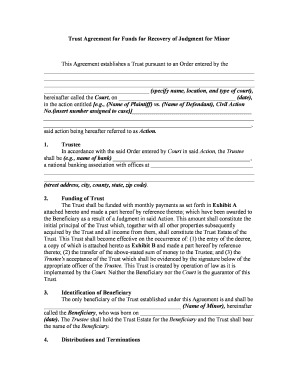

Trust Agreement for Funds for Recovery of Judgment for Minor This Agreement establishes a Trust pursuant to an Order entered by the

________________________________________________________________________ ________________________________________________________________________________________________________________________________________________ ____________________________________ (specify name, location, and type of court),

hereinafter called the Court, on ________________________________________ (date),

in the action entitled [e.g., (Name of Plaintiff) vs. (Name of Defendant), Civil Action

No.(insert number assigned to case)]_________________________________________

_______________________________________________________________________________________________________________________________________________, said action being hereafter referred to as Action. 1.Trustee In accordance with the said Order entered by Court in said Action, the Trustee

shall be (e.g., name of bank) _______________________________________________,

a national banking association with offices at ___________________________________

________________________________________________________________________ ________________________________________________________________________ (street address, city, county, state, zip code).

2. Funding of Trust

The Trust shall be funded with monthly payments as set forth in Exhibit A

attached hereto and made a part hereof by reference thereto; which have been awarded to

the Beneficiary as a result of a Judgment in said Action. This amount shall constitute the

initial principal of the Trust which, together with all other properties subsequently

acquired by the Trust and all income from them, shall constitute the Trust Estate of the

Trust. This Trust shall become effective on the occurrence of: (1) the entry of the decree,

a copy of which is attached hereto as Exhibit B and made a part hereof by reference

thereto; (2) the transfer of the above-stated sum of money to the Trustee; and (3) the

Trustee's acceptance of the Trust which shall be evidenced by the signature below of the

appropriate officer of the Trustee. This Trust is created by operation of law as it is

implemented by the Court. Neither the Beneficiary nor the Court is the guarantor of this

Trust. 3.Identification of Beneficiary The only beneficiary of the Trust established under this Agreement is and shall be

_______________________________________________ (Name of Minor), hereinafter called the Beneficiary, who was born on _______________________________________

(date). The Trustee shall hold the Trust Estate for the Beneficiary and the Trust shall bear the name of the Beneficiary. 4.Distributions and Terminations

A.During the term of the Trust, the Trustee may distribute such portions of

the net income and principal (but only if the net income is insufficient at any particular

time) as may be reasonably necessary in the discretion of the Trustee, to provide for the

support, maintenance, health, and education of the Beneficiary; provided, however, that if

any income is accumulated for that year, such undistributed income shall be added to the

principal of the trust estate. In making any discretionary distributions to the Beneficiary,

the Trustee shall consider: (1) the standard of living the Beneficiary had been accustomed

to prior to the creation of the Trust; (2) any known resources; (3) the ability of any person

who is legally obligated to support the Beneficiary to do so; and (4) the ability of the

Beneficiary to earn funds for the Beneficiary's own support and maintenance except while

obtaining an education. The Trustee may make any distribution without the intervention

of any party or other legal representative, in any of the following ways: (1) to the

Beneficiary directly; (2) to the legal or natural guardian of the Beneficiary; (3) to any

person having custody of the Beneficiary; or (4) by using the distribution directly for the

Beneficiary's benefit.B.The Trust shall terminate when the Beneficiary attains the age of (e.g., 25)

_________ years, or at the Beneficiary's death should the Beneficiary die prior to

attaining that age. On termination, the Trustee shall pay all of the then remaining trust

estate including undistributed income of the Trust to the Beneficiary or, if the Beneficiary

is then deceased, to the personal representative of the Beneficiary's estate. 5.Powers and of Trustee The Trustee shall have the following powers in addition to those conferred by

state and federal law:A.To invest and reinvest all or any part of the Trust Estate in such common

or preferred stocks, shares of investment trust and investment companies, bond,

debentures, mortgages, deeds of trust, notes, real estate, or other property as the Trustee,

in the Trustee's sole discretion, may determine to be reasonable, advisable, expedient, or

proper.B.To continue to hold in the form in which received (or the form to which

changed by reorganization, split, stock dividend, or other like occurrence) any securities

or other property the Trustee may at any time acquire under the trust created by this

instrument.C. To continue to hold any property including any shares of any Trustee's

own stock and to operate at the risk of the Trust Estate any business that the Trustee

receives or acquires under the Trust.D. To have and exercise all rights, powers, and privileges of an owner with

respect to the securities held in trust, including, but not limited to, the powers to vote,

give proxies, and pay assessment; to participate in voting trusts, pooling agreements,

foreclosures, reorganizations, consolidations, mergers, and liquidations; incident to such

participation, to deposit securities with and transfer title to any protective or other

committee on such terms as the Trustee may deem advisable; and to exercise or sell stock

subscription or conversion rights. E. To hold securities or other property in the Trustee's name as Trustee under

the Trust created by this instrument, or in the Trustee's own name or in the name of a

nominee; or the Trustee may hold securities unregistered in such condition that ownership will pass.F. To manage, control, grant options on, sell, convey, exchange, partition,

divide, improve, and repair Trust property.G. To lease Trust property for terms within or beyond the term of the Trust

created by this instrument for any purpose.H. To release or restrict the scope of any power that the Trustee may hold in

connection with the Trust created under this instrument, whether such power is expressly

granted in the instrument or implied by law.I. To purchase bonds and to pay such premiums in connection with the

purchase as the Trustee, in the Trustee's reasonable discretion, deems advisable;

provided, however, that each premium shall be repaid periodically to principal out of the

interest on the bond in such reasonable manner as the Trustee shall determine and, to the

extent necessary, out of the proceeds of the sale or other disposition of the bond.J. To purchase bonds at such discount as the Trustee, in the Trustee's

discretion, deems advisable; provided, however, that each discount shall be accumulated

periodically as interest in such reasonable manner as the Trustee shall determine and to

the extent necessary paid out of the proceeds on the sale or other disposition of the bond

or out of principal.K. To determine, except as otherwise specifically provided in this Trust

instrument, what part of the Trust Estate is principal and what part of the Trust Estate is

income and to apportion and allocate receipts and expenditures between principal and

income.L. To commence or defend, at the expense of the Trust, such litigation with

respect to the Trust or any property of the Trust Estate as the Trustee may deem

advisable; and to compromise or otherwise settle any claims or litigation against or in

favor of the Trust. M.To purchase and carry such insurance as Trustee deems advisable to

protect the Trust Estate and Trustee personally against any losses.N. To employ such attorneys, accountants, and advisors as the Trustee deems

necessary; and to act on the advice of such advisors without incurring liability for any

action taken or refrained from pursuant to that advice.

O. To withhold from distribution, without the payment of interests, all or any

part of the Trust property, if the Trustee shall determine, in the Trustee's sole discretion,

that the property may be subject to conflicting claims, to tax deficiencies, or to liabilities,

contingent or otherwise, properly incurred in the administration of the Trust Estate..P. To partition and distribute the Trust Estate, on any division or partial or

final distribution of the Trust Estate, in undivided interests or in kind, or partly in cash

and partly in kind, at valuations determined by the Trustee; to sell such property as the

Trustee may, in the Trustee's discretion, deem necessary to make such divisions or

distributions; in making any such divisions or partial or final distributions of the Trust

Estate, the Trustee shall be under no obligation to make a pro rata division, or to

distribute the same assets to beneficiaries similarly situated; the Trustee may, in the

Trustee's sole discretion, make a non-pro rata division between trusts or shares and non-

pro rata distributions to the Beneficiaries as long as the respective assets allocated to

separate trusts or shares, or distributed to the Beneficiaries, have equivalent or

proportionate fair market value. 6.Perpetuities Savings Clause Notwithstanding any other provision contained in this Trust Agreement, any Trust

created by this Agreement shall terminate not later than one day less than 21 years after

the death of Beneficiary. 7.Restriction on Alienation A. No Beneficiary shall have any power to anticipate, pledge, assign, sell,

transfer, alienate, or encumber any interest in any trust; nor shall any such interest be

liable for or subject to the debts or obligations of the Beneficiary, or to the claims of any

child, parent, spouse, or former spouse of the Beneficiary.B. Prior to the actual receipt of any distribution of any portion of the Trust

Estate by the Beneficiary, no property (whether income or principal) of the Trust shall be

subject to anticipation or assignment by the Beneficiary, or to attachment by or the

interference or control of any creditor or assignee of the Beneficiary, or be reached by

any legal or equitable process in satisfaction of any debt or liability of the Beneficiary.

Any attempt to transfer or encumber any interest in the Trust Estate of the Trust by the

Beneficiary prior to the actual distribution of it to the Beneficiary shall be wholly void.

No distribution from the Trust shall be made to satisfy any obligation to the Beneficiary if

the obligation is otherwise provided for by any federal or state assistance program as if

the Trust had not been created. 8. Compensation and Bond The Trustee shall be entitled to receive fair and reasonable compensation for such

services determined in accordance with the then customary and prevailing charges for

similar services charged by corporate fiduciaries in ______________________________

________________________________________________ (Name of County and State).

The Trustee shall also be reimbursed for all reasonable expenses incurred by the Trustee

in connection with the Trust. The fee and expenses allowed under this Agreement have

been approved by the Court at the inception of the Trust, but the Court may review those

fees and expenses at any time on its own motion or on a request of the Trustee or any

other party interested in the welfare of the Beneficiary. On a hearing of the matter, the

Court shall take any action with respect to allowing greater or lesser fees as it may deem

appropriate. The Trustee agrees to reimburse to the Trust Estate any fees previously paid

to the Trustee in the event the Court orders the Trustee to do so.9. Revocability This Trust shall not be revoked, altered, or amended by the Beneficiary or any

guardian or other legal representative of the Beneficiary; however, the Trust shall

terminate subject to amendment, modification, or revocation by the Court at any time

prior to the termination of the Trust. If the Court revokes the Trust prior to the

Beneficiary attaining the age of (e.g., 25) _________ years, the Court may enter such

further or additional orders concerning the Trust Estate as may be authorized by statute.

If the Court revokes the Trust after the Beneficiary attains the age of (e.g., 25) ________,

the Trust Estate shall be paid and delivered to the Beneficiary. 10.Successor Trustees If for any reason _____________________________________________ (Name

of Trustee) shall cease to act as Trustee, a successor trustee shall be appointed by the

Court. Any successor trustee shall succeed as Trustee as though originally named

Trustee under this trust instrument. All authority, powers, and discretions conferred on

the original Trustee under this trust instrument shall pass to any successor Trustee. No

successor Trustee shall be responsible for the acts or omissions of any prior Trustee, nor

shall any successor Trustee be under a duty to audit or investigate the accounts or

administration of any prior Trustee. Unless requested in writing by a person having a

present or future beneficial interest in the Trust, no successor Trustee shall have any duty

to take any action to obtain redress for a breach of trust committed by any prior Trustee. 11.Miscellaneous Provisions The Trust shall also be held and administered pursuant to the following terms and

conditions: A. The Trustee shall keep books of account respecting the Trust and all

transactions involving the Trust, and shall furnish to the Beneficiary, or to the person having the care and custody of the Beneficiary, if the Beneficiary is then under a legal

disability, statements at least quarterly showing receipts and disbursements of income and

corpus of the Trust, and a list of assets held in the Trust. The Trustee shall also furnish

such statements to the Court on request of the Court.B.No person or entity dealing with the Trustee under this Agreement shall be

obligated to see to the application of any money or property paid or delivered to the

Trustee, and no such person or entity shall be obliged to inquire into the expediency or

propriety of any transaction or the authority of the Trust to enter into and consummate

such transaction on such terms as the Trustee may deem reasonably appropriate.

C.The Trustee may not resign as Trustee of the Trust without receiving prior

authority from the Court to do so. 11. Trust Irrevocable This Trust Agreement and the Trust created under it are made irrevocable and

may not be altered, amended, or revoked by the Beneficiary, Trustee, parent, custodian,

or guardian, or any other person except the Court. 12.Counterparts This Agreement may be executed in any number of counterparts, each of which

shall be deemed to be an original, but all of which together shall constitute but one and

the same instrument. 13.Acceptance by Trustee The Trustee, by joining in the execution of this instrument, signifies its

acceptance of the trusts created by this agreement and agrees that it will hold and

administer the assets of the trusts and use and dispose of the assets under the terms and

provisions set forth in this instrument. Witness our signatures as of the day and date first above stated. __________________________________________(Guardian of Minor) __________________________________________(Name of Trustee) By_________________________________________________________________________________ (Name and Office in Bank) (Attach Exhibits)

STATE OF ________________________________________COUNTY OF _______________________________ Personally appeared before me, the undersigned authority in and for the said

county and state, on this ______________________________________________ (date),

within my jurisdiction, the within named ______________________________________

____________________________ (Name of Officer), who acknowledged that he is

__________________________________________________ (Name of Office) of

______________________________________________________________(Name of Bank/Trustee), a national banking association, and that for and on behalf of the said

Bank, and as its act and deed, he executed the above and foregoing instrument, after first

having been duly authorized by said corporation so to do. ____________________________________NOTARY PUBLIC My Commission Expires:_____________________STATE OF _____________________________________COUNTY OF ______________________________Personally appeared before me, the undersigned authority in and for the said

County and State, on this _____________________________________________ (date),

within my jurisdiction, the within-named ______________________________________

_____________________ (Name of Guardian), as Guardian of ____________________

___________________________ (Name of Minor) who acknowledged that she executed

the above and foregoing instrument.____________________________________NOTARY PUBLICMy Commission Expires:______________________ (Form of Acknowledgment may vary by state)