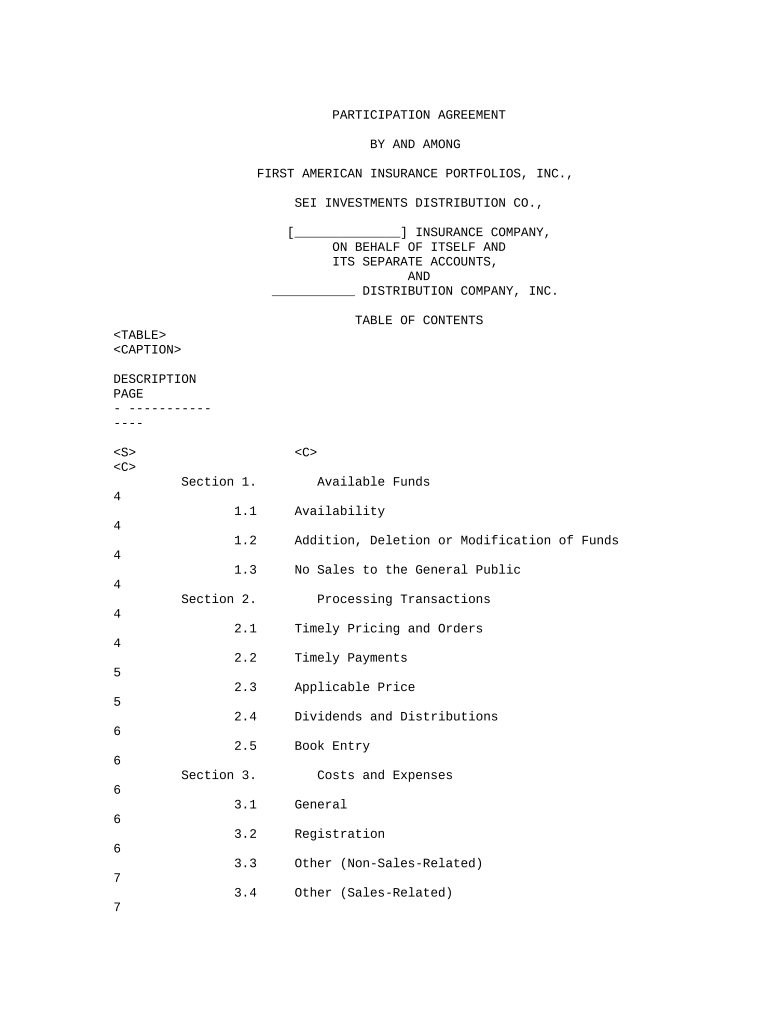

PARTICIPATION AGREEMENT

BY AND AMONG

FIRST AMERICAN INSURANCE PORTFOLIOS, INC.,

SEI INVESTMENTS DISTRIBUTION CO.,

[______________] INSURANCE COMPANY,

ON BEHALF OF ITSELF AND

ITS SEPARATE ACCOUNTS,

AND

___________ DISTRIBUTION COMPANY, INC.

TABLE OF CONTENTS

DESCRIPTION

PAGE

- -----------

----

Section 1. Available Funds

4

1.1 Availability

4

1.2 Addition, Deletion or Modification of Funds

4

1.3 No Sales to the General Public

4

Section 2. Processing Transactions

4

2.1 Timely Pricing and Orders

4

2.2 Timely Payments

5

2.3 Applicable Price

5

2.4 Dividends and Distributions

6

2.5 Book Entry

6

Section 3. Costs and Expenses

6

3.1 General

6

3.2 Registration

6

3.3 Other (Non-Sales-Related)

7

3.4 Other (Sales-Related)

7

3.5 Parties To Cooperate

7

Section 4. Legal Compliance

8

4.1 Tax Laws

8

4.2 Insurance and Certain Other Laws

10

4.3 Securities Laws

10

4.4 Notice of Certain Proceedings and Other

Circumstances 12

4.5 Company To Provide Documents; Information About

FAIP 12

4.6 FAIP To Provide Documents; Information About

Company 13

DESCRIPTION

PAGE

- -----------

----

Section 5. Mixed and Shared Funding

15

5.1 General

15

5.2 Disinterested Directors

15

5.3 Monitoring for Material Irreconcilable Conflicts

15

5.4 Conflict Remedies

16

5.5 Notice to Company

18

5.6 Information Requested by Board of Directors

18

5.7 Compliance with SEC Rules

18

5.8 Other Requirements

18

Section 6. Termination

19

6.1 Events of Termination

19

6.2 Notice Requirement for Termination

20

6.3 Funds To Remain Available

20

6.4 Survival of Warranties and Indemnifications

20

6.5 Continuance of Agreement for Certain Purposes

21

Section 7. Parties To Cooperate Respecting Termination

21

Section 8. Assignment

21

Section 9. Notices

21

Section 10. Voting Procedures

22

Section 11. Foreign Tax Credits

23

Section 12. Indemnification

23

12.1 Of FAIP and SEI by Company and Contract

Underwriter 23

12.2 Of Company and Contract Underwriter by FAIP and

SEI 25

12.3 Effect of Notice

28

12.4 Successors

28

Section 13. Applicable Law

28

Section 14. Execution in Counterparts

28

Section 15. Severability

28

Section 16. Rights Cumulative

29

Section 17. Headings

29

Section 18. Confidentiality

29

Section 19. Parties to Cooperate

30

Section 20. Amendments

30

Section 21. Assignment

30

PARTICIPATION AGREEMENT

THIS AGREEMENT, made and entered into as of the _____ day of

_________,

2000 ("Agreement"), by and among First American Insurance Portfolios,

Inc., a

Minnesota corporation ("FAIP"); SEI Investments Distribution Co., a

Delaware

corporation ("SEI"), [____________] Insurance Company, a __________ life

insurance company ("Company"), on behalf of itself and each of its

segregated

asset accounts listed in Schedule A hereto, as the parties hereto may

amend said

Schedule A from time to time (each, an "Account," and collectively, the

"Accounts"); and [______] Distribution Company, an affiliate of Company

and the

principal underwriter of the Contracts ("Contract Underwriter")

(collectively,

the "Parties").

WITNESSETH THAT:

WHEREAS, FAIP is registered with the Securities and Exchange

Commission

("SEC") as an open-end management investment company under the

Investment

Company Act of 1940, as amended (the "1940 Act"); and

WHEREAS, FAIP currently consists of three separate series

("Series"),

shares ("Shares") of each of which are registered under the Securities

Act of

1933, as amended (the "1933 Act") and may be sold to one or more

separate

accounts of life insurance companies to fund benefits under variable

annuity

contracts and variable life insurance contracts; and

WHEREAS, FAIP will make Shares of each Series listed on

Schedule A

hereto as the Parties hereto may amend said Schedule A from time to time

(each a

"Fund"; reference herein to "Fund" includes reference to each Fund, to

the

extent the context requires) available for purchase by the Accounts; and

WHEREAS, SEI is a broker-dealer registered with the SEC under

the

Securities Exchange Act of 1934 ("1934 Act") and a member in good

standing of

the National Association of Securities Dealers, Inc. ("NASD"); and

WHEREAS, Company will be the issuer of certain variable annuity

contracts and variable life insurance contracts ("Contracts") as set

forth on

Schedule A hereto, as the Parties hereto may amend said Schedule A from

time to

time, which Contracts, if required by applicable law, will be registered

under

the 1933 Act; and

WHEREAS, Company will fund the Contracts through the Accounts,

each of

which may be divided into two or more subaccounts ("Subaccounts";

reference

herein to an "Account" includes reference to each Subaccount thereof to

the

extent the context requires); and

WHEREAS, Company will serve as the depositor of the Accounts,

each of

which is registered as a unit investment trust investment company under

the 1940

Act (or exempt therefrom), and the security interests deemed to be

issued by the

Accounts under the Contracts will be registered as securities under the

1933 Act

(or exempt therefrom); and

64

WHEREAS, to the extent permitted by applicable insurance laws

and

regulations, Company intends to purchase Shares in one or more of the

Funds on

behalf of the Accounts to fund the Contracts; and

WHEREAS, Contract Underwriter is a broker-dealer registered

with the

SEC under the Securities Exchange Act of 1934 ("1934 Act") and a member

in good

standing of the National Association of Securities Dealers, Inc.

("NASD");

NOW, THEREFORE, in consideration of the mutual benefits and

promises

contained herein, the Parties hereto agree as follows:

SECTION 1. AVAILABLE FUNDS

1.1 AVAILABILITY.

FAIP will make Shares of each Fund available to Company for

purchase

and redemption on behalf of the Accounts at net asset value and with no

sales

charges, subject to the terms and conditions of this Agreement. The

Board of

Directors of FAIP may refuse to sell Shares of any Fund to any person,

or

suspend or terminate the offering of Shares of any Fund if such action

is

required by law or by regulatory authorities having jurisdiction or if,

in the

sole discretion of the Directors acting in good faith and in light of

their

fiduciary duties under federal and any applicable state laws, such

action is

deemed in the best interests of the shareholders of such Fund.

1.2 ADDITION, DELETION OR MODIFICATION OF FUNDS.

The Parties hereto may agree, from time to time, to add other

Funds to

provide additional funding media for the Contracts, or to delete,

combine, or

modify existing Funds, by amending Schedule A hereto. Upon such

amendment to

Schedule A, any applicable reference to a Fund or its Shares herein

shall

include a reference to any such additional Fund. Schedule A, as amended

from

time to time, is incorporated herein by reference and is a part hereof.

1.3 NO SALES TO THE GENERAL PUBLIC.

FAIP represents and warrants that no shares of the Funds have

been or

will be sold to the general public.

SECTION 2. PROCESSING TRANSACTIONS

2.1 TIMELY PRICING AND ORDERS.

(a) FAIP or its designated agent will use its best efforts

to

provide Company with the net asset value per Share for

each

Fund by 6:00 p.m. Central Time on each Business Day.

As used

herein, "Business Day" shall mean any day on which (i)

the New

York Stock Exchange is open for regular trading, (ii)

FAIP

calculates the Fund's net asset value, and (iii)

Company is

open for business.

65

(b) Company will use the data provided by FAIP each

Business Day

pursuant to paragraph (a) immediately above to

calculate

Account unit values and to process transactions that

receive

that same Business Day's Account unit values. Company

will

perform such Account processing the same Business Day,

and

will place corresponding orders to purchase or redeem

Shares

with FAIP by 9:00 a.m. Central Time the following

Business

Day; provided, however, that FAIP shall provide

additional

time to Company in the event that FAIP is unable to

meet the

6:00 p.m. time stated in paragraph (a) immediately

above. Such

additional time shall be equal to the additional time

that

FAIP takes to make the net asset values available to

Company.

(c) With respect to payment of the purchase price by

Company and

of redemption proceeds by FAIP, Company and FAIP shall

net

purchase and redemption orders with respect to each

Fund and

shall transmit one net payment per Fund in accordance

with

Section 2.2, below.

(d) If FAIP provides materially incorrect Share net asset

value

information (as determined under SEC guidelines),

Company

shall be entitled to an adjustment to the number of

Shares

purchased or redeemed to reflect the correct net asset

value

per Share. Any material error in the calculation or

reporting

of net asset value per Share, dividend or capital gain

information shall be reported promptly upon discovery

to

Company.

2.2 TIMELY PAYMENTS.

Company will wire payment for net purchases to a custodial

account

designated by Fund by 1:00 p.m. Central Time on the same day as the

order for

Shares is placed, to the extent practicable. FAIP will wire payment for

net

redemptions to an account designated by Company by 1:00 p.m. Central

Time on the

same day as the Order is placed, to the extent practicable, but in any

event

within three (3) calendar days after the date the order is placed in

order to

enable Company to pay redemption proceeds within the time specified in

Section

22(e) of the 1940 Act or such shorter period of time as may be required

by law.

2.3 APPLICABLE PRICE.

(a) Share purchase payments and redemption orders that

result from

purchase payments, premium payments, surrenders and

other

transactions under Contracts (collectively, "Contract

transactions") and that Company receives prior to the

close of

regular trading on the New York Stock Exchange on a

Business

Day will be executed at the net asset values of the

appropriate Funds next computed after receipt by Fund

or its

designated agent of the orders. For purposes of this

Section

2.3(a), Company shall be the designated agent of FAIP

for

receipt of orders relating to Contract transactions on

each

Business Day and receipt by such designated agent

shall

constitute receipt by FAIP; provided that FAIP

receives notice

of such orders by 9:00 a.m. Central Time on the next

following

Business Day or such later time as computed in

accordance with

Section 2.1(b) hereof.

66

(b) All other Share purchases and redemptions by Company

will be

effected at the net asset values of the appropriate

Funds next

computed after receipt by FAIP or its designated agent

of the

order therefor, and such orders will be irrevocable.

2.4 DIVIDENDS AND DISTRIBUTIONS.

FAIP will furnish notice by wire or telephone (followed by

written

confirmation) on or prior to the payment date to Company of any income

dividends

or capital gain distributions payable on the Shares of any Fund. Company

hereby

elects to reinvest all dividends and capital gains distributions in

additional

Shares of the corresponding Fund at the ex-dividend date net asset

values until

Company otherwise notifies FAIP in writing, it being agreed by the

Parties that

the ex-dividend date and the payment date with respect to any dividend

or

distribution will be the same Business Day. Company reserves the right

to revoke

this election and to receive all such income dividends and capital gain

distributions in cash.

2.5 BOOK ENTRY.

Issuance and transfer of FAIP Shares will be by book entry

only. Stock

certificates will not be issued to Company. Shares ordered from FAIP

will be

recorded in an appropriate title for Company, on behalf of its Account.

SECTION 3. COSTS AND EXPENSES

3.1 GENERAL.

Except as otherwise specifically provided herein, each Party

will bear

all expenses incident to its performance under this Agreement.

3.2 REGISTRATION.

(a) FAIP will bear the cost of its registering as a

management

investment company under the 1940 Act and registering

its

Shares under the 1933 Act, and keeping such

registrations

current and effective; including, without limitation,

the

preparation of and filing with the SEC of Forms N-SAR

and Rule

24f-2 Notices with respect to FAIP and its Shares and

payment

of all applicable registration or filing fees with

respect to

any of the foregoing.

(b) Company will bear the cost of registering, to the

extent

required, each Account as a unit investment trust

under the

1940 Act and registering units of interest under the

Contracts

under the 1933 Act and keeping such registrations

current and

effective; including, without limitation, the

preparation and

filing with the SEC of Forms N-SAR and Rule 24f-2

Notices with

respect to each Account and its units of interest and

payment

of all applicable registration or filing fees with

respect to

any of the foregoing.

3.3 OTHER (NON-SALES-RELATED).

67

(a) FAIP will bear, or arrange for others to bear, the

costs of

preparing, filing with the SEC and setting for

printing FAIP's

prospectus, statement of additional information and

any

amendments or supplements thereto (collectively, the

"FAIP

Prospectus"), periodic reports to shareholders, FAIP

proxy

material and other shareholder communications.

(b) Company will bear the costs of preparing, filing with

the SEC

and setting for printing each Account's prospectus,

statement

of additional information and any amendments or

supplements

thereto (collectively, the "Account Prospectus"), any

periodic

reports to Contract owners, annuitants, insureds or

participants (as appropriate) under the Contracts

(collectively, "Participants"), voting instruction

solicitation material, and other Participant

communications.

(c) Company will print in quantity and deliver to existing

Participants the documents described in Section 3.3(b)

above

and the prospectus provided by FAIP in camera ready

form. FAIP

will print the FAIP statement of additional

information, proxy

materials relating to FAIP and periodic reports of

FAIP.

3.4 OTHER (SALES-RELATED).

Company will bear the expenses of distribution. These expenses

would

include by way of illustration, but are not limited to, the costs of

distributing to Participants the following documents, whether they

relate to the

Account or FAIP: prospectuses, statements of additional information,

proxy

materials and periodic reports. These costs would also include the costs

of

preparing, printing, and distributing sales literature and advertising

relating

to the Funds, as well as filing such materials with, and obtaining

approval

from, the SEC, the NASD, any state insurance regulatory authority, and

any other

appropriate regulatory authority, to the extent required.

3.5 PARTIES TO COOPERATE.

Each Party agrees to cooperate with the others, as applicable,

in

arranging to print, mail and/or deliver, in a timely manner, combined or

coordinated prospectuses or other materials of FAIP and the Accounts.

68

SECTION 4. LEGAL COMPLIANCE

4.1 TAX LAWS.

(a) FAIP represents and warrants that each Fund is

currently

qualified as a regulated investment company ("RIC")

under

Subchapter M of the Internal Revenue Code of 1986, as

amended

(the "Code"), and represents that it will maintain

qualification of each Fund as a RIC. FAIP will notify

Company

immediately upon having a reasonable basis for

believing that

a Fund has ceased to so qualify or that it might not

so

qualify in the future.

(b) FAIP represents that it will use its best efforts to

comply

and to maintain each Fund's compliance with the

diversification requirements set forth in Section

817(h) of

the Code and Section 1.817-5(b) of the regulations

under the

Code. FAIP will notify Company immediately upon having

a

reasonable basis for believing that a Fund has ceased

to so

comply or that a Fund might not so comply in the

future. In

the event of a breach of this Section 4.1(b) by FAIP,

it will

take all reasonable steps to adequately diversify the

Fund so

as to achieve compliance within the grace period

afforded by

Section 1.817-5 of the regulations under the Code.

(c) Notwithstanding Section 12.2 hereunder, Company agrees

that if

the Internal Revenue Service ("IRS") asserts in

writing in

connection with any governmental audit or review of

Company

or, to Company's knowledge, of any Participant, that

any Fund

has failed to comply with the diversification

requirements of

Section 817(h) of the Code or Company otherwise

becomes aware

of any facts that could give rise to any claim against

FAIP or

its affiliates as a result of such a failure or

alleged

failure:

(i) Company shall promptly notify FAIP of such

assertion

or potential claim (subject to the

Confidentiality

provisions of Section 18 as to any

Participant);

(ii) Company shall consult with FAIP as to how to

minimize

any liability that may arise as a result of

such

failure or alleged failure;

(iii) Company shall use its best efforts to minimize any

liability of

FAIP or its affiliates resulting from such failure, including,

without

limitation, demonstrating, pursuant to Treasury Regulations

Section

1.817-5(a)(2), to the Commissioner of the IRS that such failure

was

inadvertent;

(iv) Company shall permit FAIP, its affiliates and

their

legal and accounting advisors to participate

in any

conferences, settlement discussions or other

administrative or judicial proceeding or

contests

(including judicial appeals thereof) with the

IRS,

any Participant or any other claimant

regarding any

claims that could give rise to liability to

FAIP or

its affiliates as a result of such a failure

or

alleged failure; provided,

69

however, that Company will retain control of

the

conduct of such conferences discussions,

proceedings,

contests or appeals;

(v) any written materials to be submitted by

Company to

the IRS, any Participant or any other

claimant in

connection with any of the foregoing

proceedings or

contests (including, without limitation, any

such

materials to be submitted to the IRS pursuant

to

Treasury Regulations Section 1.817-5(a)(2)),

(a)

shall be provided by Company to FAIP

(together with

any supporting information or analysis);

subject to

the confidentiality provisions of Section 18,

at

least ten (10) business days or such shorter

period

to which FAIP and Company agree prior to the

day on

which such proposed materials are to be

submitted,

and (b) shall not be submitted by Company to

any such

person without the express written consent of

FAIP

which shall not be unreasonably withheld;

(vi) Company shall provide FAIP or its affiliates

and

their accounting and legal advisors with such

cooperation as FAIP shall reasonably request

(including, without limitation, by permitting

FAIP

and its accounting and legal advisors to

review the

relevant books and records of Company) in

order to

facilitate review by FAIP or its advisors of

any

written submissions provided to it pursuant

to the

preceding clause or its assessment of the

validity or

amount of any claim against its arising from

such a

failure or alleged failure;

(vii) Company shall not with respect to any claim

of the

IRS or any Participant that would give rise

to a

claim against FAIP or its affiliates (a)

compromise

or settle any claim, (b) accept any

adjustment on

audit, or (c) forego any allowable

administrative or

judicial appeals, without the express written

consent

of FAIP or its affiliates, which shall not be

unreasonably withheld, provided that Company

shall

not be required, after exhausting all

administrative

remedies, to appeal any adverse judicial

decision

unless FAIP or its affiliates shall have

provided an

opinion of independent counsel to the effect

that a

reasonable basis exists for taking such

appeal; and

provided further that the costs of any such

appeal

shall be borne equally by FAIP and Company

hereto

except that Company shall not be liable for

such

costs if the failure to comply with Section

817 (h)

arises from a failure to meet the

requirements of

Treasury Regulation Section 1.817-5(b)(1) or

(2) or

Treasury Regulation Section 1.817-5(f)

through no

fault of Company; and

(viii) FAIP and its affiliates shall have no

liability as a

result of such failure or alleged failure if

Company

fails to comply with any of the foregoing

clauses (i)

through (vii), and such failure could be

shown to

have materially contributed to the liability.

70

As used in this Agreement, the term "affiliates" shall

have

the same meaning as "affiliated person" as defined in

Section

2(a)(3) of the 1940 Act.

(d) Company represents and warrants that the Contracts

currently

are and will be treated as annuity contracts or life

insurance

contracts under applicable provisions of the Code and

that it

will maintain such treatment; Company will notify FAIP

immediately upon having a reasonable basis for

believing that

any of the Contracts have ceased to be so treated or

that they

might not be so treated in the future.

(e) Company represents and warrants that each Account is a

"segregated asset account" and that interests in each

Account

are offered exclusively through the purchase of or

transfer

into a "variable contract," within the meaning of such

terms

under Section 817 of the Code and the regulations

thereunder.

Company will continue to meet such definitional

requirements,

and it will notify FAIP immediately upon having a

reasonable

basis for believing that such requirements have ceased

to be

met or that they might not be met in the future.

4.2 INSURANCE AND CERTAIN OTHER LAWS.

(a) FAIP will comply with any applicable state insurance

laws or

regulations, to the extent specifically requested in

writing

by Company, including, the furnishing of information

not

otherwise available to Company which is required by

state

insurance law to enable Company to obtain the

authority needed

to issue the Contracts in any applicable state.

(b) Company represents and warrants that (i) it is an

insurance

company duly organized, validly existing and in good

standing

under the laws of the State of ___________ and has

full

corporate power, authority and legal right to execute,

deliver

and perform its duties and comply with its obligations

under

this Agreement, (ii) it has legally and validly

established

and maintains each Account as a segregated asset

account under

[State] Insurance Law and the regulations thereunder,

and

(iii) the Contracts comply in all material respects

with all

other applicable federal and state laws and

regulations.

(c) FAIP represents and warrants that it is a corporation

duly

organized, validly existing, and in good standing

under the

laws of the State of Minnesota and has full power,

authority,

and legal right to execute, deliver, and perform its

duties

and comply with its obligations under this Agreement.

4.3 SECURITIES LAWS.

(a) Company represents and warrants that (i) interests in

each

Account pursuant to the Contracts will be registered

under the

1933 Act to the extent required by the 1933 Act, (ii)

the

Contracts will be duly authorized for issuance and

sold in

compliance with all applicable federal and state laws,

including, without limitation, the 1933

71

Act, the 1934 Act, the 1940 Act and [State] law, (iii)

each

Account is and will remain registered under the 1940

Act, to

the extent required by the 1940 Act, (iv) each Account

does

and will comply in all material respects with the

requirements

of the 1940 Act and the rules thereunder, to the

extent

required, (v) each Account's 1933 Act registration

statement

relating to the Contracts, together with any

amendments

thereto, will at all times comply in all material

respects

with the requirements of the 1933 Act and the rules

thereunder, (vi) Company will amend the registration

statement

for its Contracts under the 1933 Act and for its

Accounts

under the 1940 Act from time to time as required in

order to

effect the continuous offering of its Contracts or as

may

otherwise be required by applicable law, and (vii)

each

Account Prospectus will at all times comply in all

material

respects with the requirements of the 1933 Act and the

rules

thereunder.

(b) Company will at its expense register and qualify the

Contracts

for sale in accordance with the laws of any state or

other

jurisdiction if and to the extent reasonably deemed

advisable

by Company.

(c) FAIP represents and warrants that (i) Shares sold

pursuant to

this Agreement will be registered under the 1933 Act

to the

extent required by the 1933 Act and duly authorized

for

issuance and sold in compliance with Minnesota law,

(ii) FAIP

is and will remain registered under the 1940 Act to

the extent

required by the 1940 Act, (iii) FAIP will amend the

registration statement for its Shares under the 1933

Act and

itself under the 1940 Act from time to time as

required in

order to effect the continuous offering of its Shares,

(iv)

FAIP does and will comply in all material respects

with the

requirements of the 1940 Act and the rules thereunder,

(v)

FAIP's 1933 Act registration statement, together with

any

amendments thereto, will at all times comply in all

material

respects with the requirements of the 1933 Act and

rules

thereunder, and (vi) FAIP's Prospectus will at all

times

comply in all material respects with the requirements

of the

1933 Act and the rules thereunder.

(d) FAIP will at its expense register and qualify its

Shares for

sale in accordance with the laws of any state or other

jurisdiction if and to the extent reasonably deemed

advisable

by FAIP.

(e) FAIP currently does not intend to make any payments to

finance

distribution expenses pursuant to Rule 12b-1 under the

1940

Act or otherwise, although it reserves the right to

make such

payments in the future. To the extent that it decides

to

finance distribution expenses pursuant to Rule 12b-1,

FAIP

undertakes to have its Board of Directors, a majority

of whom

are not "interested" persons of FAIP, formulate and

approve

any plan under Rule 12b-1 to finance distribution

expenses.

72

(f) FAIP represents and warrants that all of its

directors,

officers, employees, investment advisers, and other

individuals/entities having access to the funds and/or

securities of the Funds are and continue to be at all

times

covered by a blanket fidelity bond or similar coverage

for the

benefit of the Funds in an amount not less than the

minimal

coverage as required currently by Rule 17g-(1) of the

1940 Act

or related provisions as may be promulgated from time

to time.

The aforesaid bond includes coverage for larceny and

embezzlement and is issued by a reputable bonding

company.

4.4 NOTICE OF CERTAIN PROCEEDINGS AND OTHER CIRCUMSTANCES.

(a) FAIP will immediately notify Company of (i) the

issuance by

any court or regulatory body of any stop order, cease

and

desist order, or other similar order with respect to

FAIP's

registration statement under the 1933 Act or FAIP

Prospectus,

(ii) any request by the SEC for any amendment to such

registration statement or Fund Prospectus that may

affect the

offering of Shares of FAIP, (iii) the initiation of

any

proceedings for that purpose or for any other purpose

relating

to the registration or offering of FAIP's Shares, or

(iv) any

other action or circumstances that may prevent the

lawful

offer or sale of Shares of any Fund in any state or

jurisdiction, including, without limitation, any

circumstances

in which (a) such Shares are not registered and, in

all

material respects, issued and sold in accordance with

applicable state and federal law, or (b) such law

precludes

the use of such Shares as an underlying investment

medium of

the Contracts issued or to be issued by Company. FAIP

will

make every reasonable effort to prevent the issuance,

with

respect to any Fund, of any such stop order, cease and

desist

order or similar order and, if any such order is

issued, to

obtain the lifting thereof at the earliest possible

time.

(b) Company will immediately notify FAIP of (i) the

issuance by

any court or regulatory body of any stop order, cease

and

desist order, or other similar order with respect to

each

Account's registration statement under the 1933 Act

relating

to the Contracts or each Account Prospectus, (ii) any

request

by the SEC for any amendment to such registration

statement or

Account Prospectus that may affect the offering of

Shares of

FAIP, (iii) the initiation of any proceedings for that

purpose

or for any other purpose relating to the registration

or

offering of each Account's interests pursuant to the

Contracts, or (iv) any other action or circumstances

that may

prevent the lawful offer or sale of said interests in

any

state or jurisdiction, including, without limitation,

any

circumstances in which said interests are not

registered and,

in all material respects, issued and sold in

accordance with

applicable state and federal law. Company will make

every

reasonable effort to prevent the issuance of any such

stop

order, cease and desist order or similar order and, if

any

such order is issued, to obtain the lifting thereof at

the

earliest possible time.

73

4.5 COMPANY TO PROVIDE DOCUMENTS; INFORMATION ABOUT FAIP.

(a) Company will provide to FAIP or its designated agent

at least

one (1) complete copy of all SEC registration

statements,

Account Prospectuses, reports, any preliminary and

final

voting instruction solicitation material, applications

for

exemptions, requests for no-action letters, and all

amendments

to any of the above, that relate to each Account or

the

Contracts, contemporaneously with the filing of such

document

with the SEC or other regulatory authorities.

(b) Company will provide to FAIP or its designated agent

at least

one (1) complete copy of each piece of sales

literature or

other promotional material in which FAIP or any of its

affiliates is named, at least five (5) Business Days

prior to

its use or such shorter period as the Parties hereto

may, from

time to time, agree upon. No such material shall be

used if

FAIP or its designated agent objects to such use

within five

(5) Business Days after receipt of such material or

such

shorter period as the Parties hereto may, from time to

time,

agree upon.

(c) Neither Company nor any of its affiliates, will give

any

information or make any representations or statements

on

behalf of or concerning FAIP or its affiliates in

connection

with the sale of the Contracts other than (i) the

information

or representations contained in the registration

statement,

including the FAIP Prospectus contained therein,

relating to

Shares, as such registration statement and FAIP

Prospectus may

be amended from time to time; or (ii) in reports or

proxy

materials for FAIP; or (iii) in published reports for

FAIP

that are in the public domain and approved by FAIP for

distribution; or (iv) in sales literature or other

promotional

material approved by FAIP, except with the express

written

permission of FAIP.

(d) Company shall adopt and implement procedures

reasonably

designed to ensure that information concerning FAIP

and its

affiliates that is intended for use only by brokers or

agents

selling the Contracts (i.e., information that is not

intended

for distribution to Participants) ("broker only

materials") is

so used, and neither FAIP nor any of its affiliates

shall be

liable for any losses, damages or expenses relating to

the

improper use of such broker only materials.

(e) For the purposes of this Section 4.5, the phrase

"sales

literature or other promotional material" includes,

but is not

limited to, advertisements (such as material

published, or

designed for use in, a newspaper, magazine, or other

periodical, radio, television, telephone or tape

recording,

videotape display, signs or billboards, motion

pictures, or

other public media, (e.g., on-line networks such as

the

Internet or other electronic messages), sales

literature

(i.e., any written communication distributed or made

generally

available to customers or the public, including

brochures,

circulars, research reports, market letters, form

letters,

seminar texts, reprints or excerpts of any other

advertisement, sales literature, or published

article),

educational or training materials or other

communications

distributed or made generally available to some or all

agents

or employees,

74

registration statements, prospectuses, statements of

additional information, shareholder reports, and proxy

materials and any other material constituting sales

literature

or advertising under the NASD rules, the 1933 Act or

the 1940

Act.

4.6 FAIP TO PROVIDE DOCUMENTS; INFORMATION ABOUT COMPANY.

(a) FAIP will provide to Company at least one (1) complete

copy of

all SEC registration statements, FAIP Prospectuses,

reports,

any preliminary and final proxy material, applications

for

exemptions, requests for no-action letters, and all

amendments

to any of the above, that relate to FAIP or the Shares

of a

Fund, contemporaneously with the filing of such

document with

the SEC or other regulatory authorities.

(b) FAIP will provide to Company camera ready or computer

diskette

copies of all FAIP prospectuses and printed copies, in

an

amount specified by Company, of FAIP statements of

additional

information, proxy materials, periodic reports to

shareholders

and other materials required by law to be sent to

Participants

who have allocated any Contract value to a Fund. FAIP

will

provide such copies to Company in a timely manner so

as to

enable Company, as the case may be, to print and

distribute

such materials within the time required by law to be

furnished

to Participants.

(c) FAIP will provide to Company or its designated agent

at least

one (1) complete copy of each piece of sales

literature or

other promotional material in which Company, or any of

its

respective affiliates is named, or that refers to the

Contracts, at least five (5) Business Days prior to

its use or

such shorter period as the Parties hereto may, from

time to

time, agree upon. No such material shall be used if

Company or

its designated agent objects to such use within five

(5)

Business Days after receipt of such material or such

shorter

period as the Parties hereto may, from time to time,

agree

upon. Company shall receive all such sales literature

until

such time as it appoints a designated agent by giving

notice

to FAIP in the manner required by Section 9 hereof.

(d) Neither FAIP nor any of its affiliates will give any

information or make any representations or statements

on

behalf of or concerning Company, each Account, or the

Contracts other than (i) the information or

representations

contained in the registration statement, including

each

Account Prospectus contained therein, relating to the

Contracts, as such registration statement and Account

Prospectus may be amended from time to time; or (ii)

in

published reports for the Account or the Contracts

that are in

the public domain and approved by Company for

distribution; or

(iii) in sales literature or other promotional

material

approved by Company or its affiliates, except with the

express

written permission of Company.

(e) FAIP shall cause its principal underwriter to adopt

and

implement procedures reasonably designed to ensure

that

information concerning Company, and its respective

affiliates

that is intended for use only by brokers or agents

selling the

75

Contracts (i.e., information that is not intended for

distribution to Participants) ("broker only

materials") is so

used, and neither Company, nor any of its respective

affiliates shall be liable for any losses, damages or

expenses

relating to the improper use of such broker only

materials.

(f) For purposes of this Section 4.6, the phrase "sales

literature

or other promotional material" includes, but is not

limited

to, advertisements (such as material published, or

designed

for use in, a newspaper, magazine, or other

periodical, radio,

television, telephone or tape recording, videotape

display,

signs or billboards, motion pictures, or other public

media,

(e.g., on-line networks such as the Internet or other

electronic messages), sales literature (i.e., any

written

communication distributed or made generally available

to

customers or the public, including brochures,

circulars,

research reports, market letters, form letters,

seminar texts,

reprints or excerpts of any other advertisement, sales

literature, or published article), educational or

training

materials or other communications distributed or made

generally available to some or all agents or

employees,

registration statements, prospectuses, statements of

additional information, shareholder reports, and proxy

materials and any other material constituting sales

literature

or advertising under the NASD rules, the 1933 Act or

the 1940

Act.

SECTION 5. MIXED AND SHARED FUNDING

5.1 GENERAL.

The SEC has granted an order to FAIP exempting it from certain

provisions of the 1940 Act and rules thereunder so that FAIP may be

available

for investment by certain other entities, including, without limitation,

separate accounts funding variable annuity contracts or variable life

insurance

contracts, separate accounts of insurance companies unaffiliated with

Company,

and trustees of qualified pension and retirement plans (collectively,

"Mixed and

Shared Funding"). The Parties recognize that the SEC has imposed terms

and

conditions for such orders that are substantially identical to many of

the

provisions of this Section 5. FAIP hereby notifies Company that, in the

event

that FAIP implements Mixed and Shared Funding, it may be appropriate to

include

in the prospectus pursuant to which a Contract is offered disclosure

regarding

the potential risks of Mixed and Shared Funding.

5.2 DISINTERESTED DIRECTORS.

FAIP agrees that a majority of the Board of Directors of the

FAIP

("Board") will consist of persons who are not "interested persons" of

the

Company, as defined by Section 2(a)(19) of the 1940 Act and the rules

thereunder

and as modified by any applicable orders of the SEC ("Disinterested

Directors"),

except that if this condition is not met by reason of the death,

disqualification, or bona fide resignation of any director, then the

operation

of this condition shall be suspended (a) for a period of forty-five (45)

days if

the vacancy or vacancies may be filled by the Board; (b) for a period of

sixty

(60) days if a vote of shareholders is required to fill the vacancy or

vacancies; or (c) for such longer period as the SEC may prescribe by

order upon

application.

5.3 MONITORING FOR MATERIAL IRRECONCILABLE CONFLICTS.

76

FAIP agrees that its Board of Directors will monitor the Funds

for the

existence of any material irreconcilable conflict between the interests

of the

Participants in all separate accounts of life insurance companies

utilizing FAIP

("Participating Insurance Companies"), including each Account, and of

participants in qualified retirement and pension plans investing in the

Funds

("Participating Plans") and determine what action, if any, should be

taken in

response to such conflicts. A material irreconcilable conflict may arise

for a

variety of reasons, including:

(a) an action by any state insurance or other regulatory

authority;

(b) a change in applicable federal or state insurance, tax

or

securities laws or regulations, or a public ruling,

private

letter ruling, no-action or interpretative letter, or

any

similar action by insurance, tax or securities

regulatory

authorities;

(c) an administrative or judicial decision in any relevant

proceeding;

(d) the manner in which the investments of any Fund are

being

managed;

(e) a difference in voting instructions given by variable

annuity

contract and variable life insurance contract

Participants or

by Participants in Participating Plans;

(f) a decision by a Participating Insurance Company to

disregard

the voting instructions of Participant; or

(g) a decision by a Participating Plan to disregard the

voting

instructions of its Participants.

Consistent with the SEC's requirements in connection with

exemptive

orders of the type referred to in Section 5.1 hereof, FAIP and Company

will

report any potential or existing conflicts to the Board and will be

responsible

for assisting the Board in carrying out its responsibilities under these

conditions by providing the Board with all information reasonably

necessary for

the Board to consider any issues raised. This responsibility includes,

but is

not limited to, an obligation of Company to inform the Board whenever it

has

determined to disregard Participant voting instructions. Company agrees

that

such responsibilities will be carried out with a view only to the

interests of

Participants.

5.4 CONFLICT REMEDIES.

(a) It is agreed that if it is determined by a majority of

the

members of the Board of Directors or a majority of its

Disinterested Directors that a material irreconcilable

conflict exists, Company will, if it is a

Participating

Insurance Company for which a material irreconcilable

conflict

is relevant, at its own expense and to the extent

reasonably

practicable (as determined by a majority of the

Disinterested

Directors), take whatever steps are necessary to

remedy or

eliminate the material irreconcilable conflict, which

steps

may include, but are not limited to:

77

(i) withdrawing the assets allocable to some or

all of

the Accounts from FAIP or any Fund and

reinvesting

such assets in a different investment medium,

including another Fund of FAIP, or submitting

the

question whether such segregation should be

implemented to a vote of all affected

Participants

and, as appropriate, segregating the assets

of any

particular group (e.g., variable annuity

contract

owners or variable life insurance contract

owners

that votes in favor of such segregation, or

offering

to the affected contract owners the option of

making

such a change; and

(ii) establishing a new registered management

investment

company or a new separate account that is

operated as

a management company.

(b) If the material irreconcilable conflict arises because

of

Company's decision to disregard Participants' voting

instructions and that decision represents a minority

position

or would preclude a majority vote, Company may be

required, at

FAIP's election, to withdraw each Account's investment

in FAIP

or any Fund. No charge or penalty will be imposed as a

result

of such withdrawal. Any such withdrawal must take

place within

six (6) months after FAIP gives notice to Company that

this

provision is being implemented, and until such

withdrawal FAIP

shall continue to accept and implement orders by

Company for

the purchase and redemption of Shares of FAIP.

(c) If a material irreconcilable conflict arises because a

particular state insurance regulator's decision

applicable to

Company conflicts with the majority of other state

regulators,

then Company will withdraw each Account's investment

in FAIP

within six (6) months after FAIP's Board of Directors

informs

Company that it has determined that such decision has

created

a material irreconcilable conflict, and until such

withdrawal

FAIP shall continue to accept and implement orders by

Company

for the purchase and redemption of Shares of FAIP. No

charge

or penalty will be imposed as a result of such

withdrawal.

(d) Company agrees that any remedial action taken by it in

resolving any material irreconcilable conflict will be

carried

out at its expense and with a view only to the

interests of

Participants.

(e) For purposes hereof, a majority of the Disinterested

Directors

will determine whether or not any proposed action

adequately

remedies any material irreconcilable conflict. In no

event,

however, will FAIP or any of its affiliates be

required to

establish a new funding medium for any Contracts.

Company will

not be required by the terms hereof to establish a new

funding

medium for any Contracts if an offer to do so has been

declined by vote of a majority of Participants

materially

adversely affected by the material irreconcilable

conflict.

(f) The Board's determination of the existence of a

material

irreconcilable conflict and its implications will be

made

known promptly and in writing to all Participants.

78

5.5 NOTICE TO COMPANY.

FAIP will promptly make known in writing to Company the Board

of

Directors' determination of the existence of a material irreconcilable

conflict,

a description of the facts that give rise to such conflict and the

implications

of such conflict.

5.6 INFORMATION REQUESTED BY BOARD OF DIRECTORS.

Company and FAIP (or its investment adviser) will at least

annually

submit to the Board of Directors of FAIP such reports, materials or data

as the

Board of Directors may reasonably request so that the Board of Directors

may

fully carry out the obligations imposed upon it by the provisions hereof

or any

exemptive order granted by the SEC to permit Mixed and Shared Funding,

and said

reports, materials and data will be submitted at any reasonable time

deemed

appropriate by the Board of Directors. All reports received by the Board

of

Directors of potential or existing conflicts, and all Board of Directors

actions

with regard to determining the existence of a conflict, notifying

Participating

Insurance Companies and Participating Plans of a conflict, and

determining

whether any proposed action adequately remedies a conflict, will be

properly

recorded in the minutes of the Board of Directors or other appropriate

records,

and such minutes or other records will be made available to the SEC upon

request.

5.7 COMPLIANCE WITH SEC RULES.

If and to the extent that Rules 6e-2 and 6e-3(T) under the 1940

Act are

amended (or if Rule 6e-3 under the 1940 Act is adopted) to provide

exemptive

relief from any provision of the 1940 Act, or the rules thereunder, with

respect

to mixed or shared funding on terms and conditions materially different

from any

exemptions granted in the order obtained by FAIP, then the FAIP and/or

Company,

as appropriate, shall take such steps as may be necessary to comply with

Rules

6e-2 and 6e-3(T), as amended, or Rule 6e-3, as adopted, to the extent

applicable.

5.8 OTHER REQUIREMENTS.

FAIP will require that each Participating Insurance Company and

Participating Plan enter into an agreement with FAIP that contains in

substance

the same provisions as are set forth in Sections 4.1(b), 4.1(d), 4.3(a),

4.4(b),

4.5(a), 5, and 10 of this Agreement.

79

SECTION 6. TERMINATION

6.1 EVENTS OF TERMINATION.

Subject to Section 6.4 below, this Agreement will terminate as

to a

Fund:

(a) at the option of any Party, with or without cause with

respect

to the Fund, upon six (6) months advance written

notice to the

other Parties, or, if later, upon receipt of any

required

exemptive relief from the SEC, unless otherwise agreed

to in

writing by the Parties; or

(b) at the option of FAIP upon institution of formal

proceedings

against Company or any of its affiliates by the NASD,

the SEC,

any state insurance regulator or any other regulatory

body

regarding Company's obligations under this Agreement

or

related to the sale of the Contracts, the operation of

any

Account, or the purchase of Shares, if, in each case,

FAIP

reasonably determines that such proceedings, or the

facts on

which such proceedings would be based, have a material

likelihood of imposing material adverse consequences

on the

Fund with respect to which the Agreement is to be

terminated;

or

(c) at the option of Company upon institution of formal

proceedings against FAIP, its principal underwriter,

or its

investment adviser by the NASD, the SEC, or any state

insurance regulator or any other regulatory body

regarding

FAIP's obligations under this Agreement or related to

the

operation or management of FAIP or the purchase of

Fund

Shares, if, in each case, Company reasonably

determines that

such proceedings, or the facts on which such

proceedings would

be based, have a material likelihood of imposing

material

adverse consequences on Company, or the Subaccount

corresponding to the Fund with respect to which the

Agreement

is to be terminated; or

(d) at the option of any Party in the event that (i) the

Fund's

Shares are not registered and, in all material

respects,

issued and sold in accordance with any applicable

federal or

state law, or (ii) such law precludes the use of such

Shares

as an underlying investment medium of the Contracts

issued or

to be issued by Company; or

(e) upon termination of the corresponding Subaccount's

investment

in the Fund pursuant to Section 5 hereof; or

(f) at the option of Company if the Fund ceases to qualify

as a

RIC under Subchapter M of the Code or under successor

or

similar provisions, or if Company reasonably believes

that the

Fund may fail to so qualify; or

(g) at the option of Company if the Fund fails to comply

with

Section 817(h) of the Code or with successor or

similar

provisions, or if Company reasonably believes that the

Fund

may fail to so comply; or

80

(h) at the option of FAIP if the Contracts issued by

Company cease

to qualify as annuity contracts or life insurance

contracts

under the Code (other than by reason of the Fund's

noncompliance with Section 817(h) or Subchapter M of

the Code)

or if interests in an Account under the Contracts are

not

registered, where required, and, in all material

respects, are

not issued or sold in accordance with any applicable

federal

or state law; or

(i) upon another Party's material breach of any provision

of this

Agreement.

6.2 NOTICE REQUIREMENT FOR TERMINATION.

No termination of this Agreement will be effective unless and

until the

Party terminating