Fill and Sign the Real Estate Investment Trust Reit Due Diligence Supplemental Checklist Form

Useful tips on setting up your ‘Real Estate Investment Trust Reit Due Diligence Supplemental Checklist’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and businesses. Bid farewell to the monotonous process of printing and scanning paperwork. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the robust features integrated into this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages everything efficiently, needing just a few clicks.

Execute this detailed guide:

- Access your account or join for a complimentary trial with our service.

- Select +Create to upload a document from your device, cloud storage, or our template library.

- Edit your ‘Real Estate Investment Trust Reit Due Diligence Supplemental Checklist’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you want to work with your colleagues on your Real Estate Investment Trust Reit Due Diligence Supplemental Checklist or send it for notarization—our solution provides everything you need to accomplish these tasks. Sign up with airSlate SignNow now and elevate your document management to new levels!

FAQs

-

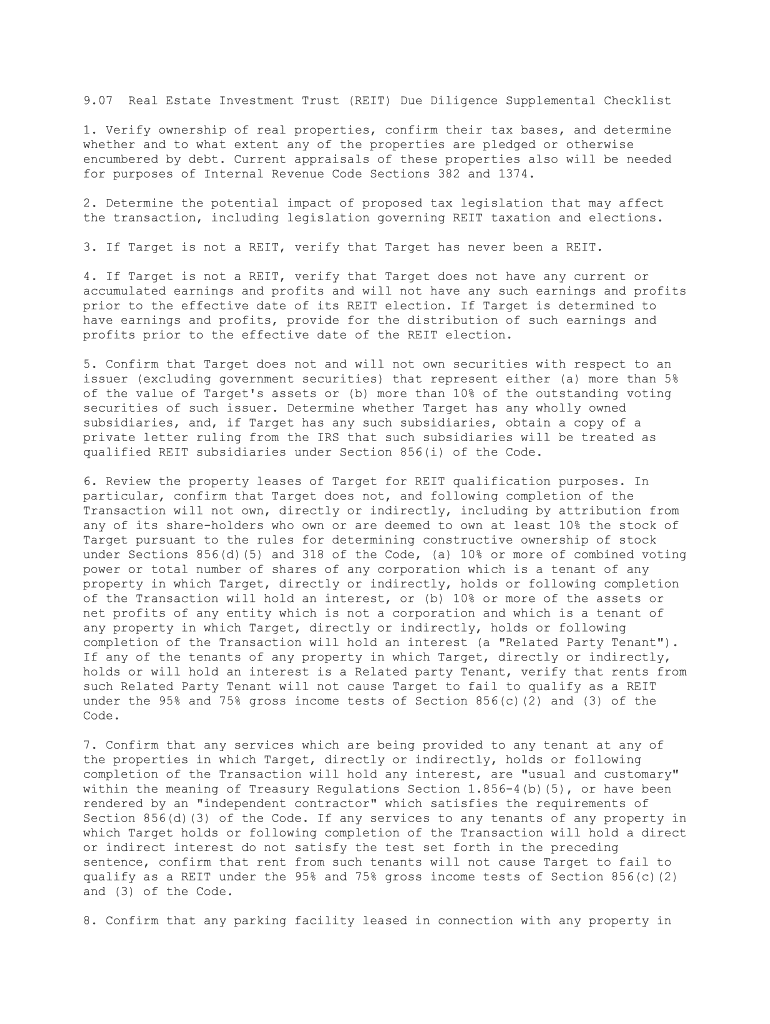

What is the Real Estate Investment Trust REIT Due Diligence Supplemental Checklist?

The Real Estate Investment Trust REIT Due Diligence Supplemental Checklist is a comprehensive guide designed to help investors evaluate the critical aspects of potential REIT investments. It includes essential factors such as financial performance, management quality, and market conditions, ensuring you make informed decisions in your real estate ventures.

-

How can the Real Estate Investment Trust REIT Due Diligence Supplemental Checklist benefit my investment strategy?

Implementing the Real Estate Investment Trust REIT Due Diligence Supplemental Checklist into your investment strategy can streamline your evaluation process. It helps identify potential risks and opportunities, allowing you to invest with confidence and maximize your returns in the real estate market.

-

Is the Real Estate Investment Trust REIT Due Diligence Supplemental Checklist easy to use?

Absolutely! The Real Estate Investment Trust REIT Due Diligence Supplemental Checklist is designed to be user-friendly, even for those new to real estate investments. Its structured format makes it easy to follow, ensuring you don't miss critical due diligence steps.

-

What features does the Real Estate Investment Trust REIT Due Diligence Supplemental Checklist include?

The Real Estate Investment Trust REIT Due Diligence Supplemental Checklist includes features such as a thorough assessment framework, customizable sections, and a step-by-step guide. These features facilitate a comprehensive review of REITs, helping you gather all necessary information effectively.

-

Are there any costs associated with the Real Estate Investment Trust REIT Due Diligence Supplemental Checklist?

The Real Estate Investment Trust REIT Due Diligence Supplemental Checklist is priced competitively, ensuring good value for the insights it provides. It is a cost-effective tool that can potentially save you money by helping you avoid poor investment decisions.

-

Can I integrate the Real Estate Investment Trust REIT Due Diligence Supplemental Checklist with other tools?

Yes, the Real Estate Investment Trust REIT Due Diligence Supplemental Checklist can be integrated with various document management and e-signature solutions, such as airSlate SignNow. This integration allows for seamless document handling and collaboration throughout your due diligence process.

-

Who should use the Real Estate Investment Trust REIT Due Diligence Supplemental Checklist?

The Real Estate Investment Trust REIT Due Diligence Supplemental Checklist is ideal for both novice and experienced investors looking to evaluate REITs effectively. Whether you're an individual investor or part of a larger investment firm, this checklist can enhance your due diligence process.

The best way to complete and sign your real estate investment trust reit due diligence supplemental checklist form

Find out other real estate investment trust reit due diligence supplemental checklist form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles