samples In Ghana?

Yes, airSlate SignNow is a cost-effective solution for creating Medical Report Samples In Ghana. With various pricing plans tailored to different business sizes and needs, you can choose a package that fits your budget while still accessing powerful document management and eSigning features.

-

Can I integrate airSlate SignNow with other systems for Medical Report Samples In Ghana?

Absolutely! airSlate SignNow offers seamless integrations with various platforms, making it easy to incorporate Medical Report Samples In Ghana into your existing workflow. This includes integrations with CRM systems, cloud storage services, and other healthcare software, enhancing your overall efficiency.

-

What are the benefits of using airSlate SignNow for Medical Report Samples In Ghana?

Using airSlate SignNow for Medical Report Samples In Ghana provides numerous benefits, including enhanced efficiency, improved accuracy, and better compliance with local healthcare regulations. Additionally, the platform allows for easy tracking of document statuses, which is vital for timely patient care and reporting.

-

How secure is my data when using airSlate SignNow for Medical Report Samples In Ghana?

Data security is a top priority for airSlate SignNow. When using the platform for Medical Report Samples In Ghana, your information is protected with advanced encryption and secure access controls. This ensures that sensitive patient data and medical reports remain confidential and secure.

Find out other medical report sample in ghana form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles