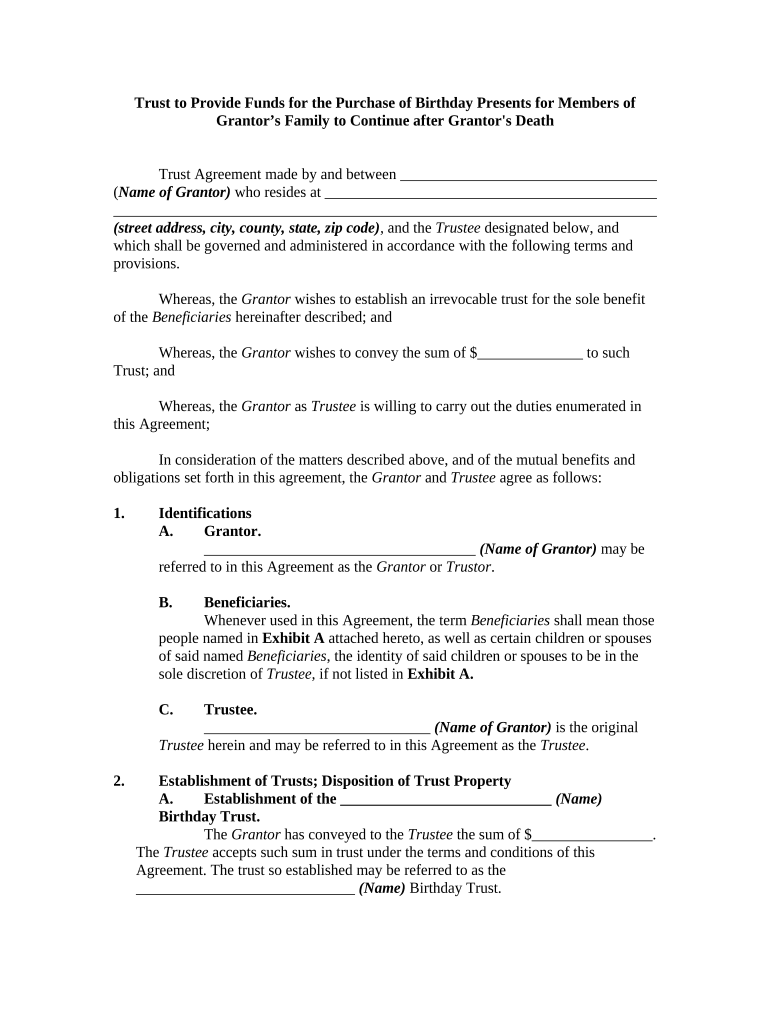

Trust to Provide Funds for the Purchase of Birthday Presents for Members of

Grantor’s Family to Continue after Grantor's Death

Trust Agreement made by and between __________________________________

( Name of Grantor) who resides at ____________________________________________

________________________________________________________________________

(street address, city, county, state, zip code) , and the Trustee designated below , and

which shall be governed and administered in accordance with the following terms and

provisions.

Whereas, the Grantor wishes to establish an irrevocable trust for the sole benefit

of the Beneficiaries hereinafter described; and

Whereas, the Grantor wishes to convey the sum of $______________ to such

Trust; and

Whereas, the Grantor as Trustee is willing to carry out the duties enumerated in

this Agreement;

In consideration of the matters described above, and of the mutual benefits and

obligations set forth in this agreement, the Grantor and Trustee agree as follows:

1. Identifications

A. Grantor.

____________________________________ (Name of Grantor) may be

referred to in this Agreement as the Grantor or Trustor .

B. Beneficiaries.

Whenever used in this Agreement, the term Beneficiaries shall mean those

people named in Exhibit A attached hereto, as well as certain children or spouses

of said named Beneficiaries , the identity of said children or spouses to be in the

sole discretion of Trustee, if not listed in Exhibit A.

C. Trustee.

______________________________ (Name of Grantor) is the original

Trustee herein and may be referred to in this Agreement as the Trustee .

2. Establishment of Trusts; Disposition of Trust Property

A. Establishment of the ____________________________ (Name)

Birthday Trust.

The Grantor has conveyed to the Trustee the sum of $________________.

The Trustee accepts such sum in trust under the terms and conditions of this

Agreement. The trust so established may be referred to as the

_____________________________ (Name) Birthday Trust.

B. Distributions during Life of Grantor.

During the Grantor 's lifetime, the Trustee shall have the power, in his sole

discretion, to accumulate all or part of the net income of the Trust and/or to

distribute all or part of the income or principal of the Trust for the purchase by

Trustee, or his designee, of birthday presents for the Beneficiaries, said presents

to have the value in the range of _________________ ($ Amount) to

______________ ($ Amount), the value of each such present to be within the sole

discretion of Trustee .

C. Distributions after Grantor's Death.

After the death of the Grantor , the Successor Trustee shall have the

power, in his or her sole discretion, to accumulate all or part of the net income of

the Trust and/or to distribute all or part of the income or principal of the Trust for

the purchase by said Trustee , or his/her designee, birthday presents to the

Beneficiaries, said presents to have the value in the range of _________________

($ Amount) to __________________ ($ Amount), the value of each such present

to be within the sole discretion of Successor Trustee .

D. Final Terminating Distribution.

This Trust shall terminate on the death of the last of the Beneficiaries

named in Exhibit A. At the termination of this Trust, the Trustee shall distribute

all of the principal and undistributed income then remaining in that Trust to the

heirs at law of the Beneficiaries named in Exhibit A, per stirpes, provided,

however, if any such heir at law is a minor, such distribution shall be made to said

minor’s parent(s) or guardian(s).

3. Trustee Appointments.

Grantor hereby appoints _____________________________ (Name of Grantor) ,

the Trustor , as Trustee of this Trust. If the Trustor is unable to serve as Trustee for any

reason, then the Trustor hereby appoints _______________________________ (Name

of Successor Trustee) as Successor Trustee . If neither the first or second Trustee are able

to serve as Trustee for any reason, then the Trustor hereby appoints

__________________________ (Name of Successor Trustee) , as Successor Trustee ,

whether one or more. The Trustee shall have all powers as provided in this Agreement

and the laws of the State of _______________________ (Name of State) .

4. Spendthrift Clause.

No part of the income or principal of which shall ever be transferred or assigned

by any Beneficiaries or distributee, or subjected to any judicial process against any

Beneficiaries or distributee before the same has been paid. No part of the interest of any

Beneficiaries or distributee shall in any event be subject to sale, hypothecation,

assignment, or transfer. Nor shall the principal or income of this Trust be liable for the

debt of any Beneficiaries or distributee. Nor shall any part of the principal or income be

seized, attached, or in any manner taken by judicial proceedings against any

Beneficiaries or distributee on account of the debts, assignments, sale, divorce, or

encumbrance of any Beneficiaries or shall pay to the Beneficiaries or distributee the sum

payable to him or her according to the Trust terms, notwithstanding any purported sale,

assignment, hypothecation, transfer, attachment, or judicial process, exactly as if the

same did not exist. Nothing contained in this paragraph shall be construed as restricting

the exercise of any power of appointment granted in this Agreement.

5. Additions to Trust Estate.

Trustor reserves the right for himself or any other person to increase this Trust by

delivering money to Trustee , by having the proceeds of insurance policies made payable

to Trustee , or by bequest or devise by will. Trustee 's duties and liabilities under this

Agreement shall under no circumstances be substantially increased by any such additions,

except with his written consent.

6. Undistributed Income Added to Principal.

Any income of any Trust not distributed within the first ( number) days following

the end of the taxable year of that Trust shall be added to the principal of the Trust and

administered as a part of such principal.

7. Rights to Trust Assets.

Except as specifically provided herein, the Beneficiaries of this trust shall have no

rights to any assets of the Trust.

8. Powers, Rights and Duties of Trustee.

In addition to any powers given to it by law or otherwise, Trustee is authorized

and empowered with respect to any property at any time held under any provision of this

Agreement, including accumulated income, if any, and any property held pursuant to any

power in Trust, and until the actual distribution of the property:

A. To sell on such terms and conditions as it in its sole discretion may

determine.

B. To invest and reinvest in and to acquire by exchange or otherwise property

of any character including stocks of any classification, obligations, or other

property, real or personal, whether or not of the same kind, and participations in

any common trust fund administered by Trustee, without regard to diversification

and without being limited to the investments authorized by law for the investment

of trust funds.

C. To retain property of any kind received by it without regard to

diversification and without being limited to the investments authorized by law for

the investment of trust funds.

D. To join in, consent to, or become a party to any reorganization, merger,

consolidation, dissolution, readjustment, exchange, or other transaction and any

plan or action under or in connection with the same; to deposit any such property

with any protective, reorganizational, or similar committee; to delegate

discretionary powers to the committee and to share in the payment of its expenses

and compensation and to pay any assessments levied with respect to the property

and to receive property under any reorganization, merger, consolidation,

dissolution, readjustment, exchange or other transaction whether or not the same

is authorized by law for the investment of trust funds.

E. To exercise all conversion, subscription, voting, and other rights of

whatsoever nature pertaining to any such property and to grant proxies,

discretionary or otherwise, with respect to those rights.

F. To make and retain joint investments and investments of undivided

interests in any property, real or personal, whether or not all the property is held

under this agreement and whether or not the provisions under which such other

property is held are similar.

G . With respect to any real property (including real property acquired on

foreclosure or by deed in lieu of foreclosure) at any time held under this

agreement, to sell, exchange, partition, lease, sublease, mortgage, improve, or

otherwise alter on such terms as it may deem proper, and to execute and deliver

deeds, leases, mortgages, or other instruments relating to the real property. Any

lease may be made for such period of time, including a lease beyond a (e.g. five)

______ -year period, as it may deem proper and without the approval of any court.

H. To extend the time of payment of any bond (or other obligation) and

mortgage held by it, or of any installment of principal or interest or hold such

bond (or other obligation) and mortgage after maturity as past due; to consent to

the alteration or modification of any terms of the same, waive defaults in the

performance of the terms of the same; to foreclose any such mortgage or

compromise or settle claims under the mortgage; to take over, take title to, or

manage the property, or any part of it, affected by any such mortgage, either

temporarily or permanently, and in partial or complete satisfaction of any claim

under the mortgage; to protect the property against or redeem it from foreclosure

or nonpayment of taxes, assessments, or other liens; to insure, protect, maintain,

and repair the property; and generally without limitation by the foregoing

specification to exercise with respect to such bond (or other obligation) and

mortgage on such property all rights and powers as may be exercised by a person

owning similar property in his or her own right.

I. To borrow money to provide funds for any purpose without resorting to

the sale of any assets; and for the purpose of securing the repayment of the

borrowed money, to pledge, mortgage, or otherwise encumber any and all such

property on such terms, covenants, and conditions as it may deem proper and also

to extend the time of payment of any loans or encumbrances which at any time

may be encumbrances on any such property irrespective of by whom the same

were made or where the obligations may or should ultimately be borne on such

terms, covenants, and conditions as it may deem proper.

J. Without limitation by the specification of the following, to exercise any

and all the powers, authorities, and discretions provided in this agreement in

respect of any shares of stock of Trustee and any successor corporation whether

by merger, consolidation, reorganization, sale, or otherwise.

K. To register any property belonging to any Trust created by this Agreement

in the name of its nominee, or to hold the same unregistered, or in such form that

title shall pass by delivery.

L. To distribute in cash or in kind or partly in cash and partly in kind

9. Authority to Act.

The approval of any court or any Beneficiaries of this Trust shall not be required

for any dealings with the Trustee of this Trust, and any person so dealing with the

Trustee of this Trust shall assume that the Trustee has the same power and authority to

act as any individual does in the management of his or her own affairs. .

10. Management of Trust Property.

All property of the Trust shall be managed by the Trustee at the direction of the

Trustor . The Trustee shall collect all income of the Trust, and shall pay and use the

income in such amounts and to such persons as the Trustor may from time to time direct.

In the absence of direction from the Trustor , the Trustee may accumulate the net income

of the Trust, or may disburse any portion of the income to or for the benefit of the

Beneficiaries . The Trustee is also authorized to pay from the principal of this Trust any

and all amounts necessary in order to carry out the intent of Grantor as set forth in

Paragraph 2 above.

11. Liability of Trustee and Persons Dealing With Trustee.

No person or corporation dealing with Trustee shall be required to investigate

Trustee 's authority for entering into any transaction or to administer the application of the

proceeds of any transaction.

12. Compensation of Trustee.

Trustee shall be entitled to reasonable compensation from time to time for

Trustee's ordinary services rendered under this Agreement, for any extraordinary services

performed by Trustee, and for all services in connection with the termination of the

Trust, either in whole or in part.

13. Bond and Qualifications.

Bond shall not be required of the Trustee or any Successor Trustee . The Trustee

and any Successor Trustee shall not be required to qualify in any court and is hereby

relieved of the requirement of filing any document and accounting in any court or with

Beneficiaries .

14. Successor Trustees.

No Successor Trustee shall be responsible for acts of any prior Trustee . In the

event a vacancy in the office of Trustee occurs, a majority of the adult Beneficiaries may

agree to a non-judicial change in the Trustee by amendment to this trust agreement. No

person shall be required to apply to any court in any jurisdiction for confirmation of said

appointment. A successor Trustee of a trust shall succeed to all the powers, duties and

discretionary authority of the original Trustee . Any appointment of a specific bank, trust

company, or corporation as Trustee is conclusively presumed to authorize the

appointment or continued service of that entity's successor in interest in the event of a

merger, acquisition, or reorganization, and no court proceeding is necessary to affirm the

appointment or continuance of service.

15. Removal of Successor Trustees.

A Successor Trustee may be removed by the last individual to serve as Trustee ;

however, if that person is deceased or incapacitated, the Successor Trustee may be

removed by a majority vote in interest in Trust income. Said removal must be in writing,

stating the reasons for removal and indicate the successor Trustee , which must be a

corporate Trustee .

Removal of a Successor Trustee shall be permitted only for the convenient

administration of the Trust and not for the purpose of influencing the exercise of the

discretionary powers of a Successor Trustee as granted by this instrument.

Removal of a Successor Trustee shall be effective upon delivery of the notice of

removal. The removed Trustee shall have a reasonable period of time to transfer assets to

his or her successor. In the event the successor Trustee believes that his or her removal is

improper, he or she may, but shall not be required to, apply to a court of competent

jurisdiction, at his or her expense, for a declaration of the propriety of the removal. In that

event, the removal shall be effective only upon the order of said court and after any

appeal. In the event the Successor Trustee prevails, he or she shall be entitled to

reimbursement from the Trust for reasonable costs and attorneys fees associated with

such action.

16. Delegation of Powers.

Any management function of any Trust may be delegated by any Trustee to any

Successor Trustee , even if such Successor Trustee is not then serving as Trustee . The

terms of such delegation of power shall be any conditions agreed to by the Trustee s

which are not detrimental to the Trust; provided, however, that the Trustee shall not

delegate ALL of the Trustee ’s duties and responsibilities.

17. Limited Amendment Power.

The Trustee shall enjoy a limited power to amend management functions of this

Trust only as may be required to facilitate the convenient administration of this Trust, to

deal with the unexpected or the unforeseen, or to avoid unintended or adverse tax

consequences. Any amendment under this provision shall be in writing and must be

consented to by the adult Beneficiaries. The amendment may be retroactive. The

dispositive provisions of any Trust shall not be affected by this limited power to amend,

and such power shall not be exercisable in such any manner as to create gift, estate, or

income taxation to the Trustee or any Beneficiaries .

18. Resignation of Trustee.

Any Trustee may resign by writing filed among the trust papers effective upon the

Trustee s’ discharge. The resigning Trustee , or other interested party, shall provide notice

to all adult Beneficiaries of the Trust. The resignation shall be effective upon agreement

of all parties entitled to notice, or thirty days after notice, whichever occurs first.

19. Action or Inaction Based on Lack of Knowledge of Events.

When the happening of any event, including but not limited to such events as

marriage, divorce, performance of educational requirements, or death, affects the

administration or distribution of the trust, a Trustee who has exercised reasonable care to

ascertain the happening of the event is not liable for any action or inaction based on lack

of knowledge of the event. A corporate Trustee is not liable prior to receiving such

knowledge or notice in its trust department office where the Trust is being administered.

20. Waiver of Accounting.

Except as otherwise provided herein, neither this trust, nor any Trustee , shall be

required to provide an accounting to any Beneficiaries .

21. Allocation to Principal and Income.

All expenses and all receipts of money or property paid or delivered to the

Trustee may be allocated to principal or income in the sole discretion of the Trustee . The

Trustee , in a reasonable and equitable manner, shall also have the discretion to allocate,

in whole or in part:

A. Expenses of administration of the Trust to income or principal.

B. Fees of the Trustee to income or principal; and

C. Any expense of Trust administration or administration of its assets which

are deductible for Federal Income Tax purposes to income.

22. Election.

The Trustee and the Personal Representative of the Trustor 's estate will have

various options in the exercise of discretionary powers, and may exercise any such

discretion without incurring liability to any Beneficiaries , nor shall any Beneficiaries

have the right to demand a reallocation or redistribution of Trust income or principal as a

result of the proper action of the Trustee or Personal Representative, subject only to the

requirement that the Trustee and the Personal Representative act in good faith and within

the bounds of their fiduciary duty. Specifically, the Trustee or Personal Representative

may make certain elections for Federal Income Tax and Estate Tax purposes which may

affect the administration of Trust income or principal.

23. Perpetuities Clause.

It is the intent of Trustor that no provision of this instrument, and no other

disposition of property made pursuant to exercise of a power of appointment granted in or

created through authority under such instrument be invalid under the rule against

perpetuities, or any similar statute or common law.

24. Employment of Agents; Expenses of Trust.

Trustee may employ agents, including counsel, and pay them reasonable

compensation. Trustee shall be entitled to reimbursement for such payments and for all

other reasonable expenses and charges of the Trust out of principal or income, as Trustee

shall determine.

25. Governing Law.

This Trust shall be governed and construed in all respects according to the laws of

the state of __________________.

26. Binding Effect.

This Agreement shall be binding on Trustor , Trustor 's executor, administrator,

successors and assigns, and Trustee and Trustee 's successors and assigns.

Grantor and Trustee have executed this Agreement as of the day and year first

above written.

______________________________ ______________________________

_______________________________ ______________________________

Name & Signature of Grantor Name & Signature of Trustee

Acknowledgment 1

STATE OF _______________________

COUNTY OF ________________________

Personally appeared before me, the undersigned authority in and for said County

and State, on this ___________________________ (date) , within my jurisdiction, the

within-named ____________________________________ ( Name of Grantor) , who

acknowledged that he/she executed the above and foregoing instrument.

___________________________

NOTARY PUBLIC

My Commission Expires:

______________________

(Attach Exhibit A)

1

Form of Acknowledgment may vary by state.