Fill and Sign the Residential Lease for Unit in Condominium or Cooperative Form

Useful tips for finalizing your ‘Residential Lease For Unit In Condominium Or Cooperative’ online

Are you fed up with the inconvenience of handling paperwork? Search no more than airSlate SignNow, the premier digital signature platform for individuals and organizations. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the extensive features incorporated within this user-friendly and economical platform and transform your document management approach. Whether you need to sign forms or gather signatures, airSlate SignNow manages it all seamlessly, requiring merely a few clicks.

Follow this detailed guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template repository.

- Access your ‘Residential Lease For Unit In Condominium Or Cooperative’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for other participants (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your version, or convert it into a multiple-use template.

No need to worry if you must collaborate with others on your Residential Lease For Unit In Condominium Or Cooperative or send it for notarization—our solution provides you with everything required to complete such tasks. Sign up with airSlate SignNow today and elevate your document management experience!

FAQs

-

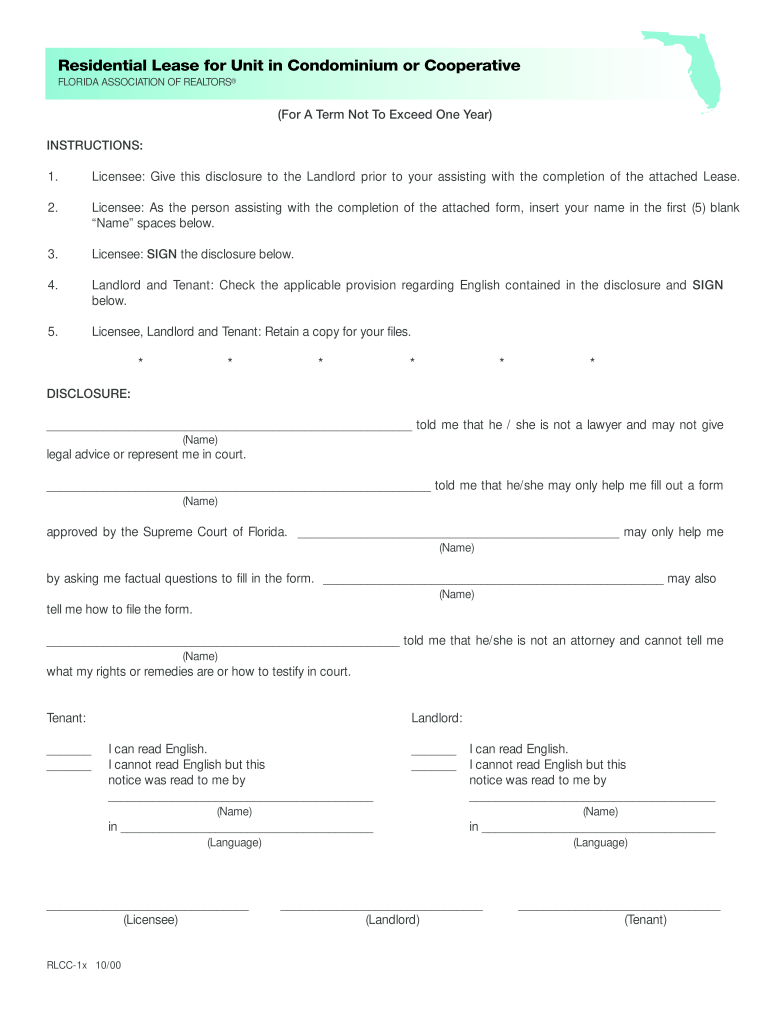

What is a Residential Lease For Unit In Condominium Or Cooperative?

A Residential Lease For Unit In Condominium Or Cooperative is a legal document that outlines the terms and conditions under which a tenant rents a unit in a condominium or cooperative. This lease specifies the rights and responsibilities of both the tenant and the landlord, ensuring clarity and protection for both parties. By using airSlate SignNow, you can easily create and sign these leases digitally, streamlining the rental process.

-

How can airSlate SignNow help me with my Residential Lease For Unit In Condominium Or Cooperative?

airSlate SignNow provides a user-friendly platform to create, send, and eSign a Residential Lease For Unit In Condominium Or Cooperative. Our solution simplifies the document management process, allowing you to customize your lease agreements and track their status in real-time. With our platform, you can ensure that all parties involved can sign securely and efficiently.

-

What are the benefits of using airSlate SignNow for my Residential Lease For Unit In Condominium Or Cooperative?

Using airSlate SignNow for your Residential Lease For Unit In Condominium Or Cooperative offers several benefits, including increased efficiency and reduced paperwork. Our electronic signing process saves time, while ensuring that your documents are legally binding and securely stored. Additionally, you can access your leases from anywhere, facilitating easier management of your rental agreements.

-

Is there a cost associated with using airSlate SignNow for Residential Lease For Unit In Condominium Or Cooperative?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individual users and businesses. The cost for using our services for a Residential Lease For Unit In Condominium Or Cooperative includes access to all features necessary for document creation and eSigning. You can choose a plan that fits your budget and requirements.

-

Can I customize my Residential Lease For Unit In Condominium Or Cooperative using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your Residential Lease For Unit In Condominium Or Cooperative to meet your specific needs. You can add clauses, adjust terms, and include any necessary disclosures to ensure the lease accurately reflects your agreement with the tenant.

-

What integrations does airSlate SignNow offer for managing Residential Lease For Unit In Condominium Or Cooperative?

airSlate SignNow integrates seamlessly with various applications, including CRM systems and document storage solutions, to enhance your workflow for managing a Residential Lease For Unit In Condominium Or Cooperative. With these integrations, you can streamline your processes and maintain all your important documents in one place, enhancing productivity.

-

How secure is the eSigning process for Residential Lease For Unit In Condominium Or Cooperative with airSlate SignNow?

The eSigning process for a Residential Lease For Unit In Condominium Or Cooperative with airSlate SignNow is highly secure. We use industry-standard encryption and comply with legal regulations to ensure that your documents are protected from unauthorized access. Our platform also provides audit trails, so you can track who signed the document and when.

Find out other residential lease for unit in condominium or cooperative form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles