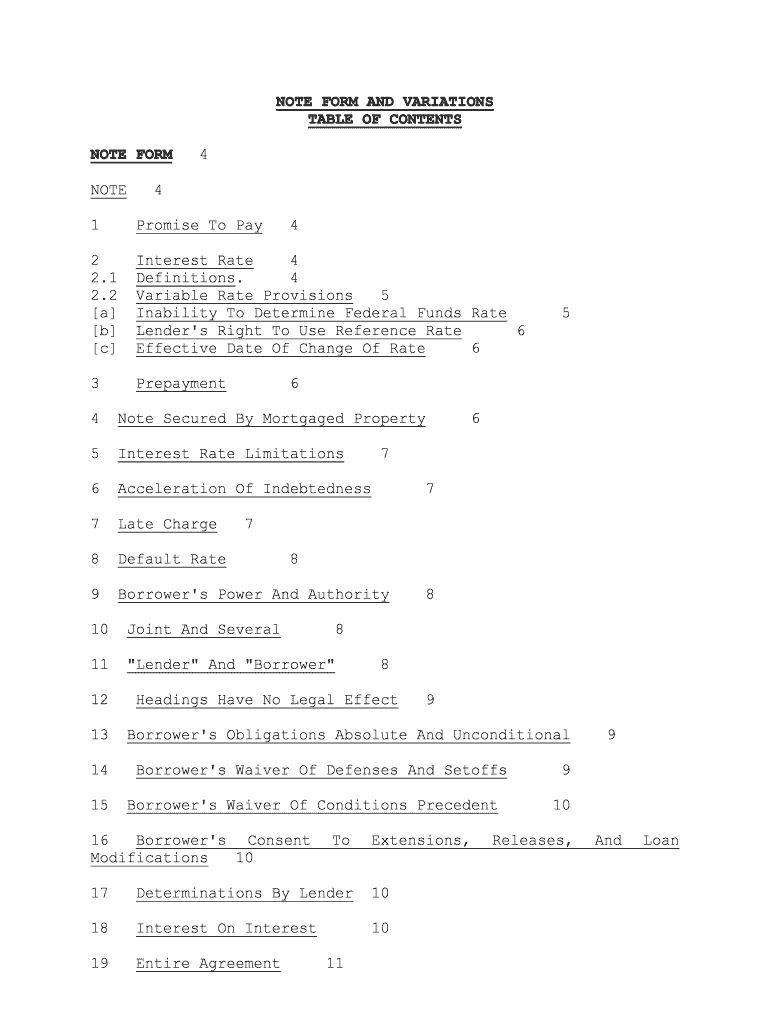

NOTE FORM AND VARIATIONS

TABLE OF CONTENTS

NOTE FORM 4

NOTE

4

1 Promise To Pay

4

2 Interest Rate

4

2.1 Definitions

. 4

2.2 Variable Rate Provisions

5

[a] Inability To Determine Federal Funds Rate

5

[b] Lender's Right To Use Reference Rate

6

[c] Effective Date Of Change Of Rate

6

3 Prepayment

6

4 Note Secured By Mortgaged Property

6

5 Interest Rate Limitations

7

6 Acceleration Of Indebtedness

7

7 Late Charge

7

8 Default Rate

8

9 Borrower's Power And Authority

8

10 Joint And Several

8

11 "Lender" And "Borrower"

8

12 Headings Have No Legal Effect

9

13 Borrower's Obligations Absolute And Unconditional

9

14 Borrower's Waiver Of Defenses And Setoffs

9

15 Borrower's Waiver Of Conditions Precedent

10

16 Borrower's Consent To Extensions, Releases, And Loan

Modifications 10

17 Determinations By Lender

10

18 Interest On Interest

10

19 Entire Agreement

11

20 No Oral Changes 11

21 Applicable Law

11

22 Borrower's Consent To Jurisdiction And Venue

11

23 No Trial By Jury

12

LENDER'S OPTIONAL PROVISIONS FOR NOTE 15

1 Principal Payments

15

1.1 Constant Payment Of Principal

15

[a] LIBOR Loans

15

[b] Other Loans

15

1.2 Equal Payments Of Principal And Interest

15

2 Interest Payment Schedule

16

2.1 LIBOR

16

2.2 Variable Rate

16

2.3 Fixed Rate

16

2.4 Interest In Advance

16

3 Fixed Interest Rate

17

4 Lender's Prime or Base Rate

17

5 Objective Prime Rate

17

6 Treasury Rate

18

7 LIBOR Rate

19

[1] APPLICABLE INTEREST RATE

22

[2] INTEREST AFTER STUB DATE

23

[3] DETERMINATION BY LENDER OF NOTE LIBOR

23

[4] SELECTION BY BORROWER OF TWO NOTE LIBORS

24

[5] UNAVAILABILITY OF LIBOR

24

[6] CHANGE IN LAWS, REGULATIONS, ETC.

25

8 Place of Determination of LIBOR

28

9 Construction Loan

28

10 Future Advances or Revolving Credit Loan

28

11 Interest Reserve

29

12 Guarantor as Mortgagor

30

13 Move Indemnities And Other Promises To Mortgage To Promote

Negotiability 30

14 Prepayment Fee And Other Requirements

31

15 Consolidation

31

16 Wraparound Note

32

17 New York Option

32

18 Miscellaneous Provisions

32

23.1 Time Of Essence

33

23.3 Right of Waiver by Lender

33

18.2 Notice

33

18.3 Specified Maximum Interest Rate

33

18.4 Escalator Clause

33

18.5 Interest Averaging Provision

34

18.6 Electronic Note Clause

34

BORROWER'S ALTERNATIVE PROVISIONS FOR NOTE 37

1 Limitation on "Loan Documents"

37

2 Borrower's Right To Prepay

37

2.1 Variable Rate

37

2.2 LIBOR

38

3 Borrower's Option To Convert LIBOR To a Variable Rate

41

4 Borrower's Right to Select Rate

42

5 Exculpation

42

6 Interest Accrues Only To The Extent Loan Advanced

43

NOTE FORM

NOTE1

${{{19/AMOUNT OF LOAN}}}

{{{28/DATE OF ORIGINAL LOAN CLOSING}}}

{{{29/COUNTY OF ORIGINAL LOAN CLOSING}}}, {{{30/STATE OF ORIGINAL LOAN CLOSING}}}

Promise To Pay

FOR VALUE RECEIVED, {{{31/BORROWER}}}, {{{40/TYPE OF

BORROWER}}}, having an address at {{{32/ADDRESS OF BORROWER}}}

(the "Borrower

"), promises to pay to {{{1/LENDER}}}, having an

address at {{{2/ADDRESS OF LENDER (FOR NOTICES)}}} (the "Lender

"), or order, the principal sum of {{{19/AMOUNT OF

LOAN}}} (${{{19/AMOUNT OF

LOAN}}}) DOLLARS (the "Original

Principal Amount "). The Original Principal Amount shall be

payable in lawful money of the United States of America as

follows: {{{26/PRINCIPAL REPAYMENT SCHEDULE}}}. The final

payment of the then unpaid balance of the Original Principal

Amount shall be paid by the Borrower to the Lender on

{{{25/MATURITY DATE}}} (the "Maturity Date

"). The Borrower

shall also pay to the Lender interest, on the unpaid balance of

this Note, at the rate and in the manner set forth in this Note.

Interest shall be computed from the date of this Note until the

entire unpaid balance of this Note has been paid in full to the

Lender. Interest shall be paid as follows: {{{24/INTEREST

PAYMENT SCHEDULE}}}. However, all interest which has accrued

(computed at the rate set forth in this Note), and is unpaid (as

of the Maturity Date), plus all other sums which have accrued

pursuant to this Note, and are unpaid (as of the Maturity Date),

if any, shall be due and payable on the Maturity Date. All

payments, pursuant to this Note, by the Borrower to the Lender,

shall be made at {{{3/ADDRESS OF LENDER (FOR PAYMENTS)}}}, or at

such other place, or in such other manner, as may be designated in writing by the holder of this Note.

Interest Rate

1See Chapter 3 of the main text of this book for guidance on the

drafting and negotiating of notes. This Chapter may discuss variations of the following form which are not included in such form and which are applicable to your particular transaction.

2.1 Definitions . The following underlined terms in

quotation marks shall have the following meanings whenever such terms are capitalized in this Note:

[a] "Alternate Base Rate

" means a rate per annum

equal to the sum of 1) {{{70.2.3.1/SPREAD OVER FEDERAL

FUNDS RATE}}}% per annum, plus 2) the Federal Funds Rate from time to time.

[b] "Business Day

" means any day on which the Lender

is open for business (as determined by the Lender) with

members of the public at the principal place of business of the Lender in the United States.

[c] "Federal Funds Rate

" means, for each day on which

any indebtedness evidenced by this Note (the

"Indebtedness

") is outstanding, a rate per annum equal to

the weighted average of the rates on overnight Federal

Funds transactions with members of the Federal Reserve

System arranged by Federal Funds brokers, as published for

each such day (or if any such day is not a Business Day,

for the next immediately preceding Business Day) by the

Federal Reserve Bank of New York. If the weighted average

of such rates is not so published for any such day which is

a Business Day, then the "Federal Funds Rate" for such day

is the average (as determined by the Lender) of the

quotations for any such day on such transactions received

by the Lender from three Federal Funds brokers of recognized standing selected by the Lender.

[d] "Loan Documents

" shall mean each document

(whether executed on, before, or after the date of this

Note) which contains any provision wholly or partially

evidencing, securing or guaranteeing the payment of this

Note, or the performance of any other obligation which is

enforceable by the Lender against the Borrower or the

interest of the Borrower in any of the collateral for the Indebtedness.

[e] "Principal Balance

" means the outstanding

principal balance of this Note from time to time.

[f] "Reference Rate

" means such rate of interest per

annum as is publicly announced by the Lender at its

principal office from time to time as its Reference Rate.

Any change in the Reference Rate shall be effective on the

date such change is announced by the Lender. The Reference

Rate is not intended to be the lowest rate of interest charged by the Lender.

[g] "Term " means the period from the date of this

Note until the Maturity Date.

[h] "Variable Rate

" means a rate per annum equal to

the sum of 1) {{{70.2.2.1/SPREAD OVER PRIME RATE}}}% per

annum plus 2) the greater, on a daily basis, of (a) the

Reference Rate, or (b) the Alternate Base Rate. 2.2Variable Rate Provisions

[a] Inability To Determine Federal Funds Rate . If

for any reason the Lender shall have determined (which

determination shall be conclusive and binding on the

Borrower) that the Lender is unable to determine the

Federal Funds Rate for any reason, including, without

limitation, the inability or failure of the Lender to

obtain sufficient bids for the purposes of determining the

Federal Funds Rate in accordance with the provisions of

this Note, then the Variable Rate shall be determined on

the basis of the Reference Rate (plus {{{70.2.2.1/SPREAD

OVER PRIME RATE}}}% per annum) until the circumstances giving rise to such inability no longer exist.

[b] Lender's Right To Use Reference Rate

.

Notwithstanding anything to the contrary contained in this

Note, the Lender shall have the right, in its sole and

absolute discretion, to calculate interest on the balance

of this Note from time to time during the term (to the

extent such balance bears interest at the Variable Rate) at

a rate per annum based upon the Reference Rate notwithstanding the fact that a rate per annum based upon

the Alternate Base Rate may, at such time, in fact be

higher. No such election by the Lender shall in any event

constitute a waiver of the Lender's right at any time

thereafter, and without prior notice to the Borrower, to

charge interest on the balance of this Note during the Term

(to the extent such balance bears interest at the Variable

Rate) strictly in accordance with the provisions of this Note.

[c] Effective Date Of Change Of Rate

. Any change in

the Variable Rate as a result of a change in the Reference

Rate or the Federal Funds Rate shall be effective on the

effective date of any such change in the Reference Rate or

the Federal Funds Rate, as the case may be. The Variable

Rate, and the components of the Variable Rate, shall be

calculated for the actual number of days elapsed on the

basis of a 360-day year. Each determination of the

Variable Rate shall be made by the Lender and shall be

conclusive and binding upon the Borrower unless and to the

extent the Borrower shall provide clear and convincing

proof to the Lender of a material error by the Lender in such determination.Prepayment

This Note may not be prepaid in whole or in part. If any

Event of Default (defined below) shall occur and the Maturity

Date shall be accelerated, then a tender of payment by the

Borrower (or by anyone on behalf of the Borrower) of the amount

necessary to satisfy all sums due under this Note made at any

time prior to both 1) the sale of the "Mortgaged Property"

(defined below) pursuant to a judgment of foreclosure, and 2)

the expiration of any period of redemption, shall constitute an

evasion of the prohibition on prepayment provided in this Note,

and shall be deemed to be a voluntary prepayment under this Note

in violation of the provisions of this Note. Any payment in

excess of the lesser of 1) $100,000, or 2) 1% of the unpaid

balance of the Loan, and which is in complete satisfaction of

the Indebtedness, whether made on the Maturity Date, any

accelerated maturity date or otherwise, shall be made by wire transfer of immediately available federal funds.

Note Secured By Mortgaged Property

This Note is secured by the Loan Documents, and the

collateral mortgaged, pledged or assigned pursuant to the Loan

Documents (collectively called the "Mortgaged Property

"). All

sums which shall or may become due and payable by the Borrower

in accordance with this Note shall be and shall be evidenced by

this Note, shall be secured by the Loan Documents, and shall

constitute part of the Indebtedness. All obligations of the

Borrower to the Lender under this Note are secured by the

Mortgage which: 1) is dated the date of this Note, 2) secures

the principal sum of ${{{19/AMOUNT OF LOAN}}}, 3) is given by the Borrower to the Lender, and 4)

covers (among other things) the interest of the Borrower in

certain property located at {{{53/ADDRESS OF REAL ESTATE}}} (the "Mortgage

"). In enforcing its rights under the Loan Documents,

the Lender shall have the right to enforce its remedies with

respect to any of the Loan Documents, or any combination

thereof, and either simultaneously or in such order as the Lender shall deem to be in its best interest. Interest Rate Limitations

At no time shall the Borrower be obligated or be required

to pay interest on the Indebtedness at a rate which is in excess

of the maximum interest rate permitted by applicable law, or

which could subject the Lender to liability as a result of being

in excess of the maximum rate which the Borrower is permitted by

law to contract or agree to pay. If by the terms of this Note

the Borrower is at any time required or obligated to pay

interest on the Indebtedness at a rate in excess of such maximum

rate, then 1) the rate of interest under this Note shall be

deemed to be immediately reduced to such maximum rate, 2)

interest payable under this Note shall be computed at such

maximum rate, and 3) any prior interest payments made, pursuant

to this Note, in excess of such maximum rate shall be applied,

and shall be deemed to have been payments made, in reduction of the Principal Balance of this Note. Acceleration Of Indebtedness

It is hereby expressly agreed that the entire Indebtedness

shall become immediately due and payable:

[a] if any portion of the Indebtedness is not paid

within ten (10) days of the due date for such portion or if

the Indebtedness is not paid in full on the Maturity Date, or

[b] at the option of the Lender, on the happening of

any other default (and the expiration of any applicable

grace period for such default) under any of the Loan

Documents or any other event by which, under the terms of

any of the Loan Documents, the Indebtedness may or shall

become due and payable (each such default or event being called an "Event of Default

").

Late Charge

If all or any portion of the Indebtedness, whether of

principal, interest, additional interest or other sum (if any)

payable under this Note, is not paid within ten (10) days after

the date on which it is due, then the Borrower shall pay to the

Lender, on demand by the Lender, an amount equal to {{{77.1/LATE

CHARGE %}}}% of each such amount or sum, which is not paid

within such ten (10) day period, as a late payment charge. The

Borrower agrees that such late charge is to compensate the

Lender for costs incurred in connection with the administration

of such default, and does not constitute a penalty. The

Borrower further acknowledges that such late charge is a

reasonable amount in light of the anticipated harm caused by the

default, the difficulties of proof of loss, and the inconvenience and difficulty of otherwise obtaining an adequate remedy.

Default Rate

In addition to any late payment charge which may be due

under this Note, if the Principal Balance is declared to be due

and payable by the Lender pursuant to the provisions of any Loan

Document, or if the Indebtedness is not paid in full on the

Maturity Date, then the Borrower shall pay interest on the

unpaid balance of this Note, from the date of such acceleration

of the Maturity Date (or the Maturity Date, if the Principal

Balance has not been previously accelerated), until the date on

which the Indebtedness has been paid in full (whether before or

after judgment), at a rate per annum (calculated for the actual

number of days elapsed on the basis of a 360-day year) equal to

the greater, on a daily basis, of (a) {{{78.1/FIXED DEFAULT

RATE}}}% per annum, or (b) the sum of I) {{{78.2/SPREAD OVER

PRE-DEFAULT RATE}}}% per annum plus II) the interest rate which

would be applicable under this Note if there was no default (the

rate which is the greater of a) or b) being called the "Default

Rate ") provided, however, that such interest rate shall in no

event exceed the maximum interest rate which the Borrower may by law pay.

Borrower's Power And Authority

The Borrower, and each undersigned representative of the

Borrower, represents and warrants and covenants that the

Borrower has full power, authority and legal right to execute

and deliver this Note and that the obligations of the Borrower

under this Note constitute valid and binding obligations of the Borrower.

Joint And Several

If the Borrower consists of more than one party, then the

obligations and liabilities of each such party under this Note shall be joint and several.

"Lender" And "Borrower"

Whenever used in this Note, the singular number shall

include the plural, and the plural shall include the singular.

The words "Lender

" and "Borrower " shall include, respectively,

the successors and assigns of the Lender and the heirs,

executors, administrators, legal representatives, successors and

assigns of the Borrower, provided, however, that the Borrower

shall in no event or under any circumstance have the right,

without obtaining the prior written consent of the Lender, to

assign or transfer the Borrower's obligations under any of the

Loan Documents, in whole or in part, to any other person, party

or entity. If the Borrower is a partnership, the provisions of

this Note shall remain in force and applicable, notwithstanding

any changes in any individual or entity constituting such

partnership. "Borrower

," as used in this Note, shall include

each alternate or successor partnership to the Borrower, but

neither any predecessor partnership to the Borrower, nor its

partners, shall thereby be released from any liability. Nothing

in the foregoing sentence shall be construed as a consent to, or

a waiver of, any prohibition or restriction on transfers of

interests in such partnership which may be set forth in any Loan Document.1 Headings Have No Legal Effect

The headings and captions of this Note are for convenience

of reference only, and have no legal effect, and are not to be

construed as defining or limiting, in any way, the scope or intent of the provisions of this Note.

Borrower's Obligations Absolute And Unconditional

The Borrower represents, warrants, and covenants that this

Note and the Borrower's obligations under this Note are and

shall at all times continue to be absolute and unconditional in

all respects, and shall at all times be valid and enforceable

irrespective of any other agreements or circumstances of any

nature whatsoever which might otherwise constitute a defense to:

1) this Note and the obligations of the Borrower under this

Note, or 2) the obligations of any other person or party

relating to this Note, or 3) otherwise with respect to the Indebtedness.

2 Borrower's Waiver Of Defenses And Setoffs

The Borrower absolutely, unconditionally and irrevocably

waives any and all right to assert each credit, defense, setoff,

right of recoupment,counterclaim or crossclaim of any nature

whatsoever with respect to: 1) the Indebtedness or any of the

Loan Documents or the obligations of the Borrower under any of

the Loan Documents, or 2) the obligations of any other person or

entity relating to any of the Loan Documents or to the

obligations of the Borrower under any of the Loan Documents or

otherwise with respect to the Indebtedness, in any action or

proceeding brought by the Lender to collect the Indebtedness, or

any portion of the Indebtedness, or to enforce, foreclose and

realize upon the liens and security interests of the Lender in

any Mortgaged Property. However, the Borrower's waiver in the

preceding sentence shall not be deemed a waiver of the

Borrower's right to assert any compulsory counterclaim maintained in a court of the United States, or of the State of

{{{56/STATE IN WHICH REAL ESTATE IS LOCATED}}} if such

counterclaim is compelled under local law or rule of procedure,

nor shall such waiver by the Borrower be deemed a waiver of the

Borrower's right to assert, in any separate action or

proceeding, any claim which would constitute a defense, setoff,

counterclaim or crossclaim of any nature whatsoever against the Lender. Borrower's Waiver Of Conditions Precedent

The Borrower waives presentment, demand for payment, notice

of dishonor, protest, notice of protest, and any or all notices

or demands in connection with the delivery, acceptance, performance, default or enforcement of this Note.

Borrower's Consent To Extensions, Releases, And Loan

Modifications

The Borrower consents to each delay, extension of time,

renewal, release of any party to any Loan Document, and release

of any available security for the Indebtedness (or any part

thereof), to any party to any of the Loan Documents, or to the

actual holder of any of the Loan Documents, and any and all

waivers or modifications that may be granted or consented to by

the Lender with regard to the time of payment or with respect to

any other provisions of any Loan Document. The Borrower agrees

that no such action, delay or failure to act on the part of the

Lender shall be construed as a waiver by the Lender of, or

otherwise affect, in whole or in part, its right to avail itself

of any remedy under the Loan Documents. No notice to or demand

on the Borrower shall be deemed to be a waiver of the obligation

of the Borrower or of the right of the Lender to take further

action without further notice or demand as provided in any Loan Document.

3 Determinations By Lender

Notwithstanding anything in this Note to the contrary,

whenever this Note provides that any matter shall be "determined

by the Lender," or shall be to the "satisfaction of the Lender,"

then the determination by the Lender shall be binding on the

Borrower unless and to the extent that the Borrower provides

substantive clear and convincing proof that the factual basis

for such determination was erroneous. If and to the extent the

Lender is required by law to reasonably determine any matter,

then the Lender shall not have any liability if its

determination is in fact unreasonable, except that the Borrower

may seek a declaratory judgment that the Lender's determination

is in fact unreasonable, in which event the Lender shall be

bound by a final judgment in such declaratory judgment action.

Also, the Lender may, in its sole and absolute discretion, waive any provision of this Note.

4 Interest On Interest

Notwithstanding anything to the contrary in this Note, if

applicable laws prohibit the charging of interest on interest

(or any other sum) which may accrue pursuant to this Note, then,

to such extent, interest shall not be deemed to accrue on

interest (or such other sum) which may accrue pursuant to this

Note; provided, however, that, in any event, interest shall

continue to accrue pursuant to this Note with respect to the unpaid Principal Balance of this Note.

5 Entire Agreement

The Borrower acknowledges that no oral or other agreements,

conditions, promises, understandings, representations or

warranties exist with respect to this Note or with respect to

the obligations of the Borrower under this Note, except those

specifically set forth in the Loan Documents. The Loan

Documents set forth the entire agreement and understanding of

the Lender and the Borrower with respect to the Indebtedness and

the rights and obligations of the Lender and the Borrower relating to the Indebtedness and the collateral securing it.

No Oral Changes

This Note may not be modified, amended, changed or

terminated orally, except by an agreement in writing signed by

the Borrower and the Lender. No waiver of any term, covenant or

provision of this Note shall be effective unless such waiver is

given in writing by the Lender and, in such case, shall only be effective in the specific instance in which given.

Applicable Law

This Note is and shall be deemed entered into in the State

of {{{87/STATE WHOSE LAW GOVERNS}}} 2

and shall be governed by and

construed in accordance with the laws of such state, without

regard to principles of conflicts of laws. No defense given or

allowed by the laws of any state or country shall be interposed

in any action or proceeding on or with respect to this Note

unless such defense is either given or allowed by the laws of the State of {{{87/STATE WHOSE LAW GOVERNS}}}.

Borrower's Consent To Jurisdiction And Venue

The Borrower agrees to submit to personal jurisdiction in

the State of {{{87/STATE WHOSE LAW GOVERNS}}} in any action or

proceeding arising out of this Note. In furtherance of such

2 Some lenders may require that the law applicable to the Note be different from the

law of the state where the Mortgaged Property is located. See § 3.02[9] supra of the

main text of this book.

agreement, the Borrower hereby agrees and consents that, without

limiting other methods of obtaining jurisdiction, personal

jurisdiction over the Borrower in any such action or proceeding

may be obtained within or without the jurisdiction of any court

located in {{{87/STATE WHOSE LAW GOVERNS}}}. Any process or

notice of motion or other application to any such court, in

connection with any such action or proceeding, may be served

upon the Borrower by registered or certified mail to, or by

personal service at, the last known address of the Borrower,

whether such address be within or without the jurisdiction of

any such court. The Borrower hereby agrees that the venue of

any litigation arising in connection with the indebtedness, or

in respect of any of the obligations of the Borrower under this

Note, may, to the extent permitted by law, be in {{{88/COUNTY FOR VENUE}}}.

No Trial By Jury

THE BORROWER HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES,

AND THE LENDER, BY ITS ACCEPTANCE OF THIS NOTE, IRREVOCABLY AND

UNCONDITIONALLY WAIVES, ANY AND ALL RIGHT TO TRIAL BY JURY IN

ANY LITIGATION WHATSOEVER ARISING OUT OF OR IN CONNECTION WITH

ANY LOAN DOCUMENT OR ANY OBLIGATION RELATED THERETO.IN WITNESS WHEREOF, the Borrower has duly executed this

Note the day and year first above written.

WITNESS/ATTEST: {{{31/BORROWER}}}

_____________________

Individual Acknowledgement3

State Of {{{30/STATE OF ORIGINAL LOAN CLOSING}}} )

ss.:

County Of {{{29/COUNTY OF ORIGINAL LOAN CLOSING}}} )

On {{{28/DATE OF ORIGINAL LOAN CLOSING}}}, before me personally came {{{31/BORROWER}}}, to me known and known to me to be the

individual described in and who executed the foregoing

instrument and acknowledged to me that {{{31/BORROWER}}} executed the same. _______________________

Notary Public Corporate Acknowledgement

State Of {{{30/STATE OF ORIGINAL LOAN CLOSING}}} )

ss.:

County Of {{{29/COUNTY OF ORIGINAL LOAN CLOSING}}} )

On {{{28/DATE OF ORIGINAL LOAN CLOSING}}}, before me personally came {{{35/BORROWER'S REPRESENTATIVE}}}, to me known, who, being by

me duly sworn, did depose and say that {{{35/BORROWER'S

REPRESENTATIVE}}} resides at {{{37/ADDRESS OF BORROWER'S

REPRESENTATIVE}}}; that {{{35/BORROWER'S REPRESENTATIVE}}} is

{{{36/TITLE OF BORROWER'S REPRESENTATIVE}}} of {{{31/BORROWER}}}, the corporation described in and which

executed the above instrument; and that {{{35/BORROWER'S

REPRESENTATIVE}}} signed the above instrument by authority of the Board of Directors of said corporation.

3 The following forms of acknowledgment are accepted for use in New

York. Most states have adopted the Uniform Acknowledgment Act, the Uniform Acknowledgments Act, the Uniform Recognition of Acknowledgments Act, or the Uniform Law on Notarial Acts, so the forms of acknowledgment generally have become standardized.

____________________________ Notary Public

General Partnership Acknowledgement

State Of {{{30/STATE OF ORIGINAL LOAN CLOSING}}} )ss.:

County Of {{{29/COUNTY OF ORIGINAL LOAN CLOSING}}} )

On {{{28/DATE OF ORIGINAL LOAN CLOSING}}}, before me personally came {{{35/BORROWER'S REPRESENTATIVE}}}, to me known and known to me

to be a partner of {{{31/BORROWER}}}, {{{40/TYPE OF BORROWER}}},

and known to me to be the individual described in and who

executed the foregoing instrument as a partner of

{{{31/BORROWER}}}, and acknowledged before me that {{{31/BORROWER}}} executed such instrument as a partner in such

partnership for the uses and purposes in said instrument set forth.

________________________________________Notary Public

LENDER'S OPTIONAL PROVISIONS FOR NOTE

6 Principal Payments

One of the following options in this Section should be

chosen, and one of the following indented subparagraphs in this Section

should be inserted at the end of the second sentence of

Section

of the Note (replacing the code {{{26/PRINCIPAL

REPAYMENT SCHEDULE}}}).

1.1 Constant Payment Of Principal

The following language is appropriate for those loans

involving a constant payment of principal by the Borrower to the Lender on a periodic basis (e.g., monthly):

[a] LIBOR Loans

The following language provides for constant payments of

principal for loans with interest at LIBOR:

The Original Principal Amount shall be payable in

( ) monthly principal payments of

$

(each such monthly principal

payment being called a "Monthly Installment

"). A

Monthly Installment shall be payable on each Re-Set Date during the term of this Note. [b]Other Loans

The following language provides for constant payments of

principal for loans with other types of interest rates:

The Original Principal Amount shall be payable in

( ) equal monthly principal payments of

$

(each such monthly principal

payment being called a "Monthly Installment

"). A

Monthly Installment shall be payable 1) commencing on

the first day of the calendar month immediately

following the calendar month in which the date of this

Note falls, and 2) on the first day of each succeeding

calendar month thereafter until the unpaid balance of this Note has been paid in full.

1.2Equal Payments Of Principal And Interest

The following indented language is appropriate for those

loans involving a constant payment (which is applied first to

interest and other charges and then to principal) by the

Borrower to the Lender on a periodic basis (e.g., monthly). If

the following indented language is used, then the sixth sentence

of Section of the Note (beginning "Interest shall be paid . .

.") should be deleted.

The Borrower shall pay to the Lender a monthly

payment of $

(each such

payment being called a "Monthly Installment

") 1)

commencing on the first day of the calendar month

immediately following the calendar month in which the

date of this Note falls, and 2) on the first day of

each succeeding calendar month thereafter until the

unpaid balance of this Note has been paid in full.

Each such Monthly Installment shall be applied first

to accrued and unpaid interest and other charges which

may accrue under this Note, and then to the unpaid principal balance of this Note.

7 Interest Payment Schedule

One of the following options should be chosen and then

substituted for the following code which appears in Section

of

the Note: {{{24/INTEREST PAYMENT SCHEDULE}}}.

2.1LIBOR

Interest shall be paid on each Re-Set Date until the unpaid balance of this Note has been paid in full.

2.2Variable Rate

Interest shall be at the Variable Rate, calculated, as

provided in this Note, on the basis of a 360-day year,

provided that interest shall be payable on the basis

of the actual number of days elapsed. Interest shall

be paid on the first day of the calendar month

immediately following the date of this Note, and on

the first day of each following month thereafter, until the unpaid balance of this Note is paid in full.

2.3Fixed Rate

The following optional language is required only if there

is a fixed periodic principal payment, or if there is a balloon.

If a periodic payment of principal and interest is made (as in

the case of the typical home mortgage loan), then see the option in Section

above of this Lender's Optional Provisions For Note .

Interest shall be at the Fixed Rate, calculated, as

provided in this Note, on the basis of a 360-day year,

provided that interest shall be payable on the basis

of the actual number of days elapsed. Interest shall

be paid on the first day of the calendar month

immediately following the date of this Note, and on

the first day of each following month thereafter, until the unpaid balance of this Note is paid in full.

2.4Interest In Advance

If interest is paid in advance for the month in which the

closing occurs, then add the following provision at the end of Section 1

of the Note:

Interest on the unpaid balance of this Note, from the date

of this Note through the end of the calendar month in which

such date occurs, shall be paid by the Borrower to the Lender on the date of this Note.

8 Fixed Interest Rate

If the interest rate on the Note is a fixed rate, then the

following changes should be made to Section 2

of the Note.

3.1 The definitions of "Alternate Base Rate," "Business

Day," "Federal Funds Rate," "Reference Rate," and "Variable Rate" can be deleted from Section

of the Note.

3.2 The following section should be substituted for

Section

of the Note:

2.2 Fixed Rate Provisions

The interest rate on the unpaid balance of this Note

shall be {{{70.1/FIXED INTEREST RATE}}}% per annum (the

"Fixed Rate

"), from the date of this Note until the unpaid

balance of this Note has been paid in full, subject to Section

("Default Rate ") of this Note and the provisions

of this Note relating to the Default Rate.

1. Lender's Prime or Base Rate

The above Note uses the Lender's "Reference Rate" as the

variable interest rate. A "Reference Rate" or "Base Rate" is a

description for the Lender's own interest rate in lieu of the

more common term known as the "Prime Rate." If the Lender calls

its variable interest rate the "Prime Rate," then borrowers may

claim that the rate actually charged by the Lender as its "Prime

Rate" is higher than its true "prime" rate. The basis for the

borrowers' argument is that the rate typically charged to the

Lender's most creditworthy (i.e., "prime") borrowers, which is

generally the Lender's lowest rate, in fact is typically lower

than the published "Prime Rate." See § 3.02[2][a][i] of the main text of this book supra.

If the Lender wants to call the variable interest rate the

"Base Rate" or the "Prime Rate", then the term "Reference Rate"

in the Note should be replaced (using the "search & replace"

feature of your word processor) with "Base Rate" or "Prime Rate," as applicable. 9 Objective Prime Rate

If the parties want to use an "objective" definition of the

"Prime Rate," then the following can be substituted for the

definition of the "Reference Rate" in Section

of the Note.

Also, the term "Reference Rate" should be replaced by "Note

Prime Rate" by means of the "search and replace" function of your word processor. The "Note Prime Rate

" shall mean the annual rate of

interest published by The Wall Street Journal from time to

time as the Prime Rate (such rate is currently published in

the column "Money Rates" as the "base rate on corporate

loans posted by at least 75% of the nation's 30 largest

banks"). If a range of rates is published as the Prime

Rate by The Wall Street Journal, then the "Note Prime

Rate," for the purposes of this Note, shall be the highest

rate in such range. Each change in the Prime Rate as

published by The Wall Street Journal shall be effective,

for the purposes of this Note, to change the Note Prime

Rate as of the date that such change is published in The

Wall Street Journal. If at any time The Wall Street

Journal ceases or fails to publish such Prime Rate, then

the Note Prime Rate for such period shall be the prime

commercial lending rate publicly announced at such other

major New York City 4

bank as the Lender may, in its sole

discretion, select.

10 Treasury Rate

6.1 The term "Reference Rate" in the Note should be

replaced (using the "search & replace" feature of your word

processor) with "Treasury Rate". Also, substitute the following definition in Section

of the Note for the term "Variable Rate":

"Variable Rate

" means a rate per annum, rounded up to

the nearest one-eighth of one percent, equal to the sum of

1) {{{70.2.2.3/SPREAD OVER TREASURY RATE}}}% per annum plus 2) the Treasury Rate.

4 The lender can choose another major lending center if it wishes.

6.2 Add the following definition to Section of the Note:

"Treasury Rate

" means the average yield on publicly

traded United States Treasury securities, adjusted to a

constant maturity of {{{70.2.1.3.1/TREASURY RATE PERIOD}}},

as made available by the Federal Reserve Board (in

Statistical Release H.15(519), the Federal Reserve Bulletin, or such other publication as may be designated by

the Lender) based on the most recent publication prior to

the Determination Date, as defined below, or if such

publication is not published during the seven day period

prior to the Determination Date, then, at the election of

the Lender, either (i) a similar rate as published in a

similar publication reasonably selected by the Lender or

(ii) the rate publicly offered by the United States

Treasury on its obligations having a maturity date of

{{{70.2.1.3.1/TREASURY RATE PERIOD}}} as such rate is

published in the Wall Street Journal

(or if the Wall Street

Journal no longer publishes such rate, then as reasonably

determined by the Lender). The Treasury Rate shall be

determined by the Lender on or as of

________________________ if it is a Business Day (or if

_________________ is not a Business Day, then on or as of

the first Business Day immediately prior thereto) (such

date on or as of which such rate is determined is called the "Determination Date

").

11 LIBOR Rate

The following changes should be made if the Note will bear

interest at the London Interbank Offered Rate ("LIBOR"):

7.1 Add the following paragraphs to Section

("Definitions") of the Note, and then redesignate, in alphabetical order, the succeeding paragraphs in such Section:

[h] "Note LIBOR

" applicable to a particular

Interest Period means a rate per annum equal to the

sum of: 1) {{{70.2.2.2/SPREAD OVER ADJUSTED LIBOR}}}%

per annum, plus 2) the Adjusted LIBOR applicable to such Interest Period.

[i] "Adjusted LIBOR

" applicable to a particular

Interest Period means a rate per annum equal to the

product arrived at by multiplying the LIBOR applicable

to such Interest Period by a fraction (expressed as a

decimal), the numerator of which shall be the number

one, and the denominator of which shall be the number

one, minus the aggregate sum of each reserve

percentage (rounded to the next higher 0.01%, and

expressed as a decimal) from time to time established

by the Board of Governors of the Federal Reserve

System of the United States or any other banking

authority to which the Lender is now or hereafter

subject, including, but not limited to, any reserve on

Eurocurrency Liabilities as defined in Regulation D of

the Board of Governors of the Federal Reserve System

of the United States, at the ratios provided in such

Regulation from time to time. Any portion of the

Principal Balance bearing interest at a Note LIBOR

shall, at the Lender's option, be deemed to constitute

Eurocurrency Liabilities, as defined by such Regulation, for the purposes of this Note. Such

Eurocurrency Liabilities shall be deemed, for the

purposes of this Note, to be subject to such reserve

requirements, without benefit of or credit for

prorations, exceptions or offsets that may be available to the Lender from time to time under such

Regulation and irrespective of whether the Lender actually maintains all or any portion of such reserve.

[j] "LIBOR

" for a given Interest Period means

the rate per annum (rounded to the next higher 0.01%)

for U.S. dollar deposits, with maturities comparable

(as determined by the Lender) to such Interest Period,

which appears (according to the Lender's records) on

AP-DJ Telerate 3750 as of 11:00 a.m., London time, two

(2) London Business Days prior to the commencement of

such Interest Period. The date which is two (2)

London Business Days prior to the commencement of such

Interest Period is called the "LIBOR Determination

Date ." However, if such rate does not appear on AP-DJ

Telerate 3750 on the LIBOR Determination Date for such

Interest Period, then the "LIBOR" applicable to such

Interest Period shall mean the rate per annum, as

determined by the Lender, at which U.S. dollar

deposits (in an amount approximately equal to the

portion of the Principal Balance which bears interest

at a Note LIBOR, during such Interest Period, pursuant

to this Note, and with maturities comparable, as

determined by the Lender, to the last day of such

Interest Period) are offered in immediately available

funds in the London Interbank Market to the London

office of the Lender, by leading banks (as determined

by the Lender) in such market, at 11:00 a.m., London

time, two (2) London Business Days prior to the commencement of such Interest Period.

[k] "AP-DJ Telerate 3750

" means the display

designated as "Page 3750" on the Associated Press-Dow

Jones Telerate Service (or such other page as may

replace Page 3750 on the Associated Press-Dow Jones

Telerate Service as the page containing quotations of

the "London Interbank Offered Rate," or, at the

Lender's option, such other service as may be

designated by the British Bankers' Association as the

information vendor for the purpose of displaying

British Bankers' Association interest settlement rates

for U.S. Dollar deposits). Any LIBOR determined, on

any LIBOR Determination Date, on the basis of the rate

displayed on AP-DJ Telerate 3750 in accordance with

the provisions of this Note shall be subject to

corrections, if any, made in such rate and displayed

by the Associated Press-Dow Jones Telerate Service by

11:59 a.m., London time, on such LIBOR Determination

Date. The records maintained by the Lender of AP-DJ

Telerate 3750 shall be available for inspection by the

Borrower and shall be conclusively binding on the Borrower, absent manifest error.[l] "Interest Period

" means the period of time

during which a particular Note LIBOR will be

applicable to all or a particular portion of the

Principal Balance pursuant to this Note, provided that:

[1] each Interest Period shall begin and shall end on

a Re-Set Date,

[2] each Interest Period shall be either one month, two months, three months or six months,

[3] no Interest Period shall extend beyond the Maturity Date, and

[4] except as provided in: (1) Section 2.3

of this Note with respect to

the last Interest Period during the Term (defined below),

(2) Section 2.3

of this Note with respect to

the unavailability of a Note LIBOR, and

(3) any provision of this Note relating to a

prepayment of all or a portion of the Principal Balance,

the entire portion of the Principal Balance with

respect to which a Note LIBOR will be reset on

the first day of a particular Interest Period

will bear interest at such Note LIBOR for such

Interest Period from and including the first day

of such Interest Period to, but not including, the last day of such Interest Period.

[m] "Re-Set Date

" means the same day of each

month (except as provided below) during the Term, the

first of which Re-Set Dates shall be {{{70.2.5/FIRST

RE-SET DATE}}}. 5

Each subsequent Re-Set Date shall be

the same day in each subsequent calendar month,

provided, however, that if such date in any such

subsequent calendar month during the Term shall not be

a London Business Day, then the Re-Set Date for such

calendar month shall be the next succeeding London

Business Day, unless the next such succeeding London

Business Day would fall in the next calendar month, in

which event the Re-Set Date for such calendar month

shall be the next preceding London Business Day. For

the purposes of this Note the period of time between

any two consecutive Re-Set Dates during the Term shall be deemed to be a period of one month.

[n] "Roll Over Date

" applicable to a particular

Interest Period means the last day of such Interest Period.

[o] "London Business Day

" means any day on

which the Lender is open for business (as determined

by the Lender) with members of the public at the

Lender's principal place of business in the United

States and on which commercial banks in the City of

London, England are open for dealings in U.S. dollar deposits in the London Interbank Market.

7.2 Add the following as a new subsection (which would be

numbered "2.3" in the current Note form) to Section

("Interest

Rate") of the Note:

5 If the Payee needs the flexibility to designate the Re-Set Date after the Note is

signed, then the Payee can substitute the following for this sentence:

"Re-Set Date

" means the same day of each month (except as

provided below), the first of which dates shall occur on a

London Business Day to be designated by the Payee, which

London Business Day shall not be earlier than five (5)

London Business Days or later than fifteen (15) London

Business Days subsequent to the date upon which the Loan is advanced."

However, since this theoretically might make it impossible for

the holder of the note to determine the amount payable solely by

examining the Note itself (see § 3.02[1][b][ii] of the main text

of this book), this optional clause may make the Note non- negotiable.

2.3 LIBOR PROVISIONS

[1] APPLICABLE INTEREST RATE . From and

including the date of this Note, to, but not

including, the first Re-Set Date during the Term, the

unpaid balance of this Note shall bear interest at the

Variable Rate. 6

From and including the first Re-Set

Date to, but not including, the last Re-Set Date, the

entire balance of this Note shall, except as

specifically provided to the contrary in this Note,

bear interest at one or more of the available Note LIBORs, 7

determined as provided in this Note. The

available Note LIBORs shall consist of a one-month

Note LIBOR, a two-month Note LIBOR, a three-month Note

LIBOR and a six-month Note LIBOR determined in accordance with this Note.

[a] The Borrower shall have the right to select from

the available Note LIBOR or Note LIBORs from time to time applicable to the unpaid balance of this Note.

[b] The Borrower shall not have the right to select a

three-month Note LIBOR or a six-month Note LIBOR prior to {{{70.2.6/LIBOR SELECTION DATE}}}.

[c] Each Note LIBOR from time to time so selected by

the Borrower shall take effect, and shall end, on a

Re-Set Date. Except as specifically provided to the

contrary in this Note, the Borrower shall not have the

right to select more than one Note LIBOR to take

effect on any given Re-Set Date or at any other time

during the Term. If the Borrower shall not select a

Note LIBOR by written notice (specifying the Note

LIBOR and the portion of the Principal Balance to

which it is applicable) given to the Lender, in

accordance with the terms of this Note, and received

by the Lender at least four (4) London Business Days

6 Some lenders would add the following language to this sentence, if the Loan may be

advanced after the date of the Note: , provided, however, that if the Loan is advanced on the first Re-Set

Date during the Term, then the provisions of this sentence shall not be

applicable.

7 If the Maker has the option to select only one Note LIBOR during the Term, then the

following changes should be made: 1) the words immediately preceding where this footnote

appears (i.e., "one or more of the available Note LIBORs") should be deleted, and the

phrase "the Note LIBOR" should be substituted for the deleted words, 2) the last sentence

of the paragraph (paragraph [1]) in which this footnote appears, and subparagraphs [a]-

[c] immediately thereafter, should be deleted.

prior to a particular Re-Set Date, then the Note LIBOR for such Re-Set Date shall be a one-month Note LIBOR. [2] INTEREST AFTER STUB DATE

. If the last

Interest Period during the Term shall end on a date

prior to the Maturity Date (the ending date of such

Interest Period being called the "Stub Date

"), then,

if the period from and including the Stub Date to and including the Maturity Date shall be equal to:

[a] less than one month, the entire amount of such

portion of the Principal Balance shall, for the

remainder of the Term, at the election of the Lender,

either bear interest at the Variable Rate or at a one-

month Note LIBOR determined in accordance with the

provisions of this Note, it being agreed that the one-

month Note LIBOR applicable to such period shall be

determined as if it were for an Interest Period of one month, or

[b] more than one month, the outstanding Principal

Balance of this Note shall bear interest at an

available Note LIBOR chosen by the Borrower, in

accordance with this Note, for a period extending from

the Stub Date to the last Re-Set Date to occur prior

to the Maturity Date and thereafter principal shall

bear interest in accordance with Section 2.3[b][1]

of

this Note.

[3] DETERMINATION BY LENDER OF NOTE LIBOR

Except as otherwise specifically provided to the

contrary in Section 2.3[b]

of this Note with respect

to the last Interest Period during the Term, the

Lender shall, as soon as practicable after 9:00 a.m.,

New York City 8

time, two (2) London Business Days prior

to the commencement of a particular Interest Period,

determine the Note LIBOR (or Note LIBORs, if applicable) 9

which will be in effect during such

Interest Period and inform the Borrower of the Note

LIBOR (or Note LIBORs, if applicable) 10

so determined.

Each determination of the Note LIBOR, the Adjusted

LIBOR and the LIBOR applicable to a particular

Interest Period shall be made by the Lender (which

determination shall be conclusive and binding upon the

Borrower unless and to the extent the Borrower shall

provide clear and convincing proof to the Lender of a

8 Some lenders may want to use a different locale.

9 The preceding parenthetical can be deleted if only one Note LIBOR will be

applicable in any given Interest Period.

10 The preceding parenthetical can be deleted if only one Note LIBOR will be

applicable in any given Interest Period.

material error by the Lender in such determination).

Interest at the applicable Note LIBOR from time to

time shall be calculated for the actual number of days elapsed on the basis of a 360-day year.[4] SELECTION BY BORROWER OF TWO NOTE LIBORS

Notwithstanding anything to the contrary in this Note,

the Borrower shall have the option from time to time

during the Term to select up to, but not in excess of,

two (2) Note LIBORs to take effect on any given Re-Set

Date. The Borrower shall make such election by

written notice given to the Lender, and received by

it, at least five (5) London Business Days prior to

the applicable Re-Set Date. In such notice the

Borrower shall specify the two (2) Note LIBORs so

selected by the Borrower and the respective portions

of the Principal Balance of this Note to which such Note LIBORs are to respectively pertain.

[a] The minimum portion of the Principal Balance

to which any such Note LIBOR may be applicable shall

be equal to at least ${{{70.2.7/MINIMUM PORTION OF PRINCIPAL BALANCE}}}.

[b] Each such Note LIBOR so selected by the

Borrower shall be applicable to the portion of the

Principal Balance of this Note to which it pertains

from and including the first day of the applicable

Interest Period to, but not including, the Roll Over Date applicable to such Interest Period, and

[c] The Borrower shall not have the right to

exercise its option pursuant to this sentence as of

any given Re-Set Date if the effect of such exercise

would be to cause more than two (2) different Interest

Periods to be in effect with respect to the Principal

Balance of this Note at any given time during the Term.

[5] UNAVAILABILITY OF LIBOR

In the event, and

on each occasion, that on the day which is two (2)

London Business Days prior to the commencement of a

particular Interest Period, the Lender shall have

determined in good faith (which determination shall be

conclusive and binding upon the Borrower) that U.S.

dollar deposits, in an amount approximately equal to

the portion of the Principal Balance which is to bear

interest at a particular Note LIBOR during such

particular Interest Period in accordance with the

provisions of this Note, are not generally available

at such time in the London Interbank Market, or

reasonable means do not exist for ascertaining a Note

LIBOR for such particular Interest Period, then the

Lender shall so notify the Borrower, and the interest

rate applicable to the portion of the Principal

Balance with respect to which such Note LIBOR was to

pertain shall automatically convert to the Variable

Rate as of the next Roll Over Date, it being agreed

that the Variable Rate shall remain in effect

thereafter with respect to such portion of the

Principal Balance unless and until the Lender shall

have determined in good faith (which determination

shall be conclusive and binding upon the Borrower)

that the aforesaid circumstances no longer exist,

whereupon the interest rate applicable to such portion

of the Principal Balance shall be converted back to a

Note LIBOR determined in the manner hereinabove set

forth in this Note effective as of the first Re-Set

Date which commences ten (10) London Business Days or

more after such good faith determination by the Lender. [6] CHANGE IN LAWS, REGULATIONS, ETC.

If any

change in any law or regulation, or in the

interpretation of any such law or regulation, by any

governmental authority charged with the administration

or interpretation of any such law or regulation (any

such change being called a "Change

") shall make it

unlawful or commercially impracticable or materially

more expensive for the Lender to make or maintain a

Note LIBOR with respect to the Principal Balance or

any portion of the Principal Balance, or to fund the

Principal Balance, or any portion of the Principal

Balance, at a Note LIBOR in the London Interbank

Market, or to perform the Lender's obligations as

contemplated by this Note, then, upon notice by the

Lender to the Borrower, 11

the Principal Balance (or if

only a portion of the Principal Balance is bearing

interest at a Note LIBOR, then only such portion) (the

Principal Balance, or portion of the Principal

Balance, to the extent affected by such Change, being

called the "Affected Portion

") shall, from and after

the date provided below, bear interest at the Variable

Rate. Any notice given by the Lender to the Borrower

pursuant to this paragraph shall either: 1) be

11 This option by the Payee may make the Note non-negotiable. See § 3.02[1][b][ii] of

the main text of this book supra. Alternatively, the Note could provide that,

instead of an option to the Payee, the interest rate could be converted automatically.

effective (unless prohibited by such Change), to the

extent such Change applies to the Affected Portion, on

the next Roll Over Date for such Affected Portion, or

2) if such Change expressly prohibits such effective

date, be effective immediately upon such notice being

given by the Lender to the Borrower. Following such

effective date, the Variable Rate shall thereafter

remain in effect with respect to such Affected Portion

unless and until the Lender shall have determined in

good faith (which determination shall be conclusive

and binding upon the Borrower) that the Change is no

longer in effect, in which case the interest rate

applicable to such Affected Portion shall be converted

to a Note LIBOR determined as set forth in this Note

effective as of the first Re-Set Date which commences

ten (10) London Business Days or more after such

determination by the Lender. If the interest rate

applicable to any portion of the Principal Balance is

converted from a Note LIBOR to the Variable Rate on a

date other than a Roll Over Date in accordance with

the provisions of this paragraph, then the Borrower

shall pay to the Lender on demand an amount equal to

the prepayment premium, if any, which would have been

due pursuant to the provisions of this Note if the

portion of the Principal Balance bearing interest at

such Note LIBOR was prepaid in full on the date of such conversion.

7.3 Add the following to the end of Section 2.3

("Indemnification By Mortgagor") of the Mortgage :

The Mortgagor shall indemnify each Holder against all

loss or expense that such Holder may sustain or incur

as a result of 1) any failure by the Mortgagor to

accept (or be available to accept) all or any portion

of the Loan on the date the Mortgagor requested that

the Loan be advanced, or 2) any failure by the

Mortgagor to draw any advance of the Loan pursuant to

any agreement between the Mortgagor and the Mortgagee,

or 3) any default by the Mortgagor in the payment of

either any portion of the Principal Balance of this

Note bearing interest at a Note LIBOR, or any interest

which has accrued at a Note LIBOR, as and when due and

payable, or 4) any default or event of default under

any of the Loan Documents. The losses and expenses

covered by the indemnification in the preceding

sentence include, but are not limited to, each loss or

expense sustained or incurred by any Holder in

liquidating or reemploying deposits from third parties

acquired to effect or maintain a Note LIBOR with

respect to all or any portion of the Principal Balance

of this Note. The Mortgagee shall provide to the

Mortgagor, following a written request by the Mortgagor,