- 1 -

RESIDENTIAL REAL PROPERTY DISCLOSURE REPORT

NOTICE: The pur pose of this report is to provide prospective buyers with information about material defects in the residential real

property. This report does not limit the parties' right to contract for the sale of residential real property in "as is" cond ition. Under

common law, sellers who disclose material defects may be under a continuing obligation to advise the prospective buyers about the

condition of the residential real property even after the report is delivered to the prospective buyer. Completion of this re port by the

seller creates legal obligations on the seller; therefore the seller may wish to consult an attorney prior to completion of t his report.

Property Address:

City, State & Zip Code:

Seller’s Name:

This Report is a disclosure of certain conditions of the residential real property listed above in compliance with the Residential Real

Property Disclosure Act. This information is provided as of (month) (day)

(year), and does not reflect any changes made or occurring after that date or information that becomes known to the

seller after that date. The disclosures herein shall not be deemed warranti es of any kind by the seller or any person representing any

party in this transaction.

In this form, “am aware” means to have actual notice or actual knowledge without any specific investigation or inquiry. In th is form,

"material defect" means a condition that would have a substantial adverse effect on the value of the residential real property or that

would significantly impair the health or safety of future occupants of the residential real property u nless the seller reasonably believes

that the condition has been corrected.

The seller discloses the following information with the knowledge that even though the statements herein are not deemed to be

warranties, prospective buyers may choose t o rely on this information in deciding whether or not and on what terms to purchase the

residential real property.

The seller represents that to the best of his or her actual knowledge, the following statements have been accurately not ed as "yes"

(correct), "no" (incorrect), or "not applicable" to the property being sold . If the seller indicates that the response to any statement,

except number 1, is yes or not applicable, the seller shall provide an explanation, in the additi onal information area of this form.

YES NO N/A

1. Seller has occupied the property within the last 12 months. (No explanation is

needed.)

2. I am aware of flooding or recurring leakage problems in the crawl space or

basement.

3. I am aware that the property is located in a flood plain or that I currently have flood

hazard insurance on the property.

4. I am aware of material defects in the basement or foundation (including cracks and

bulges).

5. I am aware of leaks or material defects in the roof, ceilings, or chimney.

6. I am aware of material defects in the walls or floors.

7. I am aware of material defects in the electrical system.

8. I am aware of material defects in the plumbing system (include such things as water

heater, sump pump, water treatment system, sprinkler system, and swimming pool).

9. I am aware of material defects in the well or well equipment.

10. I am aware of unsafe conditions in the drinking water.

11. I am aware of material defects in the heating, air conditioning, or ventilating

systems.

12. I am aware of material defects in the fireplace or woodburning stove.

13. I am aware of material defects in the septic, sanitary sewer, or other disposal

system.

14. I am aware of unsafe concentrations of radon on the premises.

- 2 -

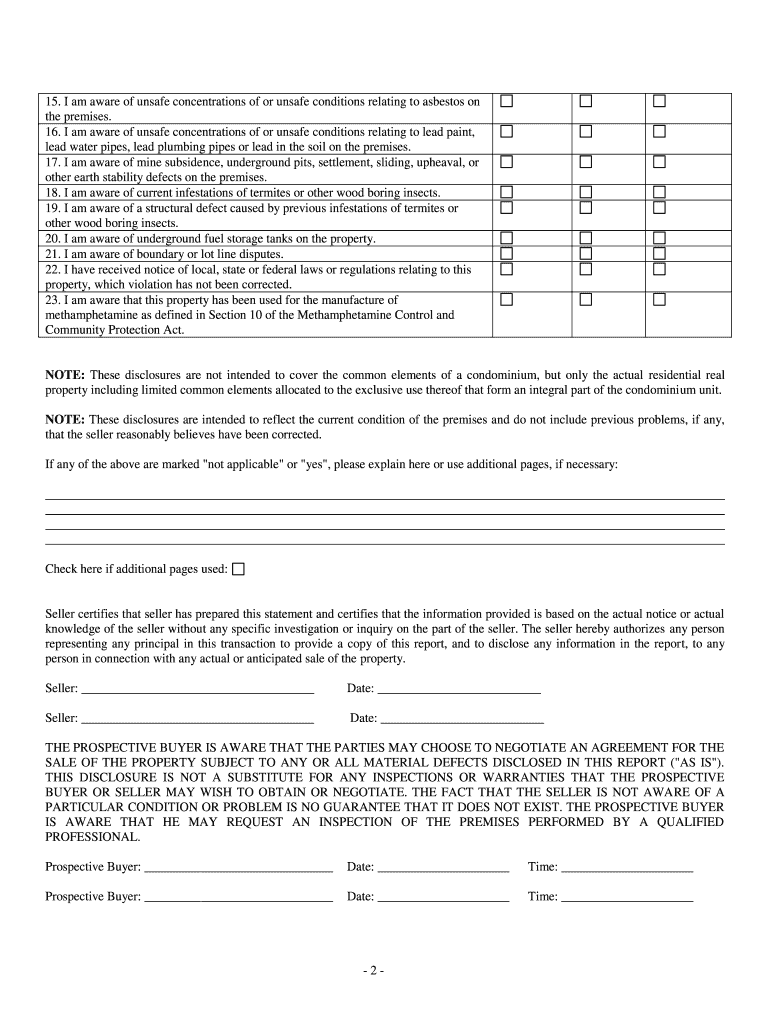

15. I am aware of unsafe concentrations of or unsafe conditions relating t o asbestos on

the premises.

16. I am aware of unsafe concentrations of or unsafe conditions relating to lead paint,

lead water pipes, lead plumbing pipes or lead in the soil on the premises.

17. I am aware of mine subsidence, underground pits, settlement, sliding, upheaval, or

other earth stability defects on the premi ses.

18. I am aware of current infestations of termites or other wood boring insects.

19. I am aware of a structural defect caused by previous infestations of termites or

other wood boring insects.

20. I am aware of underground fuel storage tanks on the property.

21. I am aware of boundary or lot line disputes.

22. I have received notice of local, state or federal laws or regulations relating to this

property, which violation has not been corrected.

23. I am aware that this property has been used for the manufacture of

methamphetamine as defined in Section 10 of the Methamphetamine Control and

Community Protection Act.

NOTE: These disclosures are not intended to cover the common elements of a condominium, but only the actual residential r eal

property including limited common elements allocated to the exclusive use thereof that form an integral part of the condomini um unit.

NOTE: These disclosures are intended to reflect the current condition of the premises a nd do not include previous problems, if any,

that the seller reasonably believes have been corrected.

If any of the above are marked "not applicable" or "yes", please explain here or use additional pages, if necessary:

Check here if additional pages used:

Seller certifies that seller has prepared this statement and certifies that the information provided is based on the actual notice or actual

knowledge of the seller without any specific investigation or inquiry on the part of the seller. The seller hereby authorizes any person

representing any principal in this transaction to provide a copy of this report, and to disclose any information in the repor t, to any

person in connection with any actual or anticipated sale of the property.

Seller: ___________________________ __________ Date: __________________________

Seller: _____________________________________ Date: __________________________

THE PROSPECTIVE BUYER IS AWARE THAT THE PARTIES MAY CHOOSE TO NEGOTIATE AN AGREEMENT FOR THE

SALE OF THE PROPERTY SUBJE CT TO ANY OR ALL MATERIAL DEFECTS DISCLOSED IN THIS REPORT ("AS IS").

THIS DISCLOSURE IS NOT A SUBSTITUTE FOR ANY INSPECTIONS OR WARRANTIES THAT THE PROSPECTIVE

BUYER OR SELLER MAY WISH TO OBTAIN OR NEGOTIATE. THE FACT THAT THE SELLER IS NOT AWA RE OF A

PARTICULAR CONDITION OR PROBLEM IS NO GUARANTEE THAT IT DOES NOT EXIST. THE PROSPECTIVE BUYER

IS AWARE THAT HE MAY REQUEST AN INSPECTION OF THE PREMISES PERFORMED BY A QUALIFIED

PROFESSIONAL.

Prospective Buyer: ______________________________ Date: _____________________ Time: _____________________

Prospective Buyer: ______________________________ Date: _____________________ Time: _____________________

- 3 -

Residential Real Property Disclosure Act - 765 ILCS 77

Reprinted in full (excluding Section 35), as per 765 ILCS 77/65.

(765 ILCS 77/Art. 1 heading)

ARTICLE 1

SHORT TITLE

(Source: P.A. 94 -280, eff. 1 -1-06.)

(765 ILCS 77/1)

Sec. 1. Short title. This Act may be cited as the Residential Real Property Di sclosure Act.

(Source: P.A. 88 -111.)

(765 ILCS 77/Art. 2 heading)

ARTICLE 2

DISCLOSURES

(Source: P.A. 94 -280, eff. 1 -1-06.)

(765 ILCS 77/5)

Sec. 5. Definitions. As used in this Act, unless the context otherwise requires the following terms have the meaning given in this

Section.

"Residential real property" means real property improved with not less than one nor more than 4 residential dwelling units; units in

residential cooperatives; or, condominium units, including the limited common elements allocated to the exclusive use thereof that

form an integral part of the condominium unit. The term includes a manufactured home as defined in subdivision (53) of Section 9 -

102 of the Uniform Commercial Code that is real property as defined in the Conveyance and Encumbrance of Manufactured Homes a s

Real Property and Severance Act.

"Seller" means every person or entity who is an owner, benefi ciary of a trust, contract purchaser or lessee of a ground lease, who

has an interest (legal or equitable) in residential real property. However, "seller" shall not include any person who has bot h (i) never

occupied the residential real property and (ii) n ever had the management responsibility for the residential real property nor delegated

such responsibility for the residential real property to another person or entity.

"Prospective buyer" means any person or entity negotiating or offering to become an owner or lessee of residential real property by

means of a transfer for value to which this Act applies.

(Source: P.A. 98 -749, eff. 7 -16-14.)

(765 ILCS 77/10)

Sec. 10. Except as provided in Section 15, this Act applies to any transfer by sale , exchange, installment land sale contract,

assignment of beneficial interest, lease with an option to purchase, ground lease, or assignment of ground lease of residenti al real

property.

(Source: P.A. 88 -111.)

(765 ILCS 77/15)

Sec. 15. The provi sions of this Act do not apply to the following:

(1) Transfers pursuant to court order, including, but not limited to, transfers ordered by a probate court in administration of an

estate, transfers between spouses resulting from a judgment of dissolut ion of marriage or legal separation, transfers pursuant to an

order of possession, transfers by a trustee in bankruptcy, transfers by eminent domain, and transfers resulting from a decree for

specific performance.

(2) Transfers from a mortgagor to a m ortgagee by deed in lieu of foreclosure or consent judgment, transfer by judicial deed issued

pursuant to a foreclosure sale to the successful bidder or the assignee of a certificate of sale, transfer by a collateral as signment of a

beneficial interest of a land trust, or a transfer by a mortgagee or a successor in interest to the mortgagee's secured position or a

beneficiary under a deed in trust who has acquired the real property by deed in lieu of foreclosure, consent judgment or judi cial deed

issued pur suant to a foreclosure sale.

(3) Transfers by a fiduciary in the course of the administration of a decedent's estate, guardianship, conservatorship, or tr ust.

(4) Transfers from one co -owner to one or more other co -owners.

(5) Transfers purs uant to testate or intestate succession.

(6) Transfers made to a spouse, or to a person or persons in the lineal line of consanguinity of one or more of the sellers.

(7) Transfers from an entity that has taken title to residential real property fr om a seller for the purpose of assisting in the relocation

of the seller, so long as the entity makes available to all prospective buyers a copy of the disclosure form furnished to the entity by the

seller.

- 4 -

(8) Transfers to or from any governmental en tity.

(9) Transfers of newly constructed residential real property that has not been occupied.

(Source: P.A. 88 -111.)

(765 ILCS 77/20)

Sec. 20. A seller of residential real property shall complete all applicable items in the disclosure docu ment described in Section 35

of this Act. The seller shall deliver to the prospective buyer the written disclosure statement required by this Act before t he signing of

a written agreement by the seller and prospective buyer that would, subject to the satis faction of any negotiated contingencies, require

the prospective buyer to accept a transfer of the residential real property.

(Source: P.A. 88 -111.)

(765 ILCS 77/25)

Sec. 25. Liability of seller.

(a) The seller is not liable for any error, inaccuracy, or omission of any information delivered pursuant to this Act if (i) the seller

had no knowledge of the error, inaccuracy, or omission, (ii) the error, inaccuracy, or omission was based on a reaso nable belief that a

material defect or other matter not disclosed had been corrected, or (iii) the error, inaccuracy, or omission was based on in formation

provided by a public agency or by a licensed engineer, land surveyor, structural pest control operato r, or by a contractor about matters

within the scope of the contractor's occupation and the seller had no knowledge of the error, inaccuracy, or omission.

(b) The seller shall disclose material defects of which the seller has actual knowledge.

(c) The seller is not obligated by this Act to make any specific investigation or inquiry in an effort to complete the disclosu re

statement.

(Source: P.A. 90 -383, eff. 1 -1-98.)

(765 ILCS 77/30)

Sec. 30. Disclosure supplement. If, prior to closing, any seller has actual knowledge of an error, inaccuracy, or omission in any prior

disclosure document after delivery of that disclosure document to a prospective buyer, that seller shall supplement the prior disclosure

document with a written supplemental disclosure.

(Source: P.A. 90 -383, eff. 1 -1-98; 91 -357, eff. 7 -29-99.)

(765 ILCS 77/35)

Sec. 35. Disclosure report form. (omitted per 765 ILCS 77/65)

(Source: P.A. 98 -754, eff. 1 -1-15.)

(765 ILCS 77/40)

Sec. 40. Material defect. If a material defect is disclosed in the Residential Real Property Disclosure Report, after accepta nce by the

prospective buyer of an offer or counter -offer made by a seller or after the execution of an offer made by a prospec tive buyer that is

accepted by the seller for the conveyance of the residential real property, then the prospective buyer may, within 3 business days after

receipt of that report by the prospective buyer, terminate the contract or other agreement without a ny liability or recourse except for

the return to prospective buyer of all earnest money deposits or down payments paid by prospective buyer in the transaction. If a

material defect is disclosed in a supplement to this disclosure document, the prospective buyer shall not have a right to terminate

unless the material defect results from an error, inaccuracy, or omission of which the seller had actual knowledge at the tim e the prior

disclosure document was completed and signed by the seller. The right to term inate the contract, however, shall no longer exist after

the conveyance of the residential real property. For purposes of this Act the termination shall be deemed to be made when wri tten

notice of termination is personally delivered to at least one of the sellers identified in the contract or other agreement or when

deposited, certified or registered mail, with the United States Postal Service, addressed to one of the sellers at the addres s indicated in

the contract or agreement, or, if there is not an addr ess contained therein, then at the address indicated for the residential real property

on the report.

(Source: P.A. 90 -383, eff. 1 -1-98.)

(765 ILCS 77/45)

Sec. 45. This Act is not intended to limit or modify any obligation to disclose created by any other statute or that may exist in

common law in order to avoid fraud, misrepresentation, or deceit in the transaction.

(Source: P.A. 88 -111.)

(765 ILCS 77/50)

Sec. 50. Delivery of the Residential Real Property Disclosure Report provided by this Act shall be by:

(1) personal or facsimile delivery to the prospective buyer;

(2) depositing the report with the United States Postal Service, postage prepaid, first class mail, addressed to the prospective

buyer at the address provided by the prospective buyer or indicated on the contract or other agreement; or

- 5 -

(3) depositing the report with an alternative delivery service such as Federal Express, UPS, or Airborne, delivery charges prepaid,

addressed to the prospective buyer at the address provided by the prospective buyer or indicated on the contract or other agr eement.

For purposes of this Act, delivery to one prospec tive buyer is deemed delivery to all prospective buyers. Delivery to an authorized

individual acting on behalf of a prospective buyer constitutes delivery to all prospective buyers. Delivery of the report is effective

upon receipt by the prospective buyer. Receipt may be acknowledged on the report, acknowledged in an agreement for the conveyance

of the residential real property, or shown in any other verifiable manner.

(Source: P.A. 91 -357, eff. 7 -29-99.)

(765 ILCS 77/55)

Sec. 55. Violations and damages. If the seller fails or refuses to provide the disclosure document prior to the conveyance of the

residential real property, the buyer shall have the right to terminate the contract. A person who knowingly violates or fails to perform

any duty pres cribed by any provision of this Act or who discloses any information on the Residential Real Property Disclosure Report

that he knows to be false shall be liable in the amount of actual damages and court costs, and the court may award reasonable attorney

fees incurred by the prevailing party.

(Source: P.A. 90 -383, eff. 1 -1-98.)

(765 ILCS 77/60)

Sec. 60. No action for violation of this Act may be commenced later than one year from the earlier of the date of possession, date of

occupancy, or date o f recording of an instrument of conveyance of the residential real property.

(Source: P.A. 88 -111.)

(765 ILCS 77/65)

Sec. 65. A copy of this Act, excluding Section 35, must be printed on or as a part of the Residential Real Property Disclosur e R eport

form.

(Source: P.A. 88 -111.)

(765 ILCS 77/Art. 3 heading)

ARTICLE 3

PREDATORY LENDING DATABASE

(Source: P.A. 94 -280, eff. 1 -1-06.)

765 ILCS 77/70)

Sec. 70. Predatory lending database program.

(a) As used in this Article:

"Adjustable rate mortgage" or "ARM" means a closed -end mortgage transaction that allows adjustments of the loan interest rate

during the first 3 years of the loan term.

"Borrower" means a person seeking a mortgage loan.

"Broker" means a "broke r" or "loan broker", as defined in subsection (p) of Section 1 -4 of the Residential Mortgage License Act of

1987.

"Closing agent" means an individual assigned by a title insurance company or a broker or originator to ensure that the execut ion of

docume nts related to the closing of a real estate sale or the refinancing of a real estate loan and the disbursement of closing fun ds are

in conformity with the instructions of the entity financing the transaction.

"Counseling" means in -person counseling pr ovided by a counselor employed by a HUD -approved counseling agency to all

borrowers, or documented telephone counseling where a hardship would be imposed on one or more borrowers. A hardship shall ex ist

in instances in which the borrower is confined to his or her home due to medical conditions, as verified in writing by a physician, or

the borrower resides 50 miles or more from the nearest participating HUD -approved housing counseling agency. In instances of

telephone counseling, the borrower must supply al l necessary documents to the counselor at least 72 hours prior to the scheduled

telephone counseling session.

"Counselor" means a counselor employed by a HUD -approved housing counseling agency.

"Credit score" means a credit risk score as defined by the Fair Isaac Corporation, or its successor, and reported under such names as

"BEACON", "EMPIRICA", and "FAIR ISAAC RISK SCORE" by one or more of the following credit reporting agencies or their

successors: Equifax, Inc., Experian Information Solutions, Inc., and TransUnion LLC. If the borrower's credit report contains credit

scores from 2 reporting agencies, then the broker or loan originator shall report the lower score. If the borrower's credit r eport contains

credit scores from 3 reporting agencies, t hen the broker or loan originator shall report the middle score.

"Department" means the Department of Financial and Professional Regulation.

"Exempt person or entity" means that term as it is defined in subsections (d)(1), (d)(1.5), and (d)(1.8) of Section 1 -4 of the

Residential Mortgage License Act of 1987.

- 6 -

"First -time homebuyer" means a borrower who has not held an ownership interest in residential property.

"HUD -approved counseling" or "counseling" means counseling given to a borrower by a counselor employed by a HUD -approved

housing counseling agency.

"Interest only" means a closed -end loan that permits one or more payments of interest without any reduction of the principal

balance of the loan, other than the first payment on the loan.

"Lender" means that term as it is defined in subsection (g) of Section 1 -4 of the Residential Mortgage License Act of 1987.

"Licensee" means that term as it is defined in subsection (e) of Section 1 -4 of the Residential Mortgage License Act of 1987.

"Mortgage loan" means that term as it is defined in subsection (f) of Section 1 -4 of the Residential Mortgage License Act of 1987.

"Negative amortization" means an amortization method under which the outstanding balance may increase at a ny time over the

course of the loan because the regular periodic payment does not cover the full amount of interest due.

"Originator" means a "loan originator" as defined in subsection (hh) of Section 1 -4 of the Residential Mortgage License Act of

1987 , except an exempt person, and means a "mortgage loan originator" as defined in subsection (jj) of Section 1 -4 of the Residential

Mortgage License Act of 1987, except an exempt person.

"Points and fees" has the meaning ascribed to that term in Section 10 of the High Risk Home Loan Act.

"Prepayment penalty" means a charge imposed by a lender under a mortgage note or rider when the loan is paid before the

expiration of the term of the loan.

"Refinancing" means a loan secured by the borrower's or b orrowers' primary residence where the proceeds are not used as purchase

money for the residence.

"Title insurance company" means any domestic company organized under the laws of this State for the purpose of conducting the

business of guaranteeing or i nsuring titles to real estate and any title insurance company organized under the laws of another State, the

District of Columbia, or a foreign government and authorized to transact the business of guaranteeing or insuring titles to r eal estate in

this Sta te.

(a-5) A predatory lending database program shall be established within Cook County. The program shall be administered in

accordance with this Article. The inception date of the program shall be July 1, 2008. A predatory lending database program s hall be

expanded to include Kane, Peoria, and Will counties. The inception date of the expansion of the program as it applies to Kane , Peoria,

and Will counties shall be July 1, 2010. Until the inception date, none of the duties, obligations, contingencies, or consequences of or

from the program shall be imposed. The program shall apply to all mortgage applications that are governed by this Article and that are

made or taken on or after the inception of the program.

(b) The database created under this p rogram shall be maintained and administered by the Department. The database shall be

designed to allow brokers, originators, counselors, title insurance companies, and closing agents to submit information to th e database

online. The database shall not be d esigned to allow those entities to retrieve information from the database, except as otherwise

provided in this Article. Information submitted by the broker or originator to the Department may be used to populate the onl ine form

submitted by a counselor, t itle insurance company, or closing agent.

(c) Within 10 business days after taking a mortgage application, the broker or originator for any mortgage on residential pro perty

within the program area must submit to the predatory lending database all of the information required under Section 72 and any other

information required by the Department by rule. Within 7 business days after receipt of the information, the Department shall compare

that information to the housing counseling standards in Section 7 3 and issue to the borrower and the broker or originator a

determination of whether counseling is recommended for the borrower. The borrower may not waive counseling. If at any time af ter

submitting the information required under Section 72 the broker or o riginator (i) changes the terms of the loan or (ii) issues a new

commitment to the borrower, then, within 5 business days thereafter, the broker or originator shall re -submit all of the information

required under Section 72 and, within 4 business days afte r receipt of the information re -submitted by the broker or originator, the

Department shall compare that information to the housing counseling standards in Section 73 and shall issue to the borrower a nd the

broker or originator a new determination of wheth er re -counseling is recommended for the borrower based on the information re -

submitted by the broker or originator. The Department shall require re -counseling if the loan terms have been modified to meet

another counseling standard in Section 73, or if the broker has increased the interest rate by more than 200 basis points.

(d) If the Department recommends counseling for the borrower under subsection (c), then the Department shall notify the borro wer

of all participating HUD -approved counseling agenci es located within the State and direct the borrower to interview with a counselor

associated with one of those agencies. Within 10 business days after receipt of the notice of HUD -approved counseling agencies, it is

the borrower's responsibility to select one of those agencies and shall engage in an interview with a counselor associated with that

agency. The selection must take place and the appointment for the interview must be set within 10 business days, although the

interview may take place beyond the 1 0 business day period. Within 7 business days after interviewing the borrower, the counselor

must submit to the predatory lending database all of the information required under Section 74 and any other information requ ired by

the Department by rule. Reason able and customary costs not to exceed $300 associated with counseling provided under the program

shall be paid by the broker or originator and shall not be charged back to, or recovered from, the borrower. The Department s hall

annually calculate to the ne arest dollar an adjusted rate for inflation. A counselor shall not recommend or suggest that a borrower

contact any specific mortgage origination company, financial institution, or entity that deals in mortgage finance to obtain a loan,

another quote, or f or any other reason related to the specific mortgage transaction; however, a counselor may suggest that the borrower

seek an opinion or a quote from another mortgage origination company, financial institution, or entity that deals in mortgage finance.

- 7 -

A co unselor or housing counseling agency that in good faith provides counseling shall not be liable to a broker or originator or

borrower for civil damages, except for willful or wanton misconduct on the part of the counselor in providing the counseling.

(e) The broker or originator and the borrower may not take any legally binding action concerning the loan transaction until th e later

of the following:

(1) the Department issues a determination not to

recommend HUD -approved counseling for the borrower in accordance with subsection (c); or

(2) the Department issues a determination that

HUD -approved counseling is recommended for the borrower and the counselor submits all required information to the database in

accordance with subsec tion (d).

(f) Within 10 business days after closing, the title insurance company or closing agent must submit to the predatory lending

database all of the information required under Section 76 and any other information required by the Department by rul e.

(g) The title insurance company or closing agent shall attach to the mortgage a certificate of compliance with the requiremen ts of

this Article, as generated by the database. If the transaction is exempt, the title insurance company or closing agent shall attach to the

mortgage a certificate of exemption, as generated by the database. If the title insurance company or closing agent fails to a ttach the

certificate of compliance or exemption, whichever is required, then the mortgage is not recordable. In addition, if any lis pendens for a

residential mortgage foreclosure is recorded on the property within the program area, a certificate of service must be simult aneously

recorded that affirms that a copy of the lis pendens was filed with the Department. The lis pendens may be filed with the Department

either electronically or by filing a hard copy. If the certificate of service is not recorded, then the lis pendens pertainin g to the

residential mortgage foreclosure in question is not recordable and is of no force and effect.

(h) All information provided to the predatory lending database under the program is confidential and is not subject to disclo sure

under the Freedom of Information Act, except as otherwise provided in this Article. Information or do cuments obtained by employees

of the Department in the course of maintaining and administering the predatory lending database are deemed confidential. Empl oyees

are prohibited from making disclosure of such confidential information or documents. Any reques t for production of information from

the predatory lending database, whether by subpoena, notice, or any other source, shall be referred to the Department of Fina ncial and

Professional Regulation. Any borrower may authorize in writing the release of databa se information. The Department may use the

information in the database without the consent of the borrower: (i) for the purposes of administering and enforcing the prog ram; (ii)

to provide relevant information to a counselor providing counseling to a borro wer under the program; or (iii) to the appropriate law

enforcement agency or the applicable administrative agency if the database information demonstrates criminal, fraudulent, or

otherwise illegal activity.

(i) Nothing in this Article is intended to prevent a borrower from making his or her own decision as to whether to proceed with a

transaction.

(j) Any person who violates any provision of this Article commits an unlawful practice within the meaning of the Consumer Fra ud

and Deceptive Business Practices Act.

(j-1) A violation of any provision of this Article by a mortgage banking licensee or licensed mortgage loan originator shall

constitute a violation of the Residential Mortgage License Act of 1987.

(j-2) A violation of any provision of this Article by a title insurance company, title agent, or escrow agent shall constitute a violation

of the Title Insurance Act.

(j-3) A violation of any provision of this Article by a housing counselor shall be referred to the Department of Housing and Urban

Development.

(k) During the existence of the program, the Department shall submit semi -annual reports to the Governor and to the General

Assembly by May 1 and November 1 of each year detailing its findings regarding the program. The report shall include, by county, at

least the following information for each reporting period:

(1) the number of loans registered with the program;

(2) the number of borrowers receiving counseling;

(3) the number of loans closed;

(4) the number of loans requiring counseling for each

of the standards set forth in Section 73;

(5) the number of loans requiring counseling where

the mortgage originator changed the loan terms subsequent to counseling;

(6) the n umber of licensed mortgage brokers and loan

originators entering information into the database;

(7) the number of investigations based on information

- 8 -

obtained from the database, including the number of licensees fined, the number of licenses suspended, and the number of lice nses

revoked;

(8) a summary of the types of non -traditional

mortgage products being offered; and

(9) a summar y of how the Department is actively

utilizing the program to combat mortgage fraud.

(Source: P.A. 97 -891, eff. 1 -1-13; 98 -1081, eff. 1 -1-15.)

(765 ILCS 77/72)

Sec. 72. Originator; required information. As part of the predatory lending datab ase program, the broker or originator must submit

all of the following information for inclusion in the predatory lending database for each loan for which the originator takes an

application:

(1) The borrower's name, address, social security

number or taxpayer identification number, date of birth, and income and expense information, including total monthly consumer debt,

contained in the mortgage application.

(2) The address, permanent index number, and a

description of the colla teral and information about the loan or loans being applied for and the loan terms, including the amount of the

loan, the rate and whether the rate is fixed or adjustable, amortization or loan period terms, and any other material terms.

(3) The bor rower's credit score at the time of

application.

(4) Information about the originator and the company

the originator works for, including the originator's license number and address, fees being charged, whether the fees are bei ng charge d

as points up front, the yield spread premium payable outside closing, and other charges made or remuneration required by the broker

or originator or its affiliates or the broker's or originator's employer or its affiliates for the mortgage loans.

(5) Information about affiliated or third party

service providers, including the names and addresses of appraisers, title insurance companies, closing agents, attorneys, an d realtors

who are involved with the transaction and the broker or originator and any moneys received from the broker or originator in

connection with the transaction.

(6) All information indicated on the Good Faith

Estimate and Truth in Lend ing statement disclosures given to the borrower by the broker or originator.

(7) Annual real estate taxes for the property,

together with any assessments payable in connection with the property to be secured by the collateral and the proposed monthly

principal and interest charge of all loans to be taken by the borrower and secured by the property of the borrower.

(8) Information concerning how the broker or

originator obtained the client and the name of its referral source, if a ny.

(9) Information concerning the notices provided by

the broker or originator to the borrower as required by law and the date those notices were given.

(10) Information concerning whether a sale and

leaseback is contemplated a nd the names of the lessor and lessee, seller, and purchaser.

(11) Any and all financing by the borrower for the

subject property within 12 months prior to the date of application.

(12) Loan information, including interest rate, term,

purchase price, down payment, and closing costs.

(13) Whether the buyer is a first -time homebuyer or

- 9 -

refinancing a primary residence.

(14) Whether the loan permits interest only payments.

(15) Whether the loan may resul t in negative

amortization.

(16) Whether the total points and fees payable by the

borrowers at or before closing will exceed 5%.

(17) Whether the loan includes a prepayment penalty,

and, if so, the terms of the penalty.

(18) Whether the loan is an ARM.

All information entered into the predatory lending database must be true and correct to the best of the originator's knowledg e. The

originator shall, prior to closing, correct, update, or amend the data as necessa ry. If any corrections become necessary after the file has

been accessed by the closing agent or housing counselor, a new file must be entered.

(Source: P.A. 97 -891, eff. 1 -1-13; 98 -1081, eff. 1 -1-15.)

(765 ILCS 77/73)

Sec. 73. Standards for cou nseling. A borrower or borrowers subject to this Article shall be recommended for counseling if, after

reviewing the information in the predatory lending database submitted under Section 72, the Department finds the borrower or

borrowers are all first -time homebuyers or refinancing a primary residence and the loan is a mortgage that includes one or more of the

following:

(1) the loan permits interest only payments;

(2) the loan may result in negative amortization;

(3) the total point s and fees payable by the borrower

at or before closing will exceed 5%;

(4) the loan includes a prepayment penalty; or

(5) the loan is an ARM.

(Source: P.A. 95 -691, eff. 6 -1-08.)

(765 ILCS 77/74)

Sec. 74. Counselor; require d information. As part of the predatory lending database program, a counselor must submit all of the

following information for inclusion in the predatory lending database:

(1) The information called for in items (1), (6),

(9), (11), (12), (13 ), (14), (15), (16), (17), and (18) of Section 72.

(2) Any information from the borrower that confirms

or contradicts the information called for under item (1) of this Section.

(3) The name of the counselor and address of the

HUD -approved housing counseling agency that employs the counselor.

(4) Information pertaining to the borrower's monthly

expenses that assists the counselor in determining whether the borrower can afford the loans or loans for which the borrow er is

applying.

(5) A list of the disclosures furnished to the

borrower, as seen and reviewed by the counselor, and a comparison of that list to all disclosures required by law.

(6) Whether the borrower provided tax returns to the

broker or originator or to the counselor, and, if so, who prepared the tax returns.

(7) A statement of the recommendations of the

counselor that indicates the counselor's response to each of the following statements:

(A) The lo an should not be approved due to

indicia of fraud.

- 10 -

(B) The loan should be approved; no material

problems noted.

(C) The borrower cannot afford the loan.

(D) The borrower does not understand the

transaction.

(E) The borrower does not understand the costs

associated with the transaction.

(F) The borrower's monthly income and expenses

have been reviewed and disclosed.

(G) The rate of the loan is above market rate.

(H) The borrower should seek a competitive bid

from another broker or originator.

(I) There are discrepancies between the

borrower's verbal understanding and the originator's completed form.

(J) The borrower is precipitously close to not

being able to afford the loan.

(K) The borrower understands the true cost of

debt consolidation and the need for credit card di scipline.

(L) The information that the borrower provided

the originator has been amended by the originator.

(Source: P.A. 97 -813, eff. 7 -13-12; 98 -1081, eff. 1 -1-15.)

(765 ILCS 77/76)

Sec. 76. Title insurance company or clos ing agent; required information. As part of the predatory lending database program, a title

insurance company or closing agent must submit all of the following information for inclusion in the predatory lending databa se:

(1) The borrower's name, a ddress, social security

number or taxpayer identification number, date of birth, and income and expense information contained in the mortgage applica tion.

(2) The address, permanent index number, and a

description of the collateral and information about the loan or loans being applied for and the loan terms, including the amo unt of the

loan, the rate and whether the rate is fixed or adjustable, amortization or loan period terms, and any other material te rms.

(3) Annual real estate taxes for the property,

together with any assessments payable in connection with the property to be secured by the collateral and the proposed monthl y

principal and interest charge of all loans to be taken by the b orrower and secured by the property of the borrower as well as any

required escrows and the amounts paid monthly for those escrows.

(4) All itemizations and descriptions set forth in

the RESPA settlement statement including items to be disbur sed, payable outside closing "POC" items noted on the statement, and a

list of payees and the amounts of their checks.

(5) The name and license number of the title

insurance company or closing agent together with the name of the agent actuall y conducting the closing.

(6) The names and addresses of all originators,

brokers, appraisers, sales persons, attorneys, and surveyors that are present at the closing.

(7) The date of closing, a detailed list of all

- 11 -

notices prov ided to the borrower at closing and the date of those notices, and all information indicated on the Truth in Lending

statement and Good Faith Estimate disclosures.

(Source: P.A. 98 -1081, eff. 1 -1-15.)

(765 ILCS 77/78)

Sec. 78. Exemption. Borrower s applying for reverse mortgage financing of residential real estate including under programs

regulated by the Federal Housing Administration (FHA) that require HUD -approved counseling are exempt from the program and

may submit a HUD counseling certificate to comply with the program. A certificate of exemption is required for recording.

Mortgages secured by non -owner occupied property, commercial property, residential property consisting of more than 4 units, and

government property are exempt but requ ire a certificate of exemption for recording.

Mortgages originated by an exempt person or entity are exempt but require a certificate of exemption for recording.

(Source: P.A. 98 -463, eff. 8 -16-13; 98 -1081, eff. 1 -1-15.)

(765 ILCS 77/80)

Sec. 80. Predatory Lending Database Program Fund. The Predatory Lending Database Program Fund is created as a special fund in

the State treasury. Subject to appropriation, moneys in the Fund shall be appropriated to the Illinois Housing Development Au thority

for the purpose of making grants for HUD -approved counseling agencies participating in the Predatory Lending Database Program to

assist with implementation and development of the Predatory Lending Database Program.

(Source: P.A. 98 -1081, eff. 1 -1-15.)

(765 ILCS 77/Art. 4 heading)

ARTICLE 4

EFFECTIVE DATE

(Source: P.A. 94 -280, eff. 1 -1-06.)

(765 ILCS 77/99)

Sec. 99. This Act takes effect on October 1, 1994.

(Source: P.A. 88 -111.)