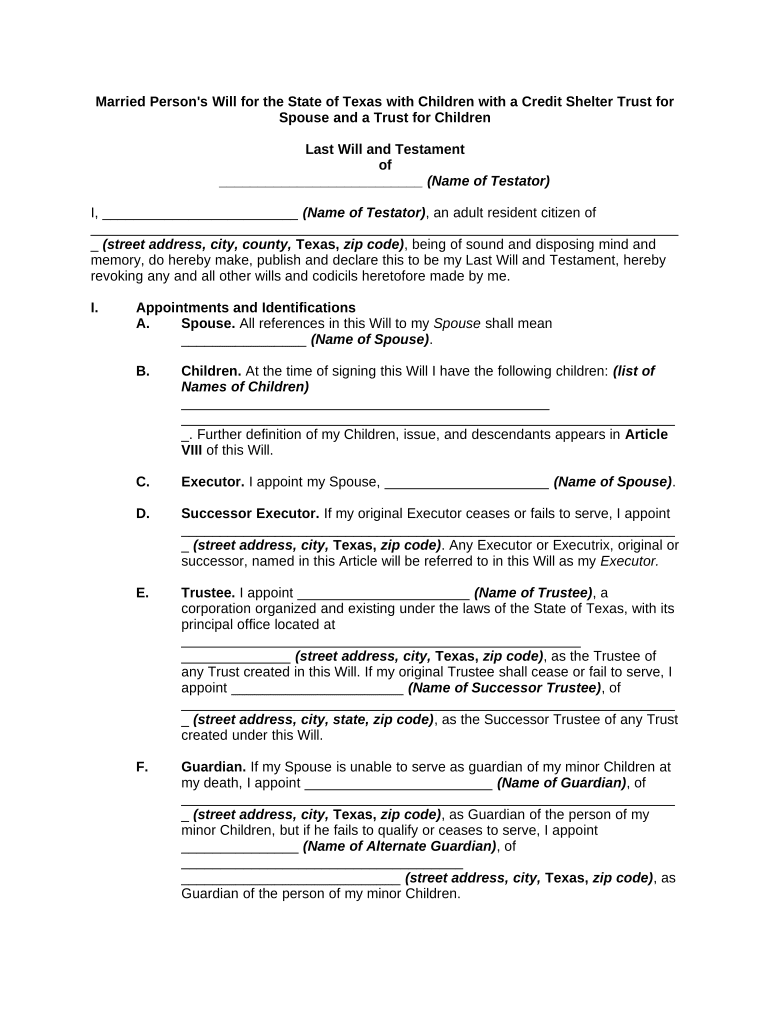

Married Person's Will for the State of Texas with Children with a Credit Shelter Trust for

Spouse and a Trust for Children

Last Will and Testament

of

__________________________ (Name of Testator)

I, _________________________ (Name of Testator) , an adult resident citizen of

___________________________________________________________________________

_ (street address, city, county, Texas, zip code) , being of sound and disposing mind and

memory, do hereby make, publish and declare this to be my Last Will and Testament, hereby

revoking any and all other wills and codicils heretofore made by me.

I. Appointments and Identifications

A. Spouse. All references in this Will to my Spouse shall mean

________________ (Name of Spouse) .

B. Children. At the time of signing this Will I have the following children: (list of

Names of Children)

_______________________________________________

_______________________________________________________________

_. Further definition of my Children, issue, and descendants appears in Article

VIII of this Will.

C. Executor. I appoint my Spouse, _____________________ (Name of Spouse) .

D. Successor Executor. If my original Executor ceases or fails to serve, I appoint

_______________________________________________________________

_ (street address, city, Texas, zip code) . Any Executor or Executrix, original or

successor, named in this Article will be referred to in this Will as my Executor.

E. Trustee. I appoint ______________________ (Name of Trustee) , a

corporation organized and existing under the laws of the State of Texas, with its

principal office located at

___________________________________________________

______________ (street address, city, Texas, zip code) , as the Trustee of

any Trust created in this Will. If my original Trustee shall cease or fail to serve, I

appoint ______________________ (Name of Successor Trustee) , of

_______________________________________________________________

_ (street address, city, state, zip code) , as the Successor Trustee of any Trust

created under this Will.

F. Guardian. If my Spouse is unable to serve as guardian of my minor Children at

my death, I appoint ________________________ (Name of Guardian) , of

_______________________________________________________________

_ (street address, city, Texas, zip code) , as Guardian of the person of my

minor Children, but if he fails to qualify or ceases to serve, I appoint

_______________ (Name of Alternate Guardian) , of

____________________________________

____________________________ (street address, city, Texas, zip code) , as

Guardian of the person of my minor Children.

No bond shall be required of any Guardian appointed in this Will.

G. In this Will, any reference to a party includes that party's heirs, executors,

administrators, successors and assigns, singular includes plural and masculine

includes feminine.

II. Dispositions

A. General. Except as otherwise provided in this Article, I intend to dispose of all of

my property.

B. Personal and Household Effects.

1. Gift to Spouse. If my Spouse survives me, I give to my Spouse all of my

Personal and Household Effects.

2. Gift to Children. If my Spouse fails to survive me:

a. My Executor shall distribute my Personal and Household Effects

among my Children who survive me, in shares of substantially equal

value as determined by my Children; but

b. If my Children fail to make this determination within _______

(number) months after my death or if they are incapable of making a

division among themselves because of age or for other reasons, then my

Executor shall determine the share of each Child.

Notwithstanding the foregoing sentence, my Executor in its sole and

absolute discretion may include my Personal and Household Effects

directly in my Residue or sell any such property and include the

proceeds in my Residue. Any division and distribution made by my

Executor shall be binding upon all persons, including my Children.

3. No Survivor. If neither my Spouse nor any of my Children survives me,

my Personal and Household Effects shall be added to my Residue.

C. Residence. If my Spouse survives me, I give my Residence,

________________ _____________ (free and clear of or subject to) any

indebtedness secured by such property, to my Spouse. If my Spouse fails to survive

me, my Residence shall be added to my Residue.

D. Residue.

1. Spouse Survives. If my Spouse survives me, my Residue shall be

divided by my Executor into two parts and disposed of as follows:

a. Marital Fund. The first part shall be known as the Marital Fund

and shall be distributed outright to my Spouse. The following assets shall

be allocated to the Marital Fund: property equal in value to the Marital

Deduction Bequest. This may include my interest in the proceeds of any

life insurance or Employee Benefit Plan includible in my gross estate for

Federal estate tax purposes and/or Texas estate tax purposes that are

payable to my estate.

b. Family Fund. The second part shall be known as the Family

Fund and shall be administered as the Family Trust in accordance with

Article III of my Will. The following assets shall be allocated to the

Family Fund:

i. The balance of my Residue.

ii. My interest in the proceeds of any life insurance or

Employee Benefit Plan that are not includible in my gross estate

for Federal estate tax purposes and that are payable to the

Trustee of a trust created pursuant to this Will (without

designating which Trust) and that are not used to satisfy the

Marital Deduction Bequest.

iii. Any other properties that are made payable or transferred

to the Family Trust by me or by others by specific reference in a

Will or other written instrument.

iv. Property allocated to the Marital Fund with respect to

which my Spouse or my Spouse's personal representative has

made a qualified disclaimer.

2. Spouse Fails to Survive. If my Spouse fails to survive me and if any

Child of mine who survives me is then less than the age of 18 years, my

Residue shall be allocated to the Family Fund and distributed in

accordance with Article III of my Will.

3. Major Disaster. If my Spouse and all of my descendants fail to survive

me, my Executor shall divide my Residue into two equal shares. One

share shall be distributed to my Heirs, and the other share shall be

distributed to my Spouse's Heirs.

III. Operation of Trusts

A. General. My Trustee in accordance with this Article III shall administer the

assets distributable or payable to my Trustee as a result of my death.

B. Administration of the Family Fund. The Family Fund shall be held as a

separate trust known as the Family Trust.

1. Income and Principal. The Trustee shall have the power to accumulate

all or part of the net income of the Family Trust or to distribute any part of the

income or principal to or for my Spouse, my Children, and the descendants of

my children in order to provide for their health, support, maintenance, and

education.

2. Standards for Distribution. It is my desire that, in determining which

Beneficiaries of the Trust shall receive distributions, the Trustee shall give

preference to the needs of the Beneficiaries in the following order: first to my

Spouse, second to my Children and, on a per stirpes basis, the living children of

a deceased Child of mine, and third to my other descendants. It is my intention

that the Beneficiaries be enabled, insofar as possible, to maintain the standard

of living to which the Beneficiaries are accustomed. In determining what

distributions, if any, should be made, the Trustee may (but is not so directed to)

take into consideration all other sources of income or principal available to each

Beneficiary. The Trustee may make unequal distributions among the

Beneficiaries, and no such distributions shall be taken into account upon final

distribution of the Trust properties.

3. Property Disclaimed by Spouse. My Spouse shall be deemed to have

survived me for purposes of the administration of property that, in Article II of

this Will, was reallocated to the Family Fund from the Marital Fund because a

qualified disclaimer was made by my Spouse or my Spouse's personal

representative.

C. Termination of Family Trust.

1. Partial Terminating Distribution. When my Spouse has died and my

youngest then-living Child who survives my Spouse and me has reached the

age of ______ years, the Trustee shall distribute _________________

(designation of fraction) of all of the principal and undistributed income then

remaining in the Family Trust to my then-living descendants, per stirpes.

2. Final Terminating Distribution. When my Spouse has died and my

youngest then-living Child who survives my Spouse and me as reached the age

of ____ years, or all have sooner died, the Trustee shall distribute all of the

principal and undistributed income then remaining in the Family Trust to my

then-living descendants, per stirpes, and the Family Trust shall terminate.

3. Major Disaster. If all of my descendants have died before or at the final

termination of the Family Trust as provided above, then the Family Trust shall

terminate and the principal and undistributed income shall be divided into two

equal shares. One share shall be distributed to my Heirs, and the other share

shall be distributed to my Spouse's Heirs.

D. Contingent Trust for Persons Less Than Age _____.

Notwithstanding the preceding provisions of this Will, this Article shall apply if

any part of my estate or any portion of the principal of any Trust created in this Will

would, upon partial or final termination of my estate, be distributable to a Beneficiary

(other than a Child of mine) who has not reached his or her _____ birthday and no

other Trust is created in this Will for that Beneficiary. If my Executor or Trustee, as the

case may be, in its sole discretion so elects, that part of my estate or portion of the

Trust shall be retained by the Trustee as a separate Trust for the benefit of the

Beneficiary. Until the Beneficiary reaches his or her ________ (ordinal number)

birthday, the Trustee shall have the power to accumulate all or part of the income of

that Trust or to distribute so much of the income and principal of that Trust to or for the

benefit of the Beneficiary as the Trustee, in its sole judgment and discretion, deems

necessary for the health, support, maintenance, and education of the Beneficiary.

When the Beneficiary reaches his or her __________ (ordinal number) birthday, the

Trustee shall distribute all of the then-remaining principal and undistributed income of

the Trust to the Beneficiary. If the Beneficiary dies before reaching his or her

_________ (ordinal number) birthday, the Trustee shall distribute the then-remaining

principal and undistributed income of the Trust to the estate of the Beneficiary.

E. Spendthrift Trusts. All trusts created in this Will shall be Spendthrift Trusts.

F. Undistributed Income Added to Principal. Any income of any Trust not

distributed within the first ______ (number) days following the end of the taxable year

of that Trust shall be added to the principal of the Trust and administered as a part of

such principal.

G. Distribution to Beneficiary for Whom Trust Already Established. If any

terminating distribution of any property previously held in trust under this Will for any

Beneficiary is to be made to another Beneficiary for whom at that time the Trustee

holds property in any trust, then such distribution, in the Trustee's sole and absolute

discretion, may be made to the latter Beneficiary or may be added to and become a

part of the latter Beneficiary's trust.

IV. Powers of Trustee

A. General Powers. The Trustee shall have the following powers:

1. Standard. To exercise all powers granted to trustees by the common law

or any applicable statutes (as they exist at this date or are subsequently

amended), to the extent they increase the powers granted to trustees. If,

however, those powers are in conflict with the provisions of this Will, the terms

of this Will shall prevail.

2. Selection and Retention of Assets. To retain, without liability for loss or

depreciation resulting from such retention, any property or undivided interests in

property received from any source, including residential property, regardless of

any lack of diversification, risk, or non-productivity, for such time as the Trustee

shall deem advisable, and the Trustee shall be under no obligation to dispose of

or convert any such property. Any investments made by the Trustee pursuant to

the terms of this Will need not be diversified, may be of a wasting nature, and

may be made or retained with a view to possible increase in value. The Trustee,

except as otherwise specifically provided in this Will, shall have as wide a

latitude in the selection, retention, or making of investments as an individual

would have in retaining or investing his or her own funds, and shall not be

limited to, nor be bound or governed by, any rules of law, statutes, or

regulations respecting investments by Trustees.

3. Sale or Disposition of Trust Property. To sell, exchange, give options

upon, partition, convey, or otherwise dispose of, with or without covenants

(including covenants of warranty of title), any property that may from time to time

be or become a part of the Trust estate, at public or private sale or otherwise,

for cash or other consideration, or on credit, and upon such terms and

conditions as the Trustee shall think advisable, and to transfer and convey the

same free of all Trusts.

4. Investment of Trust Property. To invest and reinvest the Trust estate

from time to time in any property, real, personal, or mixed, including (without

limiting the generality of the foregoing language) securities of domestic and

foreign corporations and investment trusts, bonds, preferred stocks, common

stocks, mortgage participations, and interests in common trust funds, with

complete discretion as to converting realty into personalty, or personalty into

realty, or otherwise changing the character of the Trust estate, even though

such investment (by reason of its character, amount, proportion to the total Trust

estate, or otherwise) would not be considered appropriate for a fiduciary apart

from this provision, and even though such investment causes a greater

proportion of the total Trust estate to be invested in investments of one type or

of one business or company than would be considered appropriate for a

fiduciary apart from this provision.

5. Loans of Trust Property. To make loans, secured or unsecured, in

such amounts, upon such terms, at such rates of interest, and to such persons,

firms, or corporations as the Trustee shall think advisable.

6. Acquisition of Non-Productive Property. To acquire property returning

no income or slight income, or to retain any such property, as long as the

Trustee shall think fit, without the same being in any way chargeable with

income, or the proceeds of the property in case of sale or other disposition

being in any part deemed income.

7. Improving and Leasing Trust Property. To improve any real estate

comprising a part of the Trust estate; to demolish any buildings in whole or in

part; to erect buildings; to lease real estate or personal property on such terms

and conditions and for such length of time (including 99 years or more) as the

Trustee shall think fit, even though such lease may extend beyond the term of

any Trust; to foreclose, extend, renew, assign, release, or partially release, and

discharge mortgages or other liens, and to accumulate income for the purpose

of doing so (except where the Trustee is required in this Will to distribute

income).

8. Borrowing Money. To borrow money and to execute promissory notes

for the same; to secure such obligations by mortgages or other liens or pledges

of any property of the Trust estate; to make any type of purchase or contract,

including installment contracts or credit arrangements, the effect of which is to

borrow money; to accumulate income for the purpose of repaying any

indebtedness owed by the Trustee in its capacity as Trustee under this Will.

9. Adjustment of Claims and Suits; Prepayment of Existing Mortgage.

To prosecute or defend any suit; to compromise or arbitrate any claim (including

a claim for taxes) and any litigation, either in favor of or against the Trust or the

Trustee in its capacity under this Will; to pay claims upon such evidence as the

Trustee shall think sufficient; and to prepay all or part of any mortgage.

10. Employment of Agents. To employ such brokers, bank custodians,

investment counsel, attorneys, and other agents or servants, and to delegate to

them such duties, rights, and powers of the Trustee for such period as the

Trustee shall think fit; and to pay such persons reasonable compensation out of

the Trust estate, all regardless of whether any such person or entity is a

Beneficiary or Trustee under this Will.

11. Voting Securities; Reorganization. To vote, in person or by proxy, any

stocks or other properties having voting rights; to enter into voting trusts and

voting agreements; to exercise any options, rights, or privileges pertaining to

any property in the Trust estate; to participate in any merger, reorganization, or

consolidation affecting the Trust estate; and, in connection with the same, to

take any action that an individual could take with respect to property owned

outright by such individual, including the payment of expenses or assessments,

the deposit of stock or property with a protective committee, the acceptance or

retention of new securities or property, and the payment of such amounts of

money as may seem advisable in connection with the same.

12. Insurance. To insure any part of the Trust estate against such risks as

the Trustee shall think fit, such insurance to be based on market values or

costs, and the coverage to be full or partial as the Trustee shall think fit; to pay

the premiums and to collect or adjust the losses; to acquire, hold, and pay

premiums on insurance upon the life of any person or persons, and to exercise

any and all rights to ownership of such insurance; and to purchase other types

of insurance or annuities for any Beneficiary. However, all incidents of

ownership with respect to any policy of insurance on the life of any Trustee shall

be vested in and exercisable solely by another Trustee.

13. Mineral Contracts and Sales. To execute and deliver oil, gas, and other

mineral leases containing such unitization or pooling agreements and other

provisions as the Trustee shall think fit; to execute mineral and royalty

conveyances; to purchase leases, royalties, and any type of mineral interest;

and to execute and deliver drilling contracts and other contracts, options, and

other instruments necessary or desirable to participate actively in the oil, gas, or

mining business. All of the foregoing may include such terms, conditions,

agreements, covenants, provisions, or undertakings as the Trustee shall think

fit.

14. Corporations. To incorporate any property in the Trust estate; to convey

any such property to a corporation for all or part of its capital stock or other

securities (whether or not any Trustee is also a security holder, officer, director,

or manager of such corporation in an individual, fiduciary, or other capacity); to

dissolve such corporation or any other corporation, the securities of which

comprise a part of the Trust estate; and to hold or dispose of, as a part of the

Trust estate, any property so received upon such dissolution; all in such

manner, at or for such times, and on such terms as the Trustee shall think fit.

15. Partnerships. To enter into partnerships; to transfer any property in the

Trust estate to one or more partnerships for interests in such partnerships; to

act as a partner in any partnership or with respect to any property, any part of

which may be or become part of the Trust estate originally or later; to so act as

a partner with itself acting in an individual, fiduciary, or other capacity; to

participate in the management of such partnerships; to dissolve any partnership

in which the Trustee acts as a partner; and to hold or dispose of, as part of the

Trust estate, any property received upon any such dissolution; all in such

manner, at or for such times, and on such terms as the Trustee shall think fit.

16. Businesses. To start or to enter into any business enterprise, or to

continue to operate any business interest that becomes part of the Trust estate;

to delegate all or part of the management of such business; to invest other

funds of the Trust estate in the business; to convert such business from one

form ( e.g., proprietorship, partnership, corporation, limited liability company,

etc.) to another; to enlarge, diminish, or change the scope or nature of the

activities of any business; to authorize the participation and contribution by the

business in any form of plan to benefit employees, whether or not the

contributions qualify as being tax deductible; to use the general assets of the

Trust estate for the purposes of the business; to invest additional capital in or

make loans to such business, regardless of the speculative nature or non-

productivity of such investment or loan, and without regard to diversification of

investments; to endorse or guarantee on behalf of the Trust estate any loan or

loans made to the business, and secure the loan or loans by pledge or

mortgage of any property of the Trust estate; to employ such officers,

managers, employees, or agents as the Trustee deems advisable in the

management of the business, including electing or employing directors, officers,

or employees of the Trustee to take part in the management of the business as

directors or officers or otherwise, and to pay such person or persons reasonable

compensation; and to rely upon the reports of certified public accountants as to

the operations and financial condition of the business without independent

investigation; all in such manner, at or for such times, and on such terms as the

Trustee shall think fit.

17. Special Farm Powers. To retain any farm or farm property received

from any source, and to acquire and retain other such property; to engage in

farm operations and the production, harvesting and marketing of farm products,

including livestock breeding and feeding and poultry and dairy farming, by

operating directly with hired labor, by retaining farm managers or management

agencies, by renting on shares or for cash, or in any other manner; to enter into

farm programs; to purchase or rent farm machinery and equipment, livestock,

poultry, seed and feed; to improve farm property and to repair, improve, and

construct farm buildings, fences, and drainage facilities; to borrow money for

any of these purposes; and in general to do all things customary or desirable in

farm operations.

18. Payment of Expenses and Taxes. To incur such expenses or charges

in the management of the Trust estate as the Trustee shall think fit; to render

the Trust estate for taxes if the Trustee shall think it desirable, or to refuse to do

so if the Trustee shall think it undesirable; to pay taxes, charges, and

governmental assessments against the Trust estate; and, in anticipation of such

expenses, charges, taxes, and assessments, to set up such sinking funds or

reserves as the Trustee shall think fit.

19. Reliance on Business Documents. To rely upon the authenticity of

affidavits, certificates, opinions of counsel, letters, notices, telegrams,

cablegrams, and other methods of communication in general use and usually

accepted in business as genuine and as what such documents and

communications purport to be.

20. Acceptance of Additional Property. To accept from any source any

property acceptable to the Trustee to be held as part of any Trust under this

Will. The Trustee also is authorized (but not directed) to accept from the

Executor, at the termination of the administration of any estate of which any

Trust established in this Will may be the Beneficiary, the assets delivered by the

Executor to the Trustee on the basis of the accounting for the assets as

submitted by the Executor, without requiring an audit or other independent

accounting of the acts of such Executor. No Trustee under this Will shall have

any duty, responsibility, obligation, or liability for, or any duty, responsibility,

obligation, or liability for failure to rectify, the acts or omissions of the Executor.

21. Powers Under Changed Conditions. To exercise such powers as may

be necessary or desirable in the management and control of the Trust estate,

whether or not such powers are of like kind or character to those enumerated in

this Will; and in particular to enable the Trustee to act under changed

conditions, the exact nature of which cannot now be foreseen.

B. Additional Powers. The Trustee shall also have the additional powers listed

below in this section. If a corporate Trustee is serving as Trustee, these powers shall

be vested solely in the corporate Trustee.

1. Custody of Trust Estate; Nominees; Disbursement of Funds. To

retain sole custody of the Trust estate; to keep any of the property of the Trust

estate in any place or places in Texas or elsewhere in the United States or

abroad, or with a depository or custodian at such place or places; to hold any of

the securities or other property of the Trust estate for any length of time in the

name of a nominee or nominees without mention of any Trust created in this Will

in any instrument of ownership; to make all disbursements of the Trust funds

without any counter-signature; and to make all reports, including tax returns, to

any agency of the government, local, state, or Federal.

2. Execution of Documents. To execute and deliver agreements,

assignments, bills of sale, contracts, deeds, leases, notes, powers of attorney,

warranties, covenants, guaranties, receipts, releases, discharges, acquittances,

and other papers or documents reasonably necessary or desirable to carry out

the powers granted to a Trustee.

3. Apportionment of Income and Expenses. Where not otherwise clearly

provided by law or otherwise set forth in this Will, to determine with finality, as to

each sum of money or other thing of value held or received by any Trustee,

whether and to what extent the same shall be deemed to be principal or to be

income, and as to each charge or expense paid by the Trustee, including, but

not limited to, power to apportion any receipt or disbursement between principal

and income and to determine what part, if any, of income is available for

distribution according to the terms of this Will, and what part, if any, of the actual

income received upon a wasting investment, or upon any security purchased or

acquired at a premium, shall be returned and added to principal to prevent a

diminution of principal upon exhaustion or maturity of the same; and to set up

such reserves out of principal or income as the Trustee shall think fit.

4. Division into Shares or Separate Trusts. To hold, manage, invest, and

account for the several shares or separate Trusts that may be held in trust,

either as separate funds or as a single fund, as the Trustee shall think fit; if as a

single fund, to make division of the same only upon the books of account, to

allocate to each share or Trust its proportionate part of the principal and income

of the single fund, and to charge against each share or Trust its proportionate

part of the common expenses.

5. Method of Distribution or Division. In dividing the Trust estate into

separate shares or trusts, or in distributing the same, to divide or distribute in

cash, in kind, or partly in cash and partly in kind, using different properties

according to their value or undivided interests in the same properties, as the

Trustee shall think fit; for any purpose, including division or distribution, to value

the Trust estate or any part of it reasonably and in good faith, such valuation to

be conclusive upon all parties.

6. Occupancy of Trust Property. To allow any Beneficiary to use or

occupy Trust property without payment of rent.

7. Termination of Small Trust. Notwithstanding any other provision of this

Will, to terminate any separate Trust established by this Will whenever in the

Trustee's opinion such Trust is so small in value that the administration of the

Trust is no longer economically advisable. In making this determination, the

Trustee is requested to take into consideration the financial and special

advantages to the Beneficiary or Beneficiaries of continuing the Trust estate. In

the event of a termination, the Trustee shall distribute the remaining Trust

assets to my Spouse, if living, otherwise to the then income beneficiary or

beneficiaries, per stirpes. The Trustee's judgment shall be final and binding

upon all interested parties, and distribution of Trust assets in any manner

provided in this Will shall relieve the Trustee of any further responsibility with

respect to such assets. In no event shall a Beneficiary, while serving as a

Trustee under this Will, exercise the discretion granted in this paragraph, such

discretion being exercisable solely by another Trustee.

8. Generation-Skipping Transfer Taxes and Payment. If the Trustee

considers any distribution or termination of any interest under this Will as a

distribution or termination subject to a generation-skipping transfer tax, the

Trustee is authorized:

a. To augment any taxable distribution by an amount that the

Trustee estimates to be sufficient to pay such tax and charge the same

to the particular Trust or share to which the tax relates without

adjustment of the relative interests of the Beneficiaries;

b. In the case of a taxable termination, to pay such tax from the

particular Trust or share to which the tax relates without adjustment of

the relative interests of the Beneficiaries. If such tax is imposed in part by

reason of the Trust property under this Will and in part by reason of other

property, the Trustee shall pay only the portion of such tax that the

Trustee determines in good faith to be attributable to the taxable

termination, taking into consideration deductions, exemptions, credits,

and other factors that the Trustee deems advisable; and

c. Subject to the limitations of the Rule Against Perpetuities, to

postpone final termination of any particular Trust and to withhold all or

any portion of the Trust property until the Trustee is satisfied that the

Trustee and the Trust no longer have any liability to pay any generation-

skipping transfer tax with reference to such Trust or its termination.

9. Tax Elections. The Trustee may make such elections under the tax laws

applicable to any Trust as the Trustee in its sole discretion shall determine. No

compensating adjustments between principal and income, nor with respect to

any Trust, shall be made even though the elections made under the tax laws by

the Executors of my estate and my Spouse's estate, or the Trustee, may affect

(beneficially or adversely) the interests of the Beneficiaries. The action of the

Trustee shall be binding upon all Beneficiaries.

10. Payments to Incapacitated Person. During the minority or physical or

mental incapacity of any person to whom or for whom principal or income from

the Trust estate of any Trust created in this Will may be paid (either during the

term of a trust or upon final distribution of a trust), the Trustee may make such

payment in any one or more of the following ways:

a. To such person directly;

b. To the guardian, committee, conservator, or other similar official

of such person;

c. To a relative of such person to be expended by such relative for

the benefit of such person, including payment to such relative;

d. To a custodian under an applicable Uniform Transfers (or Gifts) to

Minors Act; or

e. By the Trustee expending the same directly for the benefit of

such person.

The Trustee's determination of the minority or incapacity of any such

person shall be final, and the Trustee shall not be responsible for the

application of any payment after the same has been made to any person

in accordance with the provisions of this Article.

11. Assistance to Certain Estates. The Trustee may, in its sole discretion,

use the principal of any Trust properties as set forth in this Article, and any

payment made in the bona fide belief that it is pursuant to this Article shall be

binding upon all Beneficiaries:

a. Investments. To purchase and to retain as investments any

securities or other property, real or personal, belonging to the estate of

my Spouse or me.

b. Loans. To make loans to the Executor of my estate or of my

Spouse's estate on such terms as the Trustee deems advisable.

c. Debts and Administration Expenses. To pay any legally

enforceable debts (excluding debts secured by real estate), funeral

expenses, costs, expenses of the administration of my estate, and

Federal estate and state inheritance taxes, including interest and

penalties, which may become payable because of my death.

12. Use and Receipt of Employee Benefits. If the Trustee is designated as

the Beneficiary to receive payments under an Employee Benefit Plan in which

my Spouse or I am a participant, and such payments are exempt from Federal

estate taxation in the estate of my Spouse or me under Section 2039 of the

Code, such payments may (but are not required to) be used by the Trustee to

pay any of the participant's debts or taxes attributable to the participant's estate,

and they may (but are not required to) be used to pay any costs or expenses of

the administration of the participant's estate. The Trustee may negotiate and

receive such payments in any manner it deems prudent and consistent with the

tax (both estate and income) and other objectives of this Will first as they affect

my Spouse, second as they affect my children, third as they affect my

grandchildren, and fourth as they affect all other Beneficiaries under this Will.

The Trustee shall have the sole and absolute discretion to determine how such

payments, in whole or in part, shall be received under this Will (whether or not

the payment would be exempt from or includible in the participant's estate for

Federal and/or State estate tax purposes). The Trustee's decision in this regard

shall be final and shall be binding upon all parties howsoever interested. If such

payments otherwise would be exempt from Federal and/or State estate taxes, in

whole or in part, the Trustee is requested to consult with the personal

representative of the participant's estate before electing to receive such

otherwise exempt proceeds in such a manner as will subject them to Federal

and/or estate taxation in the participant's estate.

13. Creation of General Powers. The Trustee (other than any Beneficiary

of the Trust affected) is authorized in its sole discretion with respect to all or any

part of the principal of a Trust created pursuant to this Will that then is subject to

the terms of the Family Trust and has an inclusion ratio as defined in 26

U.S.C.A. § 2642(a) of the Code greater than zero, by an instrument filed with

the Trustee: (a) to create in a child of mine who at such time may receive

income distributions from such Trust a testamentary general power of

appointment within the meaning of 26 U.S.C.A. § 2041 of the Code (including a

power the exercise of which requires the consent of the Trustee other than any

beneficiary), which power of appointment may dispose of the property upon the

death of the child; (b) to eliminate such power or reduce it to a testamentary

power of appointment other than a general power of appointment, for all or any

part of such principal as to which such power was previously created pursuant

to this provision; and (c) irrevocably to release the right to create, reduce, or

eliminate such power of appointment. In authorizing such action, it is my desire

(but I do not direct) that a general power of appointment will be kept in effect

when the Trustee so acting believes the inclusion of the property affected by the

power in the child's gross estate may achieve a significant savings in transfer

taxes by having imposed on the property subject to the general power an estate

tax rather than a generation-skipping transfer tax. This also may permit a

greater use of the exemption from the generation-skipping transfer tax provided

under 26 U.S.C.A. § 2631 of the Code. As an inducement to the Trustee to

exercise the authority granted in this Article, I direct that the Trustee's decisions

under this Article shall be absolutely binding on all beneficiaries of the Trust and

of the estate of the person holding the power and that the Trustee shall incur no

liability by reason of any adverse consequence of such decisions to any

person.)

C. Transactions with Related Parties and Self-Dealing. The powers of the

Trustee to enter into any transaction shall in no way be limited by the fact that the same

or another party to such transaction is: a Beneficiary; the estate of a Beneficiary

(whether living or deceased); a trust created by or for the benefit of a Beneficiary

(whether living or deceased); my estate or the estate of my Spouse; a trustee of any

trust (including Trustees appointed in this Will) whether or not acting in a fiduciary

capacity; or an executor or administrator of any estate (including my estate or the

estate of my Spouse) whether or not acting in a fiduciary capacity.

D. Release of Power by Amendment of Trusts. Any Trustee shall have the

power and authority to amend the provisions of this Will in order to surrender, release,

renounce, or disclaim any one or more of the discretionary powers given by this Will to

that Trustee. Any such amendment shall be made by written instrument acknowledged

and filed in the land and/or trust records of the office of the County Clerk of my County.

After any power has been so surrendered, released, renounced, or disclaimed, it never

again shall be exercised by that Trustee.

E. Records; Inspection. The Trustee shall keep accurate and complete records of

Trust transactions. Any Beneficiary (or the Beneficiary's representative, authorized in

writing) may inspect the records at any reasonable time.

F. Annual Report. Upon written request by the Beneficiary or the Beneficiary's

personal representative, the Trustee shall make an annual report in writing to any living

Beneficiary over the age of _____ years who could, in the discretion of the Trustee,

receive any income or distribution from the Trust estate during that year. Such report

shall be for a calendar or fiscal year beginning each year on a date selected by the

Trustee as appropriate for this purpose and shall be submitted to such Beneficiary (or

to the guardian, conservator, committee, or other like official of any incapacitated

Beneficiary) with reasonable promptness after the end of such period. Each report shall

include a statement of all property on hand at the end of such year, all receipts and

disbursements during such year, all sales and purchases made during such year, and

of such other acts of the Trustee as may be necessary to furnish such Beneficiary with

adequate information as to the condition of the Trust estate.

G. Compensation and Bond. Any Trustee shall be entitled to reasonable fees

commensurate with its duties and responsibilities taking into account the value and

nature of the Trust estate and the time and work involved. The Trustee shall be

reimbursed for the reasonable costs and expenses incurred in connection with its

fiduciary duties under this Will. No Trustee, whether original or successor, shall be

required to furnish bond or other security, except as provided in this Will.

H. No Court Supervision. No Trustee shall be required to qualify before, be

appointed by, or in the absence of breach of trust, account to any court or obtain the

order or approval of any court in the exercise of any power or discretion.

I. Out-of-State Properties. If at any time any Trust estate shall consist in whole or

in part of assets located in a jurisdiction in which the Trustee is not authorized or is

unwilling to act, the Trustee may appoint an ancillary trustee for that jurisdiction and

may confer upon such ancillary trustee such rights, powers, discretions, and duties to

act solely with respect to such assets as the Trustee may deem appropriate. The

ancillary trustee shall be answerable to the Trustee for all monies and other assets that

may be received by it in connection with the administration of such property. The

Trustee may pay to the ancillary trustee reasonable compensation for its services and

may absolve it from any requirement that it furnish bond or other security.

J. Division of Trusts. I authorize (but do not direct) the Trustee to divide any Trust

established by this instrument, without court approval, into two or more separate Trusts

so that the generation-skipping transfer tax inclusion ratio as defined in 26 U.S.C.A. §

2642(a) of the Code with respect to each Trust after such division shall be either zero

or one. Unless otherwise specifically provided in this Will, the respective amounts of

any such division shall be made on the basis of the value of the assets on the date of

such division. Any such separate Trust shall have identical provisions as the trust so

divided. If a Trust is divided into separate Trusts, the Trustee may: (1) make different

tax elections with respect to each such separate Trust; (2) expend principal and

exercise or not exercise any other discretionary powers with respect to each such

separate Trust differently; (3) invest the property of each such separate Trust

differently; and (4) take all other actions consistent with each such Trust being a

separate entity. Further, the person holding any power of appointment with respect to a

Trust so divided may exercise such power differently with respect to the separate

Trusts created by the division. The Trustee is exonerated from any liability arising from

any exercise or failure to exercise these powers, provided the actions (or inactions) of

the Trustee are in good faith.

K. Merger of Trusts. If at any time the Trustee of any Trust created by this Will

(this Trust) shall also be acting as Trustee of any other trust (other Trust) for the benefit

of the same Beneficiary or Beneficiaries and upon substantially the same terms and

conditions, the Trustee is authorized and empowered, if in the Trustee's discretion such

action is in the best interest of the Beneficiary or Beneficiaries of this Trust, to transfer

and merge all of the assets then held in this Trust to and with such other Trust, and

then to terminate this Trust. The Trustee further is authorized to accept the assets of

the other Trust that may be transferred to the Trustee of this Trust and to administer

and distribute such assets in accordance with the provisions of this Will. The Trustee is

exonerated from any liability arising from any exercise or failure to exercise these

powers, provided that the actions (or inactions) of the Trustee are in good faith.

L. Corporate Trustee. The powers and authorities granted to the Trustee shall not

be limited by the fact that a Trustee is a trust company, bank, or financial institution, or

a member of a group of affiliated entities under common control, and no Trustee shall

be subject to limitations or restrictions imposed upon a trust company, bank, financial

institution, bank holding company, or upon fiduciaries generally, with respect to the type

of investment any such Trustee may make of its own funds or of the funds of others,

including affiliated entities. Specifically (but not by way of limitation), the Trustee may:

(a) retain, acquire, or otherwise deal in the capital stock or other securities of a Trustee

or of a corporation for which a Trustee is registrar, transfer agent, or affiliate of the

Trustee, such as a holding company; (b) deposit Trust funds with a Trustee or an

affiliate of the Trustee as a bank; and (c) contract or otherwise enter into transactions

with a Trustee as a bank or any of its affiliates or any other Trust for which it is acting as

Trustee.

M. Collection of Life Insurance Proceeds.

1. General. If my Trustee is the Beneficiary of any life insurance policy on

my life, then upon my death my Trustee shall promptly furnish to the insurance

company proof of loss, and shall collect and receive the proceeds of the policy,

less so much of the proceeds as shall be required to pay or provide for the

payment of any liability or obligation to the insurer in respect of the policy. In the

collection of such proceeds, the Trustee shall have the power to execute and

deliver receipts and other appropriate instruments, and to take such legal action

as is appropriate.

2. Contested Policy. If the payment of any policy is contested, the Trustee

shall be under no obligation to institute legal action for the collection of the

payment unless it is indemnified to its satisfaction for all costs, including

attorney's fees.

3. Reimbursement for Advances and Expenses. The Trustee may pay to

itself out of the funds in its hands the amount of any advances made by the

Trustee for expenses incurred in collecting or attempting to collect any sum from

any insurance company by suit or otherwise. Any such reimbursement to the

Trustee may be made prior to receipt of any sum from any insurance company.

4. Discharge of Insurance Company. No insurance company shall be

responsible for the Trustee's application or disposition of the proceeds of any

policy payable to the Trustee. The liability of an insurance company shall be

discharged upon payment of the proceeds to the Trustee.

N. Environmental Hazards.

1. Power to Deal with Environmental Hazards. The Trustee shall have

the power to use and expend the Trust income and principal to: (i) conduct

environmental assessments, audits, and site monitoring to determine

compliance with any environmental law or regulation under such law; (ii) take all

appropriate remedial action to contain, clean up, or remove any environmental

hazard including a spill, release, discharge, or contamination, either on its own

accord or in response to an actual or threatened violation of any environmental

law or regulation under such law; (iii) institute legal proceedings concerning

environmental hazards or contest or settle legal proceedings brought by any

local, state, or Federal agency concerned with environmental compliance, or by

a private litigant; (iv) comply with any local, state, or Federal agency order or

court order directing an assessment, abatement, or cleanup of any

environmental hazards; and (v) employ agents, consultants, and legal counsel

to assist or perform the above undertakings or actions.

2. Trustee's Right to Refuse Contributions. The Trustee, in its sole

discretion, may require, as a prerequisite to accepting property contributed to

the Trust, that the donor of such property provide evidence satisfactory to the

Trustee that: (i) the property is not contaminated by any hazardous or toxic

materials or substances; and (ii) the property is not being used and has never

been used for any activities directly or indirectly involving the generation, use,

treatment, storage, disposal, release, or discharge of any hazardous or toxic

materials or substances.

3. Exoneration of Trustee. No Trustee shall be liable for any loss or

depreciation in value sustained by the Trust as a result of the Trustee retaining

property upon which there is later discovered to be hazardous materials or

substances requiring remedial action pursuant to any Federal, state, or local

environmental law, unless the Trustee contributed to the loss or depreciation in

value through willful default, willful misconduct, or gross negligence.

V. Liability of Trustee and Persons Dealing with Trustee

A. Persons Dealing with Trustee. No purchaser from, or other person dealing

with, the Trustee shall be responsible for the application of any purchase money or

other thing of value paid or delivered to any Trustee, and the receipt by any Trustee

shall be a full discharge. No purchaser from, or other person dealing with, any Trustee,

and no issuer, transfer agent, or other agent of any issuer of any securities to which

any transaction with any Trustee shall relate shall be under any obligation to ascertain

or inquire into the power of the Trustee to transfer, pledge, or otherwise in any manner

dispose of or deal with any securities or other property comprising part of the Trust

estate.

B. Liability of Trustee. No Trustee shall be responsible or liable for any loss to the

Trust estate that may occur by reason of depreciation in value of the properties at any

time belonging to the Trust estate, nor for any other loss to the Trust estate that may

occur, except that each Trustee shall be liable for its own negligence or willful

misconduct.

C. Liability of Trustee for Acts of Others. No Trustee shall be liable or

responsible for the acts, omissions, or defaults of any agent or other person to whom

duties may be properly delegated under this Will (except officers or regular employees

of any Trustee), if such agent or person was appointed with due care. No Trustee shall

be liable or responsible for failure to contest the accounts of any other Trustee, or

otherwise to compel any other Trustee to redress any breach of trust, unless requested

in writing to do so by a Beneficiary or a guardian or guardian ad litem of a Beneficiary.

No Trustee shall be liable or responsible for any act within the sole power and

discretion of any other Trustee.

D. Limitation of Personal Liability of Trustee. No Trustee acting in its fiduciary

capacity under this Will shall incur any personal liability for obligations of the trust to any

third party who deals with the Trustee in the administration of the Trust estate. Each

Trustee shall be entitled to reimbursement from the Trust estate for any liability,

whether in contract or in tort, incurred in the administration of the Trust estate in

accordance with the provisions of this Will. Each Trustee may contract in such form as

to exempt the Trustee from such personal liability and to cause such liability to be

limited to the Trust estate. No successor Trustee shall have any duty, responsibility,

obligation or liability for, or any duty, responsibility, obligation, or liability for failure to

rectify, the acts or omissions of any predecessor Trustee.

E. Reliance on Probated Will of Person Possessing Power of Appointment.

Wherever in this Will a person is given a power of appointment by Will, the

Trustee may rely upon an instrument admitted to probate in any jurisdiction as

the last Will of the person possessing such power. If the Trustee has not

received written notice of the existence of such Will within a period of ______

(number) months after the death of the person possessing such power, the

Trustee may presume that such person died intestate, and the Trustee shall be

protected in acting in accordance with such presumption. This protection to the

Trustee shall not limit or qualify any power of appointment or the rights of any

person to pursue the property affected by the exercise of the power, irrespective

of the place of probate or time of discovery of any such Will.

F. Judgment and Discretion of Trustee Final. Wherever the judgment or

discretion of any Trustee may be exercised, it shall be final and binding upon every

person interested in the Trust estate. Any Trustee exercising any discretionary power

relating to the distribution or accumulation of principal or income, or to the termination

of any Trust, shall be responsible only for lack of good faith in the exercise of such

power.

VI. Change in Trustee

A. Definition of Trustee; Distribution of Powers. The Trustee, whether one or

more, whether male or female, whether individual or corporate, whether original,

successor, or substitute, is called Trustee in this Will. Each Trustee shall have the same

duties, powers, and discretions.

B. Resignation of Trustee. Any Trustee may resign by filing a written instrument

acknowledged of record in the land and/or trust records of the County Clerk of my

County, which filing shall deprive immediately any such resigning Trustee of a powers

as Trustee under this Will, except those powers appropriate to the administration of the

Trust during the time required for the transfer of the Trust assets, provided,

nevertheless, that at least ______ (number) days prior to such filing, the resigning

Trustee shall give written notice of the resignation to those persons who could in the

discretion of the Trustee receive income from the Trust estate and are at such time sui

juris. No purchaser from, or other person dealing with, any Trustee is obligated to

examine such public records, and any such person acting in good faith shall be

protected in all transactions with any Trustee whether or not any such resignation has

taken place.

C. Powers and Duties of Successor Trustee. Upon the appointment and

qualification of any successor Trustee, the same duties shall devolve upon, and the

same rights, powers, authorities, privileges, and discretions shall inure to it as to the

Trustee originally designated under this Will, and all rights, powers, authorities,

privileges, and discretions shall be exercised without the supervision of any court.

D. Reorganization or Substitution of Corporate Trustee. If a corporate Trustee

should, before or after qualification, change its name; be reorganized, merged, or

consolidated with, or acquired by any other corporation; or be converted into or assign

its trust functions to a different type of entity, the resulting entity shall be deemed a

continuation of the former one and shall continue to act as Trustee or continue to be

eligible to become a Trustee, as the case may be.

E. Investments in Common Trust Funds of a Bank. Notwithstanding anything

contained in this Will to the contrary, if any of the Trust estate is invested in a bank's or

other entity's common trust fund, removal of such bank or other entity as Trustee shall

be subject to the following provisions:

1. The authority of such Trustee to invest in the common trust fund shall

continue, and the transfer or payment of the Trust assets need not be made,

until the first evaluation date of the common trust fund that occurs at least

______ (number) days after written notice has been given to the Trustee.

2. If Trust assets are invested in more than one common trust fund, the

authority of such Trustee to invest in the common trust fund shall continue, and

the transfer or payment of the Trust assets need not be made, until each

evaluation date of the common trust funds has occurred at least once in the

period beginning ______ (number) days after written notice has been given to

the Trustee.

VII. Administration of Estate

A. Payment of Debts and Taxes. Except as otherwise provided in this Will, I direct

that all my legally enforceable debts, funeral expenses, expenses of the administration

of my estate, and Federal estate and state inheritance taxes, including interest and

penalties, becoming payable because of my death (except any generation-skipping

transfer tax imposed by 26 U.S.C.A. § 2601 of the Code, any excess retirement

accumulations tax under 26 U.S.C.A. § 4980A of the Code, or any recapture tax

imposed by 26 U.S.C.A. § 2032A of the Code) be paid out of my Residue.

Notwithstanding the foregoing sentence, I direct my Executor to recover any tax,

including interest and penalties on the same, imposed on property includible in my

gross estate by reason of 26 U.S.C.A. § 2044 of the Code or a similar provision of any

state law, from the person or entity in possession of or receiving the property as

provided in 26 U.S.C.A. § 2207A of the Code or a similar provision of state law.

However, such direction shall not apply to the extent so provided by the instrument

creating such property interest includible in my gross estate under 26 U.S.C.A. § 2044

of the Code or a similar provision of state law.

B. Powers of Executor.

1. General. In addition to the powers given to my Executor by law, I grant

to my Executor the following powers with respect to my estate:

a. To retain any property of my estate;

b. To convey, sell, transfer, exchange, partition, mortgage, pledge,

lease, assign, or otherwise dispose of, hypothecate, or deal with any and

all properties in my estate;

c. To borrow or lend money for such purposes and on such terms

and conditions as my Executor deems appropriate;

d. To invest and reinvest any assets, funds, properties, or income of

my estate in such properties or investments as my Executor deems

appropriate;

e. To extend or renew any indebtedness upon such terms and for

such time or times as my Executor deems appropriate;

f. To settle claims in favor of or against my estate;

g. To continue the operation of any proprietorship, partnership,

corporation or other business owned by my estate, including the power

to carry out and enforce the provisions of any agreement for the

disposition of my interest in any such business enterprise, even though

my Executor may be financially interested in such business or

agreement; and

h. To exercise all the powers granted to my Trustee in this Will.

My Executor may exercise these powers for any purpose and upon such

terms, conditions, and limitations (whether or not to exist longer than the

administration of my estate) that in the judgment of my Executor shall be

in the best interest of my estate and the Beneficiaries of my estate.

2. Time and Method of Distribution. Final distribution of my estate shall

be made when my Executor determines the time to be appropriate. Prior to such

time, partial distributions may be made whenever my Executor shall deem it

advisable. Distributions may be made in cash or in kind, or partly in each, and

for this purpose, the determination of my Executor as to the value of any

property distributed in kind shall be conclusive.

3. Selection of Assets for Distribution. My Executor shall in its sole and

absolute discretion select assets to be distributed in satisfaction of any devise or

bequest in my Will without respect to the income tax basis of such property. My

Executor specifically is excused from any duty of impartiality with respect to the

income tax basis of such property.

4. Conflicts of Interest. I realize that in the course of the administration of

my estate conflicts of interest may develop between Beneficiaries of my estate.

For example, conflicts may develop because of a choice of alternatives involved

in valuing assets for various purposes. In the resolution of any conflict of

interest, I request (but do not so direct) that my Executor first make a

reasonable effort to determine the overall effect of the conflict in the

administration of my estate and in the distributions to be made and then make

reasonable efforts to resolve the conflict by the mutual agreement of the

respective Beneficiaries or recipients. If a mutual agreement cannot be reached

after reasonable efforts, my Executor shall resolve the conflict in its sole and

absolute discretion.

5. Elections and Options. I confer upon my Executor the sole and

absolute discretion to exercise any election or option given to my Executor

under the revenue laws of the United States or any state in which this Will may

be probated or in which property of which I own an interest at the time of my

death may be located. My Executor may exercise such discretion without regard

to the relative interests of the Beneficiaries of my estate; without compensating

adjustments among the Beneficiaries of my estate; and notwithstanding the

possibility that such decisions may increase the amount of my taxable estate.

Without limiting the generality of the foregoing sentence, my Executor is

authorized, in its sole discretion, to claim any expense of administration of my

estate as an estate tax deduction or as an income tax deduction; to elect to

extend the payment of any tax over such period as may seem appropriate to my

Executor and available under law; to elect to value any asset of my estate under

any alternative valuation formula which may be permitted under the Code; to

select the alternative valuation dates for the valuation of my estate; to disclaim

or renounce, in whole or in part, any gift, inheritance, proceeds of any life

insurance or Employee Benefit Plan payable to or for the benefit of me or my

estate; and to file any tax returns for any year or years for which I have not filed

such return or returns prior to my death and to pay any taxes (together with any

interest and penalties) as my Executor shall deem proper.

6. Encumbered Distribution. My Executor is authorized to distribute to

any Beneficiary of my estate, including the Trustee of any trust created in this

Will or to any Beneficiary of such a trust, any asset of my estate subject to any

and all indebtedness incurred by me or by my Executor which indebtedness, in

the sole and absolute discretion or opinion of my Executor, need not be paid

first, or to distribute any such property or asset subject to any or all mortgages,

deeds of trust, or the liens, encumbrances, or obligations created by me or by

my Executor.

7. Methods of Payment to Certain Beneficiaries. If any Beneficiary to

whom my Executor is authorized by this instrument to make distributions is

under a legal disability or is, in the opinion of my Executor, incapable of properly

managing his or her affairs, my Executor may make such distributions in any

one or more of the following ways:

a. To such Beneficiary directly;

b. To the guardian, committee, conservator, or other similar official

of such Beneficiary;

c. To a relative of such Beneficiary to be expended by such relative

for the benefit of such Beneficiary, including payment to such relative;

d. To a custodian selected by my Executor under an applicable

Uniform Transfers to Minors Act;

e. To my Trustee to be held as a separate Trust for the benefit of

such Beneficiary, as provided in Article Three of this Will; or

f. By my Executor expending the same directly for the benefit of

such Beneficiary.

Any person (other than the Beneficiary) who receives a distribution for

the benefit of the Beneficiary pursuant to the preceding sentence is

authorized to give a valid receipt and discharge for the distribution. In

each case, the receipt by such Beneficiary or other person to whom

payment is made or entrusted shall be a complete discharge to my

Executor, and my Executor shall be without obligation to see to the

further application of such distribution.

8. Executor's Discretion Controlling. Any decision made under the

authority of this Article or any other provision of this Will by my Executor with

respect to any matter shall bind each Beneficiary of my estate, including the

Trustee of any trusts created in this Will, the Beneficiaries of such trusts, and

any other person interested in my estate, and my Executor shall not be required

to make any compensating adjustments between income or principal or among

any Beneficiaries, trustees, or any other person as a result of my Executor's

action or inaction.

9. Allocation of Generation-Skipping Transfer Tax Exemption. I

authorize my Executor to allocate my generation-skipping transfer tax exemption

(the “GST exemption” under 26 U.S.C.A. § 2631 of the Code) to and among

dispositions of property with respect to which I am the transferor, whether

contained in this Will or otherwise, in such manner as my Executor, in my

Executor's sole discretion, deems best calculated to secure the most effective

use of such exemption, based on circumstances and events either known or

reasonably foreseeable as of the expiration of the time within such allocation is

required to be made. While equality of treatment among different Beneficiaries

or beneficiary groups should be an important consideration in allocating such

exemption, it should not be the sole or even the primary consideration. For

example, a pro-rata allocation between two trusts might be appropriate if there

is a substantial likelihood that all or most of both of them will be distributed to or

terminate in favor of skip-persons as defined in 26 U.S.C.A. § 2613(a) of the

Code, but inappropriate if there is a substantial likelihood that all or a significant

portion of one of them will be distributed to or terminate in favor of non-skip

persons as defined in 26 U.S.C.A. § 2613(b) of the Code. Any allocation so

made