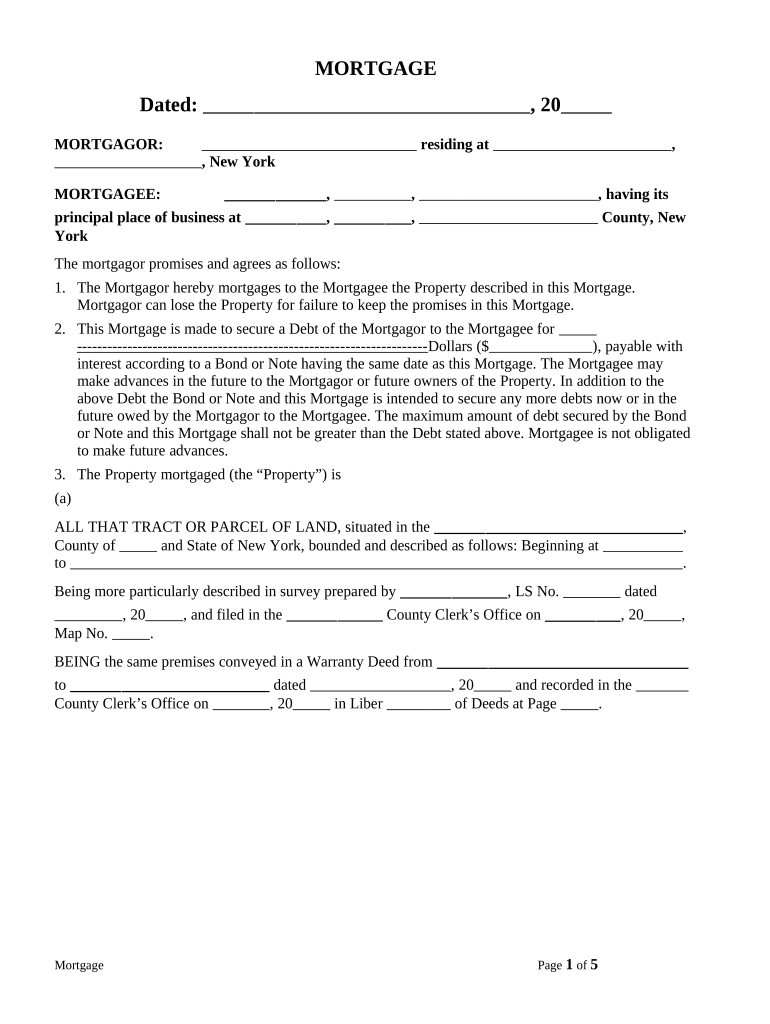

MORTGAGE

Dated: , 20

MORTGAGOR: residing at ,

, New York

MORTGAGEE: , , , having its

principal place of business at , , County, New

York

The mortgagor promises and agrees as follows:

1. The Mortgagor hereby mortgages to the Mortgagee the Property described in this Mortgage.

Mortgagor can lose the Property for failure to keep the promises in this Mortgage.

2. This Mortgage is made to secure a Debt of the Mortgagor to the Mortgagee for

--------------------------------------------------------------------- Dollars ($ ), payable with

interest according to a Bond or Note having the same date as this Mortgage. The Mortgagee may

make advances in the future to the Mortgagor or future owners of the Property. In addition to the

above Debt the Bond or Note and this Mortgage is intended to secure any more debts now or in the

future owed by the Mortgagor to the Mortgagee. The maximum amount of debt secured by the Bond

or Note and this Mortgage shall not be greater than the Debt stated above. Mortgagee is not obligated

to make future advances.

3. The Property mortgaged (the “Property”) is

(a)

ALL THAT TRACT OR PARCEL OF LAND, situated in the ,

County of and State of New York, bounded and described as follows: Beginning at

to .

Being more particularly described in survey prepared by , LS No. dated

, 20 , and filed in the County Clerk’s Office on , 20 ,

Map No. .

BEING the same premises conveyed in a Warranty Deed from

to dated , 20 and recorded in the

County Clerk’s Office on , 20 in Liber of Deeds at Page .

Mortgage Page 1 of 5

It is understood and agreed by and between the parties to this mortgage that in the event the mortgagor(s)

herein, , should sell or convey the premises herein described before

this mortgage debt is fully paid, then in such event, the entire indebtedness and accrued interest shall

become immediately due and payable at the option of the mortgagee. The mortgagors covenant and agree

that, upon any such sale by deed, contract or otherwise the mortgagee shall be promptly notified so that

its right of election may be exercised or not exercised.

(b) Together with the buildings and improvements on the Property.

(c) Together with all the Mortgagor’s right, title and interest in the streets next to the property to their

center lines.

(d) Together with all fixtures and personal property which now is or which later may be attached to or

used or useful in connection with the Property. This does not include household furniture.

(e) Together with all condemnation awards for any taking by a government or agency of the whole or

part of the real Property or any easement in connection with the Property. This includes awards for

changes of grade of streets.

4. Mortgagor will pay the Debt as promised in the Bond or Note according to its terms, if any payment

is overdue more than 15 days an additional charge will be due to Mortgagee to cover the cost of

delay. This late charge shall be

5. Mortgagor will keep the buildings on the Property insured against loss by fire and other risks included

in the standard form of extended coverage insurance. The amount shall be approved by Mortgagee but

shall not exceed full replacement value of the buildings. Mortgagor will assign and deliver the

policies to Mortgagee. The policies shall contain the standard New York Mortgage clause in the name

of Mortgagee. if Mortgagor fails to keep the buildings insured Mortgagee may obtain the insurance.

Within 30 days after notice and demand Mortgagor must insure the Property against war risk and any

other risk reasonably required by Mortgagee.

6. Mortgagor will keep the Property in reasonably good repair.

7. The Mortgagor may not, without the consent of Mortgagee, (a) alter, demolish or remove the

buildings and improvements on the Property, or (b) sell the Property or any part of it.

8. Mortgagor will pay all taxes, assessments, sewer rents or water rates within 30 days after they are

due . Mortgagor must show receipts for these payments within 10 days of Mortgagee’s demand for

them.

9. Mortgagor must pay all expenses of Mortgagee, including reasonable attorney’s fees, if (a) Mortgagee

is made a party in a suit relating to the Property, or (b) Mortgagee sues any one to protect or enforce

Mortgagee’s rights under this Mortgage.

10. Mortgagor authorizes Mortgagee to make payments necessary to correct a default of Mortgagor under

Paragraphs 5, 8 and 9 of this Mortgage. Payments made by Mortgagee together with interest at the

rate provided in the Bond or Note from the date paid until the date of repayment shall be added to the

Debt and secured by this Mortgage. Mortgagor shall make repayment with interest within 10 days

after demand.

11. Within five days after request in person or within ten days after request by mail, Mortgagor shall give

to Mortgagee a signed statement of the amount due on this Mortgage and whether there are any

offsets or defenses against the Debt.

Mortgage Page 2 of 5

12. Mortgagor warrants the title to the Property. Mortgagor is responsible for any costs or losses of the

Mortgagee if an interest in the Property is claimed by others.

13. Mortgagor shall comply with any law or governmental order or cure any legal violation concerning

the Property. Mortgagor shall comply within 90 days after the order or violation is issued or the law

takes effect.

14. Mortgagor will receive the advances secured by this Mortgage and will hold the right to receive the

advances as a trust fund. The advances will be applied first for the purpose of paying the cost of

improvement. Mortgagor will apply the advances first to the payment of the cost of improvement

before using any part of the total of the advances for any other purpose.

15. Mortgagee and any person authorized by the Mortgagee may enter and inspect the property at

reasonable times.

16. Mortgagor authorizes Mortgagee to file without Mortgagor’s signature one or more financing

statements as permitted by law to perfect the security interest of this Mortgage.

17. Mortgagee may declare the full amount of the Debt to be due and payable immediately for any

default. The following are defaults:

(a) Mortgagor fails to make any payment required by the Bond or Note or Mortgage within 15 days

of the date it is due;

(b) Mortgagor fails to keep any other promise or agreement in this Mortgage within the time stated,

or if no time is stated, within a reasonable time after notice is given that Mortgagor is in Default;

(c) On application of Mortgagee, two or more insurance companies licensed to do business in New

York State refuse to issue policies insuring the buildings and improvements on the Property.

18. If mortgagor defaults under this Mortgage and the Property is to be sold at a foreclosure sale, the

Property may be sold in one parcel.

19. If Mortgagee sues to foreclose the Mortgage, Mortgagee shall have the right to have a receiver

appointed to take control of the Property.

20. If there is a Default under this Mortgage, Mortgagor must pay monthly in advance to Mortgagee, or to

a receiver who may be appointed to take control of the Property, the fair rental for the use and

occupancy of the part of the Property that is in the possession of the Mortgagor. If Mortgagor does

not pay the rent when due, Mortgagor will vacate and surrender the Property to Mortgagee or to the

receiver. Mortgagee may evict the Mortgagor by summary proceedings or other court proceedings.

21. Mortgagee shall have the rights set forth in Section 254 of the New York Real Property Law in

addition to Mortgagee’s rights set forth in this Mortgage, even if the rights are different from each

other.

22. Delay or failure of Mortgagee to take any action will not prevent Mortgagee from taking action later.

Mortgagee may enforce those rights Mortgagee chooses without giving up any other rights.

23. Notices, demands or requests may be in writing and may be delivered in person or sent by mail.

24. This Mortgage may not be changed or ended orally.

25. 1f there are more than one Mortgagor each shall be separately liable. The words “Mortgagor” and

“Mortgagee” shall include their heirs, executors, administrators, successors and assigns. If there are

more than one Mortgagor or Mortgagee the words “Mortgagor” and “Mortgagee” used in this

Mortgage includes them.

Mortgage Page 3 of 5

26. That in the event the premises covered by this Mortgage are sold without the written consent of the

Mortgagee, or should the Mortgagors make a voluntary assignment for the benefit of creditors, the

whole amount of principal and interest hereby secured shall become immediately due and payable at

the option of the Mortgagee.

27. In the event of a foreclosure the Mortgagee will be entitled to recover reasonable attorneys’ fees.

The Mortgagor states that the Mortgagor has read this Mortgage, received a completely filled in copy of it

and has signed this Mortgage as of the date at the top of the first page.

MORTGAGOR

WITNESS _________________________________________

_______________

_________________________________________

_______________

CERTIFICATE OF ACKNOWLEDGMENT

Individual Capacity within the State of New York for Real Property

State of New York )

) ss.:

County of )

On the day of in the year before me, the undersigned,

personally appeared , personally known to me or proved to me on the basis

of satisfactory evidence to be the individual whose name is subscribed to the within instrument and acknowledged to me

that he executed the same in his capacity , and that by

his signature on the instrument, the individual , or the person upon behalf of which the individual acted, executed the

instrument.

Signature and Office of Person Taking Acknowledgement

Type/Print Name:

Individual Capacity Outside the State of New York for Real Property

Mortgage Page 4 of 5

State of ____________ )

) ss.:

County of )

On the day of in the year before me, the undersigned,

personally appeared , personally known to me or proved to me on the basis

of satisfactory evidence to be the individual whose name is subscribed to the within instrument and acknowledged to me

that he executed the same in his capacity , and that by

his signature on the instrument, the individual , or the person upon behalf of which the individual acted, executed the

instrument and that such individual made such appearance before the undersigned in the (insert the city or other

political subdivision and the State or country or other place the acknowledgment was taken).

Signature and Office of Person Taking Acknowledgement

Type/Print Name:

PLEASE RECORD AND RETURN TO:

Mortgage Page 5 of 5

Useful Advice on Finishing Your ‘Ny Mortgage Form’ Digitally

Are you fed up with the complications of handling paperwork? Your search ends here with airSlate SignNow, the top eSignature platform for individuals and businesses. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and validate paperwork online. Leverage the extensive features integrated into this user-friendly and cost-effective platform and transform your method of document handling. Whether you require to validate forms or gather signatures, airSlate SignNow manages it all seamlessly, with merely a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a no-cost trial with our service.

- Hit +Create to upload a file from your device, cloud storage, or our form repository.

- View your ‘Ny Mortgage Form’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for other participants (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Store, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your Ny Mortgage Form or send it for notarization—our solution provides everything you require to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to greater levels!