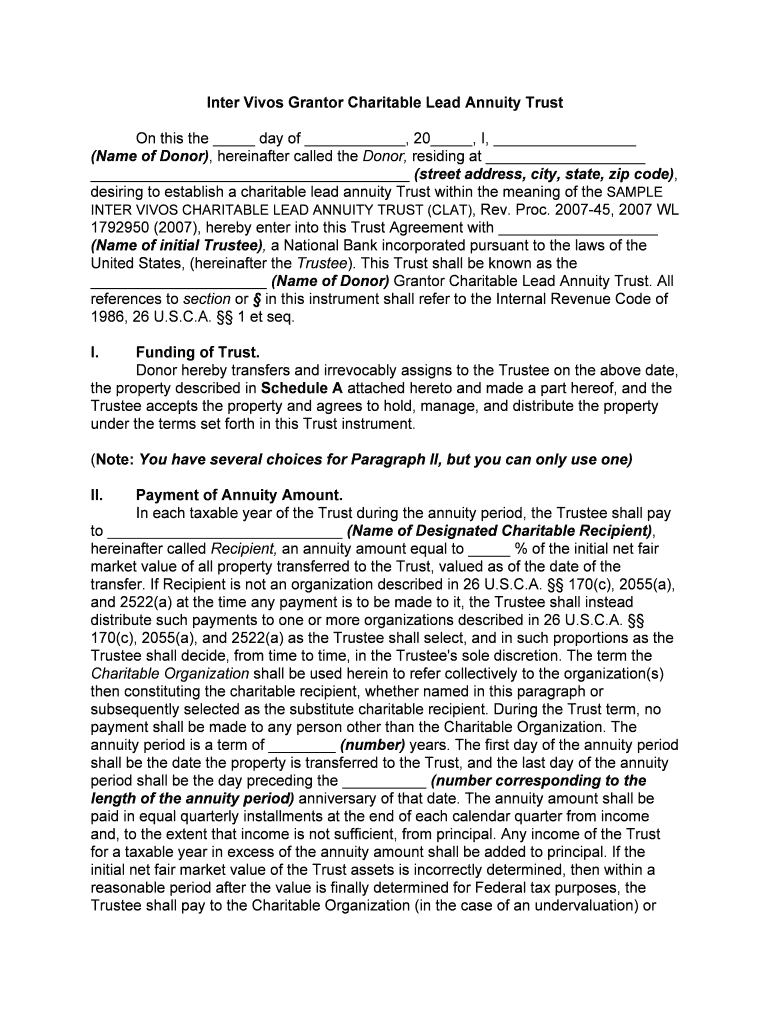

Inter Vivos Grantor Charitable Lead Annuity Trust On this the _____ day of ____________, 20_____, I, _________________

(Name of Donor), hereinafter called the Donor, residing at ___________________

______________________________________ (street address, city, state, zip code), desiring to establish a charitable lead annuity Trust within the meaning of the SAMPLE

INTER VIVOS CHARITABLE LEAD ANNUITY TRUST (CLAT), Rev. Proc. 2007-45, 2007 WL

1792950 (2007), hereby enter into this Trust Agreement with ___________________

(Name of initial Trustee), a National Bank incorporated pursuant to the laws of the

United States, (hereinafter the Trustee). This Trust shall be known as the

_____________________ (Name of Donor) Grantor Charitable Lead Annuity Trust. All

references to section or § in this instrument shall refer to the Internal Revenue Code of

1986, 26 U.S.C.A. §§ 1 et seq.I. Funding of Trust. Donor hereby transfers and irrevocably assigns to the Trustee on the above date,

the property described in Schedule A attached hereto and made a part hereof, and the

Trustee accepts the property and agrees to hold, manage, and distribute the property

under the terms set forth in this Trust instrument. (Note: You have several choices for Paragraph II, but you can only use one) II. Payment of Annuity Amount. In each taxable year of the Trust during the annuity period, the Trustee shall pay

to ____________________________ (Name of Designated Charitable Recipient),

hereinafter called Recipient, an annuity amount equal to _____ % of the initial net fair

market value of all property transferred to the Trust, valued as of the date of the

transfer. If Recipient is not an organization described in 26 U.S.C.A. §§ 170(c), 2055(a),

and 2522(a) at the time any payment is to be made to it, the Trustee shall instead

distribute such payments to one or more organizations described in 26 U.S.C.A. §§

170(c), 2055(a), and 2522(a) as the Trustee shall select, and in such proportions as the

Trustee shall decide, from time to time, in the Trustee's sole discretion. The term the

Charitable Organization shall be used herein to refer collectively to the organization(s)

then constituting the charitable recipient, whether named in this paragraph or

subsequently selected as the substitute charitable recipient. During the Trust term, no

payment shall be made to any person other than the Charitable Organization. The

annuity period is a term of ________ (number) years. The first day of the annuity period

shall be the date the property is transferred to the Trust, and the last day of the annuity

period shall be the day preceding the __________ (number corresponding to the

length of the annuity period) anniversary of that date. The annuity amount shall be

paid in equal quarterly installments at the end of each calendar quarter from income

and, to the extent that income is not sufficient, from principal. Any income of the Trust

for a taxable year in excess of the annuity amount shall be added to principal. If the

initial net fair market value of the Trust assets is incorrectly determined, then within a

reasonable period after the value is finally determined for Federal tax purposes, the

Trustee shall pay to the Charitable Organization (in the case of an undervaluation) or

receive from the Charitable Organization (in the case of an overvaluation) an amount

equal to the difference between the annuity amount(s) properly payable and the annuity

amount(s) actually paid.(OR):II. Payment of Annuity Amount. In each taxable year of the Trust during the annuity period, the Trustee shall pay

to ____________________________ (Name of Designated Charitable Recipient),

hereinafter called Recipient, an annuity amount equal to _____% of the initial net fair

market value of all property transferred to the Trust, valued as of the date of the

transfer. If Recipient is not an organization described in 26 U.S.C.A. §§ 170(c), 2055(a),

and 2522(a) at the time any payment is to be made to it, the Trustee shall instead

distribute such payments to one or more organizations described in 26 U.S.C.A. §§

170(c), 2055(a), and 2522(a) as the Trustee shall select, and in such proportions as the

Trustee shall decide, from time to time, in the Trustee's sole discretion. The term the

Charitable Organization shall be used herein to refer collectively to the organization(s)

then constituting the charitable recipient, whether named in this Paragraph or

subsequently selected as the substitute charitable recipient. During the Trust term, no

payment shall be made to any person other than the Charitable Organization. The

annuity period is a term of _________ (number) years. The annuity period is the

lifetime of _________________ (Name of designated measuring life) . The first day of

the annuity period shall be the date the property is transferred to the Trust, and the last

day of the annuity period shall be the date of death of _________________ (Name of

designated measuring life). Any income of the Trust for a taxable year in excess of

the annuity amount shall be added to principal. If the initial net fair market value of the

Trust assets is incorrectly determined, then within a reasonable period after the value is

finally determined for federal tax purposes, the Trustee shall pay to the Charitable

Organization (in the case of an undervaluation) or receive from the Charitable

Organization (in the case of an overvaluation) an amount equal to the difference

between the annuity amount(s) properly payable and the annuity amount(s) actually

paid. (OR):II. Payment of Annuity Amount. In each taxable year of the Trust during the annuity period, the Trustee shall pay

to _____________________________ (Name of Designated Charitable Recipient),

hereinafter called Recipient, an annuity amount equal to ______% of the initial net fair

market value of all property transferred to the Trust, valued as of the date of the

transfer. If Recipient is not an organization described in 26 U.S.C.A. §§ 170(c), 2055(a),

and 2522(a) at the time any payment is to be made to it, the Trustee shall instead

distribute such payments to one or more organizations described in 26 U.S.C.A. §§

170(c), 2055(a), and 2522(a) as the Trustee shall select, and in such proportions as the

Trustee shall decide, from time to time, in the Trustee's sole discretion. Notwithstanding

the preceding sentence, the Donor reserves the right to designate as the charitable

annuity recipient, at any time and from time to time, in lieu of Recipient, one or more

organizations described in 26 U.S.C.A. §§ 170(c), 2055(a), and 2522(a) and shall make

any such designation by giving written notice to the Trustee. The term the Charitable

Organization shall be used herein to refer collectively to the organization(s) then

constituting the charitable recipient, whether named in this Paragraph or subsequently

selected as the substitute charitable recipient. During the Trust term, no payment shall

be made to any person other than the Charitable Organization. The annuity period is a

term of _______ (number) years. The first day of the annuity period shall be the date

the property is transferred to the Trust, and the last day of the annuity period shall be

the day preceding the _________ (ordinal number corresponding to the length of

the annuity period) anniversary of that date. The annuity amount shall be paid in equal

quarterly installments at the end of each calendar quarter from income and, to the

extent that income is not sufficient, from principal. Any income of the Trust for a taxable

year in excess of the annuity amount shall be added to principal. If the initial net fair

market value of the Trust assets is incorrectly determined, then within a reasonable

period after the value is finally determined for federal tax purposes, the Trustee shall

pay to the Charitable Organization (in the case of an undervaluation) or receive from the

Charitable Organization (in the case of an overvaluation) an amount equal to the

difference between the annuity amount(s) properly payable and the annuity amount(s)

actually paid.(OR:)II. Payment of Annuity Amount. In each taxable year of the Trust during the annuity period, the Trustee shall pay

to one or more members of a class comprised of organizations described in 26 U.S.C.A.

§§ 170(c), 2055(a), and 2522(a) (hereinafter, collectively the Charitable Organization )

an annuity amount equal to ____% of the initial net fair market value of all property

transferred to the Trust, valued as of the date of the transfer. The Trustee may pay the

annuity amount to one or more members of the class, in equal or unequal shares, as

the Trustee, in the Trustee's sole discretion, from time to time may deem advisable.

During the Trust term, no payment shall be made to any person other than the

Charitable Organization. The annuity period is a term of _____ (number) years. The

first day of the annuity period shall be the date the property is transferred to the Trust,

and the last day of the annuity period shall be the day preceding the _______ (ordinal

number corresponding to the length of the annuity period) anniversary of that date.

The annuity amount shall be paid in equal quarterly installments at the end of each

calendar quarter from income and, to the extent that income is not sufficient, from

principal. Any income of the Trust for a taxable year in excess of the annuity amount

shall be added to principal. If the initial net fair market value of the Trust assets is

incorrectly determined, then within a reasonable period after the value is finally

determined for federal tax purposes, the Trustee shall pay to the Charitable

Organization (in the case of an undervaluation) or receive from the Charitable

Organization (in the case of an overvaluation) an amount equal to the difference

between the annuity amount(s) properly payable and the annuity amount(s) actually

paid.

(OR:)II. Payment of Annuity Amount. In each taxable year of the Trust during the annuity period, the Trustee shall pay

to _____________________________ (Name of Designated Charitable Recipient),

hereinafter called Recipient, an annuity amount equal to $_____________. If Recipient

is not an organization described in 26 U.S.C.A. §§ 170(c), 2055(a), and 2522(a) at the

time any payment is to be made to it, the Trustee shall instead distribute such payments

to one or more organizations described in 26 U.S.C.A. §§ 170(c), 2055(a), and 2522(a)

as the Trustee shall select, and in such proportions as the Trustee shall decide, from

time to time, in the Trustee's sole discretion. The term the Charitable Organization shall

be used herein to refer collectively to the organization(s) then constituting the charitable

recipient, whether named in this Paragraph or subsequently selected as the substitute

charitable recipient. During the Trust term, no payment shall be made to any person

other than the Charitable Organization. The annuity period is a term of _____ (number)

years. The first day of the annuity period shall be the date the property is transferred to

the Trust, and the last day of the annuity period shall be the day preceding the ______

(number) anniversary of that date. The annuity amount shall be paid in equal quarterly

installments at the end of each calendar quarter from income and, to the extent that

income is not sufficient, from principal. Any income of the Trust for a taxable year in

excess of the annuity amount shall be added to principal. (OR:)II. Payment of Annuity Amount. In each taxable year of the Trust during the annuity period, the Trustee shall pay

to ____________________________ (Name of Designated Charitable Recipient),

hereinafter called Recipient, an annuity amount equal to _____% of the initial net fair

market value of all property transferred to the Trust, valued as of the date of the

transfer. If Recipient is not an organization described in 26 U.S.C.A. §§ 170(c), 2055(a),

and 2522(a) at the time any payment is to be made to it, the Trustee shall instead

distribute such payments to ____________________ (Name of Designated Substitute

Charitable Recipient). If neither _________________________ (Name of Designated

Charitable Recipient) nor ____________________ (Name of Designated Substitute

Charitable Recipient) is an organization described in 26 U.S.C.A. §§ 170(c), 2055(a),

and 2522(a) at the time any payment is to be made to it, the Trustee shall instead

distribute such payments to one or more organizations described in 26 U.S.C.A. §§

170(c), 2055(a), and 2522(a) as the Trustee shall select, and in such proportions as the

Trustee shall decide, from time to time, in the Trustee's sole discretion. The term the

Charitable Organization shall be used herein to refer collectively to the organization(s)

then constituting the charitable recipient, whether named in this paragraph or

subsequently selected as the substitute charitable recipient. During the Trust term, no

payment shall be made to any person other than the Charitable Organization. The

annuity period is a term of _______ (number) years. The first day of the annuity period

shall be the date the property is transferred to the Trust, and the last day of the annuity

period shall be the day preceding the ________ (ordinal number corresponding to

the length of the annuity period) anniversary of that date. The annuity amount shall

be paid in equal quarterly installments at the end of each calendar quarter from income

and, to the extent that income is not sufficient, from principal. Any income of the Trust

for a taxable year in excess of the annuity amount shall be added to principal. If the

initial net fair market value of the Trust assets is incorrectly determined, then within a

reasonable period after the value is finally determined for federal tax purposes, the

Trustee shall pay to the Charitable Organization (in the case of an undervaluation) or

receive from the Charitable Organization (in the case of an overvaluation) an amount

equal to the difference between the annuity amount(s) properly payable and the annuity

amount(s) actually paid.III. Proration of Annuity Amount. The Trustee shall prorate the annuity amount on

a daily basis for any short taxable year. In the taxable year in which the annuity period

ends, the Trustee shall prorate the annuity amount on a daily basis for the number of

days of the annuity period in that taxable year.IV. Distribution upon Termination of Annuity Period. At the termination of the annuity period, the Trustee shall distribute all of the

principal and income of the Trust (other than any amount due to the Charitable

Organization under the provisions above) to ____________________ (Name of

Remainder Beneficiary). V. Additional Contributions. No additional contributions shall be made to the Trust after the initial contribution. VI. Prohibited Transactions. The Trustee shall not engage in any act of self-dealing within the meaning of 26

U.S.C.A. § 4941(d), as modified by 26 U.S.C.A. § 4947(a)(2), and shall not make any

taxable expenditures within the meaning of 26 U.S.C.A. § 4945(d), as modified by 26

U.S.C.A. § 4947(a)(2). The Trustee shall not retain any excess business holdings that

would subject the Trust to tax under 26 U.S.C.A. § 4943, as modified by 26 U.S.C.A. §

4947(a)(2) and (b)(3). In addition, the Trustee shall not acquire any assets that would

subject the Trust to tax under 26 U.S.C.A. § 4944, as modified by 26 U.S.C.A. §

4947(a)(2) and (b)(3), or retain assets which, if acquired by the Trustee, would subject

the Trustee to tax under 26 U.S.C.A. § 4944, as modified by 26 U.S.C.A. § 4947(a)(2)

and (b)(3). VII. Taxable Year. The taxable year of the Trust shall be the calendar year. VIII. Governing Law. The operation of the Trust shall be governed by the laws of the State of

______________ (Name of State). However, the Trustee is prohibited from exercising

any power or discretion granted under said laws that would be inconsistent with the

requirements for the charitable deductions available for contributions to a charitable

lead annuity trust.

IX. Limited Power of Amendment. This Trust is irrevocable. However, the Trustee shall have the power, acting

alone, to amend the Trust from time to time in any manner required for the sole purpose

of ensuring that the annuity interest passing to the Charitable Organization is a

guaranteed annuity interest under 26 U.S.C.A. §§ 170(f)(2)(B), 2055(e)(2)(B), and

2522(c)(2)(B) and the regulations thereunder. IX. Investment of Trust Assets. Except as provided in Paragraph VI herein, nothing in this Trust instrument shall

be construed to restrict the Trustee from investing the Trust assets in a manner that

could result in the annual realization of a reasonable amount of income or gain from the

sale or disposition of Trust assets. XI. Retained Powers and Interests. During the Donor's life, _______________________ (Name of individual other

than the Donor), the Trustee, or a disqualified person as defined in 26 U.S.C.A. §

4946(a)(1) shall have the right, exercisable only in a nonfiduciary capacity and without

the consent or approval of any person acting in a fiduciary capacity, to acquire any

property held in the Trust by substituting other property of equivalent value.WITNESS our signatures as of the day and date first above stated. ______________________ (Name of Initial Trustee)

By: ______________________________ ______________________ (Printed Name and Title)(Printed Name of Donor) ______________________________ (Signature of Officer)

Acknowledgments (form of acknowledgment may vary by state)

Attach Schedule A