CSMOD 20 .

Notice to Payor

Revised July 200 7

Page 1 of 6

STATE OF WYOMING ) IN THE DISTRICT COURT

) ss .

COUNTY OF __________________) _______________ JUDICIAL DISTRICT

________________________________ )

)

Plaintiff , )

)

vs. ) Civil Action No. ____________________

)

_________ ______________________ )

)

Defendant . )

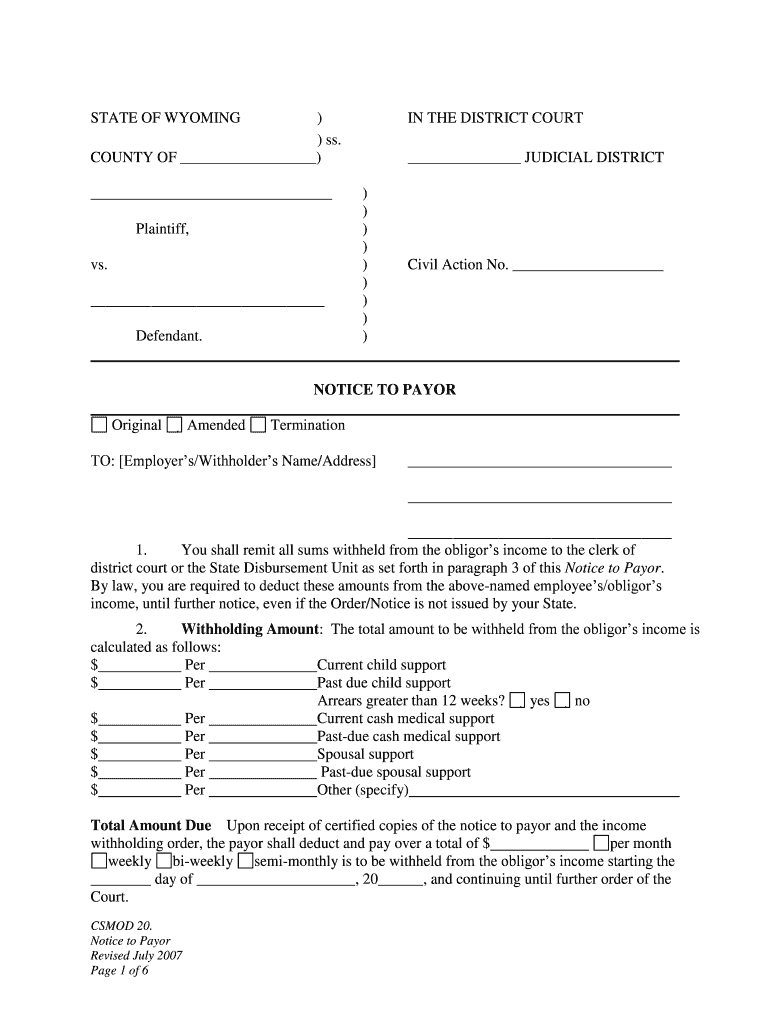

NOTICE TO PAYOR

Original Amended Termination

TO: [Employer’s /Withholder’s Name/Address] ___________________________________

___________________________________

___________________________________

1. You shall remit all sums withheld from the obligor’s income to t he clerk of

district court or the State Disbursement Unit as set forth in paragraph 3 of this Notice to Payor .

By law, you are required to deduct these amounts from the above -named employee’s/obligor’s

income, until further notice, ev en if the Order/Notice is not issued by your State.

2. Withholding Amount : The total amount to be withheld from the obligor’s income is

calculated as follows:

$ Per Current child support

$ Per Past due child support

Arrears greater than 12 week s? yes no

$ Per Current cash medical support

$ Per Past -due cash medical support

$ Per Spous al support

$ Per Past -due spousal support

$ Per Other (specif y)

Total Amount Due Upon rec eipt of certified copies of the notice to payor and the income

withholding order, the payor shall deduct and pay over a total of $ per month

weekly bi-weekly semi -monthly is to be with held f rom the obligor’s income starting the

______ __ day of ___________________ __, 20___ ___, and continuing until further order of the

Court.

CSMOD 20 .

Notice to Payor

Revised July 200 7

Page 2 of 6

3. REMITTANCE INFORMATION: When remitting payment, provide the case

identifier , the name and social security n umber of the obligor and the date the income was withheld.

If the employee’s/obligor’s principal place of employment is Wyoming, you must begin withholding

no later than the first pay period that occurs following service on the payor of this Order/Notice.

Send payment within 7 working days of the pay date/date of withholding . You do not have to vary

your pay cycle to be in compliance with the support order.

A. The payor shall remit the amount withheld to the clerk of d istrict court , whose address

is:

within seven (7) days after the date the obligor is paid, or (if checked)

the State Disbursement Unit, Wyoming Child Support Enforcement , PO Box

1027 , Cheyenne, WY 82003 .

If the employee’s/obligor’s princi pal place of employment is not Wyoming, for

limitations on withholding, applicable time requirements, and any allowable employer fees,

follow the laws and procedures of the employee’s/obligor’s principal place of employment.

4. Priority : The withholdin g under this order has priority over any other legal

process under state law (or tribal law, if applicable) against the same income. Federal tax levies

in effect before receipt of this order have priority. If Federal tax levies are in effect, p lease

cont act the State Child Support Enforcement Agency.

5. Combined Payments : You may combine withheld amounts from more than one

employee’s/obligor’s income in a single payment to each agency/party requesting withholding.

You must, however, separately identi fy the portion of the single payment that is attributable to

each employee/obligor.

6. Reporting the Pay Date/Date of Withholding: You must report the pay

date/date of withholding when sending the payment. The pay date/date of withholding is the date

on which the amount was withheld from the employee's wages. You must comply with the law

of the state of the employee’s/obligor’s principal place of employment with respect to the time

periods within which you must implement the withholding and forward the su pport payments.

7. Employee/Obligor with Multiple Support Withholdings: If there is more than

one Order or Notice against this employee/obligor and you are unable to honor all support

Orders or Notices due to federal, state, or tribal withholding limits, you must follow the state or

tribal law/procedure of the employee's/obligor's principal place of employment. You must honor

all Orders or Notices to the greatest extent possible. (See Withholding Limits below.)

CSMOD 20 .

Notice to Payor

Revised July 200 7

Page 3 of 6

8. Termination Notification: Within thirty (30) days after the employee ’s/obligor ’s

employment terminates or the employee/ obligor ceases to receive income from the payor the

payor shall give written notice to the clerk of district court. The notice shall include the

following information:

TH E EMPLOYEE/OBLIGOR NO LONGER WORKS FOR:

EMPLOYEE'S/OBLIGOR'S NAME:

CASE IDENTIFIER:

DATE OF SEPARATION FROM EMPLOYMENT:

LAST KNOWN HOME ADDRESS:

NEW EMPLOYER/ADDRESS:

9. Continuing Duty : For a period of on e (1) year from the date the

employee’s/ obligor’s employment terminates with the payor, the payor shall, upon request,

disclose to the Clerk of this Court, the following information:

A. Any new address for the obligor of which the payor may become aware;

and

B. The name and address of the obligor’s new employer, if known to the

payor.

10. Worker’s Compensation and Unemployment : In the case of worker’s

compensation or unemployment compensation benefits, nothing in W. S. 20 -6-202(a)(i) or (xv)

shall requi re a payor to withhold an amount for any type of support or arrearages not authorized

to be withheld from those benefits by federal law or regulations.

11. Change in Insurance Coverage : If insurance coverage of the obligor’s children

is provided by or through the payor, the payor shall notify the clerk within thirty (30) days of any

lapse or material change in that coverage.

12. The payor shall not be liable to the obligor for any payment or disclosure made as

authorized by this act.

13. Lump Sum P ayments: You may be required to report and withhold from lump

sum payments such as bonuses, commissions, or severance pay. If you have any questions about

lump sum payments, contact the Child Support Enforcement (IV -D) Agency.

14. Withholding Limits: The amount actually withheld for support combined with

the fee authorized by W.S. 20 -6-212(c) ( five dollars ($5.00) for each payment made pursuant to

the income withholding order) shall not exceed the maximum amount authorized by 15 U.S.C.

§1673. *

For state o rders, you may not withhold more than the lesser of: 1) the amounts allowed

by the Federal Consumer Credit Protection Act (15 U.S.C. § 1673(b)); or 2) the amounts allowed

by the state of the employee's/obligor's principal place of employment. The federal l imit applies

to the aggregate disposable weekly earnings (ADWE). ADWE is the net income left after

making mandatory deductions such as: state, federal, local taxes, Social Security taxes, statutory

CSMOD 20 .

Notice to Payor

Revised July 200 7

Page 4 of 6

pension contributions, and Medicare taxes. The payor shal l deduct the maximum amount

required by this notice, unless otherwise ordered by the court, for each pay period.

* The Federal CCPA limit is 50% of the ADWE for child support and alimony, which is

increased by 1) 10% if the employee does not support a se cond family; and/or 2) 5% if arrears

greater than 12 weeks.

For tribal orders, you may not withhold more than the amounts allowed under the law of

the issuing tribe. For tribal employers who receive a state order, you may not withhold more than

the amounts allowed under the law of the state that issued the order.

CHILD (REN )’S NAME (S): DATE OF BIRTH :

1. __________________________ ______________________

2. __________________________ ______________________

3. __________________________ ________________ ______

15. Statutory Fee : As authorized by Wyo. Stat. § 20 -6-212(c), i n addition to the

amount withheld from the obligor’s income, the payor may, subject to limitations of disposable

income under W. S. § § 20 -6-210 (b)(iii) and 27 -3-319 (c), deduct and retain from the obligor’s

remaining income $5.00 for each payment made pursuant to the Income Withholding Order .

16. Sanctions: The payor is notified that payor is subject to the sanctions of W yo .

Stat . § 20 -6-218, including the following:

A. Liability : Any payor who fails to withhold income in the amount

specified in the Notice to Payor is liable for any amount up to the accumulated

amount the payor should have withheld from the obligor’s income and remitted

to th e clerk of this court.

B. Anti -discrimination : You are subject to a fine determined under State

law for discharging an employee/obligor from employment, refusing to employ,

or taking disciplinary action against any employee/obligor because of a child

sup port withholding. The penalt ies imposed under W yo . Stat . § 20 -6-218 shall be

collected from the violator and distributed by the court to the county public

school fund. Before the court imposes a civil penalty, the payor accused of a

violation shall be not ified, in writing, of the specific nature of the alleged

violation and the time and place, at least ten (10) days from the date of the notice,

when a hearing of the matter shall be held. After hearing or upon failure of the

accused to appear at the hearin g, the court shall determine the amount of the civil

penalty to be imposed in accordance with t he limitation in W yo . Stat . § 20 -6-218 .

C. Any payor who violates the provisions set forth in Wyo. Stat. § 20 -6-202

et seq. is subject to a civil penalty in a n amount of not more than two hundred

dollars ($200.00).

D. Penalties under Wyoming statutes shall not be imposed unless service of

the notice to payor was completed by sending by certified mail return receipt

requested to, or by persona l service upon, the employer.

CSMOD 20 .

Notice to Payor

Revised July 200 7

Page 5 of 6

E. Except for a violation of subsection ( B) of this section, an employer who complies

in good faith with an income withholding order shall not be subject to civil liabilities.

F. If you have any doubts about the validity of the Order or Notice, contact the Child

Support Enforcement Agency or Clerk of District Court .

17. Duration : The Income Withholding Order is binding upon the payor until further

notice is received as provided in accordance with W.S. 20 -6-210(a).

18. This Notice to Payor shall be prepared and filed with the Clerk before an Income

Withholding Order is mailed to the payor .

DATED this ______ day of _________________, 20___.

CLERK OF DISTRICT COURT

By:________________________________

Deputy

CERTIFICATE OF MAILING

The undersigned c ertifies that a copy of the Notice to Payor and a copy of the Income

Withholding Order were mailed the ______ day of ______________ __, 20_____, by First -

class U.S. mail, postage prepaid, or certified mail return receipt requested to the last known

address of the payor (employer of the parent obligated to pay child support) and the obligor

(parent owing support) as follows:

Employer/ Payor’s Address:

_____________________________

_____________________________

_____________________________

_____________________________

Employee/ Obligor’s Address:

_____________________________

_____________________________

_____________________________

_____________________________

____________________________________

Signature (of person filing out this form)

Name: (Please print) ________________________

CSMOD 20 .

Notice to Payor

Revised July 200 7

Page 6 of 6

Valuable advice on preparing your ‘To Employerswithholders Nameaddress’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the top electronic signature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can easily fill out and sign documents online. Utilize the powerful features embedded in this intuitive and affordable platform and transform your method of document handling. Whether you need to sign papers or collect signatures, airSlate SignNow manages everything effortlessly, needing just a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘To Employerswithholders Nameaddress’ in the editor.

- Click Me (Fill Out Now) to complete the document on your end.

- Add and allocate fillable fields for others (if necessary).

- Continue with the Send Invite options to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you have to collaborate with others on your To Employerswithholders Nameaddress or send it for notarization—our platform provides everything necessary to accomplish such tasks. Create an account with airSlate SignNow today and enhance your document management to new levels!