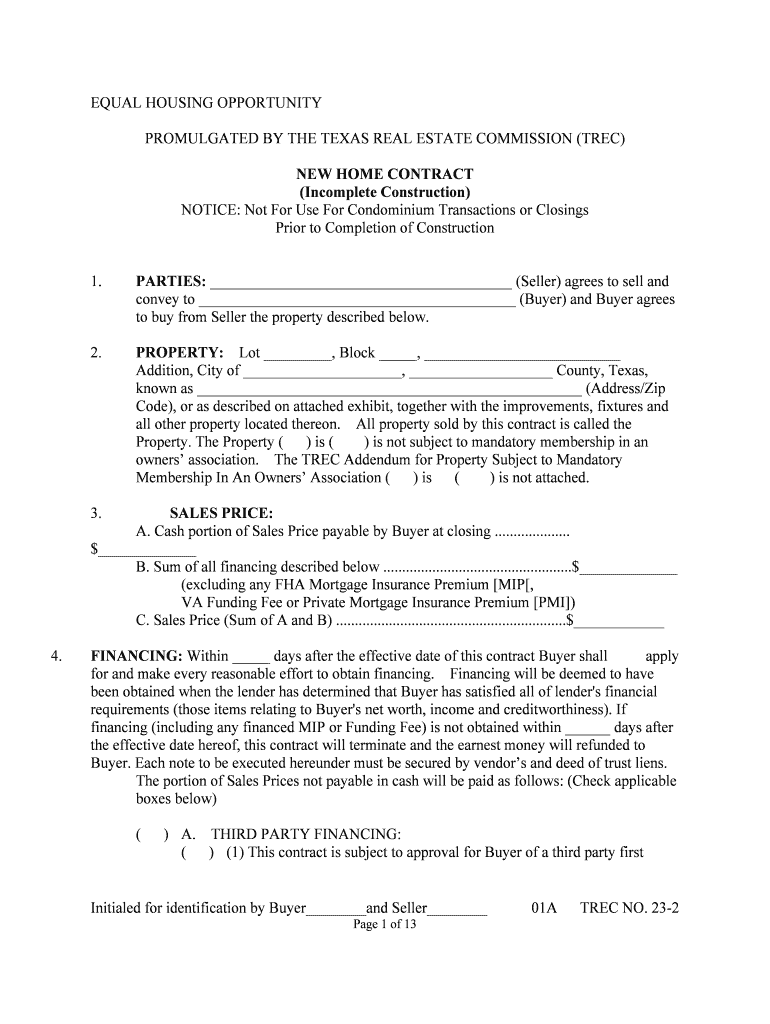

Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 1 of 13 EQUAL HOUSING OPPORTUNITY PROMULGATED BY THE TEXAS REAL ESTATE COMMISSION (TREC) NEW HOME CONTRACT(Incomplete Construction) NOTICE: Not For Use For Condominium Transactions or Closings Prior to Completion of Construction 1.PARTIES: ________________________________________ (Seller) agrees to sell and

convey to __________________________________________ (Buyer) and Buyer agrees

to buy from Seller the property described below.2.PROPERTY: Lot _________, Block _____, __________________________

Addition, City of _____________________, ___________________ County, Texas,

known as ___________________________________________________ (Address/Zip

Code), or as described on attached exhibit, together with the improvements, fixtures and

all other property located thereon. All property sold by this contract is called the

Property. The Property ( ) is ( ) is not subject to mandatory membership in an

owners’ association. The TREC Addendum for Property Subject to Mandatory

Membership In An Owners’ Association ( ) is ( ) is not attached. 3. SALES PRICE:A. Cash portion of Sales Price payable by Buyer at closing ....................

$_____________B. Sum of all financing described below ..................................................$_____________(excluding any FHA Mortgage Insurance Premium [MIP[, VA Funding Fee or Private Mortgage Insurance Premium [PMI])C. Sales Price (Sum of A and B) .............................................................$____________4. FINANCING: Within _____ days after the effective date of this contract Buyer shall apply

for and make every reasonable effort to obtain financing. Financing will be deemed to have

been obtained when the lender has determined that Buyer has satisfied all of lender's financial

requirements (those items relating to Buyer's net worth, income and creditworthiness). If

financing (including any financed MIP or Funding Fee) is not obtained within ______ days after

the effective date hereof, this contract will terminate and the earnest money will refunded to

Buyer. Each note to be executed hereunder must be secured by vendor’s and deed of trust liens.The portion of Sales Prices not payable in cash will be paid as follows: (Check applicable boxes below)( )A. THIRD PARTY FINANCING:( )(1) This contract is subject to approval for Buyer of a third party first

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 2 of 13 mortgage loan having a loan-to-loan value ratio not to exceed _______%

as established by such third party (excluding any financed PMI premium),

due in full in _________ year(s), with interest not to exceed ______% per

annum for the first ________ year(s) of the loan. The loan will be ( )

with ( ) without PMI.( )(2) This contract is subject to approval for Buyer of a third party second

mortgage loan having a loan-to-value ratio not to exceed ________% as established by such third party (excluding any financed PMI premium),

due in full in ________ year(s), with interest not to exceed _________%

per annum for the first ________ year(s) of the loan. The loan will be (

) with ( ) without PMI.( )B. FHA INSURED FINANCING: This contract is subject to approval for Buyer

of a Section _______ FHA insured loan of not less than $___________

(excluding any financed MIP), amortizable monthly for not less than _____ years,

with interest not to exceed _______ % per annum for the first ________ year(s) of

the loan. As required by HUD-FHA, if FHA valuation is unknown, "It is

expressly agreed that, notwithstanding any other provisions of this contract, the

purchaser (Buyer) shall not be obligated to complete the purchase of the Property

described herein or to incur any penalty by forfeiture of earnest money deposits or

otherwise unless the purchaser (Buyer) has been given in accordance with

HUD/FHA or VA requirements a written statement issued by the Federal Housing

Commissioner, Department of Veterans Affairs, or a Direct Endorsement Lender

setting forth the appraised value of the Property of not less than $

_____________________. The purchaser (Buyer) shall have the privilege and

option of proceeding with consummation of the contract without regard to the

amount of the appraised valuation. The appraised valuation is arrived at to

determine the maximum mortgage the Department of Housing and Urban

Development will insure. HUD does not warrant the value or the condition of

the Property. The purchaser (Buyer) should satisfy himself/herself that the price

and the condition of the Property are acceptable. If the FHA appraised value of

the Property (excluding closing costs and MIP) is less than the Sales Price (3C

above), Seller may reduce the Sales Price to an amount equal to the FHA

appraised value (excluding closing costs and MIP) and the parties to the sale shall

close the sale at such lower Sales Price with appropriate adjustments to 3A and

3B above.( )C. VA GUARANTEED FINANCING: This contract is subject to approval for

Buyer of a VA guaranteed loan of not less than $_____________ (excluding any

financed Funding Fee), amortizable monthly for not less than _____ years, with

interest not to exceed _________% per annum for the first ________ year(s) of

the loan. VA NOTICE TO BUYER: It is expressly agreed that, notwithstanding any other

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 3 of 13 provisions of this contract, the Buyer shall not incur any penalty by forfeiture of

earnest money or otherwise or be obligated to complete the purchase of the

Property described herein, if the contract purchase price or cost exceeds the

reasonable value of the Property established by the Department of Veterans

Affairs. The Buyer shall, however, have the privilege and option of proceeding

with the consummation of this contract without regard to the amount of the

reasonable value established by the Department of Veterans Affairs. If Buyer elects to complete the purchase at an amount in excess of the reasonable

value established by VA, Buyer shall pay such excess amount in cash from a

source which Buyer agrees to disclose to the VA and which Buyer represents will

not be from borrowed funds except as approved by VA. If VA reasonable value

of the Property is less than the Sales Price (3C above), Seller may reduce the

Sales Price to an amount equal to the VA reasonable value and the parties to the

sale shall close at such lower Sales Price with appropriate adjustments to 3A and

3B above.( )D. TEXAS VETERAN’S HOUSING ASSISTANCE PROGRAM LOAN: This

contract is subject to approval for Buyer of a Texas Veterans’ Housing Assistance program Loan

of $____________ for a period of at least __________ years at the interest rate established by

the Texas Veteran’s Land Board at the time of closing.( )E. SELLER FINANCING: A promissory note from Buyer to Seller of $________,

bearing _________% interest per annum, secured by vendor’s and deed of trust liens, in

accordance with the terms and conditions set forth in the attached TREC Seller Financing

Addendum. If an owner policy of title insurance is furnished, Buyer shall furnish Seller with a

mortgagee policy of title insurance.( )F. CREDIT APPROVAL ON SELLER FINANCING: Within _____ days after the

effective date of this contract, Buyer shall deliver to Seller ( ) credit report ( )

verification of employment, including salary ( ) verification of funds on deposit in financial

institutions ( ) current financial statement to establish Buyer’s creditworthiness for seller

financing and ______________________________________________________________________________ ________________________________________________________________________________________________________________________ If Buyer’s documentation is not delivered within the specified time, Seller may

terminate this contract by notice to Buyer within 7 days after expiration of the

time for delivery, and the earnest money will be paid to Seller. If this contract is

not so terminated, Seller will be deemed to have accepted Buyer’s credit. If the

documentation is timely delivered, and Seller determines in Seller’s sole

discretion that Buyer’s credit is unacceptable, Seller may terminate this contract

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 4 of 13 by notice to Buyer within 7 days after expiration of the time for delivery and the

earnest money will be refunded to Buyer. If Seller does not so terminate this

contract, Seller will be deemed to have accepted Buyer’s credit. Buyer hereby

authorizes any credit reporting agency to furnish to Seller at Buyer’s sole expense

copies of Buyer’s credit reports.5.EARNEST MONEY: Buyer shall deposit $ ___________ as earnest money with

__________________________ at ___________________________________ (Address), as

escrow agent, upon execution of this contract by both parties. Additional earnest money of $________ must be deposited by Buyer with escrow agent on or before

____________________, 20______. If Buyer fails to deposit the earnest money as required by

this contract, Buyer will be in default.6. TITLE POLICY AND SURVEY:( )A. TITLE POLICY: Seller shall furnish to Buyer at ( ) Seller’s ( ) Buyer’s expense

an owner policy of title insurance (the Title Policy) issued by __________________________

(the Title Company) in the amount of the Sales Price, dated at or after closing, insuring Buyer

against loss under the provisions of the Title Policy, subject to the promulgated exclusions

(including existing building and zoning ordinances) and the following exceptions:(1) Restrictive covenants common to the platted subdivision in which the Property

is located.(2) The standard printed exception for standby fees, taxes and assessments. (3) Liens created as part of the financing described in Paragraph 4.(4) Utility easements created by the dedication deed or plat of the subdivision in

which the Property is located.(5) Reservations or exceptions otherwise permitted by this contract or as may be

approved by Buyer in writing.(6) The standard printed exception as to discrepancies, conflicts, shortages in area

or boundary lines, encroachments or protrusions, or overlapping improvements.(7) The standard printed exception as to marital rights.(8) The standard printed exception as to waters, tidelands, beaches, streams, and

related matters.Within 20 days after the Title Company receives a copy of this contract, Seller

shall furnish to Buyer a commitment for title insurance (the Commitment) and, at

Buyer's expense, legible copies of restrictive covenants and documents evidencing exceptions in the Commitment other than the standard printed

exceptions. Seller authorizes the Title Company to mail or hand deliver the

Commitment and related documents to Buyer at Buyer's address shown below. If

the Commitment is not delivered to Buyer within the specified time, the time for

delivery will be automatically extended up to 15 days. Buyer will have 7 days

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 5 of 13 after the receipt of the Commitment to object in writing to matters disclosed in the

Commitment.( ) B. SURVEY: Within _____ days after Buyer’s receipt of a survey furnished to a

third-party lender at ( ) Seller’s ( ) Buyer’s expense, Buyer may object in writing to any

matter shown on the survey which constitutes a defect or encumbrance to title. The survey must be made by a Registered Professional Land Surveyor acceptable

to the Title Company and any lender. Utility easements created by the

dedication deed and plat of the subdivision in which the Property is located will

not be a basis for objection.Buyer may object to existing building and zoning ordinances, items 6A(1) through (8) above and matters shown on the survey if Buyer determines that any

such ordinance, items or matters prohibits the following use or activity:

____________________________________________________________________________________________________________________________________Buyer’s failure to object under Paragraph 6A or 6B within the time allowed will constitute a waiver of Buyer’s right to object; except that the requirements in

Schedule C of the Commitment will not be deemed to have been waived. Seller

shall cure the timely objections of Buyer or any third party lender within 15 days

from the date Seller receives the objections and the Closing Date will be extended

as necessary. If objections are not cured by the extended Closing Date, this

contract will terminate and the earnest money will be refunded to Buyer unless

Buyer elects to waive the objections.NOTICE TO SELLER AND BUYER:(1)Broker advises Buyer to have an abstract of title covering the Property examined by an

attorney of Buyer’s selection, or Buyer should be furnished with or obtain a Title Policy. If a

Title Policy is furnished, the Commitment should be promptly reviewed by an attorney of Buyer’s choice due to the time limitations on Buyer’s right to object.(2) If the Property is situated in a utility or other statutorily created district providing water,

sewer, drainage, or flood control facilities and services, Chapter 49 of the Texas Water

Code requires Seller to deliver and Buyer to sign the statutory notice relating to the tax

rate, bonded indebtedness, or standby fee of the district prior to final execution of this

contract.(3)If the Property abuts the tidally influenced waters of the state, Section 33.135, Texas

Natural Resources Code, requires a notice regarding coastal area property to be included

in the contract. An addendum either promulgated by TREC or required by the parties

should be used.(4)Buyer is advised that the presence of wetlands, toxic substances, including asbestos and

wastes or other environmental hazards or the presence of a threatened or endangered species or

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 6 of 13 its habitat may affect Buyer’s intended use of the Property. If Buyer is concerned about these

matters, an addendum either promulgated by TREC or required by the parties should be used.(5)Unless expressly prohibited in writing by the parties, Seller may continue to show the

Property for sale and to receive, negotiate and accept back-up offers.(6) Any residential service contract that is purchased in connection with this transaction

should be reviewed for the scope of coverage, exclusions and limitations. The

purchase of a residential service contract is optional. Similar coverage may be

purchased from various companies authorized to do business in Texas.7. PROPERTY CONDITION:A. CONSTRUCTION DOCUMENTS: Seller shall complete all improvements with

due diligence in accordance with the plans and either specifications, finish-out schedules

or allowance initialed by the parties hereto, incorporated herein and identified as

__________________________________________ together with the following changes

or alternates:__________________________________ and any other change orders hereafter agreed to by the parties in writing (all called Construction Documents).B. COST ADJUSTMENTS: Increase in costs resulting from change orders or items

selected by Buyer which exceed the allowances specified in the Construction Documents

will be paid by Buyer as

follows:________________________________________________________________ ______________________________________________________________________. A decrease in costs resulting from change orders and unused allowances will reduce

Sales Price and loan amount accordingly.C. BUYER’S SELECTIONS: If the Construction Documents permit selections by

Buyer, Buyer’s selections will conform to Seller’s normal standards as set out in the

Construction Documents or will not, in Seller’s judgment, adversely affect the marketability of the Property. Buyer will make required selections within _______ days

after receipt of written notice from Seller.D. COMPLETION: If construction has not already commenced, it must commence on

or before __________________, 20____, or within ______ days after loan approval,

whichever is later. The improvements must be substantially completed in accordance

with the Construction Docents and ready for occupancy not later than _______________,

20_____ . The improvements be deemed to be substantially competed in accordance

with the Construction Documents the final inspection and approval by all applicable

governmental authorities and any lender. If delay of construction is caused by reason of

Buyer’s acts or omissions, provided Seller has exercised reasonable and continued

diligence, or by reason of acts of God, fire or other casualty loss, strikes, boycotts or non-

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 7 of 13 availability of materials for which no substitute of equal quality and price is available, the

time of such delays will be added to the time allowed for substantial completion of the

construction. However, in no event may the time for substantial completion extend

beyond the Closing Date. Seller may substitute materials, equipment and appliances of

equal quality for those specified in the Construction Documents.E. WARRANTIES: In connection with all improvements, fixtures and all other

property located on or made a part of the Property: (check one box only)( )(1) Seller makes not express warranties.( )(2) Seller makes the express warranties stated in Paragraph 11 or as attached.Seller agrees to assign to Buyer at closing all assignable manufacturer warranties.F. INSULATION: Insulation information required under Federal Trade Commission

Regulations is included in the attached TREC addendum or a disclosure form provided

by Seller.8.BROKERS' FEES: All obligations of the parties for payment of brokers’ fees are

contained in separate written agreements.9.CLOSING: The closing of the sale will be on or before ___________________,

20_______, or within 7 days after objections to matters disclosed in the Commitment or

by the survey have been cured, whichever date is later (the Closing Date). If financing or

assumption approval has been obtained pursuant to Paragraph 4, the Closing Date will

be extended up to 15 days if necessary to comply with lender's closing requirements (for

example, appraisal, survey, insurance policies, lender-required repairs, closing

documents). If either party fails to close this sale by the Closing Date, the non-defaulting

party will be entitled to exercise the remedies contained in Paragraph 15. At closing

Seller shall furnish tax statements or certificates showing no delinquent taxes and a

general warranty deed conveying good and indefeasible title showing no additional

exceptions to those permitted in Paragraph 6.10.POSSESSION: Seller shall deliver possession of the Property to Buyer on

_______________________ in its present or required repaired condition, ordinary wear and tear excepted. Any possession by Buyer prior to closing or by Seller after closing

which is not authorized by a temporary lease from promulgated by TREC or required by

the parties will establish a tenancy at sufferance relationship between the parties.

Consult your insurance agent prior to change of ownership or possession as insurance

coverage may be limited or terminated. The absence of a written lease or appropriate

insurance coverage may expose the parties to economic loss.11.SPECIAL PROVISIONS: (Insert only factual statements and business details

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 8 of 13 applicable to this sale. TREC rules prohibit licensees from adding factual statements or

business details for which a contract addendum, lease or other form has been

promulgated by TREC for mandatory use.)12. SETTLEMENT AND OTHER EXPENSES:A. The following expenses must be paid at or prior to closing:(1) Loan appraisal fees will be paid by _______________________________________.(2) The total of loan discount fees (including any Texas Veterans’ Housing Assistance

Program Participation Fee) may not exceed _____% of the loan of which Seller shall pay

___________________ and Buyer shall pay the remainder. The total of any buydown

fees may not exceed ________________ which will be paid by ___________________.(3) Seller's Expenses: (a) All Sales: Lender, FHA or VA completion requirements, releases of existing liens,

including prepayment penalties and recording fees; tax statements or certificates;

preparation of deed; one-half of escrow fee; those expenses Buyer is prohibited by FHA

or VA from paying; and other expenses stipulated to be paid by Seller under other

provisions of this contract.(b) VA Loan Sales: Those expenses stated in 3(a) above and other expenses VA

regulation prohibits Buyer from paying.(4) Buyer's Expenses: (a) All Sales: Expenses incident to any loan, including application, origination, and

commitment fees; interest on he notes from date of disbursement to one month prior to

date of first monthly payments; recording fees; endorsements required by lender; copies

of easements and restrictions; mortgagee title policy; loan-related inspection fees; credit

reports; all prepaid items, including required premiums for flood and hazard insurance,

reserve deposits for insurance, ad valorem taxes and special governmental assessments;

tax deleting; EPA endorsement; final compliance inspection; other expenses stipulated to

be paid by Buyer under other provisions of this contract.(b) Conventional Loan Sales: Expenses noted above and other loan-related expenses,

including PMI premiums, photos, amortization schedules, one-half of escrow fee,

preparation of loan documents, courier fee, repair inspections, underwriting fee, wire transfer, tax statements or certificates.(c) FHA Loan Sales: Expenses noted above and other loan-related expends, including

photos, amortization schedules, one-half of escrow fee, preparation of loan documents,

courier fee and repair inspections.B. The VA Loan Funding Fee for FHA Mortgage Insurance Premium (MIP) not to

exceed _________________ will be paid by Buyer, and ( ) paid in cash at closing (

) added to the amount of the loan or ( ) paid as

follows:__________________________

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 9 of 13 _________________________________________________________________.C. If any expense exceeds an amount expressly stated in this contract for such expense

to be paid by a party, that party may terminate this contract unless the other party agrees

to pay such excess. In no event will Buyer pay charges and fees expressly prohibited by

FHA, VA or other governmental loan program regulations.13.PRORATIONS AND ROLLBACK TAXES: 1. PRORATIONS: Taxes for the current year, maintenance fees,

assessments, dues and rents will be prorated through the Closing Date. If

taxes for the current year vary from the amount prorated at closing,

the parties shall adjust the prorations when tax statements for the

current year are available. If taxes are not paid at or prior to closing,

Buyer will be obligated to pay taxes for the current year.2.ROLLBACK TAXES: If this sale or Buyer’s use of the Property after closing

results in the assessment of additional taxes, penalties or interest (Assessments)

for periods prior to closing, the Assessments will be the obligation of Buyer. If

Seller’s change in sue of the Property prior to closing or denial of a special use

valuation on the Property claimed by Seller results in Assessments for periods

prior to closing, the Assessments will be the obligation of Seller. Obligations

imposed by this paragraph will survive closing.14.CASUALTY LOSS: If any part of the Property is damaged or destroyed by fire or other

casualty loss after the effective date of the contract, Seller shall restore the Property to its

previous condition as soon as reasonably possible, but in any event by the Closing Date. If Seller

fails to do so due to factors beyond Seller’s control, Buyer may either (a) terminate this contract

and the earnest money will be refunded to Buyer (b) extend the time for performance up to 15

days and the Closing Date will be extended as necessary or (c) accept the Property in its

damaged condition and accept an assignment of insurance proceeds. Seller’s obligations under

this paragraph are independent of any obligations of Seller under Paragraph 7.15.DEFAULT: If Buyer fails to comply with this contract, Buyer will be in default, and

Seller may either (a) enforce specific performance, seek such other relief as may be

provided by law, or both, or (b) terminate this contract and receive the earnest money as

liquidated damages, thereby releasing both parties from this contract. If, due to factors

beyond Seller’s control, Seller fails within the time allowed to make any non-casualty

repairs or deliver the Commitment, Buyer may either (a) extend the time for performance

up to 15 days and the Closing Date will be extended as necessary or (b) terminate this

contract as the sole remedy and receive the earnest money. If Seller fails to comply with

this contract for any other reason, Seller will be in default and Buyer may either (a)

enforce specific performance, seek such other relief as may be provided by law, or both,

or (b) terminate this contract and receive the earnest money, thereby releasing both

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 10 of 13 parties from this contract.16. DISPUTE RESOLUTION: It is the policy of the State of Texas to encourage the

peaceable resolution of disputes through alternative dispute resolution procedures. The

parties are encouraged to use an addendum approved by TREC to submit to mediation

disputes which cannot be resolved in good faith through informal discussion.17. ATTORNEY'S FEES: The prevailing party in any legal proceeding brought under or

with respect to the transaction described in this contract is entitled to recover from the

non-prevailing party all costs of such proceeding and reasonable attorney’s fees.18.ESCROW: The earnest money is deposited with escrow agent with the understanding

that escrow agent is not (a) a party to this contract and does not have any liability for the

performance or nonperformance of any party to this contract, (b) liable for interest on the earnest

money and (c) liable for any loss of earnest money caused by the failure of any financial

institution in which the earnest money has been deposited unless the financial institution is acting

as escrow agent. At closing, the earnest money must be applied first to any cash down payment,

then to Buyer's closing costs and any excess refunded to Buyer. If both parties make written

demand for the earnest money, escrow agent may require payment of unpaid expenses incurred

on behalf of the parties and a written release of liability of escrow agent from all parties. If one

party makes written demand for the earnest money, escrow agent shall give notice of the demand

by providing to the other party a copy of the demand. If escrow agent does not receive written

objection to the demand from the other party within 30 days after notice to the other party,

escrow agent may disburse the earnest money to the party making demand reduced by the

amount of unpaid expenses incurred on behalf of the party receiving the earnest money and

escrow agent may pay the same to the creditors. If escrow agent complies with the provisions of

this paragraph, each party hereby releases escrow agent from all adverse claims related to the

disbursal of the earnest money. Escrow agent's notice to the other party will be effective when

deposited in the U. S. Mail, postage prepaid, certified mail, return receipt requested, addressed to

the other party at such party's address shown below. Notice of objection to the demand will be

deemed effective upon receipt by escrow agent.19. REPRESENTATIONS: Seller represents that as of the Closing Date (a) there will be no

liens, assessments, or security interests against the Property which will not be satisfied

out of the sales proceeds unless securing payment of any loans assumed by Buyer and (b)

assumed loans will not be in default. If any representation in this contract is untrue on the

Closing Date, this contract may be terminated by Buyer and the earnest money will be

refunded to Buyer. All representations contained in this contract will survive closing.20.FEDERAL TAX REQUIREMENT: If Seller is a "foreign person", as defined by

applicable law, or if Seller fails to deliver an affidavit that Seller is not a "foreign

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 11 of 13 person", then Buyer shall withhold from the sales proceeds an amount sufficient to

comply with applicable tax law and deliver the same to the Internal Revenue Service

together with appropriate tax forms. IRS regulations require filing written reports if cash

in excess of specified amounts is received in the transaction.21.AGREEMENT OF PARTIES: This contract contains the entire agreement of the

parties and cannot be changed except by their written agreement. Addenda which are a

part of this contract are

(list):______________________________________________________

_______________________________________________________________________.22.CONSULT YOUR ATTORNEY: Real estate licensees cannot give legal advice. This

contract is intended to be legally binding. READ IT CAREFULLY. If you do not

understand the effect of this contract, consult your attorney BEFORE signing.Buyer’s Seller’sAttorney is:______________________________Attorney is:__________________________23.NOTICES: All notices from one party to the other must be in writing and are effective

when mailed to, hand-delivered at, or transmitted by facsimile machine as follows:To Buyer at: To Seller at:_______________________________________ _______________________________________________________________________________________________________________________________________________________________________________________Telephone ( )__________________________ Telephone ( )_______________________Facsimile ( )____________________________ Facsimile ( )________________________EXECUTED the ____ day of _________________, 20____ (THE EFFECTIVE DATE).

(BROKER: FILL IN THE DATE OF FINAL ACCEPTANCE.)_______________________________________ ____________________________________BuyerSeller

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 12 of 13 _______________________________________ ____________________________________BuyerSellerThe form of this contract has been approved by the Texas Real Estate Commission. Such

approval relates to this contract form only. No representation is made as to the legal validity or

adequacy of any provision in any specific transaction. It is not suitable for complex

transactions. Extensive riders or additions are not to be used. Texas Real Estate Commission,

P.O. Box 12188, Austin, TX 78711-2188, 1-800-250-8732 or (512) 459-6544

(http://www.trec.state.tx.us) TREC NO. 23-2. This form replaces TREC NO. 23-1. BROKER INFORMATION AND RATIFICATION OF FEE Listing Broker has agreed to pay Other Broker _________________________ of the total sales

price when Listing Broker’s fee is received. Escrow Agent is authorized and directed to pay

Other Broker from Listing Broker’s fee at closing._______________________________________ ____________________________________Other Broker License No. Listing Broker License No.represents ( ) Seller as Listing Broker’s subagent represents ( ) Seller and Buyer as an

intermediary ( ) Buyer only as Buyer’s agent ( ) Seller only as

Seller’s agent____________________________________Listing Associate Telephone__________________________________ ____________________________________Associate TelephoneSelling Associate Telephone__________________________________ ____________________________________Broker AddressBroker Address______________________________________________________________________Telephone FacsimileTelephone Facsimile RECEIPT Receipt of ( ) Contract and ( ) $_______________ Earnest Money in the form of

________________________ is acknowledged.

New Home (Incomplete Construction) Contract Concerning _________________________________________________________________________ (Address of Property)Initialed for identification by Buyer________and Seller________01A TREC NO. 23-2 Page 13 of 13 Escrow Agent:__________________________ Date: _______________________, 20____By:_________________________________________________________________________Telephone ( )________________________Address______________________________________Facsimile ( )_________________________City State Zip Code