PRICING SUPPLEMENT DATED February 5, 2003

(to the Offering Circular Dated April 5, 2002)

$3,000,000,000

Freddie Mac

GLOBAL DEBT FACILITY

Fixed Rate Notes Due April 15, 2006

Reference Notes®

This Pricing Supplement relates to the Reference Notes (the “Notes”) of the Federal Home Loan

Mortgage Corporation ("Freddie Mac") described below and should be read in conjunction with the Offering

Circular dated April 5, 2002 and all documents incorporated by reference in the Offering Circular, including

Freddie Mac's Information Statement dated March 29, 2002 and any supplements to such Information

Statement. Freddie Mac will also publish a Supplemental Statement applicable to the Notes shortly after the

Auction (as defined herein). The Supplemental Statement will contain the interest rate for the Notes, the price

at which they will be sold as a result of the Auction, the Common Code, and other information. See “Other –

Distribution Arrangements - Auction – Supplemental Statement” in this Pricing Supplement.” Capitalized

terms used in this Pricing Supplement and not otherwise defined in this Pricing Supplement have the meanings

given to them in the Offering Circular.

Freddie Mac plans to offer the Offering Amount of Reference Notes indicated above in an Internetbased, single price, closed bid auction (the “Auction”) to be held between 8:15 a.m. and 10:15 a.m., Eastern

time (U.S.) on February 5, 2003. The terms and conditions for the Auction are contained in the Freddie Mac

Reference Note Auction Procedures (the “Auction Procedures”), available on the Freddie Mac website

(freddiemac.com/debt securities) and by calling the Freddie Mac Debt Securities Marketing Office at (571)

382-3700. You should read this Pricing Supplement in conjunction with the Auction Procedures, which are

incorporated by reference herein. See “Other – Distribution Arrangements - Auctions” in this Pricing

Supplement. Freddie Mac reserves the right, pursuant to Sec. 19(b) of the Auction Procedures to suspend,

delay or cancel the Auction. Any such suspension, delay or cancellation will be immediately publicly

announced.

The Notes are not suitable investments for all investors. In particular, no investor should purchase the

Notes unless the investor understands and is able to bear the yield, market and liquidity risks associated with

the Notes. See "Risk Factors - The Debt Securities May Not Be Suitable For You" in the Offering Circular.

The Notes are obligations of Freddie Mac only. The Notes, including any interest or return of

discount on the Notes, are not guaranteed by, and are not debts or obligations of, the United States or

any agency or instrumentality of the United States other than Freddie Mac. The Notes are not taxexempt. Non-U.S. owners generally will be subject to United States federal income and withholding tax

unless they establish an exemption. Because of applicable U.S. securities law exemptions, we have not

registered the Notes with any U.S. federal or state securities commission. No U.S. securities commission

has reviewed the Offering Circular or this Pricing Supplement.

�Certain Notes Terms

1.

Title:

2.

Fixed Rate Notes Due April 15, 2006

Form:

Book-Entry

Registered

DTC Registered Notes

Global Registered Notes

3.

Specified Payment Currency:

a. Specified Interest Currency:

b. Specified Principal Currency:

U.S. dollars

U.S. dollars

4.

Offering Amount:

$3,000,000,000

5.

Issue Date:

February 7, 2003

6.

Denominations:

$1,000 and additional increments of $1,000

7.

Maturity Date:

April 15, 2006

8.

Subject to Redemption or Repayment Prior to Maturity Date

No

Yes

9.

Amount Payable on the Maturity Date

Fixed Principal Repayment Amount

100% of principal amount

10.

Interest:

a.

Frequency of Interest Payments

Annually

Semiannually

Quarterly

Monthly

b.

Interest Payment Dates:

April 15 and October 15, commencing April 15,

2003

c. Interest rate per annum:

The interest rate for the Notes will be set in the Auction. The

interest rate established as a result of the Auction may be rounded down, if necessary, to

the nearest 1/8 of one percent increment. The interest rate established produces the price

closest to, but not above, par when the Notes and the interest rate are evaluated at the yield

awarded to successful competitive bidders. See “Other – Distribution Arrangements Auction – Determination of Auction Awards” in this Pricing Supplement.

AUCglobal379(7688)

2

�d.

Accrual Method (i.e., Day Count Convention

30/360

Actual/360

Actual/365 (fixed)

Actual/Actual

Actual/Actual (ISMA)

Additional Information Relating to the Notes

1.

Identification Number(s)

a.

CUSIP:

b.

ISIN:

c.

Common Code:

2.

3134A4SX3

US3134A4SX30

To be assigned on or after February 5, 2003

Listing Application

No

Yes

Luxembourg Stock Exchange: - An application has been made with

the Luxembourg Stock Exchange to list the Notes.

3.

Eligibility for Stripping

No

Yes

Interest for the first Interest Payment Period may not be stripped. The

minimum principal amount required for stripping the Notes will be indicated in the Supplemental

Statement.

4.

Governing Law

The Notes will be governed by the federal laws of the United States. The local laws of the

State of New York will be deemed to reflect the federal laws of the United States, unless there

is applicable precedent under federal law or the application of New York law would frustrate

the purposes of the Freddie Mac Act or the Global Facility Agreement.

Offering

1.

Auction Date:

February 5, 2003

2.

Method of Distribution:

Principal

Agent

Auction

See “Other – Auction – Plan of Distribution” in this Pricing

Supplement.

3.

Offering Price:

Fixed Offering Price:

Variable Price Offering:

4.

Purchase Price to Auction Participants: The price of the Notes will be set in the Auction. The

price of the Notes awarded to both competitive and noncompetitive bidders is the price equivalent to the

highest yield at which bids were accepted. See “Other – Distribution Arrangements - Auction - Determining

Purchase Prices for Awarded Securities” in this Pricing Supplement.

AUCglobal379(7688)

3

�Settlement

1.

Settlement Date of the Notes offered hereby:

2.

Settlement Basis

Delivery versus payment

Free delivery

3.

February 7, 2003

Settlement Clearing System

Federal Reserve Banks

DTC

Euroclear

Clearstream Banking

DISTRIBUTION ARRANGEMENTS

Auction

General

Freddie Mac intends to hold an Auction of the Notes on February 5, 2003, as noted above. Certain

Dealers will be designated as direct participants in the Auction. Investors may participate in the Auction

through one or more designated Dealers. For information on designated Dealers, you may contact the Freddie

Mac Debt Marketing Office at (571) 382-3700.

A person or an entity registered with the U.S. Securities and Exchange Commission as a broker-dealer

under the Securities Exchange Act of 1934 (15 U.S.C. Sec. 78o and Sec. 78o-5, as they may be amended from

time to time) may not submit a noncompetitive bid for its own account, either directly or through an

intermediary, in the Auction.

The terms and conditions for the Auction are contained in the Auction Procedures. The Auction

Procedures provide that all participants in the Auction certify, by their participation, that they agree to comply

with and be bound by the Auction Procedures. For a complete description of the terms and conditions

applicable to the Auction, see the Auction Procedures.

Each competitive bid submitted in the Auction must be for at least $10 million of Notes, and

increments of $1 million thereafter. Each noncompetitive bid in the Auction must be for at least $1 million of

Notes, and increments of $10,000 thereafter.

Bids for Notes are binding on the bidder as of the closing time for the Auction.

Determination of Auction Awards

Determinations of awards in the Auction will be made by Freddie Mac after the closing time for

receipt of bids (10:15 a.m., Eastern time (U.S.). In determining auction awards, Freddie Mac will first accept

in full all noncompetitive bids received by the closing time, subject to applicable award limitations. (The

maximum permitted single award for a noncompetitive bid is $25 million, less any amount by which the

bidder’s net long position as reportable under the Auction Procedures exceeds maximum single auction award

AUCglobal379(7688)

4

�amount.) If the aggregate amount of such noncompetitive bids exceeds $600,000,000 then awards in respect

of such noncompetitive bids will be prorated and each award will be rounded up to the nearest $1,000. Then

competitive bids will be accepted, subject to the maximum single auction award amount limit, starting with

those at the lowest yields through successively higher yields, up to the amount required to meet the Offering

Amount. Bids at the stop rate will be prorated, if necessary. (The maximum single auction award amount is

$750,000,000 less any amount awarded to the bidder for noncompetitive bids and less the bidder’s net long

position as reportable under the Auction Procedures.)

When the total amount of bids at the stop rate exceeds the amount of the Offering Amount remaining

after acceptance of noncompetitive bids and competitive bids at the lower yields, a percentage of the bids

received at the stop rate will be awarded. This proration is performed for the purpose of awarding a par amount

of securities close to the public offering amount. The percentage is derived by dividing the remaining par

amount needed to fill the public offering by the par amount of the bids recognized at the stop rate.

Determining Purchase Prices for Awarded Notes

Price calculations will be rounded to six decimal places on the basis of price per hundred, e.g.,

99.954321. The price of securities awarded to both competitive and noncompetitive bidders is the price

equivalent to the highest yield at which bids were accepted.

AUCglobal379(7688)

5

�

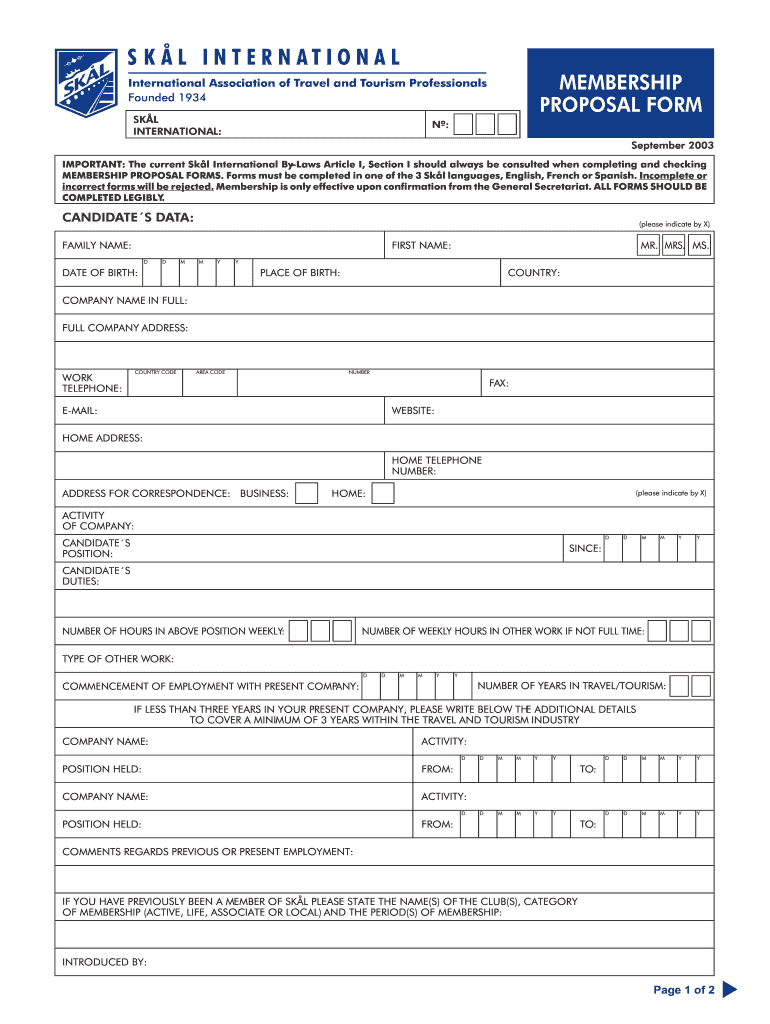

Useful suggestions for preparing your ‘Membership Proposal Form Skal Roma Skalroma’ online

Are you weary of the burden of handling paperwork? Seek no more than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the extended process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the extensive features integrated into this user-friendly and cost-effective platform and transform your strategy for paperwork management. Whether you need to sign forms or collect signatures, airSlate SignNow manages everything efficiently, with just a few clicks.

Follow this detailed guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our form library.

- Access your ‘Membership Proposal Form Skal Roma Skalroma’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need for concern if you wish to collaborate with your colleagues on your Membership Proposal Form Skal Roma Skalroma or send it for notarization—our solution provides everything necessary to complete such actions. Register with airSlate SignNow today and elevate your document management to a new level!