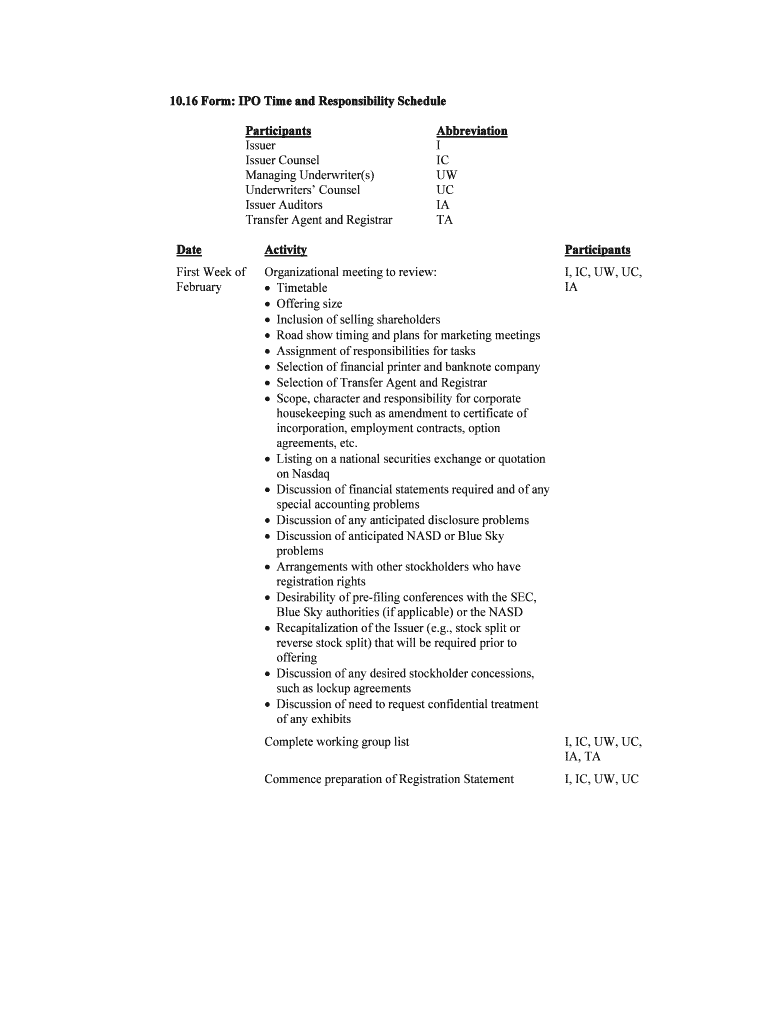

10.16 F orm: IPO Time and Responsibility Sche dule

Participant s Abbreviatio n

Issuer IIssuer Counsel IC

Managing Underwriter(s) UW Underwriters’ Counsel UCIssuer Auditors IA Transfer Agent and Registrar TA

Date Activity Participant s

First Week of

February Organizational meeting to review:

Timetable

Offering size

Inclusion of selling shareholders

Road show timing and plans for marketing meetings

Assignment of responsibilities for tasks

Selection of financial printer and banknote company

Selection of Transfer Agent and Registrar

Scope, character and responsibility for corporate

housekeeping such as amendment to certificate of

incorporation, employment contracts, option agreements, etc.

Listing on a national securities exchange or quotation on Nasdaq

Discussion of financial statements required and of any

special accounting problems

Discussion of any anticipated disclosure problems

Discussion of anticipated NASD or Blue Sky

problems

Arrangements with other stockholders who have

registration rights

Desirability of pre-filing conferences with the SEC,

Blue Sky authorities (if applicable) or the NASD

Recapitalization of the Issuer (e.g., stock split or

reverse stock split) that will be required prior to offering

Discussion of any desired stockholder concessions,

such as lockup agreements

Discussion of need to request confidential treatment of any exhibits I, IC, UW, UC, IA

Complete working group list I, IC, UW, UC, IA, TA

Commence preparation of Registration Statement I, IC, UW, UC

Date Activity Participant s

Review intended use of proceeds. Consider whether

there are any issues under the Investment Company Act of 1940I, IC, UW, UC

Commence business due diligence and legal due

diligence review IC, UC, UW

Draft Officers’ and Directors’ Questionnaires I, IC Commence preparation of Underwriting Agreement,

Agreement Among Underwriters, Underwriters’

Questionnaire, Underwriters’ Power of Attorney and

Preliminary Blue Sky Memorandum UC

Commence preparation of necessary financial statements I, IA

Draft powers of attorney for Registration Statement and amendments I, IC

Select banknote company to print stock certificates I Select financial printer I File Form ID with the SEC to obtain EDGAR access

codes for the Issuer I, IC

Second Week

of February Advise banknote company of schedule and arrange for

printing of stock certificates I

Select Transfer Agent and Registrar I, IC Select Financial Printer I, IC Send Officers’ and Directors’ and 10% Shareholders’

Questionnaires and powers of attorney, if any, to

officers, directors and 10% shareholders of Issuer I

Select and reserve stock exchange trading symbols (if

stock is to be listed on a national securities exchange);

determine availability of Nasdaq trading symbols (if

stock is to be quoted on Nasdaq) I, IC

Continue preparation of Registration Statement and

underwriting documents I, IC, UW, UC

Commence preparation of request for confidential

treatment, if necessary I, IC

Commence negotiations with lenders concerning

necessary consents and revisions of covenants that I, IC

Date Activity Participant s

would restrict offering or use of proceeds thereof

Third Week of

February Circulate drafts of Registration Statement and

Underwriting Agreement

IC, UC

Discuss Registration Statement and Underwriting Agreement I, IC, UW, UC, IA

Revise Registration Statement and Underwriting Agreement I, IC, UW, UC

Discuss comfort letter content and procedures UC, UW, IA Commence drafting required of Board resolutions I, IC

Commence preparation of stock exchange or Nasdaq listing application I, IC

Review and approve proofs of stock certificates I Circulate drafts of financial statements IAObtain completed questionnaires and powers of

attorney, if any, from officers and directors and 10%

shareholders of Issuer I

Fourth Week

of February Draft of Registration Statement to printer IC

Meeting to discuss initial printed proof of Registration

Statement and Underwriting Agreement I, IC, UW, UC, IA

Begin assembling and drafting exhibits to Registration Statement I, IC

Circulate revised proofs of Registration Statement and

Underwriting Agreement IC, UC

First Week of March Meetings to discuss revised proofs of Registration Statement

I, IC, UW, UC, IA

Complete all corporate housekeeping I, IC Obtain signature pages and powers of attorney for

Registration Statement and amendments from directors

and officers; furnish copy to Underwriters’ counsel and Issuer counsel I, IC

Date Activity Participant s

Second Week of MarchFinalize financial statements I, IA

Finalize Underwriting Agreement I, IC, UW, UC Send drafts of Registration Statements to stock

exchange on which the Issuer wishes to list stock for

confidential review of eligibility (required by the New

York Stock Exchange if listing intention language is to

be included in the preliminary prospectus) IC

Third Week of March Meeting of Board of Directors of Issuer to approve all

required actions, including adoption of resolutions relating to:

Authorization of issue, sale and delivery of stock

Approving form of Underwriting Agreement and

authorizing execution and delivery thereof

Approving Registration Statement and Prospectus and

authorizing execution and filing of Registration

Statement and all amendments thereto

Authorizing listing of stock on Nasdaq or a stock exchange

Authorizing “Blue Sky” filings

Appointing Transfer Agent and Registrar

Approving all necessary corporate housekeeping

Approving form of stock certificates I, CC

Meeting (or written consent in lieu of meeting) of

shareholders of the Issuer, at which resolutions

approving reincorporation and/or recapitalization and all

“corporate cleanup” matters that require shareholder

approval are adopted I, IC

File charter amendments necessary to effectuate

reincorporation and/or recapitalization I, IC

Circulate draft of comfort letter IA Prepare Form 8-A for Exchange Act registration if

applicable I, IC

Fourth Week of March Meeting to finalize Registration Statement I, IC, UW, UC,

IA

Complete assembly and preparation of exhibits to

Registration Statement I, IC

Date Activity Participant s

Prepare application for CUSIP number I, ICPrepare transmittal letter to SEC ICComplete application for Nasdaq or stock exchange listing I, IC

Prepare transmittal letter to NASD UC Obtain check for NASD filing fee and arrange for wire

transfer payment of SEC registration fee I

Send final changes in Registration Statement to printer;

prepare filings for SEC, NASD I, IC, UC, IA

Complete Preliminary Blue Sky Survey, if applicable UC Execute Registration Statement, Auditor’s Report and Auditor’s Consent I, IA

File Registration Statement with SEC electronically via EDGAR IC

File Form 8-A with SEC electronically via EDGAR and

with stock exchange on which listing is sought, if

applicable IC

File Registration Statement and related materials with NASD UC

File request for confidential treatment with the SEC, if

applicable IC

Issue press release regarding filing of Registration Statement I, UW

Proceed with Blue Sky qualifications, if applicable, as

designated by Managing Underwriter I, UC

Apply for CUSIP number I, IC

First and

Second Weeks of April Apply for listing on Nasdaq or stock exchange; send

copies of Registration Statement to Nasdaq or exchange

I, IC

Request estimated SEC comment date IC Begin preparation of Road Show materials UW, I

Date Activity Participant s

Third and Fourth Weeks of AprilFinalize engagement arrangements with Transfer Agent

and Registrar necessary for its initial appointment

I, IC

Obtain CUSIP number for stock I, IC Approve final proof of stock certificates IComplete Road Show materials and rehearse I, UW

Resolve outstanding issues with NASD and Blue Sky administrators UC

Resolve issues with Nasdaq or stock exchange on which stock will be listed I, IC

First Week of May Receive stock exchange or Nasdaq approval for listing

or quotation of stock IC

Receive initial comments from SEC IC Review SEC comments and prepare amendment to

Registration Statement in response thereto I, IC, UW, UC, IA

File amendment to the Registration Statement with the

SEC electronically via EDGAR IC

File amendment to the Registration Statement with the NASD UC

File amendment to the Registration Statement with

Nasdaq or stock exchange, as applicable IC

Print and distribute preliminary prospectus IC, UC

Second Week of May Commence “Road Show” marketing efforts I, UW

Third and Fourth Weeks of May Receive additional comments from the SEC and file

amendments to the Registration Statement until all open comments resolved I, IC, UW, UC

Date Activity Participant s

Obtain NASD clearance of underwriting arrangements UW, UCPrepare requests for acceleration of effective date of

Registration Statement (Form 8-A will be declared

effective automatically upon the later of (i) filing, (ii)

receipt of certification from the applicable national

securities exchange, and (iii) the effectiveness of the

Registration Statement) I, IC, UW, UC

Arrange for certification to be provided to SEC by

exchange on which stock will be listed as a prerequisite

for effectiveness of Form 8-A I, IC

Notify Nasdaq of expected effective date of Registration

Statement no less than 72 hours prior to anticipated effectiveness I, IC

Finalize comfort letter UW, IA, UC Distribute initial draft of closing memorandum UC

Commence preparation of legal opinions, certificates

and other closing documents and order good standing certificates UC, IC, TA

First Week of June Send acceleration request of the Issuer to SEC together

with letter of Managing Underwriter(s) joining in such

request and providing information concerning

distribution of preliminary prospectuses IC

Directors and officers of the Issuer file Form 3 with the

SEC, if Form 8-A will be declared effective IC

Deadline for receiving completed Underwriters’

Questionnaire and Underwriters’ Powers of Attorney

from syndicate members UW

Registration Statement declared effective by SEC

Form 8-A becomes effective

Managing Underwriter notified of effectiveness of

Registration Statement and Form 8-A, if applicable I

Nasdaq or stock exchange notified of effectiveness of

Registration Statement and Form 8-A, if applicable I

Finalize Final Blue Sky Survey UC

Date Activity Participant s

Complete Blue Sky registrations UCPreliminary Agreement reached between Issuer and

Managing Underwriter(s) as to final terms of the offering I, UW

Meeting of Issuer’s Board of Directors (or special

committee of the Board of Directors) to establish the

price of stock to Underwriters and the initial public

offering price thereof and to approve final form of

Underwriting Agreement I, IC

Sign Agreement Among Underwriters UW Sign Underwriting Agreement I, UWDeliver comfort letter IA

Prepare tombstone ad UW, UCFinalize and print final Prospectus I, IC, UC, IA

Commence public sales of stock UWIssue press release announcement offering I, UW Release tombstone ad UWBegin market-making activities UW Sign Selected Dealers’ Agreements, if applicable UWDistribute revised draft of closing memorandum UC

Contact banknote company to arrange for printing of

quantity of stock certificates I

Pricing + 1 Business Day

(Second Week of June) Tombstone appears in designated publications UW

Notify syndicate of closing date and give instructions re payment UW

File final Prospectus with SEC electronically via

EDGAR, pursuant to Rule 424(b) under the Securities Act IC

Deliver copy of final Prospectus to NASD UC

Date Activity Participant s

Deliver copy of final Prospectus to Nasdaq or stock exchangeIC

Furnish Issuer, Transfer Agent and Registrar with names

and denominations in which stock certificates are to be registered UW

Issuer Counsel opinion and instructions for certificates

to Transfer Agent and Registrar I, IC

Pricing + 2 Business Days Preliminary closing (2:00 p.m., Eastern time, on the

business day preceding the closing) I, IC, UC

Pricing + 3 Business Days Closing (10:00 a.m., Eastern time) I, IC, UW, UC,

TA

Day after effective date of Registration Statement File Form S-8 to register stock issuable pursuant to

employee benefit plans

I, IC

Within 45 days after the end of the first fiscal quarter ending after effective date of Registration Statement (unless such first fiscal quarter is the last fiscal quarter of the current fiscal year) File report on Form 10-Q with SEC I, IC, IA

Date Activity Participant s

Within 90 days after the end of the fiscal year ending after the effective date of the Registration StatementFile report on Form 10-K I, IC, IA

As soon as

practicable after the end of 12 months beginning after the effective date of the Registration Statement Make earnings statements meeting the requirements of

Section 11(a) of the Securities Act generally available to stockholders

120 days from the end of the fiscal year in which Registration Statement becomes effective Last date on which to file registration statement with

respect to common stock under the Exchange Act on

Form 8-A, if stock not voluntarily registered previously

under the Exchange Act

I, IC

Effective date of common stock registration statement under

Exchange Act Due date of initial reports of beneficial ownership of

equity securities under Section 16(a) of the Exchange

Act on Form 3 by officers, directors and 10%

shareholders of the Issuer; proxy solicitation rules now

applicable with respect to common stock of the Issuer

I, IC

Date Activity Participant s

Various dates subsequent to effective date of Registration StatementMailings to stockholders as represented in Prospectus I, IC

Provide Underwriters with copies of filings as agreed

upon in Underwriting Agreement I, CC