Fill and Sign the Mortgage Loan Commitment for Home Equity Line of Credit Form

Useful suggestions for preparing your ‘Mortgage Loan Commitment For Home Equity Line Of Credit’ online

Are you fed up with the challenges of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and organizations. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the robust features included in this user-friendly and affordable platform and transform your approach to document management. Whether you need to approve submissions or gather electronic signatures, airSlate SignNow manages everything seamlessly, with just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or begin a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Edit your ‘Mortgage Loan Commitment For Home Equity Line Of Credit’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Mortgage Loan Commitment For Home Equity Line Of Credit or send it for notarization—our platform offers everything you require to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

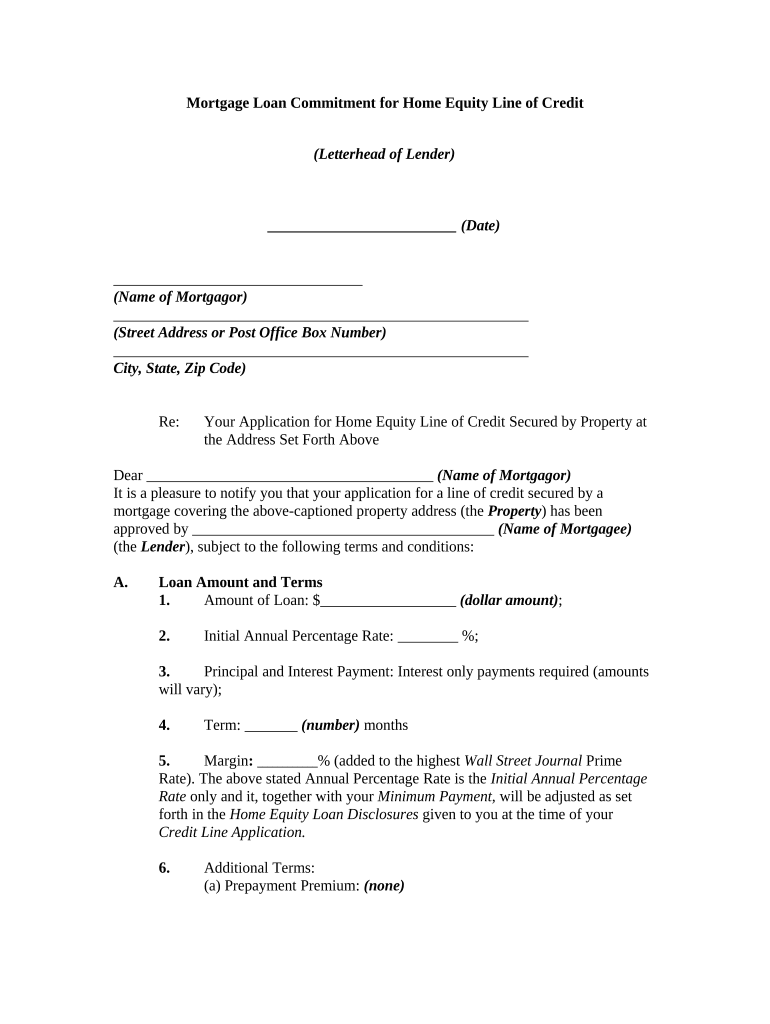

What is a Mortgage Loan Commitment For Home Equity Line Of Credit?

A Mortgage Loan Commitment For Home Equity Line Of Credit is a formal agreement from a lender outlining the terms and conditions under which they will provide funds. This document is crucial for homeowners looking to access equity in their property, as it details the loan amount, interest rate, and repayment terms. Understanding this commitment is essential for managing your finances effectively.

-

How can airSlate SignNow facilitate the Mortgage Loan Commitment For Home Equity Line Of Credit process?

airSlate SignNow streamlines the Mortgage Loan Commitment For Home Equity Line Of Credit process by allowing you to easily send, sign, and manage documents electronically. With our user-friendly interface, you can quickly prepare and send your loan commitment documents for eSignature, reducing turnaround time signNowly. This efficiency helps you secure your home equity line of credit faster.

-

What are the costs associated with obtaining a Mortgage Loan Commitment For Home Equity Line Of Credit?

The costs of obtaining a Mortgage Loan Commitment For Home Equity Line Of Credit can vary based on the lender and the specifics of your loan. Typically, you may encounter application fees, appraisal fees, and closing costs. It's important to review all fees associated with the commitment to understand the total financial impact.

-

What features does airSlate SignNow offer for managing Mortgage Loan Commitment For Home Equity Line Of Credit documents?

airSlate SignNow offers several key features for managing Mortgage Loan Commitment For Home Equity Line Of Credit documents, including customizable templates, document routing, and real-time tracking. These tools ensure that your documents are handled efficiently and securely, allowing for quick updates and easy access to all relevant information throughout the loan process.

-

How does airSlate SignNow ensure the security of my Mortgage Loan Commitment For Home Equity Line Of Credit documents?

Security is a top priority for airSlate SignNow. We use advanced encryption protocols and secure cloud storage to protect your Mortgage Loan Commitment For Home Equity Line Of Credit documents from unauthorized access. Additionally, our platform complies with industry standards to ensure that your sensitive information remains confidential and secure.

-

Can I integrate airSlate SignNow with other financial tools for my Mortgage Loan Commitment For Home Equity Line Of Credit?

Yes! airSlate SignNow can be easily integrated with various financial tools and software to enhance your Mortgage Loan Commitment For Home Equity Line Of Credit experience. This integration allows for seamless data transfer and workflow automation, enabling you to manage your documents more effectively and efficiently.

-

What benefits does eSigning provide for my Mortgage Loan Commitment For Home Equity Line Of Credit?

eSigning your Mortgage Loan Commitment For Home Equity Line Of Credit offers numerous benefits, including faster processing times and reduced paperwork. With airSlate SignNow, you can sign documents from anywhere, at any time, using any device, which eliminates the hassle of physical signatures and mailing. This convenience accelerates the overall loan approval process.

The best way to complete and sign your mortgage loan commitment for home equity line of credit form

Find out other mortgage loan commitment for home equity line of credit form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles