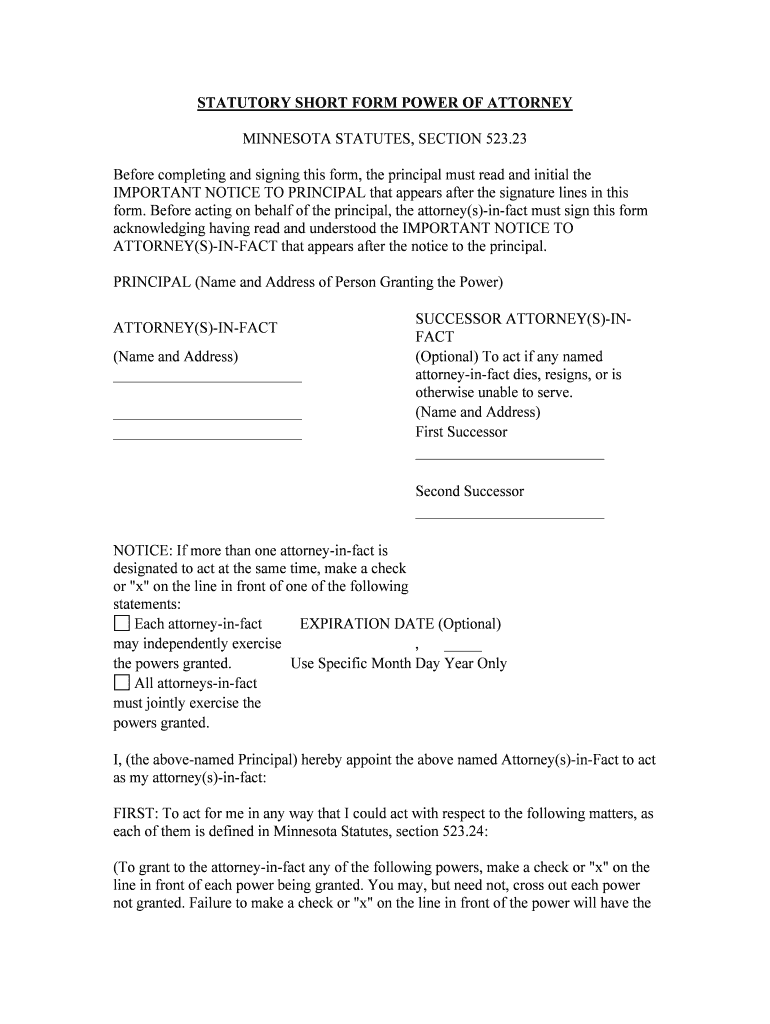

STATUTORY SHORT FORM POWER OF ATTORNEY

MINNESOTA STATUTES, SECTION 523.23

Before completing and signing this form, the principal must read and initial the

IMPORTANT NOTICE TO PRINCIPAL that appears after the signature lines in this

form. Before acting on behalf of the principal, the attorney(s)-in-fact must sign this form

acknowledging having read and understood the IMPORTANT NOTICE TO

ATTORNEY(S)-IN-FACT that appears after the notice to the principal.

PRINCIPAL (Name and Address of Person Granting the Power)

ATTORNEY(S)-IN-FACT SUCCESSOR ATTORNEY(S)-IN-

FACT

(Name and Address) _________________________ (Optional) To act if any named

attorney-in-fact dies, resigns, or is

otherwise unable to serve.

_________________________ (Name and Address)

_________________________ First Successor

_________________________

Second Successor

_________________________

NOTICE: If more than one attorney-in-fact is

designated to act at the same time, make a check

or "x" on the line in front of one of the following

statements:

Each attorney-in-fact EXPIRATION DATE (Optional)

may independently exercise , _____

the powers granted. Use Specific Month Day Year Only

All attorneys-in-fact

must jointly exercise the

powers granted.

I, (the above-named Principal) hereby appoint the above named Attorney(s)-in-Fact to act

as my attorney(s)-in-fact:

FIRST: To act for me in any way that I could act with respect to the following matters, as

each of them is defined in Minnesota Statutes, section 523.24:

(To grant to the attorney-in-fact any of the following powers, make a check or "x" on the

line in front of each power being granted. You may, but need not, cross out each power

not granted. Failure to make a check or "x" on the line in front of the power will have the

effect of deleting the power unless the line in front of the power of (N) is checked or x-

ed.)

(A) real property transactions;

I choose to limit this power to real property in __________________________

County, Minnesota, described as follows:

(Use legal description. Do not use street address.)

(If more space is needed, continue on the back or on an attachment.)

(B) tangible personal property transactions;

(C) bond, share, and commodity transactions;

(D) banking transactions;

(E) business operating transactions;

(F) insurance transactions;

(G) beneficiary transactions;

(H) gift transactions;

(I) fiduciary transactions;

(J) claims and litigation;

(K) family maintenance;

(L) benefits from military service;

(M) records, reports, and statements;

(N) all of the powers listed in (A) through (M) above and all other matters, other

than health care decisions under a health care directive that complies with

Minnesota Statutes, chapter 145C.

SECOND: (You must indicate below whether or not this power of attorney will be

effective if you become incapacitated or incompetent. Make a check or "x" on the line in

front of the statement that expresses your intent.)

This power of attorney shall continue to be effective if I become incapacitated or

incompetent.

This power of attorney shall not be effective if I become incapacitated or

incompetent.

THIRD: My attorney(s)-in-fact MAY NOT make gifts to the attorney(s)-in-fact, or

anyone the attorney(s)-in-fact are legally obligated to support, UNLESS I have made a

check or an "x" on the line in front of the second statement below and I have written in

the name(s) of the attorney(s)-in-fact. The second option allows you to limit the gifting

power to only the attorney(s)-in-fact you name in the statement.

Minnesota Statutes, section 523.24, subdivision 8, clause (2), limits the annual gift(s)

made to my attorney(s)-in-fact, or to anyone the attorney(s)-in-fact are legally obligated

to support, to an amount, in the aggregate, that does not exceed the federal annual gift tax

exclusion amount in the year of the gift.

I do not authorize any of my attorney(s)-in-fact to make gifts to themselves or to

anyone the attorney(s)-in-fact have a legal obligation to support.

I authorize (write in name(s)), as my attorney(s)-in-fact, to make gifts to themselves

or to anyone the attorney(s)-in-fact have a legal obligation to support.

FOURTH: (You may indicate below whether or not the attorney-in-fact is required to

make an accounting. Make a check or "x" on the line in front of the statement that

expresses your intent.)

My attorney-in-fact need not render an accounting unless I request it or the

accounting is otherwise required by Minnesota Statutes, section 523.21.

My attorney-in-fact must render

__________________________ (Monthly, Quarterly, Annual)

accountings to me or

__________________________ __________________________ (Name and Address)

during my lifetime, and a final accounting to the personal

representative of my estate, if any is appointed, after my

death.

In Witness Whereof I have hereunto signed my name this day of,

___________________________

(Signature of Principal)

(Acknowledgment of Principal)

STATE OF MINNESOTA )

) ss.

COUNTY OF )

The foregoing instrument was acknowledged before me this ___. day of .__________, _______ by

__________________________

(Insert Name of Principal)

_____________________________________________

(Signature of Notary Public or other Official)

Acknowledgement of notice to attorney(s)-in-fact and specimen signature of attorney(s)-

in-fact.

By signing below, I acknowledge I have read and understand the IMPORTANT NOTICE

TO ATTORNEY(S)-IN-FACT required by Minnesota Statutes, section 523.23, and

understand and accept the scope of any limitations to the powers and duties delegated to

me by this instrument.

(Notarization not required)

_____________________________________________

This instrument was drafted by: Specimen Signature of Attorney(s)-in-Fact

__________________________ (Notarization not required)

IMPORTANT NOTICE TO THE PRINCIPAL

READ THIS NOTICE CAREFULLY. The power of attorney form that you will be

signing is a legal document. It is governed by Minnesota Statutes, chapter 523. If there is

anything about this form that you do not understand, you should seek legal advice.

PURPOSE: The purpose of the power of attorney is for you, the principal, to give broad

and sweeping powers to your attorney(s)-in-fact, who is the person you designate to

handle your affairs. Any action taken by your attorney(s)-in-fact pursuant to the powers

you designate in this power of attorney form binds you, your heirs and assigns, and the

representative of your estate in the same manner as though you took the action yourself.

POWERS GIVEN: You will be granting the attorney(s)-in-fact power to enter into

transactions relating to any of your real or personal property, even without your consent

or any advance notice to you. The powers granted to the attorney(s)-in-fact are broad and

not supervised. THIS POWER OF ATTORNEY DOES NOT GRANT ANY POWERS

TO MAKE HEALTH CARE DECISIONS FOR YOU. TO GIVE SOMEONE THOSE

POWERS, YOU MUST USE A HEALTH CARE DIRECTIVE THAT COMPLIES

WITH MINNESOTA STATUTES, CHAPTER 145C.

DUTIES OF YOUR ATTORNEY(S)-IN-FACT: Your attorney(s)-in-fact must keep

complete records of all transactions entered into on your behalf. You may request that

your attorney(s)-in-fact provide you or someone else that you designate a periodic

accounting, which is a written statement that gives reasonable notice of all transactions

entered into on your behalf. Your attorney(s)-in-fact must also render an accounting if the

attorney-in-fact reimburses himself or herself for any expenditure they made on behalf of you.

An attorney-in-fact is personally liable to any person, including you, who is injured by an

action taken by an attorney-in-fact in bad faith under the power of attorney or by an

attorney-in-fact's failure to account when the attorney-in-fact has a duty to account under

this section. The attorney(s)-in-fact must act with your interests utmost in mind.

TERMINATION: If you choose, your attorney(s)-in-fact may exercise these powers

throughout your lifetime, both before and after you become incapacitated. However, a

court can take away the powers of your attorney(s)-in-fact because of improper acts. You

may also revoke this power of attorney if you wish. This power of attorney is

automatically terminated if the power is granted to your spouse and proceedings are

commenced for dissolution, legal separation, or annulment of your marriage.

This power of attorney authorizes, but does not require, the attorney(s)-in-fact to act for

you. You are not required to sign this power of attorney, but it will not take effect without

your signature. You should not sign this power of attorney if you do not understand

everything in it, and what your attorney(s)-in-fact will be able to do if you do sign it.

Please place your initials on the following line indicating you have read this

IMPORTANT NOTICE TO THE PRINCIPAL: __________

IMPORTANT NOTICE TO THE ATTORNEY(S)-IN-FACT

You have been nominated by the principal to act as an attorney-in-fact. You are under no

duty to exercise the authority granted by the power of attorney. However, when you do

exercise any power conferred by the power of attorney, you must:

(1) act with the interests of the principal utmost in mind;

(2) exercise the power in the same manner as an ordinarily prudent person of discretion

and intelligence would exercise in the management of the person's own affairs;

(3) render accountings as directed by the principal or whenever you reimburse yourself

for expenditures made on behalf of the principal;

(4) act in good faith for the best interest of the principal, using due care, competence, and

diligence;

(5) cease acting on behalf of the principal if you learn of any event that terminates this

power of attorney or terminates your authority under this power of attorney, such as

revocation by the principal of the power of attorney, the death of the principal, or the

commencement of proceedings for dissolution, separation, or annulment of your marriage

to the principal;

(6) disclose your identity as an attorney-in-fact whenever you act for the principal by

signing in substantially the following manner:

Signature by a person as "attorney-in-fact for (name of the principal)" or "(name of the

principal) by (name of the attorney-in-fact) the principal's attorney-in-fact";

(7) acknowledge you have read and understood this IMPORTANT NOTICE TO THE

ATTORNEY(S)-IN-FACT by signing the power of attorney form.

You are personally liable to any person, including the principal, who is injured by an

action taken by you in bad faith under the power of attorney or by your failure to account

when the duty to account has arisen.

The meaning of the powers granted to you is contained in Minnesota Statutes, chapter

523. If there is anything about this document or your duties that you do not understand,

you should seek legal advice.

Useful advice on setting up your ‘Powers Of Attorney Forms Minnesota Cle’ online

Are you fed up with the burden of handling documents? Look no further than airSlate SignNow, the premier eSignature solution for both individuals and businesses. Bid farewell to the laborious procedure of printing and scanning files. With airSlate SignNow, you can easily complete and sign documents online. Take advantage of the extensive features included in this user-friendly and cost-effective platform to transform your method of document management. Whether you need to sign forms or gather signatures, airSlate SignNow takes care of it all effortlessly, needing only a few clicks.

Follow this comprehensive guide:

- Sign in to your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Edit your ‘Powers Of Attorney Forms Minnesota Cle’ in the editing tool.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to obtain eSignatures from others.

- Download, print your copy, or convert it into a multi-use template.

Don’t fret if you need to work with others on your Powers Of Attorney Forms Minnesota Cle or send it for notarization—our platform offers everything required to accomplish such tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!