Prepared by U.S. Legal Forms, Inc.

Copyright 2016 - U.S. Legal Forms, Inc.

STATE OF MONTANA

SUMMARY ADMINISTRATION OF ESTATE

Control Number – MT – ET20

NOTES ON COMPLETING THESE FORMS

The form(s) in this packet contain “form fields” created using Microsoft Word. “Form

fields” facilitate completion of the forms using your computer. They do not limit you

ability to print the form “in blank” and complete with a typewriter or by hand.

It is also helpful to be able to see the location of the form fields. Go to the View

menu, click on Toolbars, and then select Forms. This will open the forms toolbar.

Look for the button on the forms toolbar that resembles a “shaded letter “a”.

Click in this button and the form fields will be visible.

By clicking on the appropriate form field, you will be able to enter the needed

information. In some instances the form field and the line will disappear after

information is entered. In other cases it will not. This is appropriate and the way the

form is designed to function.

DISCLAIMER

These materials were developed by U.S. Legal Forms, Inc. based upon statutes and forms

for the State of Montana. All Information and Forms are subject to this Disclaimer: All

forms in this package are provided without any warranty, express or implied, as to their

legal effect and completeness. Please use at your own risk. If you have a serious legal

problem we suggest that you consult an attorney. U.S. Legal Forms, Inc. does not

provide legal advice. The products offered by U.S. Legal Forms (USLF) are not a

substitute for the advice of an attorney.

THESE MATERIALS ARE PROVIDED "AS IS" WITHOUT ANY EXPRESS OR

IMPLIED WARRANTY OF ANY KIND INCLUDING WARRANTIES OF

MERCHANTABILITY, NONINFRINGEMENT OF INTELLECTUAL PROPERTY,

OR FITNESS FOR ANY PARTICULAR PURPOSE. IN NO EVENT SHALL U. S.

LEGAL FORMS, INC. OR ITS AGENTS OR OFFICERS BE LIABLE FOR ANY

DAMAGES WHATSOEVER (INCLUDING, WITHOUT LIMITATION DAMAGES

FOR LOSS OF PROFITS, BUSINESS INTERRUPTION, LOSS OF INFORMATION)

ARISING OUT OF THE USE OF OR INABILITY TO USE THE MATERIALS, EVEN

IF U.S. LEGAL FORMS, INC. HAS BEEN ADVISED OF THE POSSIBILITY OF

SUCH DAMAGES.

SUMMARY ADMINISTRATION PACKAGEMT-ET20

INCLUDED:

Form One - Petition for Informal Appointment of Personal Representative/Informal Probate of Will

Form Two - Notice of Petition

Form Three - Proposed Order Approving Petition

Form Four - Notice of Appointment or Probate

Form Six - Inventory and Appraisement

Form Five - Verified Closing Statement

Selected Montana Statutes

PLEASE NOTE: The following is a limited set of instructions regarding the use of the

included forms. This in no way should be considered a complete discussion of the

process of probating an estate. Montana statutes regarding probate are complex, and

care should be taken to read and understand applicable statutes. Consultation with a

knowledgeable attorney is always advised.

Step One – Submit a petition to the probate court requesting to be named as

the estate administrator, or if there is a will to admit the will to

probate. Notice of this petition must be given to given to any

interested person who has demanded it, to any former

administrators of the estate, and to any other party entitled to be

appointed.

Step Two – Contact the court administrator regarding a hearing date for the petition.

Step Three – Upon approval of petition by probate judge, tender to the judge an order approving the petition, and provide notice of the approval to

interested parties.

Step Four – Prepare an accounting of the estate and provide a copy to any

interested party who has requested one.

Step Five – Distribute the estate and file a closing statement.

- 1 -

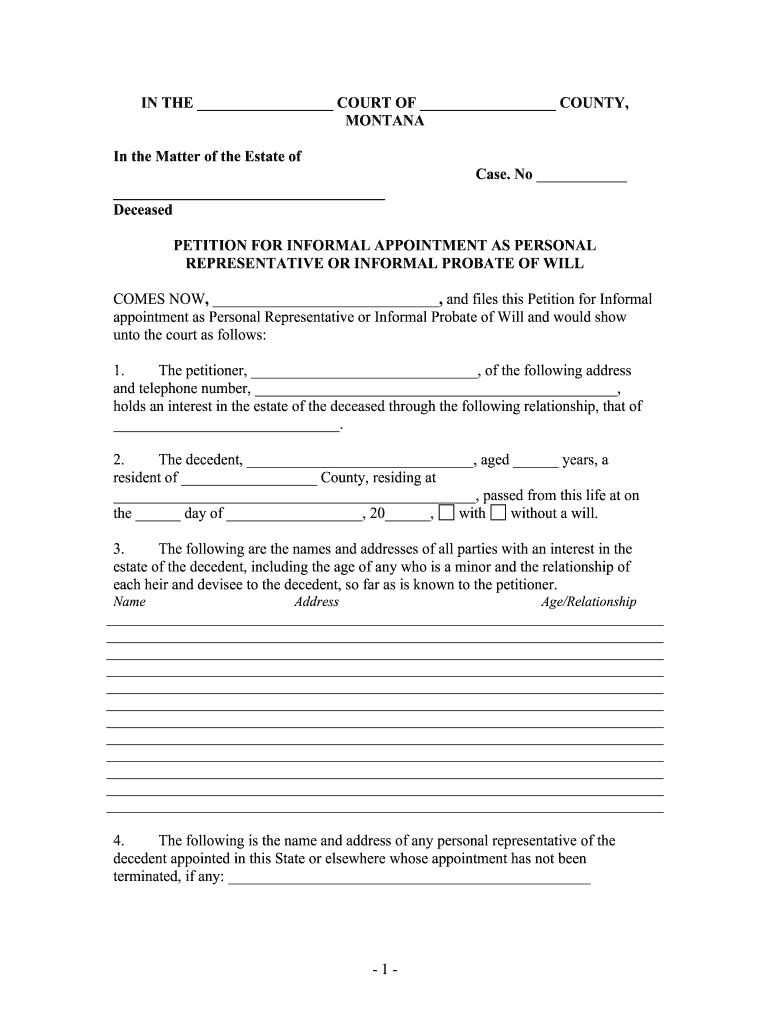

IN THE __________________ COURT OF __________________ COUNTY, MONTANA

In the Matter of the Estate of Case. No ____________

____________________________________

Deceased

PETITION FOR INFORMAL APPOINTMENT AS PERSONAL REPRESENTATIVE OR INFORMAL PROBATE OF WILL

COMES NOW , ______________________________ , and files this Petition for Informal

appointment as Personal Representative or Informal Probate of Will and would show

unto the court as follows:

1. The petitioner, ______________________________, of the following address

and telephone number, ________________________________________________,

holds an interest in the estate of the deceased through the following relationship, that of ______________________________.

2. The decedent, ______________________________, aged ______ years, a

resident of __________________ County, residing at

________________________________________________, passed from this life at on

the ______ day of __________________, 20______,

with without a will.

3. The following are the names and addresses of all parties with an interest in the

estate of the decedent, including the age of any who is a minor and the relationship of

each heir and devisee to the decedent, so far as is known to the petitioner.

Name Address Age/Relationship

4. The following is the name and address of any personal representative of the

decedent appointed in this State or elsewhere whose appointment has not been

terminated, if any: ________________________________________________

- 2 -

5. A will exists. The original of the decedent's last will is in the possession of

this Court, or accompanies this application, or an authenticated copy of a will probated in

another jurisdiction accompanies this application. Further, the applicant, to the best of

the applicant's knowledge, believes the will to have been validly executed, and that after

the exercise of reasonable diligence, the applicant is unaware of any instrument revoking

the will, and that the applicant believes that the instrument which is the subject of the

application is the decedent's last will. The will was executed on the ______ day of

__________________, 200______, and was tendered for probate or an application for

probate was filed on the ______ day of __________________, 20______. 6.

A will does not exist, and that after the exercise of reasonable diligence, the

applicant is unaware of any unrevoked testamentary instrument relating to property

having a situs in this State or any instrument purporting to be a will of the decedent.

7. The petitioner

has has not received a demand for notice, and/or is

is not aware of any demand for notice of any probate or appointment proceeding

concerning the decedent that may have been filed in this State or elsewhere.

8. The time limit for informal probate has not expired either because three years or

less have passed since the decedent's death, or, if more than three years from death have

passed, that circumstances as described by §72-3-122 authorizing tardy probate or

appointment have occurred.

THEREFORE, PREMISES CONSIDERED, the petitioner would respectfully request

that this Court issue an order informally appointing the petitioner as personal

representative of this estate with authority to resolve said estate through the process of

summary administration, or informally admitting the will of the decedent to probate, as

well as any other relief that the Court finds appropriate.

Under penalties of perjury, the undersigned declares that he is the petitioner

named in the foregoing petition and knows the contents thereof; that the pleading is true

of his own knowledge and belief, and that the statements contained in the application are

true. This the ______ day of __________________, 20______.

Petitioner

Type or Print Name

I ______________________________ say on oath or affirm that I have read the

foregoing (or attached) document and believe all statements made in the document are

true.

Petitioner’s Signature

- 3 -

Type or Print Name

Subscribed and sworn to or affirmed before me at ______________________________,

on the ______ day of __________________, 20______.

Signature of Officer

Title of Officer

State of Montana

County of __________________

The instrument was acknowledged before me on this ______ day of __________________, 20 ______, by ______________________________.

Notary Public

My commission expires:

Type or Print Name

- 1 -

IN THE __________________ COURT OF __________________ COUNTY, MONTANA

In the Matter of the Estate of Case. No

____________________________________

Deceased

NOTICE OF HEARING ON PETITION FOR INFORMAL APPOINTMENT AS ADMINISTRATOR OR INFORMAL PROBATE OF WILL

PLEASE TAKE NOTICE , that ____________________________________ filed with

the court a Petition for Informal Appointment as Personal Representative or Informal

Probate of Will. A hearing on the petition has been set for the ______ day of

__________________, 20______, at the hour of ______ ______.M. at the above-named

Court which is located at ______________________________, Montana.

DATED this the ______ day of __________________, 20______.

Signature of Party

Printed Name

Address

City, State, and Zip

Telephone Number

- 1 -

IN THE __________________ COURT OF __________________ COUNTY, MONTANA

In the Matter of the Estate of Case. No ______________

____________________________________

Deceased

ORDER APPROVING PETITION

Upon consideration of the petition of ______________________________, this

Court finds that said Petition is well taken and it is hereby ordered that:

The petitioner be informally appointed as personal representative of the estate of

______________________________, and be granted authority as a personal

representative, with all the entitlements and responsibilities inherent thereto.

The Petitioner’s request that the will of the above-named decedent be entered for

informal probate is hereby granted.

SO ORDERED THIS THE ______ DAY OF __________________, 20______.

_______________________________

Judge of the Probate Court

- 1 -

IN THE __________________ COURT OF __________________ COUNTY, MONTANA

In the Matter of the Estate of Case. No ______________

____________________________________

Deceased

NOTICE OF APPROVAL OF PETITION FOR INFORMAL APPOINTMENT AS ADMINISTRATOR OR INFORMAL PROBATE OF WILL

PLEASE TAKE NOTICE , that ______________________________ filed with the

court a Petition for Informal Appointment as Personal Representative or Informal Probate

of Will on or about the ______ day of __________________, 20______. Said petition

was approved by order of the Court on the ______ day of __________________, 20______. Any creditors to the estate of the deceased must present their claims to the

undersigned personal representative at the following address ______________________________ , within four (4) months of the date that notice of

the approval of the petition or have their claim forever barred.

DATED this ______ day of __________________, 20______.

Signature of Party

Printed Name

Address

City, State, and Zip

Telephone Number

- 1 -

IN THE __________________ COURT OF __________________ COUNTY, MONTANA

In the Matter of the Estate of Case. No ______________

____________________________________

Deceased

NOTICE OF APPOINTMENT AS PERSONAL ADMINISTRATOR

PLEASE TAKE NOTICE , that ______________________________ filed with the

court a Petition for Informal Appointment as Personal Representative or Informal Probate

of Will on or about the ______ day of __________________, 20______. Said petition

was approved by order of the Court on the ______ day of __________________, 20______. Pursuant to statute, this notice is provided to the heirs and devisees of the

decedent no later than thirty (30) days after the appointment of the personal

representative and provides notice of the following: 1. The name and address of the personal representative of the decedent is

____________________________________________________________.

2.

A bond has been filed.

A bond has not been filed.

3. The Court in which documents relating to the administration of this estate

may be found is located at and described as: ____________________________________________________________.

4. The estate is being administered by the personal representative under the

uniform probate code without supervision by the court. Recipients of this notice are

entitled to information regarding the administration from the personal representative and

may petition the court in any matter relating to the estate, including distribution of assets

and expenses of administration.

DATED this ______ day of __________________, 20______.

Signature of Party

Printed Name

Address

- 2 -

City, State, and Zip

Telephone Number

- 1 -

IN THE __________________ COURT OF __________________ COUNTY, MONTANA

In the Matter of the Estate of Case. No

__________________

____________________________________

Deceased

Inventory and Appraisement

COMES NOW , ______________________________ , as duly appointed administrator of

the estate of ______________________________, deceased, and pursuant to Montana

statute §72-3-607 hereby provides the following inventory and appraisement of the assets

of the estate of the above-named decedent.

ASSET DESCRIPTION FAIR MARKET VALUE DEBTS OWED ON ASSET, IF ANY.

- 2 -

This the ______ day of __________________, 20______._________________________________

Signature

- 1 -

IN THE __________________ COURT OF __________________ COUNTY, MONTANA

In the Matter of the Estate of Case. No

__________________

____________________________________

Deceased

VERIFIED CLOSING STATEMENT OF PERSONAL REPRESENTATIVE

COMES NOW, ______________________________, as the personal representative of

the decedent, ______________________________, and files this Sworn Statement for

the purpose of closing this estate, and would attest to the following:

1. To the best of my knowledge, the value of the entire estate, less liens and

encumbrances, does not exceed the decedent’s homestead allowance, exempt property,

family allowance, costs and expenses of administration, reasonable funeral expenses, and

reasonable, necessary medical and hospital expenses of the last illness of the decedent;

2. I have fully administered this estate by disbursing and distributing it to the

persons entitled thereto.

3. I have sent a copy of this Closing Statement to all the distributees of this estate

and to all creditors or other claimants of whom I am aware whose claims are neither paid

nor barred and have furnished a full account in writing of the administration to the

distributees whose interests are affected.

I have read the foregoing Statement and know of my own knowledge that the facts stated

therein are true and correct. This the ______ day of __________________, 20______. ___________________________________

Signature

Acknowledgment of Individual

State of Montana

County of __________________

The instrument was acknowledged before me on this ______ day of __________________, 20 ______, by ______________________________.

- 2 -

Notary Public

My commission expires:

Type or Print Name

- 3 -

SELECTED MONTANA STATUTES

72-1-301. Notice -- method and time of giving. (1) If notice of a hearing on any

petition is required and except for specific notice requirements as otherwise provided, the

petitioner shall cause notice of the time and place of hearing of any petition to be given to

any interested person or his attorney if he has appeared by attorney or requested that

notice be sent to his attorney. Notice shall be given:

(a) by mailing a copy thereof at least 14 days before the time set for the hearing by

certified, registered, or ordinary first-class mail addressed to the person being notified at

the post-office address given in his demand for notice, if any, or at his office or place of

residence, if known;

(b) by delivering a copy thereof to the person being notified personally at least 14 days

before the time set for the hearing; or

(c) if the address or identity of any person is not known and cannot be ascertained

with reasonable diligence, by publishing in a weekly paper once a week for 3 consecutive

weeks and, if in a newspaper published more often than once a week, by publishing on at

least 3 different days of publication, and it shall be so published that there must be at least

10 days from the first to the last day of publication, both the first and last day being

included.

(2) The court for good cause shown may provide for a different method or time of

giving notice for any hearing.

(3) Proof of the giving of notice shall be made on or before the hearing and filed in the

proceeding.

72-3-201. Applications to be verified. Applications for informal probate or informal

appointment shall be directed to the clerk and verified by the applicant to be accurate and

complete to the best of his knowledge and belief as to the information required by 72-3-

202 through 72-3-205.

72-3-202. Required contents of application. Every application for informal probate of a

will or for informal appointment of a personal representative, other than a special,

ancillary, or successor representative, shall contain the following:

(1) a statement of the interest of the applicant;

(2) the name and date of death of the decedent, his age, and the county and state of his

domicile at the time of death and the names and addresses of the spouse, children, heirs,

and devisees and the ages of any who are minors so far as known or ascertainable with

reasonable diligence by the applicant;

(3) if the decedent was not domiciled in the state at the time of his death, a statement

showing venue;

(4) a statement identifying and indicating the address of any personal representative of

the decedent appointed in this state or elsewhere whose appointment has not been

terminated;

(5) a statement indicating whether the applicant has received a demand for notice or is

aware of any demand for notice of any probate or appointment proceeding concerning the

decedent that may have been filed in this state or elsewhere.

- 4 -

72-3-203. Probate and appointment under will -- additional information required.

(1) An application for informal probate of a will shall state the following in addition to

the statements required by 72-3-202:

(a) that the original of the decedent's last will is in the possession of the court or

accompanies the application or that an authenticated copy of a will probated in another

jurisdiction accompanies the application;

(b) that the applicant to the best of his knowledge believes the will to have been

validly executed;

(c) that after the exercise of reasonable diligence, the applicant is unaware of any

instrument revoking the will and that the applicant believes that the instrument which is

the subject of the application is the decedent's last will;

(d) that the time limit for informal probate as provided in this chapter has not expired

either because 3 years or less have passed since the decedent's death or, if more than 3

years from death have passed, that circumstances as described by 72-3-122 authorizing

tardy probate have occurred.

(2) An application for informal appointment of a personal representative to administer

an estate under a will shall describe the will by date of execution and state the time and

place of probate or the pending application or petition for probate. The application for

appointment shall adopt the statements in the application or petition for probate and state

the name, address, and priority for appointment of the person whose appointment is

sought.

72-3-204. Appointment in intestacy -- additional information required. An

application for informal appointment of an administrator in intestacy shall state in

addition to the statements required by 72-3-202:

(1) that after the exercise of reasonable diligence, the applicant is unaware of any

unrevoked testamentary instrument relating to property having a situs in this state under

72-1-201 or a statement why any such instrument of which he may be aware is not being

probated;

(2) the priority of the person whose appointment is sought and the names of any other

persons having a prior or equal right to the appointment under 72-3-501 through 72-3-508.

72-3-211. Informal probate -- notice requirements. (1) The moving party must give

notice as described by 72-1-301 of his application for informal probate:

(a) to any person demanding it pursuant to 72-3-106; and

(b) to any personal representative of the decedent whose appointment has not been

terminated.

(2) No other notice of informal probate is required.

72-3-215. Clerk to issue statement of informal probate -- effect -- procedural defect

not to void probate. (1) Upon receipt of an application requesting informal probate of a

will, the clerk, upon making the findings required by 72-3-212 and 72-3-213, shall issue a

written statement of informal probate if at least 120 hours have elapsed since the

decedent's death.

- 5 -

(2) Informal probate is conclusive as to all persons until superseded by an order in a

formal testacy proceeding.

(3) No defect in the application or procedure relating thereto which leads to informal

probate of a will renders the probate void.

72-3-221. Informal appointment -- notice requirements. (1) The moving party must

give notice as described by 72-1-301 of his intention to seek an appointment informally:

(a) to any person demanding it pursuant to 72-3-106; and

(b) to any person having a prior or equal right to appointment not waived in writing

and filed with the court.

(2) No other notice of an informal appointment proceeding is required.

72-3-603. Notice of appointment to heirs and devisees. (1) Not later than 30 days after

his appointment, every personal representative, except any special administrator, shall

give information of his appointment to the heirs and devisees, including, if there has been

no formal testacy proceeding and if the personal representative was appointed on the

assumption that the decedent died intestate, the devisees in any will mentioned in the

application for appointment of a personal representative. The information shall be

delivered or sent by ordinary mail to each of the heirs and devisees whose address is

reasonably available to the personal representative. The duty does not extend to require

information to persons who have been adjudicated in a prior formal testacy proceeding to

have no interest in the estate.

(2) (a) The information must:

(i) include the name and address of the personal representative;

(ii) indicate that it is being sent to persons who have or may have some interest in the

estate being administered;

(iii) indicate whether bond has been filed; and

(iv) describe the court where papers relating to the estate are on file.

(b) The information must state that the estate is being administered by the personal

representative under the uniform probate code without supervision by the court but that

recipients are entitled to information regarding the administration from the personal

representative and may petition the court in any matter relating to the estate, including

distribution of assets and expenses of administration.

(3) The personal representative's failure to give this information is a breach of his duty

to the persons concerned but does not affect the validity of his appointment, his powers,

or other duties.

(4) A personal representative may inform other persons of his appointment by delivery

or ordinary first-class mail.

72-3-607. Inventory -- appraisal -- copy to department of revenue. (1) If the estate

must file a United States estate tax return, within the time required for the filing of the

United States estate tax return plus any extensions granted by the internal revenue

service, a personal representative, who is not a special administrator or a successor to

another representative who has previously discharged this duty, shall prepare and file or

mail an inventory. The inventory must include a listing of all property that:

(a) the decedent owned, had an interest in or control over, individually, in common, or

jointly, or otherwise had at the time of the decedent's death;

- 6 -

(b) the decedent had possessory or dispository rights over at the time of death or had

disposed of for less than its fair market value within 3 years of the decedent's death; or

(c) was affected by the decedent's death for the purpose of estate taxes.

(2) The inventory must include a statement of the full and true value of the decedent's

interest in every item listed in the inventory. In this connection, the personal

representative shall appoint one or more qualified and disinterested persons to assist the

personal representative in ascertaining the fair market value as of the date of the

decedent's death of all assets included in the estate. Different persons may be employed

to appraise different kinds of assets included in the estate. The names and addresses of

any appraiser must be indicated on the inventory with the item or items appraised.

(3) The personal representative shall send a copy of the inventory to interested persons

who request it, or the personal representative may file the original of the inventory with

the court. In any event, a copy of the inventory and statement of value must be mailed to

the department of revenue.

72-3-801. Notice to creditors. (1) Unless notice has already been given under this

section, a personal representative upon his appointment shall publish a notice once a

week for 3 successive weeks in a newspaper of general circulation in the county

announcing his appointment and address and notifying creditors of the estate to present

their claims within 4 months after the date of the first publication of the notice or be

forever barred.

(2) A personal representative may give written notice by mail or other delivery to any

creditor, notifying the creditor to present his claim within 4 months from the published

notice if given as provided in subsection (1) or within 30 days from the mailing or other

delivery of the notice, whichever is later, or be forever barred. Written notice must be the

notice described in subsection (1) or a similar notice.

(3) The personal representative is not liable to any creditor or to any successor of the

decedent for giving or failing to give notice under this section. 72-3-1103. Small estates -- summary administration procedure. If it appears from the

inventory and appraisal that the value of the entire estate, less liens and encumbrances,

does not exceed homestead allowance, exempt property, family allowance, costs and

expenses of administration, reasonable funeral expenses, and reasonable and necessary

medical and hospital expenses of the last illness of the decedent, the personal

representative, without giving notice to the creditors, may immediately disburse and

distribute the estate to the persons entitled thereto and file a closing statement as provided

in 72-3-1104.

72-3-1104. Small estates -- closing by sworn statement of personal representative. (1)

Unless prohibited by order of the court and except for estates being administered by

supervised personal representatives, a personal representative may close an estate

administered under the summary procedures of 72-3-1103 by filing with the court, at any

time after disbursement and distribution of the estate, a verified statement stating that:

(a) to the best knowledge of the personal representative, the value of the entire estate,

less liens and encumbrances, did not exceed homestead allowance, exempt property,

family allowance, costs and expenses of administration, reasonable funeral expenses, and

reasonable, necessary medical and hospital expenses of the last illness of the decedent;

- 7 -

(b) the personal representative has fully administered the estate by payment of estate

taxes and by disbursing and distributing it to the persons entitled to it; and

(c) the personal representative has sent a copy of the closing statement to all

distributees of the estate and to all creditors or other claimants of whom the personal

representative is aware whose claims are neither paid nor barred and has furnished a full

account in writing of the administration to the distributees whose interests are affected.

(2) If actions or proceedings involving the personal representative are not pending in

the court 1 year after the closing statement is filed, the appointment of the personal

representative terminates.

(3) A closing statement filed under this section has the same effect as one filed under 72-3-1004.