Frequently Asked Questions

Amendment 1 (SB 4D and SB 1588) Implementation

Florida Department of Revenue

Last update: August 12, 2008

These FAQs contain general information offered by the Department to assist in the

administration of Chapter 2007-339, Laws of Florida. See Emergency Rule 12DER08-21

Transfer of Assessment Limitation Difference; “Portability;” Sworn Statement Required,

effective July 18, 2008

Section A: Portability

1/18/08

A1

What documentation is required from a person applying for the transfer

of a homestead assessment limitation difference?

Each applicant will have to fill out Form DR-501T, “Transfer of

Homestead Assessment Difference,” in the office of the property

appraiser of the county in which their new home is located.

Required information on this form includes the date that the

previous homestead was sold or no longer used as a homestead,

the address and parcel identification number of the previous

homestead, a list of all other owners of the previous homestead,

an affirmative statement that none of the previous owners

remained in the homestead and continued to receive a homestead

exemption, and a sworn statement that he or she received the

homestead exemption on the previous parcel. Form DR-501,

“Original Application for Ad Valorem Tax Exemption” should

also be completed to apply for the homestead exemption on the

new homestead.

8/5/08

A2

What information will the property appraiser in the county where the

new homestead is located rely on to calculate and grant the transfer?

It is likely that in most cases the applicant’s new and old

homestead will be in the same county. In this case, the property

appraiser’s records of the previous homestead should be used to

determine eligibility and calculate the transfer amount. If the old

homestead is located in a different county, the transfer

application form (DR-501T) will be transmitted to that county by

the new property appraiser together with a copy of the

homestead application form. The previous property appraiser

will complete Form DR-501RVSH, “Certificate for Transfer of

Homestead Assessment Difference” providing details concerning

the previous homestead sufficient to calculate the transfer

amount.

1

�1/18/08

A3

Can the property appraiser in the county where the previous homestead

was located rely on the application for a transfer of a homestead

assessment limitation difference as a sufficient statement for the

removal of the homestead exemption on the previous homestead?

No. There may be a homeowner continuing to live in the home

and qualifying for the exemption. The application for transfer

may be in error. (see A8 and A9 below)

1/18/08

A4

If a homestead assessment limitation difference is transferred to a new

homestead and it is subsequently found that the difference should not

have been transferred or that the transferred amount was incorrect, how

should the assessment be corrected?

The property appraiser should follow the procedures for the

correction of errors found in s. 193.155(9) and (10), F.S. These

sections provide for tax liens to be placed against the property,

with notification to the taxpayer and, in certain instances, for

penalties and interest on unpaid taxes.

1/18/08

A5

Can a person who sold a homestead in 2006 transfer the assessment

difference to a new homestead established as of January 1, 2008?

No, the law does not provide for the transfer of homestead

assessment limitation differences from homesteads abandoned

prior to January 1, 2007. Section 193.155(8), F. S., states “A

person who establishes a new homestead as of January 1, 2008,

is entitled to have the new homestead assessed at less than just

value only if that person received a homestead exemption on

January 1, 2007”. The law also does not allow the transfer of an

assessment limitation difference from a homestead abandoned in

2006 if the person received a homestead exemption on a new

homestead on January 1, 2007 and subsequently abandoned that

homestead and established a new homestead on January 1, 2008.

8/05/08

A6

Section 193.155(8)(c) and (d), F.S., provides the procedures for the

transfer of the homestead assessment limitation difference when a

homestead (either current or previous) is “jointly owned and jointly

titled” by two or more persons. In applying these provisions, is there a

difference between property held as “joint tenants with right of

survivorship,” as “tenants in common” or held by married persons?

Yes. In situations where the title of the previous homestead

contains specific ownership shares, each owner’s share of the

assessment limitation difference is proportional to his/her

ownership share in the property. When the title does not contain

2

�specific ownership shares, the assessment limitation difference is

divided equally by the number of owners who received the

homestead exemption on the property. The only exception is

when all the owners of the previous homestead jointly establish a

new homestead with no additional owners, in which case the

entire assessment limitation difference (up to a maximum of

$500,000) may be transferred, subject to rules for downsizing.

8/5/08

A7

With the passage of Senate Bill 1588, is there still a two-year eligibility

requirement to establish a new homestead in order to transfer an

assessment limitation differential?

Yes. A homeowner must establish a new homestead within 2 years

(assessment years) of abandoning a previous homestead. This

requirement has not changed. The requirement that a homeowner must

have abandoned a previous homestead after January 1, 2007 also has not

changed.

What did change in SB1588 is that homeowners may apply for

portability in a future year on that new homestead if, for whatever

reason, they failed to apply for portability in the year they established

the new home as their homestead (S. 193.155(8)(j), F.S.). If they do

apply for portability in a future year, any reduction in assessed value on

the new homestead is applied to the assessed value in the year the

transfer is first approved, and no refunds may be made for previous

years.

Example:

Homesteader John Doe abandons his homestead (Property A) in March

2007 and establishes a new homestead (Property B) in April 2007. John

Doe’s previous homestead (Property A) had a homestead exemption and

an assessment limitation differential of $100,000. John Doe applies for

and receives a homestead exemption on Property B for the 2008 tax

year. However, John Doe does not apply for the transfer of his

assessment limitation difference from Property A until February 2010.

Under S. 193.155(8)(j), John Doe is eligible to transfer his assessment

limitation differential from Property A to Property B for the (January 1)

2010 tax year (subject to any upsizing/downsizing/splitting/joining

provisions). Any reduction in assessed value on Property B resulting

from the transfer of the assessment limitation differential from Property

A is only applicable for the 2010 tax year and any subsequent years

John Doe qualifies for the homestead exemption on Property B. In

addition, the amount of the assessment limitation difference that can be

transferred is calculated based on the just value of Property B in the year

in which John Doe established Property B as his homestead (in this

example 2008) and not in the year in which he applied for the transfer of

3

�his assessment limitation difference (in this example 2010).

8/12/08

A8

Is there any provision of law that would allow the transfer of a

homestead assessment limitation difference when one or more owners

remain in the previous homestead?

Yes. Starting with the 2008 tax year, Section 193.155(8)(f), F.S.

allows an owner of a homestead to abandon the homestead and

reestablish the property as a new homestead even though it

remains his or her primary residence by notifying the property

appraiser of the county where the homestead is located. This

provision allows owners who no longer live at the previous

homestead to transfer their share of the assessment limitation

difference and for the owners who remain in the previous

homestead to transfer back in their share of the assessment

limitation difference as of the next January 1, if the owner still

residing at the previous homestead voluntarily abandons the

homestead. When any transfer of an assessment limitation

difference occurs, the previous homestead must be reassessed at

just value on January 1 and the owner remaining in the

homestead must reapply for the homestead exemption and apply

to transfer their share of the assessment limitation difference.

8/5/08

A9

In order to transfer an assessment limitation difference, does the

previous homestead have to be sold?

No. The previous homestead must have been abandoned by all

owners, but there is no requirement that there be a change of

ownership of the property.

1/30/08

A10

If two people abandon a jointly owned homestead with an assessment

limitation difference greater than $500,000 and move to two separate

homesteads, can they transfer their proportionate share of the previous

homestead assessment difference as long as their individual share is not

greater than $500,000?

No. The total reduction in just value for all new homesteads

established by the owners of a single previous homestead may

not exceed $500,000. Therefore, the maximum assessment

limitation difference that could be transferred by two previous

joint owners of a single homestead establishing different

homesteads is $250,000 each.

2/13/08

A11

If two people who previously owned separate homesteads join in

establishing a new homestead, can the assessment limitation difference

that is transferred from the new homesteader with the highest transfer

amount be fully transferred even if it exceeds the maximum transfer

4

�amount of the other new homesteader?

Yes. The highest difference of the new homesteaders may be

transferred, subject to the downsizing provisions and the

$500,000 maximum transfer limit. Note that if the new owners

are joint tenants without right of survivorship or tenants in

common, the calculation of the amount of assessment limitation

difference that may be transferred must be based on the

difference between the just and assessed values of each person’s

interest in the new property.

1/18/08

A12

If the previous homestead is qualified for both a homestead exemption

and an agricultural classified use assessment, how is the amount of

transfer to be calculated?

The amount eligible for transfer is equal to the reduction in value

due to the limitation on homestead assessment increases.

Therefore, the difference eligible for transfer is equal to the

difference between just and assessed value on the homestead

portion of the property.

2/13/08

A13

A previous homestead was jointly owned (titled) by two people on

January 1, 2007. They abandoned the previous homestead and both

moved to a new property in 2007. However, the new property is only

owned (titled) by one of these individuals, who intends to establish the

new property as his/her homestead on January 1, 2008. Since they both

lived at the previous homestead and now both live at the new property,

can they transfer the entire assessment limitation difference from the

previous property to the new property in 2008?

No. One of the individuals is not on the deed for the new

property and is therefore not eligible for a homestead exemption

on the new property. In addition, since all the owners of the

previous homestead are different than all the owners of the new

homestead, this is not a “transfer without splitting or joining.”

Therefore, only the owner of the new homestead is eligible to

transfer his/her share of the assessment limitation differential

from the previous homestead, which is 50 percent, subject also to

the provisions for upsizing and downsizing.

2/13/08

A14

What are the calculations for determining how much of an assessment

limitation difference can be transferred from a previous homestead to a

new homestead?

Specific examples showing the calculation of the assessment

limitation difference under various circumstances can be found

5

�at: http://dor.myflorida.com/dor/property/portfaqexamples.pdf

2/13/08

A15

If a homeowner sold a homestead in December 2006, purchased a new

property in December 2006 and claimed a homestead exemption on the

new property as of January 1, 2007, can that person transfer (port) the

assessment limitation differential from the 2006 homestead to the new

homestead in 2008?

No. Section 193.155(8), F.S. states that the following two

conditions must be met in order to transfer an assessment

limitation difference in 2008. First, the previous homestead

must have received a homestead exemption on January 1, 2007.

Second, the new homestead must qualify for a homestead

exemption on January 1, 2008. In the scenario above, the new

homestead (instead of the previous homestead) received a

homestead exemption on January 1, 2007, so the owners are not

eligible to transfer an assessment limitation difference.

6

�

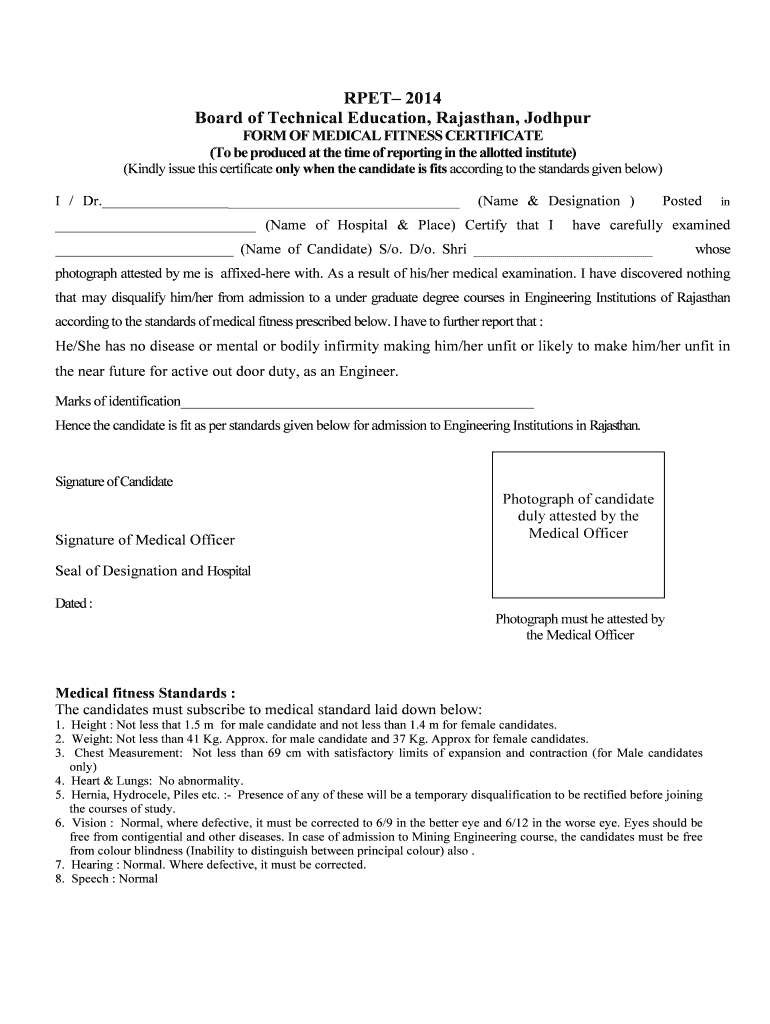

Valuable advice for finalizing your ‘Reap Medical Certificate 2022’ online

Are you fed up with the complications of dealing with paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can smoothly complete and sign documents online. Utilize the robust features embedded in this user-friendly and affordable platform and transform your method of document management. Whether you need to authorize forms or collect signatures, airSlate SignNow makes it all simple with just a few clicks.

Follow this comprehensive guide:

- Access your account or register for a free trial with our platform.

- Select +Create to upload a file from your device, cloud, or our template library.

- Open your ‘Reap Medical Certificate 2022’ in the editor.

- Click Me (Fill Out Now) to get the form ready on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or change it into a multi-usable template.

No need to worry if you wish to collaborate with your colleagues on your Reap Medical Certificate 2022 or send it for notarization—our service provides everything necessary to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to a new height!