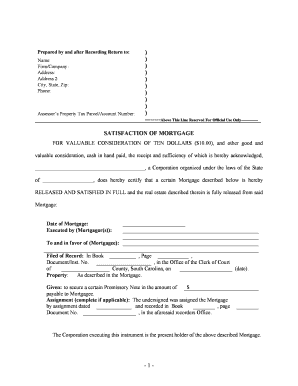

Fill and Sign the Sc Satisfaction Mortgage Form

Valuable suggestions for preparing your ‘Sc Satisfaction Mortgage’ online

Are you exhausted from dealing with the trouble of handling documents? Look no further than airSlate SignNow, the premier eSignature solution for both individuals and enterprises. Bid farewell to the tedious procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the extensive features embedded in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow manages it all smoothly, needing just a few clicks.

Follow this comprehensive guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Sc Satisfaction Mortgage’ in the editor.

- Click Me (Fill Out Now) to complete the form on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your coworkers on your Sc Satisfaction Mortgage or send it for notarization—our solution offers everything necessary to accomplish those tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is the SC Satisfaction Mortgage and how does it work?

The SC Satisfaction Mortgage is a financial instrument designed to help homeowners manage their mortgage satisfaction process efficiently. By utilizing airSlate SignNow, users can easily eSign and send necessary documents, ensuring quick processing and compliance with legal requirements. This solution simplifies the traditional mortgage satisfaction process, making it more accessible and streamlined for all parties involved.

-

How does airSlate SignNow enhance the SC Satisfaction Mortgage experience?

airSlate SignNow enhances the SC Satisfaction Mortgage experience by providing a user-friendly platform that allows for seamless document management and eSigning. With features like automated workflows and secure document storage, users can complete their mortgage satisfaction processes without hassles. This not only saves time but also reduces the risk of errors, ensuring that your mortgage is satisfied promptly.

-

What are the pricing options for using airSlate SignNow with SC Satisfaction Mortgage?

Pricing for airSlate SignNow varies based on the features and plans you choose, allowing for flexibility to meet your specific needs for SC Satisfaction Mortgage. There are cost-effective plans available that cater to both individuals and businesses, ensuring that you can find a solution that fits your budget. For detailed pricing information, it's best to visit our website or contact our sales team.

-

Can I integrate airSlate SignNow with other applications for SC Satisfaction Mortgage?

Yes, airSlate SignNow offers a wide range of integrations with popular business applications, which can enhance your SC Satisfaction Mortgage experience. Integrating with tools like CRM systems, document management software, and cloud storage services allows for a more cohesive workflow. This means you can manage all your mortgage-related documents in one place, making the process more efficient.

-

What security features does airSlate SignNow provide for SC Satisfaction Mortgage documents?

Security is a top priority at airSlate SignNow, especially when handling important documents related to SC Satisfaction Mortgage. The platform employs advanced encryption methods, secure access controls, and compliance with industry standards to protect your data. This ensures that all sensitive information remains confidential and secure throughout the eSigning process.

-

How can airSlate SignNow help speed up the SC Satisfaction Mortgage process?

airSlate SignNow can signNowly speed up the SC Satisfaction Mortgage process by allowing users to eSign documents instantly from anywhere, at any time. With automated reminders and tracking features, you can ensure that all parties complete their required actions promptly. This reduces delays and helps finalize your mortgage satisfaction more quickly.

-

Is there a mobile app for managing SC Satisfaction Mortgage documents?

Yes, airSlate SignNow offers a mobile app that allows you to manage your SC Satisfaction Mortgage documents on the go. The app provides all the essential features of the web platform, including eSigning, document sharing, and tracking. This convenience means you can handle your mortgage satisfaction tasks anytime, anywhere, enhancing your overall experience.

The best way to complete and sign your sc satisfaction mortgage form

Find out other sc satisfaction mortgage form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles