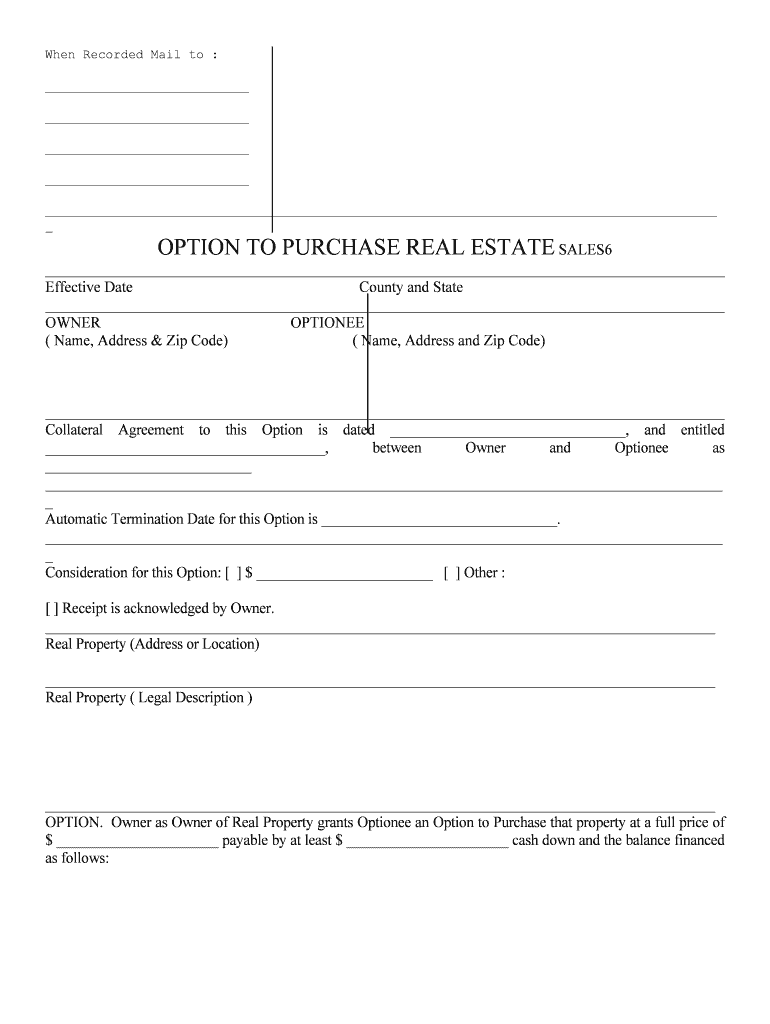

Fill and Sign the Real Estate Tax Sales and Tax Deeds in Illinois Form

Useful suggestions for preparing your ‘Real Estate Tax Sales And Tax Deeds In Illinois’ online

Feeling overwhelmed with the burden of paperwork? Look no further than airSlate SignNow, the top eSignature option for individuals and small to medium-sized businesses. Wave goodbye to the tedious task of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the robust features integrated into this user-friendly and affordable platform to transform your document management practices. Whether you need to approve documents or gather eSignatures, airSlate SignNow makes it simple, requiring just a few clicks.

Follow this detailed guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘Real Estate Tax Sales And Tax Deeds In Illinois’ in the editor.

- Click Me (Fill Out Now) to fill out the form on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or transform it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your Real Estate Tax Sales And Tax Deeds In Illinois or send it for notarization—our solution provides everything necessary to complete such tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What are REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS?

REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS refer to the process where local governments sell properties due to unpaid property taxes. Buyers can acquire these properties at a tax sale, often at a lower price. Understanding this process is crucial for investors looking to capitalize on real estate opportunities.

-

How can airSlate SignNow assist with REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS?

airSlate SignNow provides a streamlined solution for managing documents related to REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS. With our eSigning capabilities, you can easily sign and send necessary paperwork, ensuring a smooth transaction process. This efficiency can save you time and reduce the hassle of traditional document handling.

-

What are the costs associated with REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS?

Costs for REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS can vary based on the property and the county's regulations. Typically, buyers must pay the outstanding taxes, fees, and sometimes additional costs for the auction process. It's essential to conduct thorough research to understand all potential expenses involved.

-

What features does airSlate SignNow offer for managing tax deed documents?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time collaboration for managing tax deed documents. These tools simplify the process of preparing and signing documents related to REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS. Our platform ensures that all parties can access and complete necessary paperwork efficiently.

-

Are there any benefits to using airSlate SignNow for tax sales documentation?

Using airSlate SignNow for tax sales documentation provides numerous benefits, including increased efficiency and reduced turnaround times. Our platform allows for quick eSigning and document sharing, which is essential for REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS. This can lead to faster transactions and a better overall experience for buyers and sellers.

-

Can airSlate SignNow integrate with other tools for real estate transactions?

Yes, airSlate SignNow can integrate with various tools and platforms commonly used in real estate transactions. This includes CRM systems, accounting software, and other document management solutions. Such integrations enhance the workflow for managing REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS, making it easier to keep track of all necessary documents.

-

What should I consider before participating in REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS?

Before participating in REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS, it's important to research the properties available and understand the local laws governing tax sales. Additionally, consider your budget and the potential risks involved. Being well-informed can help you make better investment decisions.

The best way to complete and sign your real estate tax sales and tax deeds in illinois form

Find out other real estate tax sales and tax deeds in illinois form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles