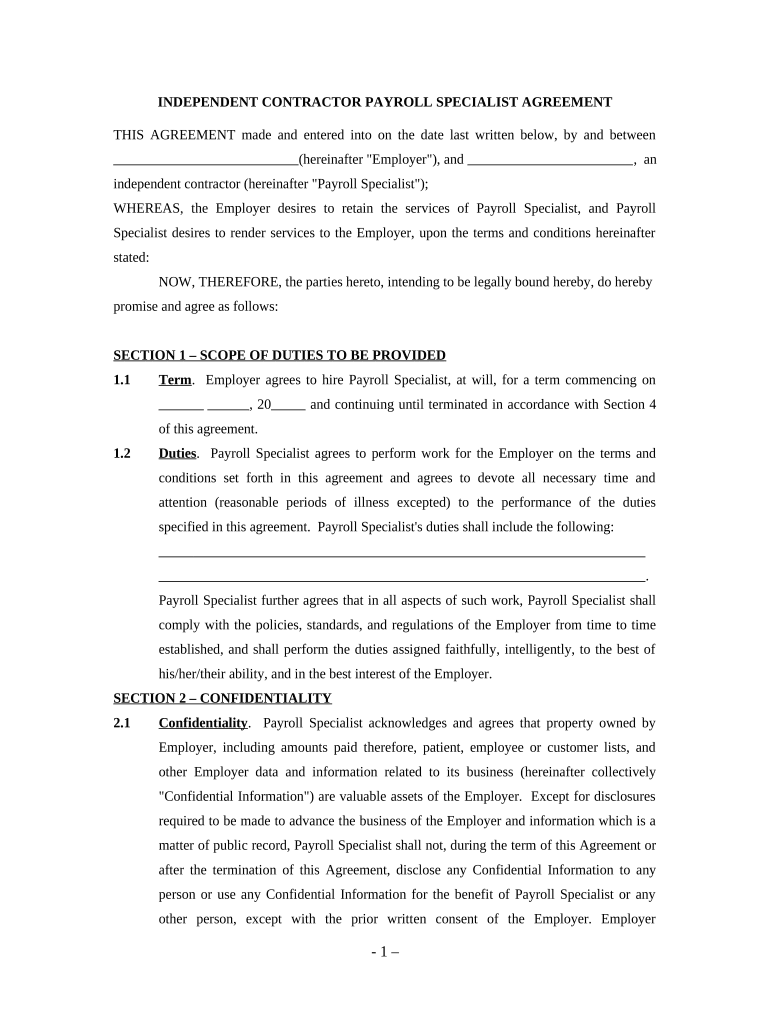

Fill and Sign the Payroll Independent Contractor Form

Practical advice on setting up your ‘Payroll Independent Contractor’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and enterprises. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign documents online. Utilize the robust features included in this intuitive and cost-effective platform and transform your document management strategy. Whether you need to sign documents or collect eSignatures, airSlate SignNow takes care of it all effortlessly, requiring only a few clicks.

Follow this detailed guide:

- Access your account or sign up for a free trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our form repository.

- Edit your ‘Payroll Independent Contractor’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your Payroll Independent Contractor or send it for notarization—our platform provides everything necessary to accomplish these tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is airSlate SignNow and how does it support Payroll Independent Contractors?

airSlate SignNow is a digital signing solution designed to streamline document management for businesses, including Payroll Independent Contractors. It enables users to easily send, sign, and manage contracts electronically, which enhances efficiency and reduces paperwork. By using airSlate SignNow, Payroll Independent Contractors can ensure timely document processing and secure electronic signatures.

-

How can airSlate SignNow help me manage my Payroll Independent Contractor agreements?

With airSlate SignNow, managing Payroll Independent Contractor agreements becomes seamless. Users can create templates for common contracts, send them for signature, and track their status in real-time. This feature not only saves time but also ensures that all agreements are legally binding and easily accessible.

-

What are the pricing options for airSlate SignNow for Payroll Independent Contractors?

airSlate SignNow offers flexible pricing plans suitable for Payroll Independent Contractors. Each plan is designed to accommodate varying needs, from basic document signing to advanced features for teams. By choosing airSlate SignNow, Payroll Independent Contractors can find a cost-effective solution that fits their budget and business requirements.

-

Does airSlate SignNow integrate with other tools I use for managing Payroll Independent Contractors?

Yes, airSlate SignNow integrates seamlessly with a variety of tools commonly used by Payroll Independent Contractors, including Google Drive, Dropbox, and CRM systems. These integrations allow for a more streamlined workflow, enabling users to manage documents from multiple platforms without hassle. This connectivity enhances productivity and simplifies the management of contracts and agreements.

-

What security measures does airSlate SignNow implement for Payroll Independent Contractor documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents related to Payroll Independent Contractors. The platform uses advanced encryption methods, secure servers, and compliance with international data protection regulations. This ensures that all signed documents are safe from unauthorized access and bsignNowes.

-

Can I use airSlate SignNow on mobile devices for Payroll Independent Contractor tasks?

Absolutely! airSlate SignNow offers a mobile-friendly platform that allows Payroll Independent Contractors to manage their documents on-the-go. Whether you’re sending contracts for signature or reviewing agreements, the mobile app provides full functionality, ensuring you can work efficiently from anywhere.

-

What are the benefits of using airSlate SignNow for Payroll Independent Contractors?

Using airSlate SignNow provides numerous benefits for Payroll Independent Contractors, including faster contract turnaround times, enhanced organization, and reduced paperwork. The user-friendly interface makes it easy to navigate, while the electronic signature feature ensures that agreements are legally binding. Overall, it empowers Payroll Independent Contractors to focus more on their work rather than administrative tasks.

The best way to complete and sign your payroll independent contractor form

Find out other payroll independent contractor form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles