Sample Private Placement Memorandum

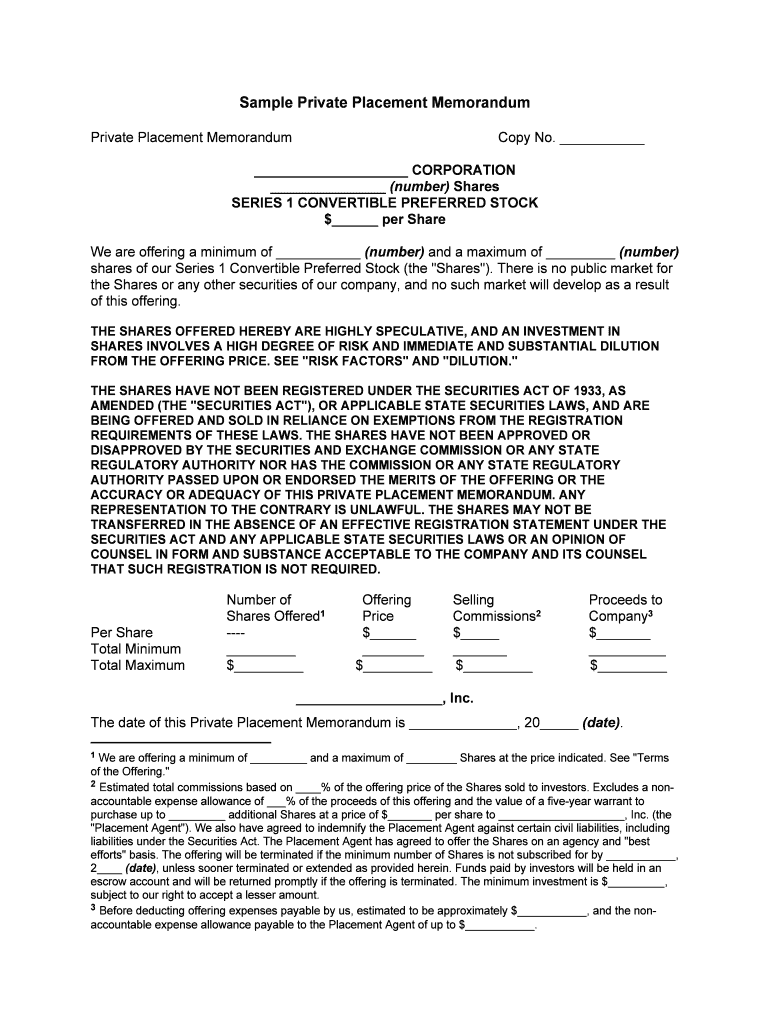

Private Placement Memorandum Copy No. ___________ ____________________ CORPORATION_______________ (number) Shares

SERIES 1 CONVERTIBLE PREFERRED STOCK $______ per Share

We are offering a minimum of ___________ (number) and a maximum of _________ (number)

shares of our Series 1 Convertible Preferred Stock (the "Shares"). There is no public market for

the Shares or any other securities of our company, and no such market will develop as a result

of this offering.

THE SHARES OFFERED HEREBY ARE HIGHLY SPECULATIVE, AND AN INVESTMENT IN

SHARES INVOLVES A HIGH DEGREE OF RISK AND IMMEDIATE AND SUBSTANTIAL DILUTION

FROM THE OFFERING PRICE. SEE "RISK FACTORS" AND "DILUTION."

THE SHARES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS

AMENDED (THE "SECURITIES ACT"), OR APPLICABLE STATE SECURITIES LAWS, AND ARE

BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION

REQUIREMENTS OF THESE LAWS. THE SHARES HAVE NOT BEEN APPROVED OR

DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE

REGULATORY AUTHORITY NOR HAS THE COMMISSION OR ANY STATE REGULATORY

AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE

ACCURACY OR ADEQUACY OF THIS PRIVATE PLACEMENT MEMORANDUM. ANY

REPRESENTATION TO THE CONTRARY IS UNLAWFUL. THE SHARES MAY NOT BE

TRANSFERRED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE

SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS OR AN OPINION OF

COUNSEL IN FORM AND SUBSTANCE ACCEPTABLE TO THE COMPANY AND ITS COUNSEL

THAT SUCH REGISTRATION IS NOT REQUIRED.

Number of Offering Selling Proceeds to

Shares Offered1

Price Commissions 2

Company 3

Per Share ---- $______ $_____ $_______

Total Minimum _________ ________ _______ __________

Total Maximum $_________ $_________ $_________ $_________

___________________, Inc.

The date of this Private Placement Memorandum is ______________, 20_____ (date).

1

We are offering a minimum of _________ and a maximum of ________ Shares at the price indicated. See "Terms

of the Offering." 2 Estimated total commissions based on ____% of the offering price of the Shares sold to investors. Excludes a non-

accountable expense allowance of ___% of the proceeds of this offering and the value of a five-year warrant to

purchase up to _________ additional Shares at a price of $_______ per share to ____________________, Inc. (the

"Placement Agent"). We also have agreed to indemnify the Placement Agent against certain civil liabilities, including

liabilities under the Securities Act. The Placement Agent has agreed to offer the Shares on an agency and "best

efforts" basis. The offering will be terminated if the minimum number of Shares is not subscribed for by ___________, 2____ (date), unless sooner terminated or extended as provided herein. Funds paid by investors will be held in an

escrow account and will be returned promptly if the offering is terminated. The minimum investment is $_________,

subject to our right to accept a lesser amount. 3 Before deducting offering expenses payable by us, estimated to be approximately $___________, and the non-

accountable expense allowance payable to the Placement Agent of up to $___________.

No person has been authorized to give any information or to make any representations

in connection with the offer made by this private placement memorandum, nor has any person

been authorized to give any information or make any representations other than those

contained in this private placement memorandum, and if given or made, such information or

representations must not be relied upon. This private placement memorandum does not

constitute an offer to sell or solicitation of an offer to buy in any jurisdiction in which

such offer or solicitation would be unlawful or to any person to whom it is unlawful to make such

offer or solicitation. Neither the delivery of this private placement memorandum nor any sale

made hereunder shall, under any circumstances, create an implication that there as has been

no change in the affairs of our company since the date hereof.

This private placement memorandum is submitted on a confidential basis for use by a

limited number solely in consideration of the purchase of the Shares described herein in a

private placement. The acceptance of this private placement memorandum constitutes an

agreement on the part of the recipient hereof and the recipient's representatives to maintain the

confidentiality of the information contained herein. This private placement memorandum may

not be reproduced in whole or in part. The use of this private placement memorandum for any

purpose other than an investment in the Shares described herein is not authorized and is

prohibited.

Table of Contents Page

Summary ----------------------------------------------------------------------------------------------------- ___

Risk Factors ------------------------------------------------------------------------------------------------- ___

Use of Proceeds ------------------------------------------------------------------------------------------- ___

Capitalization ------------------------------------------------------------------------------------------------ ___

Dilution--------------------------------------------------------------------------------------------------------- ___

Selected Financial Data ---------------------------------------------------------------------------------- ___

Management's Discussion and Analysis of Financial Condition and Results of Operations ------ ___

Business -------------------------------------------------------------------------------------------------------- ___

Management -------------------------------------------------------------------------------------------------- ___

Certain Transactions ---------------------------------------------------------------------------------------- ___

Principal Stockholders -------------------------------------------------------------------------------------- ___

Description of Securities ----------------------------------------------------------------------------------- ___

Terms of the Offering --------------------------------------------------------------------------------------- ___

Legal Matters ------------------------------------------------------------------------------------------------- ___

Experts --------------------------------------------------------------------------------------------------------- ___

Additional Information -------------------------------------------------------------------------------------- ___

SUMMARY

The following summary is qualified in its entirety by the detailed information appearing

elsewhere in this private placement memorandum. See "Risk Factors" for information to be

considered by prospective investors. All information in this private placement memorandum

assumes a one-for-three reverse stock split, various modifications to the terms of the Existing

Preferred Stock, and the conversion of certain outstanding debt into Series E Preferred Stock. The Company

Introduction

We provide solutions that (describe) ________________________________________

_______________________________________________ . These solutions include providing

(describe) __________________________________________________________________

___________________________________________________________________________ .

We believe we differentiate our services by (describe) ________________________________

____________________________________________________________________________ .

The principal services we provide for (describe) _____________________________________

___________________________________________________ currently include the following:

____________________________________________________________________

_____________________________________________________________________

Market Opportunity and Strategy

(For example, the Wall Street Journal) ____________________ reports that the

__________________ (name) market was $_____ ___________ (million, billion) in 20____

and is estimated to grow to $______ ____________ (million, billion) by the end of 20____.

The _______________ (Name) Group predicts that by 20____, more than _______ million

users worldwide, including one-third of the U.S. work force, will be engaging in some form of

remote access. We believe the following are key driving forces behind our current market

opportunity: The growth of (describe) _________________________________,

The increasing demand for (describe) _____________________________,

The increase in remote access (describe) ____________________________,

The increasing demand for (describe) ____________________________, and

The adoption of (describe) ______________________________ .

Our goal is to be a leading single-source provider of solutions that (describe) ________

____________________________________________________________________________ .

Key elements of the strategy to achieve this goal include the following: ____________________________________________________________________

_____________________________________________________________________

____________________________________________________________________

_____________________________________________________________________

Principal Offices

Our principal offices are located at __________________________________________

___________________________________________ (street address, city, state, zip code),

telephone (___) ___________, facsimile (___) ___________. We were incorporated in __________________ (Name of State) in ___________________ (date).

The Offering

Securities Offered

We are offering a minimum of ____________ (number) and a maximum of __________

(number) Shares at $______ per share.

The minimum purchase per investor is __________Shares, or $________. The Shares

will be convertible into Common Stock on a one-for-one basis, subject to adjustments to reflect

any stock splits, stock dividends, and recapitalizations (the "Conversion Ratio"). At the option of

the holders, the Shares will be convertible into Common Stock at the then Conversion Ratio at

any time prior to redemption. The Shares will be converted automatically into Common Stock at

the Conversion Ratio then in effect upon the closing of an initial public offering. The Shares will

have a Liquidation Preference over the Existing Preferred Stock (as defined below) and the

Common Stock in an amount equal to the purchase price per share plus any accrued and

unpaid dividends. Unless previously converted, the Shares will be redeemable at our option at a

price equal to the Liquidation Preference, and at the option of the holders at a price equal to the

Liquidation Preference plus _____% per annum, commencing ____________ (number) and

______________ (number), respectively, after the completion of this offering. In the event of

any liquidation, dissolution, or winding up of our company, the Shares will have a preference

over our Common Stock and any outstanding Existing Preferred Stock in an amount equal to

the Liquidation Preference of the Shares. For this purpose, a merger or consolidation that

results in the stockholders of our company owning 50% or less of the voting power of the

surviving entity or a sale of substantially all of our assets (each a "Change in Control") will be

treated as a liquidation. However, holders of the Shares may elect to convert the Shares into

Common Stock immediately prior to any such event, in which case they would receive

consideration upon the event as holders of Common Stock in lieu of a Liquidation Preference.

The holders of the Shares will have voting rights equal to the same proportion of

Common Stock to be owned after conversion and will have certain registration rights as

described herein and, voting as a class, will be entitled to vote upon certain matters that would

adversely affect their rights and preferences as holders of Shares and to elect no less than one

member of our Board of Directors. See "Description of Securities - Series 1 Convertible

Shares."

Use of Proceeds

The net proceeds of this offering will be used to expand our marketing, sales, and

distribution capabilities; purchase or lease touch screen terminals for the electronic ordering and

sale of our products and services; implement our ordering system; provide funding for strategic

acquisitions; and provide working capital. We believe that the net proceeds will be sufficient to

fund our operations for approximately 12 to 15 months in the event of the Maximum offering.

Shares Outstanding

There are currently outstanding _________ shares of our Common Stock; ___________

shares of our Series A Convertible Preferred Stock, ______________ shares of our Series B

Convertible Preferred Stock, ______________ shares of our Series C Convertible Preferred

Stock, _____________ shares of our Series D Convertible Preferred Stock, and ___________

shares of our Series E Convertible Preferred Stock (the "Existing Preferred Stock"). The

Existing Preferred Stock is convertible into Common Stock on a one-for-one basis, subject to

adjustments to reflect any stock splits, stock dividends, and recapitalizations. Assuming

completion of this offering and the conversion of the Shares and the Existing Preferred Stock,

we would have outstanding, ______________ shares of Common Stock (if the minimum

number of Shares is sold) or _______________ shares of Common Stock (if the maximum

number of Shares is sold). In addition, we will issue to the Placement Agent five-year warrants

to purchase up to _______________ Shares at a price of $_______ per share.

Furthermore, we have the right to grant stock options to acquire up to _______________ shares

of Common Stock under our 20____ (year) Stock Option Plan. There are options outstanding to

purchase __________ shares of Common Stock at this time .

Helpful suggestions for preparing your ‘Private Placement Memorandum’ online

Are you exhausted from the inconvenience of dealing with paperwork? Look no further than airSlate SignNow, the leading eSignature platform for individuals and organizations. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the comprehensive features integrated into this user-friendly and affordable platform to transform your method of document management. Whether you need to sign forms or gather signatures, airSlate SignNow simplifies the entire process with just a few clicks.

Follow this detailed guide:

- Log into your account or commence a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form collection.

- Open your ‘Private Placement Memorandum’ in the editor.

- Click Me (Fill Out Now) to complete the form on your end.

- Insert and assign fillable fields for other participants (if needed).

- Proceed with the Send Invite options to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Private Placement Memorandum or send it for notarization—our solution has everything you need to achieve those tasks. Sign up with airSlate SignNow today and take your document management to new levels!