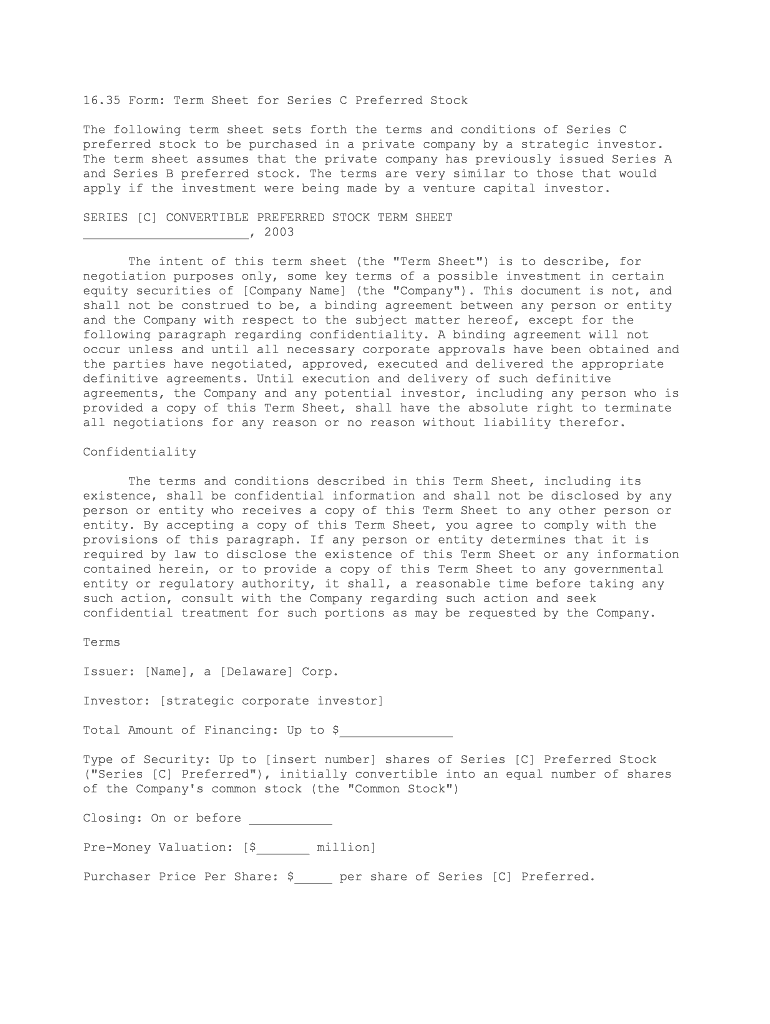

16.35 Form: Term Sheet for Series C Preferred Stock

The following term sheet sets forth the terms and conditions of Series C

preferred stock to be purchased in a private company by a strategic investor.

The term sheet assumes that the private company has previously issued Series A

and Series B preferred stock. The terms are very similar to those that would

apply if the investment were being made by a venture capital investor.

SERIES [C] CONVERTIBLE PREFERRED STOCK TERM SHEET

______________________, 2003The intent of this term sheet (the "Term Sheet") is to describe, for

negotiation purposes only, some key terms of a possible investment in certain

equity securities of [Company Name] (the "Company"). This document is not, and

shall not be construed to be, a binding agreement between any person or entity

and the Company with respect to the subject matter hereof, except for the

following paragraph regarding confidentiality. A binding agreement will not

occur unless and until all necessary corporate approvals have been obtained and

the parties have negotiated, approved, executed and delivered the appropriate

definitive agreements. Until execution and delivery of such definitive

agreements, the Company and any potential investor, including any person who is

provided a copy of this Term Sheet, shall have the absolute right to terminate

all negotiations for any reason or no reason without liability therefor. Confidentiality

The terms and conditions described in this Term Sheet, including its

existence, shall be confidential information and shall not be disclosed by any

person or entity who receives a copy of this Term Sheet to any other person or

entity. By accepting a copy of this Term Sheet, you agree to comply with the

provisions of this paragraph. If any person or entity determines that it is

required by law to disclose the existence of this Term Sheet or any information

contained herein, or to provide a copy of this Term Sheet to any governmental

entity or regulatory authority, it shall, a reasonable time before taking any

such action, consult with the Company regarding such action and seek

confidential treatment for such portions as may be requested by the Company. Terms

Issuer: [Name], a [Delaware] Corp.

Investor: [strategic corporate investor]

Total Amount of Financing: Up to $_______________

Type of Security: Up to [insert number] shares of Series [C] Preferred Stock

("Series [C] Preferred"), initially convertible into an equal number of shares

of the Company's common stock (the "Common Stock")

Closing: On or before ___________

Pre-Money Valuation: [$_______ million]

Purchaser Price Per Share: $_____ per share of Series [C] Preferred.

The Purchase Price has been calculated by dividing (1) the pre-money

valuation by (2) the fully diluted amount of Common Stock and "common stock

equivalents" expected to be outstanding immediately before closing, including:

(a) All issued and outstanding shares of Common Stock;

(b) All issued and outstanding shares of Preferred Stock

(excluding the Series [C] Preferred);

(c) Shares issuable upon exercise of all outstanding options and

warrants to purchase any such Common or Preferred Stock;

(d) Shares issuable upon exercise of all options reserved for

future awards under the Company's stock incentive plan; and

(e) Any other outstanding commitments, contingent or otherwise, to

issue shares, options or warrants, including any and all senior securities or

obligations convertible into Common Stock or Preferred Stock and any warrants

granted to vendors or strategic partners.

Rights and Preferences of Series [C] Preferred:

Dividend Rights: The Series [C] Preferred would be entitled to an annual per

share dividend equal to [__%] of the Purchase Price, payable when and if

declared by the Board of Directors (the "Board"). The dividends would be

[non]cumulative and would be paid prior to payment of any dividend with respect

to the Common Stock [and any [existing or future] other series of Preferred

Stock]. After payment of the preferential dividend to the holders of the Series

[C] Preferred [and any other series of preferred stock], any further dividends

would be paid pari passu to the holders of the Series [C] Preferred, [the other

series of Preferred Stock] and the Common Stock on a pro rata, as-converted

basis. The Series [C] Preferred also would be entitled to receive pari passu

with the holders described immediately above any noncash dividends declared by

the Board on a pro rata, as-converted basis. [Note: A cumulative dividend is one that accrues over time even if not

declared by the Board. When the Board ultimately declares a dividend or upon

liquidation (including a change of control event), the holder is entitled to all

of the accrued dividends whether or not declared, if the dividends are

cumulative. See "Liquidation Preference" below.]

Liquidation Preference: In the event of any liquidation, dissolution or winding

up of the Company, the holders of the Series [C] Preferred would be entitled to

receive, prior to any distribution to the holders of the Common Stock [or any

other series of Preferred Stock], an amount equal to [___ times] the Purchase

Price, plus all [declared but unpaid][accrued but unpaid, whether or not

declared] dividends thereon (the "Preference Amount"). After the full

liquidation preference on all outstanding shares of Series [C] Preferred [and

the other series of preferred stock] has been paid, any remaining funds and

assets of the Company legally available for distribution to stockholders would

be distributed pari passu among the holders of the Series [C] Preferred, [other

series of preferred stock] and the Common Stock on a pro rata, as-converted

basis[; provided, however, that the maximum amount to be paid per share of

Series [C] Preferred would in no event exceed [insert multiple or rate of

return]. If the Company had insufficient assets to permit payment of the

Preference Amount in full to all Series [C] Preferred holders, then the assets

of the Company would be distributed ratably to the holders of the Series [C]

Preferred in proportion to the Preference Amount each such holder would

otherwise be entitled to receive.A merger, acquisition, change of control, consolidation or other

transaction or series of transactions in which the Company's stockholders prior

to such transaction or transactions would not retain a majority of the voting

power of the surviving entity, or a sale of all or substantially all the

Company's assets, would be deemed to be a liquidation, dissolution or winding up

of the Company for purposes of the liquidation preference. [Note: The liquidation preference formula raises a number of issues that

are heavily negotiated. In the case of preferred stock that is not

participating, the investors must choose between converting to common or

receiving their liquidation preference. In the case of participating preferred,

the investors need not make a choice. They receive their preference and then

share the balance with the common on an as-converted basis. The formula for the

liquidation preference can have several structures: (1) amount paid, plus

declared but unpaid dividends; (2) amount paid, plus a cumulative dividend from

the date of issuance, whether or not declared; (3) a multiple (e.g., 1.5x, 2.0x,

3.0x) of the original purchase price; and (4) a combination of (1) and (3), or

(2) and (3). If the preferred is participating, it is not unusual for the

preferred holders to be subject to an upside cap at some multiple of the

original amount invested or a specified rate of return from the date of issuance.]

Redemption: Subject to any legal restrictions on the Company's redemption of

shares, at any time after [Insert date], the holders of a majority of the then

outstanding Series [C] Preferred may require the Company to redeem the

outstanding Series [C] Preferred. The redemption price for each share of Series

[C] Preferred would be [insert appropriate formula] of the Purchase Price, plus

all declared but unpaid dividends thereon to the date of redemption (the

"Redemption Price"). The Redemption Price would be proportionally adjusted for

stock splits, stock dividends, etc. If, on the redemption date, the number of

shares of Series [C] Preferred that may then be legally redeemed by the Company

is less than the number of such shares to be redeemed, then the shares to be

redeemed but that may not be legally redeemed would be redeemed as soon as the

Company had legally available funds therefore.

Conversion Rights: The holders of the Series [C] Preferred would have the right

to convert the Series [C] Preferred into shares of Common Stock at any time. The

initial conversion rate for the Series [C] Preferred would be one-for-one.

Automatic Conversion: The Series [C] Preferred would automatically convert into

Common Stock, at the then-applicable conversion rate, upon the closing of a

firmly underwritten public offering of shares of Common Stock of the Company

pursuant to a registration statement on Form S-1 under the Securities Act of

1933, for listing on a [inter]nationally recognized exchange, at an effective

public offering price of at least [$____] per share and gross proceeds to the

Company in excess of [$________ million] (a "Qualified IPO"). [Note: The Qualified IPO amount is typically a multiple of the preferred

issuance price.] The Series [C] Preferred would also automatically convert into Common

Stock, at the then-applicable conversion rate, upon approval of the holders of

[a majority][66 2/3%] of the outstanding shares of Series [C] Preferred.

Antidilution Provisions: The conversion price of the Series [C] Preferred would

be subject to adjustment on a [full-ratchet] [broad-based weighted

average][narrow-based weighted average] basis for issuances at a purchase price

less than the then-effective conversion price with a carve-out for issuances of

(1) shares upon conversion, exchange and/or exercise of securities outstanding

on the date of the closing or issued after such date but permitted by Clauses

(2) through (5); (2) stock option or other incentive awards to employees,

consultants and directors[ involving up to [insert number] shares of Common

Stock] (3) shares of Common Stock, or warrants or other securities exercisable

or exchangeable for, or convertible into, such shares, to equipment or other

lessors, financial institutions or other lenders in connection with commercial

credit arrangements, real estate leases, equipment leases or other similar

financings; (4) equity securities pursuant to the acquisition by the Company of

another business entity, products or technologies; and (5) shares of Common

Stock, or warrants or other securities exercisable or exchangeable for, or

convertible into, such shares, to suppliers, customers or other strategic

partners, provided, however, that each such event described in clauses (2)

through (5) is approved by a majority of the Board.[Note: The three types of antidilution price protection are, (1) full

ratchet; (2) broad-based weighted average and (3) narrow-based weighted average.

A full ratchet adjusts the conversion price downwards to the price of securities

issued subsequent to the preferred round. An issuer can make strong arguments

that full-ratchet dilution overcompensates the preferred. When financing

conditions are difficult, however, investors may insist on full-ratchet

protection. A broad-based weighted average, sometimes described as only weighted

average or fully diluted, is the most common type of price based antidilution

protection. It takes into account the actual economic dilution based on the size

of round and the issuance price. "Fully diluted" means that, when calculating

the dilution, the number of shares outstanding, pre-round, includes shares

issuable pursuant to outstanding options, warrants and other common stock

equivalents, but not shares reserved for issuance upon future awards of options

under incentive plans. It is to the company's advantage to make the definition

of the number of shares outstanding, pre-issuance, as large as possible because

it reduces the dilution adjustment. The "narrow-based weighted average" formula

is similar to the broad-based weighted average formula, but excludes the impact

of outstanding options and warrants.]

Voting Rights: Each share of Series [C] Preferred would carry a number of votes

equal to the number of shares of Common Stock then issuable upon its conversion

into Common Stock. The Series [C] Preferred would generally vote together with

the Common Stock on all matters submitted to a vote of stockholders and not as a

separate class, except as provided below.

Protective Provisions: Consent of the holders of at least [a majority/66 2/3%]

of the outstanding Series [C] Preferred, voting separately as a class, would be

required for: (1) any amendment or change to the rights, preferences, privileges

or powers of, or the restrictions provided for the benefit of, the Series [C]

Preferred; (2) any action that authorizes, creates or issues shares of any class

of stock having preferences superior to or on a parity with the Series [C]

Preferred; (3) any action that reclassifies any outstanding shares into shares

having preferences or priority as to dividends or assets senior to or on a

parity with the preference of the Series [C] Preferred; (4) any amendment of the

Company's Certificate of Incorporation that adversely affects the rights of the

Series [C] Preferred; (5) any merger, consolidation, acquisition or similar

transaction or series of transactions, of the Company with one or more other

corporations in which the stockholders of the Company prior to such transaction

or series of transactions, would hold stock representing less than a majority of

the voting power of the outstanding stock of the surviving corporation

immediately after such transaction or series of transactions; (6) the sale of

all or substantially all the Company's assets; (7) the liquidation or

dissolution of the Company; (8) the declaration or payment of a dividend on the

Common Stock (other than a dividend payable solely in shares of Common Stock) or

the redemption or repurchase of any securities, other than repurchases following

termination of employment at the original purchase price therefor; (9 ) any

increase in the authorized number of or the issuance of any additional shares of

Common Stock or Preferred Stock; or (10) any increase or decrease in the

authorized number of directors of the Company.[Note: Issuers typically prefer that protective provisions be subject to a

vote of all classes of preferred voting together as a single class, which would

have the effect of diluting the new round's power to determine the outcome of

any vote on these issues.]

Terms of the Stock Purchase Agreement and Rights Agreement: The purchase of

shares of Series [C] Preferred would be made pursuant to a Stock Purchase

Agreement and a Registration Rights Agreement reasonably acceptable to the

Company and investors, which agreement would contain, among other things,

customary representations and warranties of the Company, covenants of the

Company reflecting the provisions set forth herein, and appropriate conditions

of closing, including, an opinion of counsel for the Company.

Board of Directors: The Company's Certificate of Incorporation and bylaws would

provide for a Board of Directors consisting of [insert number] members. The

number of directors could not be changed except by an amendment to such charter

documents approved by a vote of the Series [C] Preferred in accordance with the

Protective Provisions described above. In addition, the investor would have the

right to appoint a representative to attend all meetings of the Board and

committees thereof as an observer. On and after the Closing Date, the Board of Directors would consist of

[__________, __________ and __________].

[Note: This Term Sheet contemplates an observer right and not a right to

appoint a director. Many strategic corporate investors will not, as a matter of

policy, want an actual Board seat, preferring an observer right. They are

concerned about a variety of fiduciary obligations that apply to directors under

state corporation statutes. In July 2000, Delaware adopted a statute permitting

disclaimer of the "corporate opportunity" doctrine by companies by including

language to that effect in the Certificate of Incorporation. The corporate

opportunity doctrine, developed by case law not by statute, stands for the

proposition that opportunities that a director receives in his or her capacity

as a director of a company must be offered to the company. Although the new

statute may alleviate one of the fiduciary-related concerns, there are other

fiduciary duties as well, such as what should a director do when the stockholder

he or she represents has different interests than other stockholders.]

Use of Proceeds: The Company intends to use the proceeds from the Series [C]

Preferred Financing for working capital and general corporate purposes.

Rights of First Offer: Each holder of Series [C] Preferred would have a right of

first offer to purchase up to its pro rata share (based on such holder's

percentage of the Company's outstanding common shares, calculated on a fully

diluted, as-converted basis) of any equity securities offered by the Company,

other than: (1) securities issued in a transaction registered under the

Securities Act of 1933; and (2) securities issued in any of the circumstances

described in Clauses (1) through (5) under "Antidilution Provisions" above. The

holder would be entitled to purchase such securities at the same price and terms

and on the same conditions as the Company offers such securities to other

potential investors (with a right of oversubscription if any holder of Series

[C] Preferred elected not to purchase its pro rata share). This right would not

apply to and would terminate upon the closing of a Qualified IPO. [Any holder

who does not exercise his or her right in full with respect to an issuance of

securities would lose that right in connection with future issuances.Rights of first offer are also sometimes called preemptive rights. This

provision allows investors to (1) purchase all or any portion of the new

securities being offered on a pro rata basis (a "full gobble up") and (2) elect

to purchase any shares not subscribed for by other existing investors. "Full

gobble up" provisions are fairly rare and over-allotment elections are also

unusual because they delay closings. Normally, rights of first offer only allow

investors to purchase a portion of the securities to enable them to maintain

their percentage ownership in the company. By setting up the preemptive rights

in that manner, the Company can bring in new investors.

Right of First Refusal and Co-Sale Agreement: The Company, each holder of Series

[C] Preferred, the founders of the Company (the "Founders") and [insert other

key stockholders ("Other Stockholders")] would enter into a Co-Sale Agreement

that would give the holders of the Series [C] Preferred first refusal rights and

co-sale rights providing that any Founder [or Other Stockholder] who proposes to

sell all or a portion of such person's shares to a third party must permit the

holders of the Series [C] Preferred hereunder at their option (1) to purchase

such stock on the same terms as the proposed transferee, or (2) sell a

proportionate part of their shares on the same terms offered by the proposed

transferee. This right would terminate upon the closing of a Qualified IPO.

Information Rights: So long as shares of Series [C] Preferred are outstanding,

the Company would deliver to each holder: (1) audited annual financial

statements within ninety (90) days after the end of each fiscal year; (2)

unaudited quarterly financial statements within forty-five (45) days of the end

of each fiscal quarter; and (3) an annual operating budget and strategic plan

within thirty (30) days prior to the end of each fiscal year. For so long as

shares of Series [C] Preferred are outstanding, such holders would have standard

inspection rights. These information and inspection rights would terminate upon

the Company's Qualified Public Offering.

Registration Rights:

(1) Demand, S-3 and Piggyback Rights: The holders of Series [C] Preferred

would have registration rights customary in financings of this nature. The

specific terms of such registration rights would include at least the following:

(1) beginning at any time after the earlier of the [insert number] anniversary

of the closing of the Series [C] Preferred round or six months after the

Company's initial public offering, [one/two/three] demand registrations upon

request of holders of at least [insert %] of the registrable securities and

covering the registration of capital stock having an aggregate offering price in

excess of at least $[insert amount] million; (2) unlimited registrations on Form

S-3 assuming that each such registered offering has an aggregate offering price

of not less than $ [insert amount] million; (3) unlimited piggyback

registrations in connection with registrations of shares for the account of the

Company or selling stockholders exercising demand rights; and (4) cut-back

provisions providing that registrations must, other than in the Qualified IPO,

include at least [insert %] of the shares requested to be included by the

holders of registrable securities. [Officers, directors, founders, other

employees of the Company and consultants would be cut back in their entirety

before the holders of registrable securities would be cut back.]

(2) Expenses: The Company would bear the registration expenses (excluding

underwriting discounts and commissions, but including all other expenses related

to the registration) of all such demand, piggyback and S-3 registrations.

(3) Transfer of Rights: The registration rights may be transferred.

(4) Termination: The registration rights would not apply to any holder who

can sell all of such holder's shares in any three-month period without

registration pursuant to Rule 144 promulgated under the Securities Act of 1933.

(5) Additional Registration Rights: The Company would not grant

registration rights to any other holder of the Company's securities superior to

[or on parity with] the rights granted to the holders of the Series [C]

Preferred without the prior approval of a majority of the Series [C] Preferred.

(6) Market Stand-Off: The holders of Series [C] Preferred would agree not

to sell shares of any Common Stock or other capital stock for one hundred eighty

(180) days following the Company's initial public offering, so long as all

directors, officers and 1 % stockholders entered into similar agreements. [The

holders of Series [C] Preferred would have the right to be released pro rata

from such agreement in the event the underwriters released any other

stockholders from similar agreements.]

Confidentiality: The terms and conditions of the financing, including its

existence, would be confidential information and would not be disclosed to any

third party by the Company, except as provided below. The Company would be able

to disclose the existence of the financing, as well as each investor's

investment in the Company, solely to the Company's investors, investment

bankers, lenders, accountants, legal counsel, business partners, and bona fide

prospective investors, employees, lenders and business partners in each case

only where such persons or entities were under appropriate nondisclosure obligations.

Confidential Information and Invention Assignment Agreement: Each officer and

[key] employee of the Company would have entered into an acceptable confidential

information and invention assignment agreement. [The Company would use its best

efforts to have the remainder of the employees and officers sign such an agreement.]

Legal Fees: The Company would pay at the closing the fees and expenses of one

counsel for the investor (not to exceed $__________) arising in connection with

the transactions contemplated by this Term Sheet.

Employee Vesting: Stock issued to employees directors and consultants would be

subject to vesting/repurchase over four years. [At least [50%] of each founder's

shares would be subject to four years of vesting. Each of the founders would

execute a stock restriction agreement covering the shares held by such founder

providing that any unvested shares may be repurchased by the Company for the

original issue price in the event the employment of such founder is terminated.

Founder shares would vote as if fully vested for each founder remaining employed

by the Company.]

Governing Law: Delaware law.

Capitalization: After the closing of the Series [C] Preferred round, the

capitalization of the Company would be as follows:

[Insert capitalization table.]