Fill and Sign the Quotation of Insurance Form

Useful suggestions for preparing your ‘Quotation Of Insurance’ online

Are you fed up with the complications of handling paperwork? Your search ends with airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Wave farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can smoothly finalize and sign documents digitally. Take advantage of the powerful features housed within this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Adhere to this detailed guide:

- Sign in to your account or create a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Access your ‘Quotation Of Insurance’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Insert and assign fillable fields for others (if required).

- Proceed with the Send Invite settings to obtain eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your Quotation Of Insurance or send it for notarization—our solution offers all the features you require to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

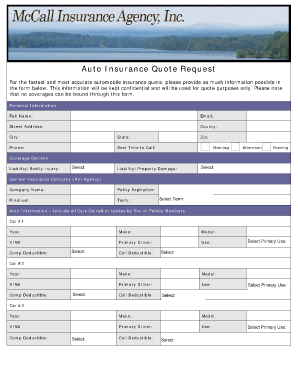

What is a Quotation Of Insurance and how does it work?

A Quotation Of Insurance is a formal document provided by insurance companies that outlines the terms and pricing for an insurance policy. With airSlate SignNow, you can easily create, send, and eSign your Quotation Of Insurance, streamlining the process for both you and your clients.

-

How can airSlate SignNow help in managing Quotation Of Insurance documents?

airSlate SignNow offers a user-friendly platform that allows businesses to manage their Quotation Of Insurance documents efficiently. You can upload templates, customize your quotes, and send them for eSignature, ensuring a fast and secure transaction.

-

What features does airSlate SignNow provide for creating a Quotation Of Insurance?

With airSlate SignNow, you have access to customizable templates, drag-and-drop fields, and automated workflows that simplify the creation of a Quotation Of Insurance. These features allow you to tailor your quotes to meet specific client needs while ensuring compliance and accuracy.

-

Is there a cost associated with using airSlate SignNow for Quotation Of Insurance?

Yes, there is a pricing structure for using airSlate SignNow, which varies based on the features you need. However, it remains a cost-effective solution for managing your Quotation Of Insurance, especially when compared to traditional paper-based methods.

-

Can I integrate airSlate SignNow with other software for handling Quotation Of Insurance?

Absolutely! airSlate SignNow seamlessly integrates with various CRM and accounting software, allowing you to enhance your workflow when handling Quotation Of Insurance. This integration ensures that your documents are easily accessible and managed in one place.

-

What are the benefits of using airSlate SignNow for Quotation Of Insurance?

Using airSlate SignNow for your Quotation Of Insurance brings several benefits, including faster turnaround times, reduced paperwork, and improved accuracy. Additionally, the eSigning feature enhances client engagement and helps you close deals more efficiently.

-

How secure is the data when using airSlate SignNow for Quotation Of Insurance?

airSlate SignNow prioritizes data security, employing advanced encryption and compliance with industry standards to protect your Quotation Of Insurance documents. You can have peace of mind knowing that your sensitive information is safeguarded throughout the signing process.

Find out other quotation of insurance form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles