De cember 200 0

Trade Talk

Co un t ry Fo cus

C

AN EXECUTIVE BRIEFING FOR TREASURY PROFESSIONALS

ANADA

Ce rta i nl y U.S. eco n o m i c p e rfo r ma n ce in re ce n t yea rs has been re ma r ka ble – and the env y

o f m u ch of the rest o f the wo r ld.

Ye t in ma ny ways the Ca nad ian eco n o my has o u t- p e rformed tha t o f the United S ta tes. In

the U.S. st ro ng growth co m bined with low inflation has cu t un e m pl oy m e n t f rom 7.8 perce n t

in 1992 to just 4 perce n t cu r re n t l y and has turned a fe d e ra l d e f i ci t e q u i va le n t to 4 perce n t

o f g ross d o m est i c p ro d u c t i n to a risi ng su r pl us. Bu t d u r i ng tha t same period of t i m e ,

Ca nada cu t i t s un e m pl oy m e n t ra te by m o re than 5 perce n tage points – from a wo r r is o m e

p ea k o f 12.1 perce n t to just 6.8 perce n t cu r re n t l y – while ma ki ng an even bi gger fisca l

ad j ust m e n t as i t e rased a defici t e q u i va le n t to 7 perce n t o f G D P. More ove r, while there is

co n t i n u i ng co n cern over a U.S. trade defici t t ha t n ow exce e ds $200 billion, Ca nada is

re co rd i ng a cu r re n t a cco un t su r pl us !

The U. S. / Canadian Co n nec t i o n

Be ca use of Ca nada ’ s st ro ng eco n o m i c p e rfo r ma n ce, it has been one of our most vi b ra n t

ex p o rt ma r kets. Ca nada has l o ng been the U.S.’s si ng le bi ggest ove rs eas ma r ket, bu t last

yea r ’ s resul t s we re pa rt i cula r l y re ma r ka ble. Not o nl y did Ca nada acco un t for 24 perce n t o f

to ta l U.S. mercha n d ise ex p o rts, bu t t h ese pu rchas es exceeded those of the entire Eu ro p ea n

contin ued on page 2

�contin ued from pa ge 1

Union – an eco n o m i c a rea with a population te n

t i m es the si ze of Ca nada – and we re three times

la rger than U.S. sa les to Japa n !

Of co u rse, trade is a two - way st reet, and the

st re ngth of the U.S. eco n o my, co m bined with a

l owe r i ng of t rade ba r r i e rs under the Nort h

A m e r i can Free Trade Agreement, has been a

ma jor fa c tor in Ca nada ’ s e co n o m i c su ccess. Last

year go o ds f rom the United S ta tes a cco un ted fo r

76 perce n t o f Ca nada ’ s to ta l i m p o rts, up from 72

p e rce n t t we n t y yea rs ago. The U.S. sha re of

Ca nad ian ex p o rt s was e ven la rge r, rea ch i ng 85

p e rce n t o f the to ta l. T h is p e rce n tage is co nsi d e ra bl y higher than the 68 perce n t s ha re ba ck in the

ea r l y 1980s.

Another fa c tor tha t may ha ve helped boost

Ca nad ian ex p o rt s to the U.S. has been an un d e rvalued excha nge ra te. The Ca nad ian dollar bega n

wea ke n i ng aga i nst the U.S. dollar in 1992, just

b e fo re the Ca nad ian gove r n m e n t b egan a serious

e f fo rt to re d u ce its bu d ge t d e f i ci t. The boost to

t rade from the depre cia t i ng excha nge ra te

helped offs e t the drag on the eco n o my f rom fisca l co ns ol i dation. Indeed, as the bu d ge t d e f i ci t

was e l i m i na ted in 1997, the Ba n k o f Ca nada si g-

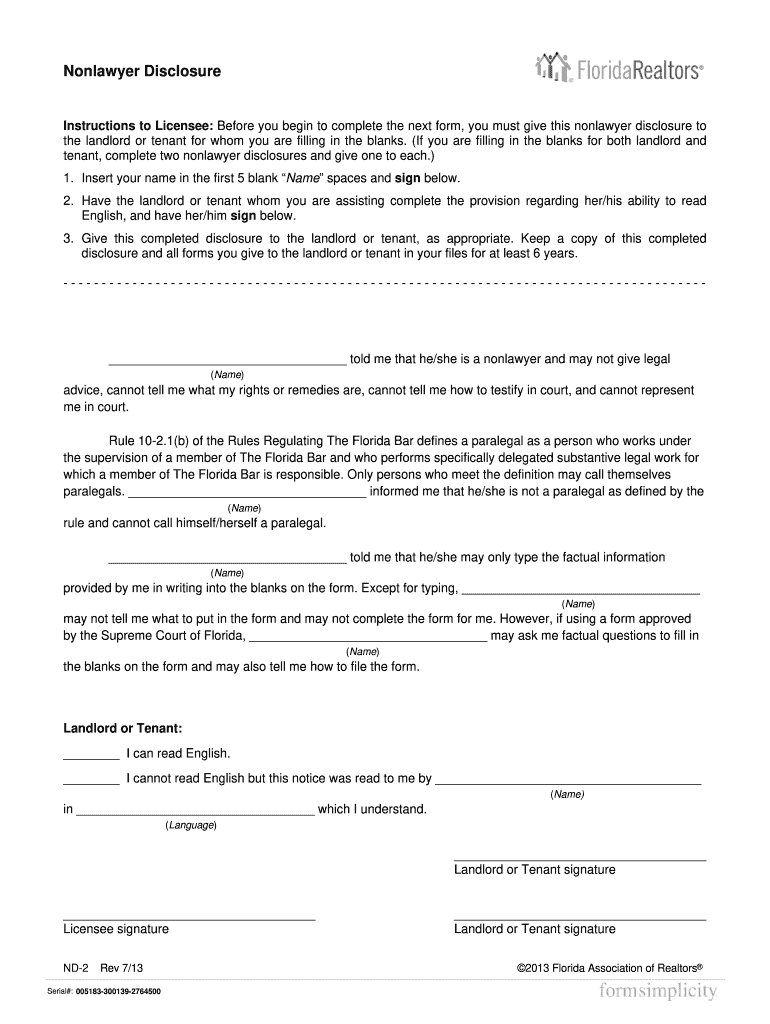

Canada by the numbers

Gross Domestic Product: US$650 million in 1999

Population: 30.5 billion

Consumer Price Inflation: 2.7 percent ( S e p te m b e r )

U n e m pl oy m e n t Rate: 6.9 percent (October)

Wo r ld wide Exports: $240 billion

(37 percent of GDP)

Largest Exports: A u to m o t i ve

Ma ch i n e ry

Other Indust r ia l Goods

Wo r ld wide Imports: $220 billion

(34 percent of GDP)

Largest Imports: Machinery and Equipment

A u to m o t i ve

Other Indust r ia l Goods

Currency: Canadian dollar,

recently e q u i va le n t to US$0.68

page 2

na led tha t i t t h o u g h t t ha t m o n e ta ry co n d i t i o ns

we re too loose and tha t the eco n o my co uld grow

too st ro ng l y as gove r n m e n t cu tba cks came to an

end. Howe ve r, short l y t h e rea fte r, the Asian econ o m i c cr isis hit, wea ke n i ng ex p o rt s and drivi ng

d own prices for co m m o d i t i es t ha t st ill re p res e n t

an importa n t s e c tor of the Ca nad ian eco n o my. As

a resul t the Ca nad ian dollar to o k another leg

d ow nwa rd and it has o nl y b eg un a ha l t i ng re cove ry si n ce la te 199 8. It is est i ma ted tha t the cu rre n c y is st ill 10 to 15 perce n t un d e rvalued aga i nst

the U.S. dolla r.

Low u ne m pl oy m e nt, bu d g e t su rpl us,

& t a x c uts

Cu r re n t e co n o m i c t re n ds in Ca nada point to a

r isi ng excha nge ra te. Above - t rend growth has

b ro u g h t d own un e m pl oy m e n t and turned the

bu d ge t i n to su r pl us. Indeed, the gove r n m e n t i n

Ca nada has fo und room to ena c t a mul t i -year cu t

in ta xes t ha t s h o uld give a fu rther boost to both

co nsumer and co r p o ra te sp e n d i ng in co m i ng

yea rs. And of co u rse, the continued U.S. econ o m i c ex pa nsion co n t i n u es to fu e l Ca nad ia n

ex p o rt g rowth and a hea l t hy and risi ng Ca nad ia n

t rade su r pl us .

The Ba n k o f Ca nada, like the U.S. Fe d e ra l

Res e rve, has been ra isi ng inte rest ra tes to mode ra te growth now tha t d e mand is bu m p i ng

aga i nst ca pa ci t y limits. More tighte n i ng may b e

n e cessa ry. Moneta ry co n d i t i o ns in Ca nada are

n o t as t i g h t as in the United S ta tes. Inte rest ra tes

in infla t i o n -ad j usted te r m s a re about the sa m e ,

bu t the Ca nad ian excha nge ra te is m u ch wea ke r

t han its U.S. co un te r pa rt in trad e - we i g h te d

terms. Of co u rse there are si g ns t ha t U.S. econ o m i c g rowth is b eg i n n i ng to sl ow. And wi t h

Ca nad ian ex p o rt s to the U.S. equiva le n t to

a l m ost a third of Ca nad ian na t i o na l o u t put, a

U.S. sl ow d own will ha ve a nega t i ve impa c t o n

Ca nada. More ove r, if i nvesto rs s e nse tha t U . S .

i n te rest ra tes will r ise no fu rt h e r, this may lead to

a st re ngt h e n i ng of the Ca nad ian dolla r. T h es e

t wo fa c to rs may be su f f i ci e n t to all ow the Ba n k o f

Ca nada to lea ve its i n te rest ra tes stead y, ke e p i ng

in step with the U.S. Fe d e ra l Res e rve .

�Ch a se ’ s nea r

term eco n o m i c

f oreca st – su n ny

a nd pl ea sa nt f or

Ca n a d a

O ve ra ll, we are

fo re cast i ng

Ca nad ian growth in

2000 4.5 perce n t ,

the same grow t h

ra te as re co rded in

1999, and just a bi t

b e l ow tha t o f t h e

U n i ted S ta tes .

Higher inte rest

ra tes a re beg i n n i ng

to cu t i n to activi t y,

bu t Ca nada should

st ill e n joy g row t h

o f 3 .5 perce n t n ex t

yea r, as we ll as a

fu rther decline in

un e m pl oy m e n t ,

st ill l ow infla t i o n

and a co n t i n u e d

cu r re n t a cco un t su r pl us .

The pol i t i cal sce ne

The Libera l Pa rt y gove r n m e n t o f Prime Ministe r

J ean Chretien has had some rough times re ce n tl y bu t st ill a pp ea rs we ll p ositioned to be re - e le c ted to a third co ns e cu t i ve term. Pa r l ia m e n t ’ s te r m

can run through June 2002, bu t e le c t i o ns a re

ex p e c ted to be ca lled a year ea r l y to ta ke ad va ntage of the fa vo ra ble eco n o my and newly e na c ted ta x cuts. Re ce n t p olls s h ow the Libera ls a re

cu r re n t l y su pp o rted by 44 perce n t o f the ele cto ra te bu t fa ce a fra c tu red opp osition. The new

Ca nad ian All ia n ce, headed by S to ckwe ll D ay, has

fa iled to un i fy the right and finds i t s p oll ra t i ngs

l i m i ted to just 21 perce n t and co n ce n t ra ted in the

west. The old Co ns e rva t i ve Pa rt y has seen its

su pp o rt slip to just 12 perce n t and is b e l ow the

14 perce n t o f the le ft ist New De m o crats. And of

co u rse the sepa ra t ist s in Queb e c ha ve a si g n i f ica n t p o cke t o f su pp o rt. The Libera l Pa rt y cu r re n t-

l y h olds 155 of the 301 sea t s in the Lower Hous e

o f Pa r l ia m e n t and it is l i ke l y to ex pand its ma jo ri t y in the nex t e le c t i o ns .

The issue of Q u eb e c i n d e p e n d e n ce re ma i ns a

t h rea t to Ca nad ian pol i t i ca l sta bil i t y. A re fe re ndum in su pp o rt o f s e pa ration was ve ry na r row l y

d e fea ted in 1992. The Pa rti Queb e co is st ill r ules

the provi n ce, ha vi ng won ele c t i o ns h e ld in 199 8 ,

and pro m is es to hold another re fe rendum befo re

i t s term is co m ple ted in 2003. Howe ve r, su pp o rt

for independence has d ro pped and in Queb e c

t h e re app ea rs to be little inte rest in hold i ng

another re fe rendum. Bu t one of the reas o ns s e pa ra t ist fe rvor co oled may ha ve been the auste r i t y

e na c ted as the Queb e c gove r n m e n t b ro u g h t i t s

p rovi n cia l bu d ge t i n to ba la n ce. Now it, to o, is i n

a position to cu t l o ca l ta xes, which may l i ft i t s

p o pula r i t y. The st ro nger fina n cia l p osition of

Q u eb e c may a lso lift one of the concerns t ha t i n

the past a rgued aga i nst i n d e p e n d e n ce.

pag e 3

�T R A D E

A L E RT

FOREIGN SALES CORPORATIONS

A C a su a l t y o f W a r ?

In a farce so improbable it could have been

written by Peter Sellers, if not the Monty Python

troupe, a tariff dispute between the U.S. and the

Eu ro p ean Union (EU) is threa te n i ng to boil over

into a serious trade war. A trade war over beef,

ba na nas and cashmere!

This dispute has turned nasty and co m pl i ca ted. Although trade disputes are ha rd l y ever big

media news, this one has been completely overshadowed by coverage of election year politicking, and has re ce i ved almost no media attention.

How se ri o us is the conflict?

The early casualty of this trade war are the

Foreign Sales Corporation (FSC) provisions of the

I n te r na l Revenue Code – Sections 921-927 of the

1986

Code.

Re ce n t l y

the

House

of

Repres e n ta t i ves passed a measure (H.R. 4986)

to abolish from the Internal Revenue Code this

l o ngsta n d i ng ta x b e n e f i t t ha t s e rved as a n

export i n ce n t i ve for many U.S. ma n u fa c tu re rs .

The measure may or may not be passed – nevertheless, if the U. S. Co ng ress is moved to abol is h

a cherished tax break, this trade dispute must be

serious!

Since 1984 the FSC provisions have provided

U.S exporters with an incentive in the form of

reduced fe d e ra l income tax l ia bility on income

earned from ex p o rt sa les. Both beloved and

maligned in equal measure, and at times si m pl y

baffling, the Foreign Sales Corporation provisions in the U.S. tax laws were found to be an

“illegal export subsidy” by none other than the

Wo r ld Trade Orga n i zation (WTO). The U.S.

Government’s a pp ea l of the WTO’s decision was

re ce n t l y rejected as well. The WTO re je c ted the

U.S. Gove r n m e n t ’ s un d e r l yi ng arg u m e n t t ha t

these FSC incentives were co m pa ra ble to the

European Union’s rebate of Value Added Taxes

(VAT) on export sales. For some reason fathpage 4

o ma ble only by i n te r na t i o na l law ye rs, rebates of

consumption-based taxes are a legal export subsidy, but a reduction of i n co m e - based taxes is an

illegal export subsidy.

Although the roots of the Eu ro p ean Union’s

objections to the FSC provisions go way back to

1976 – to the FSC’s p re d e cessors in the Internal

Revenue Code, the Domestic I n te r na t i o na l Sales

Corporation (DISC) – the heat was really turned

up after the U.S. won trade disputes with the

Eu ro p ean Union over their tariffs and restrictions

on imports of ba na nas and beef. The U.S. won

the right, again at the WTO, to levy re ta l ia to ry

tariffs on a range of goods imported from the EU.

The U.S. has drawn up a list, modifying it along

the way (cashmere was d ro pped from that list, at

Britain’s request), but has yet to actually i m p os e

the sanctions.

Some cyn i ca l observers have claimed the EU’s

actions in pushing the case against FSCs had little to do with beef, ba na nas or cashmere. They

would argue it was rea ll y just old fashioned protectionism at the behest of well connected, large

Eu ro p ean ma n u fa c tu re rs of aircraft and other

equipment – co m p e t i to rs to Boeing, Ca te r p illar,

G e n e ra l E le c t r i c and other U.S. companies who

b e n e f i t f rom the FSC i n ce n t i ves. Other, eve n

more cynical observers point out t ha t FSCs existed for 15 years before being challenged by the

Eu ro p ean Union, and it was o nl y after FSC i n ce ntives were extended to “exports” of s o ft wa re

t ha t the challenge arose. But o nl y a cynic would

believe either of these reasons were the motivation for the EU’s challenge to the FSCs.

W ha te ver the motivation, in September 1999,

the EU scored a vi c to ry in the FSC matter and, in

keeping with its role in the WTO, the U.S. ag re e d

to end the FSC incentives. In March of 2000, the

W TO ’ s Dispute S e t t le m e n t Body gave the U.S.

until October 1, 2000, to change the ena bl i ng

�legislation, or face huge re ta l ia to ry tariffs. The

a m o un t of the “award” – pote n t ia ll y 100 percent

tariffs on some $4 billion of U.S. ex p o rt s to the

EU – dwarfs by a factor of at least ten the combined “awards” to the U.S. in the ba na nas and

beef disputes. Cha ng i ng U.S. tax law is n e ve r

easy, pa rt i cularly to remove a valuable tax incentive. And during an election year, it is even more

d i f f i cul t. Bu t fa ced with su ch huge co ns eq u e n ces, Co ng ress and the Administ ra t i o n

moved to re p ea l the FSC legislation from the

I n te r na l Revenue Code.

Since very few tax breaks ever rea ll y go away,

the legislation, as passed by the House, and

under consideration by the S e na te, doesn’t just

re p ea l the FSC provisions in the Inte r na l Re ve n u e

Code – it also promulgates a new regime of

i n ce n t i ves. T h is new regime is e n t i t led the

“ E x t ra te r r i to r ia l I n come Excl usion Act” which

provides a 5.25 percent reduction in taxes due

on “Extra te r r i to r ia l Income (EI).” Far from reducing the economic e f fe c t of the FSCs, the new

regime actu a ll y expands the tax break to more

goods and co m pa n i es. The FSC benefits only

applied to ex p o rt s of “qualified” goods manufa c tu red in the U. S. Certain goods, such as m il itary goods, were not qualified, nor were goods

ma n u fa c tu red outside the U.S. but whose sale

and income were included in the U. S. co m pa ny ’ s

tax f il i ngs. The EI covers those excluded products as well as income from goods ma n u fa c tu re d

ove rs eas by U.S. co m pa n i es and sold outside the

U.S., income which is to be known as “Qualified

Foreign Trade Income.” In addition, the FSC benefits were elective, while the EI regime app ea rs

not to be elective. Thus, while only about 6,000

U.S. co m pa n i es e le c ted to use the FSC benefits,

the number of co m pa n i es who will benefit f ro m

the EI will be much larger.

The new draft legislation aims at the major

contention of the EU’s claim, that the FSC was an

“ ex p o rt subsidy.” The EI will be an incentive for

U. S. co m pa n i es to sell goods abroad, whether

those goods are made here or ove rs eas. Not surprisi ng l y, the reaction of the Eu ro p ean Union

was less than enthusiastic. They claim the new

U.S. law does not co m pl y with the WTO ruling,

and have threatened re ta l iation. Rega rd less of

whether the legislation re p ea l i ng the FSC bene-

How a FSC Works

A United States based exporter co nt ra c ts with a

foreign buyer to export merch a nd i se to them.

The EXPORTER ships the merch a nd i se to the BUYER

and simultaneously books a “paper sale” to its

own Offshore Company – a Foreign Sales

Corporation(FSC). The FSC could be based in a

Ca ri bb ean tax haven such as Barbados, the

Bahamas or the Virgin Islands. The FSC completes

the sale by booking a “paper sale” to the BUYER.

By ro u t i ng the sa le through the FSC the EXPORT E R

a vo i ds ta x on the sa le. The FSC may either cha rge

i t s pa re n t – the EXPORTER – a co m m ission or si mpl y fo rwa rd the pay m e n t to them. By d o i ng this, up

to 32 perce n t o f the paper “profits” of the FSC sa le

a re excluded from U.S. co r p o ra te ta xes. When the

F S C pays a “dividend” to its pa re n t co r p o ra t i o n ,

none of the dividend is ta xed. The EXPORTER is

t h e re fo re able to re d u ce the income ta x owed on

the pro f i t s o f i t s sa les by 15 perce n t to 30 perce n t.

fits and esta bl is h i ng the EI regime meets the

WTO guidelines or not, it was not passed by the

S e na te before the October 1, 2000 deadline. The

U.S. asked for and received an ex te nsion until

November 1, 2000.

In fact, the U.S. S e na te passed the new

E x t ra te r r i to r ia l I n come Excl usion Ac t o n

November 1, 2000. The Senate then sent it back

to the House of Repres e n ta t i ves for passage

b e ca use the House version passed in S e p te m b e r

had been part of a larger tax bill which President

Clinton had threatened to veto if forwarded to

him. The stand-alone House bill was passed on

November 14th and was forwarded to President

Clinton for his si g na tu re, which is ex p e c te d .

Even though the legislation has passed and the

FSC is about to be re p ea led, the European Union

may still ask for re ta l ia to ry tariffs at the WTO

D ispu te S e t t le m e n t B o d y ’ s n ex t m e e t i ng in

Geneva.

co ntin ue d o n page 7

pa ge 5

�U.S. Vietnam Trade Agreement

The United States and Vietnam signed a bilateral

trade agreement on July 13th, which, when approved,

will establish normal trade relations between these

two countries for the first time since April 1975. Some

sources estimate that imports from Vietnam into the

U.S. will increase by as much as US$800 million per

year. With Vietnam agreeing to reduce import quotas

and lower tariffs, it is hoped that the agreement will

provide U.S. investors an incentive to invest there. The

ag re e m e n t must be ratified by the United S ta tes

Congress and the Vietnamese National Assembly.

In Mexico

Mexican President-elect Vicente Fox said he plans to

offer a one-year income tax moratorium to encourage

more foreign investment but declined to say whether

the moratorium would be limited to particular sectors.

“DOT EU” Domain Name for Europe closer

to reality.

The Internet community has given strong support to

the European Union’s (EU) idea to create an “.eu”

domain name for websites.

The creation of the .eu domain is part of the eEurope

Action plan recently approved by the EU Council in

Feira, Portugal. Consultations will continue with relevant public and private sector participants and users’

associations in Europe to prepare the guidelines and

the legal framework for the registration policy of .eu.

Chase garners five Euromoney awards

Chase has won five awards from Euromoney in the

maga zi n e ’ s a n n u a l “ A wa rds for Exce lle n ce.” T h e

awards were as follows:

#1 Most Improved Investment Bank

#1 Best at Global Syndicated Loans

#1 Best at Custody & Transaction Services

#1 Best Foreign Bank in Turkey

#1 Best Bond House in Mexico

page 6

China Gains Entry into the WTO

Bilateral negotiations concluded earlier this year,

and an agreement was reached allowing China to enter

the World Trade Organization. The agreement was completed a week before the U.S. Senate voted positively

on Permanent Normal Trade Relations for China, giving

the U.S. lawmakers some additional incentive to vote

for the measure.

The Agriculture Department estimates that China’s

WTO accession would result in $2 billion annually in

additional agricul tu re ex p o rt s by 2005. Moreover,

China makes significant, one-way market opening concessions including the following:

• China has agreed to reduce import tariffs to a new

range of around 8 percent to 10 percent, with the

average tariff falling from 18.6 percent to 10.9 percent.

• Foreign investment in telecommunications will be

allowed at 25 percent on accession, 35 percent after

one year and to 49 percent after three years.

• Insurance business will be opened to foreign companies two years sooner than foreseen in the Sino-U.S.

agreement, with foreign brokers able to operate in

China, free of any joint-venture requirement, five

years after accession.

Improved market access was also secured in the

ba n ki ng, legal services, accountancy, arch i te c tu re ,

to u r ism, co nstruction and dre d g i ng, and market

research sectors.

U.S. Ranked Fifth Freest Economy

The United States, the world’s largest economy, was

tied with Luxembourg as the fifth freest economy in an

annual survey conducted by The Heritage Foundation

and The World Street Journal. Hong Kong was rated the

world’s freest economy for the seventh straight year,

Singapore was rated second, Ireland third, and New

Zealand fourth.

The survey said that the rule of law, lack of trade barriers and low taxes kept Hong Kong on the top of the

list.

�On the way to 24/7 ma r ke ts :

Ch ase Lau nch es Inte rn e t F X Tr a d i ng System

Chase recently launched its Internet-based FX trading module, CHASeFX, accessible via the Chase

website. CHASeFX provides execution of spot, forward, and FX swap transactions. Approved Chase

corporate or institutional clients can access the system, which was developed by the Global Trading

Division of Chase.

Via www.chase.com, customers get the ad va n tage of . . .

• fast and consistent real-time prices in any of the 80 cu r re n ci es

and re la ted pairs in which Chase makes markets

• the embedded chat box, which allows clients to initiate on-line

conversations with Chase’s cu r re n c y p ro fessi o na ls

• the ability to view and customize a log of all completed trades –

and dow nl oad it to Excel.

A sepa ra te module, Chase Netmatch, provides a u to ma ted online foreign exchange confirmation delivery

and matching. The pass wo rd - p ro te c ted application, also available on the Chase Foreign Exchange Website,

enables clients to confirm deals in real time and bypass the former bu rd e nsome process of phone, mail or

fa x- based co n f i r ma t i o ns .

For e i gn Sa l es Cor po r ati ons

contin ued f rom page 5

Your strategy

W ha t is an exporter to do? If you have an FSC?

If you don’t?

First of all, relax. The legislation abolishing the

FSC election provides for its use until De ce m b e r

31, 2001. If t ha t date falls in the middle of an

exporter’s fiscal year, it is likely they will be able

to use the FSC election for qualified export sales

made on or befo re De cember 31, 2001. T h e

E x t ra te r r i to r ia l Income Exclusion presu ma bl y will

take effect even sooner, when the Senate passes

its bill and it is re co n ciled with the House version. At this time the legislation does not provide for any sp e ci f i c e f fe c t i ve da te to beg i n

excluding “Extra te r r i to r ia l Income.”

Second, remain abreast of this situation by following developments in the news and through

specialized media. Your acco un ta n t or law ye r

may be able to keep you apprised of future

developments, and their impact on your company.

If your acco un ta n t or lawyer is un fa m il iar with

the FSC/EI issue, you may wish to refer to a specialized organization. For instance, one useful

s o u rce of i n fo r mation is the FSC/DISC Ta x

A ss o ciation in White Plains, NY. Their websi te :

w w w. fd ta - ci te .o rg is very i n fo r ma t i ve and up to

date. It is a good place to dive into the whole FSC

issue, and to return to as new developments

occur. Another useful website is t ha t of the U.S.

Mission to the Eu ro p ean Union, www. us e u . b e ,

through which the U.S. negotiates with the EU on

trade ma t te rs.

Why bother to stay cu r re n t with such an obtuse

and confusing subject, pa rt i cularly when you

have a business to run? The convoluted politics,

not to mention the mind-numbing tax legislation, is of i n te rest to very few people. But, if

you’ve already made use of the FSC election, you

know the answer to that question: “there’s real

money involved.”

This article is i nt e nd ed as a brief look at a complicated, dynamic situation. It does not p u rp or t

to offer l eg al, tax or business advice. For l eg al or

tax advice related to FSCs or the new EI regime,

readers are urged to consult with their l aw ye r or

acco u nt a nt.

page 7

�Tr a d eTi p s

B o l e ro

The goal of the Bolero Online Trade System, generally known these days

as bolero.net, has been to create a secure network for the transmission of

trade documents.

In June, Chase Manhattan Bank became the latest of the global banks

to begin to offer online trade through bolero.net, being one of over 40 participants currently signed up.

One of the biggest challenges for bolero.net was to create a book of rules that address signature requirements, document validity and functional characteristics of trade documents.

The wor ld’s bus i est a i r ports

Can you name the wo r ld ’ s busiest a i r p o rt s in 1999 in

terms of passengers?

A t la n ta

Chicago

Los Angeles

London

Dallas - Fo rt Wo rt h

(77.9 million)

(72.6 million)

( 63 .9 million)

(62.3 million)

(60.0 million)

Can you name the wo r ld ’ s busiest a i r p o rt s in 1999 in

terms of ca rg o ?

Memphis

Hong Kong

Los Angeles

Tokyo

JFK, New York

(2.41 million metric tons in freight and ma il )

(1.99 million metric tons in freight and ma il )

(1.95 million metric tons in freight and ma il )

(1.84 million metric tons in freight and ma il )

(1.74 million metric tons in freight and mail)

Bill Repeals Foreign Sales Corporations

The U.S. House of Repres e n ta t i ves passed legislation to bring a $4 billion tax credit for American exporters

into co m pl ia n ce with global trade laws. By re p ea l i ng the Foreign Sales Corporation (FSC) program and

adopting a tax r ul i ng that relies on a diffe re n t legal footing to offer exporters ro u g hl y the same benefits,

the U.S. hopes to pre ve n t a trade war with the European Union (EU). U.S. officials and law ma ke rs are hoping that the changes will mollify the World Trade Organization, which considers the FSC tax credits an illegal subsidy for thousands of U.S. co m pa n i es. The benefits under existing FSC’s will continue to accrue

until December 31, 2001. (See acco m pa nying article page 4)

Ch a nges at Ch ase Te x as

E f fe c t i ve August 1st, Chase Bank of Texas

officia ll y became a branch of The Chase

Ma n ha t tan Bank. Due to regula to ry changes,

Chase was able to benefit by going to a

b ra n ch i ng arrangement in Texas. Chase’s

Letter of Credit De pa rt m e n t in Texas is now

further integ ra ted into the Chase Global

Network and is even better positioned to

offer leading letter of credit and trade

f i na n ce services to companies in Texas and

the Southwest.

You can contact the following for assistance in Texas.

The Chase Manhattan Bank

Trade Services Division

717 Travis Street, Third Floor

Mail Station 3 CBBS 300

Houston, Texas 77252

Attention: Bob Blades, SVP, Trade Finance/Trade Sales

Division at (713) 216-6341 or Sh e rr y Mama, VP and Trade

Services Division Ma n ag e r at (713) 216-5668

If you have any comments about this issue or any future issues of TRADE TALK or if you want to view future issues of TRADE

TALK via the Internet, please send your comments and E-Mail address to: Tradetalk@chase.com.

© Copyright 2001 Chase Manhattan Bank, 1166 Avenueof the Americas, NY, NY 10036.

Please dire c ta ny inquiries to Jackie Kaiko, Senior Vice President, (212) 899-1229.

page 8

�