Fill and Sign the Ulm Transcript Formpdffillercom

Useful tips for preparing your ‘Ulm Transcript Formpdffillercom’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature platform for both individuals and businesses. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the extensive features offered by this user-friendly and affordable platform, transforming your document management approach. Whether you need to sign forms or collect signatures, airSlate SignNow takes care of everything seamlessly, needing just a few clicks.

Follow this step-by-step guide:

- Access your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

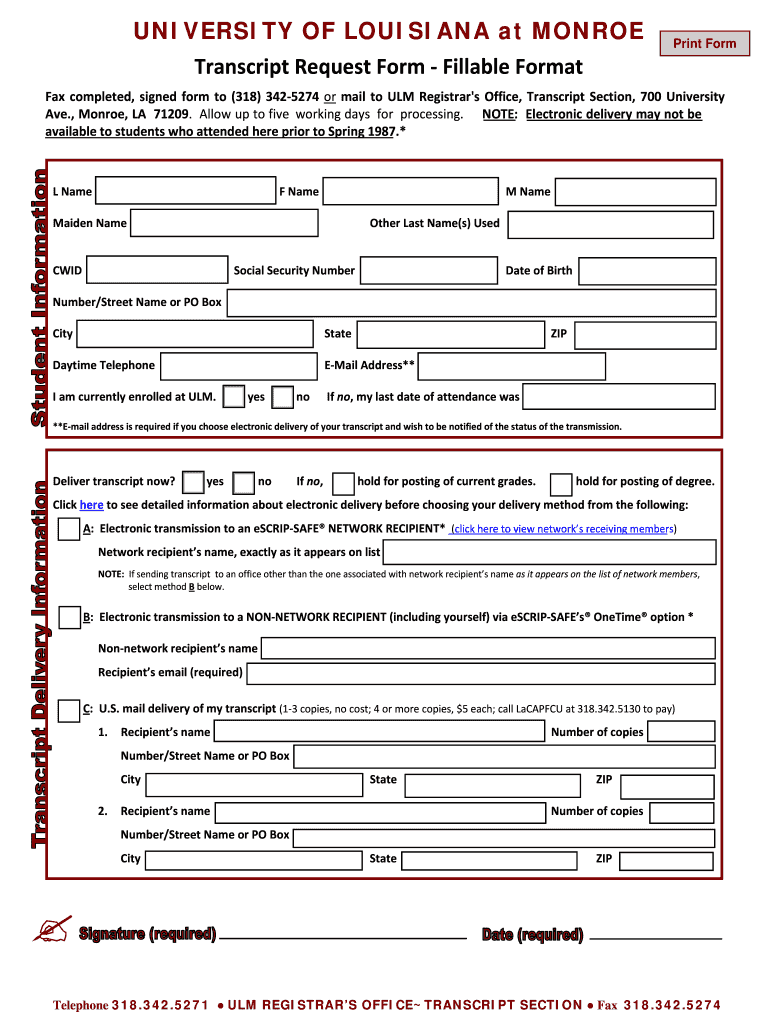

- Open your ‘Ulm Transcript Formpdffillercom’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite options to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your Ulm Transcript Formpdffillercom or send it for notarization—our platform has everything you require to complete such tasks. Create an account with airSlate SignNow today and upgrade your document management to a higher level!

FAQs

-

How can I initiate a University Of Louisiana At Monroe Transcript Request using airSlate SignNow?

To initiate a University Of Louisiana At Monroe Transcript Request, simply log into your airSlate SignNow account. From there, you can create a new document, select the transcript request form, and fill in the necessary details. Once completed, you can eSign and send it directly to the university for processing.

-

What are the benefits of using airSlate SignNow for my University Of Louisiana At Monroe Transcript Request?

Using airSlate SignNow for your University Of Louisiana At Monroe Transcript Request streamlines the process, making it quicker and more efficient. With features like eSignatures and document tracking, you can ensure your request is submitted and processed without delays. Additionally, airSlate SignNow is user-friendly, making it accessible for everyone.

-

Is there a cost associated with making a University Of Louisiana At Monroe Transcript Request through airSlate SignNow?

airSlate SignNow offers various pricing plans, allowing you to choose one that fits your needs for making a University Of Louisiana At Monroe Transcript Request. While the basic features may be free, premium plans provide enhanced functionalities like advanced integrations and additional document storage. Check our pricing page for detailed information.

-

Can I track the status of my University Of Louisiana At Monroe Transcript Request in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your University Of Louisiana At Monroe Transcript Request in real-time. You will receive notifications when your document is viewed and signed, ensuring you stay informed throughout the process. This feature adds peace of mind and transparency to your request.

-

What features does airSlate SignNow offer for a University Of Louisiana At Monroe Transcript Request?

airSlate SignNow provides a range of features to facilitate a University Of Louisiana At Monroe Transcript Request, including customizable templates, eSignature capabilities, and document sharing options. You can easily create and modify your request form, ensuring all necessary information is included. The platform also offers secure storage for your documents.

-

How does airSlate SignNow integrate with other applications for the University Of Louisiana At Monroe Transcript Request?

airSlate SignNow seamlessly integrates with various applications, enhancing your experience when making a University Of Louisiana At Monroe Transcript Request. You can connect it with tools like Google Drive, Dropbox, and more to streamline document management and storage. This integration helps keep all your relevant materials in one place.

-

What security measures does airSlate SignNow have in place for University Of Louisiana At Monroe Transcript Requests?

Security is a priority at airSlate SignNow, especially when handling sensitive documents like a University Of Louisiana At Monroe Transcript Request. The platform uses advanced encryption protocols and secure cloud storage to protect your data. Additionally, all eSignatures are legally binding, giving you peace of mind in your document transactions.

Find out other ulm transcript formpdffillercom

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles