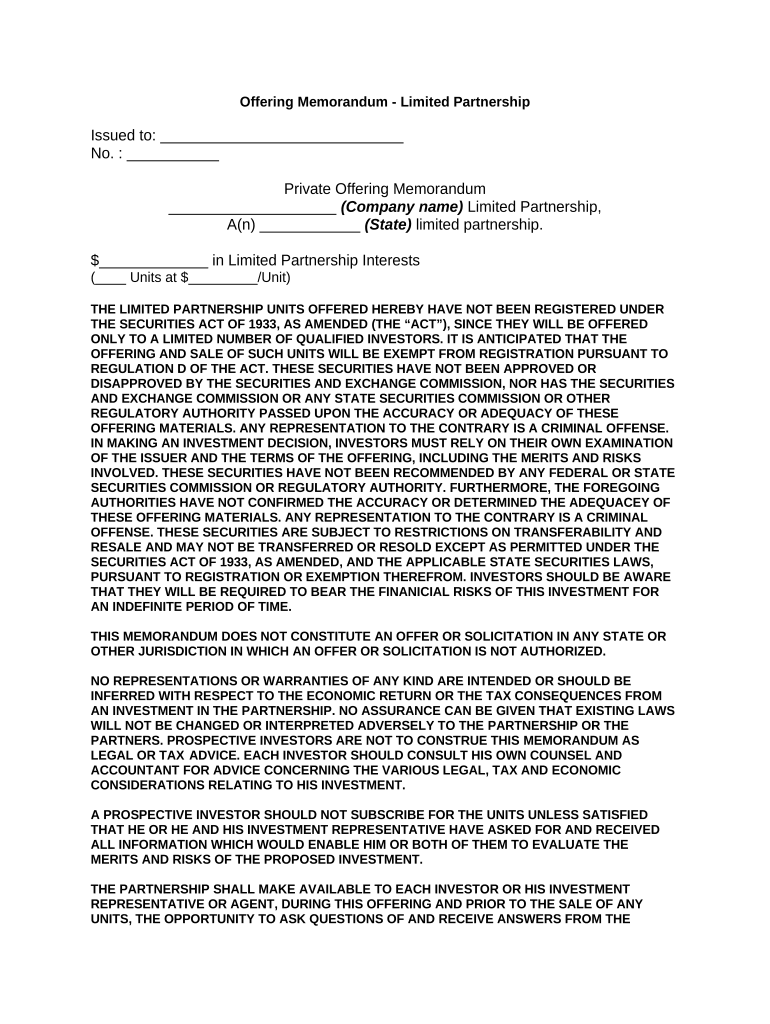

Offering Memorandum - Limited Partnership

Issued to: _____________________________

No. : ___________

Private Offering Memorandum

____________________ (Company name) Limited Partnership,

A(n) ____________ (State) limited partnership.

$_____________ in Limited Partnership Interests

(____ Units at $_________/Unit)

THE LIMITED PARTNERSHIP UNITS OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER

THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), SINCE THEY WILL BE OFFERED

ONLY TO A LIMITED NUMBER OF QUALIFIED INVESTORS. IT IS ANTICIPATED THAT THE

OFFERING AND SALE OF SUCH UNITS WILL BE EXEMPT FROM REGISTRATION PURSUANT TO

REGULATION D OF THE ACT. THESE SECURITIES HAVE NOT BEEN APPROVED OR

DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES

AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION OR OTHER

REGULATORY AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY OF THESE

OFFERING MATERIALS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION

OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS

INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE

SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING

AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACEY OF

THESE OFFERING MATERIALS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND

RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE

SECURITIES ACT OF 1933, AS AMENDED, AND THE APPLICABLE STATE SECURITIES LAWS,

PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE

THAT THEY WILL BE REQUIRED TO BEAR THE FINANICIAL RISKS OF THIS INVESTMENT FOR

AN INDEFINITE PERIOD OF TIME.

THIS MEMORANDUM DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY STATE OR

OTHER JURISDICTION IN WHICH AN OFFER OR SOLICITATION IS NOT AUTHORIZED.

NO REPRESENTATIONS OR WARRANTIES OF ANY KIND ARE INTENDED OR SHOULD BE

INFERRED WITH RESPECT TO THE ECONOMIC RETURN OR THE TAX CONSEQUENCES FROM

AN INVESTMENT IN THE PARTNERSHIP . NO ASSURANCE CAN BE GIVEN THAT EXISTING LAWS

WILL NOT BE CHANGED OR INTERPRETED ADVERSELY TO THE PARTNERSHIP OR THE

PARTNERS. PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THIS MEMORANDUM AS

LEGAL OR TAX ADVICE. EACH INVESTOR SHOULD CONSULT HIS OWN COUNSEL AND

ACCOUNTANT FOR ADVICE CONCERNING THE VARIOUS LEGAL, TAX AND ECONOMIC

CONSIDERATIONS RELATING TO HIS INVESTMENT.

A PROSPECTIVE INVESTOR SHOULD NOT SUBSCRIBE FOR THE UNITS UNLESS SATISFIED

THAT HE OR HE AND HIS INVESTMENT REPRESENTATIVE HAVE ASKED FOR AND RECEIVED

ALL INFORMATION WHICH WOULD ENABLE HIM OR BOTH OF THEM TO EVALUATE THE

MERITS AND RISKS OF THE PROPOSED INVESTMENT.

THE PARTNERSHIP SHALL MAKE AVAILABLE TO EACH INVESTOR OR HIS INVESTMENT

REPRESENTATIVE OR AGENT, DURING THIS OFFERING AND PRIOR TO THE SALE OF ANY

UNITS, THE OPPORTUNITY TO ASK QUESTIONS OF AND RECEIVE ANSWERS FROM THE

GENERAL PARTNER OR ITS REPRESENTATIVES CONCERNING ANY ASPECT OF THE

PARTNERSHIP AND ITS PROPOSED BUSINESS AND TO OBTAIN ANY ADDITIONAL RELATED

INFORMATION TO THE EXTENT THE PARTNERSHIP POSSESSES SUCH INFORMATION OR CAN

ACQUIRE IT WITHOUT UNREASONABLE EFFORT OR EXPENSE.

Table of Contents Page

I. Investment Summary _____

II. Investment Objectives _____

A. General _____

B. Investment Benefits _____

C. Pricing, Adjusters and Conditions of Payment _____

D. Tax Shelter Registration _____

E. _____________ Limited Partnership Investment Benefits _____

III. The Partnership, the General Partner, and the Development

Team _____

A. Structure of the Partnership and the General Partner

B. Sponsor: The _____ Community Development Corporation _____

C. Architect _____

D. Contractor _____

E. Development and Syndication Consultant,

Management Agent _____

F. Other Associated Professionals _____

IV. The Property _____

A. Background and Property Description _____

B. Development Plan _____

C. Municipal and Neighborhood Description _____

D. Site Location Map and Architectural Renderings _____

V. Financing, Government Subsidies, and Reserves _____

A. Sources and Uses of Development Funds _____

1. First Mortgage Loan _____

2. Sponsor Loan _____

3. Acquisition Loan _____

4. Limited Partner Capital Contributions _____

B. Sources and Uses of Operating Funds _____

1. Rents _____

2. Sponsor Operating Subsidy _____

3. Operating Subsidy _____

4. Replacement Reserves _____

C. Bridge Financing _____

D. Development Fee Loan _____

E. Project Reserves _____

VI. Summary of the Partnership Agreement _____

A. Partnership Allocations _____

B. Rights and Duties of the General Partner _____

C. Rights and Duties of the Limited Partners _____

D. Transfer of Limited Partnership Interests _____

E. Reports, Accounting, and Elections _____

VII. Risks of Investment _____

A. Tax Risks _____

B. Regulatory Risks _____

C. Financial Forecasts _____

D. Construction Risks _____

E. Operating Risks _____

F. Conflicts of Interest _____

G. Other Partnership Matters _____

VIII. Corporate Financial and Investment Considerations _____

A. Investment Suitability/Accredited Investors _____

B. Special Considerations for Corporate Investors _____

IX. Tax Opinion _____

X. Further Information _____

Appendix A: Financial Forecasts, Summary of Significant Forecast Assumptions

and Accounting Policies. (Separately Bound)

Appendix B: Subscription Documents. (Separately Bound)

I. Investment Summary

In an effort to motivate the private sector to invest in the creation and rehabilitation of

affordable housing, Congress has created important tax credit incentives for certain types of

investments. Originally established as part of the Tax Reform Act of 1986, low income housing

tax credits represent an attractive way for corporations and other institutional investors to obtain

significant after tax returns, while assisting in solving a pressing domestic priority -- affordable

housing.

_________________ (Company name) Limited Partnership (the "Partnership") is a(n)

__________ (state) limited partnership which has been formed to acquire, develop, own, and

operate the residential facilities known as ________________ (Project name) (the "Project")

located in the ______________ (name) community of _________ (city) , _________________

(state) . The development of this project will result in ____ (number) rental units enclosing an

open courtyard at ______________ Company) . There will be ____ (number) one bedroom

units, ____ (number) two bedroom units, ___ (number) three bedroom units and ___

(number) four bedroom units. ________ (Word number) (68%) of these units will be affordable

to low income families, and will qualify for the low income housing tax credit. The Project is

sponsored by the ______________________ (Corporations (the "_______ (initials) " or the

"Sponsor"), a tax-exempt nonprofit community development corporation serving _________

(city) 's _____________ (name/area) Area. It is the only membership-based agency organized

as a community development corporation serving the Greater ____________________

(name/area) Community.

Various private and governmental agencies will provide construction and

permanent financing to the project.

The total proposed equity investment in the Partnership (the "Investment") totals

$_____________, consisting of _____ (number) units ("Units") of $___________ each, to be

contributed in three installments from ______ (year) through _______ (year) . No units will be

sold unless subscriptions are received and approved for all of the five units. The general partner

may accept subscriptions for multiple or fractional units and may withdraw this offering at any

time.

The benefits of the Investment to corporate investors (referred to as "Investors,"

"Partners," or "Limited Partners") include approximately $____________ ($_________ per Unit)

in low- income housing tax credits available over a ten year period, and annual loss deductions

throughout the life of the Investment. These losses, valued using a 34% maximum Federal

corporate tax rate, constitute approximately $_________ million ($___________ per Unit) in net

tax savings over an approximate ____ (number) -year projected holding period. In addition,

some Investors may be entitled to savings on state and local taxes, but these are not taken into

account in the Financial Forecasts. No cash flow to the Investors is anticipated over the life of

the Investment. As more fully described below, the Investment is expected to have an internal

rate of return of approximately 15% on an after tax basis.

Residual values are not expected to be a benefit of the investment to the Limited

Partners. The taxes due on sale of the Project at the end of the investment period are estimated

assuming a projected sale at the minimum price allowable under Section 42 of the Code. The

rental restrictions inherent in the Project financing rule out an unrestricted market sale. The

forecasts estimate that the Limited Partners would have a projected net tax cost of

approximately $___________ ($__________ per unit) from the sale. However, when offset by

the dollar value of all the forecasted benefits achieved over the life of the investment, the

Limited Partners would have achieved aggregate net benefits of $_________ ($__________ per

unit). In this case, the Limited Partners would achieve an overall sale plus holding period ratio of

benefits to capital contributed of 1.21 to 1 when both capital and benefits are discounted at

10%, and a net, after- tax internal rate of return of 15%.

These investment materials do not constitute legal or tax advice, and the results for each

Investor will depend on its own tax situation. Each Investor is urged to consult its own legal and

tax advisors regarding the benefits of the Investment.

The Investment involves certain risks, which should be carefully considered

by each Investor (see "Risks of Investment").

THE INVESTMENT IS STRUCTURED TO PROVIDE TAX BENEFITS TO CORPORATE

INVESTORS, AND ONLY ACCREDITED CORPORATIONS MAY INVEST . ACCREDITED

CORPORATIONS INCLUDE BANKS, SAVINGS AND LOAN ASSOCIATIONS, INSURANCE

COMPANIES, AND ANY CORPORATION WITH TOTAL ASSETS IN EXCESS OF $5,000,000. THIS

INVESTMENT IS NOT APPROPRIATE FOR CORPORATIONS VHICH HAVE MADE "S" ELECTIONS

OR ARE PERSONAL SERVICE CORPORATIONS OR FOR MOST CLOSELY HELD "C

CORPORATIONS.

The proposed investment is structured for "C corporations” which are not closely held

(i.e., for which 50% or more of the stock is not held by 5 or fewer stockholders). Although

closely-held "C corporations" may use passive credits and losses against both active and

passive income, they may be subject to "at risk" rules that could limit the use of such tax

benefits and, in any event, they will not be able to use passive losses to offset portfolio income.

Subchapter S and "personal service corporations" are also restricted in their use of certain

of the benefits available, and should not invest unless they expect to have substantial net

passive income over an extended period of time.

II. Investment Objectives

A. General

This Investment is structured to provide expected tax benefits in return for capital

investments of qualified corporate investors. Under the Tax Reform Act of 1986, certain

corporations will achieve the maximum potential benefit available from such investments in

affordable housing. ALL PROSPECTIVE INVESTORS SHOULD CONSULT THEIR TAX ADVISORS

ON THE SUITABILITY OF THIS INVESTMENT.

B. Pre-elected Investment Benefits

The Investment offers several types of benefits, each of which is described briefly below.

Further information concerning the amount and timing of these benefits is available in Appendix

A, Financial Forecasts and Summary of Significant Forecast Assumptions and Accounting

Policies (the "Financial Forecasts" or the "Forecasts").

C. Low - income housing tax credits ("Credits"), created by the Tax Reform Act of 1986

(the "Act"), are the primary benefit of the Investment. Credits are subject to the limitation on

general business credits which allows a corporation to claim credit equal to the excess of its

tax liability over the greater of (i) its "tentative minimum tax" or (ii) 25% of the excess of its

regular tax liability over $25,000. Credits are a direct dollar for dollar reduction of taxes due,

and as such, may increase the cash flow of a company but may not be used to reduce the

Alternative Minimum Tax obligation. Any currently unused Credits may be carried forward for up

to fifteen years and back three years.

Affordable housing developments may be eligible for Credits if 20% or more of the

apartments are "rent restricted" and occupied by tenants whose income is equal to or less than

50% of the area median income, or if 40% or more of the apartments are "rent restricted" and

occupied by tenants earning 60% or less of the median income. Credits may be claimed on

more than 20% (or 40%) of the units to the extent additional units are used to house low income

families, but the initial proportion of low- income units must be sustained over a 15 year

compliance period to avoid recapture

The Credit is determined by multiplying Eligible Basis (ordinarily the same as the

adjusted basis used for purposes of depreciation) by the lower of the percentage of total

apartment units or the percentage of total apartment floor space which meet the requirements of

low income status as statutorily defined. This percentage is determined annually. The

resulting Qualified Basis is multiplied by the Credit Percentage to determine the Credit amount.

The Credit Percentage is computed so chat the present value of the total Credits taken with

respect to the Qualified Basis of a building over the ten-year Credit period will equal 70% (In the

case of certain new construction and rehabilitation expenditures) or 30% (in the case of

acquisition costs and other Federally subsidized costs) of such Qualified Basis. Present value

calculations use a discount rate based upon 72% of the average of the Federal mid- term and

long-term rates for the month in which the project is placed in service. However, a taxpayer can

irrevocably elect to determine the Credit Percentage at the level of the Federal rates published

for the month in which the Credit allocation is received for the project, in advance of the

building's placed in service date. The Credit is then available each year during a 10-year

period commencing with the taxable year in which the project is placed in service or the

subsequent taxable year, at the owner's election. The Code provides that Eligible Basis may be

multiplied by up to 130% if a project is located in a "qualified census tract", defined as any

census tract in which at least 50% of households have an income less than 60% of the area

median gross income, subject to certain limitations, or in a "difficult development area", defined

as any area designated by the Secretary of the U.S. Department of Housing and Urban

Development as an area which has high construction, land, and utility costs relative to the area

median income. The Project is located in a "difficult development area," and accordingly.

Eligible Basis for the rehabilitation has been multiplied by 130%.

The Project is expected to qualify for the 70% present value Credit for rehabilitation

expenditures financed by taxable debt. The Forecasts assume that the interest rates applicable

to determine the Credit Percentages will result in a rate equal to approximately 9.0%, which is

subject to change until the month in which the units are placed in service. As of June 1992,

the rate for the 70% present value Credit was equal to 8.76%.

The Partnership has entered into a Carryover Allocation Agreement with the

__________________________ (Organization) and has been allocated Credits totaling

$___________ based on the assumption that ____ (number) of the ____ (number) units (68%)

will be tax credit eligible. The Forecasts project that $_________ of Low Income Housing Tax

Credits are to be distributed annually over a ten year period.

Tax losses are a deduction from all forms of income for most corporations, although

closely-held C corporations may not utilize them to offset portfolio income. The tax savings

available from tax losses depend on the corporation's Federal income tax bracket. For example,

a corporation in the 34% Federal tax bracket having $100,000 of tax losses would achieve

$34,000 in tax savings from such losses. This Investment assumes a 34% maximum Federal

tax bracket in all years of the Forecast period. The benefits of these tax losses would be

partially offset by any taxable income and associated tax liability anticipated upon a sale of the

Project. Tax losses are generated In this Investment primarily through depreciation of the costs

of the Project, amortization of certain expenditures, and accrued interest deductions. Additional

state tax savings may also be available, although they are not incorporated into the Forecasts.

Cash flow is not anticipated to be a benefit of the Investment. Any excess operating

income will be utilized for maintenance and operating reserve accounts for the future benefit of

the Project.

Residual values which would be available to Investors are significantly limited by

various restrictions imposed by the Sponsor (or an affiliate) and the government agencies which

have subsidized the Project. In the case of this Investment, the Sponsor will have an option to

purchase the Project for the outstanding debt on the Project or the defined minimum option

price as allowed under Section 42(i)(7) of the Internal Revenue Code. There is, however, no

assurance that this option will be exercised. Residual values are therefore not expected to be a

benefit of the Investment.

The taxes due on sale of the project at the end of the investment period are estimated

assuming a projected sale at the minimum price allowable under Section 42 of the Code, which

for simplicity is assumed to be equivalent to the sum of the outstanding debt on the Project plus

$1.00.

D. Pricing, Adjusters and Conditions of Payment Pricing

Pricing: The Investment is priced with the objective of achieving an internal rate of

return ("IRR") of 15% on invested capital on an after tax basis. Assuming that the Investment

performs in accordance with the Forecasts, this objective is met based upon the benefits

currently projected for the approximately 17-year investment period.

Adjusters: In the event that, as of the third capital contribution installment date (when

the qualified units are placed in service), the then-projected IRR is more than 10% above or

below the 15% IRR originally projected in the Forecasts the amount of the third capital

contribution installment shall be increased or decreased, as the case may be, in order

for the Investment to achieve a 15% IRR. If a decrease to the capital contributions is required by

the adjuster, and such decrease exceeds the amount of the third capital contribution installment,

the excess adjustment will be made out of proceeds of sale or refinancing.

Conditions of Payment: The first payment of Limited Partner capital will be made upon

admission to the Partnership, which is to occur after commitment of permanent financing, and

upon closing on the construction financing. The second payment will be made within 10 days of

receipt of the architect's certification in writing that the Project construction is 80% complete.

The third payment will be made on the later of: when 80% of the apartment units in the Project

have received a Certificate of Occupancy (C. of O.), or when stabilized occupancy has been

reached for a period of three months, or ____________, 2____ (date) .

Each Limited Partner's obligation to make future installments of ____% capital

contribution will be evidenced by an Investor promissory note and may be secured by a security

agreement pledging the Limited Partner’s Interest in the Partnership. The Limited Partner's

promissory notes and security agreements may be assigned to a bridge lender who will provide

interim financing for the Project.

E. Tax Shelter Registration

As required by the Internal Revenue Service, the Partnership is filing tax shelter

registration statement with the Internal Revenue Service and the Service will issue a tax

shelter registration number to the Partnership. Issuance of the registration number does

not indicate that the Investment or the claimed tax benefits have been reviewed,

examined or approved by the Internal Revenue Service. Each limited partner will be

furnished the tax shelter registration number by the Partnership and will be required to

include that number with its tax return.

F. __________________ Limited Partnership Investment Benefits

Investors in ________________- Limited Partnership are projected to earn the

following financial benefits while assisting in solving the pressing need for affordable

housing. Investors will receive 99% of the Partnership's tax benefits and 99% of any

distributable cash flow. No distributable cash flow is expected.

Total tax benefits currently expected to be distributed to limited partners in return for

capital contributions of $__________ are as follows:

$__________ ($_____ per dollar invested) of Low Income Housing Tax Credits are

projected to be distributed over a ten year period. Investors can apply these Tax Credits

as a dollar-for-dollar reduction against federal income taxes otherwise due. Tax Credits

may be carried backward for up to three years and carried forward for up to fifteen years

to offset tax liability.

$___________ ($_______ per dollar invested) of annual loss deductions are projected

to be distributed over a sixteen year period. Investors can apply these annual loss

deductions to reduce taxable income. Assuming investors have a federal income tax rate

of 34%, investors will reduce their tax liability by 34% of the annual loss deductions

received, or $__________. Investors able to reduce state tax liability with these loss

deductions will receive even more benefits. Annual loss deductions can also be carried

backward for up to three years and carried forward for up to fifteen years.

Tax savings from annual loss deductions will be partially offset by capital gains taxes

estimated at $_________ which will be payable by Investors at the end of the investment period

if the Sponsor exercises its option to purchase the Property from the Partnership for a price

equal to a minimum option price as allowed by the Internal Revenue Code. Tax savings from

annual loss deductions, net of capital gains tax, equals $___________.

Total projected financial benefits are as follows:

$ ________ Total tax credits over ten years

+ _________ Additional tax savings from annual loss deductions during sixteen years

___________ net of potential capital gains tax payable at end of sixteen years

$ ________ Net Federal tax savings projected

These projected benefits, offered in return for $_________ of Investors' capital

contributions, are expected to earn Investors an after- tax internal rate of return of 15%. The

timing of capital contributions and receipt of tax benefits is a critical factor in calculating the

internal rate of return or net present value of this investment.

Non-financial benefits of this investment include community goodwill, assistance in

providing construction jobs in the local economy, and assistance in furthering a high domestic

priority: the provision of high quality affordable housing. Investors who are banks can help meet

community reinvestment objectives with this Investment.

Investing in _________________ Limited Partnership offers Investors one of the few

opportunities available to earn a significant potential financial return while promoting an

important social good. Also see Section VII. Risks of Investment , and Section VIII, Corporate

Financial and Investment Considerations below.

THESE PROJECTED BENEFITS OF INVESTMENT ARE NOT GUARANTEED BY THE

SPONSOR OR GENERAL PARTNER, AND ARE SUBJECT TO CIRCUMSTANCES THAT MAY BE

BEYOND THEIR CONTROL.

III. The Partnership, the General Partner, and Development Team

A. Structure of the Partnership and the General Partner

The Project will be owned by a limited partnership with a single corporate general

partner, _______________ (General Partner name) Corporation (the "General Partner"), a(n)

____________ (state) business corporation, the common stock of which is owned by the

Sponsor. The Sponsor anticipates that it will sell a minority stock interest (21%) in the General

Partner to a non-profit corporation not affiliated with the Sponsor.

The General Partner of the Partnership will be allocated 1% of the profits, losses, tax

credits, and cash flow from the Property, and 50% of the gains, losses, and proceeds from any

sale or refinancing (after certain other priorities), with 99% of profits, losses, tax credits and

cash flow and 50% of residual proceeds allocated to the Investors. A full statement of

allocations is set forth in the First Amended and Restated Agreement and Certificate of Limited

Partnership of the Partnership (the "Partnership Agreement")

B. Sponsor: The _________________________________ (Sponsor name/Corporation)

The Sponsor of the Project is the __________________________ (Sponsor name) of

____________ (city) , _____________ (state) . _______________ (Company initials or

acronym) is a non-profit, 501(c)(3), community development corporation, organized in _______

(year) to serve ___________________ (city/area) . The development of affordable housing has

been the organization's main in order to alleviate acute and persisting problems of housing

shortages and overcrowding. ______________ (Sponsor) has viewed its role as the catalyst for

overall housing and economic development in _______________ (area/community) and as a

planning and development vehicle to address unmet local needs. _______________ (Sponsor)

is a membership-based organization, with strong roots in and supported by the community at

large.

__________________ (Sponsor) 's twenty member Board of Directors consists of

individuals with strong and varied records of professional success and community

achievements. A majority of board members were born and raised in _______________ (area) .

Their professional roles include: __________________________________________________

____________________________________________________________________________

____________________________________________________________________________.

In addition to their professional roles, all have long histories of active leadership in local

community development social services and community advocacy. _______________

(Sponsor) 's Board members have held key roles in ___________________________________

____________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________.

_______________ (Sponsor) 's Executive Director and Assistant Director devote their

housing expertise and community-based experience to the development of ________________

Company name) . _______________ (Company initials or acronym) 's Executive Director has

helped shape local housing policy through her tenure as the former Executive Director of the

___________________________; as an active leader in the conception and implementation of

the first city-approved ____________________ Plan and as a former member and co-chair of

the ______________________ Neighborhood Council. She was also the recipient of the

__________ (City) Fair Housing Commission's Community Service Award. The Assistant

Director for the ________________ (name) Community Development Corporation has provided

consultation to CDCs and public agencies on economic development during her tenure at Policy

and Management Associates. She has also analyzed and recommended housing policies for

the Citizens' Housing and Planning Association and the Urban Institute. She/He is the recipient

of national awards from the American Planning Association and the Urban Land Institute for her

research in the field of affordable housing development.

The combined vision and expertise of ____________ (Sponsor) 's Board members and

staff provides a strong foundation for successful housing development. ____________ (Project

name) as an organizational whole reflects a diverse collection of individuals who have extensive

knowledge and expertise in community development and the various stages of the development

process. For a complete list of professional credentials, ___________ (Company initials or

acronym) 's List of Directors is available upon request.

C. Architect

__________________, Inc. of ___________ (city) and _______________, Inc., of

____________ (city) , ________________ (state) are providing architectural services to the

Partnership. ________________ (name) has over ________ (number) years of experience in

design and planning. Her/His prior achievements include residential, commercial and

institutional projects. While at _________________ Associates, Mr./Mrs. _____________ was

responsible for a number of large, multi-unit housing developments throughout _____________

(area/region) , including family housing, elderly housing, and special needs housing. She/He

also designed ______________________________________________________. As a senior

partner at __________________ (Organization) , Mr./Mrs. ___________ participated in projects

involving _________________________________. At that time she/he was project architect for

___________________ in ____________, ____________ (city, state) , a library addition and

renovation for a college in ____________ (state) , and a waterfront redevelopment plan for

_________________, _____________ (city, state) . _____________________ (Organization)

is also currently involved in the design of several single family residences in addition to

designing __________________ (Project name) .

In addition to his professional practice, Mr./Mrs. ___________ has taught architectural

design and is active in _____________ (city) 's community and civic organizations. She/He has

served as advisor to _______________ (city, area) and ____________ (name) neighborhoods

in land use planning and housing policy matters, and as a panelist concerning various urban

design issues.

________________ (name) Associates is the consulting architect for the ____________

(Company) project. Mr./Mrs. ______________’s credits include responsibility for the design and

construction of many multi- family developments in the _________ (region) United States, as

well as _________) (number) residential units which were part of ____________ (city) 's

___________________ (name/area) .

D. Contractor

The Partnership will be seeking bids from a pre-selected list of experienced and qualified

contractors in the coming months. A contractor is expected to be selected by __________

(month __________ (year) .

E. Development and Syndication Consultant, Management Agent

_____________________, Inc. (" (initials) ") is the development and syndication

consultant to the Partnership and will enter into a contract to manage the Property. TCB is a

nonprofit corporation formed under Chapter 180 of the _______________ (state) General

Laws, and is tax-exempt under Section 501(c)(3) of the Internal Revenue Code of 1986. Since

its founding in 1964, ____________ (Consultant) has both developed and assisted community

based organizations in the creation of more than ________ (number) units of affordable

housing. _____________ (Consultant) currently manages approximately __________

(number) units of nonprofit sponsored housing in _____ (number) developments throughout

____________ (city/area) . ___________ (Consultant) 's economic development division has

assisted neighborhood-based developers in the creation of ______________ square feet of light

industrial, R & D, retail and office space. In addition, _______________ (Consultant) has

assisted in the design and implementation of a number of housing program initiatives.

Originally based in ___________ (city) , _______ (Consultant) now works throughout

the ____________ (region) , and has offices in _____________ (city) and _____________

(city) , _____________ (state) , _________ (city) , _____________ (state) , ___________ (city) ,

____________ (state) , and __________ (city) , _____________ (state) .

Since _________ (year) , _______________ (Consultant) has also organized ______

(number) limited partnerships to which investors have contributed over $_____ million, and

which have total debt and equity financing of over $_____ million. In exchange, the investors

have received the rights to share in the tax and other benefits generated by housing

developments sponsored by _____________ (Consultant) and by the corporation's nonprofit

clients.

_________________ (Consultant) 's development staff has specialized expertise in debt

and equity finance, construction, law, and economic development. ________________ (name)

its Executive Director since _________ (year) , has been with _______ (Company initials or

acronym) since receiving her/his degree from _______________ (college) in _______ (year) .

Mr./Mrs. _______________ formerly served as chairman of the _______________________

Committee of the _____________ (state) Housing Finance Agency, and now serves as a

director of the _______________________, Inc., as a member of the ___________________ _

Council, and as a member of the ______________________________ (Organization) at

_______________ (state) ___________________ (Organization or Institute) .

__________________ (Consultant) provides consultation to _______________ (Sponsor) for

the overall planning, structuring, financial packaging and management of the development

program.

F. Other Associated Professionals

1. The law firm of ___________________ of ____________, ___________ (city,

state) is counsel to the Partnership. In this capacity, the firm will provide legal advice on

real estate and related matters to the Partnership related to the development and

financing of Project.

2. Tax Counsel: The law firm of __________________ of ____________,

___________ (city, state) is tax counsel to the Partnership. The firm will provide legal

advice on tax and related matters to the Partnership in connection with the development

and financing of the Project, the admission of Investors, and will render a tax opinion to

the Partnership. In addition, the firm will assist in the preparation and review of the

Partnership Agreement and related documentation.

These attorneys will not represent the Investors, who should consult their own attorneys

and financial advisors concerning the Investment.

IV. The Property

A. Background and Property Description

______________ (Sponsor) is currently developing _______________ (Project name)

(the "Project"), located in the heart of the residential district of the _______________

(area/community) of __________, ___________ (city, state) . _______________ (Project)

consists of ____ (number) units of mixed income family rental housing. The project has

garnered tremendous community and official support as the first new construction of large scale

affordable housing in _________________ (area/community) since 20____. Currently, the

parcel is a blighted lot with a dilapidated building, posing safety risks to community residents

and undermining the physical environment. The _______________ (Project name) project

reflects the vision and years of successful activism by community leaders and residents to

provide new affordable housing resources for the growing ____________ (Sponsor) population

in ____________ (city) as well as ensure meaningful development that benefits the entire

community. ______________ (Project name) is a critical development because it will be built

on one of the last remaining public parcels of land in __________ (area/community) available

for development. This residential housing development will be a significant asset to the

community, adding vibrancy, housing resources and community life to the area.

______________ (Project name) has evolved through careful consideration of

(city/area) 's needs and unique characteristics. _______________ (Project name) 's scale,

affordability, bedroom mix, open spaces and design reflect ____________ (area/community) 's

dire need for affordable large family-size units, recreational open space and the traditional

family values of generational cohabitation.

The sponsor, ______________________ (Sponsor) (" (initials) ") is proud of its large

scale and affordable housing program at _______________ (Project name) . ______________

(Project) will be a family-oriented housing development where all generations can live, enjoy

recreational activities and be close to the social, political and cultural activities of both

______________ (area/community) and downtown ____________ (city) . As the site is located

close to _____________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________,

and numerous other amenities, ___________________ (Project name) will be a very attractive

site to all types of renters.

B. Development Plan

The project's ____ (number) rental units will enclose an open courtyard. Sixty (68%) of

these units will be affordable to low income families. There will be ______ (number) one

bedroom units, _____ (number) two bedroom units, _____ (number) three bedroom units and

_____ (number) four bedroom units. A _______________ (building type) on ____________

Street will house ____ (number) mostly one and two bedroom units; four story, double duplex

townhouses on _____________ Street and _____________ Street will house ______

(number) family units; while three story townhouses on _____________ (street) will house

____ (number) four bedroom units. One of the attractive design features is that ______

(number) family units are walk up units with separate private entrances from the street or

courtyard. In addition, approximately ___________ square feet will be provided for commercial

uses.

The layout and design of ______________ (Project name) embody elements of

traditional architecture such as an interior courtyard surrounded by dwelling units and an

______________ (Sponsor) -influenced landscaping motif. The creation of newly landscaped

open space and a community garden will greatly improve the pedestrian environment and serve

both the residents of the development and the community. The primary urban objective for

_____________ (Sponsor) is to create housing that reinforces the strong cultural identity of

______________ (area/community) , while relating to the scale, quality and ambience of the

historic ________________ (area) . The scale of the row houses to the east is maintained at the

eastern edge of the site where the proposed buildings are only three and four stories high. A

"signature" tower marking a gateway into ______________ (area/community) rises to ten

stories at ___________ Street, where the adjacent context is of a larger scale and the street

width is greater. The housing will enclose a private courtyard designed for family use. A public

open space, designed to include a community garden, will create a quiet recreation space on

the ______________ (Project name) edge of the project. ________________ (number)

parking spaces for residents will be available offsite across from the Project on

____________________ (Street name) .

Successful marketing of the ___________________ (Project name) project has been

ensured through specific amenity development which complements the attractive design and

location of the project. The project's amenities include central air conditioning, additional

bathrooms for large-sized units, garbage disposals, washer-dryer hook-ups, and dishwashers.

________________ (Project name) will be built on a ____________ square foot parcel

which formerly belonged to the _____________ (city) Development Authority ("______"). The

parcel was acquired from the __________ (city) Development Authority in ____________

(month) 20_____. The Partnership expects to construct the Project over a _____ (number) -

month construction period. Total acquisition and development costs are currently estimated to

be approximately $_______________.

The development of ______________ (Project name) is a key affordable housing

development initiative for the City of ____________. In addition, the creation of

______________ (Project name) dramatically fulfills one of the major housing goals in the

20____ _______________ (area/community) Community Plan. In 20____, the

___________________ (area/community) Community and the City of ____________ adopted

comprehensive development and zoning guidelines for ____________ (city) ______________

(area/community) . The ________________ (area/community) Community Plan is one of

_____________ (city) 's first community-based planning efforts involving collaboration between

a key neighborhood and the _______________ (city) Redevelopment Authority. The goal of the

plan is to ensure meaningful housing, community services, urban design, development control,

historic preservation, business development, open space, and transportation planning and

development.

C. Municipal and Neighborhood Description

________________ (area/community) is an extremely attractive location due to the

proximity to many important amenities such as _________________ food markets; bilingual

services; specialized new immigrant services; employment opportunities and services;

outstanding medical services; excellent transportation access; department stores; theatre and

entertainment areas; fine dining facilities; and large public open spaces such as the

_______________ and the ______________. The location is desirable because it is a 5-20

minute walk to popular City sites such as ___________________________________________

______________________________________________ and many educational institutions

such as the __________________________________________________________________.

Abutters include the ___________________________________________________________.

The _____________________ is located one block away from the proposed project, and an

_________________ bus stops right in front of the ______________ Street entrance of

__________________. Residents would be close to employment opportunities as well as

_____________ (city) 's financial and commercial districts.

The ___________________________ will also provide new resources to ____________

(area/community) through its I-C project, a new development underway just across the street

from __________________ (Project name) . The _____________ square foot project will

contain research space, ambulatory care, intensive care, maternity care, community services

and other programs. The construction of this project will also begin this fall. The

____________________ (hospital/medical center) 's project will provide hundreds of

employment opportunities and expanded health care services in ___________________

(area/community) . Despite its proximity to downtown _____________ (city) ,

_______________ (area/community) is one of the city's poorest neighborhoods with the

highest rate of overcrowding and one of the highest ratios of deteriorated housing stock in the

City of ___________. Due the tremendous need for affordable housing in _______________

(area/community) and the strength of the development team, this Project has generated

tremendous community and City-wide support. On file are approximately _______ (number)

letters of support written by elected officials, institutions, community groups, businesses,

abutters and individuals as well as a petition signed by _______ (number) members of the

_____________ (name) community endorsing ________________ (Sponsor) as the

designated developer of __________________ (Project name) and supporting

________________ (Sponsor) 's funding applications.

The Partnership has received a forward commitment from the AFL-CIO Housing

Investment Trust to purchase the bonds.

This loan will have a twenty year term and bear interest of 9 0% plus a 0.5% servicing

fee. At construction completion the construction loan will be replaced with permanent first

mortgage financing in the amount of $_________. The loan will bear an annual interest rate of

9.0% plus a 0.5% servicing fee. Interest payments will be paid monthly in the amount of

$_________ or $________ per year based on a thirty year amortization schedule.

Sponsor Loan: (Source: Community Development Action Grant

and Neighborhood Housing Trust Linkage Funds)

The City of ____________'s Neighborhood Housing Trust has awarded the Sponsor

$________ in Linkage Funds, and the _______________ (state) Executive Office of

Communities and Development has committed to the Sponsor $_________ in Community

Development Action Grant funds. With these funds, the Sponsor will provide a loan to the

Partnership in the amount of $__________ to be used for certain development and pre-

development work. This loan will be nonrecourse, secured by a fourth mortgage, and will bear

interest at 8.25% per annum. Principal and interest repayments will be deferred and will be paid

upon the earlier of sale or refinancing or loan maturity in 20 years.

Acquisition Loan

In order to finance the acquisition of the Property, the Partnership entered into a loan

agreement with the Sponsor in the amount of $___________, and assumed obligations of the

Sponsor on a $__________ Mortgage Note and Security Agreement to the _____________

(city) Redevelopment Authority ("_____ (initials) ”), which sold the parcel of land to the Sponsor.

Both loans will be nonrecourse, secured by a second mortgage and shall accrue interest at the

rate of eight percent (8%) per annum for twenty (20) years. Neither note requires current

payments from property operations, but the _____________ (city) Redevelopment Authority

Mortgage Note and Security Agreement require that the property be developed as affordable

housing. Principal and interest repayments will be deferred and will be paid upon the earlier of

sale or refinancing or loan maturity in 20 years.

Limited Partner Capital Contributions

Limited Partner Capital Contributions are needed to fund Project

Costs. See Section II above, and Appendix A.

B. Sources and Uses of Operating Funds

1. Rents

Thirty (34%) of the apartments in the Project are to be rented at below-market

rates to qualifying moderate income tenants (whose incomes do not exceed 60%

of the median), another thirty (34%) to low- income tenants who qualify for rental assistance

under the Section 8 program (see below), whose incomes do not exceed 50% of the

area median, and twenty-eight (32%) to market rate tenants The rents are projected to

be sufficient to cover all the operating expenses, but not all of the debt service. Hence,

the Sponsor will provide an operating subsidy to cover the remaining operating

obligations of the Project.

2. Sponsor Operating Subsidy

The Sponsor has an application pending for $_________ in Linkage Funds. With

$_________ from the Sponsor out of the first investor, payment, a total of $_________

will be invested in a tax-free annuity- type security with an average rate of return of

7.5%. The proceeds will then be loaned by the Sponsor as an operating subsidy paid in

annually as needed to satisfy operating deficits. The loan totaling $_________ will be

secured by a note and a third mortgage on the Project. The outstanding loan balance will

accrue interest at eleven percent (11.0%) per annum for twenty years, beginning at the

close of permanent financing.

3. Operating Subsidy - Section 8

The ______________ (city) Housing Authority has allocated project-based

Section 8 rental subsidy assistance for ____ (number) of _____ (number) units. This

allocation is subject to the approval of the U.S. Department of Housing and Urban

Development (HUD). The contract for this subsidy will be assigned to the Partnership.

The initial contract will be for a term of up to five years. Historically, HUD has renewed

project-based contracts in all cases in which an owner in good standing has requested

renewal.

Nevertheless, the Partnership will set aside funds from the second investor

payment for operations totaling $_________. These funds will be invested in a tax-

exempt interest bearing account, and withdrawals may be made from this account to

supplement operating income in the event that the Section 8 PBA contracts are not

renewed.

4. Replacement Reserves

A capital replacement reserve will be established for repair and replacement of

physical assets of the Property. Annual contributions are projected at $_______, or

$_____ per unit, initially with 5% annual increases. Surplus operating cash, if any, will be

applied to the replacement reserve and any deferred maintenance items that the

Property may require to keep it in full working order.

C. Bridge Financing

It has been assumed in the Forecasts that bridge financing totaling approximately

$____________ will be required and that principal and interest at 11% will be payable from

capital contributions received by the Partnership.

D. Development Fee Loan

The Sponsor will be paid a total of $____________ for a development fee in the form of

a note secured by a junior mortgage on the Property. Payments estimated to total $__________

will be made on this note in annual installments through 20____, and interest will be charged at

a rate of 8% compounded annually. Any unpaid fee will be deferred, will accrue interest, and be

paid out of the future capital installments, or upon the earlier of sale or refinancing or loan

maturity in twenty years.

E. Project Reserves

It is anticipated that the capital contributions of the investor Limited Partners will exceed

the direct development requirements and net worth requirements by an estimated $_________.

A portion of the surplus will be available to fund deferred development consultant fees, and the

remainder will be paid to the Sponsor for deferred developer's overhead.

VI. Summary of the Partnership Agreement

The following is intended to highlight some of the key elements of the Limited

Partnership Agreement (the "Agreement"). This summary does not purport to be thorough, and

Investors are advised to review the complete Agreement.

A. Partnership Allocations

Limited Partners will be entitled to 99.0% of the profits, losses and credits of the

Partnership, allocated on a per unit basis with 1.0% allocated to the General Partner.

Allocations of gain or loss from a capital transaction differ from allocations attributable to

operations, and after certain tax related adjustments, will be allocated equally between the

Limited Partners and the General Partner.

On liquidation, final distributions will be made in accordance with the partners' capital

account balances, as adjusted to reflect these allocations

B. Rights and Duties of the General Partner

The Partnership agreement will provide that the General Partner will have full, complete

and exclusive rights to manage and control the business of the Partnership, subject to

requirements of the regulatory agencies, and is required to make all decisions affecting the

business and affairs of the Partnership to the best of its ability and use best efforts to carry

out the purposes of the Partnership. In so doing and to the extent consistent with the

Partnership's purposes, the General Partner is required to take all actions necessary or

appropriate to protect the interests of the Limited Partners as a group and of the Partnership. It

is further required to devote such time as is necessary to the affairs of the Partnership.

The Partnership agreement will provide that the General Partner may not sell, assign, or

encumber its general partnership interest in the Partnership or voluntarily withdraw from the

Partnership without the consent of the Partners to its withdrawal and approval of the person

admitted as General Partner in its place.

C. Rights and Duties of the Limited Partners

No Limited Partner will be required to make additional capital contributions in excess of

its agreed capital contributions. The liability of the Limited Partners will be limited to the amount

of their capital contributions to the Partnership made or agreed to be made, and to the amount

of distributions representing a return of capital received by them. Following admission of the

Limited Partners, no interest will be paid on any capital contributions and no Limited Partner will

have the right to withdraw its capital. Limited Partners will have certain rights to require the

General Partner to call meetings of all the partners, to approve a sale or refinancing transaction,

and to approve amendments to the Agreement.

Transfer of Limited Partnership Interests

(See the Agreement, and Section VIII: "Corporate Financial and Investment Considerations"

below.)

Reports, Accounting, and Elections

The General Partner shall mail to the Limited Partner all necessary tax information not later than

March 15 of every year. The General Partner shall cause to be mailed to the Limited Partners

not later than __________ (month) ______ (day/number) of every year, beginning

___________, 20____ (date) , an annual report of the Partnership, including (i) a report of prior

calendar year, including a profit and loss statement, a balance sheet, a statement of Partner's

equity, and a cash flow, statement, and (ii) an unaudited comparison of the actual results of the

operations of the Partnership during the prior calendar year with projections set forth in the

Financial Forecasts.

The General Partner will retain a certified public accounting firm experienced in low- income

housing partnerships as accountants for the Partnership. All decisions as to accounting matters,

except as may otherwise be specifically provided in the Partnership Agreement, shall be

made by the General Partner in accordance with the accounting methods utilized for Federal

income tax purposes and otherwise in accordance with generally accepted accounting

principles and procedures applied in a consistent manner. All of the elections required or

permitted to be made by the Partnership under the Internal Revenue Code of 1986, as

amended (the "Code") will be made by the General Partner, after consultation with the

accountants for the Partnership, in such manner as will, in its sole opinion, be most

advantageous to a majority in interest of the Limited Partners.

The books and records of the Partnership will be maintained at the Partnership's office and

each Limited Partner or its duly authorized representative will have access to them and the right

to inspect and copy them at all reasonable times during normal business hours.

VII. Risks of Investment

In light of the risk factors discussed below, among others, the Investment is suitable only

for Investors of substantial financial means who have no need for liquidity of their Investment in

the Partnership. There will be no public market of the Units. (See "Corporate Financial and

Investment Considerations.")

Some of the major risk factors and how they may affect the business of the Partnership

and the ownership of the units offered are discussed below. This discussion represents merely

a summary of certain risk factors. Investors are advised to read this document in its entirety for

further information concerning risk factors . RISKS OTHER THAN THOSE SET FORTH IN THIS

SECTION MAY EXIST, AND IT SHOULD NOT BE INFERRED FROM THE FAILURE TO SPECIFY OR

TO DISCUSS THESE OTHER RISKS IN THIS SECTION THAT SUCH RISKS MAY NOT TURN OUT TO

BE SIGNIFICANT. INVESTORS MUST ACCEPT THE SUBSTANTIAL ECONOMIC RISKS INVOLVED

IN THE INVESTMENT IN THIS

PARTNERSHIP, INCLUDING THE POSSIBILITY OF THE LOSS OF CONTEMPLATED TAX BENEFITS

AND THE LOSS OF THEIR CASH INVESTMENT. EACH INVESTOR

SHOULD CONSULT ITS OWN PROFESSIONAL ADVISORS AS TO THE LEGAL, TAX OR RELATED

MATTERS CONCERNING AN INVESTMENT IN THE PARTNERSHIP.

A. Tax Risks

The following summary of tax risks is qualified in its entirety by reference to the tax

opinion which is expected to be delivered in connection with the admission of investors as

Limited Partners and, a form of which will be provided to prospective Investors in advance of the

date by which they will be asked to subscribe.

Low Income Housing Tax Credit:

There are certain risks associated with the use of the Credits. The provisions of the tax laws

governing the Credits are complicated and many provisions have not yet been interpreted or

clarified in Treasury regulations or rulings. There is a general risk that clarifications or

modifications of the Act may alter the treatment of the Credit or other tax positions which have

been used to form the basis of the Financial Forecasts

Increases in tenant's income over time could cause his/her income to exceed the maximum

permissible income for the Credits. When this occurs, the next available apartment of the same

size would have to be rented to a low income tenant. Failure to do so could result in recapture of

Credits with interest and penalties.

Furthermore, if the initial percentage of low income units is not sustained over the 15-year

Compliance Period, the "accelerated portion" of the Credits taken is subject to recapture. The

accelerated portion is the difference between the Credits taken over a 10-year period and the

same total Credit amount as if it were taken over a 15-year period. Only the accelerated portion

of Credits taken on the eligible basis of the units lost is recaptured. Moreover, if the minimum

40% eligibility threshold is not sustained, the accelerated portion of all Credits taken will be

recaptured.

The Partnership has entered into a 20___ Carryover Allocation Agreement with the

______________________ (Organization) . The requirements of such Agreement are that 10%

of the Project's anticipated basis plus land must have been incurred prior to ______________,

20____ (date) , and that the Project must be placed in service by _______________, 20____

(date) . The Partnership has met the former requirement.

Investors should note that the Credit may not be used to offset the Alternative Minimum Tax but

can be carried forward and back.

Tax Treatment of Various Costs and Fees:

The Summary of Significant Forecast Assumptions and Accounting Policies describe the tax

treatment of the various syndication and development costs and fees. The treatment assumed

could be questioned and possibly adjusted by the Internal Revenue Service ("IRS") if an audit

should occur. This could result in a reduction of the tax benefits of the Investment.

Risk of Audit:

Investments in the Partnership, because it is classified as a tax- sheltered investment, could

increase the likelihood of an IRS audit of the Partnership and of the individual Investors.

Other Federal Income Tax Risks:

There are several Federal income tax risks and considerations in connection with an

Investment. These risks and considerations include the following:

If the Partnership is classified as an association taxable as a corporation for Federal income

tax purposes, rather than as a partnership, substantially all of the tax benefits of the

Investment would be eliminated, and otherwise tax-free distributions from the Partnership

may be taxable to Investors,

If the Development Fee or Sponsor Loans were considered to be equity rather than debt for

Federal income tax purposes,

Interest on such loans would not be deductible,

Credits and losses attributable to such loans would be reallocated for the Investors to

the General Partner, thus reducing the deductions and credits allocable to Investors and

Some or all of the Project would be tax-exempt use property, causing the recovery

period over which the Project is depreciated to be increased from 27.5 to 40 years;

If the Development Fee or Sponsor Loans were classified as recourse debt, the Limited

Partners might not be able to include some or all of such loans in their basis and there

would be a reallocation of Credits and losses as set forth in above;

If the allocations of profit, loss, or credit among the Partners are not respected, such items

may be reallocated among the Partners in accordance with their interests in the Partnership,

thus possibly reducing the tax benefits allocable to the Investors, or reducing their basis for

their Partnership interests, and triggering income; and

If at any time during the compliance period the fair market value of the Project, considering

all of the facts and circumstances, including the Sponsor's option to acquire the Project, is

less than the liabilities to which the Project is subject, then the Partnership might not be

viewed as being able to deduct the accrued interest of the Project for tax purposes, resulting

in the loss of some of the tax benefits.

B. Regulatory Risks

The use of city, state and Federal subsidies imposes numerous regulatory requirements

on the Project. Failure to comply with such requirements can subject the Project to a range of

penalties. Furthermore, rent increases will be restricted by the requirements of the Credit and

various regulatory agreements

C. Financial Forecasts

The economic and tax results to the Limited Partners set forth in the Financial Forecasts

are based upon the assumptions described in this document and the Summary of Significant

Forecast Assumptions and Accounting Policies. Such Forecasts are hypothetical and based

upon the Partnership operations contemplated for the future and upon assumptions and

estimates which are subject to the uncertainties of future events beyond the control of the

Partnership. The timing of certain events, including the admission of the Limited Partners, may

have a substantial impact on actual results. While the General Partner believes that the

Forecasts reflect the most likely set of conditions and the most probable outcome of the

economic and tax consequences of the Partnership's business operations, the results can

in no manner be guaranteed.

THE FINANCIAL FORECASTS INCLUDED IN APPENDIX A ARE FOR PURPOSES OF

ILLUSTRATION ONLY, AND NO ASSURANCE IS GIVEN THAT THE ACTUAL RESULTS WILL

CORRESPOND WITH THE RESULTS CONTEMPLATED IN THE FINANCIAL FORECASTS. ACTUAL

RESULTS CAN AND WILL VARY, PERHAPS MATERIALLY.

D. Construction Risks

Construction risks include the potential for construction cost overruns which could not be

funded through existing resources, delays in and/or failure to complete construction as a result

of natural disaster, strikes or other causes, and/or poor management or poor workmanship

resulting in an inferior product.

E. Operating Risks

Operating risks include the potential for mismanagement, underestimation or rapid

inflation of operating costs, overestimation of rents or excessive vacancy levels. Assumptions

concerning operating budgets are described in the Financial Forecasts.

F. Conflicts of Interest

Substantial fees, expenses and reimbursements are payable to the Sponsor, an affiliate

of the General Partner, out of the proceeds of this offering. The General Partner and the

Sponsor and their respective officers are not required to, and will not, devote their full time to the

affairs of the Partnership. The General Partner may be involved in the future in the development

and management of other ventures, including ventures similar to that described in this

document, or in other transactions with its affiliates. Furthermore, the officers, directors and

employees of the General Partner and/or the Sponsor may be officers, directors and partners

of corporations and partnerships to be formed in the future which may be engaged in making or

arranging investments, including investments which may be similar to the business of the

Partnership. Conflicts may arise regarding the allocation of time of the officers, directors and

employees of the General Partner and/or the Sponsor between the Partnership and those

other corporations and partnerships; and other conflicts may arise in connection with the

business of the Partnership and of the other ventures.

Other Partnership Matters; Restriction on Transfer

Units will not be registered under the Securities Act of 1933, as amended, or