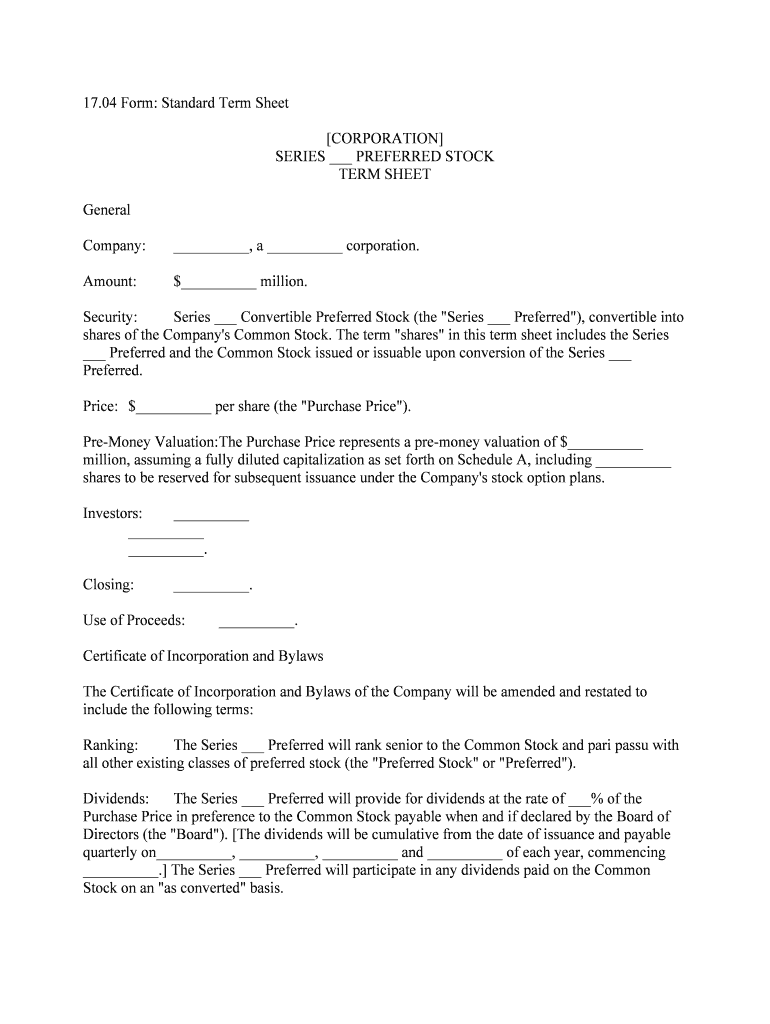

17.04 Form: Standard Term Sheet[CORPORATION]

SERIES ___ PREFERRED STOCK TERM SHEET

General

Company: __________, a __________ corporation.

Amount: $__________ million.

Security: Series ___ Convertible Preferred Stock (the "Series ___ Preferred"), convertible into

shares of the Company's Common Stock. The term "shares" in this term sheet includes the Series

___ Preferred and the Common Stock issued or issuable upon conversion of the Series ___

Preferred.

Price: $__________ per share (the "Purchase Price").

Pre-Money Valuation:The Purchase Price represents a pre-money valuation of $__________

million, assuming a fully diluted capitalization as set forth on Schedule A, including __________

shares to be reserved for subsequent issuance under the Company's stock option plans.

Investors: __________ __________ __________.

Closing: __________.

Use of Proceeds: __________.

Certificate of Incorporation and Bylaws

The Certificate of Incorporation and Bylaws of the Company will be amended and restated to

include the following terms:

Ranking: The Series ___ Preferred will rank senior to the Common Stock and pari passu with

all other existing classes of preferred stock (the "Preferred Stock" or "Preferred").

Dividends: The Series ___ Preferred will provide for dividends at the rate of ___% of the

Purchase Price in preference to the Common Stock payable when and if declared by the Board of

Directors (the "Board"). [The dividends will be cumulative from the date of issuance and payable

quarterly on__________, __________, __________ and __________ of each year, commencing

__________.] The Series ___ Preferred will participate in any dividends paid on the Common

Stock on an "as converted" basis.

Preference & Participation: Upon an acquisition or liquidation of the Company, each [Series ___

Preferred holder (the "Series ___ Preferred Stockholder")] [and each Preferred Stock holder (the

"Preferred Stockholder")] will receive the Purchase Price for each share held plus any [declared]

[accumulated] but unpaid dividends (the "Preference Amount") in preference to any distribution to

the Common Stockholders (the "Common Stockholders"). After the payment of the Preference

Amount to the Series ___ Preferred Stockholders, the remaining assets will be distributed ratably to

the Common and Series ___ Preferred Stockholders on an "as converted" basis [until such time as

the Series ___ Preferred Stockholders have received an additional ___ times the Purchase Price for

each share held]. An "acquisition" includes a merger, consolidation, or sale of all or substantially

all of the assets of the Company in any transaction or series of related transactions in which the

stockholders of the Company do not own 50% of the voting power of the surviving corporation.

Optional Conversion: Each share of Series ___ Preferred will convert at any time at the option of

the holder into one share of Common Stock, subject to adjustment as provided below.

Mandatory Conversion: The Series ___ Preferred will automatically convert into Common

Stock at the then-applicable conversion ratio: (1) with the consent of at least [a majority] [two-

thirds] of the outstanding [Preferred Stockholders] [Series ___ Preferred Stockholders]; or (2) upon

the closing of an underwritten public offering of the Company's Common Stock [on a national

securities exchange] at a price per share of not less than ___ times the Purchase Price with gross

proceeds of at least $__________ million.

Anti-Dilution: The conversion ratio of the Series ___ Preferred will be subject to a [full ratchet]

[broad-based weighted average] [narrow-based weighted average] adjustment if the Company

issues additional equity securities at a price less than the then-applicable conversion price. No

adjustment will be made for shares issuable upon the exercise of currently outstanding securities,

shares included in the option pool, shares issued to banks or equipment lenders[, shares issued in

connection with [real estate] licensing or partnering transactions] [or shares issued with the

unanimous approval of the Board]. The conversion price initially will equal the Purchase Price. The

conversion price will also be subject to proportional adjustment for stock splits, stock dividends,

recapitalizations and the like.

Board Composition: The Board will be comprised of__________, __________, __________,

__________ and__________, and the size of the Board will be set at [five members]. The directors

will be allocated among the Preferred and Common Stock classes as follows: (1) the [Series ___

Preferred Stockholders] [Preferred Stockholders] will elect [two] board members; (2) the Common

Stockholders will elect [two] board members; and (3) the Common and [Series ___ Preferred

Stockholders] [Preferred Stockholders], voting together as a class, will elect the remaining board

members. [The investors also will enter into an agreement with the Company pursuant to which [the

lead investor] will designate one [Series ___] Preferred director and [the other investors] will

designate the other [Series ___] Preferred director, and all of the Preferred [and Common]

Stockholders will agree to vote in favor of such designees.] [Each committee will include Series

___ Preferred directors in at least the same proportion as they are represented on the Board]. [A

majority of the members of the Compensation Committee will be comprised of Series ___

Preferred designees.]

Voting Rights: The Series ___ Preferred and Common Stockholders will vote together and not as a

separate class, except as provided below or as required by law. The Series ___ Preferred will have

the number of votes equal to the number of shares of Common Stock then issuable upon

conversion.

Protective Votes: As long as [at least __________] [any] shares of Series ___ Preferred remain

outstanding, the consent of the holders of at least [a majority] [two-thirds] of the Series ___

Preferred will be required to: (1) adversely affect the rights, preferences or privileges of the Series ___ Preferred;

(2) increase or decrease the authorized number of shares of Common or Preferred Stock;

(3) create or issue any new class or series of shares having rights, preferences, or privileges

[pari passu] [senior] to the Series ___ Preferred;

(4) amend, waive or repeal any provision of the Company's Certificate or Bylaws [in a

manner that adversely affects the Series ___ Preferred];

(5) increase or decrease the authorized size of the Board;

(6) declare or pay any dividend on the Common [or Preferred] Stock or redeem, repurchase

or acquire any shares of Common [or Preferred Stock], subject to customary exceptions; (7) effect any merger, sale, consolidation or reorganization of the Company;

(8) effect any transaction or series of related transactions in which more than [50%] of the

voting power of the Company is transferred or disposed; (9) sell, lease, assign, transfer or otherwise convey all or substantially all of the assets of the

Company; or (10) liquidate or dissolve the Company.

Investor Rights Agreement

The Company and the investors will enter into an Investor Rights Agreement that will include the

following terms:

Information Rights: As long as an investor continues to hold [at least __________] [any] shares,

the Company will deliver to the investor: (1) audited financial statements within [90] days after

each fiscal year; and (2) unaudited quarterly financial statements within [45] days after each fiscal

quarter. [In addition, so long as an investor holds at least [__________] [any] shares, the Company

will provide the investor with: (1) monthly financial statements within [20] days after the last day

of each month; (2) annual operating budgets within [30] days prior to the beginning of the ensuing

fiscal year; and (3) customary inspection and visitation rights.]

The information rights will expire upon an initial public offering [or the acquisition] of the

Company.

Registration Rights: Demand - On not more than two occasions, the Company will register for

resale of the shares of Common Stock issued upon conversion of the Series ___ Preferred Stock

requested by investors then holding at least [50%] of the shares. However, the Company will not be

required to register the shares prior to the [third] anniversary of the Closing and will have the right

to delay such registration or suspend sales under certain circumstances.Piggyback - The investors will be entitled to unlimited "piggyback" rights on all

registrations filed by the Company (other than on Form S-4 or S-8). If the offering is to be

underwritten, the number of shares included in the registration by the investors may be reduced on

a pro rata basis at the request of the managing underwriter.

S-3 - The investors will be entitled to [unlimited] [up to three] demand registrations on

Form S-3 if the Company qualifies for this form and the anticipated aggregate offering price of the

demand is at least [$1 million].

Expenses - The Company will pay the registration expenses other than underwriting

discounts and commissions of each registration, including the expenses of one special counsel of

the selling stockholders.

Lock-Up - The investors will not sell their shares for 180 days following the effective date

of the Company's initial public offering.

Transfer - The registration rights may be transferred to: (1) any affiliate or partner of an

investor; (2) any family member or trust for the benefit of any holder that is an individual; or (3)

any transferee who acquires at least __________ shares.

[Other Purchasers - Any registration rights previously granted by the Company will be

included with the registration rights of the investors in the Investor Rights Agreement. The

Company may add additional investors and others to the Investor rights Agreement without the

consent of the investors. [The Company may not grant future registration rights that are superior to

the rights granted to the investors.]]

Preemptive Rights: Investors will have the right to purchase their pro rata share of any new

securities the Company proposes to issue other than shares issuable upon the exercise of currently

outstanding securities, shares included in the option pool, shares issued to banks or equipment

lenders[, shares issued in connection with [real estate] licensing or partnering transactions] [or

shares issued with the unanimous approval of the Board]. [Any securities not subscribed for by an

investor will be reallocated among the other eligible investors.]

Proprietary Information & Inventions: The Company has or will enter into a proprietary

information and inventions agreement with each current and former officer, employee and

consultant of the Company.

Amendment: The Investor Rights Agreement may only be amended, with the approval of the

holders of [a majority] [two-thirds] of the investors.

Co-Sale Agreement

The Company and the investors will enter into a Co-Sale Agreement with __________ and

__________ (the "Founders"), [employees, officers, directors and consultants] that will include the

following terms:

Co-Sale Rights: The Founders[, employees and officers] may not sell, transfer or exchange

their stock unless each investor has an opportunity to participate in the sale on a pro rata basis,

subject to customary exceptions.

Stock Purchase Agreement

The investment shall be made pursuant to a Stock Purchase Agreement that contains

representations and warranties of the Company, covenants of the Company and conditions of

closing, including an opinion of counsel for the Company.

Representations & Warranties: The agreement will include representations and warranties

such as: organization and good standing; capitalization structure; due authorization; valid stock

issuances; possession of all governmental consents; no adverse litigation; ownership of intellectual

property; disclosure agreements with employees; assurances of full disclosure; good title to all

assets; tax returns and complete corporate records; accuracy of financial statements; absence of

adverse developments; material contracts; no conflicts; no environmental liabilities; no ERISA

issues; and nonapplicability of the Investment Company Act.

Closing Conditions: The closing of the sale of the Series ___ Preferred is subject to the following

conditions precedent:(1) completion of legal documentation satisfactory to the investors;

(2) [completion of due diligence satisfactory to the investors;] and

(3) [receipt of detailed budget satisfactory to the lead investor.]

Fees and Expenses:

The Company will pay the reasonable fees and expenses of counsel to the lead investor [(not to

exceed $__________)].

Optional Provisions

[Redemption: [At the election of at least [a majority] [two-thirds] of the Series __ Preferred

Stockholders], the Company will redeem the outstanding Series __ Preferred as follows:

Percentage of Shares

then Outstanding Date of Redemption

[33%] [fifth anniversary of closing]

[50%] [sixth anniversary of closing]

[100%][seventh anniversary of closing]

The Company will redeem the shares by paying in cash the Purchase Price plus any [declared]

[accumulated] but unpaid dividends [plus ___% for each year the Series ___ Preferred is

outstanding]. [If the Company fails to redeem the Series ___ Preferred when due, the conversion

price of the Series ___ Preferred thereafter will immediately decrease by ___%, and will decrease

by an additional ___% every month thereafter, and the Board will be expanded so that the holders

of the Series ___ Preferred, voting as a single class, will be entitled to elect a majority of the

directors.]]

[Stock Vesting: After the Closing, all equity securities issued to employees, officers,

directors and consultants will be subject to vesting as follows: [25% to vest at the end of the first

year following such issuance, with the remaining 75% to vest monthly over the next three years.]

[All of] [___% of] the outstanding equity securities currently held by the Founders will become

subject to monthly vesting over the [four] [two] years after the Closing.]

[Right of First Refusal: The Company will have a right of first refusal on all transfers of

Common Stock by Founders[, employees and officers], subject to customary exceptions. If the

Company elects not to exercise its right, the Company will assign its right to the investors.]

[Indemnification: The Certificate will limit liability of the Board and the Bylaws will require

indemnification of the Board to the fullest extent permitted by applicable law.]

[Finders: The Company and the investors shall each indemnify the other for any broker's or

finder's fees for which either is responsible.]

[Executive Search: The Company will use its best efforts to hire a [CEO/CFO] acceptable to the

investors as soon as practicable following the Closing.]

[Observation Rights: So long as an investor holds at least __________ shares, the investor will be

entitled to have one representative present at each Board meeting.]

[Insurance: The Company will obtain and maintain key-person life insurance policies for each of

the Founders in the amount of [$1 million]. The Company will obtain and maintain D&O insurance

coverage for its directors and officers on terms reasonably satisfactory to the investors.]

[Tag-Along Rights: If any investor proposes to transfer its shares to a third party, then each other

investor shall have the right to participate in such sale by selling a pro rata number of shares on the

same terms and conditions as the selling investor[; provided that each investor shall be permitted to

transfer up to [10%] of its shares without triggering such right].]

[Drag-Along Rights: If investors holding __% of the outstanding Preferred Stock propose to

transfer their shares to a third party or approve an acquisition of the Company, the other

stockholders will be required to sell their shares to the third party, at the same price and upon

identical terms and conditions as the investors, or to vote in favor of the acquisition of the

Company. Each of the other stockholders will be required to: (1) make representations and

warranties in connection with such transaction regarding (a) ownership and authority to sell the

shares to be sold by it and (b) existence of any material violations as a result of such sale under any

material agreement to which such stockholder is a party; (2) obtain any consents or approvals that

can be obtained without significant expense; and (3) pay its pro rata share of expenses incurred in

connection with the transaction.]

[Super-Majority Board Votes: The Company's Bylaws will be amended to provide that

approval by an [80%] vote of the Board will be required to approve the following: merger or

dissolution of the Company; the issuance, sale, purchase or redemption of securities of the

Company; establishment of Board committees; certain sales of assets; restricted payments;

declaration of dividends; filing of bankruptcy petition; approval of annual budget; guarantees of

third-party obligations other than in the ordinary course of business; debt incurrence; certain major

investment, capital expenditures, acquisitions or charitable donations; entry into a new line of

business; creation of liens, mortgages or other encumbrances; surrender of property; institution,

termination or settlement of litigation; election of senior executive officers; contracts or agreements

not in the ordinary course of business; leasing of real or personal property; creation of executive

compensation and employee benefit programs; adoption of any major policy changes regarding the

manufacture or sale of products or services; modification of significant accounting policies;

selection of independent accountants; change in domicile; any material financing; any transacti on

which would result in a change of control; adoption or material amendment of any equity-based

compensation or similar plan; affiliate transactions; and change in the number of directors.]

[Affirmative Covenants: The agreement will include other affirmative covenants of the

Company such as: retention of independent accountants; maintenance of corporate existence and

rights; compliance with laws, including, without limitation, environmental laws; performance of

obligations; maintenance of properties in good repair; maintenance of appropriate and adequate

insurance; insurance for and indemnification of directors; payment of taxes and other liabilities;

notice of defaults, litigation and other adverse actions; and further assurances.]

[Negative Covenants: The agreement will include negative covenants such as limitations on:

incurrence of indebtedness; liens; issuance of equity securities by the Company or its subsidiaries;

loans, investments and joint ventures; guarantees or other contingent obligations; restricted

payments (including dividends, redemptions and repurchases of capital stock); fundamental

changes (including limitations on mergers, acquisitions and asset sales); operating leases; sale-

leaseback transactions; transactions with affiliates; dividend and other payment restrictions

affecting subsidiaries; capital expenditures; lines of business; amendment of indebtedness and other

material documents; and prepayment or repurchase of indebtedness.]

[Management Rights: The Company will provide the investor with the right to substantially

participate in, or substantially influence the conduct of, the management of the Company.]

[Nonsolicitation: The Company will not solicit for employment or employ: (1) any person who

is, or has been within the previous twelve months, an employee of [the lead investor] or its

affiliates; [or (2) any member of the management team of any entity in which [the lead investor]

has had an investment within the previous twelve months], without the prior written consent of [the

lead investor].]

By executing this term sheet, the Company agrees to keep each of the provisions herein, as well as

the existence of this term sheet, confidential. [The Company further agrees that it will not, directly

or indirectly, solicit, encourage or entertain proposals from or enter into negotiations with or

furnish any information to any other person or entity regarding any alternative financing from

parties other than the investors for a period of [30] days following execution of this term sheet.]

This term sheet does not create a binding offer or[, except for the preceding paragraph,] a binding

agreement. This term sheet is intended to set forth the fundamental terms of the proposed

transaction, but it may be revised and new issues may be presented as they arise from further

investigation by the Company or the investors. A binding agreement to consummate this

transaction will come into existence only upon the Company's and the investors' due authorization,

execution and delivery of definitive agreements. This term sheet will expire if not accepted by __________.Investor X

By:____________________

Title:___________________

Accepted and Agreed:

[CORPORATION]

By:___________________

Title:__________________

Schedule A

Capitalization Table Existing Pro Forma

Common Common

Share Ownership Share Ownership

Equivalent Percentage Equivalent Percentage

Common Stock: Founder A % %

Founder B % %

Employee Options: Outstanding % %

Reserved for

Subsequent Issuance % %

Other Options/Warrants

Existing Preferred

Series ___ Preferred:Lead Investor % %

Other Investor(s) % %

Total 100% 100%

Practical advice for completing your ‘Start Up Ampampamp Emerging Companies Planning Financing And ’ online

Are you fed up with the inconvenience of handling paperwork? Your search ends here with airSlate SignNow, the premier eSignature service for individuals and small to medium-sized businesses. Wave farewell to the tedious task of printing and scanning documents. With airSlate SignNow, you can smoothly fill out and sign documents online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform and transform your method of document management. Whether you need to sign forms or collect signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow this detailed guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Start Up Ampampamp Emerging Companies Planning Financing And ’ in the editor.

- Click Me (Fill Out Now) to finish the form on your end.

- Add and designate fillable fields for others (if required).

- Proceed with the Send Invite settings to seek eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to work with others on your Start Up Ampampamp Emerging Companies Planning Financing And or send it for notarization—our solution provides everything necessary to accomplish those tasks. Sign up with airSlate SignNow today and elevate your document management to new levels!