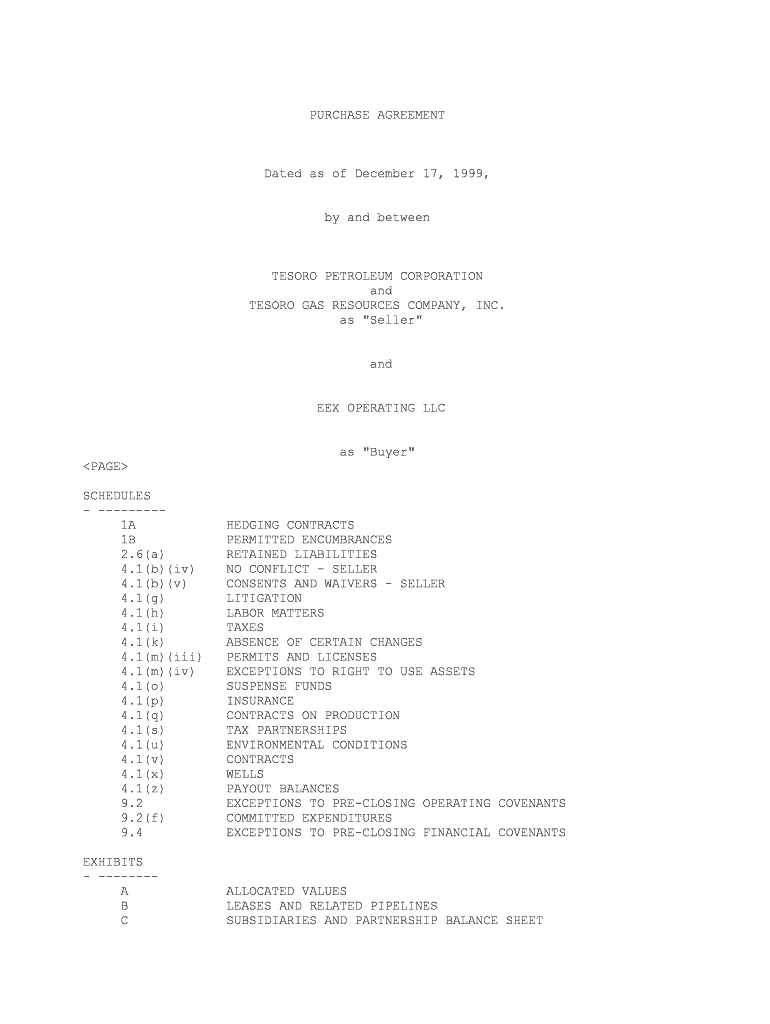

PURCHASE AGREEMENT

Dated as of December 17, 1999,

by and between

TESORO PETROLEUM CORPORATION and

TESORO GAS RESOURCES COMPANY, INC.

as "Seller" and

EEX OPERATING LLC

as "Buyer" SCHEDULES

- ---------

1A HEDGING CONTRACTS

1B PERMITTED ENCUMBRANCES

2.6(a) RETAINED LIABILITIES

4.1(b)(iv) NO CONFLICT - SELLER

4.1(b)(v) CONSENTS AND WAIVERS - SELLER 4.1(g) LITIGATION

4.1(h) LABOR MATTERS 4.1(i) TAXES

4.1(k) ABSENCE OF CERTAIN CHANGES

4.1(m)(iii) PERMITS AND LICENSES

4.1(m)(iv) EXCEPTIONS TO RIGHT TO USE ASSETS

4.1(o) SUSPENSE FUNDS 4.1(p) INSURANCE

4.1(q) CONTRACTS ON PRODUCTION

4.1(s) TAX PARTNERSHIPS

4.1(u) ENVIRONMENTAL CONDITIONS 4.1(v) CONTRACTS 4.1(x) WELLS

4.1(z) PAYOUT BALANCES

9.2 EXCEPTIONS TO PRE-CLOSING OPERATING COVENANTS

9.2(f) COMMITTED EXPENDITURES

9.4 EXCEPTIONS TO PRE-CLOSING FINANCIAL COVENANTS EXHIBITS

- --------

A ALLOCATED VALUES

B LEASES AND RELATED PIPELINES

C SUBSIDIARIES AND PARTNERSHIP BALANCE SHEET

D SETTLEMENT STATEMENT

PURCHASE AGREEMENT

THIS PURCHASE AGREEMENT is dated December 17, 1999, but effective as of the

Effective Time, between Tesoro Petroleum Corporation, a Delaware corporation,

and Tesoro Gas Resources Company, Inc., a Delaware corporation, collectively as

"Seller", and EEX Operating LLC, a Delaware limited liability company, as"Buyer". WITNESSETH: -----------

WHEREAS, Tesoro Gas Resources Company, Inc. owns all of the Membership

Interests in Tesoro Grande LLC, a Delaware limited liability company ("Grande");and

WHEREAS, Tesoro Petroleum Corporation, a Delaware corporation, and Tesoro

Gas Resources Company, Inc., a Delaware corporation, collectively as "Seller",

and EEX Operating LLC, a Delaware limited liability company, as "Buyer", and EEX

Corporation, entered into a Stock Purchase Agreement (the "Stock Purchase

Agreement") dated October 8, 1999 providing for the sale by Seller to Buyer of

all shares of capital stock of Tesoro Exploration and Production Company, a

Delaware corporation ("Exploration") and Tesoro Reserves Company, a Delaware

corporation ("Reserves"), together with the partnership interests in Tesoro E&P

Company, L.P., a Delaware limited partnership (the "Partnership"); and

WHEREAS, the Partnership owns certain assets used in the business of the

exploration, production, gathering, transportation and marketing of oil, natural

gas, condensate and associated hydrocarbons; and

WHEREAS, on the date of the Stock Purchase Agreement, Exploration and

Reserves were the two partners in the Partnership, in which Exploration was the

general partner owning a 1% interest and Reserves was the limited partner owning

a 99% interest; and

WHEREAS, the Partnership was converted into a series limited partnership,

with the entire Series B limited partnership interest being transferred to

Grande, insofar as such interest covers the revenues, expenses, profits and

losses from the Properties described in Exhibit B; and

WHEREAS, Section 9.12 of the Stock Purchase Agreement provides for the

Parties to cooperate at no cost or liability to Buyer, to enable Seller at

Seller's election, to transfer the Operating Assets to Buyer in a manner

enabling the transfer to qualify as a part of a like-kind exchange of property

by Seller within the meaning of Section 1031 of the Code; and

WHEREAS, the Stock Purchase Agreement has been amended to provide for such

a like-kind exchange of property, among other purposes, by a First Amendment to

Stock Purchase Agreement dated December 16, 1999 (the "Amendment"); and

WHEREAS, to facilitate such a like-kind exchange transaction, Seller has

arranged to assign its interests in the proceeds of the sale of Grande and its

interest in the Properties to Bank One Exchange Corporation, as a QualifiedIntermediary;

1

WHEREAS, the Parties have agreed to restructure the Transaction set forth

in the Stock Purchase Agreement, to allow the separate sale of Grande and its

interest in the Properties through the Qualified Intermediary; and

WHEREAS, Seller desires to sell to Buyer and Buyer desires to purchase from

Seller all issued and outstanding Membership Interests of Grande, including all

of Grande's rights and interests in the Partnership and the Properties, under

the terms and conditions set forth in this Agreement and the Stock PurchaseAgreement.

NOW, THEREFORE, in consideration of the mutual covenants and agreements

hereinafter set forth, the parties hereby agree as follows: ARTICLE I. DEFINITIONS -----------

"Accepting Party" shall have the meaning set forth in Section 16.1(e).

"Accounts Receivable" shall have the meaning set forth in Section 13.4.

"Action" means any action, appeal, petition, plea, charge, complaint,

claim, suit, demand, litigation, arbitration, mediation, hearing, inquiry,

investigation or similar event, occurrence, or proceeding.

"Adjustment Assets and Liabilities" shall mean the items set forth in

Section 2.7.

"Affiliate" shall have the same meaning set forth in Rule 12b-2 of the

regulations promulgated under the Securities Exchange Act of 1934, as amended.

"Agreement" shall mean this Purchase Agreement.

"Allocated Value" shall mean the monetary value allocated to each Property

or group of Properties and the Hedging Contracts on Exhibit A.

"Amendment" shall mean the First Amendment to Stock Purchase Agreement

dated December 16, 1999, by and among Tesoro Petroleum Corporation, a Delaware

corporation, Tesoro Gas Resources Company, Inc., a Delaware corporation, and EEX

Operating LLC, a Delaware limited liability company, and EEX Corporation, a

Texas corporation, for the limited purposes set forth therein

"APO" shall mean "after payout", as such payout may be established under

the respective farmout agreements, joint operating agreements, participation

interests and similar agreements affecting each Property, including payouts

providing reversionary rights of parties who have elected not to participate in

an operation under a joint operating agreement. If there are multiple

outstanding payouts affecting any particular well or Property, then the APO

interest shall mean the interests after all applicable payouts have occurred.

If at the Effective Time there are no outstanding payout balances affecting any

particular well or Property, then the listed APO interest in such well or

Property shall reflect the Partnership's WI and NRI at the Effective Time. 2

"Applicable Environmental Laws" means all Applicable Laws in effect

pertaining to (i) pollution, or the protection of the environment, including

those relating to waste materials and/or hazardous substances, (ii) the

protection of Persons or property from actual or potential exposure (or the

effects of exposure) to an actual or potential spill or release of Hazardous

Substances or petroleum or produced brine or (iii) the manufacture, processing,

production, gathering, transportation, use, treatment, storage or disposal of a

Hazardous Substance or petroleum or produced brine.

"Applicable Law" means any statute, law, rule, or regulation or any

judgment, order, writ, injunction, or decree of any Governmental Authority to

which a specified Person, Operating Asset or property is subject.

"Balance Sheets" shall mean the unaudited combined financial balance sheet

of Grande and the Partnership as of June 30, 1999, attached hereto as Exhibit C.

"Books and Records" shall mean all of the following which pertain to the

conduct of the Business: books, records, manuals and other materials, accounting

books and records, continuing property records for property, plant and

equipment, land and lease files, title opinions, suspense records, production

records, any inventories of equipment and property, well files, engineering

files, maps, surveys, electric logs, seismic records, geological and geophysical

files, and all other technical data, division order files, contract files, other

files, computer tapes, disks, other storage media and records, advertising

matter, correspondence, lists of customers and suppliers, maps, photographs,

production data, sales and promotional materials and records, purchasing

materials and records, work and recent salary history for personnel, credit

records, manufacturing and quality control records and procedures, patent and

trademark files and disclosures, litigation files, leases, oil and gas leases,

deeds, easements and other instruments relating to the Business, any copies of

Tax Returns filed by or with respect to Grande or the Partnership, including

copies of all work papers and calculations relating to Grande and the

Partnership in support of such Tax Returns, and any comparable information with

respect to predecessors of Grande or the Partnership to the extent available,

and copies of any other applicable accounting and tax records of the Seller and

the Partnership pertaining to the Business.

"BPO" shall mean "before payout", as such payout may be established under

the respective farmout agreements, joint operating agreements, participation

interests and similar agreements affecting each Property, including payouts

providing reversionary rights of parties who have elected not to participate in

an operation under a joint operating agreement. If at the Effective Time there

is an outstanding payout balance affecting any particular well or Property, the

listed BPO interest in such well or Property shall reflect the Partnership's WI

and NRI at the Effective Time.

"Business" shall mean the Partnership's business of exploring for,

developing, producing, gathering, transporting and marketing natural gas,

condensate and oil.

"Business Day" shall mean any day exclusive of Saturdays, Sundays and

national holidays.

"Buyer Group" shall have the meaning set forth in Section 15.3.

3

"Buyer's Knowledge" shall mean knowledge of Buyer and management employees

of Buyer's ultimate parent, EEX Corporation, with knowledge of Buyer's

activities, including the negotiation of this Agreement.

"Bylaws" shall mean a corporation's bylaws, code of regulations or

equivalent document.

"Charter" shall mean a company's management agreement, articles of

association, articles of incorporation, certificate of incorporation or

equivalent organizational documents.

"Closing" shall have the meaning set forth in Section 12.1.

"Closing Date" shall have the meaning set forth in Section 12.1.

"Closing Settlement Price" shall mean the Settlement Price calculated in

accordance with the best information available to the Seller prior to Closing,

as reflected on the Settlement Statement delivered prior to Closing pursuant to

Article X and Section 13.1(a).

"Code" shall mean the United States Internal Revenue Code of 1986 and any

successor statute thereto, as amended.

"Consent to Assignment" shall mean an existing contractual or legal right

of any third party to consent to the Partnership's assignment of a Property to

Buyer under such terms as are set forth in this Agreement.

"Contracts" shall mean all of the contracts that govern or relate to the

ownership or operation of the Operating Assets (including without limitation,

the wells, facilities and equipment associated therewith and the production

therefrom, acreage contribution agreements, assignments, bidding agreements,

bottom-hole agreements, contribution agreements, drilling contracts, dry-hole

agreements, exploration agreements, development agreements, farm-in and farmout

agreements, gas balancing agreements, joint venture agreements, production,

sales, marketing and/or brokerage contracts, gas processing agreements,

operating agreements, participation agreements, service contracts, storage

contracts, gathering agreements, transportation agreements, treating contracts,

water rights agreements and the unitization, unit operating, communitization and

pooling declarations, agreements and orders that create or govern units). To

the extent that Seller, Grande or the Partnership have rights of indemnification

or warranty rights with respect to any Operating Asset or any part of an

Operating Asset, the same shall be included in the meaning of "Contracts."

"Damages" shall mean any and all claims, actions, causes of action,

demands, assessments, losses, damages, liabilities, judgments, settlements,

penalties, costs, and expenses (including reasonable attorneys' fees and

expenses, expert fees and expenses and court costs), of any nature whatsoever.

"Effective Time" shall mean July 1, 1999, at 12:00 a.m. local time for each

Operating Asset. 4

"Encumbrance" shall mean any interest (including any security interest),

pledge, mortgage, lien, charge, adverse claim or other right of third Persons.

"Environmental Conditions" shall have the meaning set forth in Section 7.3

of the Stock Purchase Agreement.

"Exploration LLC" shall mean Tesoro Exploration and Production LLC, a

Delaware limited liability company.

"Final Settlement Price" shall mean the Settlement Price calculated in

accordance with the best information available to the Parties during the one

hundred twenty (120) day period after Closing, as reflected on the Final

Statement agreed upon pursuant to Article XIII.

"Final Statement" shall mean the final accounting statement to be agreed

upon by the Parties no later than one hundred twenty (120) days after Closing

pursuant to Section 13.1(b).

"Financial Assets and Liabilities" shall mean the assets, liabilities and

other financial items on the Balance Sheets, effective as of 11:59 p.m. on June

30, 1999, (i) as adjusted for revenues, income, expenses and other assets and

liabilities incurred between the Effective Time and the Closing Date and

included within the Adjustment Assets and Liabilities, and (ii) as adjusted for

the Pre-Closing Financial Adjustments and (iii) as otherwise adjusted as

provided herein. The term "Financial Assets" shall not include any assets,

liabilities or other financial items included within the Operating Assets.

"GAAP" shall mean U.S. generally accepted accounting principles, unless

expressly described otherwise.

"Governmental Authority" shall mean any international, national, Federal,

state, municipal or local government, governmental authority, regulatory or

administrative agency, governmental commission, department, board, bureau,

agency or instrumentality, court, tribunal, arbitrator or arbitral body.

"Governmental Order" shall mean any order, writ, rule, judgment,

injunction, decree, stipulation, determination or award entered by or with any

Governmental Authority.

"Grande" shall mean Tesoro Grande LLC, a Delaware limited liability company

"Hazardous Substance" means a substance, chemical, pollutant, waste or

other material (i) that consists, wholly or in part, of a substance that is

regulated as toxic or hazardous to human health or the environment under any

Environmental Law or (ii) that exists in a condition or under circumstances that

constitute a violation of any Environmental Law. "Hazardous Substance" includes

without limitation any "hazardous substance" under the Comprehensive

Environmental Response, Compensation and Liability Act, any "hazardous chemical"

under the Occupational Safety and Health Act, any "hazardous material" under the

Hazardous Materials Transportation Act, any "hazardous chemical substance" under

the Federal Water Pollution Control Act and any "hazardous waste" under the

Resource Conservation and Recovery Act. 5

"Hedging Contracts" shall mean those natural gas derivative pricing

contracts listed on Schedule 1A.

"Income Taxes" shall mean any Taxes, including franchise taxes, which are

based upon or in respect of income.

"Indemnified Party" shall mean any Party or other Person entitled to an

indemnity under Article XV of this Agreement, with respect to the indemnity soowed.

"Indemnifying Party" shall mean a Party owing an indemnity to any other

Party or Person under Article XV of this Agreement, with respect to the

indemnity so owed.

"Lender" shall have the meaning set forth in Section 9.12(d).

"Liabilities" shall mean any and all debts, claims, liabilities and

obligations of any nature whatsoever, whether accrued or fixed, absolute or

contingent, mature or unmatured or determined or indeterminable.

"Material Adverse Effect" shall mean any event with respect to, change in,

or effect on, Grande, the Partnership or the Business which, individually or in

the aggregate, is reasonably likely to have a material adverse effect on the

Business, or the financial results of operations, assets or properties or

financial condition of Grande and the Partnership, taken as a whole, but the

term "Material Adverse Effect" shall not include any change in market conditions

or other conditions affecting the oil and gas exploration and production

industry generally.

"Membership Interests" shall mean shall mean all issued and outstanding

membership interests in Grande.

"NORM" shall have the meaning set forth in Section 7.2.

"NRI" shall mean the decimal net revenue interest in oil and gas production

from a Property.

"Operating Assets" shall mean all property rights and interests of the

Partnership being sold hereunder in the lands and leases described in Exhibit B,

as set forth in Section 2.4.

"Other Taxes" shall mean all Taxes other than Income Taxes.

"Parties" shall mean Buyer and Seller, collectively.

"Partnership" shall mean Tesoro E&P Company, L.P., a Delaware limited partnership.

"Partnership Agreement" means the Agreement of Limited Partnership of the

Partnership, as amended.

"Party" shall mean either Buyer or Seller.

"Permitted Encumbrances" shall include any Encumbrance which is: (i) listed

on Schedule 1B, for which a duly executed release in recordable form will be

delivered to Buyer at 6

or before Closing; (ii) a lien securing amounts claimed for services provided by

operators or other oil field contractors which are not yet due and owing or

which are being contested in good faith, through adequate procedures; (iii) a

statutory lien arising for Taxes not yet delinquent or which are being contested

in good faith, through adequate procedures; (iv) a reservation, exception,

limitation, encumbrance or burden expressly included within a recorded oil and

gas lease constituting part of a Property with respect to which Seller or the

Partnership is not in default at Closing which does not reduce the Partnership's

NRI in such Property below the respective decimal interests set forth in Exhibit

A; (v) any royalty, overriding royalty or other production burden affecting any

Property which does not and will not reduce the Partnership's NRI in such

Property below the respective decimal interests set forth in Exhibit A; (vi) any

joint operating agreement containing terms and conditions reasonable and

customary in the industry (other than a Preferential Right to Purchase that is

exercised prior to Closing or a required Consent to Assignment, or a

reversionary right that is not reflected in the BPO and APO interests on Exhibit

A); (vii) the right of a third party under any equipment rental or lease

contract, oilfield service contract, production sales contract or transportation

contract affecting any Property, which either may be terminated by the parties

thereto without penalty or does not extend for a term of more than sixty days

after the Closing Date; (viii) any other easement, operating right, concurrent

use right or similar encumbrance that does not affect the Partnership's rights

to a Property or reduce the production revenues attributable thereto or increase

the costs associated with ownership or operation of that Property; and (ix) a

severance tax, production tax, occupation tax, ad valorem tax or similar tax of

general application.

"Person" shall include any individual, trustee, firm, corporation,

partnership, limited liability company, Governmental Authority or other entity,

whether acting in an individual, fiduciary or any other capacity.

"Post-Closing Return" shall have the meaning set forth in Section 16.2(c).

"Pre-Closing Financial Adjustments" shall mean those certain financial

accounting adjustments and payments set forth in Section 2.6.

"Pre-Closing Period" shall have the meaning set forth in Section 16.2(c).

"Pre-Closing Return" shall have the meaning set forth in Section 16.2(c).

"Preferential Right to Purchase" shall mean the right of any third party

under an existing contract or agreement allowing that third party to purchase

the Partnership's interest in a Property whenever Seller proposes to transfer

its interests in the Partnership under terms such as are set forth in this

Agreement and the Stock Purchase Agreement.

"Production" shall mean all oil, natural gas, condensate, natural gas

liquids, and other hydrocarbons or products produced from or attributable to theProperties.

"Properties" shall mean, collectively, (i) all valid and existing oil and

gas leaseholds and mineral fee rights, and all rights and interests appurtenant

thereto, which are owned by the Partnership in the lands and leases described on

Exhibit B attached hereto, including without limitation all oil and gas WIs,

NRIs, mineral fee interests, oil, gas and mineral deeds, leases

7

and/or subleases, royalties, overriding royalties, leasehold interests, mineral

servitudes, production payments and net profits interests, fee mineral

interests, surface estates, fee estates, royalty interests, overriding royalty

interests, or other non-working or carried interests, reversionary rights,

farmout and farmin rights, operating rights, pooled or unitized acreage, and all

other rights, privileges and interests in such oil, gas and other minerals (and

the production thereof), and other mineral rights of every nature now owned by

the Partnership in such lands and leases listed on Exhibit B hereto, (ii) all of

the contractual rights to interests described in (i) above and in all units in

which such interests are pooled, communitized or unitized, and in any other oil,

gas and/or mineral leases or assets arising pursuant to the terms of the oil and

gas leases listed on Exhibit B hereto, and any other rights and agreements or

contracts affecting or relating to interests described in (i) above, or to

Production, whether or not listed on Exhibit B, including any tenements,

appurtenances, surface leases, easements, permits, licenses, servitudes,

franchises or rights of way.

"Property" shall mean any individual one of the Properties.

"Property Tax Period" shall have the meaning set forth in Section 13.2(a).

"Property Taxes" shall have the meaning set forth in Section 13.2(a).

"Proposed Settlement" shall have the meaning set forth in Section 16.1(e).

"Purchase Price" shall have the meaning set forth in Section 3.1.

"Qualified Intermediary" shall mean Bank One Exchange Corporation, in its

capacity as a qualified intermediary to implement a like-kind exchange of the

Properties under Section 1031 of the Code.

"Refusing Party" shall have the meaning set forth in Section 16.1(e).

"Reserves LLC" shall mean Tesoro Reserves Company, LLC, a Delaware limited

liability company.

"Seller" shall mean, collectively, Tesoro Petroleum Corporation, a Delaware

corporation, and Tesoro Gas Resources Company, Inc., a Delaware corporation.

"Seller's Knowledge" shall mean actual knowledge of any fact, circumstance

or condition by the officers or management employees (including those with

titles of "Manager", "Vice President" and "President" or those in the internal

legal department of Seller, Grande and the Partnership who provide specific

advice related to the operations of the Business) of Seller, Grande and the

Partnership involved and knowledge of any fact, circumstance or condition which

such officer or management employee would have been aware of with the exercise

of reasonable diligence and inquiry in the course of his or her duties.

"Settlement Price" shall have the meaning set forth in Section 3.2. 8

"Settlement Statement" shall mean the accounting statement calculating the

Settlement Price, to be furnished by Seller to Buyer prior to Closing, pursuant

to Article X and Section 13.1(a).

"Southeast" shall mean Tesoro Southeast LLC, a Delaware limited liability company.

"Stock Purchase Agreement" shall mean the Stock Purchase Agreement dated

October 8, 1999, as amended by the Amendment, by and among Tesoro Petroleum

Corporation, a Delaware corporation, Tesoro Gas Resources Company, Inc., a

Delaware corporation, and EEX Operating LLC, a Delaware limited liability

company, and EEX Corporation, a Texas corporation, for the limited purposes set

forth therein.

"Straddle Period" shall have the meaning set forth in Section 16.1(e).

"Straddle Return" shall have the meaning set forth in Section 16.2(c).

"Subsidiaries" shall mean Exploration LLC, Grande, Southeast and Reserves

LLC, collectively.

"Tax" shall mean any federal, state, local, or foreign income, gross

receipts, license, payroll, parking, employment, excise, severance, stamp,

occupation, premium, windfall profits, environmental (including taxes under

Section 50A of the Code), customs duties, capital stock, franchise, profits,

withholding, social security (or similar), unemployment, disability, real

property, personal property, sales, use, transfer, registration, ad valorem,

value added, alternative or add-on minimum, estimated tax, or other tax of any

kind whatsoever, including any interest, penalty, or addition thereto, whether

disputed or not, including such item for which Liability arises as a transferee

or successor-in-interest.

"Tax Claim" shall have the meaning set forth in Section 16.1(c).

"Tax Return" shall mean any return, declaration, report, claim for refund,

information return or statement relating to Taxes, including any schedules or

attachments thereto, and including any amendment thereof.

"Taxing Authority" shall mean any Governmental Authority responsible for

the imposition or collection of any Tax.

"Tesoro Group" shall have the meaning set forth in Section 4.1(i).

"Tesoro Parent" shall have the meaning set forth in Section 4.1(i).

"Transaction" shall mean the purchase and sale of the Membership Interests

pursuant to this Agreement and the related transactions contemplated herein.

"WI" shall mean a working interest under an oil and gas lease or other

Contract affecting a Property which shall reflect the decimal interest for

participation in the decisions, costs and risks concerning operations. 9

"Working Capital" shall mean, at any time, the difference between (a) the

sum of the amounts on the line items "cash", "accounts receivable",

"inventories" and "prepayment and other" on the Balance Sheet, less (b) the sum

of the amounts on the line items "accounts payable" and "accrued liabilities" on

the Balance Sheet; all as computed in accordance with GAAP and past practice for

Grande and the Partnership except as expressly provided herein, and in a manner

as reflected on the Balance Sheets; provided, however, that the amounts on the

line items "prepayment and other", "accounts payable" and "accrued liabilities"

on the Balance Sheet shall not include the impact of any amounts referred to in

the first proviso in Section 3.2(a)(i); and provided further, that the stated

amount of Working Capital shall be reduced by the amount of inventories that

existed as of the Effective Time.

"Working Capital Accounts" shall mean the line items "cash", "accounts

receivable", "inventories", "prepayment and other", "accounts payable" and

"accrued liabilities" on the Balance Sheet, all as computed in accordance with

GAAP and past practice for Grande and the Partnership, and in a manner as

reflected on the Balance Sheets; provided, however, that the line items

"prepayment and other", "accounts payable" and "accrued liabilities" shall not

include the impact of any items referred to in the first proviso in Section3.2(a)(i).

ARTICLE II.

PURCHASE AND SALE -----------------

2.1 Sale of Membership Interests. Subject to the terms and conditions of ----------------------------

this Agreement, Seller agrees to sell and assign to Buyer, and Buyer agrees to

purchase and pay for, at Closing, all of the Membership Interests.

2.2 Effect of Sale. The sale of the Membership Interests at Closing --------------

shall transfer to Buyer all of Seller's rights in Grande. On the Closing Date,

Grande shall hold certain interests, assets and liabilities, as set forth in

this Article II. Except as otherwise specifically set forth in this Agreement,

the transfer of Seller's rights in Grande shall assign to Buyer all of Seller's

beneficial right, title, interest and obligations in and to such interests,

assets and liabilities held by Grande.

2.3 Partnership. On the Closing Date, Exploration LLC and Grande shall -----------

own the rights and interests in the Partnership, insofar as they pertain to the

Properties. Exploration LLC shall be the general partner of the Partnership and

Grande shall own the entire Series B limited partnership interest in the

Partnership insofar as it pertains to allocable revenues and expenses

attributable to the Properties. The partnership rights and interests of Grande

described in this Section 2.3 shall pass to Buyer as an attribute of the sale of

the Membership Interests pursuant to this Agreement.

2.4 Operating Assets. On the Closing Date, the Partnership shall own the ----------------

Operating Assets, subject to the Permitted Encumbrances, as follows:

(a) Exploration and Production Assets. ---------------------------------

(i) the Properties;

10

(ii) All the interests in oil and gas wells described on Exhibit A,

together with an interest in the production, compression,

treating, dehydration or processing facilities and other real

or tangible personal property appurtenances and fixtures, which

are located on the lands covered by or within the Properties or

are being used by the Partnership in connection with the

operations on the Properties or Production;

(iii) Subject to the license granted under the License Agreement

(with respect to the rights covered thereby), rights and

interests in geological data and records, seismic data, whether

in digital or paper format, well logs, well files, geological

data, records and maps, land and contract files and records,

accounting files, data and records, computer hardware and

software and other materials (whether electronically stored or

otherwise) used or held for use by Seller, Grande or the

Partnership, or any of their direct or indirect parents,

subsidiaries or other Affiliates, regarding ownership of the

Properties or operations and Production which relate to the

Properties, and other files, documents and records which relate

to the Properties;

(iv) Rights, obligations, title and interests in and to permits,

orders, contracts, abstracts of title, leases, deeds,

unitization agreements, pooling agreements, operating

agreements, farmout agreements, participation agreements,

division of interest statements, division orders, participation

agreements, and other agreements and instruments applicable to

the Properties;

(v) All the rights, obligations, title and interests of Seller in

and to all easements, rights of way, certificates, licenses and

permits and all other rights, privileges, benefits and powers

conferred upon the owner and holder of interests in the

Properties, or concerning software used in conjunction with

ownership or operation of the Properties;

(vi) All the rights, title and interests of Seller and the

Partnership in and to the Bob West Field compression facility

and the Bob West Field amine plant;

(vii) Rights, title, obligations and interests in or concerning any

gas imbalances affecting the Properties; and

(viii) All office equipment, computer equipment, light tables,

drafting tables, drafting equipment, office supplies, facsimile

machines, pool cars and any other equipment or furniture not

herein named which is utilized by the Partnership in its day to

day operations.

(b) Leased Assets. To the extent any of the items of office equipment -------------

listed in Section 2.4(a) above are leased and not owned, Seller, Grande and the

Partnership shall use their best efforts to cause such leases to be assigned to

Buyer at Closing. 11

2.5 Financial Assets and Liabilities. On the Closing Date, the --------------------------------

Partnership shall own the Financial Assets and Liabilities. Grande shall be

allocated its share of the Partnership's respective Financial Assets and

Liabilities attributable to ownership and operation of the Properties in

proportion to its ownership of the Partnership's interests in the Properties.

The Financial Assets and Liabilities at Closing of the Partnership and each

partner in the Partnership shall be computed by Seller in accordance with GAAP,

and shall be allocated to the Properties and the partners in the Partnership in

accordance with the Partnership Agreement. The Financial Assets and Liabilities

shall be adjusted from those set forth on the Balance Sheet to reflect certain

Pre-Closing Financial Adjustments and the Adjustment Assets and Liabilities, as

set forth in Sections 2.6 and 2.7.

2.6 Pre-Closing Financial Adjustments. Prior to the Closing Date, Seller ---------------------------------

shall make certain accounting adjustments and payments regarding the assets,

liabilities and equity of the Partnership and Grande, to the effect that Sellers

shall remove all intercompany accounts involving the Partnership, Grande and

their Affiliates, and all intercompany liabilities shall have been removed. At

Closing the only assets and liabilities of the Partnership and Grande shall be

the Operating Assets and the Adjustment Assets and Liabilities.

(a) Certain Accounts. Immediately prior to the Closing, Seller shall ----------------

take, and shall cause Grande and the Partnership to take, all necessary action

deemed appropriate to adjust the Balance Sheets to account for those items that

are to be retained by Seller, as set forth in Schedule 2.6(a). In doing so,

Seller shall take, and shall cause Grande and the Partnership to take, all

necessary actions deemed appropriate so that the Balance Sheets as of the

Closing Date, as adjusted to reflect such actions, will show zero for those line

items listed in Schedule 2.6(a) as financial items that are to be retained bySeller.

(b) Pre-Closing Cash Distribution. Immediately prior to the Closing, -----------------------------

Tesoro Gas Resources Company, Inc. shall cause Grande to pay to it an amount

equal to the arithmetic mean of Seller's and Buyer's good faith estimates of the

consolidated cash and cash equivalents (other than amounts in suspense accounts)

of Grande as of the Closing Date.

(c) Changes in Balance Sheets Due to Continuing Operations. Buyer and ------------------------------------------------------

Seller expressly recognize that the assets and liabilities of Grande and the

Partnership shall be affected by the effects of ongoing ownership and operation

of the Operating Assets between the Effective Time and the Closing Date. These

changes shall be handled exclusively by adjustments to the Settlement Price as

set forth in Section 3.2 and Article XIII.

2.7 Adjustment Assets and Liabilities. At Closing, the Partnership shall ---------------------------------

retain, to the extent permitted by applicable law and regulations, the following

interests:

(a) All rights, obligations, liabilities, title and interests of Seller

and the Partnership in and to all Hedging Contracts in effect at the Effective

Time or thereafter;

(b) All Working Capital Accounts; and 12

(c) All rights to future proceeds, defenses and indemnities owed under any

bonds or insurance policies covering the Operating Assets, the Partnership,

Grande or the Business for policy periods prior to the Closing Date, for losses,

claims or occurrences, as applicable, arising prior to the Closing Date.

ARTICLE III.

PURCHASE PRICE AND SETTLEMENT PRICE -----------------------------------

3.1 Purchase Price. The monetary consideration ("Purchase Price") for --------------

the sale and conveyance of all the Membership Interests to Buyer, effective as

of the date of Closing, is Buyer's payment of $115,304,126 in cash.

3.2 Settlement Price. Pursuant to the provisions as described below, the ----------------

Purchase Price to be paid by Seller will be subject to certain adjustments made

at Closing and within one hundred twenty (120) days thereafter, as set forth in

Article XIII, to determine the Settlement Price amount that will actually be

paid by Buyer. The Settlement Price will be calculated as follows:

(a) Increases. The Purchase Price shall be increased by the following ---------amounts:

(i) An amount equal to the expenses properly accrued in accordance

with GAAP and past practice, and allocated to Grande under the

Partnership Agreement, and as provided for in Section 13.3,

attributable to the period from the Effective Time to the end

of business on the Closing Date; provided, however, that such

expenses shall exclude all (1) depreciation, depletion and

amortization, (2) income and franchise taxes, (3) one-half of

the amount accrued by and the Partnership and allocated to

Grande under the Partnership Agreement, incentive compensation

arrangements for the Retained Employees, as provided in Section

9.9(c), and (4) severance obligations and other amounts accrued

under any employment retention and management stability

agreements, as provided in Section 9.9(b); provided, further,

however that Seller and the Partnership shall be permitted to

accrue no more than $40,000 per month from the close of

business on June 30, 1999 to the Closing Date for corporate

general and administrative expenses;

(ii) An amount equal to the capital expenditures relating to the

Business properly accrued in accordance with GAAP and past

practice and allocated to Grande under the Partnership

Agreement, attributable to the period from the Effective Time

to the end of business on the Closing Date; and

(iii) The amount of change in Working Capital and allocated to Grande

under the Partnership Agreement between the Effective Time and

the end of business on the Closing Date, if the amount of

change is a positive number.

(b) Decreases. The Settlement Price shall be decreased by the following ---------amounts: 13

(i) An amount equal to the revenues properly accrued in accordance

with GAAP and past practice and allocated to Grande under the

Partnership Agreement attributable to the period from the

Effective Time to the end of business on the Closing Date;

(ii) An amount equal to any Settlement Price Adjustment allocated to

Grande under the Partnership Agreement, subject to the

application of Section 13.1;

(iii) The amount, stated as a positive number, of any change in

Working Capital and allocated to Grande under the Partnership

Agreement between the Effective Time and the end of business on

the Closing Date, if and only if, the amount of change is a

negative number.

The Purchase Price as adjusted pursuant to this Section 3.2 is herein called the

"Settlement Price".

ARTICLE IV.

REPRESENTATIONS AND WARRANTIES ------------------------------

4.1 Seller's Representations and Warranties. Effective as of the Closing ---------------------------------------

Date, Seller shall represent and warrant that:

(a) Disclosure. To Seller's Knowledge, the representations and warranties ----------

set forth in this Section 4.1 of this Agreement, the exhibits to this Agreement,

and the information, documents and Balance Sheets provided under the terms of

this Agreement represent full and fair disclosure as of the Closing Date and do

not contain any untrue statement of any material fact or omit any material fact

necessary in order to make the facts stated not misleading.

(b) Authorization and Enforceability. --------------------------------

(i) This Agreement and the Transaction have been duly authorized by

each Seller.

(ii) Neither the execution and delivery of this Agreement by Seller,

nor the consummation by Seller of the transactions contemplated

hereby, will violate or conflict with, or result in the

acceleration of rights, benefits or obligations under, (1) any

provision of any of Seller's, Grande's or the Partnerships'

respective Charters, Bylaws, management agreements, limited

liability company agreements, operating agreements or

partnership agreements, or (2) any applicable statute, law,

regulation or Governmental Order to which Seller or Grande or

the Partnerships or the assets and properties of such entities,

including without limitation the Operating Assets, are bound or subject.

(iii) This Agreement has been duly executed and delivered by each

Seller and constitutes the valid and binding obligation of each

Seller, enforceable against it in accordance with its terms,

except as such enforceability may be limited by bankruptcy,

insolvency or other laws relating to or affecting 14

the enforcement of creditors' rights generally and general

principles of equity (regardless of whether such enforceability

is considered in a proceeding in equity or at law).

(iv) Except as set forth on Schedule 4.1(b)(iv), or as otherwise

specifically provided herein, the execution, delivery, and

performance of this Agreement (assuming that all applicable

consents are received and all applicable Preferential Rights to

Purchase individual Operating Assets are waived) will not (A)

be in violation of any provisions of any regulation or order

that could reasonably be expected to adversely affect the

ownership or operations of the Operating Asset affected thereby

or give rise to damages, penalties or claims of third parties,

or (B) result in the breach of, or constitute a default under,

any indenture or other material agreement or instrument to

which Seller, Grande or the Partnerships are bound, or (C)

cause the recognition of gain for which the Buyer (or, after

the Closing, the Subsidiaries) will be responsible for the tax

thereon or subject any Subsidiary or its assets to any Tax

other than Tax for which Seller is responsible under Article XVI;

(v) Except as set forth on Schedule 4.1(b)(v) or as otherwise

specifically provided herein, no consent, waiver, approval,

order or authorization of, notice to, or registration,

declaration, designation, qualification or filing with, any

Governmental Authority or third Person, domestic or foreign, is

or has been or will be required on the part of Seller in

connection with the execution and delivery of this Agreement or

the consummation by Seller of the transactions contemplated

hereby or thereby, other than (A) consents and Preferential

Rights to Purchase affecting individual Operating Assets; (B)

filings required (1) to form Grande under Delaware law; (C) tax

filings or (D) where the failure to obtain such consents,

waivers, approvals, orders or authorizations or to make or

effect such registrations, declarations, designations,

qualifications or filings (1) is not reasonably likely to

prevent or materially delay consummation of the transactions

contemplated by this Agreement (2) could reasonably be expected

to adversely affect the Business or (3) could give rise to

damages, penalties or claims of third parties.

(c) Organizational Status. ---------------------

(i) Each Seller: (1) is a corporation duly organized, validly

existing and in good standing under the laws of Delaware, (2)

is duly qualified to transact business in each jurisdiction

where the nature and extent of its business and properties

require such qualification, and (3) possesses all requisite

authority and power to conduct its business and execute,

deliver and comply with the terms and provisions of this

Agreement and to perform all of its obligations hereunder.

There are no pending or threatened Actions (or basis therefor)

for the dissolution, liquidation, insolvency, or rehabilitation

of any Seller. 15

(ii) Grande(1) is a limited liability company duly organized,

validly existing and in good standing under the laws of

Delaware, (2) is duly qualified to transact business in each

jurisdiction where the nature and extent of its business and

properties require such qualification, and (3) possesses all

requisite authority and power to conduct its business. There

are no pending or threatened Actions (or basis therefor) for

the dissolution, liquidation, insolvency, or rehabilitation of Grande.

(iii) The Partnership (1) is a limited partnership duly organized,

validly existing and in good standing under the laws of

Delaware, (2) is duly qualified to transact business in each

jurisdiction where the nature and extent of its business and

properties require such qualification, and (3) possesses all

requisite authority and power to conduct its business. There

are no pending or threatened Actions (or basis therefor) for

the dissolution, liquidation, insolvency, or rehabilitation of

the Partnership.

(d) Subsidiary and Other Equity Interests. -------------------------------------

(i) Grande has no subsidiaries and does not own any stock or other

interest in any other corporation, partnership, joint venture,

or other business entity, with the exception of the Partnership.

(ii) The Partnership has no subsidiaries and does not own any stock

or other interest in any other corporation, partnership, joint

venture, or other business entity.

(e) Membership Interests and Partnership Interests. -----------------------------------------------

(i) Grande has authorized membership interests, of which all are

issued and outstanding and owned by Tesoro Gas Resources

Company, Inc. The membership interests have been duly

authorized by Grande, and the membership interests owned by

Tesoro Gas Resources Company, Inc. are validly issued and

outstanding, fully paid and nonassessable. There are no

preemptive rights, subscriptions, options, consents to

assignment or rights of first refusal, convertible securities,

warrants, calls, stock appreciation rights, phantom stock,

profit participation, or other similar rights, or other

agreements or commitments obligating Seller or Grande to issue

or to transfer (or preventing the transfer of) any membership

interests, capital stock or other equity interest in Grande.

(ii) In the Partnership, the entire Series B limited partnership

interest (representing a 100% interest in all of the capital

and assets of Series C) is held by Grande. Exploration LLC is

the general partner of the Partnership (representing a 1%

interest in all of the capital and assets of Series A). Such

interests are duly authorized under the agreement governing the

Partnership, as currently amended, and are valid. There are no

preemptive rights, or authorized or outstanding subscriptions,

options, consents to assignment or rights of first refusal,

convertible securities, warrants, calls, appreciation rights,

phantom interests, profit participation, or other similar

rights, or other agreements or commitments obligating Seller, the 16

Partnership, Reserves LLC, Grande, Southeast or Exploration LLC

to issue or to transfer (or preventing the transfer of) any

equity interest in the Partnership.

(iii) Seller has delivered to correct and complete copies of Grande's

and the Partnership's respective Charter, Bylaws, management

agreement, limited liability company agreement, operating

agreement or partnership agreement, as amended to date, and the

minute books of Grande and the Partnership. Neither Grande nor

the Partnership is in breach of any provision of its Charter,

Bylaws, management agreement, limited liability company

agreement, operating agreement or partnership agreement.

(f) Title to Membership Interests, Partnership Interests and Assets. ---------------------------------------------------------------

(i) The Membership Interests constitute all of the issued and

outstanding membership interests and other equity interests in

Grande. All of the issued and outstanding membership interests

of Grande are owned of record and beneficially with good and

valid title by Tesoro Gas Resources Company, Inc., free and

clear of any Encumbrance. Upon delivery to Buyer of the

certificates representing the Membership Interests in the

manner and with the powers described in Section 12.2(a),

assuming that Buyer pays the consideration contemplated by this

Agreement and has no notice of any adverse claim, good and

valid title to the Membership Interests will have been

transferred to Buyer, free and clear of any Encumbrances.

Neither Tesoro Petroleum Corporation nor Tesoro Gas Resources

Company, Inc. has received any notice of any adverse claim to

their title to the Membership Interests.

(ii) All of the issued and outstanding partnership interests in the

Partnership are owned of record and beneficially with good and

valid title by Reserves LLC, Grande, Southeast, and Exploration

LLC, free and clear of any Encumbrance. Neither Reserves LLC,

Grande, Southeast, nor Exploration LLC has received any notice

of any adverse claim to their respective interests in the Partnership.

(iii) Grande and the Partnership have good title to all of the assets

and properties (except the Operating Assets) which they own or

purport to own, including the Financial Assets and Liabilities

reflected on the Balance Sheets and allocable to the Properties

under the Partnership Agreement, except for properties sold,

consumed or otherwise disposed of in the ordinary course of

business since the date of the Balance Sheets, free and clear

of any Encumbrances other than Permitted Encumbrances.

(g) Litigation. Except as set forth in Schedule 4.1(g), none of Seller, ----------

Grande or the Partnership have been served with and, to Seller's Knowledge,

there are no pending or threatened Actions before any Governmental Authority

against or affecting Seller, Grande, the Partnership or the Operating Assets,

which, if adversely determined, either would be reasonably expected to expose

Grande or the Partnership to a risk of loss after the Effective Time or would

interfere with 17

Seller's ability or right to execute and deliver this Agreement or consummate

the transactions contemplated by this Agreement.

(h) Labor Matters. Except as set forth on Schedule 4.1(h), there are no -------------

contracts, agreements, or other arrangements whereby Grande or the Partnership

are obligated to compensate or provide health and welfare benefit plans or

retirement benefits to any employees or other persons, except for employment

agreements that are terminable at will, without breach or penalty. To Sellers'

Knowledge, Seller, Grande and the Partnership are in compliance with all

federal, state, and local laws respecting employment and employment practices,

terms and conditions of employment, and wages and hours and are not engaged in

any unfair labor practice with regard to those persons employed in connection

with Grande's or the Partnership's operations. No employee of Grande is covered

under any collective bargaining agreement. There is no unfair labor practice

complaint against Grande pending or, to Seller's Knowledge, threatened before

the National Labor Relations Board or any comparable state or local Governmental

Authority. There is no labor strike, slowdown or work stoppage pending or, to

Seller's Knowledge, threatened against or directly affecting Grande, and no

grievance or any Action arising out of or under collective bargaining agreements

is pending or, to Seller's Knowledge, threatened against Grande.

(i) Taxes. -----

(i) Except as set forth in Schedule 4.1(i), Seller, and the

Partnership have timely filed or caused to be timely filed (or

will timely file or cause to be timely filed) with the

appropriate Taxing Authorities, all Tax Returns required to be

filed on or prior to the Closing Date by or with respect to

Sellers and the Partnership (or their respective Operating

Assets) and have timely paid or adequately provided for (or

will timely pay or adequately provide for) all Taxes shown

thereon as owing, except where the failure to file such Tax

Returns or pay any such Taxes would not, or could not

reasonably be expected to, in the aggregate, result in losses

or costs or expenses to Grande's interests or the Partnership

after the Closing Date.

(ii) Sellers are members of an affiliated group of corporations

which file consolidated federal income tax returns ("Tesoro

Group") with Tesoro Petroleum Corporation as the common parent

("Tesoro Parent"). Grande is not required to and does not file

federal income tax returns as a taxpaying entity, and, for

purposes of federal income taxation, Grande is accounted for

and included as a part of Tesoro Gas Resources Company, Inc..

The Tesoro Group has been subject to normal and routine audits,

examinations and adjustments of Taxes from time to time, but

there are no current audits or audits for which written

notification has been received, other than those set forth in

Schedule 4.1(i). There are no written agreements with any

Taxing Authority with respect to or including Grande's

interests which will in any way affect liability for Taxes

attributable to Grande's interests after the Closing Date.

(iii) Except as set forth in Schedule 4.1(i), no assessment,

deficiency or adjustment for any Taxes has been asserted in

writing or, to the knowledge 18

of Sellers, is proposed with respect to any Tax Return of, or

which includes, Grande's interests.

(iv) Except as set forth in Schedule 4.1(i), there is not in force

any extension of time with respect to the due date for the

filing of any Tax Return of or with respect to or which

includes Grande's interests or any waiver or agreement for any

extension of time for the assessment or payment of any Tax of

or with respect to or which includes Grande's interests.

(v) Except for Taxes due with respect to Tax Returns that will be

paid by Tesoro Parent (and not subject to reimbursement by

Grande), the accounting records of Grande will include

immediately prior to the Closing Date adequate provisions for

the payment of all Taxes allocable to Grande's interests for

all taxable periods or portions thereof through the Closing

Date.

(vi) All Tax allocation or sharing agreements or arrangements have

been or will be canceled on or prior to the Closing Date. No

payments are or will become due by Grande after the Closing

Date pursuant to any such agreement or arrangement.

(vii) Except as set forth on Schedule 4.1(i), none of the Sellers or

Grande will, as a result of the transactions contemplated by

this Agreement, be obligated to make a payment after the

Closing Date to an individual that would be a "parachute

payment" as defined in Section 280G of the Code without regard

to whether such payment is reasonable compensation for

personal services performed or to be performed in the future.

(viii) Neither Grande nor the Partnership have participated in or

cooperated with an international boycott within the meaning of

Section 999 of the Code.

(ix) Neither Grande nor the Partnership has filed a consent under

Code Section 341(f) concerning collapsible corporations.

(x) Neither Grande nor the Partnership has been a United States

real property holding corporation within the meaning of Code

Section 897(c)(2) during the applicable period specified in

Code Section 897(c)(1)(A)(ii).

(xi) All monies required to be withheld by either Seller, Grande

and the Partnership and paid to Taxing Authorities for all

Taxes have been (i) collected or withheld and either paid to

the respective Taxing Authorities or set aside in accounts for

such purpose or (ii) properly reflected in the Balance Sheets.

(j) Balance Sheets. --------------

(i) The Balance Sheets have been prepared in accordance with GAAP

applied on a basis consistent with prior periods, except as

described in the notes thereto, which will qualify that the

Partnership and Grande have been accounted for as part of a

consolidated financial group with their affiliates and not as

completely separate stand-alone entities. 19

(ii) The Balance Sheets present fairly, in all material respects,

the financial condition of the combined Partnership and Grande

as of June 30, 1999. The books and records of Grande and the

Partnership from which the Balance Sheets were prepared were

complete and accurate in all material respects at the time of

such preparation.

(iii) Grande and the Partnership have no Liabilities, except for

Liabilities (1) reflected in the Balance Sheets, (2) incurred

by Grande or the Partnership in the ordinary course of

business and consistent with past practices since the date of

the Balance Sheets, or (3) which are Permitted Encumbrances,

or (4) for which the Buyer is being indemnified hereunder. As

used in this subparagraph, the term "Liabilities" excludes any

Liabilities not required to be reflected in the Balance Sheets

under GAAP.

(k) Absence of Certain Changes. Except as set forth in Schedule 4.1(k), or --------------------------

as otherwise contemplated by this Agreement (including without limitation

Sections 2.5 and 2.6), or with Buyer's prior written consent, since the close of

business on June 30, 1999:

(i) Neither Grande nor the Partnership has sold, leased,

transferred, or ass