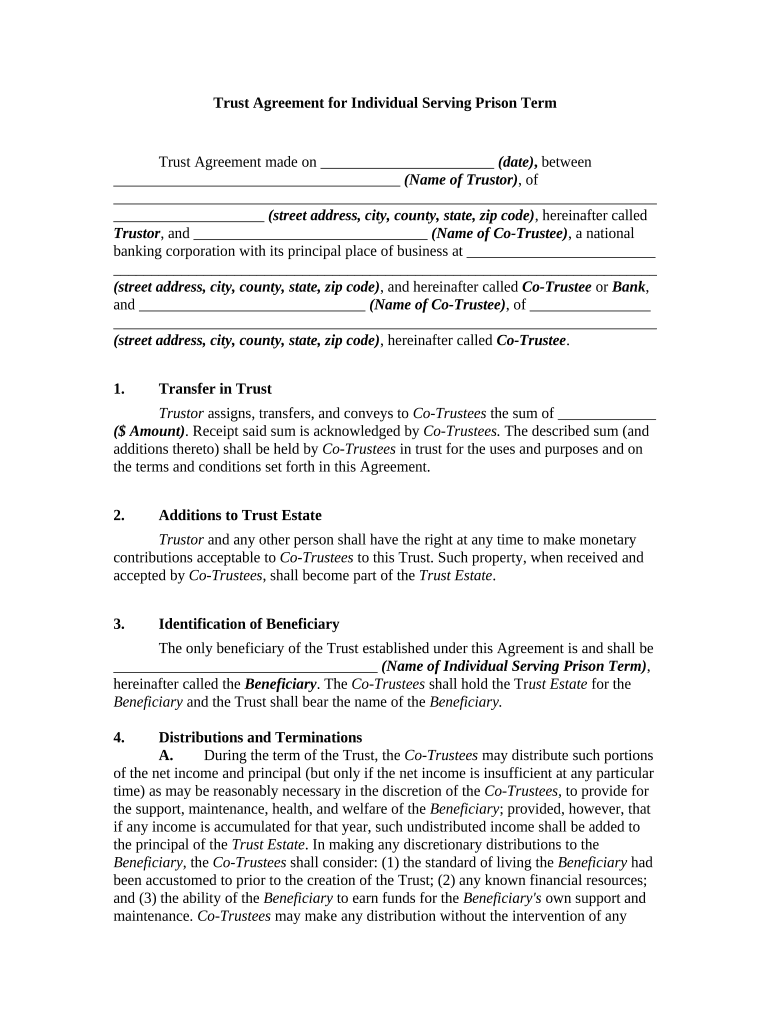

Trust Agreement for Individual Serving Prison Term

Trust Agreement made on _______________________ (date) , between

______________________________________ (Name of Trustor) , of

________________________________________________________________________

____________________ (street address, city, county, state, zip code) , hereinafter called

Trustor , and _______________________________ (Name of Co-Trustee) , a national

banking corporation with its principal place of business at _________________________

________________________________________________________________________

(street address, city, county, state, zip code) , and hereinafter called Co-Trustee or Bank ,

and ______________________________ (Name of Co-Trustee) , of ________________

________________________________________________________________________

(street address, city, county, state, zip code) , hereinafter called Co-Trustee .

1. Transfer in Trust

Trustor assigns, transfers, and conveys to Co-Trustees the sum of _____________

($ Amount) . Receipt said sum is acknowledged by Co-Trustees. The described sum (and

additions thereto) shall be held by Co-Trustees in trust for the uses and purposes and on

the terms and conditions set forth in this Agreement.

2. Additions to Trust Estate

Trustor and any other person shall have the right at any time to make monetary

contributions acceptable to Co-Trustees to this Trust. Such property, when received and

accepted by Co-Trustees , shall become part of the Trust Estate .

3. Identification of Beneficiary

The only beneficiary of the Trust established under this Agreement is and shall be

___________________________________ (Name of Individual Serving Prison Term) ,

hereinafter called the Beneficiary . The Co-Trustees shall hold the Tr ust Estate for the

Beneficiary and the Trust shall bear the name of the Beneficiary.

4. Distributions and Terminations

A. During the term of the Trust, the Co-Trustees may distribute such portions

of the net income and principal (but only if the net income is insufficient at any particular

time) as may be reasonably necessary in the discretion of the Co-Trustees, to provide for

the support, maintenance, health, and welfare of the Beneficiary ; provided, however, that

if any income is accumulated for that year, such undistributed income shall be added to

the principal of the Trust Estate . In making any discretionary distributions to the

Beneficiary, the Co-Trustees shall consider: (1) the standard of living the Beneficiary had

been accustomed to prior to the creation of the Trust; (2) any known financial resources;

and (3) the ability of the Beneficiary to earn funds for the Beneficiary's own support and

maintenance. Co-Trustees may make any distribution without the intervention of any

party or other legal representative, to the Beneficiary directly or by using the distribution

directly for the Beneficiary's benefit.

B. The Trust shall terminate upon the death of the Beneficiary or when the

Beneficiary is released from incarceration from the ______________________________

_____________________________________ (Name of Prison) after having served his

sentence of ___________________________ (time of sentence), upon parole, pardon or

as a result of some other early release program. On termination, the Co-Trustees shall pay

all of the then remaining Trust Estate including undistributed income of the Trust to the

Beneficiary or, if the Beneficiary is then deceased, to the personal representative of the

Beneficiary's estate.

5. Irrevocability of Trust

This Trust shall be irrevocable and shall not be revoked or terminated by Trustor

or any other person, nor shall it be amended or altered by Trustor or any other person.

6. Powers of Trustee

In addition to any powers given to it by law or otherwise, Co-Trustees are

authorized and empowered with respect to any property at any time held under any

provision of this Agreement, including accumulated income, if any, and any property

held pursuant to any power in Trust, and until the actual distribution of the property:

A. To sell on such terms and conditions as it in its sole discretion may

determine.

B. To invest and reinvest in and to acquire by exchange or otherwise property

of any character including stocks of any classification, obligations, or other

property, real or personal, whether or not of the same kind, and participations in

any common trust fund administered by Bank , without regard to diversification

and without being limited to the investments authorized by law for the investment

of trust funds.

C. To retain property of any kind received by it without regard to

diversification and without being limited to the investments authorized by law for

the investment of trust funds.

D. To join in, consent to, or become a party to any reorganization, merger,

consolidation, dissolution, readjustment, exchange, or other transaction and any

plan or action under or in connection with the same; to deposit any such property

with any protective, reorganizational, or similar committee; to delegate

discretionary powers to the committee and to share in the payment of its expenses

and compensation and to pay any assessments levied with respect to the property

and to receive property under any reorganization, merger, consolidation,

dissolution, readjustment, exchange or other transaction whether or not the same

is authorized by law for the investment of trust funds.

E. To exercise all conversion, subscription, voting, and other rights of

whatsoever nature pertaining to any such property and to grant proxies,

discretionary or otherwise, with respect to those rights.

F. To make and retain joint investments and investments of undivided

interests in any property, real or personal, whether or not all the property is held

under this agreement and whether or not the provisions under which such other

property is held are similar.

G . With respect to any real property (including real property acquired on

foreclosure or by deed in lieu of foreclosure) at any time held under this

agreement, to sell, exchange, partition, lease, sublease, mortgage, improve, or

otherwise alter on such terms as it may deem proper, and to execute and deliver

deeds, leases, mortgages, or other instruments relating to the real property. Any

lease may be made for such period of time, including a lease beyond a (e.g. five)

_____________ -year period, as it may deem proper and without the approval of

any court.

H. To extend the time of payment of any bond (or other obligation) and

mortgage held by it, or of any installment of principal or interest or hold such

bond (or other obligation) and mortgage after maturity as past due; to consent to

the alteration or modification of any terms of the same, waive defaults in the

performance of the terms of the same; to foreclose any such mortgage or

compromise or settle claims under the mortgage; to take over, take title to, or

manage the property, or any part of it, affected by any such mortgage, either

temporarily or permanently, and in partial or complete satisfaction of any claim

under the mortgage; to protect the property against or redeem it from foreclosure

or nonpayment of taxes, assessments, or other liens; to insure, protect, maintain,

and repair the property; and generally without limitation by the foregoing

specification to exercise with respect to such bond (or other obligation) and

mortgage on such property all rights and powers as may be exercised by a person

owning similar property in his or her own right.

I. To borrow money to provide funds for any purpose without resorting to

the sale of any assets; and for the purpose of securing the repayment of the

borrowed money, to pledge, mortgage, or otherwise encumber any and all such

property on such terms, covenants, and conditions as it may deem proper and also

to extend the time of payment of any loans or encumbrances which at any time

may be encumbrances on any such property irrespective of by whom the same

were made or where the obligations may or should ultimately be borne on such

terms, covenants, and conditions as it may deem proper.

J. Without limitation by the specification of the following, to exercise any

and all the powers, authorities, and discretions provided in this agreement in

respect of any shares of stock of Bank and any successor corporation whether by

merger, consolidation, reorganization, sale, or otherwise.

K. To register any property belonging to any Trust created by this Agreement

in the name of its nominee, or to hold the same unregistered, or in such form that

title shall pass by delivery.

L. To distribute in cash or in kind or partly in cash and partly in kind.

7. Compensation of Trustee

Co-Trustees shall be entitled to reasonable compensation from time to time for

Co-Trustees's ordinary services rendered under this Agreement, for any extraordinary

services performed by Co-Trustees, and for all services in connection with the

termination of the Trust, either in whole or in part.

8. Successor Trustee

If for any reason either Trustee shall cease to act as Trustee, a successor trustee

shall be appointed by the living adult brothers and sisters of Beneficiary. Any successor

trustee shall succeed as Trustee as though originally named Trustee under this trust

instrument. All authority, powers, and discretions conferred on the original Trustees

under this trust instrument shall pass to any successor Trustee. No successor Trustee shall

be responsible for the acts or omissions of any prior Trustee, nor shall any successor

Trustee be under a duty to audit or investigate the accounts or administration of any prior

Trustee. Unless requested in writing by a person having a present or future beneficial

interest in the Trust, no successor Trustee shall have any duty to take any action to obtain

redress for a breach of trust committed by any prior Trustee .

9. Invasion of Principal

In the event that the net income of this Trust is at any time insufficient to provide

for the care, comfort, maintenance, and support of Beneficiaries , Co-Trustees , in their

uncontrolled discretion, may pay or apply for those purposes such sums from the

principal of the Trust Estate as Co-Trustees may deem proper.

10. Allocation of Principal and Income

Except as otherwise specifically provided in this Agreement, Co-Trustees shall

have full power and authority to determine, in its absolute discretion, what shall

constitute principal of the Trust Estate , gross income from the Trust Estate , and net

income of the Trust Estate distributable under the terms of this Agreement.

11. Accounting

Co-Trustees at any time shall be entitled to render to the Beneficiary an account

of the acts of Co-Trustees and transactions with respect to the income and principal of the

Trust Estate from the date of the creation of the Trust or from the date of the last previous

account of Co-Trustees . The Beneficiary shall have full power and authority on behalf of

all persons now or later interested in the trust to finally settle and adjust such account.

Approval of the account by the Beneficiary shall constitute a full and complete discharge

and release of Co-Trustees from all further liability, responsibility, and accountability for

or with respect to the acts and transactions of Co-Trustees as set forth in the account, both

as to income and principal.

11. Governing Law

The validity, construction, and effect of this agreement and of the trust created under it

and its enforcement shall be determined by the laws of ___________________________

(name of state) .

Trustor and Co-Trustees have executed this Agreement as of the day and year

first above written.

______________________________ ______________________________

______________________________ ______________________________

Name & Signature of Trustor Name & Signature of Co-Trustee

_____________________________

_____________________________

Name & Signature of Co- Trustee

( Acknowledgments before Notary Public)